Soon to be introduced to the market, Collective Mining is the newest miner you’ve never heard about but should have. In fact, it isn’t as new as it seems. Collective has a top-notch team of seasoned operators at the helm coming over from Continental Gold (Sold for C$2 billion in March 2020). Coming together to start new projects with ESG principles at the forefront of the company’s guiding philosophy and operational standards, this team is highly specialized in recognizing early-stage exploration projects with world-class potential.

Collective Mining, responsible for discovering and building the largest gold mine in Colombia, is poised to bring their unique blend of environmental, social, and governmental expertise into action for their San Antonio and Guyabales projects.

Results Coming Soon

With a new 5000 metre drill program beginning this month, initial results are anticipated in May/June, giving investors, both current and potential, something to be very excited about. The company is creating new strategic partnerships with key agricultural-focused groups in Caldas to deliver on many of the promises made in the ESG arena.

A Collaborative Approach to Mining

The name of the company makes it immediately clear that this is a company built on the foundations of collaborative and inclusive management, and a collective commitment to the values that investors prioritize for both stakeholders and investors. They accomplish this by working with local groups and planning projects that benefit the local mining community, minority groups, local development projects, and investors.

This approach to their projects fits well with the developed Colombian economy hosting ancillary mining services, agriculture, and tourism industries. The entire Colombian economy and country stand to benefit as a strategic alliance across a myriad of industries works with Collective Mining to build strong and profitable porphyry gold, copper, molybdenum projects.

San Antonio and Guayabales

Collective’s property in Colombia consists of two key projects – San Antonio and Guayabales – that comprise a historical and current gold endowment of more than 10 million Ozs on contiguous property. Despite having more than 500 years of mining history, the district never consolidated until the company brought their vision to the region.

With a mining friendly jurisdiction, no security issues, and access to the site and necessary infrastructure, operation of these prime projects is sure to bring in the kind of production they are aiming for. Plans are to extract porphyry gold, copper, and molybdenum from a newly-identified large-scale source at the sites. After thorough exploration costing more than $10 million historically (inflation adjusted), Collective is ready to scale up and mine the rewards of their patience.

Stay Tuned

As Collective Mining gears up to go public through a reverse takeover of shell company POCML5 in the second quarter of 2021, investors will be eager to get in on the action when shares are available. Until then, it’s time to get informed and stay updated on the company’s projects and plans, and how they plan to bring the benefits of their management team from multibillion-dollar Continental Gold.

Based on the team’s previous history, the market is likely to welcome Collective Mining’s public offering with open arms, and a healthy valuation to boot.

Welcome to the dog days of summer. The low volatility in precious metals continues. Janet Yellen or some other Fed heads said something Friday. Precious Metals sold off but quickly recovered. It appears that not much has transpired in recent weeks as precious metals have grinded higher, albeit slowly. However, while it may be a fledgling development, the miners appear to be leading Gold now.

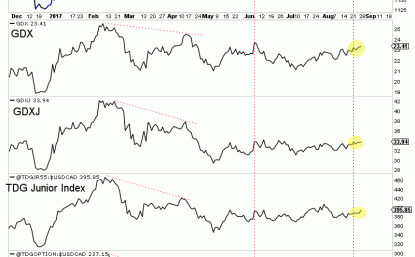

In the chart below we plot a number of markets including Gold, GDX, GDXJ, our 55-stock junior index and our optionality index. We marked three points that help inform our analysis.

From point 1 to point 3, the gold stocks went from underperforming Gold to slightly leading Gold. The gold stocks began to underperform in late winter. They peaked in February and did not even come close to reaching those highs in March while Gold made a higher high. Gold retested that high at point 2 in June while miners made another lower high. However, there has been a change from then to point 3. Gold is at the same level at point 3 as point 2 but so are the miners! Furthermore, in recent days (since point 3) the gold stocks have made higher highs while Gold has not.

The most important recent development in precious metals could be the renewed relative strength in the gold stocks. Volatility has been very low and Gold has yet to break $1300/oz but the gold stocks have managed to reverse their previous underperformance. They were lagging badly from late winter through spring. Ratio charts (not shown) show that the underperformance ended in May and the outperformance began only days ago. If that holds up into September and Gold breaks above $1300/oz then the gold stocks could enjoy strong gains over the weeks ahead.

Jordan Roy-Byrne CMT, MFTA

If you would like to receive our free newsletter via email, simply enter your email address below & click subscribe.

CONNECT WITH US

Tweets

Tweet with hash tag #miningfeeds or @miningfeeds and your tweets will be displayed across this site.

MOST ACTIVE MINING STOCKS

Daily Gainers

Azincourt Energy Corp. Azincourt Energy Corp. |

AAZ.V | +50.00% |

|

ADD.AX | +50.00% |

|

ERA.AX | +50.00% |

|

DEV.AX | +31.82% |

|

CASA.V | +30.00% |

|

RMD.V | +25.00% |

|

BMG.AX | +25.00% |

|

CUL.AX | +25.00% |

|

NOW.V | +22.81% |

|

ACS.V | +22.58% |

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan