The dovish Federal Reserve lit a fire under gold and its miners’ stocks this week. As universally expected the FOMC hiked rates for the 9th time in this cycle. But it also lowered its 2019 rate-hike outlook bowing to the stock-market selloff. Traders dumped gold initially thinking that wasn’t dovish enough. But market reactions to the FOMC formed over a couple days, and gold surged overnight. Its post-Fed rally has great potential.

Gold-futures speculators dominate gold’s short-term trading action. They punch way above their weight in capital terms thanks to the extreme leverage inherent in gold futures. This week, the minimum margin for trading each 100-ounce contract controlling $125,000 worth of gold at $1250 was just $3400! These traders can run crazy maximum leverage as high as 36.8x, compared to the stock markets’ legal limit of 2x.

At 10x, 20x, or 30x leverage, every dollar of capital deployed in gold futures has 10x, 20x, or 30x more price impact on gold than a dollar invested outright. Further compounding speculators’ hegemony over gold prices, gold’s world reference price derives directly from US gold-futures trading. Naturally extreme leverage means extreme risk. At 37x a mere 2.7% gold move against positions wipes out 100% of capital risked!

In order to survive, gold-futures traders are forced to have an ultra-short-term focus. Their time horizons are measured in hours, days, and maybe weeks instead of months and years. And there is nothing that motivates them to trade aggressively like meetings of the Fed’s Federal Open Market Committee. Gold volatility often surges in their wakes, as speculators watch the U.S. dollar’s reaction and do the opposite in gold.

Gold-futures speculators are convinced Fed rate hikes are bearish for gold because they are bullish for the US dollar. They logically reason that the higher prevailing US interest rates, the more attractive the US dollar becomes relative to other currencies. And a stronger dollar usually means weaker gold since they are competing currencies. That all sounds rational, but the big problem is history doesn’t bear this out.

The FOMC started today’s rate-hike cycle way back in mid-December 2015, raising the federal-funds rate for the first time in 9.5 years. Gold-futures speculators fled leading into that, ultimately crushing gold to a deep 6.1-year secular low of $1051 the day after. But that oversold extreme marked the birth of a new bull market that would catapult gold 29.9% higher over the next 6.7 months! That same bull persists today.

In the 3.0 years since which includes this week’s 9th Fed rate hike of this cycle, gold is still up 18.1% and the US Dollar Index is down 2.1%. That’s no anomaly either. This is actually the Fed’s 12th rate-hike cycle since the early 1970s. During the exact spans of the prior 11, gold averaged strong gains of 26.9%! That was an order of magnitude higher than the stock markets’ 2.8% average gains per the flagship S&P 500.

Gold-futures speculators either don’t know market history or their extreme leverage forces them to run as a herd no matter how irrational that stampede is. They can’t afford to be wrong for long or risk suffering catastrophic losses. This week they apparently expected the FOMC to prove even more dovish on future rate hikes than it was. That led to volatile gold action surrounding this latest critical Fed decision on rates.

The FOMC meets 8 times per year, about every 6 weeks. But up until now, only every other meeting was accompanied by a Summary of Economic Projections and followed by the Fed chairman holding a press conference. That meant the Fed was only “live”, likely to hike rates, once a quarter at that every-other meeting. Incidentally Jerome Powell will start holding press conferences after every meeting starting in January.

That decision was made in mid-June, it had nothing to do with the recent stock-market volatility. Since the Fed doesn’t want to spook traders and ignite selloffs, rate hikes are well-telegraphed in advance. 3 weeks after each FOMC meeting, its full minutes are released. They are long and detailed, offering all kinds of clues about whether top Fed officials are thinking about hiking rates at the next FOMC meeting.

Market-implied Fed-rate-hike odds are always available through federal-funds futures trading. The big wildcard at each live FOMC meeting is a part of the SEP known as the “dot plot”. It collates where each individual top Fed official personally expects the federal funds rate to be in each of the next several years and beyond. It’s literally a bunch of dots plotted on a table, hence the name. It can really move gold futures.

Though Powell and other FOMC members stress the dot plot is not an official rate-hike forecast or outlook by the Fed, traders universally use it as such. A hawkish dot plot implies more future rate hikes than the previous one, and dovish less. Gold, currency, and stock-index futures speculators trade aggressively based on the quarterly changes in the dot plot. FOMC statements and press conferences also play roles.

At the FOMC’s previous meeting accompanied by a dot plot in late September, those forecasts implied top Fed officials expected this week’s rate hike, another 3 in 2019, and 1 final one in 2020. But market conditions were way different then. That decision came just 4 trading days after all-time record highs in the lofty euphoria-drenched U.S. stock markets. Top Fed officials are boldly hawkish when stocks look awesome.

In early October Powell doubled down on this hawkishness, saying in an evening speech that the federal-funds rate was “a long way from neutral at this point, probably” and that “We may go past neutral.” The very next day the stock markets started sliding and haven’t looked back since. By this Monday that selloff had gradually mushroomed into a moderate 13.1% correction in the S&P 500. Many blame it on Fed hawkishness.

Facing withering criticism led by president Trump himself, Powell tried to walk back his own many-more-rate-hikes-to-come outlook in late November after the S&P 500 had passed the 10% correction threshold. Powell said “Interest rates are still low by historical standards, and they remain just below the broad range of estimates of the level that would be neutral for the economy…” Stock selling was softening the Fed.

While traders fully expected the rate hike of this cycle Wednesday, they were sure the dot-plot outlook of future rate hikes would be far more dovish than late September’s 5 including this week’s. Gold rallied nicely in anticipation, climbing from $1214 before Powell’s second speech to $1249 the day before this latest FOMC meeting. In the hours before this new dot plot’s release, gold was bid to a new upleg high of $1261.

Market expectations were for just 1 rate hike in 2019 compared to the previous 3 implied, followed by an actual rate cut in 2020! That seemed excessive, so I figured top Fed officials would kill one of the hikes next year leaving 2 in 2019 and remove 2020’s lone hike as well. While this latest dot plot was indeed dovish as expected, it wasn’t dovish enough. 2019’s outlook shrunk to 2 more hikes, and 2020’s kept that final one.

So instead of going from 4 future hikes down to 1 or 2 as hoped, the dot plot only retreated from 4 to 3. Both dollar-futures and gold-futures speculators expected more dovishness, leading to moderate gold selling after the dot plot. Gold fell from $1251 just before its release to $1242 a couple hours later, and closed 0.6% lower on the day. Stock markets fared worse, the S&P 500 falling 1.5% to a new correction low!

But the impact of FOMC decisions usually takes a day or two to settle out. They are released at 2pm New York time when Asian and European markets are closed. So until foreign traders get their chances to react to the Fed, the market outcome isn’t known. Even American traders have to get past their initial kneejerk reactions, so the next trading day following the FOMC is crucial as actual implications sink in.

Gold was slowly bid heading into Thursday in Asian markets, heading back up near $1248 by the time Europe was opening. And then gold quickly surged to $1256, a new closing upleg high. In U.S. afternoon trading the day after this FOMC decision, gold surged as high as $1266! Top Fed officials’ future rate-hike outlook falling from 4 to 3 might not have been dovish enough, but it was still certainly dovish absolutely.

Seeing the Fed waver on future rate hikes in response to the mounting stock-market selloff this quarter is super-bullish for gold and its miners’ stocks going forward. Both gold-futures speculators and normal investors remain way under-deployed in gold, with vast room to buy. Odds are this week’s dovish FOMC will accelerate major gold and gold-stock uplegs. That’s happened after past Fed rate hikes in this cycle too.

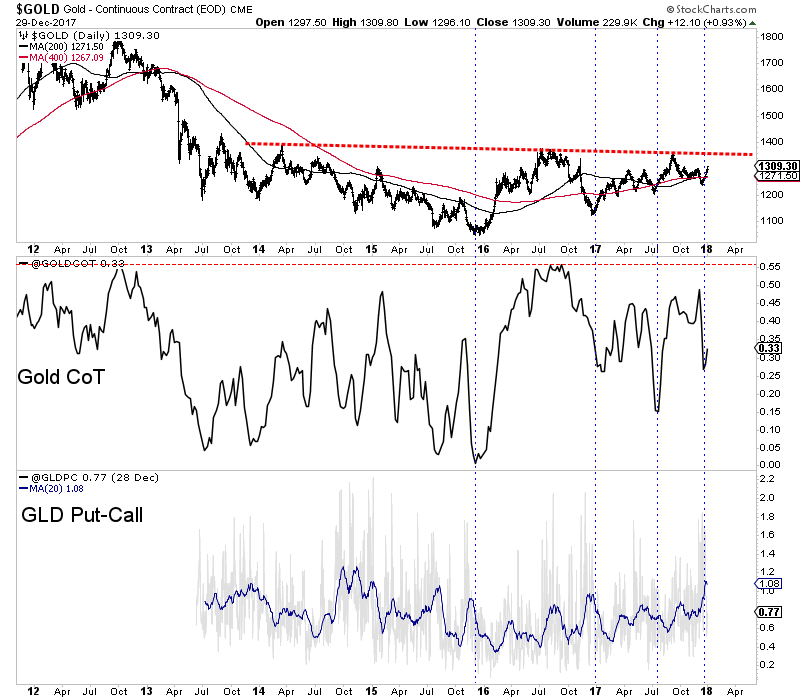

This first chart superimposes gold prices over the total gold-futures long and short contracts speculators hold, which are rendered in green and red respectively. All 9 Fed rate hikes of this cycle are highlighted in blue. Gold has often surged strongly on gold-futures buying in recent years following FOMC rate-hiking decisions, or more precisely dot-plot changes in the future rate-hike outlook. Gold is set up to surge again.

Again, this entire gold bull was born the day after the Fed’s first rate hike of this cycle, resulting in that big initial 29.9% gold upleg over 6.7 months in essentially H1’16. That left gold overbought so it started to correct like normal. But that was greatly exacerbated by Trump’s surprise election victory which ignited a monster stock-market rally on hopes for big tax cuts soon. Investors aggressively fled gold to chase stocks.

But gold bottomed in mid-December 2016 the day after this cycle’s second rate hike, and soon started surging sharply higher. Yet gold-futures speculators didn’t learn their lesson, and continued to dump gold heading into FOMC decisions with expected rate hikes. Gold rallied strongly immediately out of the 3rd, 5th, and 6th hikes of this cycle, and soon after the 4th and 8th. Rate hikes have definitely proven bullish for gold!

The 7th rate hike in mid-June 2018 was a major exception. Gold fell sharply in subsequent days as gold-futures speculators lapsed into a stunning extreme record orgy of short selling. Initially sparked by a U.S. dollar rally, that epic gold-futures shorting soon took on a life of its own driving total short contracts to their highest levels ever by far! That ultimately blasted gold to a deep and unsustainable 19.3-month low in mid-August.

Most of that shorting spree has been covered since, fueling most of gold’s young upleg since. But the long-side gold-futures speculators who control much more capital than short-side guys have barely started to buy. Short covering is legally mandated to repay the debts incurred by borrowing to short sell. But long buying is totally voluntary, speculators have to believe gold is heading higher to make leveraged bets on it.

At the end of November the day before Powell’s about-face on how far rates were from neutral, the total gold-futures longs held by speculators had crumbled to just 204.9k contracts. That was a serious 2.9-year low, levels last seen in late January 2016 just as this gold bull was starting to march higher. So gold-futures speculators are nearly as under-deployed in gold as they were near the end of its last secular bear!

That leaves vast room for them to buy to reestablish normal positions. Back in essentially the first half of 2016, speculators added 249.2k longs while covering 82.8k shorts to help catapult gold 30% higher. It’s amazing to see similar long-buying potential today, with speculators’ total longs running just 7% up into their past year’s trading range. We’re nearing the tipping point where short covering ignites far-bigger long buying.

Gold bull uplegs have 3 distinct stages that trigger and unfold in telescoping fashion. They all start out of major lows with that mandatory gold-futures short covering, the first stage. That eventually pushes gold high enough for long enough to entice long-side gold-futures speculators to return, the second stage. I suspect this week’s dovish FOMC meeting could prove the catalyst that ignites big stage-two gold buying.

This latest dot plot may not have been dovish enough for traders, but Fed dovishness will snowball with stock-market weakness. The lower the stock markets slide, whether or not Fed hawkishness is really to blame, the more pressure on the FOMC to slow or even stop its future-rate-hike tempo. Gold-futures speculators will crowd into gold to chase its upside momentum with their feared rate-hike boogeyman fading.

But all the stage-one and stage-two gold-futures buying that fuels young gold uplegs is just the prelude to far-larger stage-three investment buying. After gold’s upleg grows large enough and lasts long enough to spawn investor interest, their capital inflows soon dwarf anything the gold-futures speculators could ever manage. There’s also precedent in this cycle for Fed rate hikes soon leading to surging gold investment demand.

A great high-resolution proxy for gold investment-demand trends is the amount of physical gold bullion held in trust by the dominant GLD SPDR Gold Shares gold ETF. It effectively acts as a conduit for the vast pools of American stock-market capital to slosh into and out of gold. Just a couple weeks ago I wrote an essay on how GLD works and why it is critically important to gold prices, especially during stock selloffs.

This next chart looks at GLD’s holdings superimposed over the gold price, with all 9 Fed rate hikes of this cycle highlighted. While gold-futures trading usually dominates gold prices, it is still easily overpowered by material flows of American stock-market capital into or out of gold via GLD. Investors have started to return to gold again on the stock-market selloff, and this prudent reallocation should accelerate on Fed dovishness.

The last time American stock investors were worried enough about stock-market selloffs to redeploy into gold for refuge was that first half of 2016. Since gold is a rare counter-moving asset that tends to rally as stock markets weaken, investment demand soars when the S&P 500 slides long enough to ignite serious concerns. We’re certainly getting to that point again, as worries are mounting about this latest major selloff.

Gold went from being left for dead in mid-December 2015 to surging 29.9% higher in just 6.7 months solely on American stock investors returning! This is no generalization, the hard numbers prove it without a doubt. The world’s best gold fundamental supply-and-demand data comes from the venerable World Gold Council. It releases fantastic quarterly reports detailing the global buying and selling happening in gold.

Gold blasted higher on stock weakness in Q1’16 and Q2’16. According to the latest data from the WGC, total world gold demand climbed 188.1 and 123.5 metric tons year-over-year in those key quarters. That was up 17.1% and 13.2% YoY respectively! But the real stunner is exactly where those major demand boosts came from. It wasn’t from jewelry buying, central-bank buying, or even physical bar-and-coin investment.

In Q1’16 and Q2’16, GLD’s holdings alone soared 176.9t and 130.8t higher on American stock investors redeploying into gold after back-to-back S&P 500 corrections. Incredibly this one leading gold ETF accounted for a staggering 94% of overall global gold demand growth in Q1’16 and 106% in Q2’16! So there’s no doubt without American stock investors fleeing into gold via GLD this gold bull never would’ve been born.

Gold was holding those sharp gains throughout 2016 until Trump’s surprise presidential victory unleashed a monster stock-market run on hopes for big tax cuts soon. Gold was pummeled in Q4’16 as American stock investors pulled capital back out to chase the newly-soaring S&P 500. That quarter total global gold demand per the WGC fell 103.4t YoY or 9.0%. GLD’s 125.8t Q4’16 holdings draw accounted for 122% of that!

Fast-forward to summer 2018, and investors again started shifting out of gold to chase euphoric U.S. stock markets nearing new record highs. That forced GLD’s holdings to a deep 2.6-year low, investors hadn’t been so underinvested in gold since early in this bull market when they started flooding back in helping to catapult gold sharply higher. That gives them massive room to buy back in since their allocations are so low.

This mass exodus of American stock-market capital out of gold via GLD ended in mid-October the exact day the S&P 500 started plunging in what’s grown into this newest correction-grade selloff! Ever since GLD’s holdings have continued recovering on more capital inflows, helping to drive gold higher. This trend should only accelerate as stage-two gold-futures long buying on Fed dovishness further lifts gold prices.

Investors are often as momentum-driven as futures speculators, but over much-longer time horizons. So as this young gold upleg grows, gold is going to look much more attractive to them. Their desire to chase its upside performance is really intensified by material stock-market weakness. That makes gold stand out as not just a safe-haven capital-preservation hedge, but a way to grow wealth while everything else burns.

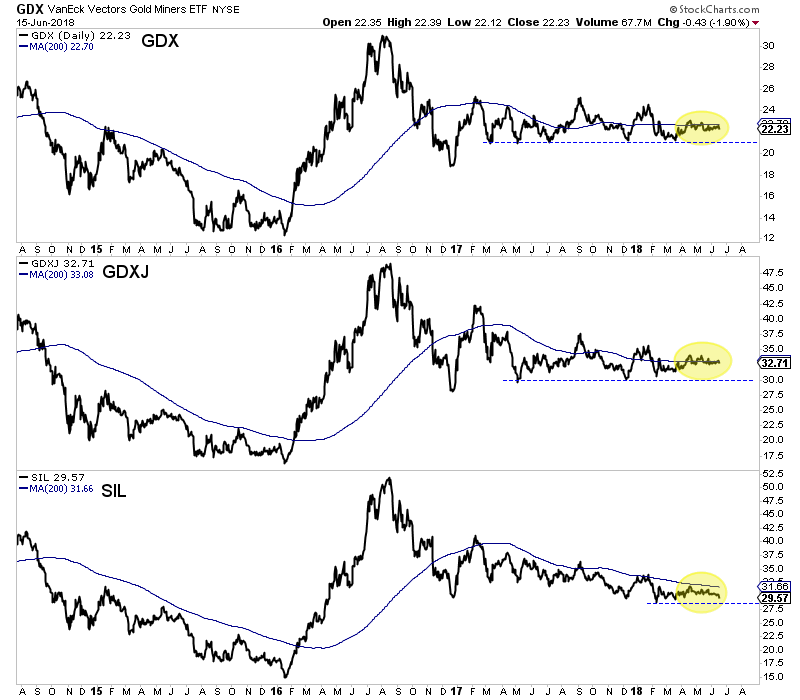

And as goes gold, so go the stocks of its miners. Last week I wrote a whole essay detailing the imminent major upside triple breakout in gold stocks likely to be triggered by a dovish FOMC. That indeed started to happen this week before the Fed, as this updated GDX chart shows! The GDX VanEck Vectors Gold Miners ETF is the leading gold-stock investment vehicle and benchmark, and remains poised for massive gains.

Three major resistance zones have converged at GDX $21. They include its 200-day moving average, past-year descending-triangle overhead resistance, and the old consolidation basing trend’s support. In anticipation of a gold rally on a dovish Fed, GDX closed above $21 on Tuesday. And in the hours before that FOMC decision Wednesday, it hit $21.47 intraday which was very-bullish decisive-breakout territory.

But when futures speculators bid the U.S. dollar higher and pushed gold lower on this latest dot-plot rate-hike outlook not being dovish enough, the gold stocks reversed hard. GDX plummeted a staggering 7.3% intraday across that FOMC decision! It closed 5.4% lower, making for absurd 9.0x downside leverage to gold’s small 0.6% Fed Day loss. That was a wildly-irrational downside anomaly that never should’ve happened.

In trying to figure out why after Wednesday’s close, I waded through dozens of gold stocks to see if there was some adverse news besides a not-dovish-enough FOMC. There was nothing. But provocatively in after-hours trading soon after the U.S. stock-market close, many if not most of the gold stocks had already regained 2/3rds to 3/4ths of that day’s crazy losses! So traders realized that kneejerk selloff wasn’t righteous.

Indeed right out of the gates Thursday GDX surged 4.1% higher erasing over 7/10ths of the extreme Fed Day losses. Remember market reactions to FOMC decisions usually aren’t fully apparent until the entire next trading day, after the implications have sunk in and overseas traders have reacted. Gold stocks’ major-upside-breakout thesis portending a powerful new upleg remains intact, the Fed likely accelerated it.

The beaten-down gold miners’ stocks remain the last cheap sector in the entire stock markets, a coiled spring ready to soar as gold returns to favor. The more shorts covered and longs bought by gold-futures speculators, and the more capital investors allocate back into gold, the greater the upside the gold miners’ stocks have as gold powers higher. Their potential gains are enormous, dwarfing anything else in 2019.

Again the last time major stock-market weakness rekindled gold investment demand was essentially the first half of 2016, when gold powered 29.9% higher. That drove a parallel monster 151.2% gold-stock upleg per GDX, making for huge 5.1x upside leverage. The gains in major gold stocks generally amplify gold upside by 2x to 3x, and smaller mid-tier miners with superior fundamentals tend to do much better than that.

The key to riding any gold-stock bull to multiplying your fortune is staying informed, both about broader markets and individual stocks. That’s long been our specialty at Zeal. My decades of experience both intensely studying the markets and actively trading them as a contrarian is priceless and impossible to replicate. I share my vast experience, knowledge, wisdom, and ongoing research through our popular newsletters.

Published weekly and monthly, they explain what’s going on in the markets, why, and how to trade them with specific stocks. They are a great way to stay abreast, easy to read and affordable. Walking the contrarian walk is very profitable. As of Q3, we’ve recommended and realized 1045 newsletter stock trades since 2001. Their average annualized realized gains including all losers is +17.7%! That’s double the long-term stock-market average. Subscribe today and take advantage of our 20%-off holidays sale!

The bottom line is this week’s FOMC decision is very bullish for gold and its miners’ stocks going forward. While only seeing 1 of 3 projected 2019 rate hikes axed wasn’t considered dovish enough, it still showed the Fed’s hawkish resolve is cracking. That dovishness will mount the longer stock markets remain weak, further shortening and shrinking this rate-hike cycle. That green lights capital returning to gold in a big way.

There is massive room to buy back in, with both speculators’ gold-futures longs and stock investors’ gold held via GLD just modestly above major multi-year lows. Dovish Fedspeak, weaker stock markets, and higher gold prices will really motivate them to reestablish normal gold positions and portfolio allocations. The gold miners’ stocks will be the major beneficiaries of higher gold prices, nicely leveraging gold’s gains.

Adam Hamilton, CPA

December 21, 2018

Copyright 2000 – 2018 Zeal LLC (www.ZealLLC.com)

- The U.S. stock market continues to implode. At the same time, precious metals, bitcoin, and the Indian stock market are acting as superb safe havens.

- Please click here now. Double-click to enlarge this great short term gold chart.

- Note the positive bounce from buy-side support at $1237, and the inverse H&S bottom pattern. A fresh rate hike from the Fed tomorrow could crush the stock market again, but if there’s no rate hike, that could also crash the stock market.

- That’s because money managers would believe the Fed thinks the supposed “world growth leader” economy is too weak to handle even a 2.5% Fed funds rate!

- This Fed meeting could be an important catalyst that makes institutional money managers start to get serious about viewing gold as a respected asset class… that is here to stay.

- On that note, please click here now. While an overdue import duty cut remains elusive, the citizens of India (and China) are the clear leaders in the quest to make gold the world’s most respected asset class.

- On the government side, the Chinese government has been a leader in building gold market infrastructure to move price discovery from the dingy trading rooms of the Western fear trade to the more positive love trade environment of the East.

- The Indian government is beginning to play “catch-up”, and that’s very good news for gold investors around the world.

- Please click here now. There are currently about 400 million Indians who have internet access, and that is expected to double to 800 million quite quickly.

- The World Gold Council (WGC) estimates that 3 million Indians buy gold online, and they predict that number will soon quintuple to 15 million!

- In 2014 I predicted a “gold bull era” was being born and it would be founded on a gargantuan ramp-up in Chindian online gold demand.

- Indians can already get physical delivery from most of the online platforms when total purchases reach just one gram of online-purchased gold.

- Warren Buffett is buying into one of the platforms (Paytm). This man is an elephant hunter!

- Please click here now. Double-click to enlarge this magnificent big picture gold chart.

- An almost surreal array of positive love trade and inflation trade price drivers are converging at the same time.

- This is happening as gold bullion begins a majestic ascent from the right shoulder low of a gargantuan inverse head and shoulders bull continuation pattern.

- Sadly, to view something much less than majestic, please click here now. Double-click to enlarge. My proprietary “Graceland Traffic Light” on the weekly Dow chart has just turned amber.

- This is a rare and ominous event. U.S. stock market investors who ignore these major traffic light signals risk tremendous portfolio damage.

- If the signal stays amber as of Friday’s close, I’ll consider it a full U.S. stock market sell signal, and any positions bought above the Dow 10,000 level should be sold.

- In global stock market downturns like the current one, Canadian money managers will throw the junior mining stocks baby out with the stock market bathwater.

- Most of the smaller junior miners trade on the Canadian CDNX exchange, so it’s very important for all gold market investors to be properly diversified in what is obviously the world’s greatest asset class. Junior mining stock investors should own some of the bigger miners to get that diversification.

- Please click here now. Double-click to enlarge this spectacular GDX chart. GDX put in another day of strong upside action yesterday, and it did so as the Dow fell almost 500 points!

- On Saturday I urged my gublockchain.com subscribers to buy bitcoin (and some “alts”)… right before the latest upside blast that I predicted would be “explosive”. It was explosive, and I have the excited investors in profit booking mode now.

- I’ll boldly predict that a few more daily closes above $20.50 are going to produce an equally explosive price surge for GDX and a huge array of individual gold stocks!

Special Offer For Website Readers: Please send me an Email to freereports4@gracelandupdates.com and I’ll send you my free “Juniors With The Juice!” report. While most junior miners have a lot of hurdles to overcome, I highlight six that are likely poised for five bagger gains in 2019! I include daily chart buy and sell points for each stock.

Stewart Thomson

Graceland Updates

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?

If we want to know where Gold is going we should follow Gold. Right?

How about following gold stocks? At times, they lead Gold.

What about the U.S. Dollar? Wrong!

In 2019, one market more than any other will impact Gold.

That is the stock market.

History argues (within the current context) that when the Federal Reserve ends its rate hikes, Gold’s downtrend will be over and when the Fed cuts rates, the bull market shall begin.

Fed policy is dictated by economic data and financial conditions which of course can be reflected by the stock market, which is also a reflection of corporate profits.

Extended weakness in the stock market should bring the Fed that much closer to rate cuts. However, if the stock market is able to mount a decent counter trend rally in 2019, it could raise the possibility of another hike. Right now, the market expects no hikes in 2019 and even half of a quarter point cut in 2020.

Other than the cyclical bull market of 1985 through 1987, Gold has never enjoyed a real bull market without outperforming the stock market.

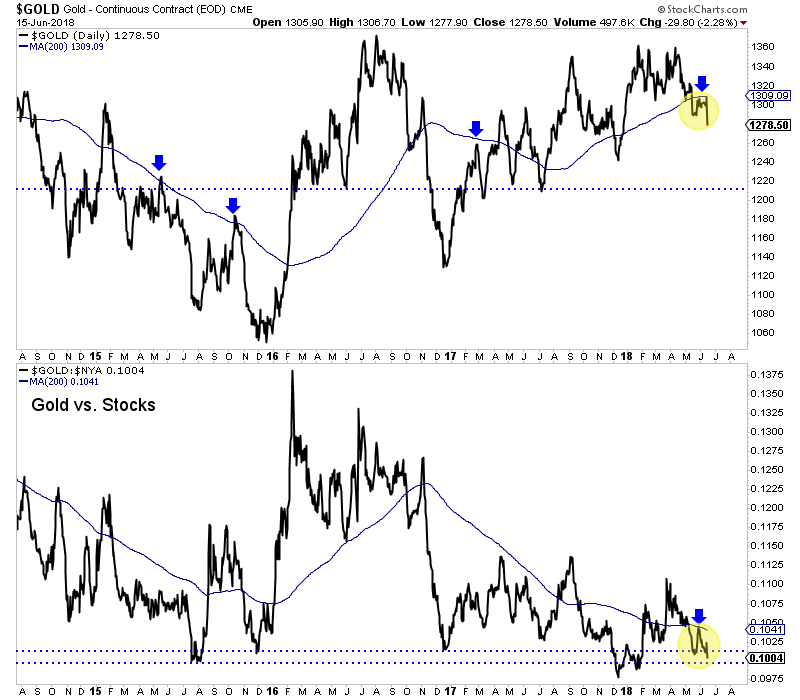

Below we plot Gold and Gold against the broad stock market (NYSE). Gold is still trading below a confluence of resistance ($1260-$1270) and the Gold to stock market ratio, while trading above its 200-day moving average has not broken out of its downtrend yet.

As we pen this, the stock market is breaking lower but Gold is also down and remains below a confluence of resistance at $1260-$1270/oz.

Is our thesis wrong?

The current weakness in equities has not completely changed Fed policy yet. Sure, the weakness in the equity market definitely could cause the Fed to pause its rate hikes and the market has already discounted that for 2019.

However, for the bull market in Gold to be ignited the Fed needs to move from a pause to the start of rate cuts. The current talk is about a pause, not rate cuts.

Hence, Gold is catching a bid and starting to perform better in real terms but has not reached bull market status yet.

Until Gold proves its in a bull market (and the market begins pricing in a rate cut) it would not be wise to chase strength. There will be plenty of time to get into cheap juniors that can triple and quadruple once things really get going. To prepare yourself for an epic buying opportunity in junior gold and silver stocks in 2019, consider learning more about our premium service.

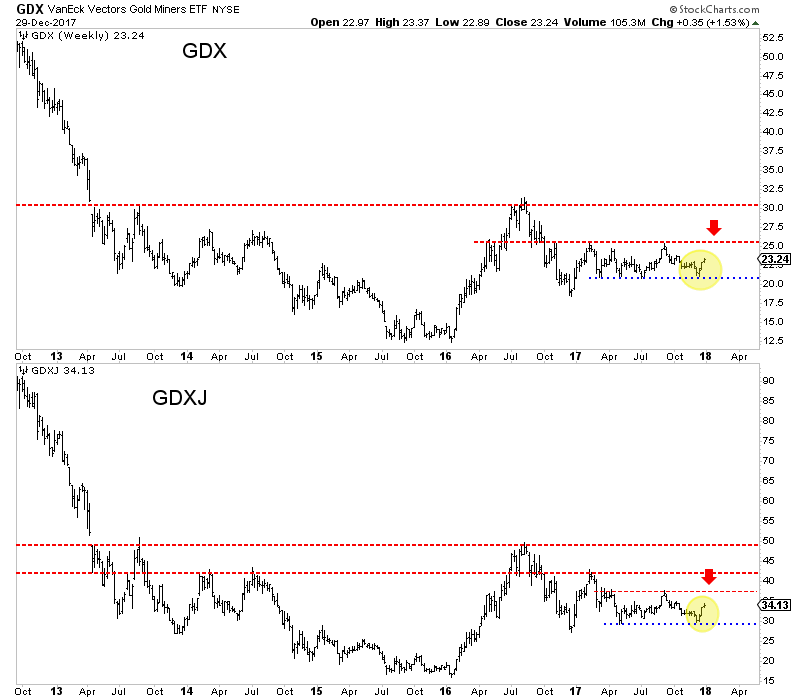

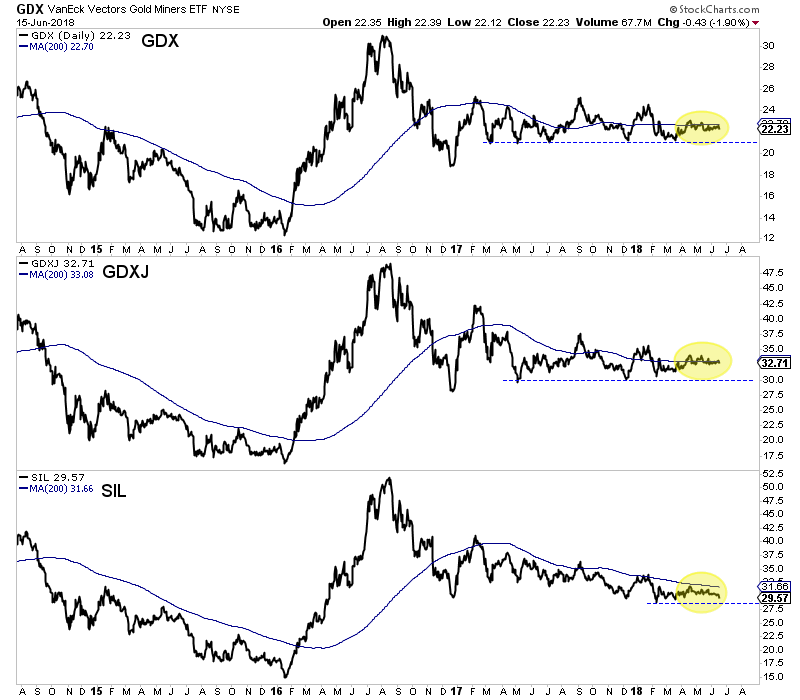

The beleaguered gold stocks are recovering from their late-summer capitulation, enjoying a solid young upleg as investors gradually return. Their buying has pushed the leading gold-stock ETF near a major triple breakout technically. That event should really boost capital inflows into this sector, accelerating the rally. A major gold and gold-stock buying catalyst is likely imminent too, a more-dovish Fed this week.

The gold miners’ stocks have always been a small contrarian sector, a little-watched corner of the stock markets. But they’ve been even more unpopular than usual in recent months. That pessimistic sentiment is driven by price action, which has mostly proven poor in 2018. That’s really evident in the performance of the flagship gold-stock investment vehicle, the GDX VanEck Vectors Gold Miners ETF which is struggling.

As of the middle of this week, GDX was down 12.0% year-to-date. That leveraged gold’s YTD decline of 4.4% by 2.7x, which is perfectly normal. Because gold-stock earnings are heavily dependent on prevailing gold levels, gold-stock prices tend to amplify gold’s moves by 2x to 3x. That’s a double-edged sword, really profitable when gold rallies but cutting deeply when it retreats. The drawdowns are challenging to weather.

But gold stocks’ inherent leverage to gold is starting to work again on the upside, portending big gains ahead. This first chart looks at the major gold stocks’ technicals through the lens of GDX over the past several years. This sector soared in a new bull market, plunged with gold after Trump’s surprise election win goosed the stock markets, consolidated sideways to base, and then suffered an extreme capitulation selloff.

Investors and speculators often forget how explosive gold-stock upside is when gold is powering higher in an upleg. In largely the first half of 2016, GDX skyrocketed 151.2% higher in just 6.4 months! Capital just flooded back into the gold miners driven by a new gold bull’s parallel 29.9% upleg. That catapulted GDX to very-overbought levels and a 3.3-year high in mid-2016. So a normal correction got underway soon after.

GDX found support at its critical 200-day moving average, which is often the strongest support zone seen in ongoing bull markets. But that failed in November 2016 after an anomalous surprise. Trump defied the polling and odds to win the presidency while Republicans controlled both chambers of Congress. So the stock markets soared in that election’s wake on euphoric hopes for big tax cuts soon. Gold wilted on that rally.

So the gold stocks naturally followed it lower, again mirroring and amplifying its price action. After it had enjoyed stellar 5.1x upside leverage to gold in its powerful H1’16 upleg, GDX dropped 39.4% over the next 4.4 months. That leveraged gold’s own correction by 2.3x, relatively low in that usual 2x-to-3x range. GDX soon bounced sharply with gold and established a new consolidation trading range between $21 to $25.

The major gold stocks mostly meandered within that GDX range for 21.5 months. While it was vexing at times to see upside-breakout attempts fail, basing consolidations are very bullish. They provide time for bullish newer investors to acquire shares from bearish exiting ones, establishing new price norms well above previous bear-market lows. And the $23 midpoint of that GDX trading range proved relatively high.

This gold-stock bull was born out of fundamentally-absurd lows of GDX $12.47 in mid-January 2016. It peaked at $31.32 in early August that year. Oscillating around $23 on balance, GDX was basing 4/7ths up into its young bull’s entire range. The major gold stocks GDX holds were biding their time waiting for another major gold upleg to catapult them higher. They nearly broke out above $25 in early-September 2017.

But that attempt’s failure damaged psychology so traders gradually sold, this small contrarian sector left for dead. The subsequent lower highs over the next 10.4 months into mid-July 2018 formed a downward-sloping resistance line. Gold-stock prices were being compressed into a bearish descending triangle, as lower highs slumped ever closer to that major $21 support. This sector really needed a major gold rally.

Unfortunately the opposite happened this past summer, gold got hammered crushing the weakened gold stocks. The US stock markets were powering higher trying to regain record highs in July and August 2018, heavily retarding gold investment demand. On top of that the U.S. Dollar Index was surging too, both on expectations for more Fed rate hikes and an emerging-markets currency crisis led by the Turkish lira.

So gold-futures speculators started short selling gold at extreme record levels, blasting their aggregate downside bets far up into anomalous territory never before witnessed. Gold fell sharply on that record gold-futures shorting spree, dragging the struggling gold stocks down with it. So in early August GDX plunged and knifed through its longstanding $21 support. That major breakdown spawned self-feeding selling.

Gold stocks are an exceptionally-volatile sector not for the faint of heart. So it is essential to run loose trailing stop losses on gold-stock positions. While these protect investors from excessive losses, they greatly exacerbate selloffs. The lower gold stocks fell this past summer, the more stop losses were hit. These mechanical automatic sell orders then add to the downside pressure, pushing gold stocks lower still.

That vicious circle of selling begetting selling snowballed into an extreme capitulation in gold stocks, as GDX plummeted in August and early September. In just 5 weeks GDX collapsed 17.0%, far worse than gold stocks should’ve performed with gold merely slipping 1.4% lower in that span. That devastated already-shaky sentiment, leaving most investors and speculators to throw up their hands in disgust and flee.

But with GDX being pummeled to a deep 2.6-year low, the major gold stocks were wildly oversold. I explained all this in depth in an essay on gold stocks’ forced capitulation in mid-September. They were due to mean revert dramatically higher after that extreme selling anomaly. And that process has indeed been underway ever since. The gold stocks have been recovering, clawing their way out of those deep lows.

As usual gold stocks’ dominant primary driver has been gold, which has been grinding higher in its own young upleg as speculators cover their record gold-futures shorts. Investors started returning too when the lofty US stock markets began rolling over hard in mid-October. As of the middle of this week, GDX just hit a new upleg high of $20.45 on close. That extended gains since the capitulation low to 16.4% in 3.0 months.

Although considerable, the gold stocks’ rally still hasn’t grown large enough to return to the radars of contrarian investors. That could be about to change though as a rare triple breakout looks imminent! GDX, the leading gold-stock investment vehicle, is on the verge of simultaneous upside breakouts from its 3 major upper-resistance zones. That will likely unleash big gold-stock buying from technically-oriented traders.

These major resistance levels have all converged near $21. The first and most important is GDX’s key 200-day moving average, which was $20.78 this week. 200dmas are seen as the dividing line between bull and bear markets. When prices surge back above 200dmas after long periods underneath them, the upside momentum often explodes. Traders love chasing gains and 200dma breakouts portend big ones.

The past few years have several examples of gold stocks surging dramatically after 200dma breakouts. The main one was in early February 2016, when GDX rocketing back over its 200dma after deep lows confirmed a new bull market was underway. The great majority of its initial massive 151.2% upleg came after that 200dma upside breakout. Another upleg surged after a 200dma breakout in mid-August 2017.

The latest one came in late December 2017, although that was truncated early by gold stalling out. Realize that no technical line is more important to traders than 200dmas. When they see major gold stocks power decisively back over their 200dma as measured by GDX, they are likely to rush to buy in to ride the momentum. Like selling, buying begets buying. The more gold stocks rally, the more traders want them.

That imminent 200dma breakout will be all the more potent as a new-upleg signal because 2 other major resistance lines have converged there. That downward-sloping resistance line of the descending triangle has also extended right on $21. So once GDX powers decisively above it, this past year’s vexing trend of lower highs will end. Traders will see that as evidence the major gold-stock trend is reversing to higher.

The final resistance line of that triple breakout is the major $21 support of GDX’s consolidating basing range that held rock solid for over a year-and-a-half. When prices fall, old support zones often become new overhead resistance. Traders tend to want to sell again when those old support levels near. So when GDX decisively breaks back out above $21, technical fears of that former support level will vanish.

Once back over $21, GDX will return to its multi-year consolidation basing trend between $21 to $25. So the triple breakout above that old support line, downward-sloping resistance line, and 200dma would set the stage for a sharp surge back towards the top of that old trading range. While GDX $25 isn’t very high in absolute terms, it’s still another 22.2% above this week’s levels. Such a rally would spark some excitement.

Because historical gold-stock uplegs have been so enormous, generating life-changing wealth, there is always latent gold-stock interest lurking. Contrarian investors and speculators alike sour on gold stocks when they are weak, but quickly return when they show technical signs of life. A GDX triple breakout sure qualifies as that! And much-higher gold-stock prices are certainly justified fundamentally, long overdue.

Gold miners’ earnings and thus ultimately stock prices are largely a function of gold levels. Mining costs are essentially fixed during mine-planning stages. So higher gold prices flow directly through to bottom lines in amplified fashion. This is easy to understand with an example. A month ago I waded through the Q3’18 results of GDX’s major gold miners. Their average all-in sustaining costs weighed in at $877 per ounce.

That is what it costs them to produce and replenish gold, and $877 was right in line with their previous 4 quarters’ average of $867. Those collective costs will remain stable even as gold’s upleg accelerates. At gold’s own extreme-futures-short-selling-driven bottom of $1174 in mid-August, the major gold miners of GDX were still earning about $297 per ounce. Such solid levels prove that capitulation wasn’t righteous.

Last Friday gold hit a new upleg high of $1248, up 6.3% from its anomalous late-summer lows. Imagine this young upleg grows to 30% like the H1’16 one, which is quite small by historical standards. That would leave gold near $1525. At those $877 average GDX AISCs, the major gold miners’ profits would rocket to $648 per ounce. That’s 118% higher on a 30% gold upleg! Big gold-stock upside is fundamentally justified.

The ratio between the closing prices of GDX and the dominant GLD SPDR Gold Shares gold ETF is an easy approximation of the critical fundamental relationship between gold-stock prices and gold levels. This last chart is updated from a mid-October essay where I explained why gold stocks are the last cheap sector in all the stock markets. The GDX/GLD Ratio shows gold stocks have vast room to mean revert higher.

This GGR construct has averaged 0.186x during the 3.0 years of this current gold bull so far. This week the GGR clawed back to 0.174x, hitting its own 200dma. But at the gold stocks’ deep capitulation low in mid-September, the GGR plunged all the way down to 0.155x. That’s 0.031x below normal for this bull. After GGR extremes in either direction, this key ratio tends to mean revert the other way and overshoot proportionally.

That argues GDX is easily likely to surge far enough leveraging gold’s gains to regain a 0.217x GGR. That’s certainly not a high level even in the modest context of this gold bull. At this week’s $1245 gold levels which translated near $118 in GLD terms, GDX would have to surge to $25.56 to accomplish that normal mean-reversion overshoot. That’s another 25.0% higher, which would make for a solid upleg well worth riding.

And that GGR target is still incredibly low in longer secular context. In the 2 years before 2008’s first stock panic in a century, the GGR averaged 0.591x. Though gold stocks plummeted in the extreme fear that panic spawned, the GGR rebounded to average 0.422x in the 2 years after that epic anomaly. Over a longer 4-year post-panic span, it averaged 0.381x. So seeing it regain 0.217x is nothing, it should go far higher.

The bigger gold’s own upleg, the more the gold stocks will outperform by the usual 2x to 3x and force the GGR higher. At $1525 gold after a relatively-small 30% upleg, that 2009-to-2012 post-panic-average GGR of 0.381x would yield a GDX upside target around $55 per share. That’s 169% higher from this week’s levels, even without an overshoot! Gold-stock profits growth from higher gold prices justifies huge gains.

And rather conveniently on the verge of that GDX triple breakout, a major gold-buying catalyst is likely this week. On Wednesday December 19th, the Fed’s FOMC meets to decide on whether or not to hike rates for the 9th time in this cycle. That rate hike has been universally expected for months now, it is fully baked in. But the thing gold-futures and dollar-futures traders are really watching is the rate-hike forecast.

While the FOMC meets 8 times per year, at every other meeting it releases something called the dot plot. That summarizes where top Fed officials making the decisions think the federal-funds rate should be in coming years. The last dot plot was published on September 26th when the S&P 500 remained just 0.8% under its all-time record high from a week earlier. Fed officials are boldly hawkish when stocks are high.

But the stock markets soon fell apart in Q4’18, the first in history seeing full-speed quantitative-tightening monetary destruction by the Fed! Various Fed officials including the chairman have waxed more dovish since stocks started sliding. Fearing a negative wealth effect adversely impacting the US economy, their resolve to hike rates withers. So there’s a good chance this week’s dot plot will be more dovish than the last one.

Late September’s had effectively forecast 5 more Fed rate hikes including at next week’s meeting. So if this new dot plot shows less than 4 total rate hikes forecast in 2019 and 2020, dollar-futures speculators will likely sell motivating gold-futures speculators to buy aggressively. Fewer expected rate hikes are very bullish for gold, as proven in past dot plots. A great example was the 5th hike of this cycle in December 2017.

A year ago this week the FOMC hiked, but its dot-plot rate-hike forecast was dovish. Instead of upping it to 4 rate hikes in 2018 as traders expected, Fed officials left it at 3. So over the next 6 weeks, gold shot up 9.2% to $1358 on heavy gold-futures buying by speculators. A similar rally after next week’s meeting if the dot plot forecasts fewer rate hikes than the last one would drive gold right back up near $1360 again.

That’s on the verge of a major bull-market breakout which would likely unleash massive new investment buying. And any material gold rally will light a big fire under the gold stocks, rapidly driving them higher. That would put GDX’s triple breakout in the bag with haste. Nothing drives big capital inflows into the gold stocks faster than seeing them decisively rally. They are perfectly set up for major gains in coming months!

A big mean-reversion rebound higher is inevitable and likely imminent. While traders can play it in GDX, that’s mostly a bet on the largest gold miners with slowing production. The best gains by far will be won in smaller mid-tier and junior gold miners with superior fundamentals. A carefully-handpicked portfolio of elite gold and silver miners will generate much-greater wealth creation than ETFs dominated by underperformers.

The key to riding any gold-stock bull to multiplying your fortune is staying informed, both about broader markets and individual stocks. That’s long been our specialty at Zeal. My decades of experience both intensely studying the markets and actively trading them as a contrarian is priceless and impossible to replicate. I share my vast experience, knowledge, wisdom, and ongoing research through our popular newsletters.

Published weekly and monthly, they explain what’s going on in the markets, why, and how to trade them with specific stocks. They are a great way to stay abreast, easy to read and affordable. Walking the contrarian walk is very profitable. As of Q3, we’ve recommended and realized 1045 newsletter stock trades since 2001. Their average annualized realized gains including all losers is +17.7%! That’s double the long-term stock-market average. Subscribe today and take advantage of our 20%-off holidays sale!

The bottom line is the gold stocks are nearing a rare triple breakout. Three major GDX resistance zones have converged just above current levels. Once the gold stocks surge decisively over, the technically-oriented traders will take notice. They will likely start chasing the momentum accelerating the gains, with buying begetting buying. And gold stocks are so undervalued big gains are totally justified fundamentally.

This bullish outlook should be really bolstered by this week’s FOMC meeting. Worried about the recent stock-market selloff and surging volatility, top Fed officials are likely to dial back their rate-hike forecasts for next year. That will almost certainly hit the US dollar and goose gold. If gold surges again on a dovish dot plot like it has after other rate hikes in this cycle, the gold stocks will blast higher achieving that triple breakout.

Adam Hamilton, CPA

December 17, 2018

Copyright 2000 – 2018 Zeal LLC (www.ZealLLC.com)

- Where are the populist government leaders who are cutting their outrageous government debts?

- The answer, unfortunately, is that they do not exist.

- Citizens riot in France over insane fuel taxes, central bankers resign in India, markets crash in America, and England’s citizens watch their Brexit turn into an overpriced wet noodle.

- None of this fazes the world’s populist leaders. They believe they alone can fix what debt broke… with more debt!

- Please click here now. Double-click to enlarge. In the middle of all the mayhem and madness, the uncrowned queen of the world, gold bullion, sits cooler than a cucumber. Gold is showcasing a nice steady uptrend on this medium-term price chart.

- Please click here now. Heavyweight analysts at JP Morgan, Goldman, Wells Fargo, and other big banks are bullish on gold now, but many amateur analysts and investors are worried (with some sounding outright terrified) that gold is going lower.

- This is a classic wall of worry rally, and I expect the upside price action to accelerate in January and February.

- There’s also a real possibility that Trump piles on more destructive tariffs by March. If that happens, it would occur just as Chinese New Year gold buying really accelerates.

- In that scenario, gold could surge towards the key $1400 area and the US stock market would likely crash like it did in 1929.

- Please click here now. Double-click to enlarge. Investors must keep their eye on the big picture, which is all about the growth of the Chindian love trade and the rise of inflation, especially in the West.

- A new pillar of gold bullion demand could also emerge now that India’s populist leader (Modi) has essentially taken control of the nation’s central bank. A fresh survey shows that 90% of Indian households see substantially higher inflation coming in 2019. That survey was done before the nation’s top central banker resigned yesterday!

- The world’s populist leaders want interest rates to stop rising so their governments can borrow even more money and waste it on silly “people helper” programs.

- Some of the populist leaders want to buy more bombs, some want more welfare programs, but what they all have in common is they want to spend more, and more, and more! This is highly inflationary.

- Please click here now. While many amateur gold analysts have talked about their fear of lower prices, I’ve urged investors to focus on the epic upside breakout taking place on the world’s most important gold mining company. That company is: Barrick.

- Junior gold and silver stock enthusiasts can expect to see their stocks begin to follow the Barrick leader. It’s already happening with many of the CDNX-listed stocks, and this morning’s pre-market “super surge” in Barrick’s price is going to start the next major wave higher for most of the junior miners.

- What seals the deal? Answer: A weekly close above $14 for Barrick. I expect it to happen this week and investors who waste time reading the fears of the gold bears risk missing out on years of upside price action. The bottom line:

- This is not the start of a gold bull market. It’s the start of a bull era that will last a hundred years.

- I’ve predicted three U.S. rate hikes for 2019. Goldman was predicting four, but yesterday their chief economist Jay Hatzius reduced his forecast to three.

- We’re on the same page now, with both of us predicting three hikes, a surprising rise in U.S. inflation, and GDP growth that fades under the 2% marker by the second half of 2019.

- Ray Dalio is head of the world’s largest hedge fund (Bridgewater). Ray predicts an “inflationary depression” will envelop America within about two years. I think it takes three to four years, but given the danger, does the time frame really matter? The timing of a hurricane doesn’t change the fact that people need to get out of its way.

- On that note, please click here now. Just as most big bank analysts are positive about gold now, they have increasingly negative forecasts for the U.S. dollar.

- The policies of the world’s “spendaholic” populist leaders are extremely inflationary. The bank analysts know that’s bad news for dollar bugs and great news for gold stock investors.

- Please click here now. Double-click to enlarge this magnificent GDX price chart. My short term guswinger.com swing trading service has caught all the key swings in the GDX base formation, reducing boredom while making investors richer! I focus on NUGT and DUST for the short term moves and unleveraged GDX for the home run plays!

- We booked solid profits yesterday as GDX edged towards the important $20.50 price zone. After a brief pitstop at this minor resistance zone, the GDX bull is poised to drive its golden horns into the bears… and begin a magnificent charge up to $23.50!

Special Offer For Website Readers: Please send me an Email to freereports4@gracelandupdates.com and I’ll send you my free “Golden Outperformers” report. I highlight six GDXJ component stocks that are poised to immediately follow Barrick with major upside breakouts of their own! I highlight key technical signals and provide tactics to help investors book great profits.

Stewart Thomson

Graceland Updates

Written between 4am-7am. 5-6 issues per week. Emailed at aprox 9am daily.

Email:

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?

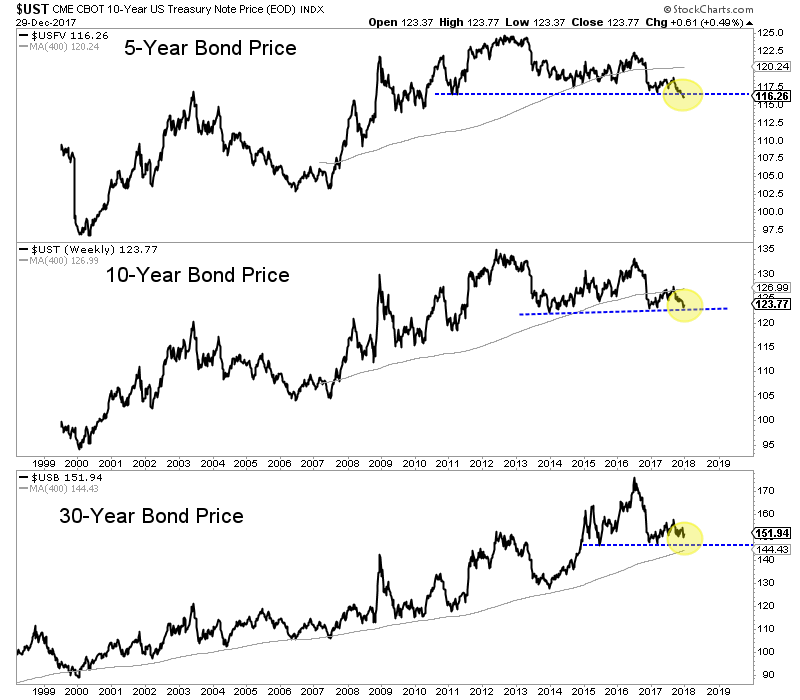

In recent days we’ve seen the beginnings of an inversion in the yield curve.

The 2-year yield and the 5-year yield have inverted but not yet the the 2-year yield and the 10-year yield, the curve that is watched most. However, “2s and 10s” as bond traders would say appear headed for an inversion very soon.

We know that an inversion of the yield curve precedes a recession and bear market. That is good for Gold. But timing is important and the key word is precedes.

In order to analyze the consequences for Gold we should consult history.

First let’s take a look at the 1950-1980 period.

In the chart below we plot the Barron’s Gold Mining Index (BGMI), Gold, the Fed funds rate (FFR) and the difference between the 10-year yield and the FFR (as a proxy for the yield curve).

The six vertical lines highlight peaks in the FFR and troughs in the yield curve (YC), which begins to steepen when the market discounts the start of rate cuts. A steepening YC is and has been bullish for Gold except when it’s preceded by inflation or a big run in Gold.

Note that five of the six lines also mark a recession except in 1966-1967.

At present, the yield curve is on the cusp of inverting for only the third time since 1990.

The previous two inversions in 2000 and 2007 were soon followed by a steepening curve as the market sensed a shift in Fed policy.

The initial rate cut in 2000 marked an epic low in the gold stocks and the start of Gold strongly outperforming the stock market. In summer of 2007 the rate cuts began and precious metals embarked on another impulsive advance.

The historical inversions carry a different context but the takeaways are not so different.

Aside from the mid 1970s to the early 1980s, we find that a steepening of the curve (which accelerates from the start of Fed rate cuts) is bullish for precious metals. (This also includes a steepening in late 1984 that preceded the bull market in the mid 1980s).

With that said, the inversion itself is not bullish for precious metals because there can be a lag from then to the first rate cut and steepening of the curve.

I took a careful look at four of the previous inversions and counted the time from that point to the next significant low in gold stocks. The average and median time of those four is 10 months.

That appears to be inline with my thinking that the Federal Reserve’s final rate hike will be sometime in 2019.

In the meantime, precious metals are rallying but the inversion of the yield curve and Fed policy argue it would not be wise to chase this strength. There will be plenty of time to get into cheap juniors that can triple and quadruple once things really get going. To prepare yourself for an epic buying opportunity in junior gold and silver stocks in 2019, consider learning more about our premium service.

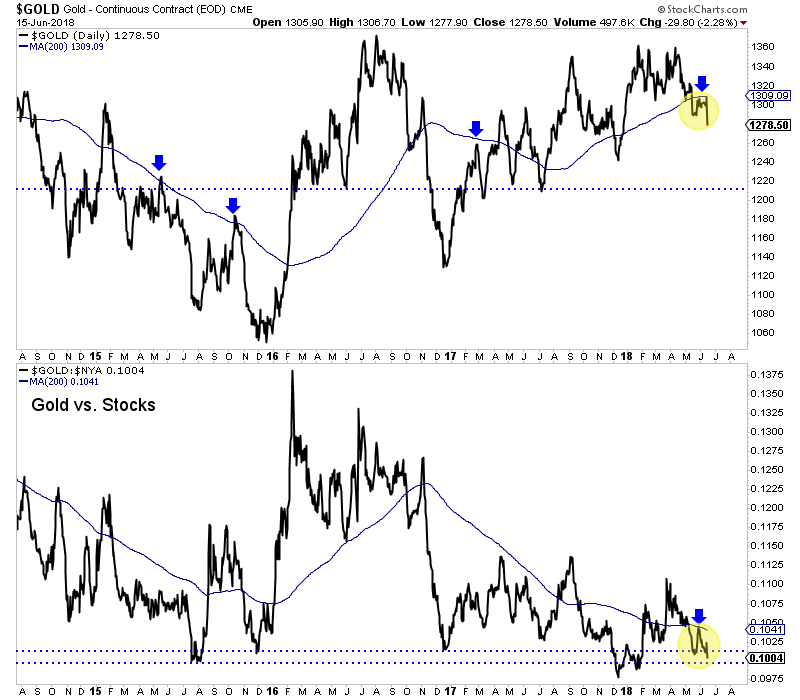

The recent stock-market selloff is persisting, fueling mounting worries among investors. The intensifying volatility and lack of a quick rebound higher is strangling euphoric sentiment, spawning self-reinforcing selling pressure. Scoffed at a few months ago, the notions that a young bear market is underway and a recession looms are gaining traction. The great beneficiary of this ominous stock-market downturn will be gold.

Gold has always been an essential asset class for prudently diversifying investment portfolios. Uniquely it tends to rally when stock markets weaken, offsetting some of the losses in typical stock-heavy portfolios. Gold acts like portfolio insurance, usually soaring when stock markets plunge on unforeseen news. All throughout history, wise investors have recommended everyone have 5% to 10% of their portfolios in gold.

But like insurance in general, the important role gold plays in portfolios is gradually forgotten when it isn’t needed. Just a few months ago, the U.S. stock markets seemed invincible. The flagship S&P 500 broad-market stock index (SPX) had powered 333.2% higher over 9.5 years by late September. That made for the 2nd-largest and 1st-longest stock bull in U.S. history! Investors were convinced that would last indefinitely.

The SPX had surged 9.6% year-to-date by that latest peak, while gold had slumped 7.3%. Thus investors felt no need to allocate virtually any capital to gold, they were and are radically underinvested in it. This is especially true of American stock investors, who were wildly optimistic after long years of big stock-market gains. Their effective portfolio exposure to gold was vanishingly small back in late September.

The 500 elite stocks of the SPX had an extreme collective market capitalization way up at $26,141.4b as that topping month waned. It is interesting contrasting that with the physical gold bullion holdings of the world’s dominant gold exchange-traded fund, the American GLD SPDR Gold Shares. GLD has long been the go-to destination for American stock investors looking to allocate capital for gold exposure in their portfolios.

At the end of September as stock euphoria peaked, GLD’s total holdings were merely worth $28.4b. That implies American stock investors were running trivial gold allocations around 0.11%! That’s on the order of only 1/50th the minimum 5% that’s been universally advised for centuries if not millennia. So it’s not much of a stretch to argue American stock investors had zero gold exposure, they were effectively all-out.

The sharp stock-market selloff in the few months since those halcyon all-time record highs has surprised most, but it shouldn’t have. As Q4’18 dawned, something ominous happened that was unprecedented in stock-market history. The US Federal Reserve upped its quantitative-tightening campaign necessary to start unwinding its $3625b of quantitative-easing money creation over 6.7 years to its terminal velocity.

October 2018 would be the first month ever to see the Fed’s monetary destruction ramp to a staggering $50b-per-month pace. And even to unwind just half of the Fed’s radical QE, QT would have to keep on destroying $50b per month of QE-conjured money for 30 months! At the end of September when the SPX was just 0.6% off its all-time record high, I explained all this in depth warning it was this bull’s death knell.

And indeed within a week of Fed QT going full-throttle, the SPX started to slide. There was no way QE-levitated stock markets could ignore QT obliterating that QE money. Every daily selloff since had its own unique story and specific drivers, which I discussed and analyzed in our subscription newsletters. These all added up to enough selling to spawn an ongoing stock-market correction, an SPX selloff exceeding 10%.

Blame it on Fed QT, stock-market bubble valuations, mounting US-China trade-war threats, Republicans losing the House, or whatever you want, but by Black Friday the SPX had fallen 10.2% over 2.1 months since that euphoric record peak. The stock markets staged some sharp rallies within that span, but they quickly fizzled proving to be dead-cat bounces. This recent action is ominously looking very bear-market like.

We can’t know for sure whether the long-overdue new bear market driven by epic record Fed tightening is indeed upon us until the SPX falls 20%+ on a closing basis. This recent correction would still have to double to hit that bear-market threshold. But gold has certainly been the main beneficiary of the recent stock-market weakness. Investors are starting to remember the ages-old wisdom of diversifying into gold.

This week’s chart looks at the US-dollar gold price superimposed over the SPX during the past 4 years or so. Despite gold being forgotten in recent years as the stock markets surged ever higher, it remains in a young bull market. And that was spawned by the last set of back-to-back corrections in the SPX, which catapulted gold sharply higher. We’re likely on the verge of another stock-selloff-driven major gold upleg!

GLD’s physical-gold-bullion holdings held in trust for its shareholders reveal how American stock investors feel about gold. This past spring they started slumping as gold was sold to move even more capital into the lofty US stock markets. For 5 months in a row ending in September, GLD’s holdings retreated as investors dumped GLD shares faster than gold was falling. By early October GLD’s holdings hit a 2.6-year low.

I penned a whole essay on this stock-euphoria-driven gold exodus in late September, explaining why it was happening and why it was likely to soon reverse. And that shift in gold-investment sentiment began the very day the SPX started plunging in mid-October! Up until October 9th the stock markets looked totally normal, the SPX had only drifted a trivial 1.7% lower from its peak. Everyone remained wildly bullish.

But something snapped on October 10th, that fateful day the SPX plunged 3.3% out of the blue on no catalyst at all. Heavy technically-motivated selling accelerated led by the market-darling mega tech stocks. For years investors had believed them bulletproof, their businesses so good they could weather any stock selloff or economic slowdown. Fears surged on the worst SPX down day since back in early February.

That very day American stock investors started returning to gold. They poured capital into GLD shares so aggressively they forced a major 1.2% holdings build. GLD’s mission is to track the gold price, but it has its own supply-and-demand profile independent from gold’s. So when GLD shares are being purchased faster than gold is bought, GLD’s share price threatens to decouple to the upside on that excess demand.

So GLD’s managers must vent that differential buying pressure directly into the physical gold market in order to equalize it and maintain tracking. They do this by issuing enough new GLD shares to satisfy all the excess demand, and then plow the cash proceeds into gold bullion. Thus rising GLD holdings show American stock-market capital is flowing into gold. That proved to be GLD’s biggest build in 6.7 months.

That fateful day proved a major inflection point for both near-record US stock markets and the extremely-unpopular gold. As the SPX continued to weaken over the next couple months, GLD continued to enjoy modest builds on investment gold buying. By late November GLD’s holdings had climbed a considerable 4.5% over 6 weeks. That has helped push gold 5.5% higher since its mid-August lows, a solid young upleg.

Odds are that gold buying via GLD by American stock investors is only beginning. The longer this stock-market weakness persists, the deeper their worries will grow. And the more their stock-heavy portfolios bleed, the quicker they will remember they should’ve allocated 5% to 10% to gold. Once gold investment demand is kindled by falling stock markets, it tends to balloon dramatically and take on a life of its own.

Gold’s young bull market today that was forgotten this summer began as 2016 dawned. Much like this year, in the first half of 2015 the US stock markets were powering to dazzling new record highs. Since it seemed like stocks could do nothing but rally indefinitely, gold was forgotten and shunned. It slumped to a brutal 6.1-year secular low by mid-December 2015, with investors really wanting nothing to do with it.

But their ironclad euphoria started to crack soon after the stock markets corrected. In mid-2015 the SPX finally suffered its first correction in an incredibly-extreme 3.6 years after being levitated by relentless Fed money creation from its third quantitative-easing campaign. Gold caught a bid on that 12.4% SPX selloff over 3.2 months, but then faded again into the expected first Fed rate hike in 9.5 years in mid-December.

Then the SPX fell into another 13.3% correction over 3.3 months into early 2016. Seeing menacing back-to-back corrections after long years without one really deflated gold-suppressing stock-market euphoria. So in early 2016 American stock investors began prudently rediversifying their stock-dominated portfolios into gold. That birthed today’s gold bull, and the gold-buying momentum fed on itself to drive a powerful upleg.

Gold went from being left for dead in mid-December 2015 to surging 29.9% higher in just 6.7 months solely on American stock investors returning! This is no generalization, the hard numbers prove it without a doubt. The world’s best gold fundamental supply-and-demand data comes from the venerable World Gold Council. It releases fantastic quarterly reports detailing the global buying and selling happening in gold.

Gold blasted higher on SPX weakness in Q1’16 and Q2’16. According to the latest data from the WGC, total world gold demand climbed 188.1 and 123.5 metric tons year-over-year in those key quarters. That was up 17.1% and 13.2% YoY respectively! But the real stunner is exactly where those major demand boosts came from. It wasn’t from jewelry buying, central-bank buying, or even physical bar-and-coin investment.

In Q1’16 and Q2’16, GLD’s holdings alone soared 176.9t and 130.8t higher on American stock investors redeploying into gold after back-to-back SPX corrections. Incredibly this one leading gold ETF accounted for a staggering 94% of overall global gold demand growth in Q1’16 and 106% in Q2’16! So there’s no doubt without American stock investors fleeing into gold via GLD this gold bull never would’ve been born.

Gold was holding those sharp gains throughout 2016 until Trump’s surprise presidential victory unleashed a monster stock-market run on hopes for big tax cuts soon. Gold was pummeled in Q4’16 as American stock investors pulled capital back out to chase the newly-soaring SPX. That quarter total global gold demand per the WGC fell 103.4t YoY or 9.0%. GLD’s 125.8t Q4’16 holdings draw accounted for 122% of that!

Gold’s fortunes are being driven by American stock investors’ collective buying and selling of GLD shares. And nothing motivates them to redeploy capital into gold to diversify their stock-heavy portfolios like major SPX selloffs. Recent months’ one has already proven serious enough to rekindle differential GLD-share buying. And as H1’16 proved, once investors start driving gold higher its rallies tend to become self-feeding.

The more physical gold bullion American stock investors buy via GLD shares, the more gold climbs. The higher gold rallies, the more investors want to buy it to ride the momentum and chase its gains. So buying begets buying, driving gold higher fairly rapidly. And when stock markets are sliding, gold is often the only asset class rallying. That makes it even more attractive to investors getting pounded by sliding stocks.

This latest SPX correction is even more damaging to sentiment because it is 2018’s second one. Back in early February the SPX plunged 10.2% in 0.4 months, which started to crack sentiment. Back when this gold bull was born it was the second of back-to-back SPX corrections that proved the coup de grâce in hurting stock-market sentiment enough to unleash a reallocation into gold. This scenario is playing out again.

Provocatively seeing the three major US stock indexes suffer two 10%+ corrections within any single calendar year is itself a super-bearish omen. 2018 joined 1973, 1974, 1987, 2000, 2001, 2002, and 2008 as the SPX’s only other dual-correction years. Those coincided with a 48.2% SPX bear, a 20.5% single-day SPX crash, another 49.1% SPX bear, and a third 56.8% SPX bear! All three bears triggered recessions.

This stock-market weakness isn’t only likely to persist, but the odds really favor it snowballing into another major SPX bear market. Gold investment demand will naturally surge as stocks burn, fueling a strong bull market. Gold’s 29.9% gain over 6.7 months at best so far in this bull is nothing. Gold’s last secular bull from April 2001 to August 2011 saw it soar 638.2% higher! Gold’s gains as the SPX rolls over should be massive.

With a trivial 0.1% portfolio allocation to gold, what happens to gold prices if American stock investors just return to a still-immaterial 1.0%? That’s still way under the 5% to 10% recommended in normal times, and plenty of great investors believe 20% gold allocations are necessary during stock bears. Gold’s upside from here with virtually-zero US-stock-market capital allocated to it is vast. And it could accelerate rather fast.

The timing of this current SPX correction is likely to magnify bearish psychology. It has occurred entirely within Q4’18. The SPX exited Q3’18 just 0.6% off its record peak from a week earlier. So I suspect a lot of American retirement investors have no idea just how much carnage their precious capital has suffered. When they get their quarterly statements from their money managers in January, they could really freak out.

Even worse, far too much of this retirement capital was allocated to the market-darling mega techs which were the biggest holdings across most funds. Their losses have far outpaced the SPX’s. As of that latest correction low on Black Friday when the SPX was down 10.2%, Apple, Amazon, Microsoft, Alphabet, Facebook, and Netflix had collapsed 25.8%, 26.4%, 10.8%, 19.9%, 39.4%, and 38.2% from their all-time highs!

The mega techs that nearly single-handedly pushed the SPX higher for years averaged 26.8% losses, or 2.6x the SPX’s! When investors who don’t closely follow the stock markets figure that out next month, the investment demand for rallying gold ought to explode. The first half of 2019 has a setup much like H1’16, where gold essentially powered 30% higher. A similar upleg from mid-August’s lows isn’t a stretch at all.

Another 30% run from $1174 would leave gold at $1525. And once gold climbs decisively back over its bull-to-date high of $1365 from early-July 2016, investment interest and demand will soar. Just like the mega tech stocks, the higher gold prices the more investors want to buy it. A mere 16% gold upleg off August’s lows, or another 10% higher from this week’s levels, would near that psychologically-huge bull breakout!

All investors should always have 5% to 10% of their investable capital allocated to gold. But almost none do today as a long-overdue bear market fueled by epic record Fed QT looms. If you don’t have that core gold allocation, you need to get it in place before stocks fall much farther and gold surges much higher. The gold miners’ stocks will greatly leverage gold’s gains too, their leading index soared 182.2% largely in H1’16!

Absolutely essential in bear markets is cultivating excellent contrarian intelligence sources. That’s our specialty at Zeal. After decades studying the markets and trading, we really walk the contrarian walk. We buy low when few others will, so we can later sell high when few others can. While Wall Street will deny the coming stock-market bear all the way down, we will help you both understand it and prosper during it.

We’ve long published acclaimed weekly and monthly newsletters for speculators and investors. They draw on my vast experience, knowledge, wisdom, and ongoing research to explain what’s going on in the markets, why, and how to trade them with specific stocks. As of Q3, we’ve recommended and realized 1045 newsletter stock trades since 2001. Their average annualized realized gain is +17.7%! That’s double the long-term stock-market average. Subscribe today and take advantage of our 20%-off holidays sale!

The bottom line is this stock selloff is boosting gold. Flagging gold investment demand turned on a dime when the stock markets started plunging in mid-October. Gold has rallied on balance since as American stock investors start redeploying capital. Their buying alone via GLD shares was fully responsible for gold’s sharp 30% upleg in 2016’s first half. That followed the last back-to-back corrections in US stock markets.

And between record Fed tightening running full-throttle, continuing dangerous bubble valuations, and the mounting trade wars, this recent stock selling is likely to persist on balance. So gold investment will look far more attractive. Coming from virtually-zero gold portfolio allocations, investors have massive buying to do. The higher they push gold, the more other investors will chase it. Especially as US stock markets weaken.

Adam Hamilton, CPA

Copyright 2000 – 2018 Zeal LLC (www.ZealLLC.com)

December 4, 2018

- The double bottom is the world’s most stressful chart pattern. It forms after a significant price decline. The first low in the pattern creates substantial panic and fear in most investors.

- The second low in the pattern is “softer”, but no less dangerous to emotionally vulnerable investors. The volume is generally weak and the price action makes investors feel like they are in some kind of financial gulag.

- Then the sun bursts out from behind those financial clouds, and glorious upside action begins! On that fabulous note, please click here now. Double-click to enlarge the spectacular price action on this daily gold chart.

- The long term fundamentals and liquidity flows for gold should never be confused with the medium or short term. In the long term, the biggest driver of gold price appreciation is the Chindian “wealth effect”.

- It’s all about Chinese and Indian citizens growing their standard of living and buying ever-more gold to celebrate the good times.

- In the West, inflation is the most potent driver of the gold price and America is beginning an enormous inflation cycle that will likely continue for fifteen to twenty years.

- As Chindians bring respect to gold as an asset class, Western gold bugs won’t need to hide in the closet when they buy it because everybody will be able to get it online from companies like Amazon.

- It will be as mundane as buying a coffee at Starbucks is now, but much more profitable!

- In a nutshell, the love trade of three billion Chindians combined with the inflation trade of at least 500 million Westerners will soon completely restore gold’s shimmer and place as the ultimate asset.

- Please click here now. Double-click to enlarge. All investors should keep their eye on the price action taking place on this long term gold chart. Note the RSI oscillator. It’s poised to leap above 50 and that’s in sync with the arrival of Chinese New Year seasonality.

- Some heavyweight money managers believe that an inflationary surprise is coming to America, and it could happen as early as this Friday’s jobs report.

- On that very interesting note, please click here now. Double-click to enlarge. A surprising uptick in US wage inflation is imminent and it will be a tremendous tail wind for silver’s upside price action. I don’t know if that inflationary surprise happens in Friday’s jobs report or not, but I do want investors to be positioned to get richer if it occurs!

- In the short term precious metals market, I might be shorting GDX via DUST (although the good news is that I currently hold NUGT), but that has nothing to do with the fabulous long term fundamentals in play for the entire precious metals market.

- At my short term guswinger.com trading service the average NUGT/DUST or UDOW/SDOW trade lasts only a week or two. I increased my average trade size threefold yesterday… to enhance the adrenaline rush and the profits, with professionally managed risk. Investors should always separate trading accounts from long term core position investing accounts. They are as different as night and day.

- Please click here now. Jay Powell had to “blink” with rate hikes and so did Donald Trump with tariff taxes or the U.S. stock market would have incinerated yesterday. So, when Trump “supersized” Powell’s blink with his tariffs blink, the US stock market rocketed higher and I promptly sold half my UDOW swing trade position as the market opened. From there, the rally faded. Pros sold the news.

- In the big picture, I think most stock market bulls and bears are working a bit too hard to predict either “make my stock market great” higher prices or the end of the bull market.