- Most analysts in both the gold and mainstream investment communities seem to be in “summer doldrums” mode. They are nervous about stock markets because of rate hikes and the late stage of the business cycle. That’s understandable.

- Unfortunately, they also seem to be unaware of the fabulous uptrends developing in many gold stocks.

- In contrast, I’m extremely excited by the price action in a wide array of gold stocks, silver stocks, and blockchain currencies. I have predicted that the upside fun will continue and is poised to accelerate quite dramatically in the second half of this year.

- Please click here now. Western governments focus on regime change in Mid-East while China takes another step forwards in what I call the gold bull era.

- Morgan Stanley’s stock market indexes are a institutional benchmark, and China’s gold demand growth is strongly correlated with income growth, stock market performance, and overall GDP growth.

- In terms of goods and services produced and consumed, China is by far the world’s largest economy. Soon it will become the richest as well, leaving demographically-impaired and debt-obsessed America in its wake.

- Gold investors in the West can choose to live in an emotional state of doldrums and boredom, or they can feel great comfort as they watch China put a relentlessly rising floor under the gold price.

- I choose to enjoy the mild excitement and great comfort generated by the gold bull era.

- Please click here now. While China expands its gold-oriented influence, India is functioning like a gold-oriented starship attached to a Chinese locomotive train with a gigantic rubber band.

- As the strong season for gold in India begins in the summer, inflation has suddenly started a nasty turn to the upside. Indians and Germans are the global citizens most concerned with inflation.

- As inflation begins to stun most observers with the power of its surge over the next eighteen months, I expect Indian gold demand to begin a historic leg higher. Germans will join the fun, and institutional money managers around the world will commit to substantial gold stock buy programs as that happens.

- Please click here now. Double-click to enlarge. There are only four to six weeks before the strong demand season for gold begins, and does so against the background of more rate hikes, QT, a fading US business cycle, and inflation that could grow like “Jack And The Bean Stalk”.

- There’s not much time to get positioned in my key $1310 – $1280 buy zone before the strong season and rising inflation raise the gold price floor above $1400 and keep it there for decades.

- Nervous accumulators can mitigate their nervousness with a put options strategy, but even if bullion pulls down to $1280, I expect many miners to keep rallying!

- Please click here now. I’m in absolute agreement with Pete Boockvar, and I’ll take his views a step further and suggest that in the current environment QT and rate hikes are going to make inflation grow like Jack and the golden beanstalk!

- Please click here now. My “line in the sand” head and shoulders top neckline for US T-bonds looks ready to break. There could be some hesitation but I think a June rate hike and accelerated QT from Powell will seal this deal.

- That could create an equity market panic and more concern about real estate mortgages. Previous Fed hikes have coincided with the start of significant gold price rallies, and this one could turn into a real barnburner.

- Please click here now. London’s biggest metals dealer has announced bitcoin and gold trading. There’s a growing synergy between the blockchain and gold community.

- I expect that to intensify quite dramatically as miners like Agnico and Goldcorp get more involved with the technology.

- Please click here now. The excitement being generated by the blockchain currency assets is incredible. ZCASH is a key currency and it has surged 40% just in the past twenty-four hours. The Gemini exchange run by the Winklevoss billionaires just received regulatory approval for institutional and retail trading of more great blockchain currencies like ZCASH!

- For bitcoin itself, I have an eighteen-month target of $50,000 a coin, and an ultimate target of $500,000.

- I’m a miner myself, and I’m installing a lot of solar panels to ensure I have more than enough juice to power my joyous blockchain era upside ride! Investors who want to get richer with blockchain currency action can subscribe to my maverick www.gublockchain.com newsletter.

- Please click here now. Double-click to enlarge this important GDX chart. Some individual component stocks of the GDX ETF are going to keep rising in the uptrend and others will pull back a bit before blasting higher.

- At this point it’s simply unknown which route GDX follows before global inflation begins to grow faster than what I’ll call Jack and his bull era bean stalk! What is known is that I want all gold community investors to be comfortably invested in key gold stocks so they build maximum wealth as the bean stalk of inflation begins to grow… and grow… and grow!

Thanks!

Cheers

Stewart Thomson , Graceland Updates

https://www.gracelandupdates.com

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am.The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?

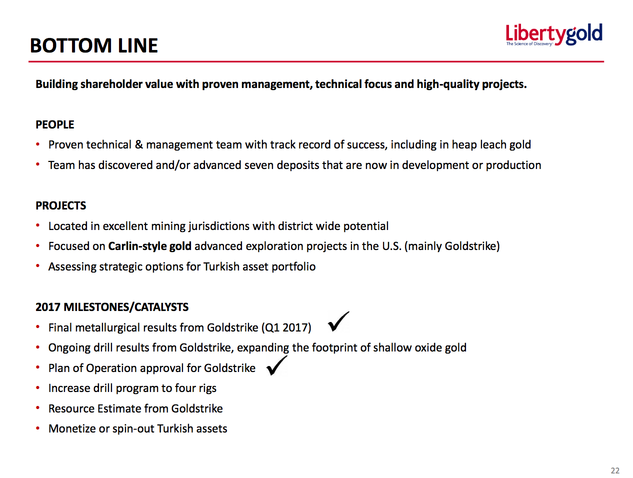

Spin-out of two (U$2.3 billion and U$190 million) gold start-up successes since 2011 has the talent and potential of the originals

Liberty Board at the historic Moosehead Pit at Goldstrike. From left: Rob Pease, Mark O’Dea, Don McInnes, Sean Tetzlaff, Cal Everett

The gold mining industry is massively depleting its reserves, not finding new deposits fast enough, and could be on the cusp of its most profitable turning point ever.

Gold mine supply will peak in 2019 and continue falling through at least 2025, according to BMO Capital Markets and Bloomberg.

Producers like Newmont (NYSE:NEM), Goldcorp (NYSE:GG), Barrick (NYSE:ABX) and Kinross (NYSE:KTO) are looking to the Western United States for their future pipeline. They have all made new investments there and are searching for more. Acquisitions are being focused in stable political and operating environments.

New gold finds have long been richly rewarded.

As an example, investors turned $200 million to $2.3 billion with Fronteer Gold, a Nevada explorer acquired by Newmont Mining (NYSE:NEM) in 2011. In 2016, Endeavour Mining purchased True Gold for U$190 million. Both discoveries were developed from the same group of scientists, led by Mark O’Dea.

Of the last 7 heap leach gold mines put into production in the world, 2 are from the O’Dea Oxygen group. They find deposits, drill them off, de-risk the discoveries and then sell or build them. Two other heap leach deposits from the same group are now being permitted to be built in Turkey by Alamos. That’s 4 projects out of a tiny universe where new discoveries are rare.

The dream team of gold scientists behind Fronteer and True Gold are doing it again.

This time, the industry is starving for new discoveries. A brutal six year bear market has prevented producing companies from investing in exploration. Meanwhile, everyday, gold miners deplete their ores. They are forced to dig deeper, and mine more difficult rock. Plus, project development timelines often take ten or twenty years.

As a result, there are now undeveloped gold resources with bigger valuations than similar projects already built — with construction costs already sunk.

“The older you get in this business, the lower-risk oriented you become in your investments,” commented Liberty Gold (TSX:LGD; OTC:LGDTF) CEO Cal Everett. Originally called Pilot Gold (TSX:PLG), the Fronteer spinout was rebranded Liberty Gold this year to reflect its Western US focus. Kicking rocks at Liberty is the same technical team who developed Fronteer and True Gold.

Liberty Team at Stamp Mill at Goldstrike

To name a couple of those key players:

- Dr. Moira Smith is Liberty’s VP of Exploration and helped drive Fronteer’s Long Canyon discovery, which is now critical to Newmont’s growth. Smith has been involved in 7 significant gold mine discoveries in her career that are now in development or in production. “The lady’s absolutely brilliant,” Everett says.

- Dr. Mark O’Dea is Liberty’s Chairman. He guided Fronteer to a $2.3 billion sale. More recently he established True Gold, a West African gold developer, that was bought out for U$190 million.

And Liberty now has fresh eyes to build towards a major discovery. It poached Cal Everett, Liberty’s President and CEO, following a recent Corporate acquisition.

Everett is a geologist from New Brunswick, Canada. His father was a military policeman. The younger Everett spent his early career in exploration working with large mining companies. He changed careers to the finance side and excelled as an investment advisor beginning in the early 1990s. Building his own proprietary resource models, and with an international network of geologists, Everett became one of the mining industry’s most influential discovery financiers, working with BMO Capital Markets, PI Financial and later, founding Axeman Resource Capital.

Everett was advising another explorer in 2014 that was competing with Liberty to acquire the past producing Goldstrike project in Utah.

When Liberty outbid, O’Dea offered Everett the top job a year later when the Company was looking for a management and direction change. For Everett, the team and projects were too good to pass up.

“They have an incredible screening process, having been all over the world. It’s no accident they do metallurgy early, avoid political risk, focus on large land positions and other vetting procedures up-front.” Everett says.

On Liberty’s assets, “Three major district-scalable projects, all that are drill confirmed and have given grade in the jurisdiction where everybody wants to be.”

“The secret to this business is when you have a big discovery in a district but still at an early stage, you never stop drilling. You drill until the market wakes up and pays attention.”

THE PROJECTS

The discovery formula is simple. Acquire past producing Carlin – style heap leach oxide gold mines in the Western US that closed 20 years ago in a U$350 gold market, re-interpret thousands of historical drill holes into a new target model and then drill out the discoveries in a higher priced gold market.

The Goldstrike asset in Utah is getting the most drilling this year with, with 3 drills operating almost year round, 50 holes in the lab on any given day and approximately 50 new holes drilled a month. Last week, a discovery was announced 6 km from the known resource area confirming the project is in a gold district by itself. Liberty is finding mineralization nearly everywhere the right rocks are outcropping at Goldstrike. There were 1519 historical holes and now 345 Liberty holes, with an 84% hit success rate over a 22 square kilometre drill confirmed target area. Fresh permits for 150 additional drill sites will help Liberty’s goal to define a million-ounce plus oxide gold resource in the near-term. Preliminary metallurgy has been released with 86% recovery of leachable gold in less than 10 days. This quick and high recovery will help establish Liberty as a low-cost gold producer.

The Kinsley property in Nevada was in production in the mid 1990s but shuttered due to low gold prices years ago. There, Liberty Gold made new high-grade gold discoveries below a past producing surface oxide gold mine and established an initial resource that remains totally open for expansion. The target is high grade at depth, not leachable gold at surface. Kinsley has excellent metallurgy and warrants aggressive follow-up drilling. Liberty is the operator of the project and holds a 79% interest. This year a short four hole drill test successfully found the extension of the high grade deposit to the east, 29.0 metres at 5.30 grams per tonne gold and 3.0 m at 3.68 grams per tonne gold, with a higher grade zone above it with 7.6 m at 6.84 grams per tonne gold and 4.6 m at 12.4 grams per tonne gold. There are many untested targets on the property.

The Black Pine project in Idaho was a significant mid-90s gold producer which Liberty acquired last year for US$800,000 cash, 300,000 shares and a 0.5% royalty. Everett says it’s a Goldstrike look-alike but 12 months behind in terms of advancement. Liberty is currently working on a Plan of Operations to gain approvals for a large exploration program at Black Pine. In the meantime, Liberty’s technical team has vast historical data to devour, including 1,866 historical drill holes. The Black Pine drill target area is drill confirmed over 12 square kilometers. Just gathering this information today for all three projects could cost in excess of Liberty’s current valuation of roughly $65 million (not including $14 million in cash at March 31, 2017).

Liberty Gold also owns an under-appreciated Turkish mineral portfolio. One of the interests, Halilaga, a copper-gold-moly deposit partnered with Teck Resources, was roughly valued at US$66 million in 2015 by Brent Cook, an influential mining analyst, but is a mere footnote in the Liberty Gold story today. Liberty also owns 60% of the TV Tower project, near Halilaga, with six gold and copper discoveries already.

The sale or joint venture of the Turkish assets could raise non-dilutive capital for Liberty to fund aggressive exploration at Goldstrike, Kinsley and Black Pine. Everett does not want to raise equity while Liberty’s stock trades near all time lows. He’s taking responsibility himself now to ramp up marketing. Liberty will have a presence at the major mining trade shows this Fall and is hosting a revolving door of technical presentations.

In the downturn, Liberty shares have fallen from over $3 in 2011 to less than 45 cents at press time. Macquarie mining analyst Mike Gray rates Liberty Gold an Outperform and Top Pick with an initial CAD $0.90 price target. That will prove to be a very conservative target if Liberty enjoys a sample of Fronteer’s success — an inevitability, according to its CEO.

In Everett’s words: “The mining companies know that if you have the district, and you keep drilling, you will find more gold. It’s as simple as that. We are advancing Goldstrike, targeting it to become a minimum 100,000 ounce gold producer. It just takes drilling and scientific back up to try and reach your goal.”

As gold producers struggle to find new mines, Liberty is literally at the ground floor of growth — advancing its three key projects. With many paths to unlock value and the industry’s brightest geologists at the helm, Liberty is one of the few companies positioned to profit from gold’s production growth problem.

Other Western USA gold plays worth mentioning:

Gold Standard Ventures (TSXV:GSV, NYSE:GSV). Moved quickly in the bear market to consolidate a large and strategic land position in Nevada’s Carlin Trend where it is making new discoveries. Gold Standard has attracted strategic investment from OceanaGold and Goldcorp. With a $500 million valuation, it is the most advanced junior in Nevada.

Newcastle Gold (TSX:NCA, OTC:CTMQF). Newcastle boasts an impressive management team led by Detour Gold founder Gerald Panneton and financial backers including mining magnates Richard Warke and Frank Giustra. Developing the multimillion ounce Castle Mountain project in California. Several drill rigs turning to grow and upgrade resources on the production fast track. Valuation today approaching $175 million.

Fiore Gold (TSXV:F, OTC:FIORF). Another Giustra-backed gold vehicle, with Pan, an operating gold mine in Nevada, Gold Rock, a nearby development project, and Golden Eagle, an exploration play in Washington State. Fiore Gold is the pending business combination of Fiore Exploration and GRP Metals, the recapitalized Midway Gold. It is expected to trade in Fall 2017 with a roughly $100 million market capitalization. Investors will be watching to see if Fiore can successfully ramp up the Pan mine and take advantage of other growth opportunities in Nevada.

Barrick Gold (NYSE:ABX). Major producer Barrick is leaning heavily on its Nevada assets to help lower production costs, and recently acquired the Robertson property from Coral Gold Resources in the Cortez District. Barrick is on track to reduce its debt to $5 billion by the end of 2018 and appears to be on track after a sold quarter.

Goldcorp (NYSE:G). It’s no secret Americas-focused gold producer Goldcorp is making bets on small exploration companies to fund its future growth, and hasn’t been shy about the Western United States, where it recently acquired a gold mine in Nevada, and backed a junior there, Gold Standard Ventures. Goldcorp has been one of the worst performing gold stocks of late but refocusing on the Western United States is a step in the right direction.

Newmont Mining (NYSE:NEM). Nevada is the workhorse of Newmont Mining, one of the world’s largest producers. Operations include 11 surface mines, eight underground mines and 13 processing facilities. Annual production from Nevada alone exceeded 1.6 million ounces in 2016, obviously requiring new discoveries or M&A to be sustained.

Kinross Gold (TSX:K, NYSE:KGC). Kinross is on track to meet its annual production guidance of 2.5-2.7 million ounces of gold and costs of $660-$720/ounce and AISC is expected at $925-$1,025/ounce. Production is expected to double at Bald Mountain in Nevada, however the Buckhorn mine in Washington State has recently run out of ore.

Disclaimer: All statements in this report, other than statements of historical fact should be considered forward-looking statements. These statements relate to future events or future performance. Forward-looking statements are often, but not always identified by the use of words such as “seek”, “anticipate”, “plan”, “continue”, “estimate”, “expect”, “may”, “will”, “project”, “predict”, “potential”, “targeting”, “intend”, “could”, “might”, “should”, “believe” and similar expressions. Much of this report is comprised of statements of projection. These statements involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such forward-looking statements. Risks and uncertainties respecting mineral exploration companies are generally disclosed in the annual financial or other filing documents of those and similar companies as filed with the relevant securities commissions, and should be reviewed by any reader of this newsletter.

Tommy Humphreys is an online financial newsletter writer. He is focused on researching and marketing resource and other public companies. Nothing in this article should be construed as a solicitation to buy or sell any securities mentioned anywhere in this newsletter. This article is intended for informational and entertainment purposes only!

Be advised, Tommy Humphreys is not a registered broker-dealer or financial advisor. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer.

Never, ever, make an investment based solely on what you read in an online newsletter, including Tommy Humphreys’ online newsletter, especially if the investment involves a small, thinly-traded company that isn’t well known.

Tommy Humphreys’ past performance is not indicative of future results and should not be used as a reason to purchase any stocks mentioned in his newsletters or on this website.

In many cases Tommy Humphreys owns shares in the companies he features, and that is the case with respect to Liberty Gold. For those reasons, please be aware that Tommy Humphreys can be considered extremely biased in regards to the companies he writes about and features in his newsletters, including Liberty Gold. Because Tommy Humphreys owns shares of Liberty Gold, there is an inherent conflict of interest involved that may influence his perspective on Liberty Gold. This is why you should conduct extensive due diligence as well as seek the advice of your financial advisor and a registered broker-dealer before investing in any securities. Tommy Humphreys may purchase more shares of Liberty Gold for the purpose of selling them for his own profit and will buy or sell at any time without notice to anyone, including readers of this newsletter.

Tommy Humphreys shall not be liable for any damages, losses, or costs of any kind or type arising out of or in any way connected with the use of this newsletter. You should independently investigate and fully understand all risks before investing. When investing in speculative stocks, it is possible to lose your entire investment.

Any decision to purchase or sell as a result of the opinions expressed in this report will be the full responsibility of the person authorizing such transaction, and should only be made after such person has consulted a registered financial advisor and conducted thorough due diligence. Information in this report has been obtained from sources considered to be reliable, but we do not guarantee that they are accurate or complete. Our views and opinions in this newsletter are our own views and are based on information that we have received, which we assumed to be reliable. We do not guarantee that any of the companies mentioned in this newsletter (specifically Liberty Gold) will perform as we expect, and any comparisons we have made to other companies may not be valid or come into effect.

Tommy Humphreys does not undertake any obligation to publicly update or revise any statements made in this newsletter.

If you would like to receive our free newsletter via email, simply enter your email address below & click subscribe.

CONNECT WITH US

Tweets

Tweet with hash tag #miningfeeds or @miningfeeds and your tweets will be displayed across this site.

MOST ACTIVE MINING STOCKS

Daily Gainers

Kermode Resources Ltd. Kermode Resources Ltd. |

KLM.V | +100.00% |

|

ADD.V | +50.00% |

|

ADD.AX | +50.00% |

|

SXL.V | +33.33% |

|

GGL.V | +33.33% |

|

CASA.V | +30.00% |

|

RKR.V | +25.00% |

|

BSK.V | +23.53% |

|

TAS.AX | +20.00% |

|

MTB.AX | +20.00% |

Articles

FOUND POSTS

Chile’s Year-End Copper Windfall Signals Mining Recovery

January 10, 2025

Oman Resumes Copper Exports After Historic 30-Year Gap

January 7, 2025

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan