On Wednesday, Aug. 8, Nevsun Resources Ltd. (T:NSU) reported a loss of $0.15 earnings per share (EPS) for the second quarter of 2017 (all amounts are in U.S. dollars). Revenues were down quarter on quarter (8%) on a decline in realized zinc prices (11%) and zinc concentrate sales (35%), but benefited from copper sales (7.7 million lbs). EPS was impacted by a $70 million, write-down of long term stockpiles and mobile equipment, reflecting a revised mine plan at Bisha from 8 to 4 years. Cash increased to $171 million from $169M in the first quarter of 2017, primarily the result of positive operating cash of $13 million, reduced taxes and a working capital release of $9 million. Zinc production was down by 17% to 43 million lbs on lower throughput, grades and recoveries, and zinc and cash costs were up 1% to $0.92/lb. However, copper production, though minor (5.7 million lbs), was up 36% for the quarter, maintaining cash costs of $1.59/lb.

Management revised production guidance to 190-210 million lbs of zinc, down from 200-230m lbs, while its outlook for copper improved with a guidance of 20-30 million lbs of copper, up from 10-20 million lbs. Revised production guidance reflects the fact that Bisha no longer produces bulk zinc concentrate. In order to improve metal recovery and material movement, the company approved an additional $24 million in capital for Bisha. A larger capital investment would have been required to maintain a longer mine life and could not have been funded by the internal cash flow from Bisha. The Bisha operation now has a reserve mine life to mid-2021, down from approximately eight years at the last reserve estimate.

The company’s main focus is to bring the Timok project into production by 2021. In 2017, the company has spent $14 million on the Upper Zone and has recently started a 10,000-metre drill program to search for additional high grade zones. Milestones achieved to date in 2017 include the completion of all planned infill drilling (30,000 metres) and the advancement of key technical mining, metallurgical and environmental studies. The company noted that it will begin a decline development to reach the ore body, rather than a shaft, in the fourth quarter of 2017.

The company delayed the preliminary feasibility study to the first quarter of 2018 and plans to deliver an update preliminary economic assessment in October, 2017. After the delivery of a feasibility study on either the Upper Zone or the Lower Zone, Freeport McMoran (US:FCX) will increase its ownership in the Lower Zone to 54% and Nevsun will own 100% of the Upper Zone and the remaining 46% of the upper zone.

The negative news has sent the shares in the company down to a year low of $2.67 (CDN), from $3.39 before the second quarter financials were released on Wednesday. These are levels that have not been seen since 2010, and a far cry from its peaks in the seven dollar range back in 2010 when Bisha was moving to production and copper was cresting at $4.50/lb.

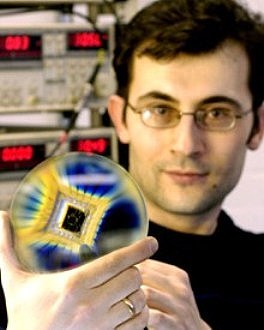

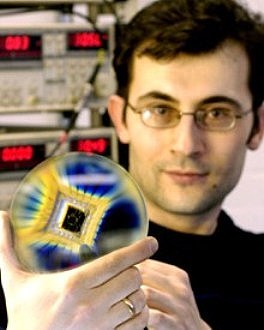

Backgrounder on Nevsun Resources CEO and President, Peter Kukielski

Nevsun Resources appointed Stanford-educated civil engineer Peter Kukielski, the former head of AcrelorMittal, as CEO and President of Nevsun in May, 2017. He ruffled feathers at ArcelorMittal by suggesting it should spin-off its mining division, joined Warburg Pincus at the beginning of 2014. He also sits on the board of Perth-based South32. At Warburg Pincus he was the executive in residence at the private equity firm, where he wanted to create not a mining fund but an operating miner with physical assets. This was back in 2014 at the bottom of the commodities downturn when several other mining executives, including former Xstrata boss Mick Davis, launched private equity funds hoping to get fire sale prices on assets as prices tumbled. Instead, they largely sat on the sidelines as prices rallied throughout 2016 according to the Global Mining Observer. Warburg Pincus pulled the plug on the $1 billion fund at the end of 2016, having failed to land any deals. One mine his fund was looking at was Rio Tinto’s IOC (Iron Ore Company of Canada) operation in Canada, but complications included a $900 million lawsuit hanging over the asset, brought by Inuit groups. Don Lindsay, the head of Vancouver-based Teck, also looked at buying the mine under Rio’s former chief executive Sam Walsh. Unphased by the closing of the fund he led, Mr. Kukielski landed at the helm of Nevsun as it is moving to its next project, Timok where he may get his wish to actually build an operating mine with assets, if he sticks around and no one pulls the plug.

The gold miners’ stocks have largely ground sideways this year, really lagging gold’s strong rally. That lack of upside has decimated sentiment, leaving a bearish wasteland bereft of hope. But this deeply-out-of-favor sector is actually a coiled spring, ready to surge dramatically as psychology shifts. Sentiment, technicals, and fundamentals all point to much-higher gold-stock prices even at today’s prevailing gold levels.

The main appeal of gold-mining stocks is their underlying profits’ leverage to gold. The gold stocks are much riskier than gold, due to many operational, geological, and geopolitical risks the metal itself doesn’t share. So investors and speculators alike must be compensated for these big added risks with superior returns to gold. That hasn’t happened so far in 2017, which is why gold stocks are so widely despised today.

All year long, the extreme Trumphoria-fueled stock-market rally has stolen the limelight. The flagship S&P 500 stock index is up 10.5% year-to-date as of this week. That’s sucked all the oxygen out of the investment world, overshadowing everything else. So investors have shunned gold this year, while the futures speculators have shorted it at near-record extremes. Gold has often been mocked on CNBC all year.

That’s pretty ironic though, as gold’s YTD performance is +10.9%! That’s a little better than the general stock markets. That should be enough to garner some attention, but gold can’t escape from the stock markets’ eclipsing shadow. Gold miners’ inherent profits leverage to gold usually enables their stock prices to amplify an underlying gold rally by 2x to 3x. Thus the gold-stock sector ought to be up 20% to 30% YTD.

The dominant gold-stock index is the HUI NYSE Arca Gold BUGS Index, which is closely mirrored by the leading GDX VanEck Vectors Gold Miners ETF. So far in 2017, its performance has been dismal relative to gold. As of this week the HUI was only up 6.6% YTD! That makes for mere 0.6x leverage to gold, unacceptable given gold stocks’ big additional risks. That’s why psychology is exceedingly bearish today.

Gold stocks are underperforming so massively this year due to sentiment. Because this small contrarian sector is languishing, traders want nothing to do with it. And because they are widely avoided, the gold stocks are trapped in consolidation hell. The only thing able to start shifting sentiment back to bullish is a meaningful gold rally igniting material gold-stock buying. The resulting gains would win back capital inflows.

Sentiment and technicals are inexorably intertwined. No matter what else is going on, when stocks are high traders get excited and bullish. That’s happening in the general stock markets today, despite their bubble valuations and the Fed’s quantitative tightening ominously looming. But when stocks are down, traders wax sullen and bearish. The markets work this way universally, the gold stocks are no exception.

As at all sentiment extremes, traders have assumed this vexing gold-stock weakness will last indefinitely. But that’s a bad bet, as sentiment perpetually meanders back and forth between excessive greed and fear. The longer sentiment stays on one side of that arc, and the more extreme it gets, the greater the odds for an imminent mean-reversion swing back the other way. And those tend to overshoot proportionally.

The last time gold stocks drifted near lows like so far this year was in the second half of 2015. They were hated, with nearly everyone predicting they were doomed to spiral lower forever. Yet sentiment shifted out of that bearish echo chamber, and the gold stocks took off like North Korean ICBMs. In merely 6.5 months, the HUI skyrocketed 182.2% higher! That amplified gold’s 25.2% concurrent rally by a breathtaking 7.2x.

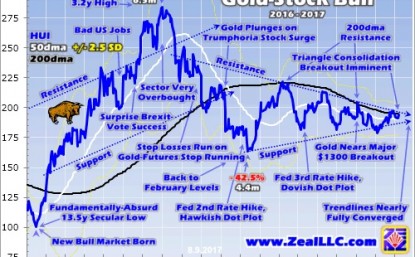

Gold stocks have long exhibited a drift-surge pattern. Long consolidations bleeding away all bullishness are soon followed by massive uplegs. They ignite just as traders are capitulating and walking away. The best time to buy is late in one of these grating drifts, because the next major upleg is just around the corner. And that’s exactly where the gold stocks are today technically, as this HUI consolidation chart reveals.

Last year’s monster gold-stock upleg that has already been forgotten is crystal-clear here. Contrarians willing to fight the herd and buy low in late 2015 when gold stocks were shunned made out like bandits. They nearly tripled their capital in about a half-year! Once this sector starts moving, shifting from drift to surge, its resulting uplegs tend to be massive. The trick is bucking bearish sentiment to get invested early.

That enormous upleg birthing a new gold-stock bull last year was followed by a gigantic drop driven by gold. Since prevailing gold prices directly drive their earnings, the gold stocks follow and amplify moves in the metal they mine. In the second half of 2016, gold plunged sharply thanks to a highly-improbable series of events. Gold’s resulting freakish drop was incredibly anomalous, which is why it bounced back this year.

First gold was hit by gold-futures stop losses being run, then by the Trumphoria stock-market surge in the wake of the surprise election results, and finally by the Fed’s second rate hike of this cycle. Seeing an isolated event-driven selloff isn’t unusual, but three in a row back-to-back is unheard of. I explained all of them in depth in past essays if you want a deeper understanding of why they were unrepeatable one-off events.

Gold fell 17.3% in 5.3 months, certainly a massive correction but well shy of new-bear-market territory at -20%. Gold stocks as measured by the HUI amplified gold’s downside by 2.5x, smack in the middle of that historical 2x-to-3x leverage range. So the huge gold-stock selloff in last year’s second half wasn’t outsized at all compared to the anomalous carnage in gold. That’s the way this sector has always worked.

Once again gold miners’ profits leverage to gold explains their price action. Consider an example, a gold miner producing gold at all-in sustaining costs of $1000 per ounce. At $1250 gold, that yields profits of $250 per ounce. If gold rallies or falls 10% to $1375 or $1125, this miner’s profits literally soar or plunge 50% to $375 or $125 per ounce! The higher any miner’s costs, the greater its profits leverage to gold prices.

In the last quarter fully reported, Q1’17, the major gold miners of GDX reported average all-in sustaining costs of $878. Q2’17 results haven’t been fully released yet, but should be by next week. At $878 AISC, $1250 gold yields profits of $372 per ounce. If gold rallies or falls 10%, these per-ounce profits change to $497 or $247. That’s up or down 34% on a 10% gold move! That’s where gold stocks’ leverage to gold comes from.

So seeing this sector largely drift sideways this year despite gold’s strong 10.9% YTD gain is anomalous, it shouldn’t have happened. And it wouldn’t have happened without stock markets’ extreme Trumphoria rally monopolizing traders’ attention. They’ve been so captivated that they’ve ignored gold’s superior gains in 2017, and that lack of interest has slaughtered the gold stocks dependent on gold being in favor.

The result technically is the major triangle consolidation rendered above. Since gold stocks’ deep low in December on a Fed rate hike, their lower support has been slowly climbing. But meanwhile their upper resistance has been trending lower. This has slowly and inexorably compressed this sector technically, tightening the gold stocks into a coiled spring. These converging trendlines guarantee an imminent breakout.

And odds overwhelmingly favor an upside resolution to this triangle consolidation pattern. Gold stocks’ resistance line is paralleling their key 200-day moving average. A decisive move above their 200dma will unleash all kinds of buying from technically-oriented traders. And that 200dma breakout will result in the simultaneous breakout from this year’s vexing consolidation. That will rapidly shift psychology away from bearish.

There are two major reasons why gold stocks are heading much higher rather than lower soon. Gold has long enjoyed a major autumn rally which tends to catapult the gold stocks higher in the coming months. I wrote about this in depth last week, explaining why it happens and quantifying it. With gold seasonals so strong in the coming months, it would be super-unlikely for gold stocks to break down from already-low levels.

On average in bull-market years, gold powers 6.9% higher between mid-June and late September. That fuels an 11.2% HUI rally on average in that same general timeframe. As gold continues powering higher over the next month, the gold stocks will almost certainly amplify its gains. This isn’t an academic point, as this year’s autumn rally is already well underway. Gold’s summer-doldrums low came in early July.

Since then gold and the HUI have climbed 5.2% and 8.6% higher as of this week. That resulting 1.7x leverage is still on the low side, but rapidly improving from the 0.6x year-to-date metric. Gold stocks are starting to outperform their profits-driving metal again, a major sign sentiment is already shifting away from extreme bearishness. But there’s a far-better reason to be bullish on gold stocks than their autumn rally.

While these coiled-spring technicals are exciting, they pale in comparison to the immense fundamental disconnect between gold-miner stock prices and gold levels. Ultimately all stock prices eventually reflect some reasonable multiple of their underlying corporate profits. But the gold stocks are now collectively trading as if gold was far under current prices, which is supremely irrational. This anomaly has to mean revert.

This last chart offers the most-compelling fundamental justification to be heavily long gold stocks today. It looks at a construct called the HUI/Gold Ratio, calculated simply by dividing the daily HUI close by the daily gold close. This HGR acts as a proxy for that core fundamental relationship between gold, miners’ profits, and their stock prices. Gold stocks have rarely been as undervalued relative to gold as they are now.

This week, the HGR was trading near 0.152x. The HUI was running at 15.2% of gold’s price. Of course like all indicators that means nothing in isolation. But the context provided by this long-term HGR chart shows how absurdly cheap the gold stocks remain relative to the metal which drives their earnings. The only year in modern history where gold stocks were cheaper was 2015, the end of an exceptional secular bear.

Early in 2016 gold stocks as measured by the HUI slumped to a fundamentally-absurd 13.5-year secular low. It made no sense whatsoever. Though gold was trading near $1087, way above this industry’s all-in sustaining costs, the HUI was trading at levels last seen when gold was near $305 in July 2002! That anomaly couldn’t and didn’t last, resulting in battered gold stocks nearly tripling in only about a half-year.

That coiled-spring reaction perfectly illustrates how explosive gold-stock upside is after this sector suffers a long, low drift resulting in extremely-bearish psychology. If today’s 0.15x HGR is actually righteous, it would’ve been seen plenty of times in modern history. But it hasn’t. Such extremely-low gold-stock price levels relative to gold were only able to persist briefly after a long secular bear. They weren’t sustainable.

Remember the Fed started aggressively levitating the US stock markets in early 2013, wreaking havoc on alternative investments led by gold. The gold market’s last normal years were sandwiched between 2008’s stock panic and 2013’s radical Fed distortions. That’s the best recent baseline for where the HGR ought to trade. And between 2009 to 2012, it was running way up at 0.346x. That’s over double today’s levels!

To simply mean revert back up to those last normal levels relative to gold, the big gold stocks dominating the HUI would have to power 127% higher from here to 441! To restore some semblance of normalcy fundamentally, the gold stocks need to more than double from here even at this week’s $1276 prevailing gold levels! The gold stocks certainly can’t stay disconnected from their own earnings realities forever.

All markets are cyclical, including gold stocks. Extreme undervaluations relative to gold are followed by overvaluations as the pendulum swings back the other way. Mean reversions after extremes never stop in the middle. Their momentum leads them to overshoot to the opposite extreme! That makes gold stocks’ coming upside far more impressive. A proportional overshoot heralds radically-higher gold-stock prices ahead.

At worst in mid-January 2016, the HGR fell to an all-time low of 0.093x. That was a staggering 0.253x under that post-panic normal-year average HGR of 0.346x. So a proportional overshoot would briefly boost the HGR 0.253x above that mean, to 0.599x. That upside extreme wouldn’t last long, as greed wouldn’t be sustainable. But it could happen in a blowoff top after gold stocks are popular following a bull.

At $1276 gold, that yields a potential HUI topping target of 764! That’s a stupendous 293% above this week’s levels. Is there any other stock sector with the potential to quadruple in the coming years? No way. Gold stocks are the only severely-undervalued sector left after this Trumphoria stock rally, so their upside is unparalleled. And incredibly these simple HGR-derived gold-stock targets are actually conservative.

They assume gold is static, stuck at $1276. That’s exceedingly unlikely. As these Fed-levitated stock markets inevitably roll over with Fed quantitative tightening dawning, gold itself will catch a major bid as investment capital returns. As a rare asset that generally moves counter to stock markets, gold is hostage to them. So when the stock markets suffer their long-overdue major selloff, gold will soar on capital inflows.

10%, 20%, and 30% gold uplegs from here would take this metal to $1403, $1531, and $1658. Plug in the HGR of your choice, the post-panic average or the mean-reversion overshoot, and you get some potential HUI targets so high they defy belief. And don’t think a 30% gold rally is out of the question. In response to the last stock-market correction, gold powered 29.9% higher in just 6.7 months in early 2016!

Don’t get bogged down in HUI upside targets, they only serve to illustrate a critical point for investors and speculators today. Gold stocks are not only radically undervalued at today’s gold prices, but even more so compared to where gold is heading in its own still-very-much-alive bull market. Even if you think gold stocks only have 50% to 100% upside, that’s vastly better than everything else in these overvalued stock markets.

Gold stocks’ leverage to gold’s gains is already accelerating in their early autumn rally. That is gradually starting to shift sentiment, pushing that pendulum away from being pegged at hyper-bearish. The more gold stocks rally, the more traders will take notice and deploy capital. That process will soon become self-feeding, and gold stocks will be off to the races again like in early 2016. That will yield massive gains.

That begs the question what are you going to do about it? Are you tough enough mentally to invest like a contrarian, to buy low and out of favor when few others are willing? Can you handle fighting the crowd, making unpopular investments? Or will you take the mainstream approach, which is waiting to buy gold stocks until they’ve already doubled from here? The biggest gains are won by the early birds who buy the lowest.

While investors and speculators alike can certainly play gold stocks’ coming breakout rally with the major ETFs like GDX, the best gains by far will be won in individual gold stocks with superior fundamentals. Their upside will trounce the ETFs’, which are burdened by over-diversification and underperforming gold stocks. A carefully-handpicked portfolio of elite gold and silver miners will generate much-greater wealth creation.

At Zeal we’ve literally spent tens of thousands of hours researching individual gold stocks and markets, so we can better decide what to trade and when. As of the end of Q2, this has resulted in 951 stock trades recommended in real-time to our newsletter subscribers since 2001. Fighting the crowd to buy low and sell high is very profitable, as all these trades averaged stellar annualized realized gains of +21.2%!

The key to this success is staying informed and being contrarian. That means buying low when others are scared, like late in this year’s vexing consolidation. An easy way to keep abreast is through our acclaimed weekly and monthly newsletters. They draw on our vast experience, knowledge, wisdom, and ongoing research to explain what’s going on in the markets, why, and how to trade them with specific stocks. For only $10 per issue, you can learn to think, trade, and thrive like contrarians. Subscribe today, and get deployed in the great gold and silver stocks in our full trading books!

The bottom line is gold stocks look like a coiled spring today despite the extreme bearishness plaguing them. Following its long drift so far this year, this sector is ready to stage a massive breakout surge in the coming months. Technically gold stocks’ triangle consolidation has nearly converged, guaranteeing an imminent breakout. But far more bullish are gold stocks’ deeply-undervalued fundamentals relative to gold.

Gold-mining profits are heavily dependent on prevailing gold prices. And with this industry’s costs way under gold’s current levels, the gold miners are already earning hefty profits today. Sooner or later their stock prices must reflect fundamental reality. That mean-reversion process is already underway, with gold stocks’ early-autumn-rally gains increasingly outpacing gold’s. Their upside leverage should only accelerate.

Adam Hamilton, CPA

August 11, 2017

Copyright 2000 – 2017 Zeal LLC (www.ZealLLC.com)

Today Osisko Mining Inc. (T:OSK) released more high-grade gold Intersected at Lynx, reporting a headline result of two metres of 379 g/t gold. In the company’s press release today, OSK-W-17-881 returned a bonanza grade of 379 g/t Au over 2.0 metres, including 1,260 g/t Au over 0.6 metre (30.7 g/t Au over 2.0 m cut). However, investors should not jump to conclusions because this is a term used a semi-qualitative/quantitative term to describe drill results in the hundreds of g/t and does not indicate the entire project but nonetheless impressive.

The drill results come from its ongoing 400,000 metre drill program at its 100% owned Windfall Lake gold project located in Urban Township, Québec. The latest drill results comprise 16 intercepts in 12 drill holes focused on infill and expansion drilling in the Lynx deposit. Currently, the company has 24 drills active on the Windfall Project; expect more results and a growing resource as the company is using these results to support an updated resource later in 2017.

Highlights from today’s drill results are as follows:

-

Drill Hole OSK-W-17-881: 2.0 metres grading 379.00 g/t gold (uncut) from a downhole depth of 412.0 metres, including 0.6 metres grading 1,260.00 g/t gold (uncut);

-

Drill Hole OSK-W-17-898: 3.0 metres grading 23.50 g/t gold from a downhole depth of 429.9 metres, including 0.8 metres grading 85.20 g/t gold;

-

Drill Hole OSK-W-17-895: 6.5 metres grading 8.98 g/t gold from a downhole depth of 221.0 metres, including 1.0 metre grading 34.70 g/t gold and 0.5 metres grading 37.40 g/t gold;

-

Drill Hole OSK-W-17-924: 6.1 metres grading 9.18 g/t gold from a downhole depth of 220.9 metres, including 1.1 metres grading 29.50 g/t gold; and

-

Drill Hole OSK-W-17-908:

-

4.2 metres grading 10.60 g/t gold from a downhole depth of 738.4 metres, including 1.6 metres grading 26.60 g/t gold;

-

4.1 metres grading 7.34 g/t gold from a downhole depth of 756.0 metres, including 1.1 metres grading 19.30 g/t gold;

-

2.5 metres grading 12.60 g/t gold from a downhole depth of 764.0 metres, including 1.0 metre grading 26.70 g/t gold.

In today’s trading on the TSX, shares in Osisko rose 8 cents to $4.77 with 855,300 changing hands. At this time last year, shares in the company were trading around $2.00. In a note to clients today, Haywood maintained its buy rating of Osisko shares with a price target of $6.50 with a very high risk rating. Upcoming catalyst events for investors will be the Windfall resource update and the Marban feasibility study due in the company’s third quarter of 2017. With results like this, there could be a significant change with the size of the Windfall resource.

Yesterday evening, Tahoe Resources Inc. (T:THO) reported its second quarter 2017 financial results of US$33.48-million. Daniel Earle of TD Securities found the results mixed. Earnings per share (EPS) beat on lower costs and the company suspended its dividend, which TD securities believes is prudent. Q2/17 adjusted EPS of $0.11 were above TD estimates of $0.08 (street consensus: $0.09) due to lower costs and expenses generally. Operating Cash Flow of $0.26 was above TD’s estimate of $0.22 (consensus: $0.23) and Haywood Securities estimate of ~US$0.20. However, the company suspended its multi-year guidance given the uncertainty at the Escobal silver mine.

On July 5, the company reported that the Supreme Court of Guatemala had issued a provisional decision to suspend the company’s Escobal mining license. The company has appealed the decision to the Constitutional Court and a ruling could come within the next three months. The company is are seeking to have its Escobal mining license reinstated during this period. TD securities is accounting for no production from Escobal for one year. The Casillas road block that is still in place, and reportedly shows no sign of immediate resolution. In a note to clients today, Geordie Mark of Haywood Securities notes that both the road block and the provisional decision to suspend the Escobal mining licence need to be resolved prior to operations returning. The Casillas road block is still in place, and there are reportedly no signs of immediate resolution to this situation.

Preliminary production results were released, with the company having reported production greater than 4 Moz Silver (Ag) and greater than 110 koz Au. Q2/17 total cash costs were not previously reported and were better than we anticipated. Until further clarity is obtained at Escobal, the company’s 2017 and multi-year guidance has been suspended and certain exploration and capital spending programs are being reviewed. 2017 gold guidance remained unchanged at 375-425 koz Au at total cash costs of $700-$750/oz.

The company has also deferred the La Arena II PEA and an investor day that was planned for mid-September. La Arena produced 48 koz gold at a cash cost of US$579/oz. Gold production was higher than our estimates (46 koz gold) on placing less (3.2 Mt vs 3.7 Mt) higher grade (0.46 g/t vs 0.43 g/t gold) on the leach pads. Cash costs bettered our forecast of US$670/oz.

Management reported that it views its expansion plans at the Shahuindo and Timmins mines as budgeted and required and that these projects are on track for completion in mid-2018. Shanuindo produced 21 koz gold, which was higher than Haywood Securities estimates of 15.4 koz gold, by placing more (1.3 Mt vs 0.98 Mt) tonnes of lower grade (0.65 g/t vs 0.73 g/t gold) on the leach pad. Reported cash costs of US$590/oz were much lower than their expectations of US$845/oz. Timmins Mines produced 41 koz gold that was lower than expectations (44 koz gold) on processing slightly more (356 kt vs 314 kt) lower grade (3.75 g/t vs 4.56 g/t gold) ore. Gold recoveries of 97% were slightly higher than the Haywood estimate of 96%. Cash cost of US$633/oz were marginally higher than Haywood’s estimates of US$632/oz

The company generated positive free cash flow (FCF) of $17 million in the second quarter of 2017, after spending $63 million in total capital expenditures. Haywood expects capex to increase in the second half of 2017. As at June 30, the company had cash and equivalents of $191 million and $35 million of debt due in April 2018. The company currently has access to $75 million from its undrawn credit facility.

On the year, shares in Tahoe Resources (T:THO) are down from a 12-month high of $22.11 and at time of publication, shares were trading down 25 cents to $6.35 on 3.6 million shares traded for the day, near 12-month lows. TD Securities provided a recommendation of hold and a high risk rating with a 12-month price target of $8.50. However, TD Securities may want to revise its price target given the uncertainty at Escobal and other brokerages price targets. Haywood Securities in a note to clients today maintained its hold rating with a price target of $6.75 (revised down from $7.25) with a high risk rating for shares of Tahoe. Significant upcoming catalysts will be any updates at the Escobal mine which should be expected in the second half of 2017.

The S&P/Venture Composite Index finished down 0.3% to 768.04 and the S&P/TSX Global Mining index was up 0.15% to 66.52 for the day as the summer doldrums roll on. Gold closed up $1.50 at $1274.90 while silver closed down 9 cents to $16.70 and copper down 1.6 cents to $2.875. On the TSX Venture, 327 issues advanced, while 368 remained unchanged and 365 declined, 115,365,198 shares traded hands in 19,555 trades worth approximately $54,171,000. On the day, 21 companies reached new highs while 69 reached new lows on the Venture Exchange and 8 venture mining companies released drill results and sample assays.

The S&P/Venture Composite Index finished down 0.3% to 768.04 and the S&P/TSX Global Mining index was up 0.15% to 66.52 for the day as the summer doldrums roll on. Gold closed up $1.50 at $1274.90 while silver closed down 9 cents to $16.70 and copper down 1.6 cents to $2.875. On the TSX Venture, 327 issues advanced, while 368 remained unchanged and 365 declined, 115,365,198 shares traded hands in 19,555 trades worth approximately $54,171,000. On the day, 21 companies reached new highs while 69 reached new lows on the Venture Exchange and 8 venture mining companies released drill results and sample assays.

Precipitate Gold Corp. (PG) released results that included the discovery of mineralization in a previously untested anomaly to the south of the main zone yielding a 1.1-metre interval of 2.59 grams per tonne gold (including 0.11 per cent copper, 0.6 per cent lead and 0.65 per cent zinc) (GR17-15) and a main zone drill intercept of 14.73 metres of 1.16 grams per tonne gold, including 2.67 metres of 2.23 grams per tonne gold (GR17-13). Laboratory results are pending for eight more holes.

Klondike Gold Corp. (KG) reported today results from its lonestar property in the Yukon with 30.7 m of 1.6 g/t Au at Lone Star in the Yukon. Thus far in 2017, the drill program has completed 35 holes. Assays for the earliest 11 holes have been received, including 9 holes released today. Twenty-four holes are still in the lab queue, while drilling continues. The market response to the news was muted as shares in the company were down half a cent on 209,000 shares to 30 cents.

Panoro Minerals Ltd. (PML) provided an update of its exploration drill program at its Cotabambas copper-gold-silver project in Peru. Highlights of the program are from Drillhole CB-157, the first hole completed at the Maria Jose zone, intersected 195.2 m of copper mineralization grading 0.34 % Cu, 0.06 g/t Au and 1.6 g/t Ag. Shares of the company remain unchanged at 15.5 cents for the day.

Altamira Gold Corp. (ALTA) identified two new zones of mineralization have been identified at both Baldo East and Toninho, at its Cajueiro Project, Brazil. Results from the initial five trenches at Baldo East include 3m @ 6.54g/t gold including 1m @ 17.54g/t gold, and 6m @ 2.26g/t gold, and 3m @ 5.83 g/t including 1m @ 16.24g/t, and 1m @ 9.15g/t, and 9m @ 1.19 g/t including 1m @ 5.62g/t . Shares in the company were down half a cent to 18.5 cents on 286,700 shares.

Aurion Resources Ltd. (AU) released 452 rock samples assayed from nil to 2,520 grams per tonne (81.4 ounces per ton) with 32 assaying greater than 31 g/t Au (one ounce per ton), 45 greater than five g/t Au and 70 assaying greater than 1.0 g/t Au from its Aamurusko gold prospect, Finland. Share price declined 3 cents to $1.78 on 436,000 shares.

Margaux Resources Ltd. (MGX) released the results from initial surface rock sampling on its Bayonne and Jackpot properties, in Southern British Columbia. The results include gold assays from grab samples of up to 27.5 g/t (grams per tonne) gold on the Bayonne and widespread zinc mineralization at Jackpot including 20.8 per cent zinc from Jackpot Main. Shares in the company remained unchanged at 28 cents on 50,500 shares.

Galantas Gold Corp. (GAL) reported grab samples of between 1.1 and 11.0 grams per tonne gold and between 1.4 and 7.0 g/t silver from its underground mine Omagh Gold Mine, Ireland. The share price remained unchanged at 8 cents on 20,000 shares.

Mexican Gold Corp. (MEX) released its initial mineral resource estimate for the El Dorado/Juan Bran and Santa Cruz zones at its Las Minas project, Mexico. Total measured and indicated resource amount to 304,000 ounces AuEq contained within 4.97 million tonnes grading 1.9 g/t AuEq. The initial mineral resource estimate is for two of the eight known zones of mineralization at Las Minas. The company was halted at remains so at the end of the trading day.

According to TMX earnings calendar for the TSX venture, Avino Silver and Gold Mines Ltd. (ASM) should be releasing its second quarter 2017 results after the close of the market on August 2, 2017. Barkerville Gold Mines (BGM), North Arrow Minerals Inc. (NAR), and Orsu Metals Corp. are expected to be publishing their earnings tomorrow as well.

© 2017 MiningFeeds.com. All rights reserved.

Negative real interest rates occur when the inflationary rate, or CPI, is greater than the current interest rate. A quick account of the G-7 and E-7 countries shows that the majority have negative real interest rates.

Across the developed G-7 countries, British citizens are the worst off with real interest rates in the U.K. sitting at negative 4.5 percent. U.S investors aren’t doing much better with rates at negative 3.25 percent and the Fed has all but guaranteed rates will remain there. Only Japan has a positive real interest rate among the G-7 and that rate is barely above zero.

Conversely, the most populous nations making up the E-7 have mostly positive real interest rates. However, the grouping’s grandest economic powerhouses, China and India, have negative real interest rates sitting around negative 2 percent.

Simply put, investors in those countries who have parked their savings in cash and low-yielding investments, such as Treasury bills and money market accounts in the U.S., are actually losing money due to inflation.

VTB Capital’s Andrey Kryuchenkov told The Wall Street Journal this week that, “Central banks are diversifying, and it has intensified to a rate that nobody had expected.” Latest estimates predict global central banks will purchase between 475-500 tons of gold in 2011.

This amount of capital flowing into gold has the potential to push prices up a level in 2012. John Mendelson from ISI Group sees gold prices reaching $2,200 an ounce during the first six months of 2012.

While real interest rates look to remain in the red for the foreseeable future, many of these same countries are printing record amounts of “green” with accommodative monetary policies. Bloomberg reports that global money supply (M2) is “set to increase the most on record in 2011.”

The reason global central banks have shifted the printing presses into overdrive is simple: they need the money. Frank Giustra reminded us of this new reality in an op-ed piece for the Vancouver Sun last week. Frank writes:

“The bottom line is that the money needed to bail out Europe and to fund America’s spiraling debt and future unfunded obligations is in the ten of trillions. IT DOES NOT EXIST. It has to be created by printing money in massive quantities, and despite all the rhetoric you will hear against such policies, in the end it’s the path of least resistance. Printing money is an invisible tax on savings, much easier to initiate, than, say, raising taxes or cutting back on services and entitlements.”

From the article entitled, “You Can’t Print More Gold” by Frank Holmes. Frank Holmes is chief executive officer of U.S. Global Investors – a registered investment adviser that manages approximately $2.8 billion. The information provided herein has been provided to MiningFeeds.com by the author and, as such, is subject to our disclaimer: CLICK HERE.

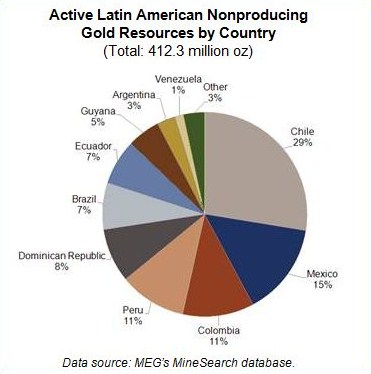

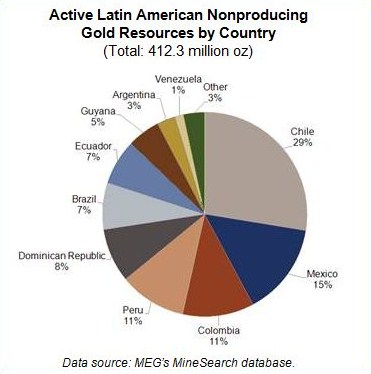

According to a recent mining industry report by Metals Economics Group (MEG), Latin American gold production should increase more than 10% in 2011. The report states that about two thirds of Latin American production is from primary gold mines and the rest is from secondary sources, mostly copper and silver mines.

Although Chile is Latin America’s fifth largest gold producer behind Peru, Mexico, Brazil, and Argentina, it holds the largest share of gold in active non-producing projects equating to 29% of gold contained in resources under development. Mexico holds the second largest non-producing gold resources and the largest producing resources holding 28% of gold contained in producing resources.

In addition to the advanced exploration projects that are progressing from reserves development to production, early-stage exploration by junior companies is contributing to the Latin American gold project pipeline. Since 2000, junior companies’ allocations to all stages of Latin American gold exploration have increased each year except three: in 2001-02 when gold prices were languishing at the $300/oz level, and in 2009 when the equity markets collapsed. The number of exploration successes (positive drill intersections and resource increases) has followed the same general trend.

From the report entitled, “Latin American Gold Output Increases in 2011” by Metals Economics Group. Metals Economics Group (MEG) is a trusted source of global mining information and analysis. With three decades of comprehensive information and analysis, MEG has an unsurpassed level of experience and historical data. The information provided herein has been provided to MiningFeeds.com by the author and, as such, is subject to our disclaimer: CLICK HERE.

With money markets and Treasuries yielding next to nothing these days, investors are finding income in new places. One area those investors should consider is gold mining. With gold rising in value, mining companies are reaping record profit margins, yet the stock prices are depressed due to lack of investor interest. A solution for both gold companies and investors may be dividends, specifically gold-linked dividends.

Several top-tier gold producers that are benefiting from higher gold prices have begun to share a portion of their profits with shareholders via a dividend payout. Thirteen of the world’s largest gold producers are expected to pay nearly $2 billion in dividends this year, according to MineFund, making it the largest payment in gold stock history. The Financial Post also reported that miners’ dividend payments are up 75 percent on a year-over-year basis, compared to a 26 percent increase in 2010.

Yamana Gold (TSX:YRI) is just one of several large producing miners to report increased revenues, expanding cash flows and record adjusted earnings. Because of the company’s strong balance sheet, Yamana increased its dividend for the second time this year to $0.20 per share annually. When discussing the enhanced payouts, CEO Peter Marrone cited that the company “continued to focus on delivering growth across all measures, enhancing shareholder value and generating significant cash flow in the third quarter.”

The latest payout represents a 67 percent increase over the past 12 months and the second increase this year.

Other miners, such as Newmont Mining (NYSE:NEM), have implemented a gold-linked dividend, which means that the amount of the dividend the shareholder receives will be linked to the average price of gold. As the yellow metal trades higher, the company would increase dividends paid out to its investors. Conversely, if gold falls in value, dividend payouts would decrease.

Eldorado Gold (TSX:ELD) has also come out with a similar dividend policy, linking dividends to the price of gold. As shown in the chart below, Eldorado Gold anticipates its next dividend payout will be 67 percent higher than the previous quarter.

Barrick Gold (TSX:ABX) also announced a third quarter dividend increase during its earnings release. Over the past five years, the company has increased its dividend by more than 170 percent on a quarterly basis. The company’s latest dividend—$0.15 per share— represents a 25 percent increase from the prior quarter.

Barrick estimates its third quarter gold cash margins have increased by 55 percent on a year-over-year basis, driven by the company’s leverage to higher gold prices. The company says it will continue to offer its shareholders a rising income stream while also expanding operations in Pueblo Viejo, Pascua-Lama and Nevada.

While the share prices of these miners have been punished in 2011, increasing dividends allow investors to get “paid to wait” for the market to turn around. The dividends are a cash incentive for investors to hold shares of the company and allow them to participate in rising earnings. We like that idea.

From the article entitled, “Get Paid to Play Gold” by Frank Holmes. Frank Holmes is chief executive officer of U.S. Global Investors – a registered investment adviser that manages approximately $2.8 billion. The information provided herein has been provided to MiningFeeds.com by the author and, as such, is subject to our disclaimer: CLICK HERE.

Since hitting $1,900 an ounce through the beginning of October, gold has declined nearly 11 percent. Over the same timeframe, the NYSE Arca Gold Miners Index lost almost 13 percent. That’s a closer performance correlation than the roughly 3-to-1 gold equities to bullion ratio we’ve historically seen and could mean the miners are finally closing the gap.

However, TD Securities Equity Research points out this interesting fact: Over a period of 18 months prior to hitting $1,900, gold rose 79 percent but TD’s basket of gold equities only increased 57 percent. The firm says this performance gap “ranks as the worst relative performance of gold equities to gold since 2001.” During the July through September period of 2008, TD Securities’ universe of gold equities declined 46 percent, while gold bullion only lost 24 percent. In October through November of 2008, the same gold equities lost 37 percent; while gold decreased 22 percent.

What’s behind today’s record disparity?

Part of it may be due to the underperformance of the explorers and developers, which, TD says, “have been hit the hardest.” The chart below shows gold miners by capitalization and their returns since April 2011. Explorers and developers have declined the most, losing 21 percent, small- and mid-cap producers have declined 6 percent and large producers lost 5 percent.

Because of the dramatic price decline in these early-stage companies, investors have the opportunity to purchase explorers & developers (E&D), often referred to as juniors, at about half of the company’s net asset value (NAV). In simplest terms, the NAV means assets minus liabilities. In fact, you can see from the chart that the current price-to-NAV level for E&D equities is sitting near record low levels…levels not seen since the financial crisis of 2008.

TD found that in seven of the past 10 rallies, gold equities beat gold—averaging a beta of 1.4 times. Looking over the next year or so, we believe the smaller gold miners may be poised to outperform this time. As TD says, “on a rebound, we expect the best performing equities to be among the ranks of the explorers and developers.”

From the article entitled, “Which Gold Miners Have Largest Upside?” by Frank Holmes. Frank Holmes is chief executive officer of U.S. Global Investors – a registered investment adviser that manages approximately $2.8 billion. The information provided herein has been provided to MiningFeeds.com by the author and, as such, is subject to our disclaimer: CLICK HERE.

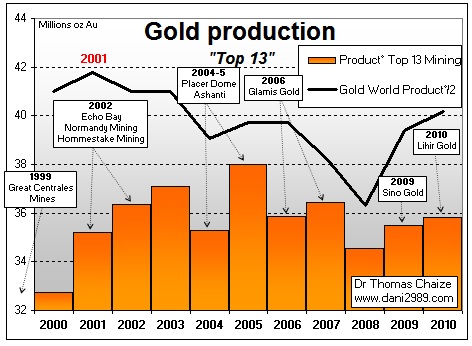

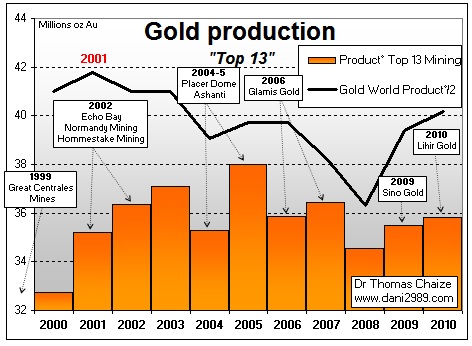

As I have explained in my previous post on the world gold production, the share of major gold producing countries in the world gold production decreases. But what about the relative production from major gold miners?

As shown in the chart below, world gold production has decreased since 2001 (black line). Similarly, the gold production of the thirteen largest gold miners in the world (orange line) has decreased since 2006. This time shift can be explained by the acquisitions that major gold producers have made on many smaller gold producers around the world. Through acquisition they were able to increase their production temporarly but this does not change the fact that, overall, their respective world gold production is decreasing.

Here are some of the main takeovers of gold producers since 1999: Great Central Mining, Echo Bay (Canada), Normandy (Australia), Hommestake (oldest gold mine in the United States which survived the great depression in 1929), Placer Dome (Canada, founded in the early 19th century), Ashanti (South Africa, producing gold since 1897), Glamis Gold (Canada), Sino Gold (Australia), and Lihir Gold (Australia).

Despite these major takeovers, accounting for tens of billions of dollars, the relative production from major gold producers around the world has declined since 2008. It decreased from 47% in 2007 to 44.5% in 2010. The increase in the world gold production observed since 2008 is the result of smaller gold mines going into production (gold miners producing less than 500,000 ounces of gold per year).

In summary, the growth of world gold production since 2008 arises from a mosaic of small producers. This “atomization” of world gold production into less rational small production requires a high gold price. Smaller producer countries and smaller gold miners have stabilized world gold production in the short term (1-3 years). However, this is not enough to revive global production which is still below its level of 2001 despite the rise in gold prices over the past 10 years.

The takeover of the largest gold mine in the world by a major copper producer in Zambia is symptomatic of the situation of the major gold miners. The large scale gold deposits are increasingly rare and large gold miners are “forced” to produce more and more copper, zinc, lead, silver, molybdenum or uranium.

From the article entitled, “Gold Production of Large Gold Miners” by Dr. Thomas Chaize author of the Mining and Energy Newsletter. The information provided herein has been provided to MiningFeeds.com by the author and, as such, is subject to our disclaimer: CLICK HERE.

Demand for gold isn’t only coming from the residents of China and India. There’s been a huge sentiment shift among central banks as well. Toussaint noted how, after many years of selling, central banks have become net buyers of gold. He says, “Western Central banks have essentially shut the tap off, and the vast majority of the buying is coming from Eastern central banks.”

In just the first half of this year, official sector purchases are up three-fold over the 2010 total to 216 tons, accord to the GFMS report. GFMS says the rise is largely due to low sales levels from Central Bank Gold Agreement (CBGA) signatories and the International Monetary Fund (IMF) completing its sales program at the end of 2010. In addition, other countries have gobbled up gold in an effort to diversify reserves away from the U.S. dollar. Scotia Capital estimates central banks’ total purchases of gold will reach 248 tons by year-end.

Some of the big buyers have been Mexico (whose central bank purchased roughly 100 tons of gold earlier this year), Korea (purchased 25 tons in June), Thailand (purchased nearly 19 tons in June) and Russia (which has purchased over 50 tons of gold from its domestic market year-to-date).

Toussaint says Eastern central banks are “catching up with the rest of the world” because their current allocation is tiny right now. However, whenever the WGC discusses these buying habits with the central banks of Korea, Taiwan and other Asian countries, they consistently say that they are interested in gold, and looking to hold it over the long-term. In other words, he says, this is not a “knee-jerk reaction to the direction of the dollar.”

GFMS also believes that this could be just the beginning. In a release announcing the report, Philip Klapwijk, Global Head of Metals Analytics at GFMS, said, “we are in essence in chapter three of the central bank story—we’ve left behind a period of heavy net sales, then a short period of neutrality and we’re now in a new environment of heavy buying.”

From the article entitled, “Perfect Storm Creates Tidal Wave of Gold Demand” by Frank Holmes. Frank Holmes is chief executive officer of U.S. Global Investors – a registered investment adviser that manages approximately $2.8 billion. The information provided herein has been provided to MiningFeeds.com by the author and, as such, is subject to our disclaimer: CLICK HERE.

1. Dalradian Resources Inc. (TSX: DNA)

Dalradian Resources was this week’s top TSX-listed mining stock percentage gainer posting a gain of 27.8%. Dalradian will be added to the S&P/TSX SmallCap Index on Monday, September 19th. Earlier this month, the company announced intersecting 3.2m grading 5.34g/t Au at its Curraghinalt Deposit in Northern Ireland.

2. TerraX Minerals Inc. (TSX-V: TXR)

On the TSX Venture board, TerraX Minerals posted a weekly gain of 37.9% which made it the number one mover this week. On Wednesday, September 14th, the company announced it intersected a porphyry-style alteration with significant sulphides at its Stewart gold-copper property in Newfoundland.

3. Aura Minerals Inc. (TSX: ORA)

Aura Minerals chalked up an 11.6% loss this week which marked the largest decline for a TSX-listed mining stock. Aura closed down $0.20 on Friday to end the week at $1.53. The company has faced a host of operational problems and the loss of its chief executive officer. In July, Dundee Capital Research analyst Ron Stewart noted, “No question in our mind, Aura has had the proverbial stuffing knocked out of it in the market.” At the time, Aura was trading at $2.13 and Stewart issued a $3.00 target on the company’s stock.

4. Copper One Inc. (TSX-V: CUO)

Copper One was off 17.5% this week which marked the biggest drop for any widely traded TSX-V listed mining stock. Volume was up considerably on Friday with over 1.4 million shares traded. The company’s stock was off $0.07 on the day to close at $0.33 on no news. On July 8th, Copper One annouced that exploration work on the Rivière Doré project in Quebec was being put on hold. At the time, the company’s shares were trading at $0.70.

5. Avion Gold Corp. (TSX: AVR)

Avion Gold was the most actively traded issuer on the TSX Exchange on Friday with over 33 million shares trading hands. The company was up $0.08 on the week to close at $2.54. Avion Gold is being added to the TSX Global Gold and Global mining Indexes effective Monday, September 19th, 2011.

6. Silver Wheaton Corp. (TSX: SLW)

Silver Wheaton was the second most actively traded stock on Friday on the TSX Exchange with almost 24 million shares traded. On Monday, September 19, 2011 Silver Wheaton will be added to the TSX 60 Index. Also upcoming, third quarterly cash dividend payment for 2011 of US$0.03 per common share will be paid to holders of record of its common shares as of the close of business on September 20, 2011.

7. Allana Potash Corp. (TSX:AAA)

This week marked the first full week of trading on the TSX for Allana Potash. The company graduated to the TSX on Friday, September, 9th. On Thursday, September 15, Allana Potash announced drill results from the company’s potash project in Ethiopia which included 8 meters of 18.54% KCl. About the news, Company President & CEO Farhad Abasov stated, “Allana management believes that the potash in this region may be amenable to mining by open pit methods and future studies will focus on this potential.”

8. Silvercorp Metals Inc. (TSX: SVM)

Silvercorp Metals was in the headlines all week after the B.C. Securities Commission announced last Friday it was conducting a regulatory investigation into anonymous allegations against the company. A second set of allegations were published on the internet this week and the company’s Chairman Dr. Rui Feng invited the authors responsible for the accusations to “come out of the shadows and participate with the regulators in their investigations“. This week the company bought back over $31 million of its own shares through a normal course issuer bid.

9. Copper Fox Metals Inc. (TSX-V: CUU)

B.C. copper miner Copper Fox intends to raise an additional $2-million via a private placement bringing the total private placement proceeds of its recently announced financing to $5-million. The offering is expected to consist of 3,333,334 units at a purchase price of $1.50 per unit. Each unit consists of one common share of Copper Fox and one-half common share purchase warrant of Copper Fox. Each whole warrant entitles the holder to acquire one common share of Copper Fox at an exercise price of $1.75 for one year.

10. Passport Potash Inc. (TSX-V: PPI)

Passport Potash was also in the B.C. Securities Commission spotlight this week when, on Monday, the regulator expressed concern that the company may be in possession of the results of an economic analysis for the Holbrook project that had not been disclosed through a news release and material change report. The company’s shares are down $0.09 on the week closing at $0.47.

In early May silver reached a high of nearly $50 an ounce. Then it seemingly hit a psychological brick wall built by the Hunt brothers and beat a hasty retreat to $32.32. But since its sharp correction, silver has been making a slow and steady comeback and now trades at around $41.50. Eric Sprott, the founder of Sprott Asset Management, calls silver “the best recommendation anyone could make this decade” and sees silver going to $100 an ounce within the next 3 to 5 years.

Sprott’s prognostication must be music to Minefinders’ ears. Minefinders is targeting gold and silver producing assets in Mexico and, after years of hard work, the company has Proven and Probable reserves of 2.34 million ounces of gold and 119 million ounces of silver. Minefinders is unhedged and expects to produce at least 65,000 ounces of gold and 3.3 million ounces of silver in 2011.

With approximately $2.30 per share in cash and little long-term debt the company has a strong balance sheet. Minefinders’ solid performance hasn’t gone unnoticed by the financial markets, the company’s shares last closed at a record high of $17.68 valuing the company at over $1.5 billion. We connected with Mark Bailey, President and CEO of Minefinders, for an exclusive one-on-one discussion.

You position Minefinders as a precious metals mining and exploration company as opposed to a gold company, is it your strategy to expand both gold and silver production going forward?

We have always liked both metals and the diversification that focusing on both brings to our business. At our Dolores Mine, we have excellent exposure to both gold and silver, our La Bolsa development project will be primarily a gold operation but we also have other properties that we have not drilled on since 2006 such as Planchas de Plata and Real Viejo which are silver deposits. We plan to recommence drilling on Planchas de Plata by the end of 2011.

The Dolores Mine is your flagship property, please talk about the property and your plans for further development.

Commercial production was declared at our Dolores Mine in May 2009. The current Reserves are about 2 million ounces of gold and 114 million ounces of silver. In 2011 we have guided to produce 65,000 to 70,000 ounces of gold and 3.3 to 3.5 million ounces of silver at a cash cost of $450 to $500 per gold-equivalent ounce. We are currently well on track to meet or exceed this guidance. Now that Dolores is producing, we are currently looking at expansion plans with the addition of a mill to process high-grade open pit ore as well as the development of an underground mine. Studies on both these projects are currently nearing completion and we expect to be able to provide more details on these projects within the next six months.

We reported the results of a draft pre-feasibility study for a 6,500 tonne per day mill in April 2010 and are finalising an optimization study for the mill with the expectation of finalising the mill size and making a construction decision within the next six month. Secondly, we expect to develop La Bolsa and have a second mine in production by the first quarter of 2013.

The development of an underground mine at Dolores will take some time. Based on our current resource model, there are about 800,000 gold equivalent inferred ounces below the current open pit reserves, which we expect to expand and elevate to reserves through the development of the underground and further exploration, expected to take three to four years. Successful development of the underground will lead to production sometime in 2016 which will further enhance our gold and silver production profile.

Regardless, we’re very pleased with the performance of the current heap leach operation and the addition of a mill and underground operations will only help to speed up recovery and increase our production.

The La Bolsa mine is your most advanced development project, what are some of the salient points?

Aside from our flagship Dolores property, La Bolsa is our current development project. La Bolsa was in fact the first property Minefinders staked in Mexico in 1995 but when we realised that Dolores was going to be a much bigger deposit we put La Bolsa on hold to focus on getting Dolores into production.

La Bolsa is located in northern Sonora state in Mexico and is a gold and silver deposit but will primarily produce gold (as the silver will not leach well) and we expect to produce about 40,000 ounces of gold per annum for the life of the mine which is about five and a half years. Logistically it is in a great location, only 32 kilometres from the town of Nogales (so close to a workforce), and is situated on a private ranch.

We filed a National Instrument 43-101 compliant pre-feasibility study in August 2010 which showed the project to be economically sound and given the current price of gold, putting La Bolsa into production looks even more attractive. With Dolores now in production and performing well we have refocused our efforts on getting La Bolsa into production and are currently finalising permitting and detailed engineering. We expect to make a construction decision by the end of the year and could have it in production within 12 months with an expected capital expenditure of US$32 million.

You note in your presentation that Minefinders has one of the more attractive enterprise values to Proven and Probable gold-equivalent reserve ratios, please expand on this for our readers.

Our share value has typically traded at a discount to our peers. We believe that on the basis of our Proven and Probable reserves alone, we are an attractive investment opportunity when compared to our peers. We believe in using reserves for comparisons, because it is what is currently economically mineable and from our perspective, a more compelling case than just comparing resources, which may or may not ever be economically minable.

You have a pretty aggressive exploration program underway at the La Virgina project. How is that progressing and what major milestones are upcoming?

La Virginia is a very exciting project and the results to date have been encouraging. The La Virginia project covers more than 32,000 hectares containing seven separate target areas, very much a grassroots project that had never been drilled before until we started our first drill program on one of the target areas in April 2010. We recently reported 6.46 grams per tonne gold equivalent over 67 metres and have drilled around 40 holes to date. Our plan is to continue exploring on this target area to improve our understanding and expand the mineralization to develop a resource within the next eighteen months. We will continue with our exploration on the other six target areas and if results are encouraging consider increasing our drilling efforts on these other prospective targets.

With gold and silver trading at record levels and competition in your sector increasing, how do you planning on growing the company and expanding its resources base?

We plan to grow our company through the development of existing assets and focused exploration. As mentioned earlier, we are currently examining the addition of a mill at our Dolores Mine as well as the development of an underground mine at Dolores.

Assuming positive construction decisions for the mill at Dolores and for the construction of a mine at La Bolsa, Minefinders expects to increase its gold equivalent production to around 300,000 ounces by 2015. This represents an 80 to 90 percent increase from current production levels.

Finally, we will leverage our strengths as explorers and continue to explore at La Virginia Property, our other exploration projects and revisit properties such as Planchas de Plata, a silver deposit, which with the current price of silver now makes sense.

In the near-term, Minefinders has a very attractive growth profile and the experience to continue to grow its resource base through exploration. Most importantly, we are fully funded to execute our growth plans for Dolores (for both the mill and the underground development) and la Bolsa. We are very excited about the Company’s future.

This interview is featured in the article 10 Most Interesting Gold Stocks – Part 4 – CLICK HERE to read more.

Another Bema? If B2Gold, a company founded in 2007 by the former executives and management of Bema keeps its current pace, the second time around might be a whole lot quicker. Bema, of course, was acquired by Kinross Gold in 2007 in a friendly takeover valued at CDN$3.5 billion. Surprisingly, B2Gold actually stumbled out of the gate; shares of the company fell from over $2 immediately after going public, to a low of $0.35 during the height of the financial crisis. Since then, however, the company has rebounded and then some. B2Gold expects to produce approximately 135,000 ounces of gold in 2011 and the company’s shares are now trading at just over $4.

A quick look at their growing portfolio of properties shows that B2Gold has inherited Bema’s international flavor; Bema had producing gold mines in Russia, Chile and South Africa as well as development projects in Russia and Chile. The company operates two producing gold mines in Nicaragua and has exploration and development projects in Colombia. This diversification, coupled with the operational track record of B2Gold’s management and lower than expected production cost, led Macquarie Capital analyst Michael Gray to call B2Gold, “One of our top picks amongst mid-tier gold producers”. Gray recently gave the company an “outperform” recommendation.

MiningFeeds.com connected with Clive Johnson to discuss the evolution of Vancouver’s mining capital markets and the prospects for B2Gold.

You’ve been involved in minerals exploration and development for many years now having built your career in Vancouver. Please talk about the evolution of the mining finance business in Vancouver from your early days with the VSE to what is now arguably the mining finance capital of the world.

As you point out in your question, Vancouver has seen significant transformation from a penny stock exploration market in the 70s and 80s to a major force for mining and mining finance. I think there are a few reasons for this. Firstly, there were a number of successful companies like Bema Gold (which we ran for over 20 years) that transitioned from exploration to successful development and production and secondly there were some very successful entrepreneurs putting together Vancouver based mining companies such as the Wheaton River/GoldCorp combination. Finally in the international world of mining a company can have its head office anywhere and Vancouver is one of the top choices for many executives.

B2Gold has a corporate mandate to grow via acquisitions, has the high price of gold affected this strategy in any way?

B2Gold’s growth strategy has always been to grow by exploration and acquisitions (as was Bema Gold’s strategy). As the gold price goes higher, quality acquisitions become harder to find. We are one of the few producers that have a proven exploration team with an impressive track record with significant gold discoveries. The cheapest ounces will always be the ones you find. While acquisitions are more challenging in this gold environment, B2Gold shares have outperformed most of the sector over the last 6 months, which may increase our opportunities for the acquisition of other companies.

To date all of B2Gold’s assets are within the America’s but you’ve focused on some lesser know Latin American countries like Uruguay and Nicaragua to build your portfolio – please explain the benefits of this strategy to our readers.

In the days of Bema and now B2Gold we have always looked for opportunities in countries that are in economic and/or political transition or are under explored. In our current portfolio Nicaragua is a country that is largely unexplored and is in a stage of positive political and economic transition, while Colombia is another country that is largely unexplored and has had a dramatic transition to a safe country to explore in. And finally, Uruguay is a very stable country with great potential that has been under explored.

The rising price of gold has resulted in a plethora of junior and intermediate gold producers now listed on the TSX Exchanges. Why should an investor select B2Gold as an investment choice over many of your counterparts?

B2Gold represents and unusual opportunity for investors because it is a combination of a company with solid profitable gold production with no gold hedging and no debt and has a portfolio of projects to grow from. In addition we have numerous high quality exploration targets and one of the most successful exploration teams in the world.

Your Limon mine experienced a force majeure and flood in late June and underground operations have been suspended. When is the mine expected to be fully operational?

The Limon Mine is expected to be back to full-scale production in September. In the meantime, production has continued from other open pits and stockpiles. The company expects to meet its guidance production for Limon of between 42,000 and 46,000 ounces of gold in 2011.

How is your exploration program progressing and what is on the horizon as we head into 2012?

Exploration programs are continuing in Nicaragua at the Libertad Mine property, Limon Mine property and on the Trebol exploration project. In Colombia, exploration and pre-feasibilty work is underway on the Gramalote property, a 51% AngloGold/49% B2Gold joint venture, and finally, exploration drilling continues on the Cebollati project in Uruguay. B2Gold’s total 2011 exploration budget is over $40 million dollars. The company intends to announce exploration results from its various projects in September, 2011. We anticipate exploration on these properties to continue through 2012.

This interview is featured in the article 10 Most Interesting Gold Stocks – Part 3 – CLICK HERE to read more.

On Monday, the price of gold traded above $1,920 an ounce which marked another record setting day for gold bullion. The record was set after the Swiss National Bank announced it would imposed an exchange rate cap on the soaring Swiss franc to stave off a recession. The Swiss National Bank intends to keep the franc at or above 1.20 to the euro by effectively buying unlimited quantities of other currencies. Profit-taking later pushed bullion down more than $50 the same day and, today, traded briefly below $1,800 an ounce.

In response to the Swiss National Bank’s move, Peter Fertig, a consultant for Quantitative Commodity Research stated, “All in all, Switzerland is now on a quantitative easing policy in the foreign exchange markets. If the Swiss franc is no longer a preferred safe haven due to intervention by the SNB, it will have (a positive) impact on the demand for gold.” And Frank McGhee, head of precious metals trading at Integrated Brokerage Services in Chicago said, “I think gold is headed for $2,000.”

Record gold prices are having a positive effect on many junior and intermediate gold producers. Alacer Gold (TSX:ASR), IAMGOLD (TSX:IMG) and Banro Corporation (TSX:BAA), which is set to head into production later this year, are all trading at or near record highs. But record highs in the price of gold have not translated into “golden days” for some junior gold miners. OceanaGold (TSX:OGC) has yet to make its move despite the fact that earlier today the company provided a progress update on construction activities at the Didipio project located in the Philippines.

Mick Wilkes, managing director and chief executive officer, commented, “We continue to make good progress on construction activities at Didipio, with the key milestone of pouring first concrete on schedule in November, 2011. Mining activity is on track to commence in January, 2012, and we expect to commission the process plant in fourth quarter 2012. This project will transform OceanaGold, producing on average 100,000 ounces of gold and 14,000 tonnes of copper at cash costs net of byproduct credits of $356 (U.S.) per ounce of gold over a 16-year mine life.”

Oceana’s experience at Didipio, located 250 km north of Manila, has been nothing short of a PR nightmare. The company has faced stiff opposition from international human rights groups, such as Oxfam Australia who say that local indigenous peoples are being forced off their land for the project. The opposition actually began in June, 2008 when local residents filed a complaint with the Phillipino Commission on Human Rights (CHR), accusing OceanaGold’s subsidiary in the Philippines of setting on fire and bulldozing 187 houses in the village without a court order. CHR later urged the government to withdraw OceanaGold’s mining rights to the project.

Despite the torrid affair, OceanaGold posted record sales and earnings from its established mines in New Zealand in 2010 and continues to work diligently towards getting the Didipio project off the ground.

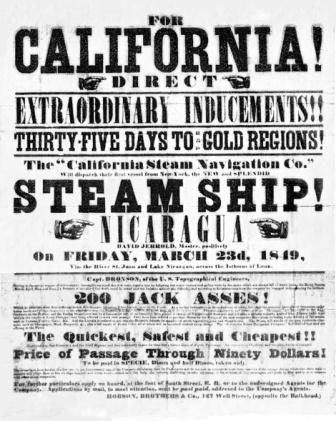

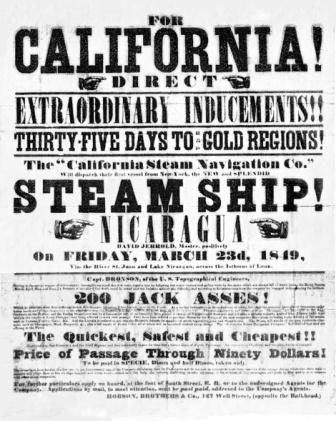

Is this the modern day version of the California gold rush or is gold in the process of forming a bubble?

Erik Sprott from Sprott Asset Management is thinking steam ships and gold pans. In an article entitled, “Debunking the Gold Bubble Myth“, Sprott argues that there has been, and will continue to be, a widely held misconception that a bubble is forming. He argues that gold buyers are not merely speculators buying on emotion with no rationale other than to sell to the ‘greater fool’ at higher prices in the future. This logic, according to Sprott, is flawed because it assumes that gold has no intrinsic value and is simply a speculative asset that has captured investors’ imaginations. Coupled with the fact that gold is actually a surprisingly under-owned asset class leads Sprott to believe that the bull market in gold is far from over.

Ross Norman, CEO of Sharps Pixley, a London-based bullion broker that sells retail physical precious metal coins and bars to UK clients doesn’t see a bubble forming. In a recent interview with Bloomberg, Norman stated, “I don’t think it’s in bubble territory. I do think underneath and underpinning this market are some very strong fundamentals that have taken us here.” Mr. Norman cites fantastic demand growth through the ETFs, the fact that international central bankers have turned from sellers to buyers and flat mine supply as reasons for gold to continue its upward price movement.

1. AuRico Gold Inc. (TSX:AUQ)

AuRico Gold, formerly Gammon Gold, had a reputation for underperformance. Last year the company overhauled much of its board and elected to freshen things up by undertaking a name change. The paperwork was completed this summer and AuRico’s Ocampo mine in Mexico was demonstrating improved results with a 19% increase in gold equivalent production and cash cost of $340 per realized gold equivalent ounce. A supportive board and strong results gave AuRico’s chief executive officer Rene Marion the green light to build the company through acquisitions.

On August 29th, AuRico announced the $1.46-billion take over of Northgate Minerals (TSX:NGX). But apparently investors in AuRico Gold did not like the sound of the deal. On the day of the announcement AuRico shares were down more than 20% and since then millions of shares have exchanged hands. What on the surface appears to be a strategic merger of equals, with the acquisition of Northgate AuRico will increase its gold reserves by more than 80 per cent, some industry analysts seemingly don’t like the deal. Desjardins Securities analyst Brian Christie downgraded his rating to “hold” from “buy” but maintained a $15 price target. His concern is that the merger will dilute the net asset value of the company.

There is a flip side to every story and, despite the sell-off, some analysts are optimistic about the merger. CIBC World Markets analyst Brian Quest upgraded AuRico to “sector outperformer” and, like his counterpart Brian Christie, maintained a price target of $15 per share. Mr. Quest stated in a research note, “…a gold producer operating in Australia, Canada, and Mexico, producing nearly 500,000 ounces of gold in 2012, should garner support in the years to come.”

Perhaps the sell-off in AuRico after the announcement was more a function of the run-up prior to the announcement. Two months ago, shares in the company could be had for as little as $9. But on the day before the announcement, AuRico shares closed at $13.72, just 8.5% shy of both analysts price targets. At press time, the company’s shares are trading at just over $12.00.

Next, we look at the company that lost an epic takeover battle to AuRico Gold, Vancouver-based Timmins Gold.

2. Timmins Gold Corp. (TSX:TMM)

Last September, Timmins Gold made a non-binding proposal to the directors of Capital Gold (TSX:CGC) to merge on a negotiated basis. The proposed value of the transaction was $4.50 per share; shares of Capital Gold were, at the time, trading at $3.89. But from the get-go, Capital Gold’s board was not receptive the proposal. Enter another company featured on our 10 Most Interesting Gold Stocks list, AuRico Gold, and you the stage was set for a contentious 7 month long take-over battle. The final price tag, AuRico’s winning bid was for $6.34 per share. $1.77 more than what was original agreed upon when Capital and AuRico signed their merger agreement.

Since losing the fight for Capital Gold, Timmins has been quiet on the M&A front but has been making noise elsewhere. The company has been continuously drilling and extending the mineralization at its flagship San Francisco gold mine located in Sonora, Mexico. And on August 11th, 2011, the company reported that it sold 17,965 gold ounces during the quarter. This represents a 59-per-cent increase in gold sales over the first quarter of the previous fiscal year. In addition to the San Franciso mine, Timmins also has a collection of interesting gold assets across Mexico. Most notably a 40,000 hectare land package in the Peňasquito area of Mexico that is contiguous to Goldcorp’s 13 million ounce Peňasquito Gold Deposit.

We caught up with Bruce Bragagnolo, President & CEO of Timmins Gold, to discuss some of the company’s past challenges and learn what’s in store for this emerging junior gold producer – CLICK HERE – for the interview.

For 10 Most Interesting Gold Stock – Part 2 – CLICK HERE.

3. Eldorado Gold Corp. (TSX: ELD)

If you were to sum up the story of the bull market in metals in two words, then “Chinese demand” might rank as high as any other pairing. Though, as some point out, Chinese demand won’t support commodity prices forever. China’s GDP growth from 1978 to 2005 was a staggering 9.5% a year.

Yet for all the success that North American miners have had because of China, Vancouver’s Eldorado Gold, in February 2007, became the first North American company to successfully construct and operate a gold mine there when it began production at the Tanjianshan mine in Qinghai Province. This probably didn’t come as a surprise to many Eldorado shareholders as the company has shown an ability to produce at a low cost in various political and economic environments. In addition to China, the company operates in Turkey, Brazil, the United States and Greece, all while keeping its operating costs between $390 and $410 an ounce. Eldorado Gold is a favourite of Desjardins Securities analyst Brian Christie who, last week, raised his price target by $0.75 to $22 (U.S.) and maintained a “buy” rating.

Eldorado’s growth has been remarkable; from just over $179 million in revenue in fiscal 2007 to $791 million in fiscal 2010. The company has also been an earnings machine, putting more than $200 million to the bottom line in 2010. And, 2011 is shaping up to be another stellar year for Eldorado, an emerging intermediate gold producer that takes its name from a legendary city of gold.

4. Guyana Goldfields Inc. (TSX: GUY)