Galway Metals (GWM.V, GAYMF) is a Canadian exploration stock with two prospective projects located in strategic locations. Fundamentally, some things stand out.

1. Insiders

Over 30% of outstanding shares are in the hands of management and insiders. High quality management as both CEO and Chief Geo come from Kirkland Lake Gold (KL.TO) where they also held management positions. Another reputable insider is Wesdome’s (WDO.TO) CEO Duncan Middlemiss, who has an advising role at Galway Metals. Connections like these could be important in a later stage should

exploration continue in the current direction.

In the past year, 5 insiders have been buying their own stock, of which CEO Robert Hinchcliffe invested the highest amount. Through 2018, he bought $285,000 worth of stock in the open market and another $100,000 in a private placement. Other insiders put in between $25,000 and $88,000 of their own money into Galway Metals.

Insiders are dedicated as well. When looking at their personal holdings, the biggest part of this is held in GWM shares. Data like this can be retrieved on marketscreener.com. Management in this business usually has seats on more than one company’s board, which means they hold more than just one stock. Therefore, it’s interesting to see the weight of these. Allocations at Galway Metals show conviction: CEO 89%, VP 73%

and Chief Geo 47%.

2. History

Galway Metals was spun out of the Galway Resources takeover by AUX in 2012. At the time, Galway Resources was sold for $340M. Management is largely the same since then, so they’re experienced in growing an exploration stage company to one that’s prepared for production. Galway Resources (GWY) shareholders received a 47% premium in that deal.

3. Projects

Galway Metals has 2 projects in Eastern Canada in mine friendly jurisdictions in areas where infrastructure such as roads, railways and mills are closeby. Both projects have an existing resource for both gold and industrial metals. One million ounces of gold have been mapped to date and if we add the other metals, there’s 1.8 million gold equivalent ounces. These past years there has been a resource upgrade yearly, and this year as well, they will upgrade their existing resources on both projects

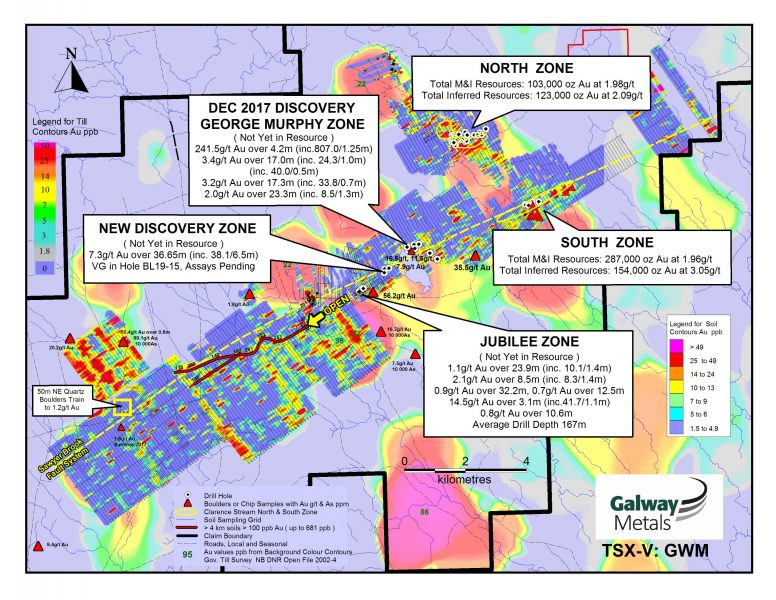

Clarence Stream

Located in mining friendly New Brunswick and in the proximity of a processing mill and (rail)roads nearby. Management hints that this project can represent a new gold district in Canada. Findings to date continue to prove this out: This project has 5 discovered zones thus

far on the main NE-SW trend with high possibility for new discoveries going by soil anomalies. Galway just announced assays from their fifth and new discovered zone: 7.3g/t over 36.7m (38.1g/t over 6.5m). A 50m stepout has been drilled which intersected visual gold twice. Results from this are pending.

This new discovery is in the middle of two known zones (Jubilee and George Murphy) that are 2km apart. Galway controls 65km of this main NE-SW trend and management believes this shares the same structure and has similar geology as Marathon’s (MOZ.TO) Valentine Lake project. Only 5km have been drilled and all zones are open in every direction. Wide mineralization at shallow depths with grades which would make this suitable for open pit mining.

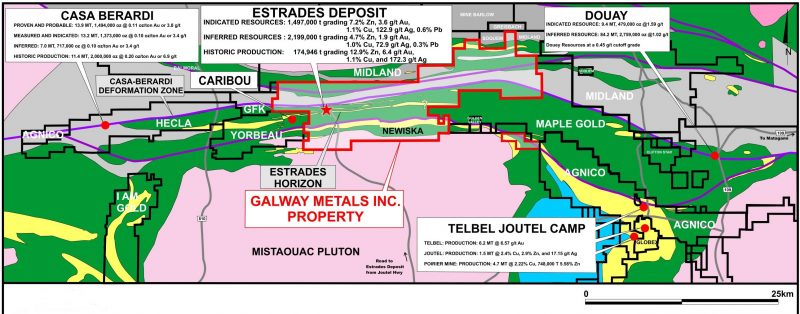

Estrades

Polymetallic project that saw production in 1990-1991:174,946 tonnes grading 6.4 g/t Au, 172.3 g/t Ag, 12.9% Zn and 1.1% Cu. Previous owner stopped production when metals prices dropped in 1991. Since then this former mine has been dormant for over 25 years. Located in mining friendly Québec with multiple deposits, active and historic mines in

the proximity. 31km of strike hosting 3 mineralized trends which hold a resource that’s high in Zinc (20.75% ZnEq) and Gold (11.28g/t AuEq).

Just like the Clarence Stream project, this is currently being drilled so news from here should flow in coming weeks.

4. Cashed up

All that drilling costs money. Therefore, it’s interesting to know that Galway has about $7M in the bank after a recently closed private placement (in which 4 insiders participated), which means they can continue this aggressive exploration. Galway Metals doesn’t have any debt. Also of importance is that chief geo and vice president bought warrants with an execution price of $0.50, which -when executed- will add $750,000 to the treasury.

5. Catalysts 2019

Two catalysts this year for a revaluation. Catalyst # 1: Exploration success and new discoveries on Clarence Stream and Estrades. On Clarence stream, investors have a couple of pending results to look

forward to from drill cores that showed visual gold as well as future step-out holes from current zones. Catalyst # 2: Resource upgrade 2019 including the new zones. Management pointed at a resource upgrade this year that will – for the first time- include 2 new zones at Clarence Stream.

6. Comparables and valuation

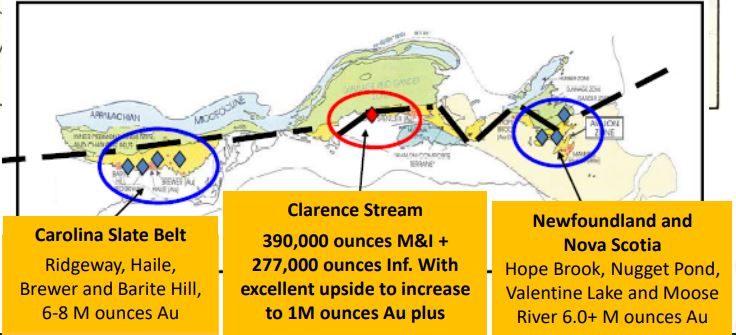

When looking at other Eastern Canadian companies that share this continent scale trend, it’s easy to see their Clarence Stream project is favourably located in between known multi million ounce gold camps.

Similarities with Oceanagold’s Haile mine, which is an open pit mine that shares shallow depth in combination with high grades. Another similar case is Atlantic Gold over in Nova Scotia. This has the same

widespread gold occurrences on their property and built a central processing facility that’s currently being fed by the surrounding deposits.

Galway is not yet at this stage and management may not have the intention to mine it themselves. Just going by similar geological features and challenges, it’s positive to see nearby succeeded projects.

As valuation goes, when looking at the only metric we can currently apply – which is the enterprise value on a proven gold ounce basis- we’re sitting at $17.4/oz whereas this sector’s (pre feasibility) average is $52/oz. Noteworthy that this number is based on the current resource, that only holds 2 of the 5 zones at Clarence Stream.

7. In Closing

As said in the intro, Galway has a lot going for it. Two catalysts this year that will continue to get fed from multiple fronts. Galway has a rather tight share float (107M) and they don’t need to collect funds any

time soon, meaning that their share price will benefit with a leverage effect when exploration continues to deliver. Management is experienced, respected, committed and on the buying side. Not to be taken for granted in any sector. Eastern Canadian gold deposits are on the rise and going by the fundamentals there’s good potential that this too will turn out to be a multi million ounce deposit, eyed by producing mining companies. Going by the EV/oz metric, there should be plenty of room for upside.

Jonas De Roose

February 22, 2019

Author Jonas De Roose is a Belgian retail investor in precious and base metals stocks with a drive for research and learning. He has a background in business development and marketing. He owns shares in Galway Metals and his article is not intended as investment advice. This article is based on his findings and based on his personal opinion. If you have suggestions regarding this company feel free to contact him at jonasderoose@hotmail.com.

- As U.S. markets re-open after the holiday, the world’s “queen of assets” continues her glorious ascent to higher prices. Please click here now. Double-click to enlarge this magnificent short term gold chart.

- The rise above $1332 ushers in my new short-term target: $1355!

- Please click here now. Gold is well on its way to becoming a mainstream asset like stocks and bonds.

- The reason for that is the “citizen wealth effect” created by the relentless rise of China and India. These gold-oriented nations are well on their way to becoming the most gargantuan economic empires in the history of the world.

- It’s simple mathematics: There are eight Chindians for every American, and about half of the Chindians are under the age of 35.

- It’s an unstoppable force that I refer to as, “The Gold Bull Era”.

- In the West, gold has been traditionally bought only when major stock, bond, currency, and real estate markets get into trouble.

- In contrast, Chindian citizens view gold as the “ultimate asset”, meaning they buy it in both good times and bad.

- This view is beginning to gain acceptance amongst Western analysts and money managers and I’m predicting it will continue to do so for many decades.

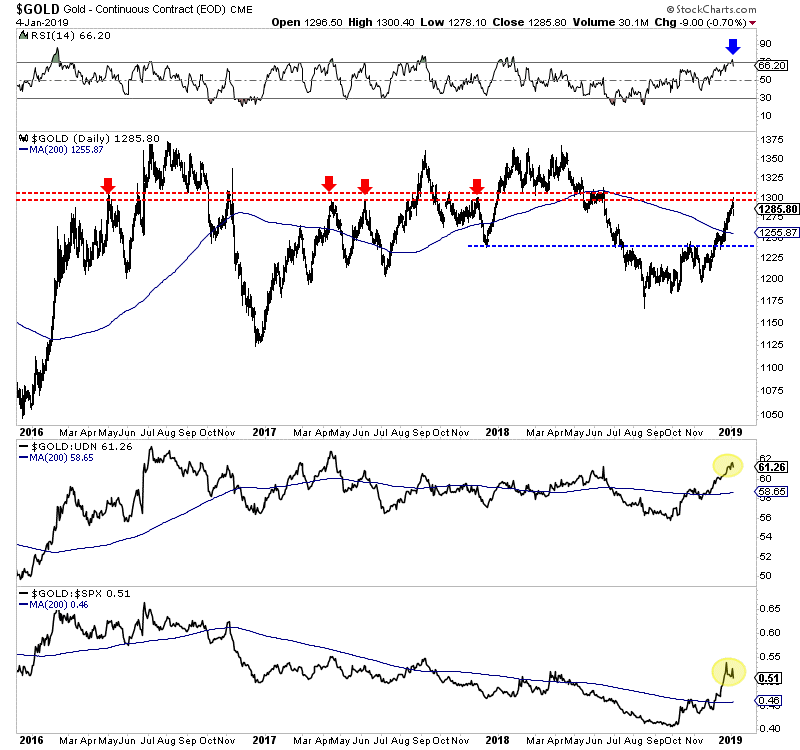

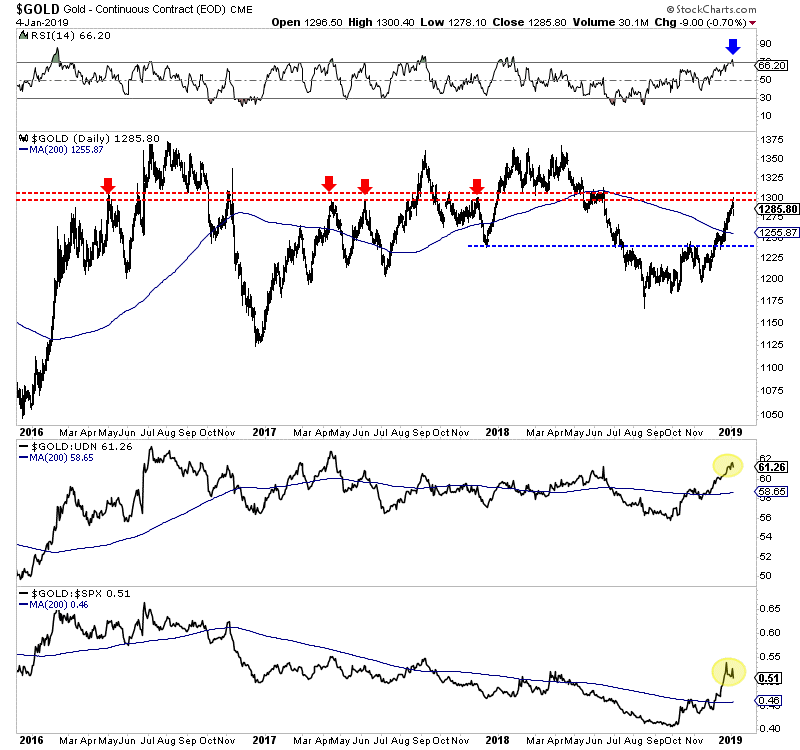

- Gold’s role as ultimate asset was showcased in the September-December period when it rose while U.S. stock markets tumbled.

- Most gold bugs were stunned by the incredible price action, and even more stunned as the GDX gold stocks ETF soared too!

- Now, gold is rallying while U.S. stock markets rise, and most analysts are again somewhat shocked as their attempted top calls for gold fail repeatedly.

- This type of “win-win” price action is unique to gold and I’ll boldly state that it is essentially here to stay!

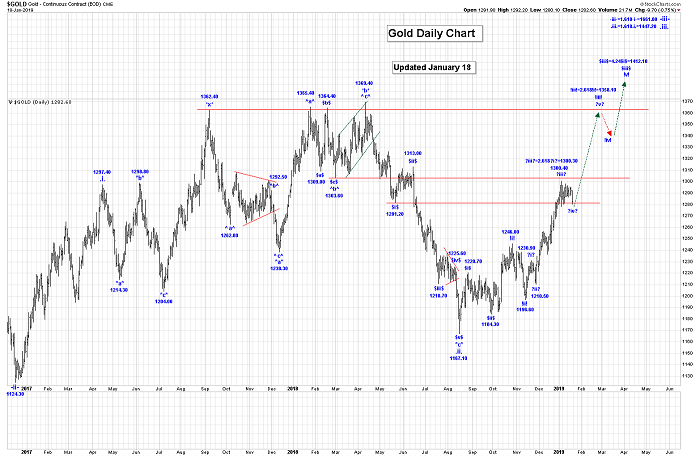

- Please click here now. Double-click to enlarge. On this daily chart, gold looks like a freight train that cannot be stopped.

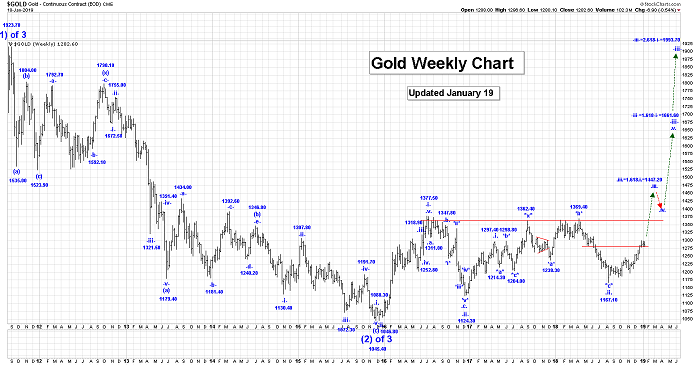

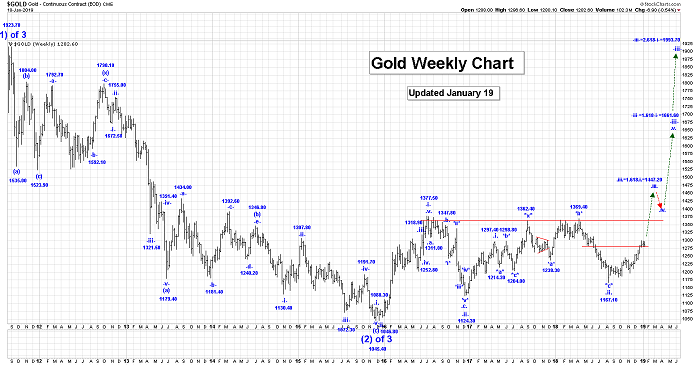

- From a big picture technical perspective, this type of daily chart action is expected and normal. To understand why I say that, please click here now. Double-click to enlarge what I consider to be the greatest weekly chart in the history of markets.

- Gold appears to be rallying from the final right shoulder in a multi-shouldered inverse H&S bull continuation pattern. Incredibly, that pattern itself appears to be just the head of a much more gargantuan pattern with a target price of $3000!

- In this situation, the current “freight train” technical action being showcased by gold on the daily chart is perfectly normal.

- Please click here now. Double-click to enlarge this key GDX daily chart. A spectacular bull flag breakout occurred on Friday.

- In pre-market action this morning, the price is gapping higher.

- Please click here now. Double-click to enlarge. That’s another look at GDX on a short-term chart.

- With the bull flag breakout now in play, stop-loss enthusiasts can now raise their protective profit-locks from $20.10 to $21.75.

- Please click here now. Double-click to enlarge this silver stocks ETF chart.

- A classic staircase chart pattern is developing. Traders can raise protective stop-loss orders from $24 to $26.

- I recommend that all investors carry some silver and associated miners in their portfolios and the $26 stop-loss level for SIL-NYSE allows investors to board this precious metals “freight train” with minimal risk and maximum potential reward!

Special Offer For Website Readers: Please send me an Email to freereports4@gracelandupdates.com and I’ll send you my free “Golden Cogs In The Bull Era Wheel!” report. I highlight six of the hottest mining stocks in the world that are poised to lead the sector in 2019, with pinpoint tactics to help traders and investors get richer!

Thanks!!

Stewart Thomson

Graceland Updates

Email:

Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?

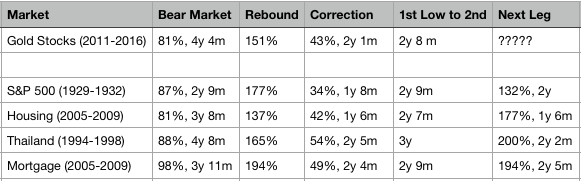

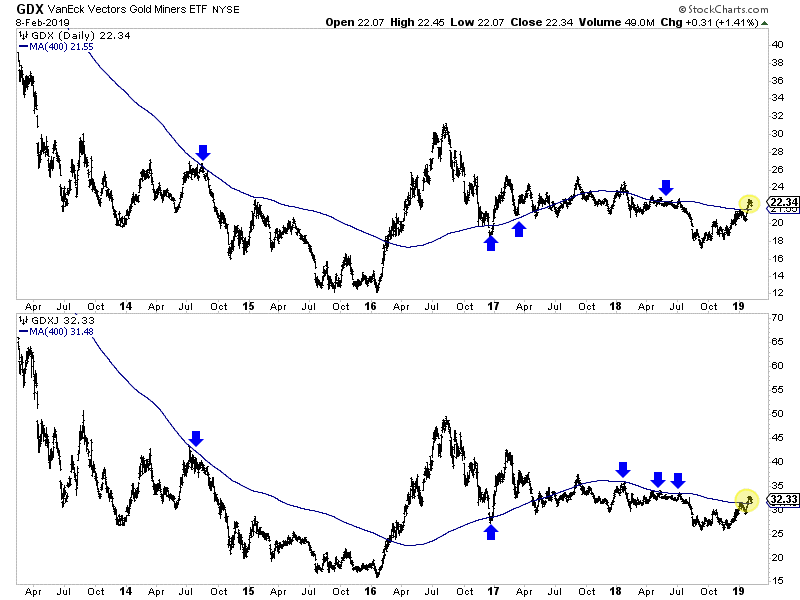

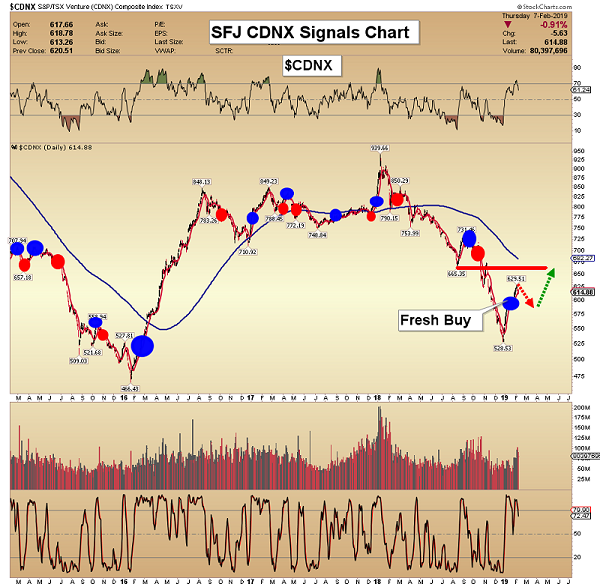

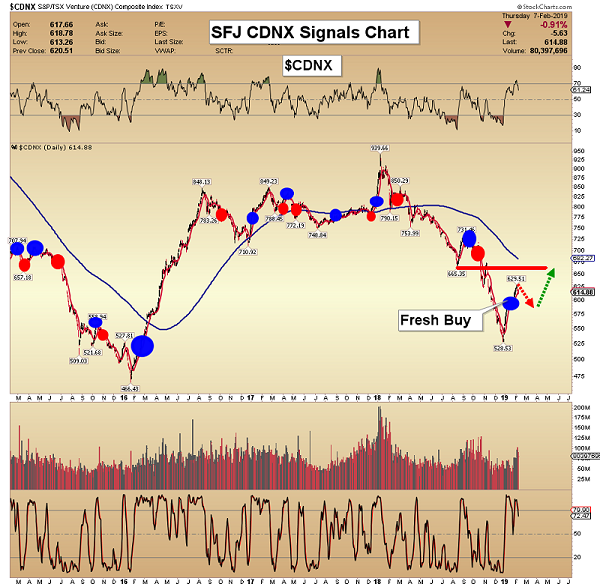

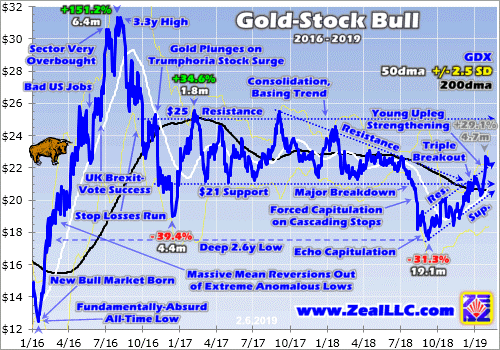

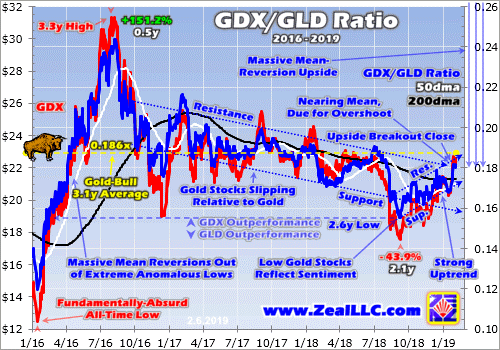

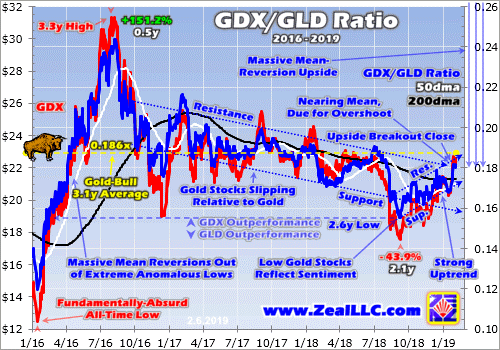

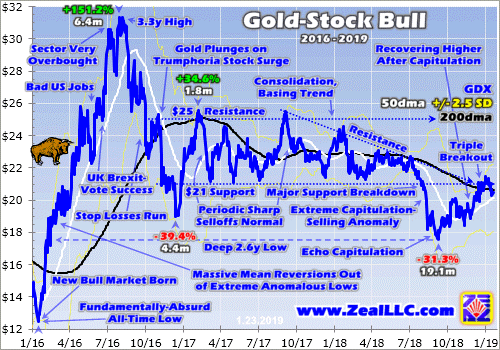

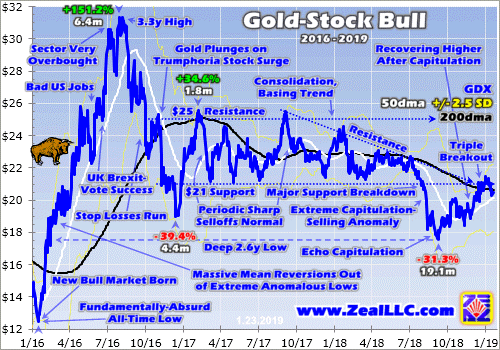

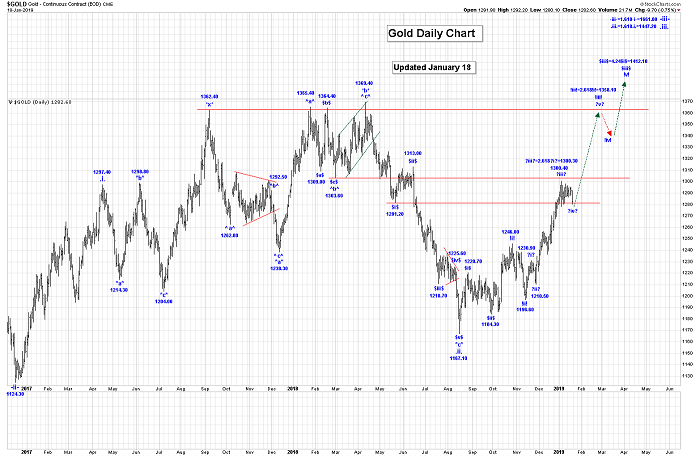

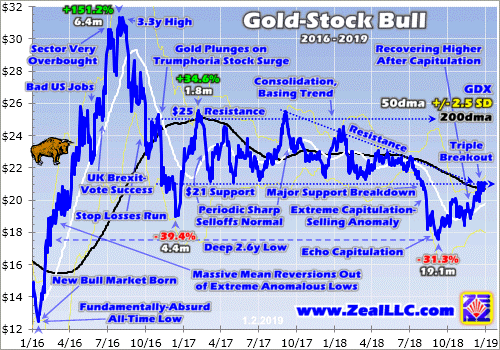

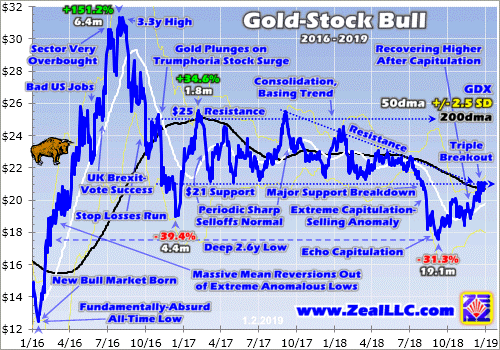

Roughly one year ago and prior to that we observed that the gold stocks could be following the recovery template from what we deemed a “mega bear market.”

We define that as a bear market that is over two and a half years in time and over 80% in price. It cuts both ways.

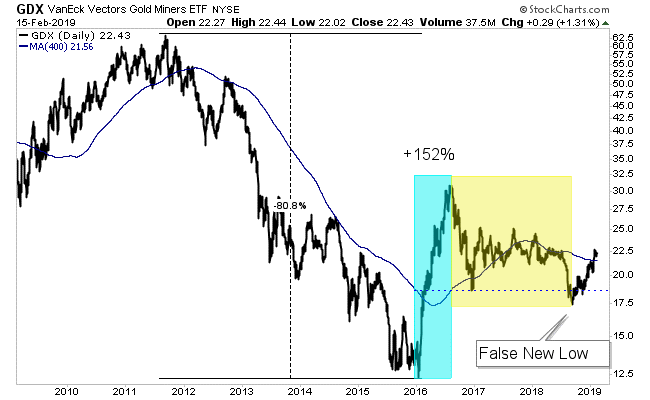

The gold stocks from 2011 to January 2016 had declined more than 80% and for more than four years. It was a textbook mega bear market.

The sharp recovery in 2016 quickly faded and left us wondering if there was a historical comparison.

Turns out, there are three strong and relevant comparisons.

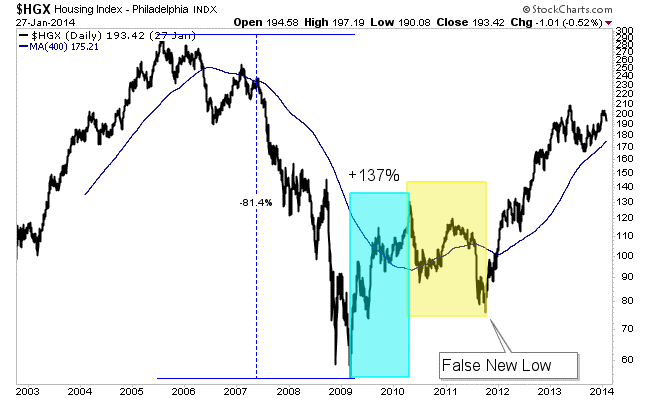

The housing sector declined 81% from its peak in 2005 to the market bottom in March 2009. Then it rebounded 137% before correcting 42% over 18 months. The correction ended with a false new low.

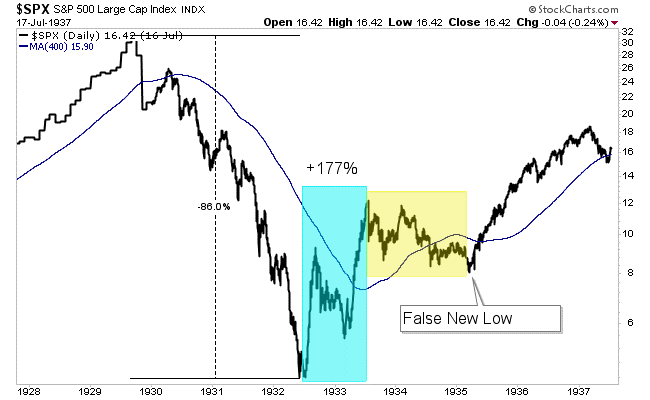

The S&P 500 crashed nearly 90% over a nearly three year period. Then it rebounded 177% before correcting for 20 months. That correction also ended in a false new low.

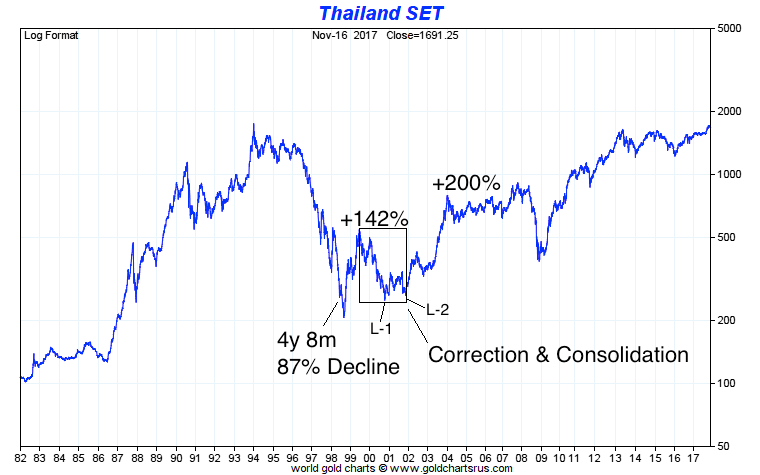

Thailand from 1994 through 2000 is quite similar to the gold stocks from 2011 through 2016. Before its 200% move higher from 2002 through 2003, Thailand corrected 54% over a 2-year and 5-month period.

Note that its final low at the end of 2001 could have been a false new low if not for the initial sharp correction down to L1.

The template for a recovery from a mega bear market is as follows.

Following the bear market low, a sharp rally begins that lasts only six to twelve months. Then the market endures a significant correction that lasts a minimum of 18 months and ends with a breakdown to new lows (which ends up being a false move).

Then the major wave higher begins.

Here is the data on those three examples, another one (Mortgage sector) and the gold stocks (GDX).

Note how the time between the bear market bottom and the correction low (for the gold stocks) is almost identical to three of the four examples. Also, note how the second leg higher surpassed the initial rebound in each example (ex S&P 500).

Here is how GDX stacks up (visually) with the others. Its rebound (and potentially second leg higher) began after the false breakdown in September.

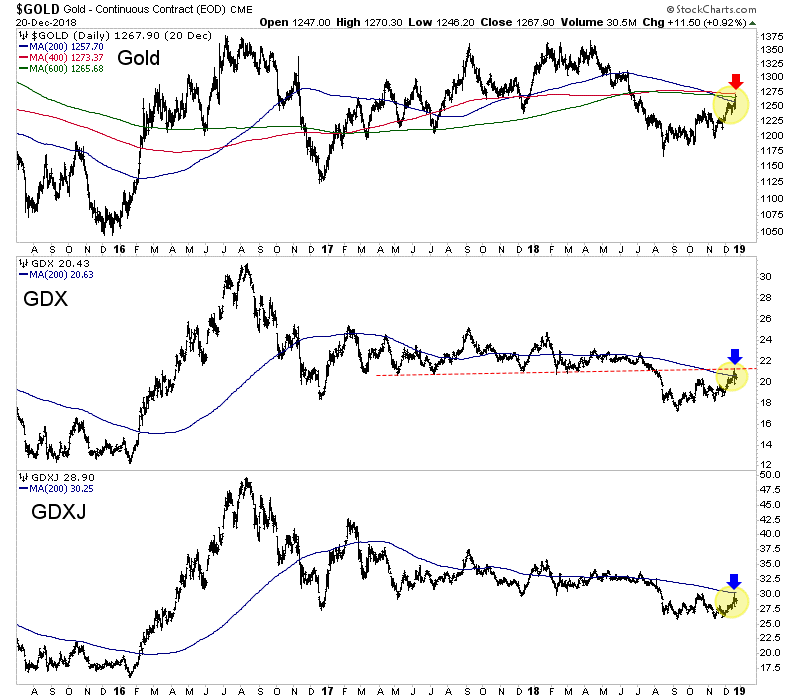

Last week we asked the question whether gold stocks would correct or consolidate in a bullish fashion. The evidence now favors a bullish consolidation. As a result, we are looking at potential near-term upside targets of $1350-$1360 for Gold, $25 for GDX and $37 for GDXJ.

The short-term trend is healthy and this historical comparison is table-pounding bullish. We’ve been increasing our exposure and will continue to do so. Plenty of great values remain and there is time to position yourself to take advantage. To learn what stocks we are buying and think have 3x to 5x potential consider learning more about our premium service.

February 20, 2019

by Jordan Roy-Byrne

The world’s two biggest gold miners both announced mega-mergers over the past 5 months or so. These huge deals briefly garnered some interest in the usually-forgotten gold-stock sector, and fleeting praise from Wall Street analysts. But gold-stock mega-mergers are bad news for gold-miner shareholders on all sides. They reveal the serious struggles of major gold miners, and really retard future upside in their stocks.

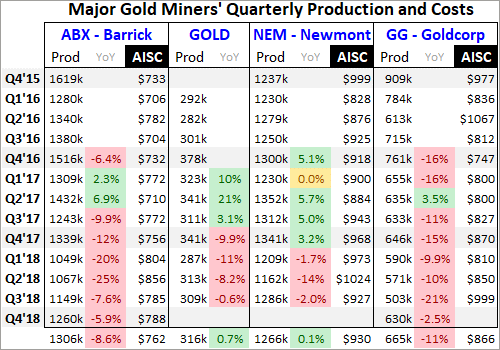

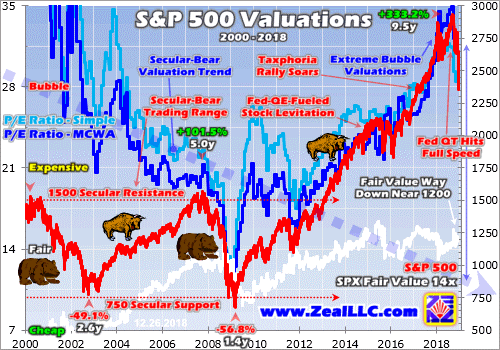

For decades the largest gold miners in the world have been Newmont Mining (NEM) and Barrick Gold (ABX). These behemoths have long dwarfed all their peers in operational scope. While the gold miners are in the process of reporting Q4’18 results now, their latest complete set remains Q3’18’s. As after every quarterly earnings season, I analyzed them in depth for the major gold miners of GDX back in mid-November.

The GDX VanEck Vectors Gold Miners ETF is the world’s leading and dominant gold-stock investment vehicle. In Q3 alone NEM and ABX mined a staggering 1286k and 1149k ounces of gold! To put this in perspective, the average of the next 8 largest gold miners rounding out the top 10 was just 508k ounces. Newmont and Barrick have long been in a league of their own, with commensurate market capitalizations.

In mid-November NEM and ABX were worth $17.1b and $14.9b, granting them massive 11.0% and 9.5% weightings within GDX. These two gold giants alone accounted for over 1/5th of GDX! That gives them outsized influence in not only that ETF, but in the entire gold-stock sector. GDX is the sector benchmark of choice for gold stocks these days, so the fortunes of NEM and ABX stocks really affect overall performance.

Gold-mining stocks are generally divided into three tiers based on their production. Anything over 1000k ounces annually is considered a major, which works out to 250k per quarter. NEM and ABX produced so much gold in Q3 they exceeded this threshold by a colossal 5.1x and 4.6x! They are really super-majors. Mid-tier gold miners produce between 300k to 1000k ounces every year, while juniors are under 300k.

Back on September 24th, 2018, Barrick Gold shocked the gold-stock world. It announced it was merging with Randgold (GOLD), which was really an all-stock acquisition of GOLD by ABX worth $6.5b. Barrick shareholders would own 2/3rds of the new combined company, while Randgold’s would own the rest. To avoid confusion, this essay uses the classic ABX and GOLD stock symbols to represent Barrick and Randgold.

ABX had been Barrick’s ticker for decades, but was just recently abandoned on January 2nd. With this mega-merger finished, the new company took over the excellent GOLD symbol going forward. That is a wise decision, as anyone who types “gold” into any brokerage account will see Barrick Gold. Years ago before Randgold got that coveted symbol, another major miner had it and really seemed to benefit from it.

In Q3 Randgold was the 10th-largest gold miner in the world producing 309k ounces. Added on top of Barrick’s 1149k, the new combined 1458k would take back the top-gold-miner crown from Newmont which produced 1286k that quarter. Apparently size matters a lot when you’re a gold-mining executive. But with both ABX and GOLD suffering chronic declining production, that mega-merger reeked of desperation.

Newmont’s leadership wasn’t happy with losing the pole position among global gold miners. So it soon got to work on looking for a mega-merger of its own. On January 14th, NEM announced it was acquiring major miner Goldcorp (GG) in an all-stock deal worth $10.0b! That looked like one-upmanship taking it to Barrick. NEM and GG shareholders would own about 2/3rds and 1/3rd of the new combined colossus.

Goldcorp was the world’s 7th-largest gold miner in Q3’18, producing 503k ounces of gold. Added on to Newmont’s 1286k, that creates a new monster running at an unprecedented 1789k-ounce quarterly rate! If bigger is better, these new combined super-major gold miners ought to be the best seen in history. But unfortunately in gold mining that isn’t true, and these new giants will likely fare worse than if they hadn’t merged.

In their merger announcements, the CEOs of all 4 of these major gold miners tried hard to sell their deals as wonderful news for shareholders. They argued that synergies and cost savings would make these new combined titans more effective at producing superior returns for their shareholders going forward. And as always with any large merger, Wall Street analysts universally applauded these mega-mergers as good.

Sadly the opposite is likely true, these deals are bad news for all the owners of Newmont and Barrick as well as former owners of Goldcorp and Randgold. These new giant super-majors are even bad news for the gold-mining sector as a whole. The odds are really high that their stocks will really underperform the smaller major, mid-tier, and junior gold miners in coming years. That will hurt this entire sector on multiple fronts.

Contrary to their CEOs’ marketing propaganda, none of these four major gold miners approached these deals from positions of strength. They’ve all been struggling with weakening production and rising costs. Gold mines are wasting assets that are constantly depleting, and it is increasingly challenging to find new gold to mine economically at the scale and pace the majors need. These mergers didn’t solve that core problem!

This table looks at the quarterly production, its year-over-year change, and all-in sustaining costs per ounce mined of Barrick, Randgold, Newmont, and Goldcorp during today’s secular gold bull. It started in late Q4’15 out of deep 6.1-year secular lows in gold. Barrick deleted Randgold’s old website, so there is no Q4’15 GOLD data. And as of Wednesday afternoon NEM and GG hadn’t yet reported full Q4’18 results.

Barrick and Newmont didn’t just effectively dilute their shareholders by 50% for some relatively-meager cost-saving synergies, but because they can’t grow their production internally. ABX’s gold mined each quarter has been falling sharply on balance for years! It has seen brutal YoY drops as high as 25.5%, which ought to be impossible for a world-class gold major. 7 of the last 9 quarters have seen big declines.

Barrick’s average quarterly production since Q4’16 plunged an astounding 8.6% YoY. The reason Barrick’s management blew $6.5b in stock buying Randgold is they desperately needed more production to mask the precipitous drop in their own. Barrick’s total 2018 production of 4525k ounces was 18.0% below the 5516k it mined only a couple years earlier in 2016. At best adding Randgold just regains those losses.

And GOLD has been suffering the same production struggles as ABX. Over its past 4 reported quarters, Randgold’s gold mined has fallen an average of 7.4% YoY. Can bringing two rapidly-depleting major gold miners together magically make a stronger one? I doubt it. Barrick’s reported production will enjoy a big temporary boost for its first four quarters as a merged company, and then waning production will again be unmasked.

While the new giant Barrick will have more capital to develop new gold mines and expand existing ones, it seems unlikely that will be enough to turn this super-major around. Barrick and Randgold operated about 12 and 4 gold mines respectively pre-merger. So bringing another few online in coming years might not move the needle enough to outpace depletion. And it takes over a decade to permit and build new mines.

The entire gold-mining industry has been greatly starved of capital largely since 2013, with 2016 being a modest exception. Thus the big investments necessary to find new large-scale gold deposits and slowly advance them to mine builds have been severely lacking. So this whole industry’s pipeline of new gold to mine has been crippled, all but pinched shut. Declining miners merging does little to solve this problem.

Newmont has fared way better than Barrick in recent years, actually enjoying strong production growth on balance from Q4’16 to Q4’17. But this past year even mighty NEM has started to suffer from waning gold production. It averaged 5.9% YoY declines in the first three quarters of 2018. I suspect NEM is just a little behind ABX in rolling over into depletion outpacing mining growth. ABX’s merger forced NEM to act.

While Goldcorp was long celebrated as the world’s best major gold miner, it has been struggling for years with slowing production. Over the last 9 quarters GG only saw one modest production gain, with its gold mined dropping a colossal 11.0% YoY each quarter on average! So although GG produces about twice as much gold as Randgold, it might be a worse acquisition target due to its faster pace of shrinking production.

Like ABX and GOLD, it’s hard to imagine combining two more weakening majors NEM and GG will yield a way to stop and reverse their falling production. Again for their first four quarters together this new giant Newmont will appear to see big annual production growth. But once that post-merger comparison rolls past, the declining gold across all its mines will again be revealed. Mega-mergers can’t negate mine depletion.

Randgold didn’t even bother reporting industry-standard all-in sustaining costs, which is why they’re not included above. But its cash costs were often on the high side, so it’s likely the new combined company will drag overall mining costs higher. Barrick’s major-leading low AISCs aren’t likely to last with GOLD’s mines thrown in the mix, which means higher costs and lower overall profitability for Barrick going forward.

Newmont should benefit more from Goldcorp’s lower cost structure. NEM averaged $975 AISCs in the first three quarters of 2018, way higher than the $877 average in Q3’18 among the GDX gold miners. GG’s AISCs averaged $886 over that 9-month span, so the new combined Newmont should benefit from lower costs. But that may not last long, as weakening production eventually pushes per-ounce costs higher.

Gold-mining costs are largely fixed quarter after quarter, with actual mining requiring the same levels of infrastructure, equipment, and employees. So slowing production yields fewer ounces to spread mining’s big fixed costs across. If these new super-major gold behemoths can’t arrest their depleting production, their costs will inevitably rise in the future hurting profitability. Again these mega-mergers didn’t solve that problem.

So it looks like the managements of Barrick and Newmont just issued $6.5b and $10.0b of new stock so they could report big merger-driven production surges for a single year! Once those pre- and post-merger year-over-year comparisons pass, the vexing waning-production problems at all four of these predecessor gold miners will again become apparent. But that’s not even the biggest reason these mergers are bad news!

Even before these mergers as apparent in mid-November when I analyzed Q3’18 results, both Newmont and Barrick already had very-large market capitalizations of $17.1b and $14.9b. That again granted them massive 11.0% and 9.5% weightings in GDX. Like most stock indexes and ETFs, GDX’s components are weighted by market cap. Goldcorp and Randgold ranked 6th and 7th then in market cap and weightings.

Adding NEM and GG together as of mid-November would catapult their market cap and GDX weighting to $25.1b and 16.0%. Adding ABX and GOLD together yields a similar $22.3b market cap and 14.5% total GDX weighting. So these two super-majors alone could account for a crazy 30.5% of GDX’s weighting! That is almost scarily concentrated, although we don’t yet know how GDX’s managers will deal with this.

As of this week the new combined Barrick only has an 11.1% GDX weighting, while Newmont is at 8.2% since its mega-merger is not yet consummated. It will be interesting to see whether the new companies’ weightings going forward are kept in market-cap proportion or somehow limited. I hope it’s the latter, as many of the other gold miners in GDX have far-better growth prospects than these new super-majors.

ETF weightings aside, higher market caps create plenty of problems of their own. I’ve written essays in the past on picking great gold stocks, and surprisingly market capitalization is the single most important factor for future gains. The gold stocks with the largest market caps usually significantly underperform their smaller peers. These new super-majors are so darned big that they really compound this problem.

In mid-November when I analyzed the GDX miners’ Q3’18 results, the average market cap of its top 34 component stocks was $4.3b. Excluding NEM and ABX, that fell to $3.5b. It takes proportionally more capital inflows, investors buying shares, to push a larger stock higher than a smaller one. If the super-majors are worth $24b, it takes 6x as much buying of their stocks to drive the same gains as on a $4b company!

Imagine the different forces involved turning a supertanker versus a tugboat. The bigger any stock in the stock markets, the more inertia it has and thus the more capital is needed to overcome that and move the stock. And market-cap issues are not just a size thing in gold stocks. Smaller major, mid-tier, and junior gold miners have way fewer gold mines and much-lower production, which makes it far easier to grow output.

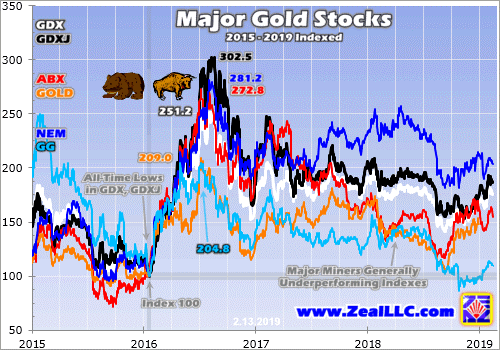

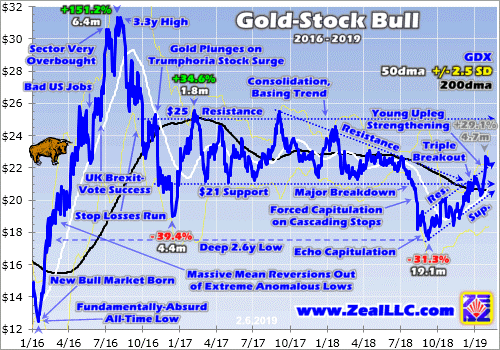

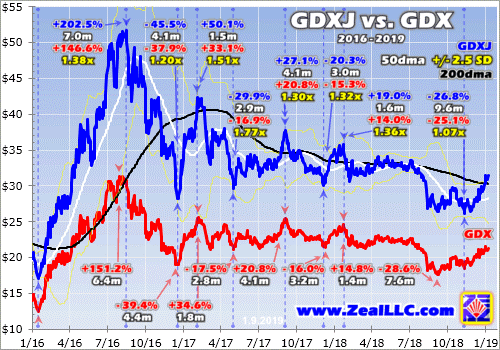

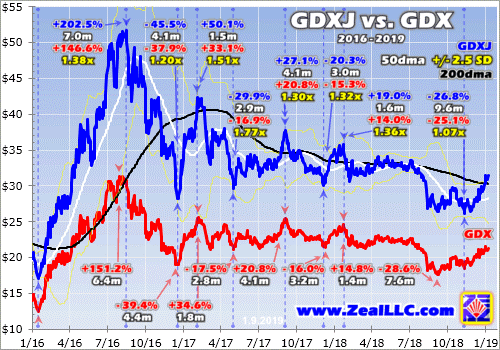

While Newmont is a temporary exception since it was bucking the major trend and growing production in 2017, Barrick, Randgold, and Goldcorp all really underperformed their sector in recent years. This chart looks at the indexed performance in ABX, GOLD, NEM, and GG stocks compared to the leading sector ETFs of GDX and the smaller GDXJ which largely tracks mid-tier gold miners under 1m ounces annually.

Both GDX and GDXJ fell to all-time lows back in mid-January 2016 when this gold-stock bull was born. So all 6 stocks are indexed to 100 as of that day, revealing their relative performance since. Despite their heavy weighting in GDX, the major gold miners generally lag their key sector benchmarks. ABX, GOLD, and GG have really struggled in recent years as their managers failed to stem big production declines.

This chart is pretty damning, showing why the managers of Barrick and Newmont are desperate to show rising production even if only for a year after their wildly-expensive mega-mergers. ABX and GOLD have both been really underperforming their peers, scaring investors away while putting serious pressure on managements to turn things around. NEM resisted that, but its production started to decline too in 2018.

And GG has been a basket case, actually managing to fall below its deep secular lows of early 2016 in recent months! That’s a sad fate for what was the world’s best major gold miner for many years. NEM buying this dog is likely to drag down NEM’s stock performance to some midpoint between what it has done and how GG has fared. For the most part the largest gold miners haven’t been good investments.

The much-larger market caps coming from combining struggling majors into super-majors is highly likely to exacerbate this underperformance trend. The new Newmont and Barrick are way bigger and far more ponderous, and will require a lot more share buying to move their stock prices materially higher. But why will most investors even bother to buy these titans when many smaller mid-tier gold miners are thriving?

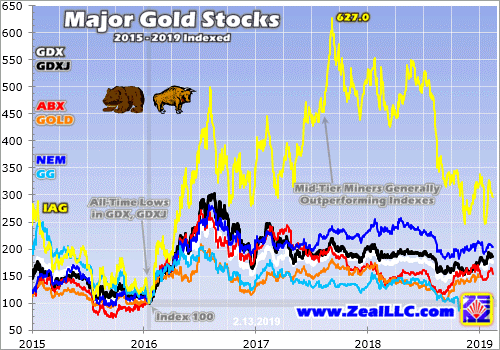

This next chart adds a single additional mid-tier gold miner to illustrate their outperformance. I chose IAMGOLD (IAG) for this example for a couple reasons. It produced 882k ounces in all of 2018, which makes it a larger mid-tier gold miner nearing that 1000k+ major threshold. And IAG is unremarkable fundamentally. It mined the same 882k ounces in 2017, so there was no production growth at all last year.

And its 2018 all-in sustaining costs are expected to come in on the high side near $1070 per ounce, which is worse than most of the majors. So there’s really nothing special about IAG operationally suggesting it should far outperform. If I wanted to cherry pick, there are other mid-tier miners that have trounced what IAG has done in recent years. Yet even IAG wildly outperformed the majors and sector ETFs during this gold bull.

If Newmont and Barrick were the only gold-mining stocks, they’d certainly be worth owning during a secular gold bull. But why own these massive supertanker-like gold miners when smaller major, mid-tier, and junior gold miners’ stocks are performing way better? The smaller miners not only have lower market caps easier to bid higher with much-smaller capital inflows, but plenty also have superior fundamentals.

They tend to have just a few or less gold mines, making it much easier to grow production by expanding existing mines or building new ones. Those expansion events act as major psychological catalysts to get investors interested in those stocks, fueling disproportionally-large buying to catapult them higher. There is really no reason to deploy capital in large majors when mid-tiers are easily running circles around them.

Even if like me you don’t own Newmont or Barrick and have no intention of investing in them, they could cause problems for the entire gold-stock sector. Their hefty GDX weightings mean their stocks have way-outsized influence in how that leading ETF fares. If these super-majors’ giant stocks lag, they are going to retard GDX’s upside which in turn will leave traders less optimistic and more skeptical on gold miners’ outlook.

So mega-market-cap gold miners could significantly slow the overall sentiment shift from bearish back to bullish which is necessary to attract in buying. If capital inflows diminish because of the perception this sector isn’t rallying enough, the bull-market uplegs will unfold slower and maybe end smaller. Even more problematic, the super-majors’ high weightings in GDX suck ETF capital away from more-deserving miners.

Most investors prefer sector ETFs over individual stocks, so lots of capital will flow into GDX as investors get interested in gold stocks again. GDX’s managers have to allocate any differential buying pressure into its underlying component companies in proportion to their weightings. The newly-merged Barrick and Newmont will likely command much-bigger weightings, starving smaller component miners of capital inflows.

But despite these mega-mergers being bad for everyone except the managers of those companies paying themselves huge compensation, all is not gloom and doom. If the new Newmont and Barrick continue to suffer waning production after their initial merger-boost year, investors will shift capital out of them into the other gold miners. That will gradually throttle their market caps and thus weightings in GDX, mitigating damage.

And if these super-majors taint the performance or expected upside in GDX enough, GDXJ may very well usurp it as the gold-stock sector benchmark of choice! While falsely billed as a Junior Gold Miners ETF, GDXJ has really become a mid-tier gold miners’ ETF. It has been increasingly outperforming GDX, and that trend could accelerate since GDXJ will hopefully never include the larger majors led by NEM and ABX.

With so many fundamentally-superior smaller gold miners to pick from, investors have no need to own the larger majors. Plenty of mid-tier miners are still growing their production organically, by expanding their existing mines or building new ones. Their upside as gold continues marching higher in its bull market is enormous, dwarfing what is possible in the giant majors struggling with waning production. Avoid the latter!

One of my important missions at Zeal is relentlessly studying the gold-stock world to uncover the stocks with the greatest upside potential. The trading books in both our weekly and monthly newsletters are currently full of these better gold and silver miners. Most of these trades are relatively new, added in recent months as gold stocks recovered from deep lows. So it’s not too late to get deployed ahead of big gains!

To multiply your wealth in stocks you have to do some homework and stay abreast, which our popular newsletters really help. They explain what’s going on in the markets, why, and how to trade them with specific stocks. Walking the contrarian walk is very profitable. As of Q4, we’ve recommended and realized 1076 newsletter stock trades since 2001. Their average annualized realized gain including all losers is +16.1%! That’s nearly double the long-term stock-market average. Subscribe today for just $12 per issue!

The bottom line is gold-stock mega-mergers are bad news for everyone in this sector. Combining major gold miners already struggling with slowing production doesn’t solve the problem, but only masks it for a single year. The resulting super-majors’ massive market capitalizations saddle their share prices with big inertia. They are going to require much-larger capital inflows to rally materially, really retarding their upside.

Their higher weightings within sector ETFs will lead to worse perceived sector performance, delaying the necessary sentiment shift from bearish back to bullish. And the super-majors will suck up more of the capital allocated to gold-stock ETFs, starving smaller and more-worthy gold miners of buying. Thankfully some of these problems can be avoided by shunning Newmont and Barrick, and sticking with great mid-tier miners.

Adam Hamilton, CPA

February 19, 2019

Copyright 2000 – 2019 Zeal LLC (www.ZealLLC.com)

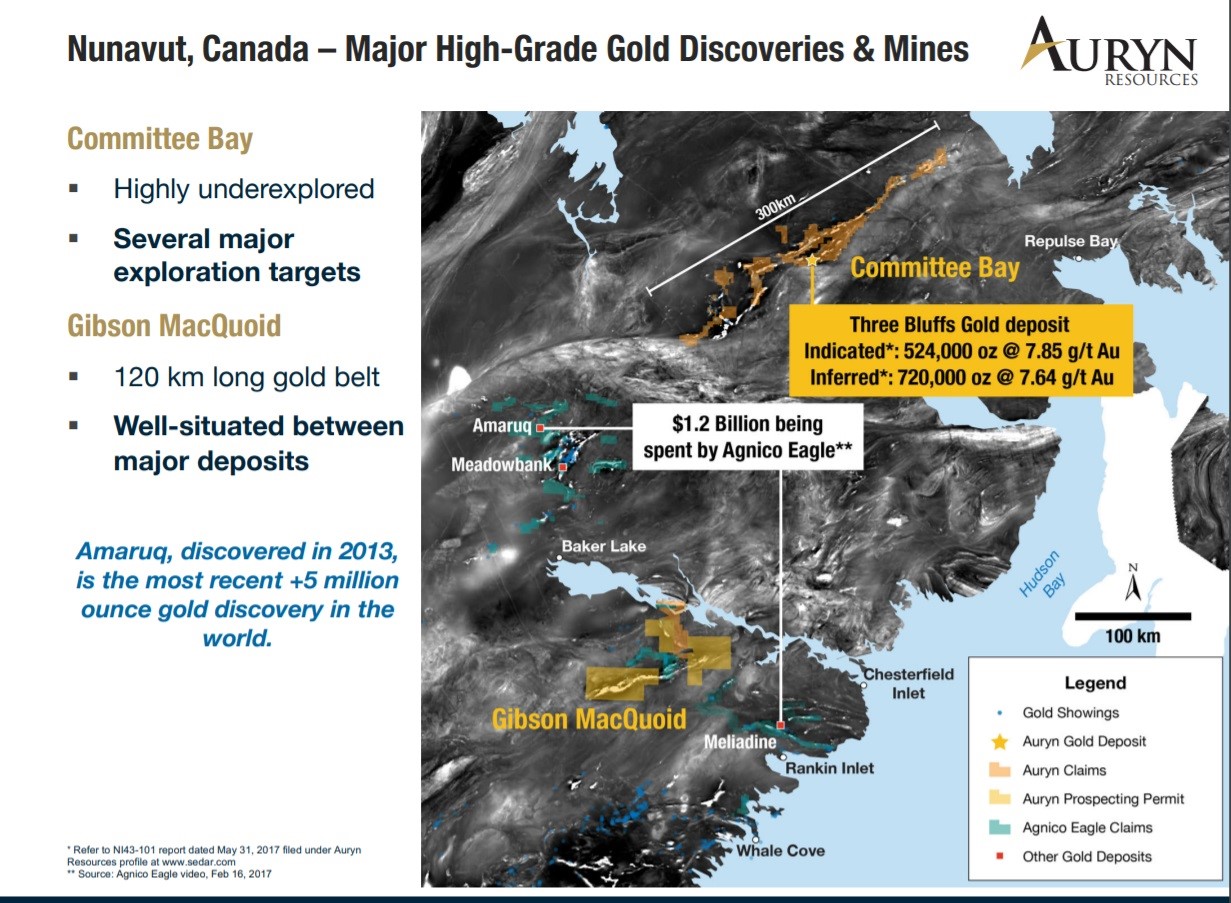

Executive Chairman Ivan Bebek and his team at Auryn Resources have already built and sold two successful exploration companies. But now they are convinced that they are on the cusp of two potential world-class discoveries that will far exceed their previous successes. In this interview, Ivan shares how Auryn assembled a top-notch technical and management team who have been able to locate and now pursue what they believe could turn out to be massive discoveries at their Committee Bay project in the Arctic and at their Sombrero property in Peru. Ivan discusses in detail not only the prospective nature of these projects, but also how he plans to fund up to four years of aggressive exploration with no shareholder dilution. Auryn Resources will see steady news flow throughout 2019, so this is an exploration story worth following.

Bill: Welcome back, and thanks for tuning into another Mining Stock Education episode. I’m Bill Powers your host. Joining me today is Ivan Bebek, executive chairman of Auryn Resources. Auryn is currently looking at numerous potential catalysts in 2019, so this is a story that you’ll definitely want to pay attention to. Auryn trades on the TSX and NYSE American under the ticker AUG. Fully diluted the company has under 97 million shares out with a current market cap of a little under US$100 million. So with that being said, Ivan, welcome to the podcast.

Ivan: Thank you so much. Pleasure to be here.

Bill: Ivan, as you know, we were able to meet in person at Minds and Money Toronto last October and we talked, it was supposed to be for 25 minutes, we ended up speaking for an hour and 15 minutes. And during the course of that conversation, we talked about one of your key projects, Sombrero, and you really got me excited by just the confidence and the belief that you’re onto something world class here. You’ve already built and sold two successful mining companies. I’d like to start off with you sharing regarding the anatomy of making a world class discovery. What does it take? You’ve done it twice, but this one seems to be even bigger with Auryn right now. What does it take to put together a team that can really pursue a world class discovery?

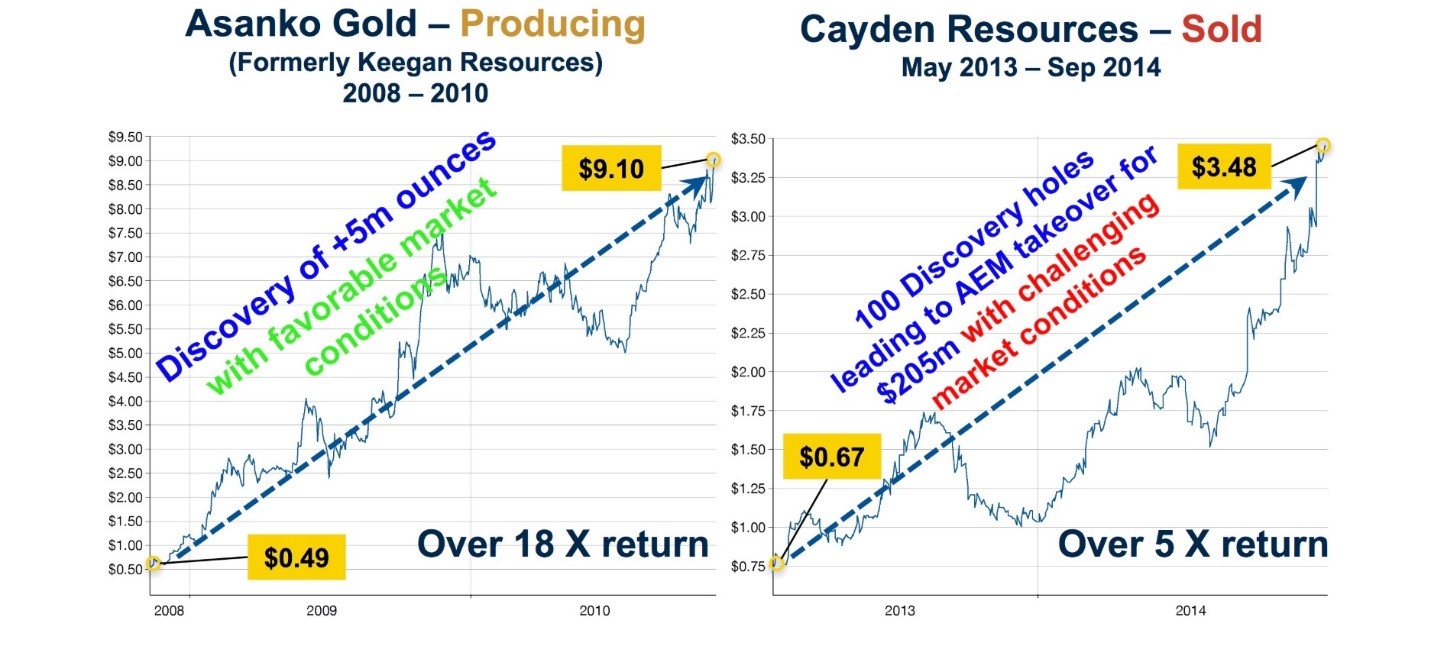

Ivan: Well thank you very much for having me on here, it was nice to meet you back in Toronto. So the anatomy of a team, it sounds easy once it’s done, but it’s actually not. We’ve been working together as a group for 13 years. My partner Shawn Wallace and myself, we started Keegan, we found 5 million ounces of gold in Ghana, West Africa that’s producing 10 million ounce gold mine. We did that with a really small team and we did that as our inaugural company to prove ourselves. We evolved as we went along, as you would, and I would say the main ingredient of creating a great team is success. And so finding 5 million ounces of gold was the first success.

We then poured into another exploration opportunity and we tried to improve on what we did with Keegan and expand that team and that’s where we came up with Cayden and where we sold it to Agnico Eagle for $205 million in 2014. Both share prices performed extremely well for shareholders. The first company went from $.49 to $9 per share. The second one went from $.67 a year before the takeout, to a $3.50 takeout share price, which doubled if you held shares Agnico for 14 months later.

So not only did we attract a lot of these really high-quality geologists, Dan McCoy, who is our key geologists that brought us into Keegan and Cayden’s assets, he’s the gentleman who recruited these Newmont gentlemen, Michael Hendrickson and Dave Smithson and are leading the charge for Auryn. So we had technical success. We impressed our own geologists with our financial capabilities and then we had market success, which gave us the ability to raise a lot of money which being over $600 million since 2005 in combined good and bad markets, which is a fairly impressive number if you followed the last decade of mining stocks and whatnot.

So that comes down to how we came together with Auryn and how this anatomy of going after these major world-class discovery exists. And this is where we took him,. The gentlemen Dave Smithson and Michael Hendrickson, both from Newmont, Michael Hendrickson was a former structural geologist, Dave was the former global mapper. They were imperative on the Cayden sale. These gentlemen brought a bunch of world experts from Newmont, including the former chief geologist of Newmont, Antonio Arribas, who’s on our board, Antonio was also the VP of Geosciences for BHP, a $140 billion base metal company today. Anyway, these guys brought in some of these world experts; about six in particular, They all have different expertise, different backgrounds. So it’s not one geologist that’s doing every element of the science is each guy has done his own science as an expert and they work together as a team.

They found several million ounces for Newmont. They were imperative in our success and Cayden. And when we assembled Auryn we went out and said, “Hey guys, we want to do something bigger than we’ve done before. Five million ounces is great. It made people a lot of money, but we want to have a 10, 20 million ounce discovery or two on our belt and let’s go shopping. Let’s go do this. We have a lot of wind behind our back from Cayden and we’ve made a lot of people money, our ability to raise money is incredible.” And then we had went out and we built a seven project portfolio in Auryn. So first major part of the anatomy is technical team. We earned that through our successes of our first two companies.

Second major part is the portfolio project and if you remember 2014 when we put Auryn together and started to assemble the company, we went out and acquired stuff that was worth pennies on the dollar. We bought Committee Bay for $18 million. It cost us 13 million shares. That company used to trade at a $200 million valuation as North Country Gold in the last bull market. So these are the kinds of asset buys we were doing and we were buying major district opportunities, large scale, that’s a 300 kilometer long gold belt. And then in that process we met a guy named Miguel Cardozo. Miguel Cardozo is part of our team. He runs our Peruvian operations. Miguel’s credited with the discovery of Yanacocha as a gold deposit when he worked with Newmont in Peru. That’s a 60 million ounce epithermal discovery in Peru that he made where he led the charge of.

So this is kind of the people we got to work with. This is kind of the outlook we went and took on and what we internally described ourselves as intelligently as a junior exploration company with a majors’ exploration team and a majors’ exploration appetite. And so fast forward a few years, we’ve obviously raised quite a bit of money for Auryn, about $100 million to date. Along that path we met Goldcorp and Goldcorp recognized the scale of some of these gold projects and copper gold now with Sombrero coming online, and they came in and gave us $36 million dollars, which was the largest investment by a major into a junior in the entire market I think in the last 20 years as initial investment. So that was a tremendous validation to what we’ve assembled, and we’re now at the pinnacle of two massive discoveries. One being potentially at Committee Bay and the other one down being at Sombrero. And the way I’ve been describing this for the investing audience is I believe as an investor and as an executive with bias because it’s our company, but I’m still looking for something on the planet that rivals the exploration potential both in Sombrero and Committee Bay and I have not found it yet. So I think categorically these are two of the biggest exploration swings you can take as an investors, as an executive right now in the business.

Bill: So you’ve been in this business for 20 years, would you say that Sombrero ranks right at the top?

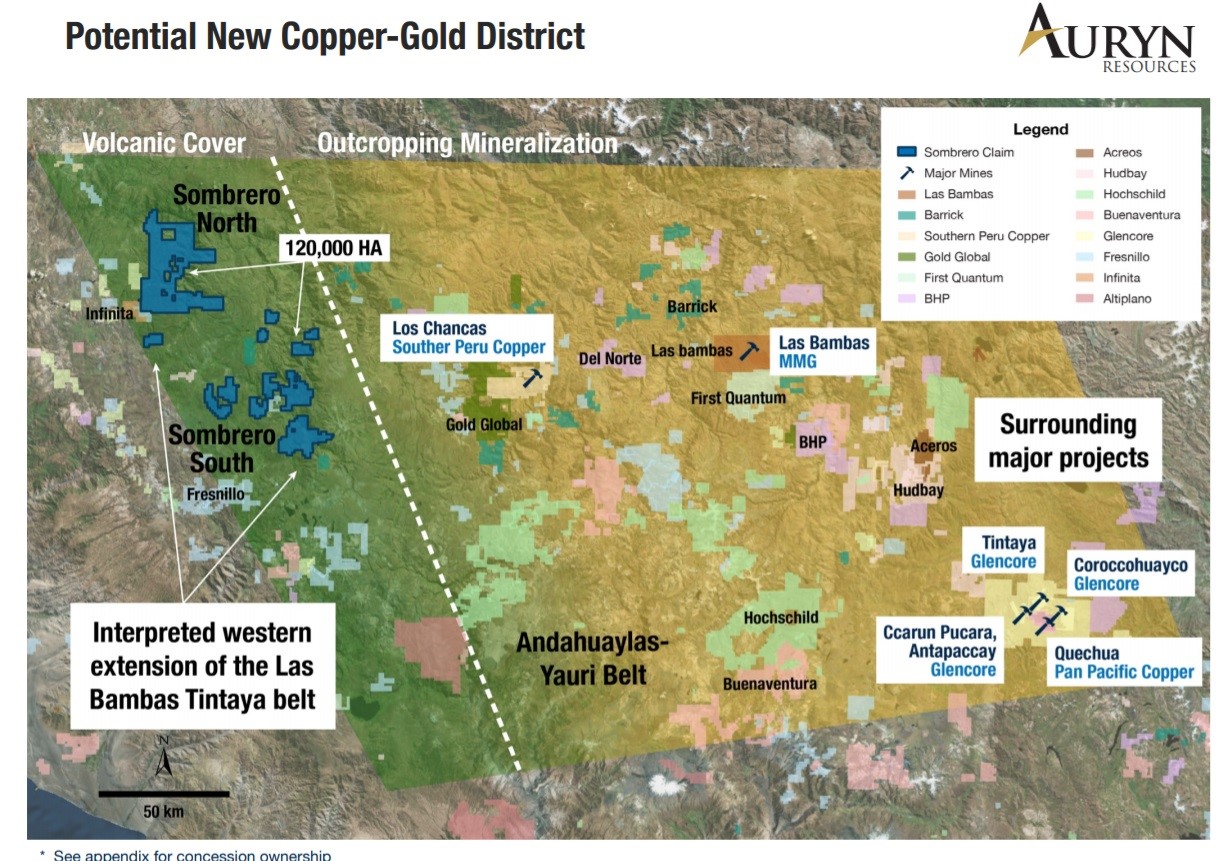

Ivan: I’d say by far, I’ve seen things as an investor, I got to be a shareholder an Aurelian, that was a tremendous discovery in Ecuador. I was a shareholder in Red Back mining, which was the discovery in Mauritania, that 30 million ounce deposit over in Africa. Looking at Sombrero pre drilling, we’re comparing it as an analog and the video on our website does a very good job of doing that to a mine called Las Bambas. Las Bambas is about equivalent of 50 million ounces of gold or $60 billion of metal. It’s copper-moly, we’re copper-gold, and that’s obviously a better factor for us, but the scale of what we’re exploring there it rivals the Las Bambas deposit in size and the more we look, and the more layers of data we take, the more confidence we have that we might be onto a big system like that. And it’s never been drilled before, the evidence is really, really strong and we’re continually signing (confidentiality agreements) on it, something I haven’t talked too much about, but several of the major mining companies around the world have come to us to sign confidentiality agreements so they could get a really close look at this before we start drilling it later this summer.

Bill: An astute investor is going to listen to us talk about the potential and they might ask themselves, well, if the potential is so great, how did MMG or BHP and some others in the region miss this opportunity? And what would be your response to such an investor?

Ivan: Well, my response would be the facts. I think about six different major companies, including the ones you have mentioned have walked on this property before and have taken a look. The first miss, and everyone’s recognizing this across that crowd because all of them have come back to sign confidentiality agreements and there’s obviously dialogue about why they missed it. The government actually mapped the volcanic rocks which cover most of the outcropping mineralizations covered by volcanic rocks. It was mapped at a very young age, that a lot of people didn’t believe would host the deposits next door, people were in a box in this part of Peru, there’s not just Las Bambas, there’s about five major copper-moly porphyries next door within 50 to 200 kilometers away, this major belt. We believe this is the extension of the belt, we believe it was missed because there’s volcanic rocks that cover a lot of the potential mineralization. People thought it was young.

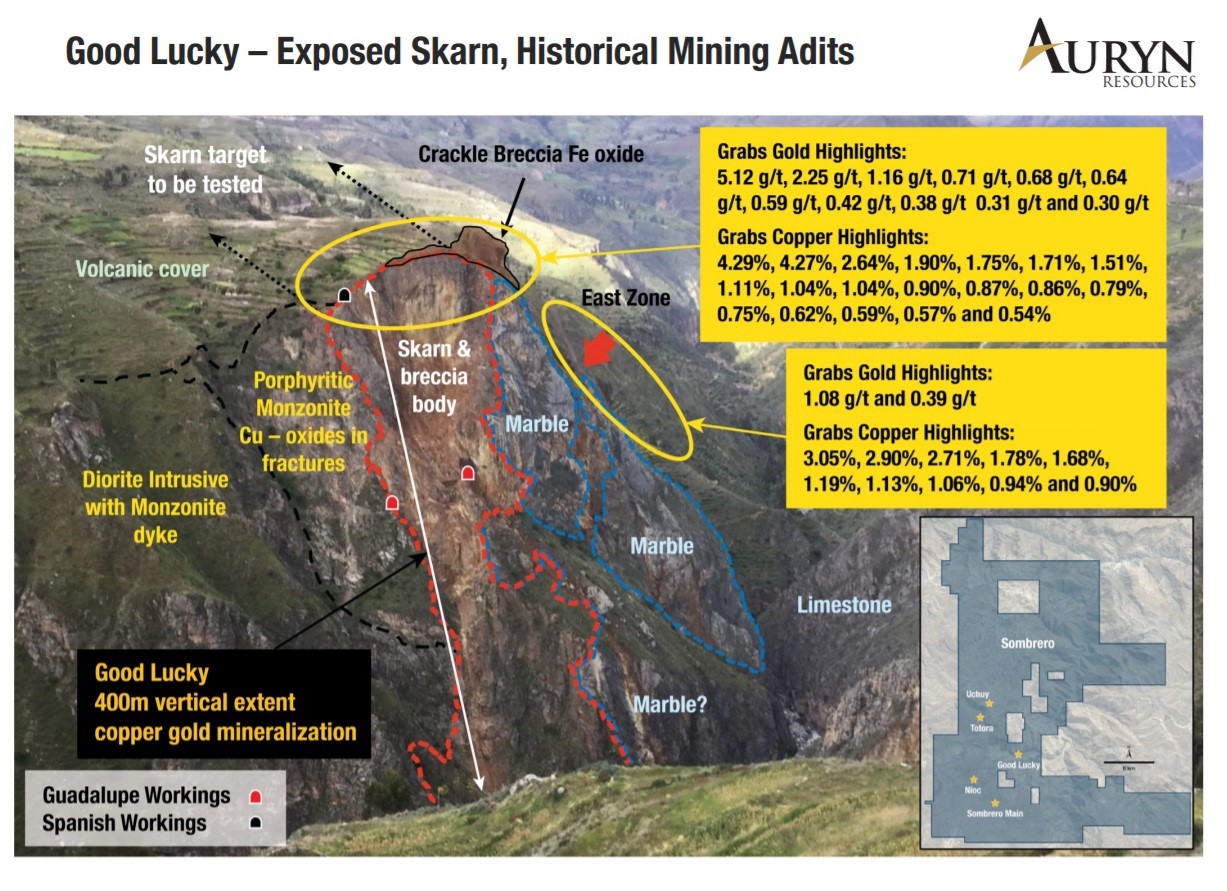

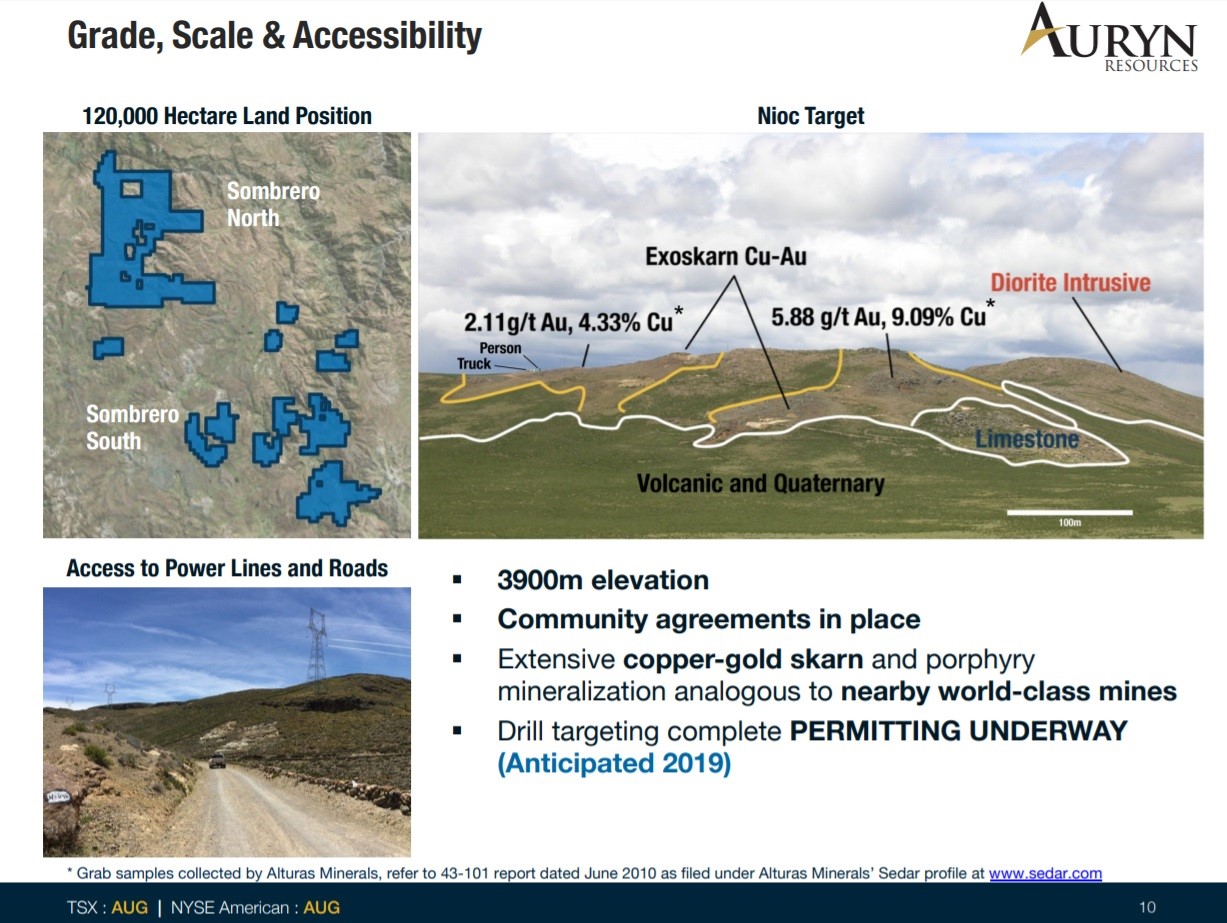

We are the first ever people to pull trenches on Sombrero. We got to pull back the cover, we got to pull back the gravels and we got to sample, one of those trenches ran 109 meters of .7% CuEq. That trench has gaps in it and we just gave ourselves zero in that calculation because we couldn’t sample the whole entire trench, but part of the trench ran 30 meters of 1.93% copper, which is spectacular. What’s even more impressive about that is that we’re trenching in the world of copper, gold porphyries, high grade copper-gold over 100 plus meters width. And that’s truly spectacular. So the guy’s like possibly MMG or BHP or any of the others that have missed this, had they seen these trenches that we’ve been pulling, we’ve got another 150 meters of a half a percent copper gold in another area. We got gold grades on surface up to a 193 grams per ton. We have copper up to 16%. There’s a tremendous metal budget here, there’s plus hundred meter widths of really, really high grade copper and gold being sampled by us. Nobody would have ignored any of this and that’s why everyone’s come to sign CA’s.

The crowd has definitely shifted and our geologists said we went outside the box and I’m going to quote Dave Smithson in here actually, his comment was, “We first came here and nobody liked it because they saw gold but they were looking for copper and we saw hill side on our second visit called “Good Lucky”. You could see on our website or in our presentation a really beautiful section of a hill where river cut a canyon and you could see mining at it in the side of the hill where they were mining high grade copper halfway down a 400 meter cliff. And then we went down to the bottom, we see bornite, which is high grade copper, huge metal for high grade copper if you know the copper world. But people were looking for copper and they were focusing on this project, considering it to possibly be a gold rich project, and obviously that changed dramatically for us and it’s been basically every visit we’ve done on the property since things have gotten better, we found more outcropping mineralization, we found sampled more high grade and a lot of other elements that are really giving us a strong indication this could be a major copper gold system.

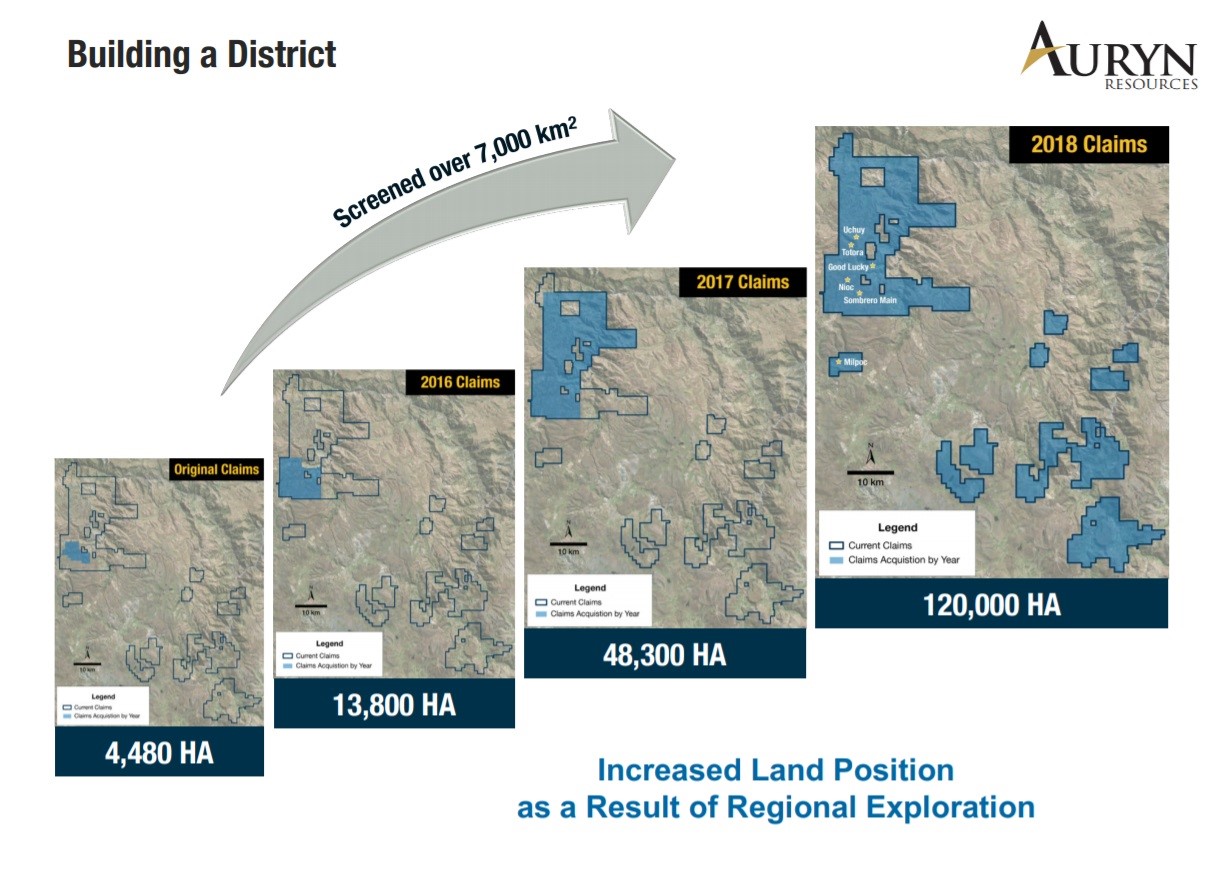

Bill: And after you discovered a lot of these excellent surface results, then you massively increased your land package. Can you talk about that?

Ivan: Yes. So we started with about 5,000 hectors, we got the project from Miguel Cardozo, the gentleman who found Yanacocha as a gold deposit. And we quickly got excited about it because we found copper gold at the edges of our property boundary. So we did what any smart, intelligent, aggressive junior would do, and we start staking ground all around us. We got to about 40,000 hectare land position through the staking. And then our guys, Michael Hendrickson and Dave Smithson, they turned and said, “Hey guys we have this very special way of sampling streams at the bottom of canyons to determine if there’s gold or copper or other metals running off the rocks that are predominantly covered. Can we go screen 8,000 square kilometers?

Jaw drops, that first 8,000 square kilometers, that’s a lot of screening. How much is this going to cost? It costs us about probably about US$700,000 to do this. Obviously we were well financed when we chose to do this, and then we increased our land position to 120,000 hectors. We did this for two reasons, one, first and foremost, because if we got Sombrero right and if this belt continues, that host some of the world’s largest copper porphyry deposits, we want to have as much of that as possible. And the second reason why we did it was we knew when we got on Sombero, everyone’s going to come if we start pulling hundred meter plus trenches of mineralization, which is exactly what’s happened as of now. So we wanted to be first. We were. We wanted to be greedy and we wanted to have the potential, not for one Las Bambas or Tintaya, we wanted multiple of those type of discoveries to be in our land position for the next decade of discoveries. And I believe we’d given ourselves the perfect shot. We got everything we wanted and now we’re comfortable to sign CA’s and let the big guys come in and take a look.

Bill: What is it going to cost to drill this project this year? Can you talk any more about the targets you have and the timeline that investors should look to this year?

Ivan: Yeah. So a couple things, right now we’re in the permitting phase, we’ve applied for 40 drill pads, which gives you a lot more room than the typical 20 you get in an initial permit, it takes a couple more months to get this permit but like I said, we’re in process, we are well on the way, we expect it June/July of this year. It can take a month or two longer, you never know. But right now we’re on track. We don’t see any foreseeable delays.

We’re going to drill 15,000 meters, is our plan on our first path, that will cost us about $5 million Canadian to do that first path of drilling, not a huge cost, we don’t have to worry about having money for that until we get permits later this summer. We’re about to resume trenching, we’ve only trenched and sampled one of five major centers that could be standalone flagship company making assets. So we’re about to get our trenching resuming to go on trench number two, number three, number four, number five, so by the time we’re actually drilling, we will have had five major centers all sampled, ready for permitting and drilling.

And so we’ve got our hands full, we’re going to have a lot of news for the market in terms of trenching these new areas. You kind of have to listen to the punchline, we’re comparing ourselves to Las Bambas and were saying that this thing could be as big as Las Bambas and we’re only on the first of five major targets, so we’re going to be following that up here quite shortly with trenching to show a bunch more things that could also be big discoveries like that. So perfect case from an exploration investor’s perspective, you’re waiting for drill permits while you keep adding more huge targets to the equation.

Bill: What about your relationship with the indigenous people and is there any infrastructure nearby?

Ivan: Yes. So a couple of things there. The local communities we took our time with them, we are under the guidance of Peruvians, Miguel Cardozo’s managing them. Instead of rushing, trying to get the drill bit out, we built really strong relations, took us about a year for the first major community agreement and that one’s been working out really well since we’ve done that. The second one has taken us just over two years and we’re just collecting signatures now, so it’s in the phase of being complete.

I’ll say one comment about Peru and communities, this is one of the major risks that can come up for any company that’s operating there, we came into Peru with a different project and the first thing we did before we took any samples off the ground was bringing a million dollar water program to bring water and irrigation to their fields. We spend about $240,000 over four years and then we brought in an NGO to come in and pick up the balance to do that. So what I heard when we first got to Peru and what we heard as a team was the people who came in the last bull market came and gave everybody money, but they left and there was no sustainability factor. Money was spent and communities, we’re a little bit upset in some areas of Peru.

So our theme as a group, as action before words. So we come in there and we started doing things for the communities before we start talking and making promises and stuff like that along the lines of what we will do. And so we’ve covered that part incredibly well. The second part of your question was asking me about the infrastructure. Since we’ve had the Sombrero project, and we like to think the government was foreshadowing the discovery because they built high tension power lines over the edge of our property. We have power for a major mine at our project. There are roads right into the project. There are two towns with about 800 people peripheral to the project, not on top of it, nobody has to be moved but nearby where we’d have a local workforce. We’re only at 3,900 meters elevation. People mine up to 5,500 meters elevation in the Andes. And so it’s reasonable an elevation, you have a road to the project, you have a power source which generally is a major cost factor.

So we have to think about, when I say all of those things, to answer your question, it’s profitability. Couldn’t be a better scenario. The only thing that could improve this would be a railway and if you go and google “Las Bambas railway”, you see there’s a lot of talk about one that’s nearly approved to be built from Las Bambas and all these other major nearby mines to the coast, which would be a tremendous add onto us. It’d be perfect infrastructure from all aspects.

Bill: You had told me back in October that you plan to aggressively pursue Sombrero as well as Committee Bay, which we haven’t spoken about yet, but how do you expect to fund this program?

Ivan: Yeah. So were we had $2 million in January last month, is how we started the year. That will take us into May before we need any more money. If you listen to me or any of my colleagues on the road right now, we’re not looking money, we’re going to be marketing our company to create awareness about the opportunity. And sharing the trenching and about the Committee Bay, which we’ll talk about in a minute. But we’re not looking for money because we have seven projects, two of them we’ve been very public about, are ones we’d consider selling if we got the right prices for them. And one of them is two years into the negotiation, the other one’s about a year and a half, so we’re at very mature stages of potentially one of these two things happening before we have to say the word “financing” again.

Conservatively, one of them would give us one year of drilling and working capital, is what we anticipate. If we sell the other one, we might end up with a combination of about four years of aggressive drilling and working capital to go out there and not have to say the word “financing” for four years would truly be spectacular for us with these kind of big projects on the deck.

Bill: If you were to sell both of them in the near term, what do you think that would do to your market capitalization?

Ivan: Oh, well, 90 million shares out issued and outstanding, the price I would speculate we net would probably be about 70 or eighty cents per share in cash, which can give you about $40 million for two of the biggest exploration swings globally, Committee Bay and Sombrero. I think there’d be a dramatic re rate on us, there’s a value to speculation about what you might drill. We saw a market cap of $250 million twice before we went to drill Committee Bay, which we haven’t even talked about yet. Now we have Sombrero online as well. Multiple projects takes away the risk, the obvious nature of the mineralization at Sombrero is going to allow people to speculate pretty aggressively. What would you pay in terms of share price as an investor to have a seat at a table where you’re taking a $60 billion swing? Finding a ball of metal in the ground with tons of indicators, big company signing CA’s, third party validations all over the place. What would you be wanting to pay if you might find something worth that much money?

Las Bambas was sold for $8 billion back in 2014, the same year we sold Cayden so middle of the bear market. I believe $6 billion was the metal content of a $60 billion ball of metal in the ground. So we have 90 million shares out, we have about $100 million market cap, we’re looking to raise about $60 to $70 million net of taxes from asset sales. I think you’d see much more than a double before we went drilling. That would be my speculation with the ability to drill for three or four years without saying the word “financing” in a rising commodity market, it would be spectacular

Bill: And if the sales didn’t go through, I know there’s a newsletter writer that I follow and he recommends your company just for the fact that you’re able to raise money easily.

Ivan: Yeah. So we’ve raised $600 million. As an insider in the public markets, I’ve bought 3.2 million dollars of Auryn shares in the last three and a half years, as high as $3.70 Canadian per share and as low as a $1.15 per share Canadian. My point there is not only do we have the ability to write a check into our own company and we’ve obviously done that, we have a tremendous following with investors. We’ve made a lot of money over the years. The money we need for one year of drilling both projects and working capital is probably around $15 million Canadian and we could get that this week if we wanted it. But we are extremely anti-dilutive. We are a very large shareholders, we own 15 percent of our company and we treat our company as investors would want to treat their own company in terms of dilution and financing.

So in that equation, with the ability to write our own checks into our own company, gives us a tremendous opportunity here to really deliver a very robust share price return by staying away from the market, from financings. If those assets sales take longer, that’s the consequence I think, not happening but they’ll happen eventually, then we would likely do a really small funding, a non-brokered private placement for $5 million which would cover trenching in Peru and G&A so that we could wait for better metal prices to get more out of those transactions. But to be honest, we’re sitting here in February, I’m marketing all month, we’re going to PDAC, we’re marketing in Europe and everything we’re doing, it doesn’t have the word “financing” attached to it. It’s just creating awareness on the opportunities that Sombrero and round five up at Committee Bay.

Bill: I was watching your share price movement and right after the Vancouver conferences in January, you saw a nice spike.

Ivan: Yeah, that’s just the crowds, we had just started talking about Sombrero. Vancouver two weeks ago was week one, we were just in California for a week, we’re in Florida next week, we are going to go through our global network and being around this business and as a group for about 13 years, we have a lot of investors to show how big the opportunities are at Sombrero and how mature we’re getting with the potential discovery at Committee Bay, underpinned with two potential asset sales that are nearly imminent to take place. So that’s what we’re excited about, that’s why we’re going out there and truly out of everything I’ve seen in 20 years, Sombrero is number one on my list and I’m going to tell the whole world about it because everybody should, who has ever bought an exploration stock should be watching the story.

Bill: Your other flagship project is Committee Bay, you’ve been at that project for four years and you’ve spent $50 million on it. What can we expect in 2019 with this project?

Ivan: So great question came up to me the other day and the question actually was you’ve been there for four years, you spent over $50 million dollars, I believe we’ve drilled over 250 holes on the project, we’ve taken over 400,000 till samples along a 300 kilometer long belt, which has gold shedding on one side to the other. And so that all being said, that’s a lot of work, where is the deposit? And you guys have the Newmont exploration team, how come you’ve spent all this money and haven’t found it? In the middle of the belt, there is a deposit, 1.3 million ounces of about eight grams per ton, but the belt is covered 95 percent by till, the whole belt is covered by till meaning there’s five to 40 meters of dirt on top of the rocks and you’re up in the Arctic, so glaciers have moved over these rocks or the dirt on the rocks. It’s not easy to find these things or we would have never been able to acquire it ourselves.

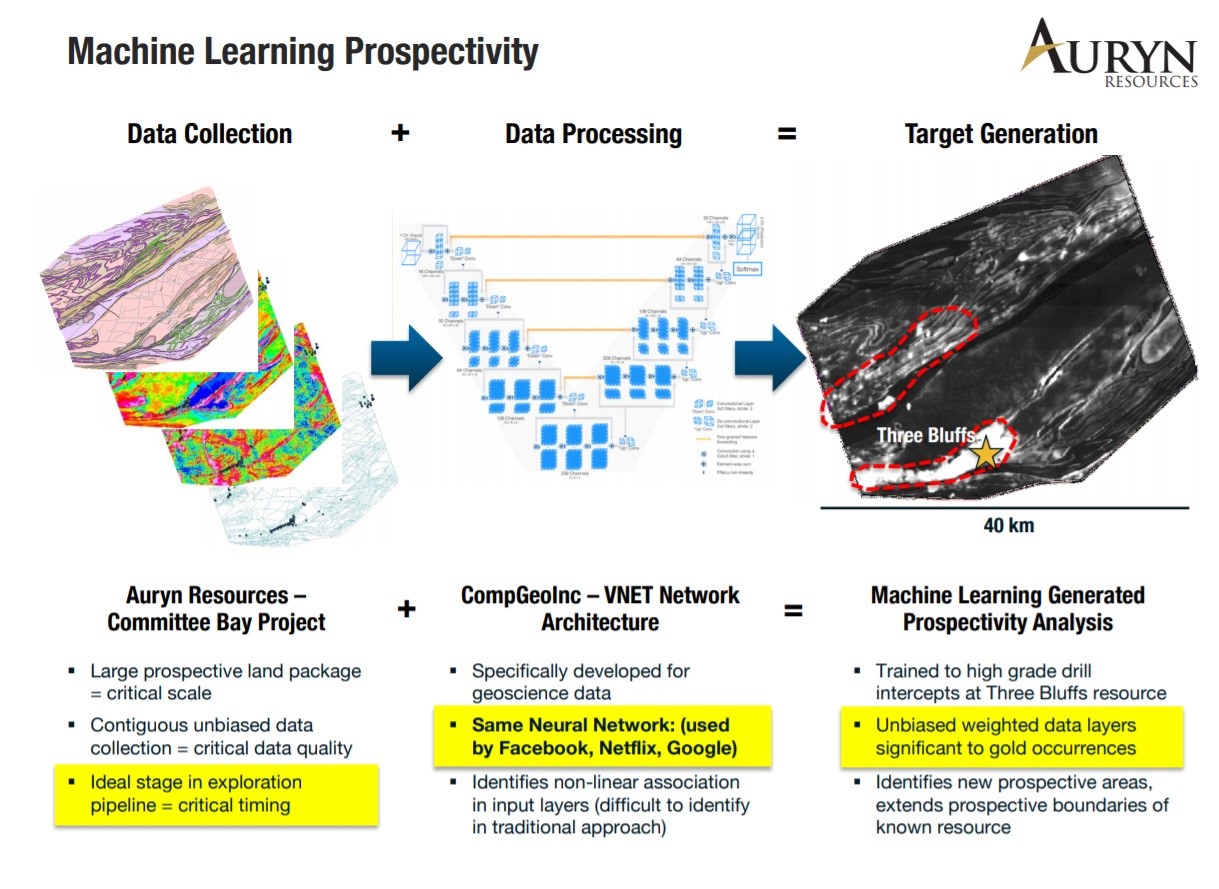

The comment I got was when you guys walk away from this project, and most certainly wouldn’t do it for another five or ten years because you have 18 targets along this big belt to go test, which is going to take time. Where the guys are at now is they’ve brought in machine learning to process all that data on the entire belt. And one of our Newmont geologists has met up or partnered up with a technical specialists, we’ve had a press release about this and it’s truly amazing what they’ve done. And first of all, the data inputs are extremely high quality of the way we take samples, the way we assay samples, the world experts formerly with Newmont that are inputting the data. So data in data out is obviously a major contributor.

The neural networks these guys are using is the same one google uses as Amazon, Facebook. And if you ever had the experience where you’re on their website, you’re looking at boats or something or tennis rackets or whatever sport you play, or you say it even out loud now you don’t even have to go look at it, and then you get some random marketing email that shows you a bunch of product for sale that you were thinking about or talking about. So imagine that exact same neural network which has been used by google, now you’re putting in geoscientific data. We took three bluffs the deposit, we gave it one third of the high grade at three bluffs and we taught it how to find in that. And then we challenge it to find the other two thirds. And it came out with about a 99 percent accuracy finding the other two thirds.

So in my opinion, it works. In about three weeks, the end of this month, end of February we’re going to have the results of the learning, which is gonna show targets that we’re going to drill this to Committee Bay alongside targets that our geologists have found. But truly the future of major discoveries is either hidden deposits or it is things like Sombrero that were overlooked or it’s contentious land owners that wouldn’t sell to an exploration company prior that finally sell. And I think if you listen to Barrick, Teck and Goldcorp and a lot of these big companies, everyone’s talking about AI platforms coming into mining and the true reason why is the computer that we’re using are the neural network and the ability for it to process data is about a thousand times the capacity of the human brain. So you’re basically saving 20 years of crunching numbers by doing it through a computer in a period of three to six months, and that’s the opportunity there.

The last comment I’ll make on Committee Bay, and this is for all the Committee Bay shareholders that have owned us, that have sold us, that have speculated with us and that can’t get enough of risking their money for Committee Bay discovery, we’ve only physically been on the ground at Committee Bay for about eight and a half months, and so we’ve drilled 250 holes, we’ve taken 400,000 till samples in eight and a half months of physically being on a property and in comparison to Sombrero where we’d been on the ground physically for about 11 months, you have to take that into context of how little time we’ve actually spent at Committee Bay.

And the reason why is we spent about two months at windows of exploration each summer, we’re not exploring through the winter, you could in the right environment of a discovery, you could drill year round. Agnico Eagle’s doing it on this major mine they found next door called Amaruq, but for us, we’ve only been on the ground for about eight and a half months since we’ve had it. We’ve collected all this data and the real discoveries are going to come out of Committee Bay, we think this season. Not only because we’ve learned so much about these deposits we’ve been going after and we feel we’re on the edge of some major discoveries, but we brought in the computer to process all that data that I’ve told you that we’ve just collected.

It’s going to be one of the most exciting drill programs that I’ve been part of with Committee Bay, but also to go test the computer learning, if it’s right, the whole belt opens up again, you have 300 kilometers of gold shedding off a belt. It becomes one of the phenomes in the world to go find major gold deposits and to quantify how hard these deposits are to find too, in those four years that we’ve been going up there so far, nobody else has found a 5 million ounce or better gold deposit. The last major mine in the world found that’s over 5 million ounces of gold is Amaruq, 6 million ounces of six grams per ton, which was found by Agnico Eagle right next to us at that Committee Bay. Nobody has found anything since 2013 of consequences in the gold side of the business that’s being explored. We’re not the only ones, but I’d liked to argue we have some of the best real estate for high grade gold in Canada and a massive copper-gold discovery in potentially in Peru.

Bill: Yeah. And it balances the portfolio, there’s going to be news flow constantly in the years to come.

Ivan: Yeah. So news flow is a main catalyst for all juniors and what we’re looking at for news flow here is the releasing of the AI targeting, Committee Bay targeting, as well as the resuming of trenching in Peru. Those would be two main drivers that drive a lot of speculation towards the summer, but you might see the first asset sale in the coming weeks or month or two. And the second one might be right behind it or they might happen both at the same time.

If you see the gold price performing, expect the asset sales to happen probably a lot quicker. If the gold price goes down, they might take longer, that’s the only way I would say you can wager how long these things might take. But, again, we’re in the very mature discussions of these asset sales and we’re confident that one or both could happen this year.

Bill: Ivan, Rick Rule always teaches speculators that they need to know at least three things that could go wrong with a gold speculative company that’s pursuing a discovery. So the question posed to you as the executive chairman would be, what would keep you up at night? When you look at the company and you look at your projects, what are some things that could go wrong?

Ivan: That’s a really great question, and I’ve had the chance to meet Rick in 2003 and get to know him for the last 15, 16 years. The first answer to that question would be communities in Peru, that’s the obvious one, that’s the easy one. We have a really good handle on that as I’ve been quite elaborate about that and I don’t think there’s any serious risks there at all, but that’s one of the big red flags that someone could throw out and lose little sleep at night.

Second one would be metal prices. We don’t need higher metal prices than today, but if the metal prices go into a massive tailspin, then that would obviously slow us down and we would be conservative with our spend and we wouldn’t get to go drill as quickly as we wanted to because we wouldn’t want to dilute ourselves in that process.

And thirdly, you’ve asked me for three, I’d have to go onto personnel. You don’t want to lose any geologists to something tragic or something else. We have incredible people on our team and I think if we lost part of our technical team somehow that would be something we could recover and repair, but it would be the other thing I don’t want anything to happen to anybody on a personal basis. There’s no danger in where we’re working, but life is interesting enough in itself, there’s airplanes, there’s all kinds of things that can happen. It was such a remarkable feat for us to put together this group of people as a team. It was such a remarkable feat to put together this portfolio of projects and we don’t want to lose anyone, so those are my three

Bill: Auryn trades under the ticker AUG, you can go on the website. It’s www.aurynresources.com. There you can listen to a Ivan’s lead geologist describing in detail in about a 17-minute youtube video, why they chose a specific targets at Sombrero, it’s very easy to understand for the non-technically trained person to understand the excitement regarding this project. There you can also view the most recent presentation that is up there to see the prospective nature of also Committee Bay, not just Sombrero. Ivan, as we conclude, is there anything else you’d like to share with the listeners?

Ivan: If you’re not going to own us, you most certainly should follow us because I think we have a chance to find the world’s biggest on two different projects.

Bill: Well, I appreciate the conversation. It was a pleasure meeting you in person. And we’ll be talking to you again throughout 2019.

Ivan: Thank you so much. Appreciate it.

by Bill Powers

ABOUT THE AUTHOR:

Bill Powers is the host of the Mining Stock Education podcast which interviews many of the top names in the natural resource sector and profiles quality mining investment opportunities. Bill is an avid resource investor with an entrepreneurial background in sales, management, and small business development. His latest interviews can be found at MiningStockEducation.com.

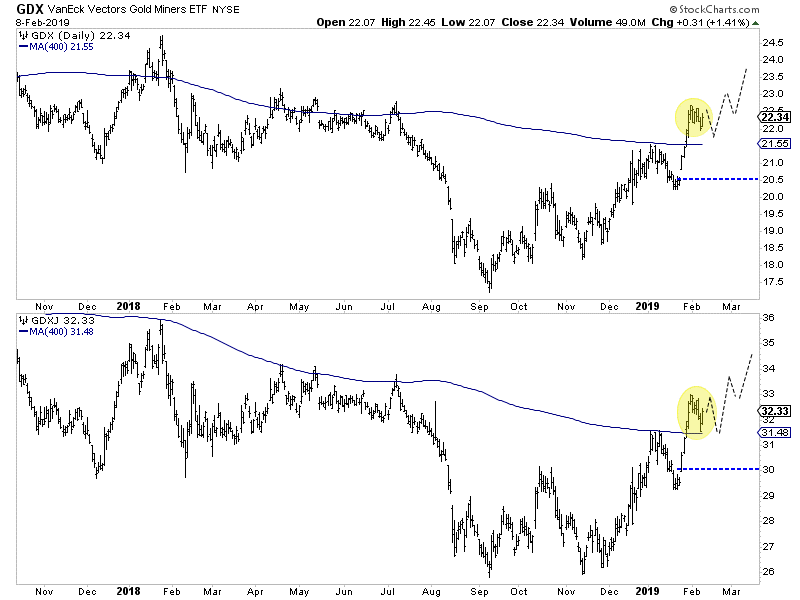

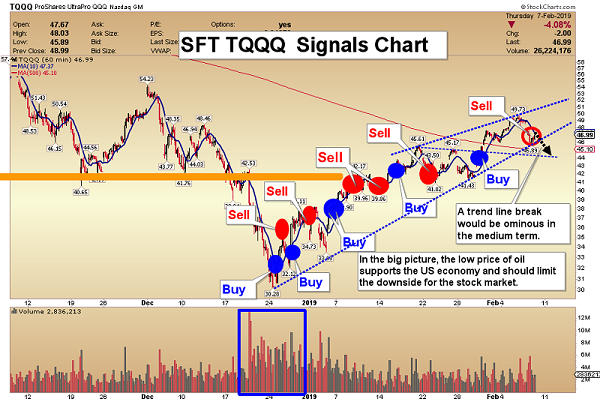

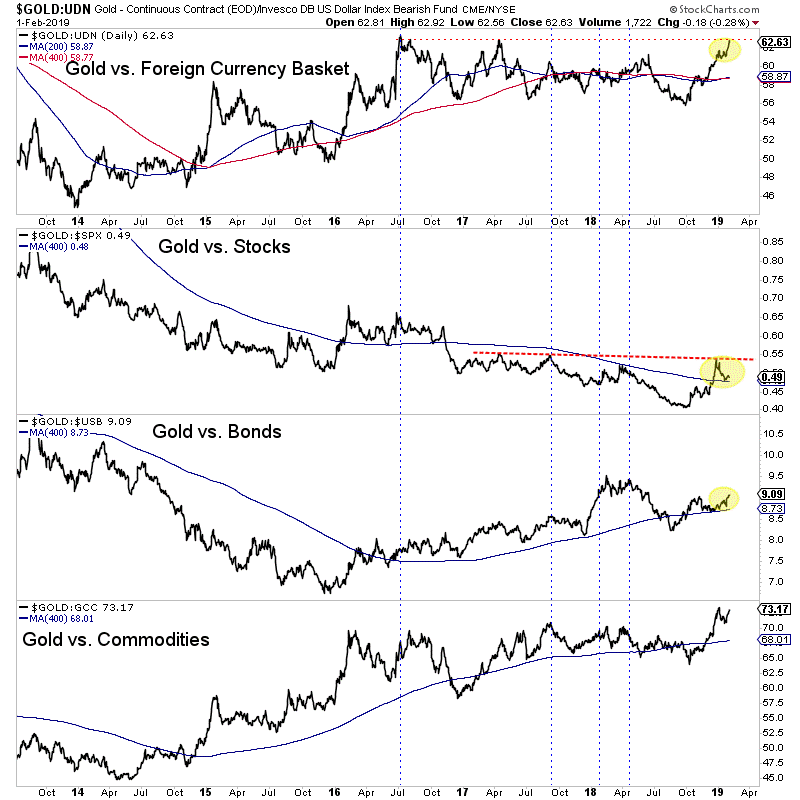

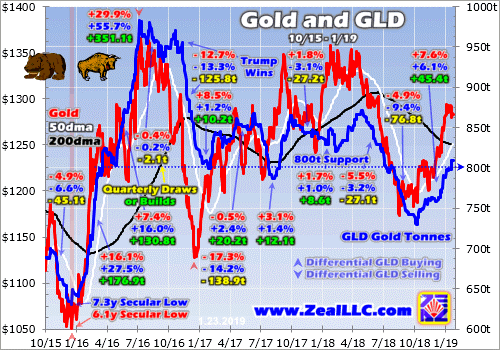

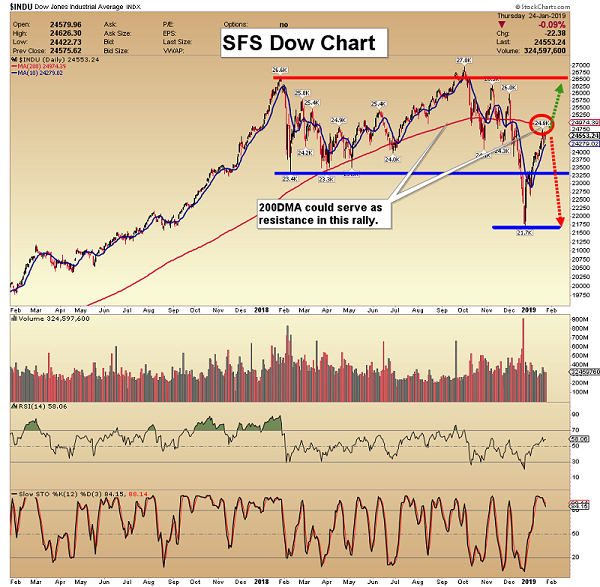

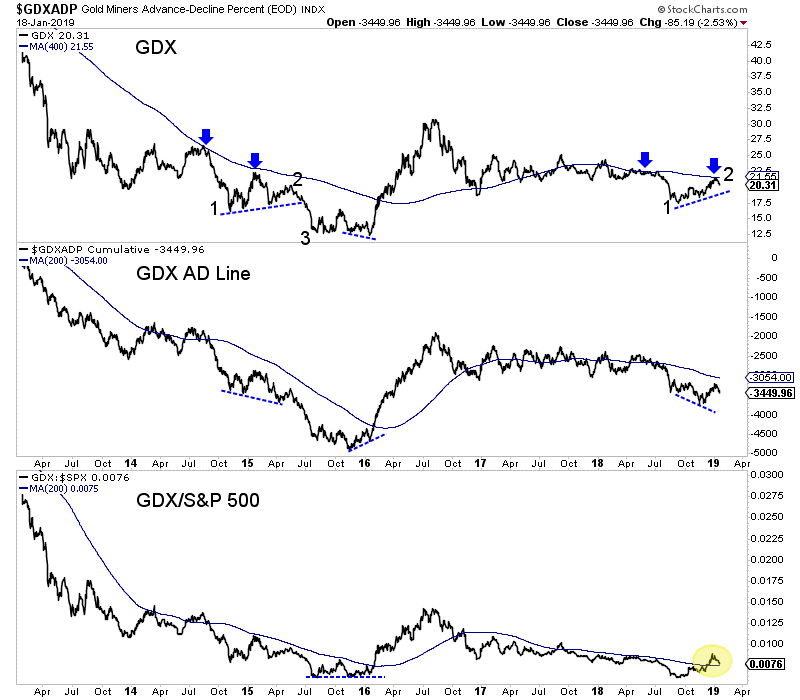

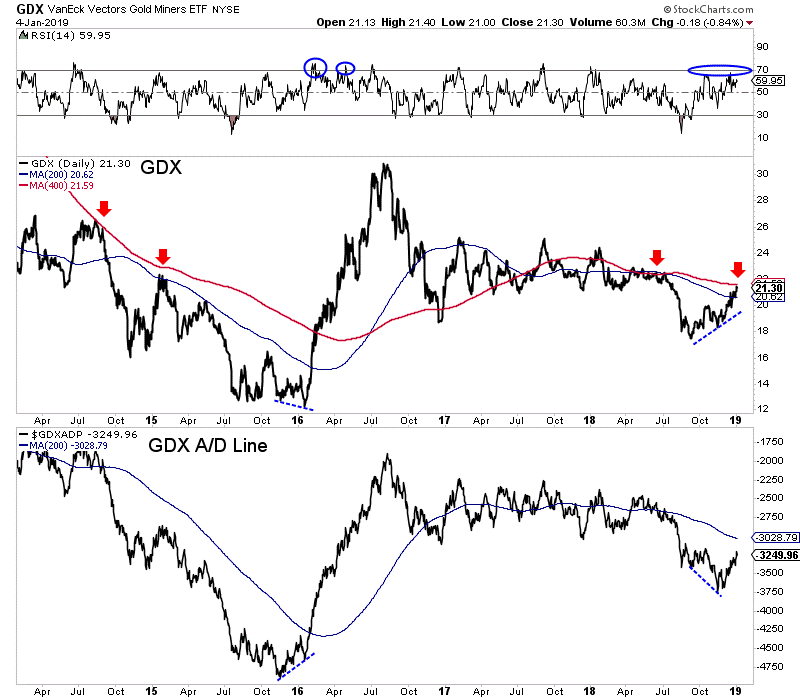

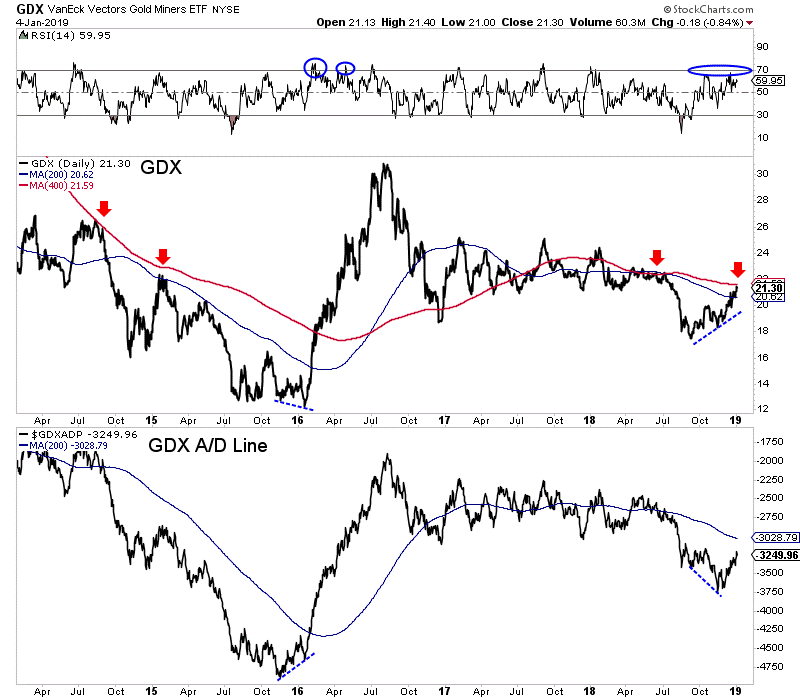

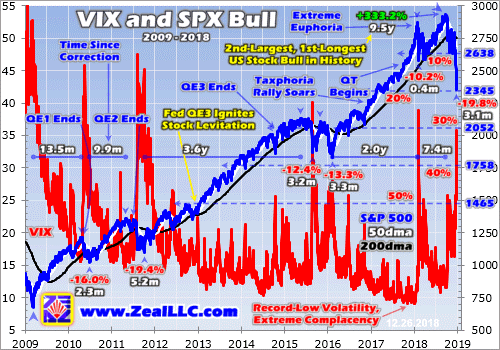

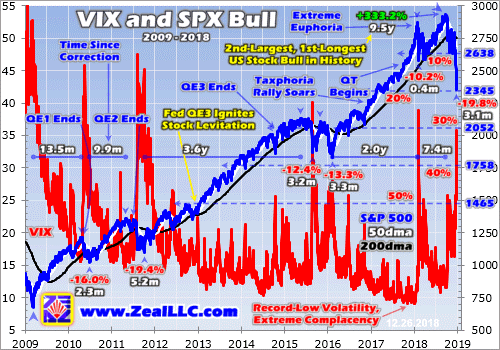

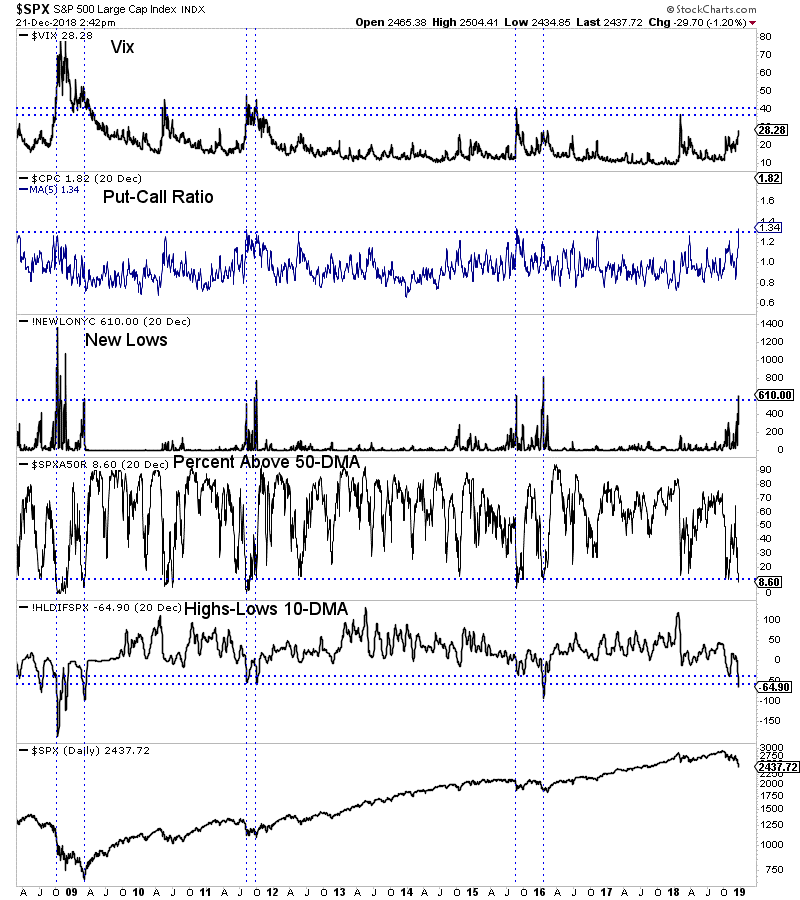

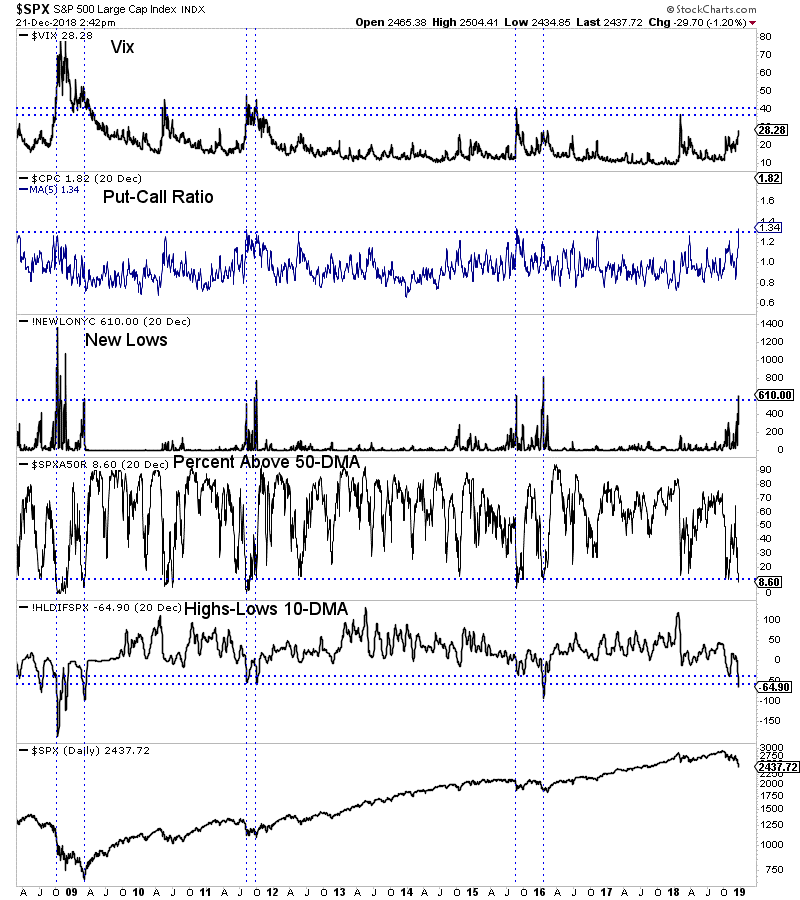

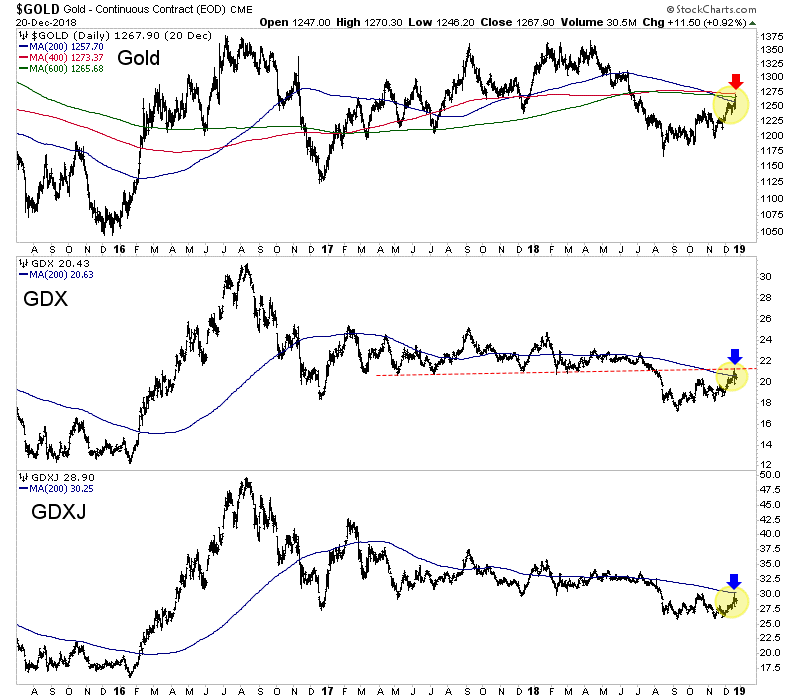

Gold stocks have to do more to confirm they are in a new bull market.

Sure, they’ve surged above key moving average resistance and breadth has improved.

However, the gold stocks have not yet broken the pattern of lower highs and breadth, while improved, is not at bull market levels yet. Let’s review where things currently stand.

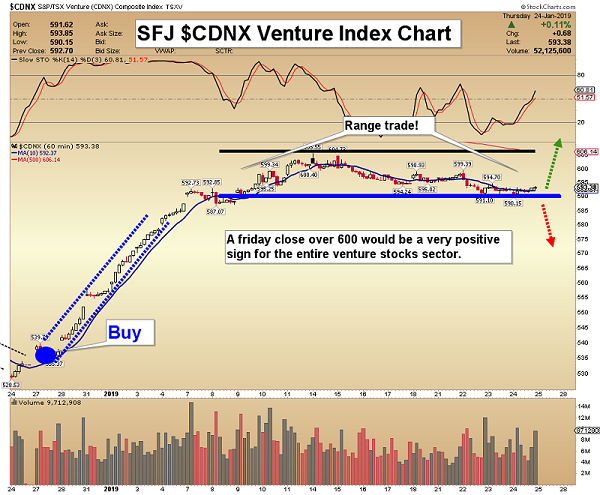

In recent weeks GDX and GDXJ surged above the critical 400-day moving average which has been an excellent indicator of the primary trend dating back to 2012. That’s positive and hasn’t happened since the summer of 2017.

Moving forward, I see two plausible scenarios for the gold stocks.

They are either going to build a bullish consolidation (as I’ve sketched out below) or they will have a longer and deeper retracement which could lead to a test of the 200-day moving averages (not shown) near $20.50 for GDX and $30 for GDXJ.

In the bullish scenario, look for the miners to hold above their 400-day moving averages and build a tight consolidation. If that develops, we would gain strong confidence in a bullish outcome.

In the bearish scenario, the miners would sell off below recent lows and threaten a test of the 200-day moving averages and the nearby open gaps.

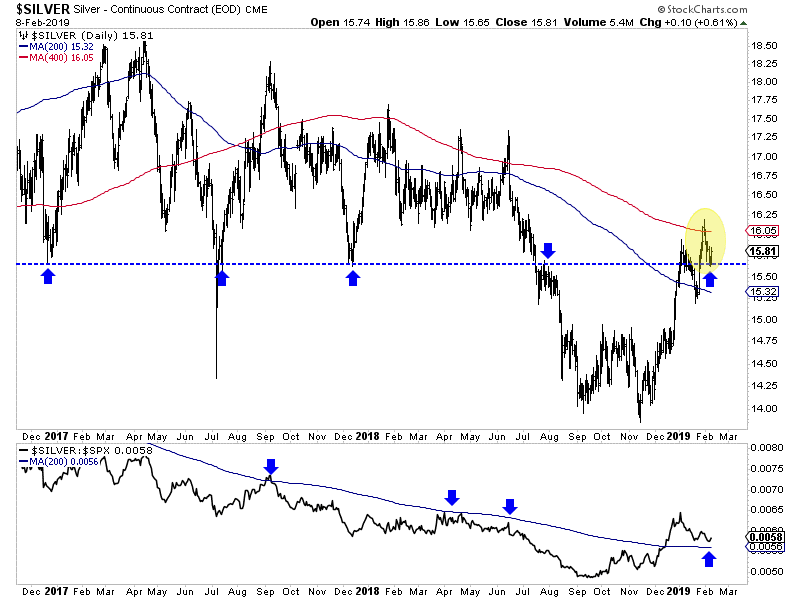

Also, keep an eye on Silver, which like the miners will outperform when the sector trend is established. Note that on Thursday Silver bounced from the $15.60-$15.65/oz level which has been a critical level over the past two years. (See the arrows in the chart).

Should Silver hold that low then it should be able to rally above its 400-day moving average for the first time in over a year and test $17.25.

At the bottom of the chart we plot Silver against the S&P 500 and according to the 200-day moving average, that relative trend has turned in favor of Silver.

The bottom line is if GDX, GDXJ and Silver can maintain the lows from last week and firm up against the S&P 500 then they are likely going higher. If those lows break convincingly then look for a longer and deeper correction.

Essentially, should a bullish consolidation develop, we will prepare to put more capital to work. If not, then a deeper and longer correction is more likely which means we can be patient. To prepare yourself for some epic buying opportunities in junior gold and silver stocks before this bull market really gets going, consider learning more about our premium service.

- Is the latest tiny price correction in gold already done?

- Please click here now. Double-click to enlarge this daily gold chart. The uptrend looks majestic, and especially so in the face of the dollar’s strength against the euro and the yen.

- Whether gold rallies from the current $1306 support zone or from $1280 is not important. What’s important is the overall strength of the market, both fundamentally and technically.

- A staircase uptrend pattern (in place now for gold) is an indication of a very healthy market.

- Please click here now. Double-click to enlarge. The big technical picture for gold is also glorious!

- On the fundamentals front, the European economy is rolling over faster than America’s is right now. This situation is positive for gold. Europeans are nervous, especially in Germany, and they are steadily putting money into gold and physical gold ETFs.

- The dollar is strong against the yen because of the rally in global stock markets. That rally is happening in the face of fading U.S. corporate earnings because of the actions of the U.S. central bank.

- Stock markets initially tend to rally as the U.S. business cycle peaks and the Fed stops raising rates, but institutional investors soon become concerned that the Fed’s about-face is related to more serious concerns about the economy. Value players have sold out and many money managers are now in a “sell the rallies” mindset rather than “buy the dips”.

- Please click here now. The Fed’s change of stance is good news for gold but not so good news for the stock market (except in the very short term). Rates have barely risen off the floor despite this being one of the longest economic upcycles in the history of America.

- The upcycle was long in terms of time but horrifying in terms of actual growth. Arguably, the biggest real economy growth has been in the part-time jobs market. It’s also plausible that there would not have been any growth at all without the massive increase in government debt.

- The democrats have control of the House now and some influential players want to tie stock market buybacks to wage increases. That’s clearly inflationary and perhaps much more so than most analysts realize. Even if the legislation doesn’t get passed, I believe it will be passed “in spirit.”

- Key democrats also support the UBI (universal basic income) and free medical care. I’ve dubbed UBI the common man’s QE. These programs are all inflationary and are being proposed as the Fed changes its stance. That’s a “done deal” recipe for major stagflation over the long term.

- In the current big picture, I’ve suggested that rate hikes, QT, QE, and rate cuts are all win-win for gold. Rate hikes put pressure on the stock buyback programs and help push the QE money ball in the commercial banking system. That’s inflationary.

- Rate hikes also put pressure on the U.S. government’s ability to finance itself. That’s positive for gold.

- Rate cuts now reduce the carry cost for gold and boost the safe haven trade as investors flee stock markets as the fear of recession grows. That’s also positive for gold.

- Please click here now. Kudos to Congressman Mooney for doing the right thing. I urge all members of the U.S. gold community to call their congressional reps and demand they back Mooney’s proposed legislation.

- I’ve predicted that with China and India leading the way, gold will become an “approved and respected” mainstream asset in the years ahead, just like stocks and bonds. If Mooney gets serious support, it can happen even faster than I’ve predicted.

- Please click here now. As noted, the big picture for gold is glorious… both technically and fundamentally.

- Please click here now. Respected mainstream firm Bernstein has obviously joined “Team Gold”. They highlight the ongoing drop in America’s share of global GDP. Nothing Trump is doing will reverse that drop because it’s related to the West’s horrifying population demographics.

- The current U.S. government plan to reverse its insane debt growth with tariff taxes, a single corporate tax cut, a few regulatory red tape chops, no more rate hikes, and a border wall… is like trying to stop Niagara Falls by throwing a few popsicle sticks into the water.

- The temptation for the debt-worshipping U.S. government to inflate will soon be overwhelming. Clearly, elite U.S. analysts like Bernstein are already anticipating this is an imminent event.

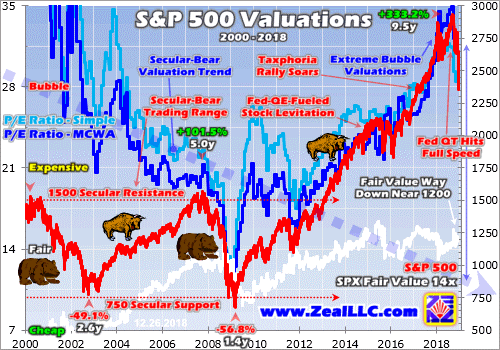

- Please click here now. Double-click to enlarge this fabulous GDX chart. GDX and most high-quality gold stocks soared from September-December and did so while the U.S. stock market crashed. Then GDX soared in January while the stock market rallied.