The junior gold miners’ stocks have spent much of the past year grinding sideways near lows, sapping confidence and breeding widespread bearishness. The entire precious-metals sector has been left for dead, eclipsed by the dazzling taxphoria stock-market rally. But traders need to keep their eyes on the fundamental ball so herd sentiment doesn’t mislead them. The juniors’ recent Q4 results proved quite strong.

Four times a year publicly-traded companies release treasure troves of valuable information in the form of quarterly reports. Required by securities regulators, these quarterly results are exceedingly important for investors and speculators. They dispel all the sentimental distortions surrounding prevailing stock-price levels, revealing the underlying hard fundamental realities. That serves to re-anchor perceptions.

Normally quarterlies are due 45 calendar days after quarter-ends, in the form of 10-Qs required by the SEC for American companies. But after the final quarter of fiscal years, which are calendar years for most gold miners, that deadline extends out up to 90 days depending on company size. The 10-K annual reports required once a year are bigger, more complex, and need fully-audited numbers unlike 10-Qs.

So it takes companies more time to prepare full-year financials and then get them audited by CPAs right in the heart of their busy season. The additional delay in releasing Q4 results is certainly frustrating, as that data is getting stale approaching the end of Q1. Compounding the irritation, some gold miners don’t actually break out Q4 separately. Instead they only report full-year results, lumping in and obscuring Q4.

I always wonder what gold miners that don’t report full Q4 results are trying to hide. Some Q4 numbers can be inferred by comparing full-year results to the prior three quarterlies, but others aren’t knowable if not specifically disclosed. While most gold miners report their Q4 and/or full-year results by 7 to 9 weeks after year-ends, some drag their feet and push that 13-week limit. That’s very disrespectful to investors.

All this unfortunately makes Q4 results the hardest to analyze out of all quarterlies. But delving into them is still well worth the challenge. There’s no better fundamental data available to gold-stock investors and speculators than quarterly results, so they can’t be ignored. They offer a very valuable true snapshot of what’s really going on, shattering all the misconceptions bred by the ever-shifting winds of sentiment.

The definitive list of elite junior gold stocks to analyze comes from the world’s most-popular junior-gold-stock investment vehicle. This week the GDXJ VanEck Vectors Junior Gold Miners ETF reported $4.5b in net assets. Among all gold-stock ETFs, that was second only to GDX’s $7.9b. That is GDXJ’s big-brother ETF that includes larger major gold miners. GDXJ’s popularity testifies to the great allure of juniors.

Unfortunately this fame created major problems for GDXJ over the past couple years, severely hobbling its usefulness to investors. This ETF is quite literally the victim of its own success. GDXJ grew so large in the first half of 2016 as gold stocks soared in a massive upleg that it risked running afoul of Canadian securities laws. And most of the world’s smaller gold miners and explorers trade on Canadian stock exchanges.

Since Canada is the center of the junior-gold universe, any ETF seeking to own this sector will have to be heavily invested there. But once any investor including an ETF buys up a 20%+ stake in any Canadian stock, it is legally deemed to be a takeover offer that must be extended to all shareholders! As capital flooded into GDXJ in 2016 to gain junior-gold exposure, its ownership in smaller components soared near 20%.

Obviously hundreds of thousands of investors buying shares in an ETF have no intention of taking over gold-mining companies, no matter how big their collective stakes. That’s a totally-different scenario than a single corporate investor buying 20%+. GDXJ’s managers should’ve lobbied Canadian regulators and lawmakers to exempt ETFs from that 20% takeover rule. But instead they chose an inferior, easier solution.

Since GDXJ’s issuer controls the junior-gold-stock index underlying its ETF, it simply chose to unilaterally redefine what junior gold miners are. It rejiggered its index to fill GDXJ’s ranks with larger intermediate gold miners, while greatly demoting true smaller junior gold miners in terms of their ETF weightings. This controversial move defying many decades of convention was done stealthily behind the scenes to avoid outrage.

There’s no formal definition of a junior gold miner, which gives cover to GDXJ’s managers pushing the limits. Major gold miners are generally those that produce over 1m ounces of gold annually. For decades juniors were considered to be sub-200k-ounce producers. So 300k ounces per year is a very-generous threshold. Anything between 300k to 1m ounces annually is in the mid-tier realm, where GDXJ now traffics.

That high 300k-ounce-per-year junior cutoff translates into 75k ounces per quarter. Following the end of the gold miners’ Q4’17 earnings season in late March, I dug into the top 34 GDXJ components. That’s just an arbitrary number that fits neatly into the tables below. Although GDXJ included a staggering 73 component stocks in late March, the top 34 accounted for a commanding 80.5% of its total weighting.

Out of these top-34 GDXJ companies, only 4 primary gold miners met that sub-75k-ounces-per-quarter qualification to be a junior gold miner! Their quarterly production is highlighted in blue below, and they collectively accounted for just 8.1% of GDXJ’s total weighting. But even that is really overstated, as half of these are long-time traditional major silver miners that have started diversifying into gold in recent years.

GDXJ is inarguably now a pure mid-tier gold-miner ETF. That would be great if GDXJ was advertised as such. But it’s very misleading if investors still believe this dominant “Junior Gold Miners ETF” still gives exposure to junior gold miners. I suspect the vast majority of GDXJ shareholders have no idea just how radically its holdings have changed since early 2016, and how much it has strayed from its original mission.

I’ve been doing these deep quarterly dives into GDXJ’s top components for years now. In Q4’17, fully 31 of the top-34 GDXJ components were also GDX components! These ETFs are separate, a “Gold Miners ETF” and a “Junior Gold Miners ETF”. So there’s no reason for them to own many of the same companies. In the tables below I highlighted the rare GDXJ components not also in GDX in yellow in the weightings column.

These 31 GDX components accounted for 76.7% of GDXJ’s total weighting, not just its top 34. They also represented 32.2% of GDX’s total weighting. So over 3/4ths of the junior gold miners’ ETF is made up of nearly a third of the major gold miners’ ETF! These GDXJ components in GDX start at the 12th-highest weighting in that latter larger ETF and extend down to 44th. Do investors know GDXJ is mostly GDX gold stocks?

Fully 11 of GDXJ’s top 17 components weren’t even in this ETF a year ago in Q4’16. They alone now account for 36.6% of its total weighting. 16 of the top 34 are new, or 43.8% of the total. In the tables below, I highlighted the symbols of companies that weren’t in GDXJ a year ago in light blue. GDXJ has changed radically, and analyzing its top components’ Q4’17 results largely devoid of real juniors is frustrating.

Nevertheless, GDXJ remains the leading “junior-gold” benchmark. So every quarter I wade through tons of data from its top components’ 10-Qs or 10-Ks, and dump it into a big spreadsheet for analysis. The highlights made it into these tables. Blank fields mean a company did not report that data for Q4’17 as of this Wednesday. Companies have wide variations in reporting styles, data presented, and report timing.

In these tables the first couple columns show each GDXJ component’s symbol and weighting within this ETF as of this week. While many of these gold stocks trade in the States, not all of them do. So if you can’t find one of these symbols, it’s a listing from a company’s primary foreign stock exchange. That’s followed by each company’s Q4’17 gold production in ounces, which is mostly reported in pure-gold terms.

Many gold miners also produce byproduct metals like silver and copper. These are valuable, as they are sold to offset some of the considerable costs of gold mining. Some companies report their quarterly gold production including silver, a construct called gold-equivalent ounces. I only included GEOs if no pure-gold numbers were reported. That’s followed by production’s absolute year-over-year change from Q4’16.

Next comes the most-important fundamental data for gold miners, cash costs and all-in sustaining costs per ounce mined. The latter determines their profitability and hence ultimately stock prices. Those are also followed by YoY changes. Finally the YoY changes in cash flows generated from operations, GAAP profits, revenues, and cash on balance sheets are listed. There are a couple exceptions to these YoY changes.

Percentage changes aren’t relevant or meaningful if data shifted from positive to negative or vice versa, or if derived from two negative numbers. So in those cases I included raw underlying numbers instead of weird or misleading percentage changes. This whole dataset offers a fantastic high-level read on how the mid-tier gold miners are faring today as an industry. Contrary to their low stock prices, they’re doing quite well.

After spending days digesting these GDXJ gold miners’ latest quarterly reports, it’s fully apparent their vexing low consolidation over the past year isn’t fundamentally righteous at all! Traders have abandoned this sector because the allure of the levitating general stock markets has eclipsed gold. That has left gold stocks exceedingly undervalued, truly the best fundamental bargains out there in all the stock markets!

Once again the light-blue-highlighted symbols are new top-34 GDXJ components that weren’t included a year ago in Q4’16. And the meager yellow-highlighted weightings are the only stocks that were not also GDX components in late March! GDXJ is increasingly a GDX clone that offers little if any real exposure to true juniors’ epic upside potential during gold bulls. Sadly this ETF has become a shadow of its former self.

VanEck owns and manages GDX, GDXJ, and the MVIS indexing company that decides exactly which gold stocks are included in each. With one company in total control, GDX and GDXJ should have zero overlap in underlying companies! GDX or GDXJ inclusion should be mutually-exclusive based on the sizes of individual miners. That would make both GDX and GDXJ much more targeted and useful for investors.

VanEck could greatly increase the utility and thus ultimate success of both GDX and GDXJ by starting with one combined list of the world’s better gold miners. Then it could take the top 20 or 25 in terms of annual gold production and assign them to GDX. That would run down near 150k or 105k ounces of quarterly production based on Q4’17 data. Then the next-largest 30 or 40 gold miners could be assigned to GDXJ.

The worst part of GDXJ now including mid-tier gold miners instead of real juniors is the latter are being relentlessly starved of capital. As investment capital flows into ETFs, they have to buy shares in their underlying component companies. That naturally bids their stock prices higher. But in GDXJ’s case, the capital investors intend to use to buy juniors is being stealthily diverted into much-larger mid-tier gold miners.

While there are still some juniors way down the list in GDXJ’s rankings, they collectively make up about 20% of this ETF’s weighting at best. Junior gold miners rely heavily on issuing shares to finance their exploration projects and mine builds. But when their stock prices are down in the dumps because no one is buying them, that is heavily dilutive. GDXJ is effectively strangling the very industry its investors want to own!

Since gold miners are in the business of wresting gold from the bowels of the Earth, production is the best place to start. These top-34 GDXJ gold miners collectively produced 4193k ounces in Q4’17. That rocketed 87% higher YoY, but that comparison is meaningless given the radical changes in this ETF’s composition since Q4’16. On the bright side, GDXJ’s miners do still remain much smaller than GDX’s.

GDX’s top 34 components, fully 19 of which are also top-34 GDXJ components, collectively produced 10,337k ounces of gold in Q4. So GDXJ components’ average quarterly gold production of 140k ounces excluding explorers was 57% lower than GDX components’ 323k average. In spite of GDXJ’s very-misleading “Junior” name, it definitely has smaller gold miners even if they’re way above that 75k junior threshold.

Despite GDXJ’s top 34 components looking way different from a year ago, these current gold miners are generally faring well on the crucial production front. 17 of these mid-tier gold miners enjoyed big average production growth of 30% YoY! Overall average growth excluding explorers was 12.2% YoY, which is far better than world mine production which slumped 1.7% lower YoY in Q4’17 according to the World Gold Council.

These elite GDXJ mid-tier gold miners are really thriving, with production growth way outpacing their industry. That will richly reward investors as sentiment normalizes. Smaller mid-tier gold miners able to grow production are the sweet spot for stock-price upside potential. With market capitalizations much lower than major gold miners, investment capital inflows are relatively larger which bids up stock prices faster.

With today’s set of top-34 GDXJ gold miners achieving such impressive production growth, their costs per ounce should’ve declined proportionally. Higher production yields more gold to spread mining’s big fixed costs across. And lower per-ounce costs naturally lead to higher profits. So production growth is highly sought after by gold-stock investors, with companies able to achieve it commanding premium prices.

There are two major ways to measure gold-mining costs, classic cash costs per ounce and the superior all-in sustaining costs per ounce. Both are useful metrics. Cash costs are the acid test of gold-miner survivability in lower-gold-price environments, revealing the worst-case gold levels necessary to keep the mines running. All-in sustaining costs show where gold needs to trade to maintain current mining tempos indefinitely.

Cash costs naturally encompass all cash expenses necessary to produce each ounce of gold, including all direct production costs, mine-level administration, smelting, refining, transport, regulatory, royalty, and tax expenses. In Q4’17, these top-34 GDXJ-component gold miners that reported cash costs averaged just $618 per ounce. That was actually up a slight 0.5% YoY, so the higher production failed to force costs lower.

This was still quite impressive, as the mid-tier gold miners’ cash costs were only a little higher than the GDX majors’ $600. That’s despite the mid-tiers each operating fewer gold mines and thus having fewer opportunities to realize cost efficiencies. Traders must recognize these mid-sized gold miners are in zero fundamental peril as long as prevailing gold prices remain well above cash costs. And $618 gold ain’t happening!

Way more important than cash costs are the far-superior all-in sustaining costs. They were introduced by the World Gold Council in June 2013 to give investors a much-better understanding of what it really costs to maintain gold mines as ongoing concerns. AISC include all direct cash costs, but then add on everything else that is necessary to maintain and replenish operations at current gold-production levels.

These additional expenses include exploration for new gold to mine to replace depleting deposits, mine-development and construction expenses, remediation, and mine reclamation. They also include the corporate-level administration expenses necessary to oversee gold mines. All-in sustaining costs are the most-important gold-mining cost metric by far for investors, revealing gold miners’ true operating profitability.

In Q4’17, these top-34 GDXJ components reporting AISCs averaged just $855 per ounce. That only rose 0.1% YoY, effectively dead flat, despite the new mix of GDXJ components. That also compares very favorably with the GDX majors, which saw nearly-identical average AISCs at $858 in Q4. The mid-tier gold miners’ low costs prove they are faring far better fundamentally today than their low stock prices imply.

All-in sustaining costs are effectively this industry’s breakeven level. As long as gold stays above $855 per ounce, it remains profitable to mine. At Q4’s average gold price of $1276, these top GDXJ gold miners were earning big average profits of $421 per ounce last quarter! That equates to fat profit margins of 33%, levels most industries would kill for. The mid-tier gold miners aren’t getting credit for that today.

Unfortunately given its largely-junior-less composition, GDXJ remains the leading benchmark for junior gold miners. In Q4’17, this ETF averaged $32.62 per share. That was down a considerable 10.2% from Q4’16’s average of $36.34. Investors have largely abandoned gold miners because they are captivated by the extreme taxphoria stock-market rally since the election. Yet gold-mining profits certainly didn’t justify this.

A year ago in Q4’16, the top-34 GDXJ components at that time also reported average all-in sustaining costs of $855 per ounce. With gold averaging $1218 then which was 4.6% lower, that implies the mid-tier gold miners were running operating profits of $363 per ounce. Thus Q4’17’s $421 surged 16.0% YoY, a heck of a jump! Yet the mid-tier gold miners’ stock prices irrationally slumped substantially lower.

Gold miners offer such compelling investment opportunities because of their inherent profits leverage to gold. Gold-mining costs are largely fixed during mine-planning stages, when engineers and geologists decide which ore to mine, how to dig to it, and how to process it. The actual mining generally requires the same levels of infrastructure, equipment, and employees quarter after quarter regardless of gold prices.

With gold-mining costs essentially fixed, higher or lower gold prices flow directly through to the bottom line in amplified fashion. This really happened in GDXJ over the past year despite its radical changes in composition. A 4.8% gold rally in quarterly-average terms catapulted operating profits 16.0% higher, or 3.3x. That’s right in line with the typical leverage of gold-mining profits to gold prices of several times or so.

But this strong profitability sure isn’t being reflected in gold-stock prices. GDXJ shouldn’t have been lower in Q4’17 with mining profits much higher. The vast fundamental disconnect in gold-stock prices today is absurd, and can’t last forever. Sooner or later investors will rush into the left-for-dead gold stocks to bid their prices far higher. This bearish-sentiment-driven anomaly has grown more extreme in 2018.

Since gold-mining costs don’t change much quarter-to-quarter regardless of prevailing gold prices, it’s reasonable to assume the top GDXJ miners’ AISCs will largely hold steady in the current Q1’18. And it’s been a strong quarter for gold so far, with it averaging over $1328 quarter-to-date. If the mid-tier gold miners’ AISCs hold near $855, that implies their operating profits are now running way up near $473 per ounce.

That would make for a massive 12.4% QoQ jump in earnings for the mid-tier gold miners in this current quarter! Yet so far in Q1 GDXJ is languishing at an average of just $32.88, flat lined from Q4 where gold prices and mining profits were considerably lower. The mid-tier gold miners’ stocks can’t trade as if their profits don’t matter forever, so an enormous mean-reversion rally higher is inevitable sometime soon.

And that assumes gold prices merely hold steady, which is unlikely. After years of relentlessly-levitating stock markets thanks to extreme central-bank easing, radical gold underinvestment reigns today. As the wildly-overvalued stock markets inescapably sell off on unprecedented central-bank tightening this year, gold investment will really return to favor. That portends super-bullish-for-miners higher gold prices ahead.

The impact of higher gold prices on mid-tier-gold-miner profitability is easy to model. Assuming flat all-in sustaining costs at Q4’17’s $855 per ounce, 10%, 20%, and 30% gold rallies from this week’s levels would lead to collective gold-mining profits surging 45%, 77%, and 108%! And another 30% gold upleg isn’t a stretch at all. In the first half of 2016 alone after the previous stock-market correction, gold soared 29.9%.

GDXJ skyrocketed 202.5% higher in 7.0 months in largely that same span! Gold-mining profits and thus gold-stock prices surge dramatically when gold is powering higher. Years of neglect from investors have forced the gold miners to get lean and efficient, which will really amplify their fundamental upside during the next major gold upleg. The investors and speculators who buy in early and cheap could earn fortunes.

Given the radical changes in GDXJ’s composition over the past year, normal year-over-year comparisons in key financial results simply aren’t meaningful. The massive rejiggering of the index underlying GDXJ didn’t happen until Q2’17, so it will be a couple quarters yet until results finally grow comparable again. But in the meantime, here are the apples-to-oranges reads on the GDXJ components’ key financial results.

The cash flows generated from operations by these top-34 GDX components rocketed 104.5% higher YoY to $1743m. That helped boost their collective cash balances by 53.9% YoY to $6577m. Sales were up 102.6% YoY to $4282m, roughly in line with the 87.4% gold-production growth. But again GDXJ was way different a year ago, so this impressive growth merely reflects bigger mid-tier gold miners replacing true juniors.

As long as OCFs remain massively positive, the gold mines are generating much more cash than they cost to run. That gives the gold miners the capital necessary to expand existing operations and buy new deposits and mines. Given how ridiculously low gold-stock prices are today, you’d think the gold miners are hemorrhaging cash like crazy. But the opposite is true, showing how silly this bearish herd sentiment is.

Unfortunately the GAAP earnings picture looked vastly worse. These top-34 GDXJ gold miners reporting Q4 earnings collectively lost $317m, compared to a minor $2m profit in Q4’16. While that certainly looks like a disaster, it’s heavily skewed. Excluding 3 big mid-tier gold miners that reported huge losses in Q4, the other 11 of these top GDXJ gold miners reporting earnings actually earned an impressive $212m in profits.

Yamana Gold, New Gold, and Endeavour Mining suffered huge $200m, $196m, and $134m losses in Q4’17. In each case these resulted from large impairment charges. As mines are dug deeper and gold prices change, the economics of producing this metal change too. That leaves some of the mid-tier gold miners’ individual mines worth less going forward than the amount of capital invested to develop them.

So they are written off, resulting in big charges flushed through income statements that mask operating profits. But these writedowns are something of an accounting fiction, non-cash expenses not reflective of current operations. They are mostly isolated one-time events as well, not representing earnings trends. As gold continues to march higher in its young bull, impairment charges will vanish as mining economics improve.

So overall the mid-tier gold miners’ fundamentals looked quite strong in Q4’17, a stark contrast to the miserable sentiment plaguing this sector. Gold stocks’ vexing consolidation over the past year or so isn’t the result of operational struggles, but purely bearish psychology. That will soon shift as stock markets inevitably roll over and gold surges, making the beaten-down gold stocks a coiled spring overdue to soar dramatically.

Given GDXJ now diverting most of its capital inflows into larger mid-tier gold miners that definitely aren’t juniors, you won’t find sufficient junior-gold exposure in this now-mislabeled ETF. Instead traders should prudently deploy capital in the better individual mid-tier and junior gold miners’ stocks with superior fundamentals. Their upside is vast, and would trounce GDXJ’s even if it was still working as advertised.

At Zeal we’ve literally spent tens of thousands of hours researching individual gold stocks and markets, so we can better decide what to trade and when. As of the end of Q4, this has resulted in 983 stock trades recommended in real-time to our newsletter subscribers since 2001. Fighting the crowd to buy low and sell high is very profitable, as all these trades averaged stellar annualized realized gains of +20.2%!

The key to this success is staying informed and being contrarian. That means buying low before others figure it out, before undervalued gold stocks soar much higher. An easy way to keep abreast is through our acclaimed weekly and monthly newsletters. They draw on my vast experience, knowledge, wisdom, and ongoing research to explain what’s going on in the markets, why, and how to trade them with specific stocks. For only $12 per issue, you can learn to think, trade, and thrive like contrarians. Subscribe today, and get deployed in the great gold and silver stocks in our full trading books!

The bottom line is the mid-tier gold miners now dominating GDXJ enjoyed strong fundamentals in their recently-reported Q4 results. While GDXJ’s radical composition changes since last year muddy annual comparisons, today’s components mined lots more gold at dead-flat costs. These miners continued to earn fat operating profits while generating strong cash flows. Sooner or later stock prices must reflect fundamentals.

As gold itself continues mean reverting higher, these mid-tier gold miners will see their profits soar due to their big inherent leverage to gold. GDXJ now offers excellent exposure to mid-tier gold miners, which will see gains well outpacing the majors. All it will take to ignite gold stocks’ overdue mean-reversion rally is gold investment demand returning. The resulting higher gold prices will attract investors back to gold miners.

Adam Hamilton, CPA

March 23, 2018

Copyright 2000 – 2018 Zeal LLC (www.ZealLLC.com)

The gold miners’ stocks remain deeply out of favor, trading at prices seen when gold was half or even a quarter of current levels. So many traders assume this small contrarian sector must be really struggling fundamentally. But nothing could be farther from the truth! The major gold miners’ recently-released Q4’17 results prove they are thriving. Their languishing stock prices are the result of irrational herd sentiment.

Four times a year publicly-traded companies release treasure troves of valuable information in the form of quarterly reports. Required by securities regulators, these quarterly results are exceedingly important for investors and speculators. They dispel all the sentimental distortions surrounding prevailing stock-price levels, revealing the underlying hard fundamental realities. They serve to re-anchor perceptions.

Normally quarterlies are due 45 calendar days after quarter-ends, in the form of 10-Qs required by the SEC for American companies. But after the final quarter of fiscal years, which are calendar years for most gold miners, that deadline extends out up to 90 days depending on company size. The 10-K annual reports required once a year are bigger, more complex, and need fully-audited numbers unlike 10-Qs.

So it takes companies more time to prepare full-year financials and then get them audited by CPAs right in the heart of their busy season. The additional delay in releasing Q4 results is certainly frustrating, as that data is getting stale approaching the end of Q1. Compounding the irritation, some gold miners don’t actually break out Q4 separately. Instead they only report full-year results, lumping in and obscuring Q4.

I always wonder what gold miners that don’t report full Q4 results are trying to hide. Some Q4 numbers can be inferred by comparing full-year results to the prior three quarterlies, but others aren’t knowable if not specifically disclosed. While most gold miners report their Q4 and/or full-year results by 7 to 9 weeks after year-ends, some drag their feet and push that 13-week limit. That’s very disrespectful to investors.

All this unfortunately makes Q4 results the hardest to analyze out of all quarterlies. But delving into them is still well worth the challenge. There’s no better fundamental data available to gold-stock investors and speculators than quarterly results, so they can’t be ignored. They offer a very valuable true snapshot of what’s really going on, shattering all the misconceptions bred by the ever-shifting winds of sentiment.

The definitive list of major gold-mining stocks to analyze comes from the world’s most-popular gold-stock investment vehicle, the GDX VanEck Vectors Gold Miners ETF. Its composition and performance are similar to the benchmark HUI gold-stock index. GDX utterly dominates this sector, with no meaningful competition. This week GDX’s net assets are 24.4x larger than the next-biggest 1x-long major-gold-miners ETF!

Being included in GDX is the gold standard for gold miners, requiring deep analysis and vetting by elite analysts. And due to ETF investing eclipsing individual-stock investing, major-ETF inclusion is one of the most-important considerations for picking great gold stocks. As the vast pools of fund capital flow into leading ETFs, these ETFs in turn buy shares in their underlying companies bidding their stock prices higher.

This week GDX included a whopping 51 component “Gold Miners”. That term is used somewhat loosely, as this ETF also contains major silver miners, a silver streamer, and gold royalty companies. Still, all the world’s major gold miners are GDX components. Due to time constraints I limited my deep individual-company research to this ETF’s top 34 stocks, an arbitrary number that fits neatly into the tables below.

Collectively GDX’s 34 largest components now account for 90.5% of its total weighting, a commanding sample. GDX’s stocks include major foreign gold miners trading in Australia, Canada, and the UK. Some countries’ regulations require financial reporting in half-year increments instead of quarterly, which limits local gold miners’ Q4 data. But some foreign companies still choose to publish limited quarterly results.

The importance of these top-GDX-component gold miners can’t be overstated. In Q4’17 they collectively produced over 10.3m ounces of gold, or 321.5 metric tons. The World Gold Council’s recently-released Q4 Gold Demand Trends report, the definitive source on worldwide supply-and-demand fundamentals, pegged total global mine production at 833.1t in Q4. GDX’s top 34 miners alone accounted for nearly 4/10ths!

Every quarter I wade through a ton of data from these elite gold miners’ 10-Qs or 10-Ks, and dump it into a big spreadsheet for analysis. The highlights made it into these tables. Blank fields mean a company did not report that data for Q4’17 as of this Wednesday. Naturally companies always try to present their quarterly results in the best-possible light, which leads to wide variations in reporting styles and data offered.

In these tables the first couple columns show each GDX component’s symbol and weighting within this ETF as of this week. While most of these gold stocks trade in the States, not all of them do. So if you can’t find one of these symbols, it’s a listing from a company’s primary foreign stock exchange. That’s followed by each company’s Q4’17 gold production in ounces, which is mostly reported in pure-gold terms.

Many gold miners also produce byproduct metals like silver and copper. These are valuable, as they are sold to offset some of the considerable costs of gold mining. Some companies report their quarterly gold production including silver, a construct called gold-equivalent ounces. I only included GEOs if no pure-gold numbers were reported. That’s followed by production’s absolute year-over-year change from Q4’16.

Next comes the most-important fundamental data for gold miners, cash costs and all-in sustaining costs per ounce mined. The latter determines their profitability and hence ultimately stock prices. Those are also followed by YoY changes. Finally the YoY changes in cash flows generated from operations, GAAP profits, revenues, and cash on balance sheets are listed. There are a couple exceptions to these YoY changes.

Percentage changes aren’t relevant or meaningful if data shifted from positive to negative or vice versa, or if derived from two negative numbers. So in those cases I included raw underlying numbers instead of weird or misleading percentage changes. This whole dataset offers a fantastic high-level read on how the major gold miners are faring today as an industry. And contrary to their low stock prices, they are thriving!

After spending days digesting these elite gold miners’ latest quarterly reports, it’s fully apparent their vexing consolidation over the past year or so isn’t fundamentally-righteous at all! Traders have mostly abandoned this sector because the allure of the levitating general stock markets has eclipsed gold. That has left gold stocks exceedingly undervalued, truly the best fundamental bargains out there in all the stock markets!

Since gold miners are in the business of wresting gold from the bowels of the Earth, production is the best place to start. The 10,337k ounces of gold collectively produced last quarter by these elite major gold miners actually fell a sizable 1.7% YoY! Interestingly that’s right in line with industry trends per the World Gold Council, as overall world gold mine production also retreated that same 1.7% YoY in Q4’17.

These biggest and best gold miners on the planet certainly had every incentive to grow their gold production. The quarterly average gold price surged 4.8% YoY in Q4’17, really boosting profitability. Of course the more gold any miner can produce, the more opportunities it has to expand thanks to higher cash flows. Investors often punish flagging production too, so the major gold miners really hate reporting it.

Most investors won’t bother studying long and detailed 10-Qs, 10-Ks, or the accompanying management discussions and analyses. So gold miners often issue short press releases summarizing some of their quarterly results. These sometimes intentionally mask production declines by excluding year-ago production, looking at quarter-on-quarter performance instead of year-over-year, or only comparing results to guidance.

As a professional speculator, investor, and newsletter writer for nearly two decades now, I spend a huge amount of time analyzing quarterly results. And I remain a CPA after my previous late-1990s gig auditing mining companies for a Big Six firm. Yet even with this exceptional experience and knowledge, I’m still surprised how deeply I have to dig for some key results miners bury and hide in hundred-plus-page-long SEC filings.

So believe me, major gold miners don’t shout out shrinking gold production from the rooftops. Yet of the 32 of these top-34 GDX gold miners reporting Q4 production as of the middle of this week, fully half saw declines. That was even with four different gold miners climbing into GDX’s top 34 components over the past year, which are highlighted in blue above. The average production decline was a serious 9.5% YoY!

Gold deposits economically viable to mine are very rare in the natural world, and the low-hanging fruit has largely been harvested. It is growing ever more expensive to explore for gold, in far-less-hospitable places. Then even after new deposits are discovered, it takes up to a decade to jump through all the Draconian regulatory hoops necessary to secure permitting. And only then can mine construction finally start.

That takes additional years and hundreds of millions if not billions of dollars per gold mine. But because gold-mining stocks have been deeply out of favor most of the time since 2013, capital has been heavily constrained. When banks are bearish on gold prices, they aren’t willing to lend to gold miners except with onerous terms. And when investors aren’t buying gold stocks, issuing new shares low is heavily dilutive.

The large gold miners used to rely heavily on the smaller junior gold miners to explore and replenish the gold-production pipeline. But juniors have been devastated since 2013, starved of capital. Not only are investors completely uninterested with general stock markets levitating, but the rise of ETFs has funneled most investment inflows into a handful of larger-market-cap juniors while the rest see little meaningful buying.

So even the world’s biggest and best gold miners are struggling to grow production. While that isn’t great for those individual miners, it’s super-bullish for gold. The less gold mined, the more gold supply will fail to keep pace with demand. That will result in higher gold prices, making gold mining more profitable in the future. Some analysts even think peak gold has been reached, that mine production will decline indefinitely.

There are strong fundamental arguments in favor of peak-gold theories. But regardless of where overall global gold production heads in coming years, the major gold miners able to grow their own production will fare the best. They’ll attract in relatively-more investor capital, bidding their stocks to premium prices compared to peers who can’t grow production. Stock picking is more important than ever in this ETF world!

But despite slowing gold production, these top-34 GDX-component gold miners remained quite strong fundamentally in Q4! Their viability and profitability are measured by the differences between prevailing gold prices and what it costs to produce that gold. Despite traders’ erroneous perception gold stocks are doomed, rising gold prices and falling mining costs are making the major gold miners much more profitable.

There are two major ways to measure gold-mining costs, classic cash costs per ounce and the superior all-in sustaining costs per ounce. Both are useful metrics. Cash costs are the acid test of gold-miner survivability in lower-gold-price environments, revealing the worst-case gold levels necessary to keep the mines running. All-in sustaining costs show where gold needs to trade to maintain current mining tempos indefinitely.

Cash costs naturally encompass all cash expenses necessary to produce each ounce of gold, including all direct production costs, mine-level administration, smelting, refining, transport, regulatory, royalty, and tax expenses. In Q4’17, these top-34 GDX-component gold miners that reported cash costs averaged just $600 per ounce. That dropped a sizable 4.4% YoY, showing serious gold-miner discipline controlling costs.

Today the gold miners’ stocks are trading at crazy-low prices implying their survivability is in jeopardy. This week the flagship HUI gold-stock index was languishing near 174, despite $1325 gold. The first time the HUI hit 175 in August 2003, gold was only in the $350s! Gold stocks are radically undervalued today by every metric. And they collectively face zero threat of bankruptcies unless gold plummets under $600.

Way more important than cash costs are the far-superior all-in sustaining costs. They were introduced by the World Gold Council in June 2013 to give investors a much-better understanding of what it really costs to maintain gold mines as ongoing concerns. AISC include all direct cash costs, but then add on everything else that is necessary to maintain and replenish operations at current gold-production levels.

These additional expenses include exploration for new gold to mine to replace depleting deposits, mine-development and construction expenses, remediation, and mine reclamation. They also include the corporate-level administration expenses necessary to oversee gold mines. All-in sustaining costs are the most-important gold-mining cost metric by far for investors, revealing gold miners’ true operating profitability.

In Q4’17, these top-34 GDX-component gold miners reporting AISC averaged just $858 per ounce. That was down a significant 2.0% YoY, extending a welcome declining trend. In 2017’s four quarters, these major gold miners’ average AISCs ran $878, $867, $868, and $858. The elite gold miners are getting more efficient at producing their metal, which is definitely impressive considering their collective lower production.

Gold-mining costs are largely fixed during mine-planning stages, when engineers and geologists decide which ore to mine, how to dig to it, and how to process it. The actual mining generally requires the same levels of infrastructure, equipment, and employees quarter after quarter. So the more gold mined, the more ounces to spread those big fixed costs across. Thus production and AISCs are usually negatively correlated.

The major gold miners have to manage costs exceptionally well to drive AISCs lower while production is also slowing. This argues against the popular complaint that gold miners’ managements are doing poor jobs. Because gold-stock prices are so darned low, traders again assume the miners must be plagued with serious fundamental problems. But it’s relentlessly-bearish herd sentiment suppressing gold-stock prices.

These top-34 GDX gold miners are actually earning strong operating profits today. Q4’17’s average gold price ran near $1276, again up 4.8% YoY. That remains far above last quarter’s low average all-in sustaining costs among these major gold miners of $858 per ounce. Thus industry profit margins are way up at $418 per ounce. Most other industries would sell their souls to earn fat profit margins at this 33% level!

A year earlier in Q4’16, the top-34 GDX gold miners reported average AISCs of $875 in a quarter where gold averaged under $1218. That made for $343 per ounce in operating profits. So in Q4’17, the major gold miners’ earnings soared 22.1% YoY to $418 on that mere 4.8% gold rally! Gold miners make such compelling investment opportunities because of their inherent profits leverage to gold, multiplying its gains.

But this strong profitability sure isn’t being reflected in gold-stock prices. In Q4’17 the HUI averaged just 189.4, actually 1.5% lower than Q4’16’s 192.3! The vast fundamental disconnect in gold-stock prices today is absurd, and can’t last forever. Sooner or later investors will rush into the left-for-dead gold stocks to bid their prices far higher. This bearish-sentiment-driven anomaly has grown more extreme in 2018.

Since gold-mining costs don’t change much quarter-to-quarter regardless of prevailing gold prices, it’s reasonable to assume the top GDX miners’ AISCs will largely hold steady in the current Q1’18. And it’s been a strong quarter for gold so far, with it averaging over $1329 quarter-to-date. If the major gold miners’ AISCs hold near $858, that implies their operating profits are now running way up near $471 per ounce.

That would make for a massive 12.7% QoQ jump in earnings for the major gold miners in this current quarter! Yet so far in Q1 the HUI is averaging just 187.1, worse than both Q4’17 and Q4’16 when gold prices were considerably lower and mining costs were higher. The gold miners’ stocks can’t trade as if their profits don’t matter forever, so an enormous mean-reversion rally higher is inevitable sometime soon.

And that assumes gold prices merely hold steady, which is unlikely. After years of relentlessly-levitating stock markets thanks to extreme central-bank easing, radical gold underinvestment reigns today. As the wildly-overvalued stock markets inescapably sell off on unprecedented central-bank tightening this year, gold investment will really return to favor. That portends super-bullish-for-miners higher gold prices ahead.

The impact of higher gold prices on major-gold-miner profitability is easy to model. Assuming flat all-in sustaining costs at Q4’17’s $858 per ounce, 10%, 20%, and 30% gold rallies from this week’s levels would lead to collective gold-mining profits surging 43%, 75%, and 107%! And another 30% gold upleg isn’t a stretch at all. In the first half of 2016 alone after the previous stock-market correction, gold soared 29.9%.

GDX skyrocketed 151.2% higher in 6.4 months in essentially that same span! Gold-mining profits and thus gold-stock prices surge dramatically when gold is powering higher. Years of neglect from investors have forced the gold miners to get lean and efficient, which will amplify their fundamental upside during the next major gold upleg. The investors and speculators who buy in early and cheap could earn fortunes.

While all-in sustaining costs are the single-most-important fundamental measure that investors need to keep an eye on, other metrics offer peripheral reads on the major gold miners’ fundamental health. The more important ones include cash flows generated from operations, actual accounting profits, revenues, and cash on hand. They generally corroborated AISCs in Q4’17, proving the gold miners are faring really well.

These top-34 GDX-component gold miners collectively reported strong operating cash flows of $4529m in Q4, surging a huge 21.6% YoY! Running gold mines is very profitable for the major miners, they have this down to a science. Of the 26 of these major gold miners reporting Q4 OCFs, every single one was positive. Most also proved relatively large compared to individual company sizes, looking really strong.

As long as OCFs remain massively positive, the gold mines are generating much more cash than they cost to run. That gives the gold miners the capital necessary to expand existing operations and buy new deposits and mines. Given how ridiculously low gold-stock prices are today, you’d think the gold miners are hemorrhaging cash like crazy. But the opposite is true, showing how silly this bearish herd sentiment is.

The top GDX gold miners’ actual GAAP accounting profits didn’t look as good, coming in at a $266m loss in Q4’17. While a big improvement over Q4’16’s $588m loss, that still seems incongruent with those great all-in sustaining costs and operating cash flows. Of the 23 of these top-34 GDX components reporting earnings in Q4, 10 had losses. Half of those were big, over $50m. I looked into the reasons behind each one.

These handful of big gold-mining losses that dragged down overall top-GDX-component earnings were mostly the result of asset-impairment charges. Some of the world’s largest gold miners led by Newmont and Barrick with $527m and $314m Q4 losses continued to write down the carrying value of some gold mines. As mines are dug deeper and gold prices change, the economics of producing the metal change too.

That leaves some of the major gold miners’ individual mines worth less going forward than the amount of capital invested to develop them. So they are written off, resulting in big charges flushed through income statements that mask operating profits. But these writedowns are something of an accounting fiction, non-cash expenses not reflective of current operations. They are mostly isolated one-time events as well.

In addition to writedowns totally irrelevant to current and future cash flows, there were also big losses recognized in Q4’17 due to the new US corporate-tax law. With tax rates slashed, deferred tax assets that were created by overpaying taxes in past years were suddenly worth a lot less. These too were non-cash charges, another accounting fiction. Finally some companies realized losses on selling gold mines.

The major gold miners all run portfolios of multiple individual gold mines, each with different AISC levels. They’ve been gradually pruning out their higher-cost operations by selling those mines to smaller gold miners, usually at losses. While this hits income statements in mine-sale quarters, it is one reason the major gold miners have been able to drive down their costs. That will lead to greater future profitability.

In price-to-earnings-ratio terms, the major gold stocks are definitely getting cheaper. Of the 23 of these top-GDX-component stocks with profits to create P/E ratios, 7 had P/Es in the single or low-double digits! There are some really-cheap gold miners out there today, even adjusted for any dilution from past share issuances. Of course P/E ratios automatically do that since stock prices are divided by earnings per share.

On the sales front these top-34 GDX gold miners’ revenues soared 13.9% YoY to $12,236m in Q4. That looks suspect given that 1.7% YoY drop in production and the 4.8% YoY rally in the average gold price. 26 of these gold miners reported Q4 sales, compared to 27 a year earlier in Q4’16. The apparent growth came from some large gold miners that didn’t disclose Q4’16 sales deciding to make that data available in Q4’17.

Cash on balance sheets is also an interesting metric to watch, because it is primarily fed by operating profitability. Nearly all the gold miners report their quarter-ending cash balances as well, whether they report quarterly like in the US and Canada or in half-year increments like in Australia and the UK. The total cash on hand reported by these top GDX gold miners surged 7.0% YoY to a hefty $13,974m in Q4’17!

That’s a big number for this small contrarian sector, and it’s conservative. I just included the bank cash reported, excluding short-term investments and gold bullion. The more cash gold miners have on hand, the more flexibility they have in growing operations and the more resilience they have to weather any unforeseen challenges. Material drops in cash at individual miners were usually spent to grow their production.

So overall the major gold miners’ fundamentals looked quite strong in Q4’17, a stark contrast to the miserable sentiment plaguing this sector. Gold stocks’ vexing consolidation over the past year or so isn’t the result of operational struggles, but purely bearish psychology. That will soon shift as stock markets inevitably roll over and gold surges, making the beaten-down gold stocks a coiled spring overdue to soar dramatically.

While investors and speculators alike can certainly play gold stocks’ coming powerful uplegs with the major ETFs like GDX, the best gains by far will be won in individual gold stocks with superior fundamentals. Their upside will far exceed the ETFs, which are burdened by over-diversification and underperforming stocks. A carefully-handpicked portfolio of elite gold and silver miners will generate much-greater wealth creation.

At Zeal we’ve literally spent tens of thousands of hours researching individual gold stocks and markets, so we can better decide what to trade and when. As of the end of Q4, this has resulted in 983 stock trades recommended in real-time to our newsletter subscribers since 2001. Fighting the crowd to buy low and sell high is very profitable, as all these trades averaged stellar annualized realized gains of +20.2%!

The key to this success is staying informed and being contrarian. That means buying low before others figure it out, before undervalued gold stocks soar much higher. An easy way to keep abreast is through our acclaimed weekly and monthly newsletters. They draw on my vast experience, knowledge, wisdom, and ongoing research to explain what’s going on in the markets, why, and how to trade them with specific stocks. For only $12 per issue, you can learn to think, trade, and thrive like contrarians. Subscribe today, and get deployed in the great gold and silver stocks in our full trading books!

The bottom line is the major gold miners’ fundamentals are quite strong based on their recently-reported Q4’17 results. While production declined, mining costs were still driven lower. That coupled with higher gold prices generated fat operating profits and strong cash flows. The resulting full coffers will help the gold miners expand operations this year, which will lead to even stronger earnings growth in the future.

Yet gold stocks are now priced as if gold was half or less of current levels, which is truly fundamentally absurd! They are the last dirt-cheap sector in these euphoric, overvalued stock markets. Once gold resumes rallying on gold investment demand returning, capital will flood back into forgotten gold stocks. That will catapult them higher, continuing their overdue mean reversion back up to fundamentally-righteous levels.

Adam Hamilton, CPA

March 16, 2018

Copyright 2000 – 2018 Zeal LLC (www.ZealLLC.com)

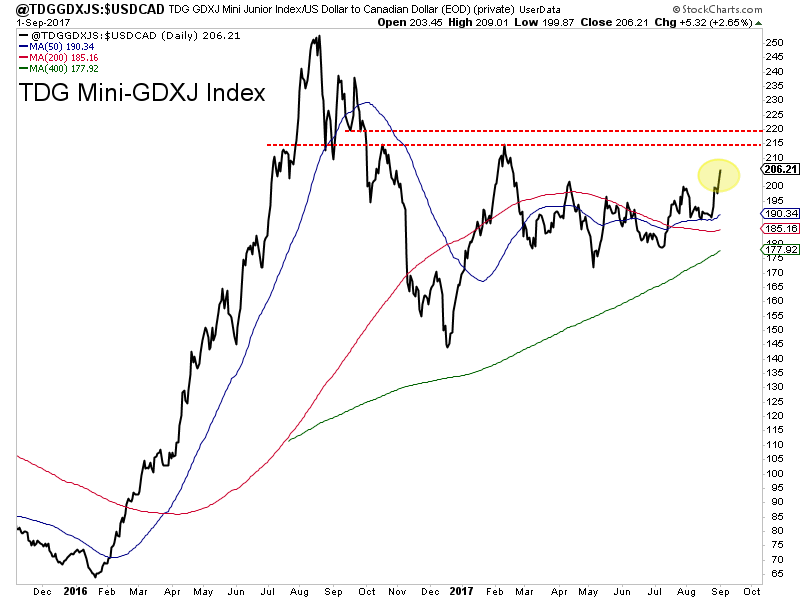

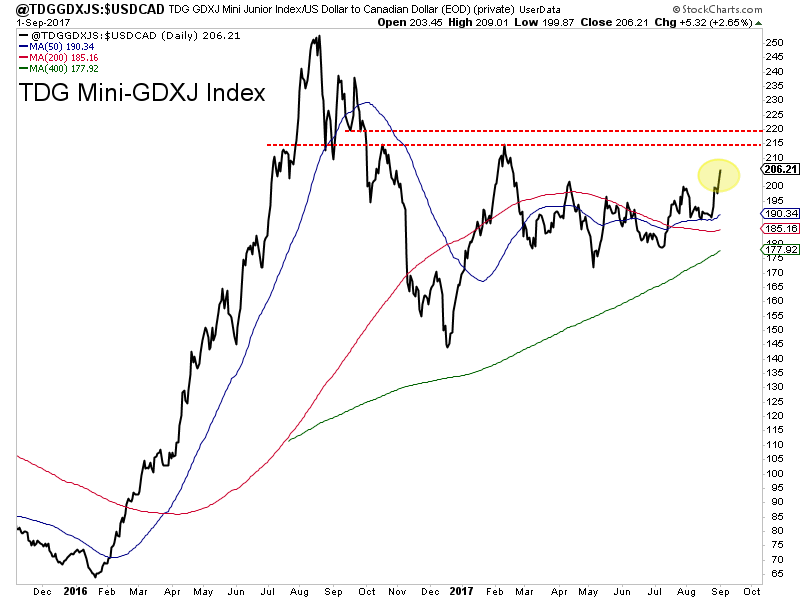

The small contrarian gold-mining sector remains deeply out of favor, universally ignored. Thus the gold stocks are largely drifting listlessly, totally devoid of excitement. But that’s the best time to buy low, when few others care. The gold stocks continue to form strong technical bases, paving the way for massive mean-reversion uplegs. And they remain exceedingly cheap relative to gold prices, which drive their profits.

Being a gold-stock investor feels pretty miserable and hopeless these days. The gold stocks have been consolidating low for 14.2 months now, stuck in a seemingly-endless sideways grind. There are still gains to be won, but they are mostly within that low-trading-range context. We haven’t seen one of the huge uplegs gold stocks are famous for since the first half of 2016. So most traders have given up and moved on.

That’s understandable psychologically, but unfortunate for multiplying wealth. Sometimes it takes a while for gold stocks to catch a bid, but once they get moving they often soar. This sector is so small relative to broader stock markets that even minor shifts in capital flows can drive enormous gains. While it’s hard waiting for gold stocks to return to favor, the vast upside when they do is well worth the buying-low pain.

The leading gold-stock measure and trading vehicle is the GDX VanEck Vectors Gold Miners ETF. It was the original gold-stock ETF launched in May 2006, and still maintains a commanding advantage in popularity. This week, GDX’s net assets of $7.7b were 24.0x larger than its next-biggest 1x-long major-gold-stock-ETF competitor! GDX is as big as all the other gold-stock ETFs trading in the US combined.

GDX’s price action shows why gold stocks are such compelling investments when everyone hates them. After gold stocks were universally despised in mid-January 2016, GDX soared 151.2% higher in just 6.4 months! After the previous time sentiment turned so overwhelmingly against gold stocks in October 2008, GDX rocketed 307.0% higher over the next 2.9 years. Buying gold stocks low has proven very lucrative.

That quadrupling of GDX after 2008’s first-in-a-century stock panic was actually the tail end of a vastly-larger secular gold-stock bull. Many years before GDX was even a twinkle in its creators’ eyes, that gold-stock bull started stealthily marching higher out of total despair. It can’t be measured by GDX since that ETF started too late, but the classic HUI NYSE Arca Gold BUGS Index reveals the magnitude of that bull run.

Over 10.8 years between November 2000 and September 2011, the gold stocks as measured by the HUI skyrocketed an astounding 1664.4% higher! And that was during a long bear-market span in the general stock markets, where the flagship S&P 500 drifted 14.2% lower. The gains in gold miners’ stocks as they mean revert from out of favor to popular are so epically enormous that they far outweigh any time lost waiting.

Gold stocks are even more attractive today given the exceedingly-overvalued and dangerous US stock markets, which are on the verge of a long-overdue major bear. Market valuations remain deep in literal bubble territory despite early-February’s correction. The simple-average trailing-twelve-month price-to-earnings ratio of the elite S&P 500 stocks was still 31.5x at the end of last month, above the 28x bubble threshold!

The market-darling stocks investors love today are crazy-expensive, portending huge downside in the next bear. The most-popular stock among professional and individual investors alike is Amazon.com, a great company. Yet AMZN stock is now trading at a ludicrous 252.5x earnings! That means if profits held steady it would take new investors today a quarter millennium just to recoup their stock purchase price.

Meanwhile the world’s largest gold miner in 2017-production terms, Barrick Gold, is now trading at a TTM P/E of 9.5x. That’s dirt-cheap by any standards! And ABX’s profits-growth potential is greater than AMZN’s. Last year Barrick mined 5.32m ounces of gold at all-in sustaining costs of $750 per ounce. That was $508 under gold’s average price of $1258 last year, fueling fat full-year profits over $1.5b on $8.4b in sales.

Every 10% increase in prevailing gold prices boosts Barrick’s earnings by 25%. And the average gold price so far in 2018 is already up 5.7%, so gold miners’ profits are growing fast. I’m not a Barrick Gold investor, and am just using this leading major gold miner as an example. There are plenty of smaller mid-tier gold miners with far more upside profits leverage to gold prices. Gold stocks are darned attractive!

They are one of the last bargain sectors remaining in these overheated stock markets. They are one of the only sectors that can rally in major bear markets, because they follow gold which drives their profits. Gold investment demand surges in weak stock markets, which brings investors back to gold stocks. At some point, investors are going to figure out how compelling gold stocks are today and stampede back in.

Despite the apathetic sentiment plaguing them, the gold stocks are still looking fine technically and even better fundamentally. This first chart looks at gold-stock technicals as rendered by their dominant GDX ETF. Given how bearish traders have waxed on gold miners, you’d think they are spiraling relentlessly lower. But they are actually consolidating nicely, establishing a strong base from which to launch their next upleg.

After plunging to fundamentally-absurd all-time lows in mid-January 2016, GDX soared into a major new bull market. While its 151.2% surge in just 6.4 months was undoubtedly extreme, that emerged out of even-more-extreme lows. And it merely catapulted GDX to a 3.3-year high in early-August 2016, nowhere close to secular topping levels. But the gold stocks were very overbought then, and soon corrected hard.

GDX’s enormous 39.4% correction in 4.4 months after that initial bull peak was also extreme, the result of a couple major anomalies. First gold-futures stops were run on major gold support failing, which ignited parallel cascading stop-loss selling in the gold miners’ stocks. Then investors fled gold in the wake of Trump’s surprise election victory, which led stock markets to soar on widespread hopes for big tax cuts soon.

Gold-stock selling finally exhausted itself in mid-December 2016, the day after the Fed’s 2nd rate hike of this cycle. Just a couple weeks later, GDX entered its now-14.2-month-old trading range that persists to this day. It is a basing consolidation trend running from $21 support to $25 resistance, which makes for a 19.0% trading range. This has held rock solid ever since, which has made gold-stock trading fairly easy.

My strategy has been simple. Given the extreme undervaluations in gold stocks that I’ll discuss shortly, a massive new upleg is likely to ignite anytime. So I want a full trading book to reap those enormous gains when they inevitably arrive. Thus every time GDX slumped down into the lower quarter of its consolidation range, between $21 to $22, I’ve been adding positions in great mid-tier gold miners with superior fundamentals.

All this is shared in real-time with our newsletter subscribers, who graciously support our research work. Buying low in the context of this vexing gold-stock consolidation has driven some great trades despite lackluster overall action. One example is Kirkland Lake Gold, an elite mid-tier miner. I added a new position in our popular weekly newsletter in December 2016. A year later I sold it for a hefty 184% realized gain!

So while this gold-stock trading range has sure felt dull, it has still created plenty of trading opportunities. And over the past month or so since that sharp stock-market correction, GDX has largely meandered in that lower quarter of its range near support again. That means it’s an excellent time to deploy capital in the unloved and cheap gold miners’ stocks today. Another surge higher is due, and it could be a big one.

While GDX $21 support has proven strong since the end of 2016, so has GDX $25 resistance. The gold stocks have tried and failed to break out above $25 four separate times since early 2017. A couple of the attempts were close, but weren’t sustainable as gold retreated. Once that $25 breakout finally comes to pass, investors will realize something different is happening and rush to chase gold stocks’ upside momentum.

Before early February’s sharp stock-market plunge that changed everything, I was looking to the release of gold miners’ Q4’17 operating and financial results as a potential catalyst to fuel that $25 breakout. That didn’t happen though, as gold and especially gold stocks were sucked into the fear surrounding the unprecedented stock-market volatility shock a month ago. That dragged GDX back down near support, which held.

This recent support approach is probably a blessing in disguise, offering another chance for investors to deploy capital in cheap gold stocks before they really start moving again. The great and sad paradox of the markets is investors are least willing to buy when stocks are low and out of favor, which is the exact time they should be buying before later selling high. Gold-stock prices can’t and won’t stay this low forever.

With stock-market volatility back, the highly-likely catalyst to ignite that GDX $25 breakout is gold rallying on resurgent investment demand. Gold is largely ignored when stock markets are high and investors are euphoric, as they feel no need to prudently diversify their portfolios. But once stock markets sell off for long enough to spook investors, they start shifting capital back into gold which often moves counter to stocks.

With the US stock markets still trading deep into bubble territory in late February, and euphoria remaining rampant as evidenced by the blistering bounce rally following that early-month plunge, there’s no way the stock-market selling is over yet. It will have to resume sooner or later with a vengeance to actually start rebalancing away greedy sentiment. When that happens, gold and gold stocks will soon catch major bids.

The fact gold stocks have held strong in their consolidation trading range for well over a year now is a glass-half-full kind of thing. It testifies to relatively-strong investment demand given the terribly-bearish sentiment pervasive in this sector. The longer prices base during bull markets, the greater the upside potential in their next upleg. It likely won’t take much of a gold rally to blast GDX back up through $25 again.

This strong technical picture and an inevitable sentiment mean reversion are reason enough for gold stocks to surge dramatically higher. But supercharging that is the dirt-cheap state of gold stocks today in fundamental terms. That includes current gold-mining profits compared to prevailing gold-stock prices, as well as near-future earnings-growth potential as gold itself continues mean reverting much higher ahead.

I’m well into my quarterly research work analyzing the Q4’17 results from the major gold miners of GDX. Unfortunately due to the complexities of preparing annual reports, the Q4 reporting season up to 90 days after quarter-ends is double the 45-day deadlines for Q1s through Q3s. So all the data isn’t quite in yet, but I expect to have enough to delve deeply into the major gold miners’ Q4’17 results in next Friday’s essay.

In the meantime, a great fundamental proxy for gold-stock valuations is the HUI/Gold Ratio. This is as simple as it sounds, dividing the daily close of that classic gold-stock index by the daily gold close and charting the resulting ratio over time. This reveals when gold stocks are expensive or cheap relative to the metal which drives their profits. And this sector has rarely been more undervalued than it is today!

This week the HGR was way down at 0.131x, meaning the HUI index’s close was running just over 13% of gold’s close. That’s incredibly low historically, showing that the gold miners’ stocks have been wildly underperforming gold. The gold stocks are trading at levels today implying gold and their profits were radically lower. This is a colossal fundamentally-absurd disconnect that can’t last forever, it has to unwind.

GDX and the HUI were way down at $21.57 and 173.4 in the middle of this week. The first time the HUI ever hit this level was way back in August 2003, years before GDX was even born. Back then gold was only running $357, and had yet to trade above $380 in its entire young secular bull. Let that sink in for a second. Gold stocks are trading at prices today first seen when gold was in the $350s fully 14.6 years ago!

This week gold was trading near $1325, an enormous 3.7x higher. That should certainly be reflected in gold miners’ stocks. Today’s super-low gold-stock levels aren’t much above the HUI’s stock-panic lows back in October 2008. There was only a week where the HUI traded lower than today at peak fear in the stock markets, and gold averaged $732 during that extreme span. This week it was trading 81% higher!

This is incredibly illogical, only explainable by irrational sentiment. If any other stock-market sector was trading at levels from a decade or more earlier despite the selling prices of its products doubling to quadrupling, investors would be beating down the doors to buy. That would rightfully be seen as a huge and unsustainable anomaly, a rare chance to buy deeply-undervalued stocks at decade-plus-old prices.

And it’s not just gold that’s far higher, so are the profit margins for mining it. With the new Q4’17 results from GDX’s major gold miners not all out yet, the latest data we have this week is Q3’17’s. During that previous quarter, the top GDX miners averaged all-in sustaining costs of just $868 per ounce. The costs of mining gold industrywide don’t change much, which is what creates profits’ big upside leverage to gold prices.

My still-incomplete Q4’17 analysis shows AISCs very similar to last quarter’s. That makes sense, as the past year’s quarters ending in Q3’17 had collective GDX AISCs of $875, $878, $867, and $868. Mining gold costs similar amounts regardless of prevailing gold prices, at least over medium-term multi-year spans too short for new gold mines to be built. So Q4’17 AISCs are likely to remain around these levels.

Assuming $868 carries forward into Q4’17 and Q1’18, gold-mining profits are really growing. Average gold prices surged from $1276 in Q4 to $1330 quarter-to-date in Q1. That’s up 4.2% sequentially, really strong. This implies major gold miners’ earnings are surging 13.2% QoQ in our current Q1’18 from $408 to $462 per ounce! That would make for strong 3.1x upside profits leverage to gold, which is impressive.

And whether the major gold miners are collectively earning $400, or $450, or even $500 per ounce today, such profits alone are much greater than the $350s prevailing gold price the first time the HUI traded at today’s levels. With fat profits like this heading much higher as this gold bull continues, it’s ridiculous for gold stocks to be priced as if gold was still in the $350s like mid-2003 or the $730s like in 2008’s stock panic.

This extreme anomaly can’t and won’t last. The gold stocks should be priced for today’s prevailing gold prices around $1325. The first time gold hit $1325 in October 2010, the HUI was trading at 522. That is triple today’s ludicrous levels! The gold stocks more than quadrupled in the years following 2008’s stock panic, another irrational situation where sentiment had battered gold stocks to fundamentally-absurd levels.

Between that first-in-a-century stock panic and extreme central-bank easing that really hit full steam in 2013, the last quasi-normal years in the markets were 2009 to 2012. During that post-panic span the HGR averaged 0.346x. If the HUI would merely mean revert back up to those levels relative to gold, it would have to soar to 458. That’s 164% higher than this week’s levels, upside unparalleled in any other sector.

For 5 years before the stock panic, the HGR averaged 0.511x. While gold stocks might not be able to sustain levels so high anymore, they could certainly blast up there in a temporary mean-reversion overshoot. After extremes, prices don’t simply migrate back to the average. Instead they overshoot proportionally to the opposing extreme as sentiment is equalized. That implies a HUI level of 677, 290% higher from here.

No one knows how high gold stocks can go, but there is zero doubt they are radically undervalued given today’s gold prices and the gold-mining profits they generate. Whether you expect this battered sector to quadruple again like after the stock panic, or merely double, that dwarfs the potential of the rest of the stock markets. Especially with the S&P 500 trading at bubble valuations after a long central-bank-goosed bull.

The gold stocks are truly a coiled spring today, ready to explode higher soon and trounce everything else. They are deeply out of favor, incredibly undervalued, and one of the only sectors that can rally sharply when general stock markets sell off. If you want to multiply your wealth this year by fighting the crowd to buy low then sell high, this small and forgotten contrarian sector is the place to be. Nothing else rivals it.

While investors and speculators alike can certainly play gold stocks’ coming powerful upleg with the major ETFs like GDX, the best gains by far will be won in individual gold stocks with superior fundamentals. Their upside will far exceed the ETFs, which are burdened by over-diversification and underperforming gold stocks. A carefully-handpicked portfolio of elite gold and silver miners will generate much-greater wealth creation.

At Zeal we’ve literally spent tens of thousands of hours researching individual gold stocks and markets, so we can better decide what to trade and when. As of the end of Q4, this has resulted in 983 stock trades recommended in real-time to our newsletter subscribers since 2001. Fighting the crowd to buy low and sell high is very profitable, as all these trades averaged stellar annualized realized gains of +20.2%!

The key to this success is staying informed and being contrarian. That means buying low before others figure it out, before undervalued gold stocks soar much higher. An easy way to keep abreast is through our acclaimed weekly and monthly newsletters. They draw on my vast experience, knowledge, wisdom, and ongoing research to explain what’s going on in the markets, why, and how to trade them with specific stocks. For only $12 per issue, you can learn to think, trade, and thrive like contrarians. Subscribe today, and get deployed in the great gold and silver stocks in our full trading books!

The bottom line is gold stocks are basing technically and cheap fundamentally today. While this small contrarian sector has largely been forgotten, its past year’s consolidation trading range continues to hold solid. The longer the basing, the greater the potential upleg when investors return. And despite trading at levels implying vastly-lower gold prices, the major gold miners are actually earning fat profits today.

Those earnings will surge dramatically as gold continues powering higher in its own bull market. It’s only a matter of time until investors see the extreme market-leading value inherent in the gold miners’ stocks. And with stock-market volatility roaring back after long years of central-bank suppression, diversifying portfolios with gold will soon return to favor. The gold stocks will soar as investment buying drives gold higher.

Adam Hamilton, CPA

March 9, 2018

Copyright 2000 – 2018 Zeal LLC (www.ZealLLC.com)

The precious metals sector continues to correct and consolidate. Gold remains in a bullish consolidation. It recently reached resistance again and even though it has failed to breakout, it remains above long-term moving averages which are sloping upward. However, the gold stocks and Silver remain in correction mode. They are trading below the long-term moving averages and at the lower end of their ranges over the past 12 months. That certainly provides an opportunity but these markets may not truly perform until Gold is ready to breakout.

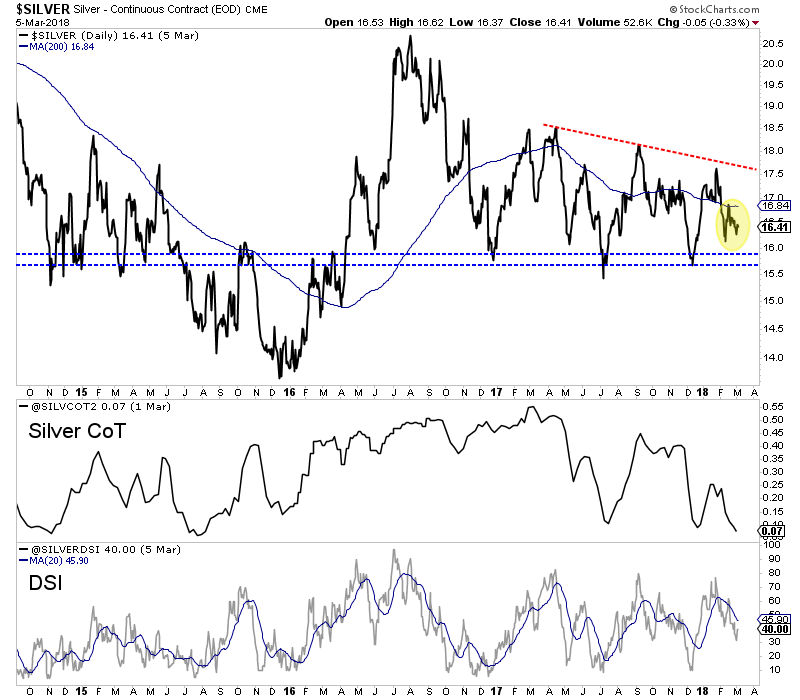

Bullish Silver commentaries (because of its CoT) have been making the rounds and I don’t disagree. In the chart below we plot the net speculative position as a percentage of open interest. It is at 7.4%, which is the lowest reading in nearly three years. Interestingly, the daily sentiment index for Silver is not at an extreme. Its at 40% bulls. Technically, Silver is wedged in between support and resistance. A break does not appear imminent.

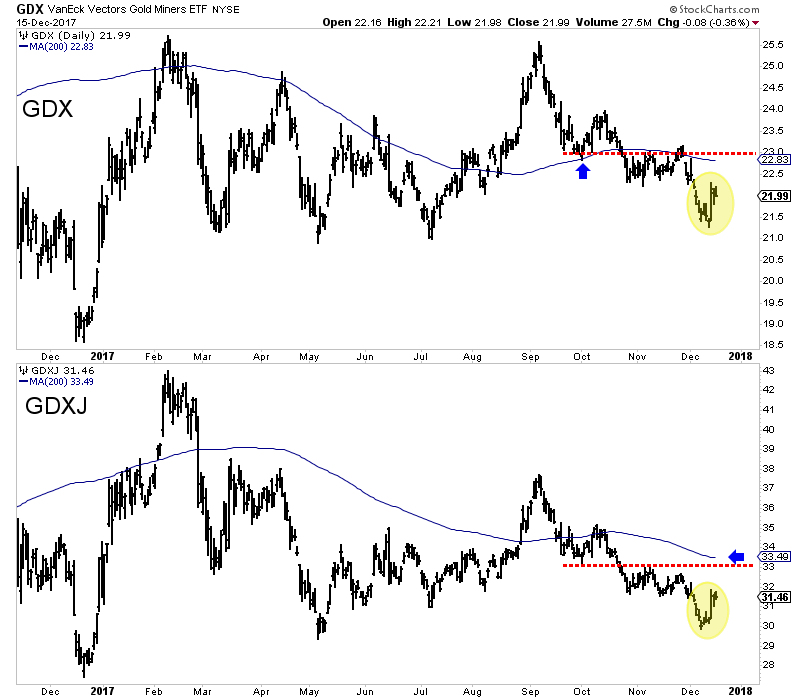

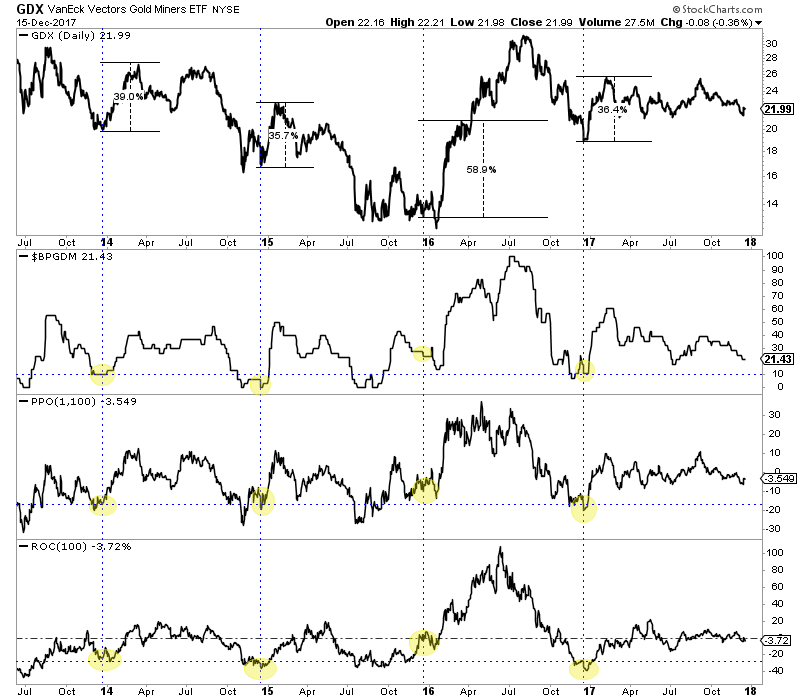

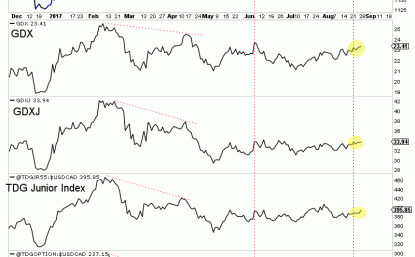

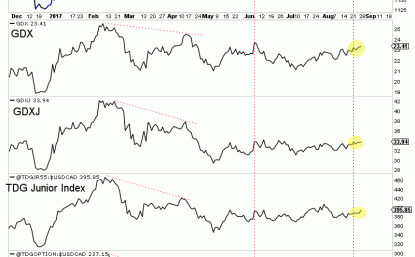

Like Silver, the gold stocks are oversold but we do not see an indication of an extreme oversold condition. In the chart below we plot GDX along with the difference between new highs and new lows. We also plot GDXJ along with the percentage of stocks (from a group of 50 we follow) that are trading above the 50-dma and 200-dma. GDX recently held above $21 again (even with over 20% of the index making new 52-week lows) while GDXJ is starting to show a bit more strength relative to GDX. At the low last Wednesday, 19% of those 50 juniors were trading above the 50-dma while 27% were trading above the 200-dma.

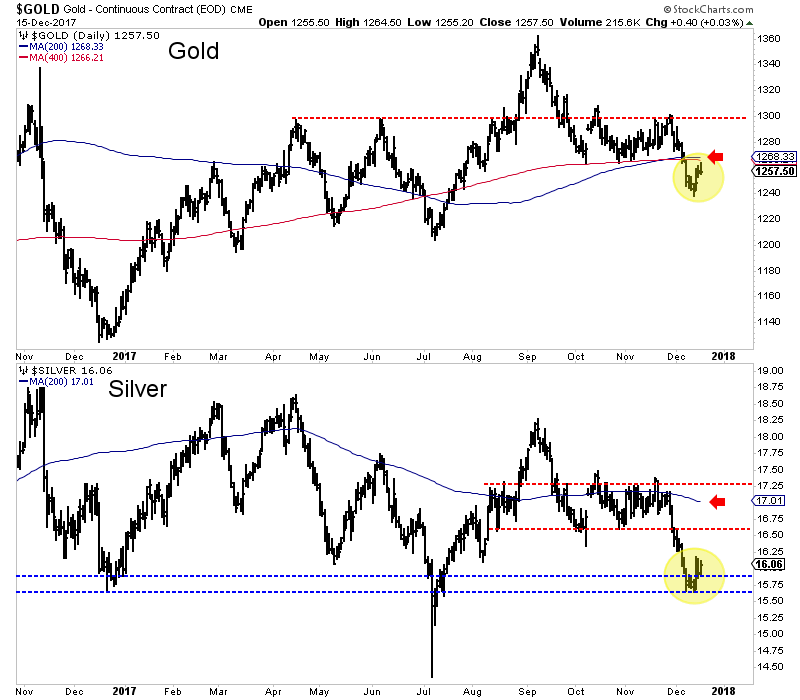

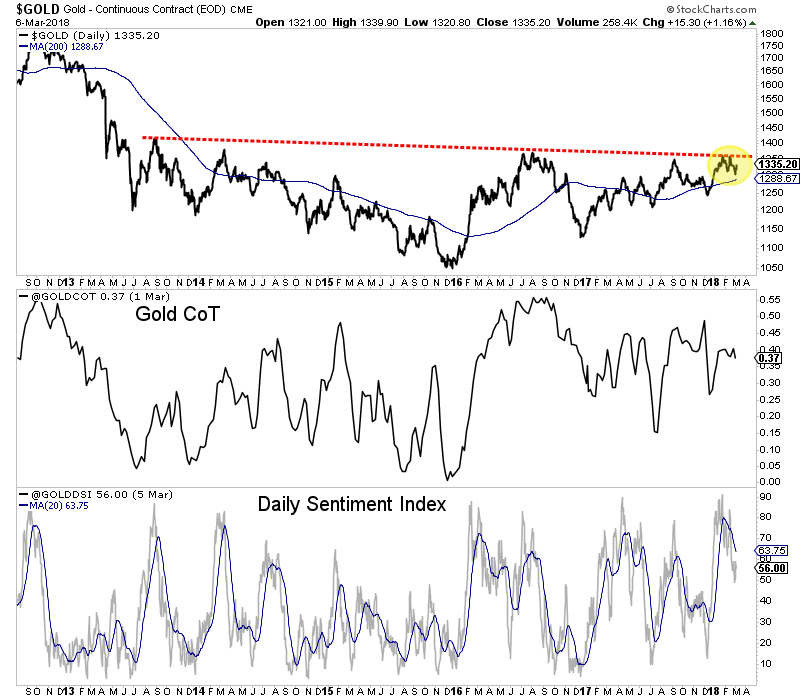

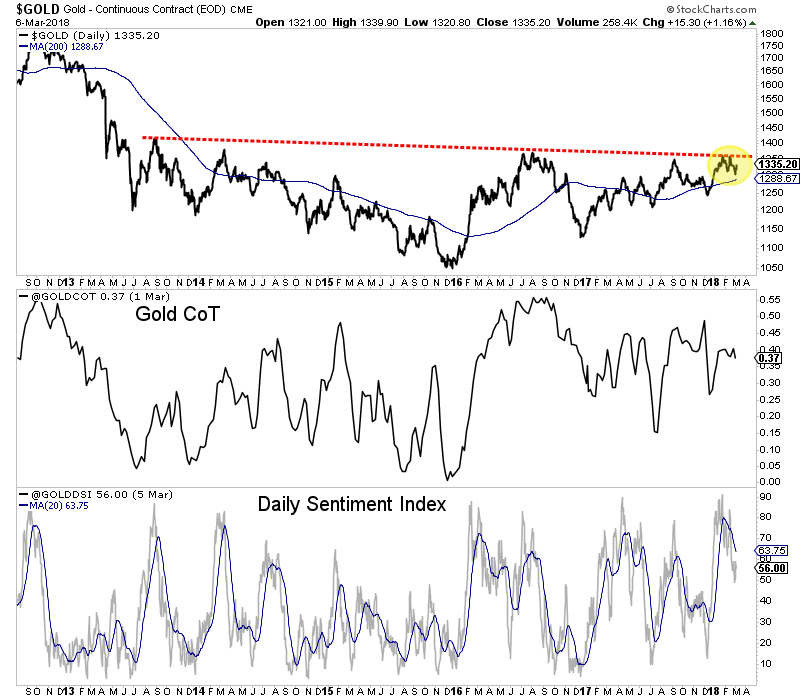

Gold, unlike Silver and the gold stocks, has not corrected much and remains much closer to resistance than support. Also, sentiment in Gold is much more optimistic than in Silver. The net speculative position in Gold is 37%, which dwarfs the 7.4% reading in Silver. Gold’s daily sentiment index is 56% bulls which is comfortably above Silver’s. During bull markets, corrections in Gold tend to push the net speculative position below 30%. Gold continues to maintain support at $1300 but we wonder if it needs to break that level and flush out some speculators before breaking out of its larger consolidation.

The gold miners’ stocks weathered the recent stock-market plunge really well. As evident in their leading GDX ETF, they were already beaten down before stock markets started falling. The resulting explosion of fear bled into GDX, forcing it even lower. Nevertheless, no major technical damage was done. GDX remained well within its consolidation trend channel and is still within striking distance of a major $25 breakout.

Gold stocks’ behavior during stock-market selloffs can seem capricious. This small contrarian sector generally amplifies the price action in gold, which drives its collective profitability. Gold tends to surge in the wake of major stock-market selloffs, which erode investors’ confidence in stocks’ near-term outlook. That greatly boosts gold investment demand as investors soon rush to wisely diversify their stock-heavy portfolios.

This drives gold prices higher after material stock-market weakness. So naturally the gold stocks mirror and amplify gold’s gains which really improve their fundamentals. But this broader strengthening trend is interrupted by a lot of chaotic noise. The collective greed and fear generated by the stock markets’ daily action heavily influences gold-stock traders, especially when the stock markets are exceptionally volatile.

The gold miners’ stocks are just that, stocks. So it’s not uncommon for them to get sucked into serious down days in the general stock markets, which fuel widespread fear. When the flagship S&P 500 stock index (SPX) falls sharply, nearly everything else is dumped in sympathy including the gold stocks. The SPX truly is the dominant center of the global financial-market-sentiment universe, greatly affecting everything.

Unfortunately sharp SPX down days’ ability to heavily influence GDX wreaks havoc on sentiment in the gold-stock sector. Traders read historical studies proving the precious-metals realm is the best place to deploy capital in and after weakening stock markets. So they rightfully expect gold-stock prices to rally on balance. But when GDX plunges on a big SPX down day, their fear soars and they abandon gold stocks.

Human psychology always tends to overweight the importance of recent and traumatic events, with our minds wanting to extrapolate short-term turmoil out into infinity. Thus when gold stocks get sucked into a sharp general-stock selloff, traders assume they can’t thrive in weak stock markets. They lose the trend forest for the daily trees! This fearful herd sentiment scares them into panicking and selling gold stocks low.

Weakening stock markets are like springtime for gold and its miners’ stocks due to higher investment demand. Just as daily temperatures gradually warm over time during spring, gold stocks rally on balance after material stock-market weakness. But spring weather also includes periodic cold snaps that can feel winter-like. They are just temporary counter trend aberrations though, like gold-stock drops on big SPX down days.

This first chart looks at gold stocks’ recent price action through the lens of GDX, the VanEck Vectors Gold Miners ETF. Since its birth in May 2006, GDX has grown into the leading and dominant gold-stock ETF. As of this week GDX’s $7.6b in assets under management ran a whopping 22.0x larger than its next-biggest 1x-long major-gold-stock-ETF competitor! GDX actually weathered the stock plunge really well.

The sharp stock-market selloff in the past couple weeks has been extraordinary, largely unprecedented on multiple key fronts. The S&P 500 was wildly overvalued and overbought in late January, deep in its longest span ever witnessed without a mere 5% pullback. Volatility was trading near record lows, which catapulted complacency off the charts. Last week I explored all this in an essay analyzing stock selling unleashed.