Brian Paes-Braga is a Vancouver financier and entrepreneur, known for his notable work in founding and developing the lithium resource company, Lithium X. The company raised roughly $50 million and just two years after going public was sold to NextView New Energy Lion Hong Kong Limited for $265 million in March 2018.

Today, Brian Paes-Braga serves as Principal, Head of Merchant Banking at SAF Group, a leading structured credit and merchant banking group which builds, invests, finances and advises high growth companies. He is also on the board of directors at Thunderbird Entertainment Group and DeepGreen Metals and an Advisory Council member of the International Crisis Group, as well as supports a range of charitable organizations through his Quiet Cove Foundation.

You’ve been a successful entrepreneur for a number of years and have worked in several industries outside of the resource sector. From your experience , what are the ingredients to successfully financing and building strong companies like Lithium X?

Brian Paes-Braga: I think it starts with people and who you hire and whether there is synergy among your team members. I know we had that at Lithium X. It’s also important to respect the share structure of the company, and that means being honest with your shareholders while you continue to raise capital. Luck plays a part and we certainly were lucky in terms of timing and lithium prices when the company went public.

On the subject of Lithium X, the company was sold just two years after going public and you managed to maximize shareholder return. Was that always the plan for Lithium X or did a buyer appear at the right time?

Brian Paes-Braga: I established this company based on the belief that we need to wean the world off fossil fuels. That was the mission of Lithium X. We were confident that the buyer, NextView New Energy, shared the same commitment to developing the lithium sector. True, the $50 million we raised to secure lithium-development projects paid off when we sold the company but that wasn’t our main objective.

You pitched business mentor and renowned Vancouver mining financier Frank Giustra on the idea of building a lithium company and you also attracted another top mining figure, Paul Matysek, who had previously served as CEO of Potash One and Lithium One. How did you manage to convince Giustra and Matysek to join the project?

Brian Paes-Braga: My background as an investment banker helping resource companies raise money for projects led me to believe that lithium had the right supply/demand outlook for getting into business. I did my research on the lithium sector and the demand for lithium-based batteries in China. I think that both Giustra and Matysek saw the potential in the lithium market and were equally excited about the project. Mentors have always been very important to me. Frank Giustra was someone I had looked up to from a very young age and I’ve learned a lot from him.

You are a believer in giving back to the community through your work with various charities and your private foundation, the Quiet Cove Foundation. Can you talk about why charitable giving is important to you?

Brian Paes-Braga: At the center of my work in the business world is the desire to remain philanthropically conscious. I have now travelled the world on various mission trips close to my heart, including working with Syrian refugees in Greece and building schools in Peru. I wanted to devote more time to philanthropy and projects I cared deeply for and that was the reason we created the Quiet Cove Foundation. It focuses on supporting innovative solutions for large scale social issues. We encourage charities to think big, take risks, and disrupt the status quo.

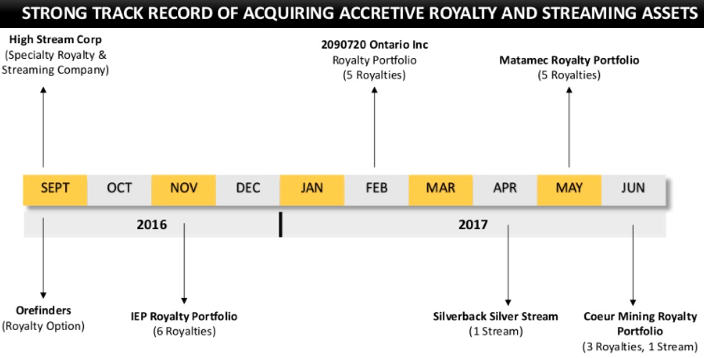

The following interview of CEO Brett Heath of Metalla Royalty & Streaming (CSE: MTA) / (OTCQB: MTAFF), was conducted by phone & email over the 3-day period ended January 21st. Metalla is a well-run, rapidly growing, precious metals Royalty & Streaming company that is relatively unknown. The Company’s tried and true business model typically commands a premium market valuation, led by industry darlings like Franco-Nevada (TSX-V: FNV) / (NYSE: FNV), Royal Gold (NYSE: RGLD) and Wheaton Precious Metals (NYSE: WPM).

{Bios of Mr. Heath and other key executives}

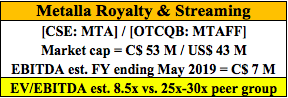

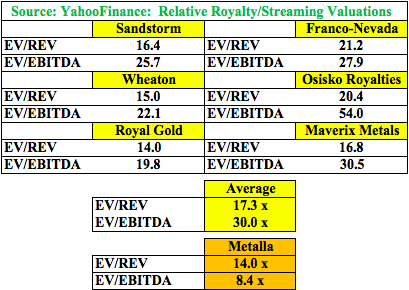

Management believes its valuation is meaningfully lower than its peers. According to YahooFinance; peers are trading at an average trailing 12 months EV/EBITDA ratio of 30.0x (25.2x excluding Osisko’s elevated 54.0x ratio), and an average EV/Revenue ratio of 17.3x. By contrast, Metalla’s anticipated [FY 2018 ending May 31, 2018] EV/EBITDA metric is just 8.4x — a 72% discount (8.4x vs. 30.0x) to its peer group.

CEO Brett Heath commented in the interview that EBITDA for FY 2019, (ending May 31, 2019), could be ~C$8-$10 M based only on existing assets in the portfolio, meaning that the 2019 EV/EBITDA ratio might be as low as ~6.5x. Pro forma for prospective new royalty/streaming acquisitions, Heath thinks EBITDA could be running at “well above” C$10 M by next year. Management expects at least 4 new deals in 2018.

At some point this year, or in my opinion by early 2019 at the latest, investors will have enough demonstrated cash flow and dividend history — and visibility towards future cash flows — to warrant a higher EV/EBITDA valuation. How much higher remains to be seen, but cutting the discount from 72% from to 40% (from and EV/EBITDA ratio of 8.4x to 18.0x) would allow for a doubling in Metalla’s share price.

Here’s my interview with Brett.

I received my first (monthly) dividend check in the mail… Thanks! What can you tell us about the dividend program moving forward this year?

We are very excited to have accomplished this important milestone early on as a company. The power of compounding dividends over time is significant when looking at total return. We expect to continue to raise the dividend this year until we reach 50% of after tax and G&A cash flow. Based on our last quarter, that has the potential to get to C$0.003/month (from C$0.001/month).

That might not sound like a lot, but it would be a 5.0% dividend yield — (all else equal, assuming no new share issuance for acquisitions) — based on the current C$0.72 share price. That would be triple the next highest yield in the precious metals royalty & streaming sector. NOTE: {Wheaton Precious Metals (NYSE: WPM) is yielding 1.62%}.

The board will meet quarterly to adjust the dividend based on silver & gold prices and the operating performance of mines that we have royalties or streams on. We started with a low dividend rate to maintain a strong balance sheet to facilitate upcoming transactions.

Please update readers on potential acquisitions of new royalty & streaming assets, are you close on anything?

Yes, we are working on some very exciting deals and hope to close at least 4 transactions this year.

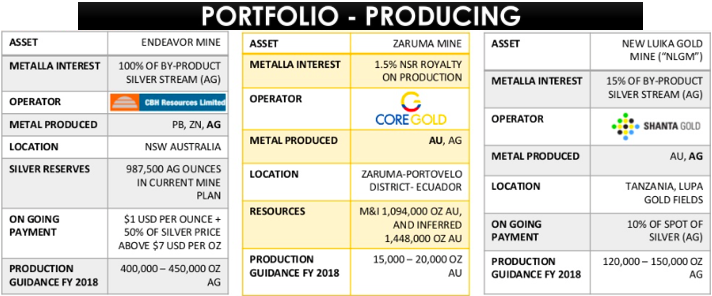

Metalla’s cash flow is heavily weighted towards silver, will it remain that way, or do you expect cash flow from gold assets to even things out?

Good question. It just so happens we are overweight silver vs. gold by virtue of executing on the best available deals at the time. We do expect gold assets to fill in as we complete more transactions. That being said, we will be heavily weighted towards silver over the next couple of years. Silver often outperforms gold in bull markets, so we are very comfortable with our positioning.

Investors have been waiting months for Metalla to be up-listed to the TSX Venture exchange. Why is it taking so long?

We are very close. I can assure you that it has been as frustrating for management as it has been for shareholders and prospective investors. A lot of it has been out of our control unfortunately, but it remains a priority and we will be a tier 1 issuer. Given the growth profile of the Company, we will be evaluating a U.S. listing as early as next year.

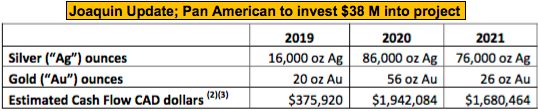

In December, your team provided an update on its 2% on the NSR Joaquin project. Tell us about Joaquin and explain the update’s significance?

This was a great update for Metalla shareholders. Pan American Silver is allocating $40 M to develop Joaquin with production starting in 2019. What this means is Metalla will have another top tier counter-party in the producer category. The mine plan is only based on one high-grade zone of the overall deposit. This asset will most likely cash flow to Metalla for many years. Our suspicion is that if we see higher silver prices, Pan American is likely to scale up the production profile.

What is your team’s latest estimate of cash flow for the fiscal year ending May 31, 2018? How should investors think about next year’s cash flow?

We are on track to hit our goal of CAD $6 M in operating cash flow for FY 2018 (ending May 31, 2018). First quarter (FY 2018) production was lower due to the ramp up of the Endeavor mine. We haven’t given formal guidance on FY 2019 yet, but internal estimates are looking to be in the CAD $7M – $9M range. That’s not including any new deals. With the addition of new transactions, our goal is to reach an annualized rate well north of CAD $10 M within the next 12 months.

Is Metalla paying any cash taxes? Or, are you benefiting from historical operating losses to offset earnings?

Unlike more established industry leaders like Franco-Nevada, Wheaton Precious Metals and Royal Gold, we don’t expect to pay any cash taxes for several years. This will support our dividend paying ability.

A slide in your corporate presentation shows how Metalla stacks up against its peers. Can you talk about that?

Yes, we are relatively unknown to investors, which might be why our valuation appears cheap compared to peers. Our FY 2018 cash flow estimate, plus ~C$1 M in “G&A,” is ~C$ 7 M in EBITDA. Our EV (market cap + debt – cash) is roughly C$ 59 M (we have ~C$ 3 M in cash & ~C$ 8.5 M of low coupon, unsecured convertible debt owned by our largest shareholder Coeur Mining). That gives us an EV/EBITDA ratio of about 8 and a half, compared to well over 20x for our peer group.

Admittedly, part of our valuation discount is probably warranted– we are a new company with a less proven track record, and we are under-followed, for example we don’t have any sell-side research coverage. But, as we grow, we believe our valuation gap will close, perhaps by a lot.

Thanks Brett. It sounds like the story is poised to gain traction with a Tier I TSX-V listing right around the corner, new acquisitions, a rising dividend payout and a cheap valuation. I look forward to updates on Metalla Royalty & Streaming (CSE: MTA) / (OTCQB: MTAFF) in the weeks and months to come.

Disclosures: The content of this interview is for illustrative and informational purposes only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research, [ER] including but not limited to, commentary, opinions, views, assumptions, reported facts, estimates, calculations, etc. is to be considered implicit or explicit, investment advice. Further, nothing contained herein is a recommendation or solicitation to buy or sell any security. Mr. Epstein and [ER] are not responsible for investment actions taken by the reader. Mr. Epstein and [ER] have never been, and are not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and they do not perform market making activities. Mr. Epstein and [ER] are not directly employed by any company, group, organization, party or person. Shares of Metalla Royalty are speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they consult with their own licensed or registered financial advisors before making investment decisions.

At the time this article was posted, Peter Epstein owned shares in Metalla Royalty and the Company was an advertiser on [ER]. By virtue of ownership of the Company’s shares and it being an advertiser on [ER], Peter Epstein is biased in his views on the Company. Readers understand and agree that they must conduct their own research, above and beyond reading this article. While the author believes he’s diligent in screening out companies that are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. Mr. Epstein & [ER] are not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article. Mr. Epstein & [ER] are not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. Mr. Epstein and [ER] are not experts in any company, industry sector or investment topic.

In early May silver reached a high of nearly $50 an ounce. Then it seemingly hit a psychological brick wall built by the Hunt brothers and beat a hasty retreat to $32.32. But since its sharp correction, silver has been making a slow and steady comeback and now trades at around $41.50. Eric Sprott, the founder of Sprott Asset Management, calls silver “the best recommendation anyone could make this decade” and sees silver going to $100 an ounce within the next 3 to 5 years.

Sprott’s prognostication must be music to Minefinders’ ears. Minefinders is targeting gold and silver producing assets in Mexico and, after years of hard work, the company has Proven and Probable reserves of 2.34 million ounces of gold and 119 million ounces of silver. Minefinders is unhedged and expects to produce at least 65,000 ounces of gold and 3.3 million ounces of silver in 2011.

With approximately $2.30 per share in cash and little long-term debt the company has a strong balance sheet. Minefinders’ solid performance hasn’t gone unnoticed by the financial markets, the company’s shares last closed at a record high of $17.68 valuing the company at over $1.5 billion. We connected with Mark Bailey, President and CEO of Minefinders, for an exclusive one-on-one discussion.

You position Minefinders as a precious metals mining and exploration company as opposed to a gold company, is it your strategy to expand both gold and silver production going forward?

We have always liked both metals and the diversification that focusing on both brings to our business. At our Dolores Mine, we have excellent exposure to both gold and silver, our La Bolsa development project will be primarily a gold operation but we also have other properties that we have not drilled on since 2006 such as Planchas de Plata and Real Viejo which are silver deposits. We plan to recommence drilling on Planchas de Plata by the end of 2011.

The Dolores Mine is your flagship property, please talk about the property and your plans for further development.

Commercial production was declared at our Dolores Mine in May 2009. The current Reserves are about 2 million ounces of gold and 114 million ounces of silver. In 2011 we have guided to produce 65,000 to 70,000 ounces of gold and 3.3 to 3.5 million ounces of silver at a cash cost of $450 to $500 per gold-equivalent ounce. We are currently well on track to meet or exceed this guidance. Now that Dolores is producing, we are currently looking at expansion plans with the addition of a mill to process high-grade open pit ore as well as the development of an underground mine. Studies on both these projects are currently nearing completion and we expect to be able to provide more details on these projects within the next six months.

We reported the results of a draft pre-feasibility study for a 6,500 tonne per day mill in April 2010 and are finalising an optimization study for the mill with the expectation of finalising the mill size and making a construction decision within the next six month. Secondly, we expect to develop La Bolsa and have a second mine in production by the first quarter of 2013.

The development of an underground mine at Dolores will take some time. Based on our current resource model, there are about 800,000 gold equivalent inferred ounces below the current open pit reserves, which we expect to expand and elevate to reserves through the development of the underground and further exploration, expected to take three to four years. Successful development of the underground will lead to production sometime in 2016 which will further enhance our gold and silver production profile.

Regardless, we’re very pleased with the performance of the current heap leach operation and the addition of a mill and underground operations will only help to speed up recovery and increase our production.

The La Bolsa mine is your most advanced development project, what are some of the salient points?

Aside from our flagship Dolores property, La Bolsa is our current development project. La Bolsa was in fact the first property Minefinders staked in Mexico in 1995 but when we realised that Dolores was going to be a much bigger deposit we put La Bolsa on hold to focus on getting Dolores into production.

La Bolsa is located in northern Sonora state in Mexico and is a gold and silver deposit but will primarily produce gold (as the silver will not leach well) and we expect to produce about 40,000 ounces of gold per annum for the life of the mine which is about five and a half years. Logistically it is in a great location, only 32 kilometres from the town of Nogales (so close to a workforce), and is situated on a private ranch.

We filed a National Instrument 43-101 compliant pre-feasibility study in August 2010 which showed the project to be economically sound and given the current price of gold, putting La Bolsa into production looks even more attractive. With Dolores now in production and performing well we have refocused our efforts on getting La Bolsa into production and are currently finalising permitting and detailed engineering. We expect to make a construction decision by the end of the year and could have it in production within 12 months with an expected capital expenditure of US$32 million.

You note in your presentation that Minefinders has one of the more attractive enterprise values to Proven and Probable gold-equivalent reserve ratios, please expand on this for our readers.

Our share value has typically traded at a discount to our peers. We believe that on the basis of our Proven and Probable reserves alone, we are an attractive investment opportunity when compared to our peers. We believe in using reserves for comparisons, because it is what is currently economically mineable and from our perspective, a more compelling case than just comparing resources, which may or may not ever be economically minable.

You have a pretty aggressive exploration program underway at the La Virgina project. How is that progressing and what major milestones are upcoming?

La Virginia is a very exciting project and the results to date have been encouraging. The La Virginia project covers more than 32,000 hectares containing seven separate target areas, very much a grassroots project that had never been drilled before until we started our first drill program on one of the target areas in April 2010. We recently reported 6.46 grams per tonne gold equivalent over 67 metres and have drilled around 40 holes to date. Our plan is to continue exploring on this target area to improve our understanding and expand the mineralization to develop a resource within the next eighteen months. We will continue with our exploration on the other six target areas and if results are encouraging consider increasing our drilling efforts on these other prospective targets.

With gold and silver trading at record levels and competition in your sector increasing, how do you planning on growing the company and expanding its resources base?

We plan to grow our company through the development of existing assets and focused exploration. As mentioned earlier, we are currently examining the addition of a mill at our Dolores Mine as well as the development of an underground mine at Dolores.

Assuming positive construction decisions for the mill at Dolores and for the construction of a mine at La Bolsa, Minefinders expects to increase its gold equivalent production to around 300,000 ounces by 2015. This represents an 80 to 90 percent increase from current production levels.

Finally, we will leverage our strengths as explorers and continue to explore at La Virginia Property, our other exploration projects and revisit properties such as Planchas de Plata, a silver deposit, which with the current price of silver now makes sense.

In the near-term, Minefinders has a very attractive growth profile and the experience to continue to grow its resource base through exploration. Most importantly, we are fully funded to execute our growth plans for Dolores (for both the mill and the underground development) and la Bolsa. We are very excited about the Company’s future.

This interview is featured in the article 10 Most Interesting Gold Stocks – Part 4 – CLICK HERE to read more.

Another Bema? If B2Gold, a company founded in 2007 by the former executives and management of Bema keeps its current pace, the second time around might be a whole lot quicker. Bema, of course, was acquired by Kinross Gold in 2007 in a friendly takeover valued at CDN$3.5 billion. Surprisingly, B2Gold actually stumbled out of the gate; shares of the company fell from over $2 immediately after going public, to a low of $0.35 during the height of the financial crisis. Since then, however, the company has rebounded and then some. B2Gold expects to produce approximately 135,000 ounces of gold in 2011 and the company’s shares are now trading at just over $4.

A quick look at their growing portfolio of properties shows that B2Gold has inherited Bema’s international flavor; Bema had producing gold mines in Russia, Chile and South Africa as well as development projects in Russia and Chile. The company operates two producing gold mines in Nicaragua and has exploration and development projects in Colombia. This diversification, coupled with the operational track record of B2Gold’s management and lower than expected production cost, led Macquarie Capital analyst Michael Gray to call B2Gold, “One of our top picks amongst mid-tier gold producers”. Gray recently gave the company an “outperform” recommendation.

MiningFeeds.com connected with Clive Johnson to discuss the evolution of Vancouver’s mining capital markets and the prospects for B2Gold.

You’ve been involved in minerals exploration and development for many years now having built your career in Vancouver. Please talk about the evolution of the mining finance business in Vancouver from your early days with the VSE to what is now arguably the mining finance capital of the world.

As you point out in your question, Vancouver has seen significant transformation from a penny stock exploration market in the 70s and 80s to a major force for mining and mining finance. I think there are a few reasons for this. Firstly, there were a number of successful companies like Bema Gold (which we ran for over 20 years) that transitioned from exploration to successful development and production and secondly there were some very successful entrepreneurs putting together Vancouver based mining companies such as the Wheaton River/GoldCorp combination. Finally in the international world of mining a company can have its head office anywhere and Vancouver is one of the top choices for many executives.

B2Gold has a corporate mandate to grow via acquisitions, has the high price of gold affected this strategy in any way?

B2Gold’s growth strategy has always been to grow by exploration and acquisitions (as was Bema Gold’s strategy). As the gold price goes higher, quality acquisitions become harder to find. We are one of the few producers that have a proven exploration team with an impressive track record with significant gold discoveries. The cheapest ounces will always be the ones you find. While acquisitions are more challenging in this gold environment, B2Gold shares have outperformed most of the sector over the last 6 months, which may increase our opportunities for the acquisition of other companies.

To date all of B2Gold’s assets are within the America’s but you’ve focused on some lesser know Latin American countries like Uruguay and Nicaragua to build your portfolio – please explain the benefits of this strategy to our readers.

In the days of Bema and now B2Gold we have always looked for opportunities in countries that are in economic and/or political transition or are under explored. In our current portfolio Nicaragua is a country that is largely unexplored and is in a stage of positive political and economic transition, while Colombia is another country that is largely unexplored and has had a dramatic transition to a safe country to explore in. And finally, Uruguay is a very stable country with great potential that has been under explored.

The rising price of gold has resulted in a plethora of junior and intermediate gold producers now listed on the TSX Exchanges. Why should an investor select B2Gold as an investment choice over many of your counterparts?

B2Gold represents and unusual opportunity for investors because it is a combination of a company with solid profitable gold production with no gold hedging and no debt and has a portfolio of projects to grow from. In addition we have numerous high quality exploration targets and one of the most successful exploration teams in the world.

Your Limon mine experienced a force majeure and flood in late June and underground operations have been suspended. When is the mine expected to be fully operational?

The Limon Mine is expected to be back to full-scale production in September. In the meantime, production has continued from other open pits and stockpiles. The company expects to meet its guidance production for Limon of between 42,000 and 46,000 ounces of gold in 2011.

How is your exploration program progressing and what is on the horizon as we head into 2012?

Exploration programs are continuing in Nicaragua at the Libertad Mine property, Limon Mine property and on the Trebol exploration project. In Colombia, exploration and pre-feasibilty work is underway on the Gramalote property, a 51% AngloGold/49% B2Gold joint venture, and finally, exploration drilling continues on the Cebollati project in Uruguay. B2Gold’s total 2011 exploration budget is over $40 million dollars. The company intends to announce exploration results from its various projects in September, 2011. We anticipate exploration on these properties to continue through 2012.

This interview is featured in the article 10 Most Interesting Gold Stocks – Part 3 – CLICK HERE to read more.

El Dorado, the “Lost City of Gold“, has fascinated and eluded explorers since the days of the Spanish Conquistadors. The story of El Dorado was born through a combination of myths and legends. Dating back to the 1500s, the story originated from the Muisca people who spoke of a golden city hidden in remote South America. The promise of an ancient city of gold enticed European explorers to search for El Dorado for more than two centuries. The geographical location of the mysterious city has morphed along with the myths and legends over the years. Gold coins, precious stones, and streets paved with gold are thought to be located somewhere in Columbia, Venzuela or Guyana.

Sir Walter Raleigh searched for the elusive city in 1595 and reportedly found it. He described El Dorado as a city on Lake Parime far up the Orinoco River in Guyana where “every stone they picked up promised either gold or silver“. The city was actually marked on English maps until its existence was disproved by Alexander von Humboldt during his Latin-America expedition in the early 1800s. Though many have searched and failed to find this city of gold, no evidence of such a place has ever been found.

One TSX listed company, Guyana Goldfields, has certainly not let the failed efforts to find El Dorado prevent them from finding gold in Guyana. The company has been successfully operating in Guyana for 15 years and now boasts a resource estimate of just over 6.6 million ounces of gold from 2 different projects. UBS analyst Dan Rollins likes the company. On July 25th Rollins wrote, “Given the company’s attractive valuation, market capitalization of less than $1 billion, near-term production potential from Aurora and exploration potential at Aranka, we believe Guyana Goldfields could be an acquisition target for an intermediate or mid-cap producer seeking to expand its presence in South America.”

MiningFeeds.com recently connected with Claude Lemasson, President and COO of Guyana Goldfields for an exclusive interview.

The European myth concerning the gold-paved city of El Dorato originated from the Guianas but gold was actually discovered there years later in the 1840s. Please tell our readers about your gold assets and the geology.

Guyana Goldfields has been operating in Guyana since 1996 and has established a second office in the capital of Georgetown. Throughout the years of operating in the country, we have been able to significantly grow the land position and have accumulated over 417,000 acres. Our main groups of properties are called Aurora, where the Aurora Gold Project can be found with a total measured & indicated resource of 5.34M ounces of gold, and Aranka, where we discovered our newest property called Sulphur Rose hosting an initial gold inferred resource of 460,000 oz. The Aurora Gold Project is currently in the pre-development stage with construction and development slated to begin in the first quarter of 2012. Aurora is comprised of 3 main zones called Rory’s Knoll, Mad Kiss and Aleck Hill. Rory’s Knoll has disseminated pyrite and gold mineralization associated with intense silica-fuchsite-sericite-carbonate alteration found in a tonalite intrusive while the 2 other zones are mesothermal gold veins hosted in the shear zones of metavolcanic and metasedimentary rocks.

What are the current mining policies and regulations in Guyana and what does the royalty or fee structure look like?

We are currently in discussion with Guyana’s government on developing a Mineral Agreement in order to obtain the final Mining License or Permit to operate and build the Aurora Gold Project. Earlier this year the government decreased its Corporate Tax from 35% to 30% for all large foreign mining companies to further attract investment into the country. Historically the royalty was at 5% and we are negotiating the royalty and other terms within the Mineral Agreement. We hope to conclude these discussions very shortly.

It has been reported that a new mining policy is needed in Guyana which takes into account the indigenous Amerindians which represent 7% of the population – what is your take on this situation?

This policy does not effect us as it only effects areas where indigenous Amerindians are located. We do not have any indigenous populations nearby and are developing projects where indigenous Amerindians not located.

You have an advanced project in Guyana, the Aurora project, with a NI 43-101 resource estimate of just over 6.7 million ounce of gold. When do you expect to reach production and estimated costs of production, and what additional hurdles do you have to overcome?

First commercial gold production at the Aurora Gold Project is targeted for the first quarter of 2014, producing an average of 300,000 oz/yr. The current mine plan is a combination of open pit and underground mining for the first 9 years with an average output of approximately 9,500 tpd and approximately 4,400 tpd for years 10-17 from underground feed only. Total mine life is 17 years with operating cash costs in the lower quartile of all producing gold mines at ~US$420/oz. Total planned production is over 4+ million ounces with the resource currently known to date. Exploration drilling continues on geophysic targets within the vast land package that has largely been unexplored.

You are also developing a secondary project, the Aranka project, please tell us about this project.

At the Aranka Properties, currently in advanced staged exploration, drilling of highly prospective targets is ongoing. The Company discovered a new gold zone at Sulphur Rose in early 2010 and identified an initial inferred resource of 460,000 ounces in December 2010. A revised resource estimate will be issued in the fourth quarter of 2011 to take into effect infill drilling conducted earlier this year. We will continue to explore this region and surrounding areas within Aranka.

Have you developed any strategic partnerships to help advance your projects?

We have been partnered with The International Finance Corporation (IFC) of the World Bank Group since 2006 and are following recognized international standards. The IFC is currently the third largest shareholder at 6.3% ownership. We’ve received support from the IFC on our Environmental and Social Impact Assessment work and they have mentioned an interest in potential future financial assistance.

This interview is featured in the article 10 Most Interesting Gold Stocks – CLICK HERE – to read more.

Last September, Timmins Gold made a non-binding proposal to the directors of Capital Gold (TSX:CGC) to merge on a negotiated basis. The proposed value of the transaction was $4.50 per share; shares of Capital Gold were, at the time, trading at $3.89. But from the get-go, Capital Gold’s board was not receptive the proposal. Enter AuRico Gold, and you set the stage for what was a contentious 7 month long take-over battle. The final price tag, AuRico’s winning bid was for $6.34 per share. $1.77 more than what was original agreed upon when Capital and AuRico signed their merger agreement.

Since losing the fight for Capital Gold, Timmins has been quiet on the M&A front but has been making noise elsewhere. The company has been continuously drilling and extending the mineralization at its flagship San Francisco gold mine located in Sonora, Mexico. And on August 11th, 2011, the company reported that it sold 17,965 gold ounces during the quarter. This represents a 59-per-cent increase in gold sales over the first quarter of the previous fiscal year. In addition to the San Franciso mine, Timmins also has a collection of interesting gold assets across Mexico. Most notably a 40,000 hectare land package in the Peňasquito area of Mexico that is contiguous to Goldcorp’s 13 million ounce Peňasquito Gold Deposit.

We caught up with Bruce Bragagnolo, President & CEO of Timmins Gold, to discuss some of the company’s past challenges and learn what’s in store for this emerging junior gold producer.

The economic crisis of 2008 caught a lot of companies off guard and Timmins Gold was no exception – the company’s shares dropped from $1.25 to $0.25. What specific challenges did you face during those difficult times.

The economic crisis caught us at the exact time that we were financing the startup at the mine. At the end of March, 2008 we came out with our initial 43-101 report which recommended the restart of the mine. After March of 2008 there was a softening of the market which we initially attributed to the usual seasonality issue of sell in May and stay away. It turned out that March of 2008 was the precursor to a systemic crash and not just seasonal softness. Despite the softness in the markets we managed to raise $19 million in June of 2008 and the plan was to return to the market in the Autumn and raise an additional $20 million through a combination of debt and equity. By September the market had softened even farther and by October the debt and equity markets dried up completely during the crisis. It was only in April of 2009 that the equity markets recovered enough for us to raise additional funds and eventually the debt market returned as well.

The company’s recovery since 2009 has been nothing short of amazing and your shares are now trading close to $3.00 per share. To what do you attribute this stellar recovery?

I can attribute this to two main reasons. First, the fact that we had a very successful startup period, and second, the high price of gold has increased our operating margins.

Including your flagship San Francisco mine in Sonora, Timmins has six different properties in Mexico. Could you please outline your exploration strategy and development plans heading into 2012?

Right now we are having a lot of success around and beneath the pit at San Francisco. We can not justify moving one of our 11 rigs to go anywhere else at present. We hope this will change in 2012 when we would like to complete at least one drill program on each of our other projects.

Is the company looking at additional projects or is your plate pretty full right now?

No we’re not actively looking, our plate is full.

The price of gold has been on a long term bull trend since 2002. What is your take on the gold market and at what point do you consider hedging production?

I believe the gold market is going much higher. I think you could consider hedging production when gold gets to a price that is so incredible you can’t believe it and, at the same time, the costs of production are dropping.

This interview is featured in the article 10 Most Interesting Gold Stocks – CLICK HERE – to read more.

Cobalt is classified as a strategic metal by the United States Government and a critical metal by the European Union. Highly purified cobalt, a technology metal, has applications in the aerospace industry because it is very resistant to corrosion and damage, even at high temperature. It is also used in the manufacturing of rechargeable batteries and in medicine.

Although cobalt’s use is varied, only about 76,000 tons of refined cobalt was produced globally in 2010. With cobalt trading on the London Metals Exchange for$35,000 per tonne, this represents an estimated market value of US$2.7 billion. The main source of the element is as a by-product of copper and nickel mining. The copper belt that runs across the Democratic Republic of the Congo and the Republic of Zambia yields most of the cobalt mined worldwide. But one company is looking to break tradition.

Formation Metals is well on their way to becoming North America’s next cobalt producer having raised over $170 million in equity financing. Based on a NI 43-101 technical report released by the company in 2007, the Idaho cobalt project’s projected output will be equivalent to 3.3% of global cobalt supply which translates into 14.9% of North American’s annual demand. With political issues in the Congo which have, since 1998, chronically threatened to disrupt global cobalt supply, Cobalt’s recent status as a strategic metal and proximity to local markets in the U.S., some think Formation Metals is a good bet.

Jennings Capital analyst, Ken Chernin, issued a speculative buy recommendation on May 26th, 2011 with a 12 month target of $2.60, more than double today’s current price of $1.24. Chernin sites low costs of production, few impurities, the mine’s U.S. location and the company’s hydrometallurgical facility as reasons for his recommendation.

MiningFeeds.com recently connected with the President & CEO of Formation Metals, Mari-Ann Green, to find out more about cobalt and the company’s progress in Idaho.

Cobalt is a minor metal, one that many of our readers may not be familiar with, could you please provide some background on pricing and production?

Cobalt is a metal that many readers may not be familiar with, but they come across it every day in items from re-chargeable batteries to jet aircraft. It is also used in a number of green energy technologies including hybrid cars, fuel cell and wind turbine technologies, and as a catalysts in oil de-sulfurization and in Gas to Liquids technologies. Because of its use in jet turbine engines, cobalt is alloyed with steel to form high strength critical components of the moving parts of these engines. The U.S. government considers cobalt a strategic metal and yet they have no domestic source. We plan on providing the U.S. with a stable domestic source of this critical metal.

The price of cobalt has averaged around $22/lb over the past couple of decades, and high purity super-alloy grade material, 99.9% purity or better, the variety that Formation plans to produce, goes for about $20/lb today. Last year in February, the London Metal Exchange started trading “Grade B” material, which ranges in purity from 99.3% – 99.8%. This “low grade” cobalt trades at around $16.00 lb at the moment.

The copper belt in the Congo and Zambia yields most of the cobalt metal mined worldwide; however, your lead project is based in Idaho in the United States. Please tell us about the project.

That’s correct. Western Africa accounts for about 65% of the world’s production. Historically, the price of cobalt has risen sharply in response to political developments in the region that led to uncertainty of future supplies. Our project, on the other hand, is located in the heartland of the United States, who accounts for 58% of the world’s consumption of superalloy grade cobalt. We also own and operate a hydrometallurgical refining facility, which will be capable of producing the high purity cobalt metal right here in the U.S. – and we will be the only company in the country doing that.

What are the key differences between your deposit and those found in Africa?

There are a number of differences. Firstly, as was pointed out already, the project is located in the United States which is a big consumer of cobalt but does not have a domestic source of the metal. Secondly, it is the only primary cobalt deposit in the country. Just as importantly, we know from metallurgical test work that it will be capable of producing high purity cobalt suitable for critical applications in the superalloy sector. Lastly, being able to refine the metal ourselves offers the great advantage of producing value added end products that meet the high standards and specifications for domestic end users.

We hear about cobalt being a “conflict metal” but cobalt production in the Congo is produced in the Katanga province, hundreds of miles away from the conflict zones in the eastern part of the country. What is your take on this status?

Cobalt from the Congo is not defined as a conflict mineral, unlike coltan from the eastern provinces where niobium and tantalum are extracted. However, cobalt produced from the Congo often ends up being comingled with ore from other areas and refined out of the country. This produces end products with uncertain supply chains. End users, like large electronic companies, are being held to task more and more about where the raw materials used in their products originate from. Being able to clearly demonstrate a continuous supply chain of ethically sourced raw materials is becoming more and more important in today’s emerging socially responsible corporate world.

Formation Metals also has gold/silver projects and uranium projects, to what degree are you focused on developing your other projects and what are your long term plans in these other areas?

Yes, we have several satellite projects that we expect to do more work on as the cobalt project nears production. We have a number of gold projects in Idaho that have been on care and maintenance while we moved the cobalt project towards construction. Strong precious metal prices has resulted in renewed interest in these projects, which are likely to see more work done on them by ourselves, or through joint venture opportunities.

In the state of Tamaulipas in Mexico, we own a high grade silver-lead zinc project where grab samples have returned silver values near 2kg/ton. We recently announced we had acquired additional central ground on the project, and we expect to do more exploration work to define drill targets in the fall and winter of this year.

Lastly, we have two uranium projects in the Athabasca basin of Northern Saskatchewan joint ventured with Cameco and AREVA. One of the projects, the Virgin River project, where Cameco is acting as operator, has discovered the Centennial Deposit, a high grade uranium deposit that has been traced for over 650 metres. Cameco has indicated they are looking for a McArthur River style deposit, the largest and highest grade deposit on the planet, and to date they have spent over $26 million dollars developing the Centennial deposit. The project has returned results as high as 8.8% U3O8 over 34 metres – that’s 8.8% over 110 feet! They are currently drilling the project with a budget of $3 million for this year. We have a vested 2% interest in the project with the first right of offer to earn up to 10%. Time will tell how that project develops, but at this stage the future looks promising with continued excellent results coming from the project.

On July 26th Formation announced that mine site earthworks construction commenced on your Idaho Cobalt Project, what does the timeline look like going forward and when do you hope to be in production?

We actually completed Stage I construction last year with timber clearing and site preparation, and this Stage II of construction will see the development of the portal bench and the construction of the mine site structures. If all goes according to plan, it is expected to take about a year to construct, so conceivably, we could be in production by this time next year.

This interview is featured in the article 5 Critical Mineral Stocks to Watch – CLICK HERE – to read more.

Graphite is one of fourteen critical minerals that were identified by a recent report by the European Commission as being under “supply risk”.

According to the United States Geological Survey (USGS), world production of natural graphite in 2008 was 1,110 thousand tonnes (kt), of which the following major exporters are: China (800 kt), India (130 kt), Brazil (76 kt), North Korea (30 kt) and Canada (28 kt). The mineral graphite is one of the eight allotropes of carbon. The most common allotrope being diamonds. While diamonds are a girl’s best friend could graphite become an investor’s best friend? Greg Bowes, President and CEO of Northern Graphite certainly thinks so and points to graphene, a next-generation material made from graphite.

Graphene is a one-atom-thick planar sheet of carbon atoms that are densely packed in a honeycomb crystal lattice. It can be thought of as an atomic-scale chicken wire made of carbon atoms and their bonds. Scientists around the world believe that graphene is a strong candidate to replace semiconductor chips. Moore’s Law observes that the density of transistors on an integrated circuit doubles every two years. But silicon and other existing transistor materials are thought to be close to the minimum size where they can remain effective. Graphene transistors can potentially run at faster speeds and cope with higher temperatures. Graphene could be the solution that will allow computing technology to continue to grow in power whilst shrinking in size, extending the life of Moore’s law by many years.

Northern Graphite, based in Ottawa, recently closed a $4 million initial public offering at $0.50 per unit and began trading on the TSX-V Exchange on April 20th, 2011. And so far so good. The company’s shares took-off and hit a high of $1.55 in early June and have since settled back to the $1.20 range. Northern Graphite’s principal asset is the Bissett Creek graphite project located 100km east of North Bay, Ontario. The Company has completed an NI 43-101 preliminary assessment report on the project and anticipates that it will be in a position to begin construction of the mine early in 2012, subject to positive results from the bankable final feasibility study and the availability of financing.

MiningFeeds.com recently sat down with Northern Graphite’s top executive Greg Bowes to talk about the company’s future prospects and to learn more about the project.

To provide some context for our readers, why should an investor be looking at graphite mining as an opportunity?

Lithium and rare earths have demonstrated that it is possible to make money with minerals other than precious and base metals. Now investors are looking for other strategic minerals that are undervalued and, in our opinion, graphite is one of them. Graphite industrial demand is growing 5% per year due to the effect of growing demand in China and India for traditional steel and auto markets. Since 2005, the price of graphite has increased by almost three times. New uses like lithium ion batteries, fuel cells, nuclear and solar are all big graphite users and will create more demand as these technologies become more widely adopted. Currently, China produces 70% of the world’s graphite and its production and exports are expected to decline like in the situation of the rare earth elements.

Please tell us about your project?

Northern Graphite has a large resource, located in Canada close to infrastructure, with simple open pit mining and metallurgy. The deposit will produce high value, high growth, flake graphite. The company expects to have a bankable feasibility and permitting done and start construction in the first part of 2012.

What are some of the challenges associated with developing and mining graphite?

In our case, not many. Our project involves simple mining methodologies and metallurgy. As mentioned before, our project is close to infrastructure and with no environmental issues.

Who are the dominate players in the industry and, once mined, how is graphite bought and sold?

China, in general terms is the dominant player since they produce 70% of the world’s supply. Most other mines outside of China are owned by large private industrial companies. There are only two public companies in North America with graphite development projects. There is no spot market for graphite, prices are negotiated between buyers and sellers but it is a very large and efficient market. Prices for the most common grades are published in industrial minerals magazine.

In 2010, scientists at the University of Manchester won the Noble Prize in Physics for isolating graphene. Please tell our readers about graphene and what applications it might be used for.

Graphene is transparent in infra-red and visible light, flexible, and stronger than steel. It conducts heat 10 times faster than copper and can carry 1,000 times the density of electrical current of copper wire. Graphene is expected to be a revolutionary material that could change the technology of semiconductors and LCD touch screens and monitors, create super small transistors and super dense data storage, increase energy storage and solar cell efficiency, and will transform many other applications. According to a professor at Georgia Tech University, there are nearly 200 companies, including Intel and IBM, currently involved in graphene research. In 2010 graphene was the subject of approximately 3,000 research papers and the European Union and South Korea have each recently started $1.5 billion efforts to build industrial scale, next generation display materials using graphene.

Having just listed on the TSX-V Exchange in April of this year, what are your plans for the balance of 2011 and beyond?

We are working towards a new resource estimate for next month; and, a bankable feasibility study and hopefully a strategic partnership by the end of the year. Next year, we would like to have our permitting completed in early 2012 and construction start-up shortly thereafter.

This interview is featured in the article 5 Critical Mineral Stocks to Watch – CLICK HERE – to read more.

President Obama likes vanadium; or rather, he likes to say the word vanadium. Last February Obama joked that “Vanadium redox fuel cells is one of the coolest things I’ve ever said out loud“. Obama also said this “next generation energy storage system will help families and businesses cut down on energy waste, save money and reduce dangerous carbon emissions”. So what is vanadium and, more importantly, what is a vanadium redox fuel cell?

Vanadium is the 23 element on the periodic table and is a soft silver-grey ductile transition metal. It is primarily produced in Russia and China from steel smelter slag and in a few other countries around the world as a flue dust of heavy oil or a byproduct of uranium mining. Most vanadium, approximately 85%, is used as an alloy called ferrovanadium as an additive to improve steels. But recently its vanadium’s status as a strategic metal and its green energy applications that have people, including President Obama, talking. Although, the more correct terminology is the vanadium redox flow battery.

Vanadium redox flow batteries are distinguished from fuel cells by the fact that the chemical reaction involved is reversible meaning that they can be recharged without replacing the electroactive material. Also, an important factor in the redox flow battery is that the power and energy density of the batteries are independent of each other in contrast to rechargeable secondary batteries which avoids cross contamination. These special characteristics make the vanadium redox flow battery uniquely applicable for energy storage applications including transportation and utilities.

Although vanadium has only recently been grabbing media headlines, one TSX-V listed company decided to pursue vanadium as an emerging opportunity when they fortuitously discovered the critical element in Nevada while drilling for base metals back in November, 2007. That company was American Vanadium which, at the time, was operating as Rocky Mountain Resources.

American Vanadium recently reported they are on track at the Gibellini vanadium project in Nevada to delivery of Feasibility Study in Q3, 2011 and is looking to start of production by 2013. This will position the company to have the only vanadium mine in the US, which is by some accounts, an enviable position.

Chris Barry, an analyst at House Mountain Partners, notes in a recent report, “With its low-cost project economics, AVC presents a unique opportunity to join the ranks of vanadium producers and contribute to the growing demand for this little-known metal. This is where we think AVC can create value for shareholders, near-term production of a strategic metal in a stable geopolitical jurisdiction.” Mr. Barry went on to say that, “Vanadium is most exciting because there is an increasing potential demand for the metal in the energy storage and battery spaces.”

MiningFeeds.com interviewed Bill Radvak, President & CEO of American Vanadium, to get to the bottom of vanadium and to find out what’s in store for the company.

Vanadium is certainly not a house-hold name, please tell our readers about vanadium, its uses and why you were attracted to this particular transition metal.

I volunteered for this job eighteen months ago because it is was perfect mix for me as a start-up where I could use my education and experience as a mining engineer and also leverage my fifteen year stint in the technology industry. And that is what the American Vanadium opportunity is about: an advanced vanadium resource which truly gives us the capability to lead the creation of the mass storage industry in the US using vanadium flow batteries.

The street knowledge of Vanadium has jumped tremendously in the time I have been with AVC and that is only going to continue to increase due to its growing importance and new critical uses that will affect everyday life. Historically, vanadium is all about being a premiere steel strengthener which was first used in the Model T Ford and since then has become increasingly critical to the steel industry. A great example is that on July 1 of this year, China implemented a new regulation for their rebar grade that will result in an additional 27,000 Metric tons of Vanadium consumed in China which is a 40% increase in global vanadium consumption in the next few years. As well, Vanadium is absolutely critical and irreplaceable in the production of titanium alloys for aircraft and the defense industry, catalytic converters and important chemical production.

A great statement we heard recently from the US Department of Energy was “the electric grid is the world’s largest supply chain without a warehouse”. Their biggest urgency is to build these “warehouses” and the most advanced mass storage battery technology is the vanadium flow battery. Essentially these are massive vats of vanadium in sulphuric acid that allow the continual storing and discharging of electrical energy. The key is that these vanadium flow batteries are scalable to meet any needs and will last for decades and that is why there is a huge effort to commercialize these batteries worldwide.

Vanadium is on the Critical Element list in America, how might this help shape American Vanadium?

Given that the US government has recognized it is in a terrible spot trying to secure supplies of rare earth metals, it taking a very serious look at all their supply chains. We have helped them further recognize that the US only domestically produces 5% of its raw vanadium needs as a by-product of a uranium mine while 80% of its needs are met by the Venezuela, China, Russia and South Africa. One hundred percent of the supply for the vanadium flow battery industry will come from these same countries. And 100% of the vanadium required for their titanium alloys used in the aircraft and defense industries comes from a single source in Russia.

When key industries and national defense rely on a critical element primarily from Venezuela, China, Russian and South Africa, the US has to look for domestic supply. And there is no other domestic US option on the table or being considered other than American Vanadium. As we are driving fast on our timetable to begin production by the end of 2012, we are being taken seriously by the US Government agencies as the key domestic source of vanadium for current and future needs. Importantly, this gives us tremendous leverage in partnering with vanadium flow battery companies as anyone seriously wanting to capitalize on the huge need in the US logically has to have access to our production which could easily be turned 100% to meet this premium need.

Please tell us a bit about the background of the company and, specifically, some background on your flag-ship Gibellini project in Nevada?

American Vanadium was built around the Gibellini Project which was historically drilled up by Union Carbide, Noranda and Atlas mining. What has made this project economic is we have recognized that the unique geology enables us to use simple and cost-effective heap leach processing to extract the vanadium. Being located in the middle of Nevada, the unique sedimentary hosted deposit is essentially a ridge of exposed, heavily oxidized, crumbled rock with a strip ratio of a remarkable 0.2.

A Scoping Study was completed by AMEC in 2008 and the operation they designed had an after tax IRR of 40% with a capital cost of less than $100 million. AMEC has been engaged to complete a Feasibility Study and we expect this to be delivered in this quarter.

The Gibellini project has a defined 43-101 resources estimate of 122 million pounds of indicated vanadium (i.e., vanadium pentoxide or V205) grading at 0.339%, where does this put American Vanadium in terms of size and grade of other known deposits?

At 3 million tons per year mined, our mining project could be considered small relative in the mining industry, but this production rate would represent about 50% of the United States annual vanadium demand or about 5% of the world supply this year. This makes our operation very important to the vanadium industry, particularly the US consumers. We are fortunate that we are in a very friendly mining jurisdiction where we can control costs on an already inexpensive mining and processing operation. Therefore, while our grade is relative low, we expect it to be very economic as most other mines have a magnetite that requires stages of crushing, grinding, magnetic separation and roasting.

We also have a very expandable resource potential. We focused on getting to production base on the historic drilling on the main occurrence. Now that the Feasibility Study on this occurrence is nearing completion, we are turning our immediate attention on building the resource on expanding this main occurrence and upgrading the already drilled Louie Hill that is adjacent to the Gibellini. After that there are a handful of other occurrences on the property we will be exploring as well as looking regionally.

What does the end-user market look like for Vanadium and how is Vanadium sold into that market?

The vanadium market has been in a state of oversupply for the past decade and is now transitioning into an extended period of undersupply; coincidentally, this is anticipated around the time we expect to reach production. This bodes well for the producers as the price of vanadium is forecast to climb for the next 5 – 10 years. And this does not take into account any demand at all from the vanadium redox battery so obviously we are thrilled with market timing and the vanadium outlook.

The consumers are now becoming worried about surety of supply. Our priority, while the vanadium flow battery market grows, is to pursue the US consumers beginning with the handful of steel companies that rely on foreign sources. We can offer a longer term, domestic supply to satisfy their surety of supply concerns. Additionally, we will be focussing on the titanium market where vanadium sells for a premium. While on a global scale only 4% of world vanadium is consumed in titanium alloys, in the US almost 20% of the vanadium is consumed in titanium alloys due to the significant aircraft and defense industries which rely on a sole source of vanadium from Russia.

What milestones do you hope to reach before the end of 2011?

We have a number of very important milestones we expect to deliver in the coming months including the completion of our bankable Feasibility Study by AMEC in Q3, issuing a revised NI43-101 within 45 days of the Feasibility Study and testing of our vanadium electrolyte for the mass storage industry. We will leverage these near term milestones to pursue a number of key initiatives such as joint ventures and partnerships with international leaders in the Vanadium Flow Battery space and off-takes with steel producers for our early production. Project wise, we are going to put a lot of energy towards increasing the resource thereby extending the mine life. All in all, there is lots going on and lots to look forward to for the remainder of this year and next.

This interview is featured in the article 5 Critical Mineral Stocks to Watch – CLICK HERE – to read more.

The completion of an IPO earlier in late 2010 marked the arrival of a new late-stage player on the Canadian listed rare earths scene, Frontier Rare Earths. Frontier began trading on the TSX exchange on November 17th, 2010 after the completion of a $60 million unit financing at $3.40 concurrent with the company’s IPO. The unit offering consisted of 1 share and 1/2 share purchase warrant at $4.60 expiring after 2 years. Since then, the company’s shares have been trending down hitting a low of $1.86 earlier this month and are now trading at $1.97.

Frontier’s flagship project is the Zandkopsdrift rare earth element deposit in the Northern Cape province of South Africa. The company’s NI 43-101 technical report states that Zandkopsdrift is one of the largest known undeveloped rare earth deposits outside China. The independent report, prepared by South African consultants MSA Group in October, 2010, identifies an indicated resource of approximately 23 million tonnes at an average grade of 2.32 percent TREO, representing 532,000 tonnes of contained TREO. In addition, the report identifies an additional inferred resource of approximately 21 million tonnes at an average grade of 1.99 percent TREO, representing 415,000 tonnes of contained TREO. Frontier hopes to supply up to 20,000 tonnes per year of REO and is working on validating the production potential from the ongoing prefeasibility study projected to be completed towards the end of this year. The company is quick to point out that their Zandkopsdrift B Zone, which is contained within the overall Zandkopsdrift resource estimate, is the third highest grade rare earth deposit outside of China after Lynas and Molycorp.

Jacob Securities Analyst Luisa Moreno likes Frontier Rare Earths, she has a price target of $9.83 on the stock. In a report from June 8th, 2011, she states, “Although Molycorp’s grade at Mountain Pass deposit is 8.28% compared to Frontier’s with 2.16% TREO, Frontier’s critical heavy element grades (dysprosium, europium and terbium) are higher, which means that Frontier will be able to produce more of these critical materials (circa 370 tonnes) and generate higher sales for these elements than Molycorp (circa 80 tonnes) despite Molycorp’s overall production target being twice that of Frontier.”

The Prospecting Right for Zandkopsdrift is held by Sedex Minerals, a South African company that is 74% owned by Frontier while the remaining 26% of Sedex is held by South Africa’s Black Economic Empowerment (BEE) through which 21% ownership is extended to Namaqualand Empowerment Trust (NET). NET is a broad-based community trust established for the benefit of historically disadvantaged South Africans principally in the Namaqualand region of the Northern and Western Cape Provinces of South Africa. From the BEE Commission Report in 2002, the post-apartheid program is aimed at redressing the imbalances of the past by seeking to substantially and equitably transfer and confer ownership, management and control of South Africa’s financial and economic resources to the majority of the citizens. It seeks to ensure broader and meaningful participation in the economy by black people to achieve sustainable development and prosperity. An interesting approach that has proven to be somewhat successful in South Africa.

Although Frontier has a direct 74% interest in Zandkopsdrift, company Chief Executive James Kenny noted that the provisions of Sedex’s shareholder agreement in fact gives Frontier an effective 95% economic interest in Zandkopsdrift when he connected with MiningFeeds.com.

Frontier recently completed an IPO on the TSX raising $60 million via a unit offering at $3.40 per unit on the strength of your rare earth project in South Africa. Could you talk about the genesis of the project prior to your IPO?

I have been involved in the natural resource earth sector for many years as have other members of my family. In 1994 I travelled to South Africa for the first time, shortly after the first democratic elections which followed Nelson’s Mandela’s release from prison. Although South Africa is a country abundant in natural resources, it had virtually no junior mining industry due to the apartheid regime. With the country opening up to foreign investment I travelled to South Africa with my brother, Philip, and my father. On an early visit we were very fortunate to meet a renowned diamond exploration geologist by the name of Hugh Jenner-Clarke who had, at that time, spent over 40 years in the diamond exploration sector in South Africa and elsewhere and had some important discoveries to his name. On a handshake we formed a partnership with Hugh and established Firestone Diamonds plc, an emerging diamond producer now with operating diamond mines in Botswana and Lesotho. Firestone Diamonds is listed on the AIM market in UK and continues to be run by my brother Philip Kenny. In 2004 we decided to look at other mineral opportunities and identified the rare earth sector as one having very significant promise due to the now very evident trends of Chinese production dominance and the anticipated growth in demand for rare earths. We strongly believed that the west coast of South Africa and, in particular, the Namaqualand region was highly prospective for rare earths. The Zandkopsdrift Project area which hosts the Zandkopsdrift rare earth deposit which we are developing was at the time ‘open ground’ and we applied for and were granted a Prospecting Right covering 60,000 hectares in the area in 2006. Between this time and our IPO in November 2010 we advanced Zandkopsdrift to the point that the NI 43-101 report confirmed it as one of the largest, highest grade code-compliant resources in the world outside of China.

The deposit is a carbonatite complex and the rare earth mineralization is principally contained in a monazite complex. What sort of challenge do you expect to face cracking the minerals in your deposit and describe the availability of the associated technologies?

Rare earths do not occur in free form and are bound up in host minerals from which they must be cracked or liberated. Up to 200 different types of mineral can host rare earths, the very large majority of which have never had a process, let alone a commercial process, for the extraction of the contained rare earths. The two most ‘conventional’ rare earth host minerals are bastnaesite and monazite with the flow sheet for the monazite having been established for decades and is widely available. The primary host mineral at Zandkopsdrift is monazite and so the challenge for Frontier will be to adapt and optimise this established flow sheet for the recovery of rare earths from the Zandkopsdrift deposit.

Which rare earth elements, in your opinion, are key to Frontier’s economic model and why?

I think that one has to look at the ‘balance’ in any rare earth deposit as all rare earth elements will be recovered together and then sequentially separated and sold. Clearly some rare earths such as cerium and lanthanum are relatively plentiful and as such I think that the medium term price is likely to be considerably below current price levels. Similarly we believe that five of the ten heavy rare earths are of very low or limited value due to the small size of the global market. We are very fortunate in that the Zandkopsdrift deposit has elevated levels of what we call the ‘Big Five’ namely neodymium and praseodymium of the light rare earths and europium, terbium and dysprosium of the heavy rare earths. I think that these five elements exhibit the most attractive supply/demand price outlook and will be key to Frontier’s economic model

Infrastructure is always a key component when putting a mine into production, please tell our readers about what is available in the area?

Our Zandkopsdrift development is located approximately 450km north of Cape Town, just off the N7 Highway in the Namaqualand region. Namaqualand is South Africa’s oldest mining province with over 150 years of gold, copper, base metals and diamond mining history. Although certain of these mines are no longer operational, there remains very good infrastructure, qualified staff and mining support services in the area. Of particular significance is the town of Bitterfontein which lies 30km from Zandkopsdrift and is the site of the nearest railhead and Saldahna Bay some 250km to the south and which is one of Southern Africa’s deepest water ports. The most capital intensive and complex part of the rare earth recovery process will be the separation stage and Frontier plans to construct a 20,000 tonne rare earth separation plant at Saldahna Bay proximate to other comparable plants and facilities. This is expected to significantly reduce Frontier capital expenditure requirement and development lead time.

What is the environmental permitting process like in South Africa and can you speak to the environmental part of the equation?

South Africa has a well-developed exploration, development and mine permitting regime. As part of the advancement of Zandkopsdrift Frontier will be required to do extensive assessment of the impacts of our current and proposed activities on, for example, the flora, fauna, wildlife, water resources of the area. Zandkopsdrift is not an area of particular environmental or other sensitivity and Frontier expects that the findings of its environmental studies will not impede the permitting and development of Zandkopsdrift. Of particular importance in the rare earth sector is the presence of the radioactive elements, specifically, of thorium (178 ppm at Zandkopsdrift) and uranium (56ppm at Zandkopsdrift) which fortunately are considered to be at very low levels in both absolute and relative terms at Zandkopsdrift.

Having completed your IPO, now that the dust has settled, what is on the horizon for Frontier Rare Earth and what key milestones do you hope to accomplish with the money you just raised?

We have a very busy 18 month program which will involve the completion of a Preliminary Economic Assessment due at the end Q3/early Q4 2011, with a Prefeasibility Study scheduled to follow 3-4 months thereafter and a Definitive Feasibility Study in Q4 2012. This work is fully funded with the proceeds of our IPO competed late last year. In addition we expect to investigate the some 30 satellite intrusions we have identified around Zandkopsdrift as well as initiating a regional scale exploration elsewhere in the Zandkopsdrift permit area.

This interview appeared in 5 Most Interesting Rare Earth Stocks – Part 1 – CLICK HERE for the article.

Dacha Strategic Metals is in the rare earth elements business but, interestingly enough, Dacha is not a mining company. And perhaps more interesting to Dacha’s investors, yesterday the company hit a 52 week high closing at $0.89. Dacha has effectively created the world’s first and only stockpile of rare earth elements and offers investors and industrial consumers the ability to participate in the physical ownership of these critical elements. Similar to a physical trust.

As of June 24, 2011, in addition to its metal inventory, which had an estimated fair market value of $96.1 million, Dacha’s equity investments had an estimated fair market value of approximately $2.7 million along with a cash position of approximately $4.7 million for a total of $103.5 million, or $1.39 per share, based on 74.4 million shares outstanding.

We recently discussed the value proposition of Dacha Strategic Metals with the company’s President & CEO, Scott Moore, and addressed the company’s normal course issuer bid share buy-back that was announced earlier this month.

Dacha Strategic Metals is not a mining company but operates in the rare earth element sector. Please tell our readers about your business model and the history of the company?

We have a unique, but very simple business model which provides an investment alternative for investors interested in gaining exposure to rare earth elements without the risks inherent to mining companies. Quite simply, Dacha’s objective is to achieve, long-term capital appreciation through the buying, holding and selling of rare earth elements, which are predominantly supplied by China.

Just over a year ago, anticipating that the prices of rare earth elements would begin to appreciate quite rapidly, we began working with this model and started accumulating a stockpile of the particular physical rare earth elements that we perceived had the greatest potential to gain value.

Since we began, we have acquired approximately 300 tonnes of rare earth elements from within China – most of which we acquired when Chinese export quotas were at their lowest – and have proven the liquidity of our inventory through making, selective, opportunistic sales to downstream customers. We began implementing our business model in April 2010 with an equity raise of $22 million which we deployed into an inventory of approximately $20 million, and we recently announced that as of June 24, 2011 that our inventory is worth over C$96 million. Each week we update the inventory chart on our website (CLICK HERE to view) and on a monthly basis we put out a press release announcing our Asset Value, which is inclusive of our metal inventory, marketable securities, and cash. If a substantially material change has occurred with our inventory we would also press release that change in a timely manner.

Are there comparable companies to Dacha in the marketplace or did you conceptualize this business model?

At present there are no companies in the rare earth market with a similar business model to Dacha. The majority of rare earth element companies in the market are exploration and development projects – as you mentioned earlier, we are not a mining company. In actuality, we can be more closely compared to a physically backed ETF – such as a gold bullion fund. But there are obvious differences, we trade on the TSX-V as a corporation and do not have the associated “management” or “commission” fees as a traditional fund would. The Central Fund of Canada (TSX-CEF) and the Uranium Participation Corp. (TSX-U) are two similar companies except that Dacha has the ability to hold multiple metals and trade in and out of their positions.

Shortly after you went public you announced that Dacha acquired an operating license in the People’s Republic of China for rare earth elements through the acquisition of a trading company in China. Could you explain the nature of that license and what terms are associated with it, if any?

Our China license allows Dacha to buy, hold and sell rare earth elements within the Chinese market. It does not allow us to have export quotas but does allow us to import rare earths, such as concentrate. However, I should note that Dacha is more tax effective outside of China and as such we are focusing our inventory to be held outside China. As Dacha operates out of Barbados, our effective tax rate on income is 2.5%, therefore providing an investor with almost the full upside on the metal price. This is one area where the market may be discounting us as they may not realize the tax effectiveness of the model.

Rare earth elements is a relatively new sector of the mining investment community, what are the key demand drivers that are shaping the industry and what is the price sensitivity of the marketplace?