Over the last month, I’ve received numerous questions pertaining to the direction of the gold price. The fact is, I don’t have a crystal ball and, while I believe we will see higher gold prices in the future, I have no idea when, and really, I don’t care.

Why? Simply, I don’t invest in junior mining companies because I believe the price of gold is going to go up. I believe you invest in junior mining companies because you see value creation via discovery, or you see a clear path in the development of a project into a future mine.

There are many ways to make money in the junior resource sector, but for me, it’s a process which is linked to finding quality – the best people, who pick the best projects and execute well thought-out plans to achieve a specific goal.

In particular, discovery pays in any part of the market cycle and, therefore, while the risks associated with exploration are HUGE, I think it’s prudent to invest in the highest quality gold exploration companies the market has to offer.

Today, I would like to bring your attention to Klondike Gold Corp., a gold exploration company that is cashed up and ready to execute a 5000m drill program in the heart of the Yukon.

Let’s take a look!

Klondike Gold Corp. (KG: TSXV)

MCap – $24 million (at the time of writing)

Shares – 95 million

Fully Diluted – 120 million

Cash – $7 million

Ownership:

Frank Giustra – 14%

Eric Sprott – 13%

Key Investors – 10%

Insiders – 11%

NOTE: As you can see from the ownership breakdown, Klondike is tightly held by a small number of hands. Specifically, Canadian billionaires, Frank Giustra and Eric Sprott, who collectively control almost a third of the company’s outstanding shares and, I think, speaks to the upside potential that is seen in Klondike Gold and its district sized land package in the heart of the Yukon.

Klondike Gold’s Leadership

Klondike Gold Corp. is led by CEO, Peter Tallman, who is a geologist by trade and has over 35 years of experience in the mining industry.

During a conversation with Tallman, he related his start in the mining sector back to when he was in his early teens and helped build a log cabin just south of Algonquin Park, located in central Ontario. The key to this experience didn’t have anything to do with building or geology, but was important because Tallman became an avid and skilled canoeist, which would later be a key component in him attaining his first geology job outside of university.

After completing his geology degree at the University of Western Ontario, Tallman’s first job was with Selco (later BP-Selco), where he was hired to prospect for diamonds in northern Ontario. A key prerequisite for this job was proficient canoeing skills, which Tallman had in spades, and so he got his start in the mining business. Additionally, with Selco, he moved to Newfoundland where, while working in a remote corner of the province, chipped the discovery outcrop of what later became the Hope Brook gold mine.

Tallman has worked for a number of different companies in senior roles, over the course of his career, including Noranda Exploration, Prime Equities International (Murray Pezim), and Messina Minerals, just to name a few. Each of these experiences over the course of the last 35+ years has prepared Tallman well for leading Klondike Gold in their mission to discover an economic gold deposit in the Klondike.

The Klondike team is rounded out by CFO, Jessica Van Den Akker, and Board of Director members, Gordon Keep (CEO of Fiore Management & Advisory Corp.), John Pallot, Steve Brunelle and Tara Christie. The team has recently expanded the team with the addition of Ian Perry, VP Exploration who has extensive experience managing advanced exploration projects towards development stage.

Yukon

As the company name suggests, Klondike Gold is focused on gold exploration in Canada’s Yukon Territory. For those who may not be familiar with Canada’s geography, the Yukon is located north of British Columbia and it shares its western border with Alaska.

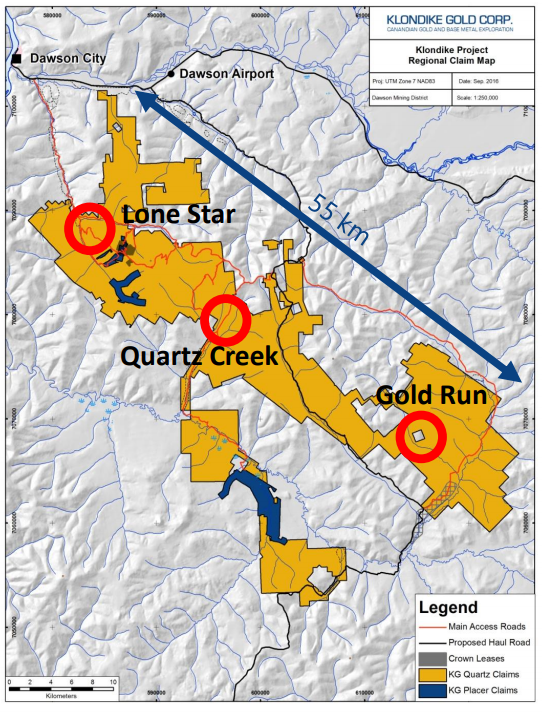

Klondike Gold Regional Claim Map

Klondike Gold owns 100% of its 2,942 contiguous claims, totaling 557 square kilometers, which sit in close proximity to Dawson City. Dawson City was built to support gold miners during the Klondike Gold Rush of the 1890s and hosts the major infrastructure needed for the exploration and development of mining projects, such as an airport, access to supplies and electrical infrastructure.

13th in the World for Mining Investment Attractiveness – Fraser Institute Ranking

The Yukon is a premier jurisdiction for mining and attained a score of 79.67, or 13th in the world, for mining investment attractiveness, according to the Fraser Institute’s 2018 rankings. The Fraser Institute uses a number of criteria in evaluating a jurisdiction, such as political stability, mining law, taxation and, arguably the most important, mineral potential.

The Yukon has well developed infrastructure, including more than 4,800km of all-weather roads, airports, power, Internet and cell phone service. Additionally, for companies that require international export of their concentrates, deep sea ocean ports are accessible across the Yukon’s western border in Alaska.

Yukon Mining Alliance

Uniquely, to my knowledge, many of the junior and major mining companies with projects in the Yukon have formed the Yukon Mining Alliance (YMA) with the Yukon Provincial Government and the Canadian Northern Economic Development Agency.

The YMA’s mandate is to,

“promote Yukon’s competitive advantages as a top mineral investment jurisdiction and its member companies and their Yukon-based project.” ~ YMA

In my opinion, this is a huge advantage of investing in companies with projects in the Yukon, as clearly, the marketing and promotion of mining within the Territory’s borders is a major priority. Bottom line, narrative plays a big role in the success of junior mining companies, and with the added help of the YMA, Yukon-based companies have a distinct advantage working together to promote the Yukon mining jurisdiction narrative.

Personally, I have seen the YMA presence at a couple of the top mining conferences in Canada, such as PDAC and Cambridge’s Vancouver Resource Investment Conference (VRIC). The YMA is putting the Yukon on the map for interested resource investors which, I believe, will pay off in spades as we move into the next leg of the bull market.

Klondike Gold Rush

The Klondike Gold Rush began in August of 1896, as three prospectors, George Carmack, Jim Mason and Dawson Charlie, discovered gold in what they referred to as “Rabbit” Creek, or what is now referred to as Bonanza Creek. With the discovery and the rush to stake their claim, word quickly spread of their discovery, and so spurred a historic gold rush in Canada’s Yukon Territory and the United States’ Alaska.

Source: Yukon Government Archive

It’s estimated that the Klondike Gold Rush attracted 100,000 people from all walks of life, testing their luck against the odds to find their fortune. Many of the new American prospectors found their way north via ships boarded in Seattle. Former ports, such as Dyea, Alaska, were accessible at high tide and allowed prospectors to begin the lengthy trip north toward the center of the Gold Rush, Dawson City, which is roughly 700km north.

Source: Yukon Government Archive

Unfortunately, for the vast majority of newly minted prospectors, their aspiration of discovering a fortune never happened; if it wasn’t the weather and the long trip to the prospective gold claims, it was the exorbitant costs that came with exploring and living in the north. In many of the articles I read while researching the Klondike Gold Rush, many estimated costs being 10 times higher than what many of the people would have experienced in their former lives, living in Toronto, New York or Chicago.

Source: Yukon Government Archive

The Klondike Gold Rush is estimated to have produced $29 million in gold over its 3 year span. Additionally, the Yukon Geological Survey estimates that a total of 20 million ounces of gold has been extracted from the Klondike goldfields since 1896. Gold mining can be credited with spurring the development of much of Canada’s and America’s northern most territories and states. In my opinion, the Yukon holds tremendous mineral potential and will only increase its prestige within the mining community.

Tr’ondëk Hwëch’in First Nation

Klondike Gold’s claims lie within the Tr’ondëk Hwëch’in First Nation lands, which are in the Dawson City area. To note, Goldcorp’s Coffee Gold Project, which was acquired from Kaminak Gold Corp, and sits 130km south of Dawson City, is also within the Tr’ondëk Hwëch’in First Nation lands.

Tr’ondëk Hwëch’in First Nation is based in Dawson City and consists of roughly 1,100 Hän-speaking people. The First Nation is governed by an elected Chief and four councillors, who take direction from the Elder’s Council, a group of Tr’ondëk Hwëch’in people, aged 55 and over. The governing body oversees all agreements affecting the First Nation, including finance, health, social programs, housing and natural resources.

In recent news, the Tr’ondëk Hwëch’in First Nation signed a collaboration agreement with Goldcorp over the development of their Coffee Gold Project. In my opinion, the success of this negotiation was imperative to any of the mining companies exploring or developing within the Tr’ondëk Hwëch’in lands, giving each company a glimpse of what a future deal with them might look like, if they are able to discover an economic deposit or move forward with the development of what they already have.

Klondike Gold Project

As stated earlier, the Klondike has a rich history in gold mining, as 20 million ounces of placer gold have been mined there. The question that Tallman and his team at Klondike Gold are trying to answer is, where did the placer gold come from? When this question is finally answered, there’s a good possibility that the discovery of an economic gold deposit will follow soon thereafter.

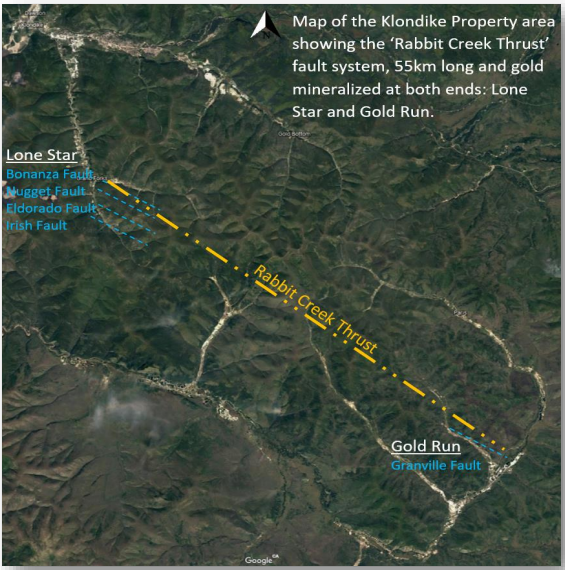

Thus, since taking the helm of Klondike Gold, Tallman has set out to determine if the fault system, which he identified in his original desktop review of the company, plays a role in controlling gold mineralization. Specifically, in our discussion of the property, Tallman refers to the Rabbit Creek Thrust Fault, which stretches roughly 55 km from the Lone Star target to the Gold Run target.

Tallman believes that this is a very important fault and, ultimately, is the key driver in the gold mineralizing event. As you can see in the image above, secondary fault systems, which Tallman refers to as horse tail faults, have been identified around the outer limits of the Rabbit Creek Thrust Fault, and are the areas of focus for Klondike’s upcoming drill program.

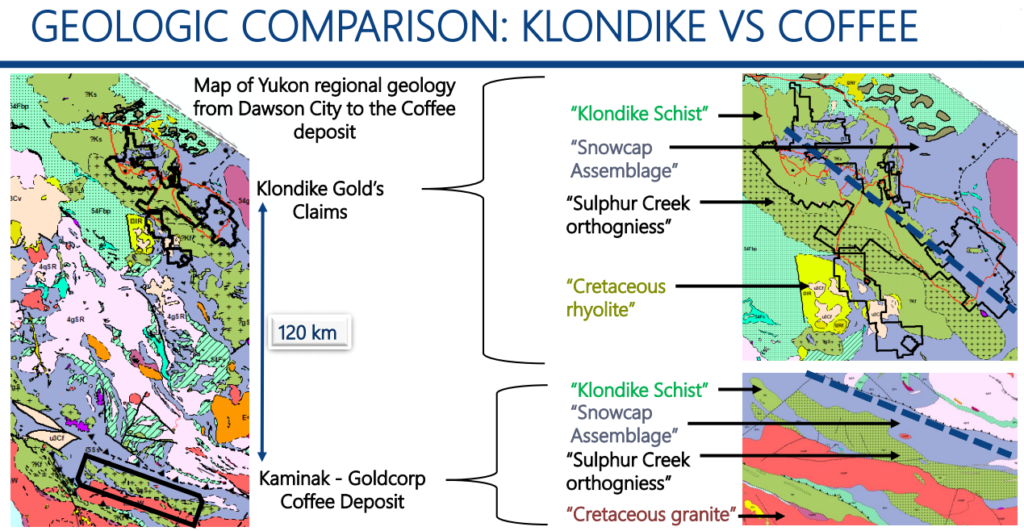

What I found most interesting about our conversation regarding the geology of the targets is how they resemble Goldcorp’s, formerly Kaminak Gold’s, Coffee Gold Project geology. Examining a few of Klondike’s slides from their latest Corporate Presentation, they outline the similarities in geological structures.

Klondike Gold Corporation Presentation – Slide 16

In my opinion, the identification of these similarities is a HUGE plus for Tallman and his team, as they are using the knowledge and processes laid out by Kaminak to influence their plans for exploration on their Lone Star and Gold Run targets. Not only does this make the exploration more efficient, but also speaks to the potential of what Klondike may have in terms of gold mineralization.

While it’s important to understand downside risk before investing in a junior mining company, it’s also very important to understand the upside potential. Therefore, I think it’s safe to say that the upside potential for Klondike can be found in a comparison to the Coffee Gold Project, which has 2.16 million ounces of gold reserves (Proven and Probable) and an additional 2 million ounces of gold resources (Indicated and Inferred). To note, Goldcorp paid Kaminak roughly $100/oz in ground for Coffee. Given Klondike’s current MCAP, the upside potential looks very good.

2018 Exploration

Klondike’s plan for its 2018 exploration program has three main components:

- Airborne Mapping – Complete 2500 to 3000 line kilometers of airborne surveys across the entire 557 square kilometer property. In my discussion with Tallman, he stated a few times how inadequate the old government geological maps of the property are. Accurate maps of the property are integral for efficient drill target gathering.

- Soil Sampling – Groundtruth Exploration has been hired to complete 5000 soil samples and complete the ortho-photographic modelling footage via drone. Airborne mapping overlain with soil sampling data will help the Klondike team narrow down their focus for the diamond drill program.

- Drill Program – 50 to 70 holes will be drilled for an estimated total of 5000 meters. This is a preliminary drilling budget, which Tallman suggests could be expanded, depending on results. Drilling on Klondike’s Lone Star target should begin very soon, with drilling on the Nugget and Gold Run targets to follow.

PUSH: Watch for drill results in the weeks ahead, as Klondike should have steady news flow of drill results over the next couple of months.

Metallurgical Work

Additionally, Tallman mentioned that they will be drilling a few holes of HQ core, which has a diameter of 96mm, which is almost 20mm larger than that standard NQ or CHD 76 core which is typically used in exploration drilling. Why the larger core size? Klondike will be using the larger core sample for the beginnings of a metallurgical study, which should shed some light onto economic viability of the Klondike mineralization.

Concluding Remarks

In my opinion, Klondike Gold has the basis for success when it comes to gold exploration:

- Experienced management team which is supported by smart money, via billionaire investors, Frank Giustra and Eric Sprott.

- District scale land package of 557 square kilometers with the premier mining jurisdiction that is the Yukon. NOTE: The Yukon ranks 13th in the world in mining investment attractiveness as per the Fraser Institute’s 2018 Survey.

- The Klondike Goldfields have produced 20 million ounces of placer gold over their history.

- Extensive 2018 exploration program, which includes airborne mapping, soil samplings and a 5000m drill program. High news flow throughout the summer.

- Exploration program is supported by a robust plan which is rooted in the geological similarities between Klondike’s target geology and Goldcorp’s 4 Moz Coffee Gold Project, which is just south of Dawson City.

- CASH – $7 million

Gold exploration is a risky endeavour, one that is fraught with more failure than success. In Klondike Gold’s case, failure is a very real possibility, however, I believe with the strengths outlined above, Klondike has positioned themselves to have the best possible probability of success in discovering economic gold as we as investors could hope. Therefore, I’m a buyer of Klondike Gold and am looking forward to a summer of what I think will be good news flow and share price appreciation!

Don’t want to miss a new investment idea, interview or financial product review? Become a Junior Stock Review VIP now – it’s FREE!

Until next time,

Brian Leni P.Eng

Founder – Junior Stock Review

Disclaimer: The following is not an investment recommendation, it is an investment idea. I am not a certified investment professional, nor do I know you and your individual investment needs. Please perform your own due diligence to decide whether this is a company and sector that is best suited for your personal investment criteria. I do own shares in Klondike Gold Corp. All Klondike Gold Corp. analytics were taken from their website and press release. Klondike Gold Corp. is a Sponsor of Junior Stock Review.

If you would like to receive our free newsletter via email, simply enter your email address below & click subscribe.

CONNECT WITH US

Tweets

Tweet with hash tag #miningfeeds or @miningfeeds and your tweets will be displayed across this site.

MOST ACTIVE MINING STOCKS

Daily Gainers

Ironbark Zinc Ltd. Ironbark Zinc Ltd. |

IBG.AX | +8,400.00% |

|

EDE.AX | +100.00% |

|

RG.V | +50.00% |

|

EOX.V | +50.00% |

|

RLC.AX | +50.00% |

|

MTB.AX | +50.00% |

|

PJX.V | +45.45% |

|

MEX.V | +42.86% |

|

PLY.V | +33.33% |

|

TMX.AX | +33.33% |

Articles

FOUND POSTS

Orosur Mining (TSXV:AIM) Provides Update on Exploration at Anzá Project

December 31, 2024

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan