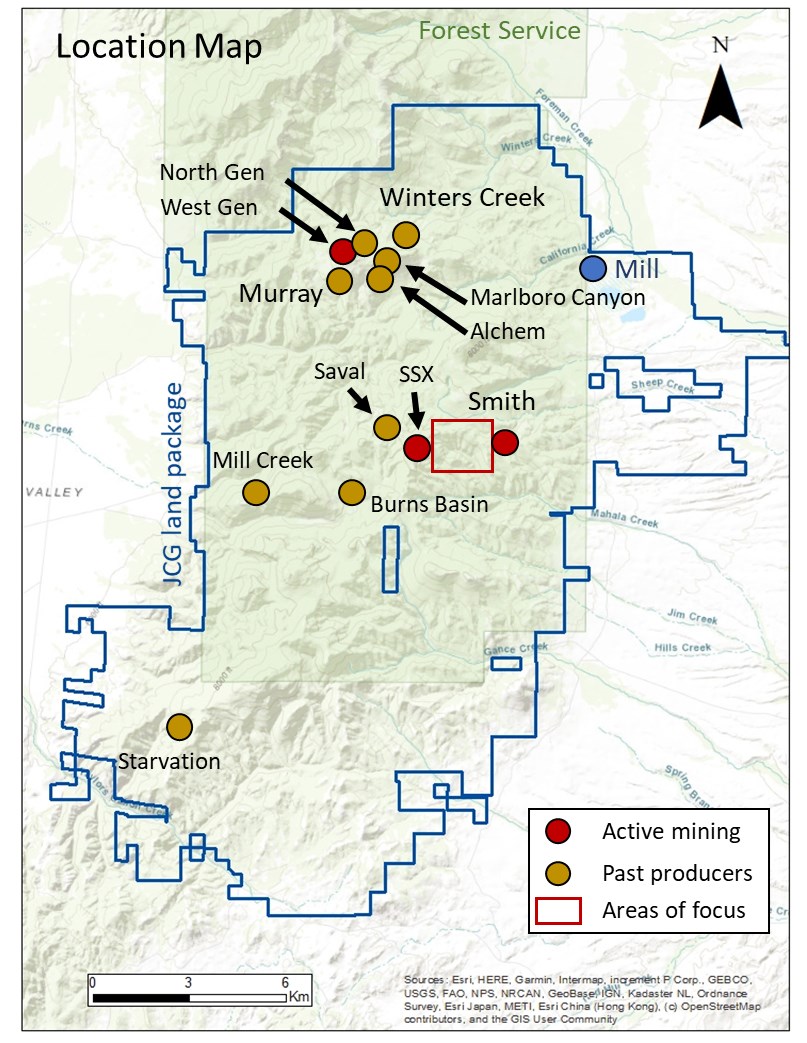

First Majestic Silver (TSX:FR) announced this morning new drill results from the ongoing exploration program at the Jerritt Canyon Gold Mine in Nevada. Roughly 120,000m of drilling is planned at Jerritt Canyon in 2022. Drilling will focus on the Smith and SSX mines, Winters Creek, Murray, Wheeler, and Waterpipe areas. The campaign is focused on short-term underground core drilling testing extensions for known ore controls. These are near active mining.

Other mid-term focused drilling is focused on validating and testing the presence of mineralized volumes near historic workings. Finally, the long-term drilling of the program will aim to make new gold discoveries in this important district.

Keith Neumeyer, President and CEO of First Majestic, commented in a press release: “Today’s exploration results continue to validate our thesis that the area between the operating SSX and Smith mines is favourable for new, near-mine gold discoveries. Hole-1102 intersected what looks like a new high-grade area on the north side of the SSX/Smith connection drift. Nine follow up drill holes are being planned to further define this potential new zone. In addition, follow up drilling at Zone 10 in the Smith mine has confirmed the presence of a high-grade pod of gold mineralization approximately 90 metres southeast from the connection drift. Over the past few months, we advanced the mine development towards this high-grade pod in anticipation of initial ore extraction in early October. Furthermore, ore production from the West Gen mine is also planned to begin in October and expected to increase the amount of fresh ore production at Jerritt to over 3,000 tonnes per day by the end of 2022.”

Highlights from the Company’s ongoing exploration program are as follows:

Drilling at Smith Zone 10:

- Follow up drilling to hole SMI-LX-1112 (8.39 grams of gold per tonne (g/t Au) over 29.7m, reported May 2022) delineated a new gold mineral zone located above the water table, approximately 90m southeast of the new connection drift between the SSX and Smith mines. Geologic interpretation and modeling of the drilling results determined that the gold zone is flat-lying, similar to nearby deposits. Results from Smith Zone 10 include:

- SMI-LX-1067: 6.98 g/t Au over 17.6m

- SMI-LX-1068: 8.61 g/t Au over 12.8m

- SMI-LX-1069: 8.61 g/t Au over 24.4m

- SMI-LX-1071: 14.60 g/t Au over 13.2m

Drilling from the SSX/Smith Mine connection drift:

- SMI-LX-1102: 19.35 g/t Au over 23.2m: the intercept is approximately 75m north and 40m above the connection drift (above the current water table). The geometry of the mineralization appears to be sub-horizontal with the drilling intersecting at a low angle.

- SSX-SR-612: 10.27 g/t Au over 14.7m and 9.53 g/t Au over 13.7m: the intercepts are approximately 300m SE and 75m below the connection drift. The drill hole likely intercepted the mineralization at a low angle and may be correlated to results from hole SSX-SR-608 reported in May 2022.

Drilling at Smith:

- SMI-LX-799: 32 g/t Au over 13.7m: identified gold mineralization approximately 150m north and 15m below active mine workings. Geologic interpretation suggests that this intercept is stratigraphically controlled (sub-horizontal) and drilling has intersected it at a low angle.

Drilling at SSX Zone 5:

- Intersected mineralization approximately 100m from active mining and above the water table. The geometry of the mineralization is not yet known, a combination of sub horizontal controls along stratigraphy (for low angle intersects) and vertical controls are under investigation.

- SSX-SR-486: 6.53 g/t Au over 11.3m

- SSX-SR-490: 11.22 g/t over 35.3m

Table 1: Summary of Significant Gold Intercepts:

| Drillhole | Target | Drill type | Intercept | |||

| From (m) | To (m) | Length (m) | Au (g/t) | |||

| SMI-LX-1067 | Smith | DDH | 126.6 | 138.0 | 11.4 | 5.30 |

| SMI-LX-1067 (2) | Smith | DDH | 149.4 | 167.0 | 17.6 | 6.98 |

| SMI-LX-1068 | Smith | DDH | 127.1 | 134.7 | 7.6 | 9.13 |

| SMI-LX-1068 (2) | Smith | DDH | 151.5 | 164.3 | 12.8 | 8.61 |

| SMI-LX-1069 | Smith | DDH | 120.7 | 145.1 | 24.4 | 8.61 |

| SMI-LX-1071 | Smith | DDH | 93.3 | 106.5 | 13.2 | 13.76 |

| SMI-LX-1071 (2) | Smith | DDH | 110.0 | 116.1 | 6.1 | 3.60 |

| SMI-LX-1071 (3) | Smith | DDH | 119.2 | 132.9 | 13.7 | 14.60 |

| SMI-LX-1071 (4) | Smith | DDH | 137.5 | 143.7 | 6.2 | 8.88 |

| SMI-LX-1102 | Smith | DDH | 91.7 | 114.9 | 23.2 | 19.35 |

| SMI-LX-799 | Smith | DDH | 171.3 | 185.0 | 13.7 | 32.00 |

| SSX-SR-486 | SSX | DDH | 116.7 | 128.0 | 11.3 | 6.53 |

| SSX-SR-490 | SSX | DDH | 81.7 | 90.8 | 9.1 | 13.03 |

| SSX-SR-490 (2) | SSX | DDH | 98.5 | 133.8 | 35.3 | 11.22 |

| SSX-SR-612 | SSX | DDH | 266.6 | 281.3 | 14.7 | 10.27 |

| SSX-SR-612 (2) | SSX | DDH | 284.5 | 298.2 | 13.7 | 9.53 |

DDH is abbreviation for Diamond Drill Hole;

From, To and Length indicated in metres, true width of the mineralized intercepts is unknown at this time.

Source: First Majestic Silver

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

First Majestic Silver (TSX:FR) has announced its unaudited interim consolidated financial results for the second quarter of 2022. The company saw mining operation earnings of $11.6 million in Q2 2022, down 61% YoY. The company cited significant volatility in the silver price as one of the headwinds for the company and the reason it reduced some 2022 capital investments. Despite this, the company generated healthy profits across several operations and continues to see opportunities ahead due to the current low production cost per ounce.

President and CEO of First Majestic Silver Keith Neumeyer commented in a press release: “Throughout the second quarter, the silver price continued to experience significant volatility, declining approximately 20% from $25 to $20. As a result of this weakness, the Company refocused and successfully reduced its 2022 capital investments without impacting its strong growth in projected production. In Mexico, our three operations generated healthy profit margins as approximately 80% of our total production came in at a low AISC cost of $15.34 per ounce. In addition, we expect consolidated AISC to continue to trend lower throughout the next two quarters as production ramps up at Santa Elena and Jerritt Canyon, as well as other inflationary cost saving measures are achieved.”

Highlights from the Second Quarter 2022 are as follows:

- Total production of 7.7 million silver equivalent (“AgEq”) ounces, up 20% compared to Q2 2021. Total production consisted of 2.8 million ounces of silver and 59,391 ounces of gold

- Quarterly revenues totalled $159.4 million, an increase of 3% compared to Q2 2021. The Company withheld approximately 0.2 million ounces of silver in inventory at the end of the quarter. Had the Company sold the withheld inventory, the Company would have generated approximately $5.2 million in additional revenue

- Mine operating earnings of $11.6 million, or a decrease of 61% compared to Q2 2021

- Operating cash flows before movements in working capital and taxes totalled $33.0 million, a decrease of 36% compared to Q2 2021

- Cash costs were $14.12 per AgEq ounce and All-in sustaining costs (“AISC”) (see “Non-GAAP Financial Measures”, below) were $19.91 per AgEq ounce

- Adjusted earnings of ($5.7) million (adjusted EPS of ($0.02)) (see “Non-GAAP Financial Measures”, below) after excluding non-cash and non-recuring items

- As of June 30, 2022, the Company had cash and cash equivalents of $117.7 million and restricted cash of $141.6 million totalling $259.3 million. Restricted cash is inclusive of $44.1 million which is expected to be converted to cash and cash equivalents in the third quarter

- Declared a cash dividend payment of $0.0061 per common share for the second quarter of 2022 for shareholders of record as of the close of business on August 16, 2022, and will be distributed on or about August 31, 2022

- Subsequent to quarter end, the Company repurchased 100,000 common shares at an average price of C$8.52 per share as part of its share repurchase program

OPERATIONAL AND FINANCIAL HIGHLIGHTS

| Key Performance Metrics | 2022-Q2 | 2022-Q1 | Change

Q2 vs Q1 |

2021-Q2 | Change

Q2 vs Q2 |

|||||||||

| Operational | ||||||||||||||

| Ore Processed / Tonnes Milled | 903,791 | 877,118 | 3% | 826,213 | 9% | |||||||||

| Silver Ounces Produced | 2,775,928 | 2,613,327 | 6% | 3,274,026 | (15% | ) | ||||||||

| Silver Equivalent Ounces Produced | 7,705,935 | 7,222,002 | 7% | 6,435,023 | 20% | |||||||||

| Cash Costs per Silver Equivalent Ounce (1) | $14.12 | $14.94 | (5% | ) | $13.89 | 2% | ||||||||

| All-in Sustaining Cost per Silver Equivalent Ounce (1) | $19.91 | $20.87 | (5% | ) | $19.42 | 3% | ||||||||

| Total Production Cost per Tonne(1) | $114.55 | $118.51 | (3% | ) | $104.94 | 9% | ||||||||

| Average Realized Silver Price per Silver Equivalent Ounce (1) | $23.93 | $26.68 | (10% | ) | $27.32 | (12% | ) | |||||||

| Financial (in $millions) | ||||||||||||||

| Revenues | $159.4 | $156.8 | 2% | $154.1 | 3% | |||||||||

| Mine Operating Earnings | $11.6 | $15.1 | (23% | ) | $29.4 | (61% | ) | |||||||

| Net (Loss) earnings | ($84.1 | ) | $ | 7.3 | NM | $ | 15.6 | NM | ||||||

| Operating Cash Flows before Movements in Working Capital and Taxes | $ | 33.0 | $ | 35.3 | (7% | ) | $ | 51.2 | (36% | ) | ||||

| Cash and Cash Equivalents | $ | 117.7 | $ | 192.8 | (39% | ) | $ | 227.1 | (48% | ) | ||||

| Working Capital (1) | $ | 199.8 | $ | 194.4 | 3% | $ | 276.3 | (28% | ) | |||||

| Free Cash Flow (1) | ($37.5 | ) | ($40.4 | ) | (7% | ) | ($37.2 | ) | 1% | |||||

| Shareholders | ||||||||||||||

| (Loss) Earnings per Share (“EPS”) – Basic | ($0.32 | ) | $ | 0.03 | NM | $ | 0.06 | NM | ||||||

| Adjusted EPS (1) | ($0.02 | ) | ($0.02 | ) | 8% | $ | 0.05 | (141% | ) |

NM – Not meaningful

(1) The Company reports non-GAAP measures which include cash costs per silver equivalent ounce produced, all-in sustaining cost per silver equivalent ounce produced, total production cost per tonne, average realized silver price per ounce sold, working capital, adjusted EPS and free cash flow. These measures are widely used in the mining industry as a benchmark for performance, but do not have a standardized meaning under the Company’s financial reporting framework. See “Non-GAAP Financial Measures” below.

Q2 2022 FINANCIAL RESULTS

The Company realized an average silver price of $23.93 per AgEq ounce during the second quarter of 2022, representing a 12% decrease compared to the second quarter of 2021 and a 10% decrease compared to the prior quarter.

Revenues generated in the second quarter totaled $159.4 million compared to $154.1 million in the second quarter of 2021. The increase in revenues was primarily attributed to inclusion of a full quarter of production from Jerritt Canyon and the processing of the Ermitaño ore at the Santa Elena mill, partially offset by weaker metal prices. Additionally, the Company withheld sales of approximately 0.2 million ounces of silver at the end of the quarter. Had the Company sold the withheld inventory, the Company would have generated approximately $5.2 million in additional revenue using the quarterly average realized price of $23.93 per ounce.

Mine operating earnings totaled $11.6 million compared to $29.4 million in the second quarter of 2021. The decrease in mine operating earnings is primarily attributed to lower metal prices, an increase in cost of sales and depreciation and depletion attributed to the addition of Jerritt Canyon and Ermitaño, partially offset by an increase in AgEq ounce sold.

During the quarter, following the completion of a tax audit, the Company successfully negotiated and signed a conclusive agreement with the Mexican tax authority, the Servicio de Administration Tributaria (“SAT”) via Corporación First Majestic S.A. de C.V. (“CFM”) through Mexico’s Office of the Taxpayer Ombudsman (“PRODECON”) to settle an uncertain tax position relating to intercompany debt financing in Mexico. In accordance with the conclusive agreement, CFM made a one-time payment of approximately $21.3 million in the period which has been recognized as a current tax expense during the period. In addition to the payment made, CFM agreed to surrender certain tax loss carry forwards resulting in a non-cash deferred tax expense of $54 million.

The Company reported net earnings of ($84.1 million) (EPS of ($0.32)) compared to $15.6 million (EPS of $0.06) in the second quarter of 2021. The decrease in net earnings was primarily attributed to a $78.7 million income tax expense compared to an expense of $1.0 million in the second quarter of 2021. This was partially offset by a reversal of impairment recorded at La Guitarra of $7.6 million as the mine was classified as an asset held-for-sale following the announcement in May 2022 to sell the property to Sierra Madre Gold and Silver Ltd. for approximately $35 million in share consideration.

Adjusted net earnings for the quarter was ($5.7) million (adjusted EPS of ($0.02)) compared to $12.7 million (adjusted EPS of $0.05) in the second quarter of 2021.

Cash flow from operations before movements in working capital and income taxes in the quarter was $33.0 million compared to $51.2 million in the second quarter of 2021.

As of June 30, 2022, the Company had cash and cash equivalents of $117.7 million and restricted cash of $141.6 million totalling $259.3 million. Restricted cash is inclusive of $44.1 million which is expected to be converted to cash and cash equivalents in the third quarter. The Company has total available liquidity of $299.8 million, including $100.0 million of available undrawn revolving credit facility.

OPERATIONAL HIGHLIGHTS

The table below represents the quarterly operating and cost parameters at each of the Company’s four producing mines during the quarter.

| Second Quarter Production Summary | San Dimas | Santa Elena | La Encantada | Jerritt Canyon | Consolidated |

| Ore Processed / Tonnes Milled | 197,102 | 228,487 | 264,555 | 213,647 | 903,791 |

| Silver Ounces Produced | 1,527,465 | 384,953 | 863,510 | – | 2,775,928 |

| Gold Ounces Produced | 18,354 | 22,309 | 96 | 18,632 | 59,391 |

| Silver Equivalent Ounces Produced | 3,046,664 | 2,241,763 | 871,365 | 1,546,143 | 7,705,935 |

| Cash Costs per Silver Equivalent Ounce | $10.41 | $12.34 | $14.09 | $23.99 | $14.12 |

| All-in Sustaining Cost per Silver Equivalent Ounce | $14.97 | $15.34 | $16.65 | $29.29 | $19.91 |

| Cash Cost per Gold Equivalent Ounce | N/A | N/A | N/A | $1,989 | N/A |

| All-In Sustaining Costs per Gold Equivalent Ounce | N/A | N/A | N/A | $2,429 | N/A |

| Total Production Cost per Tonne | $155.09 | $109.50 | $44.58 | $169.16 | $114.55 |

(1) The Company reports non-GAAP measures which include cash costs per silver equivalent ounce produced, all-in sustaining cost per silver equivalent ounce produced, total production cost per tonne, average realized silver price per ounce sold, working capital, adjusted EPS and cash flow per share. These measures are widely used in the mining industry as a benchmark for performance, but do not have a standardized meaning under the Company’s financial reporting framework. See “Non-GAAP Financial Measures”, below

Total production in the second quarter was 7.7 million AqEq ounce, consisting of 2.8 million ounces of silver and 59,391 ounces of gold, representing a 20% increase compared to the second quarter of 2021 primarily due to a full quarter of production from the Jerritt Canyon mine and successful ramp up of the Ermitaño mine at Santa Elena.

COSTS AND CAPITAL EXPENDITURES

Cash cost for the quarter was $14.12 per AgEq ounce, compared to $14.94 per ounce in the previous quarter. The decrease in cash costs per AgEq ounce was primarily attributed to an increase in AgEq production and implementation of costs saving measures. Production at Santa Elena and La Encantada increased by 20% and 34%, respectively, compared to the prior quarter, driven by the successful ramp up of the Ermitaño mine and a 30% increase in silver grades at La Encantada compared to the prior quarter. Additionally, the Company has implemented a number of costs saving measures in an effort to combat the inflationary impacts.

AISC in the second quarter was $19.91 per ounce compared to $20.87 per ounce the previous quarter. The decrease in AISC per AgEq ounce was primarily attributed to lower cash costs per AgEq ounce as well as a decrease in general and administrative costs and share-based payments during the quarter.

Total capital expenditures in the second quarter were $70.0 million, primarily consisting of $14.4 million at San Dimas, $16.4 million at Santa Elena, $2.8 million at La Encantada, $26.9 million at Jerritt Canyon and $9.5 million for strategic projects.

Q2 2022 DIVIDEND ANNOUNCEMENT

The Company is pleased to announce that its Board of Directors has declared a cash dividend payment in the amount of $0.0061 per common share for the second quarter of 2022. The second quarter cash dividend will be paid to holders of record of First Majestic’s common shares as of the close of business on August 16, 2022 and will be distributed on or about August 31, 2022.

Under the Company’s dividend policy, the quarterly dividend per common share is targeted to equal approximately 1% of the Company’s net quarterly revenues divided by the Company’s then outstanding common shares on the record date.

The amount and distribution dates of future dividends remain at the discretion of the Board of Directors. This dividend qualifies as an ‘eligible dividend’ for Canadian income tax purposes. Dividends paid to shareholders outside Canada (non-resident investors) may be subject to Canadian non-resident withholding taxes.

Source: First Majestic Silver Corp.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

If you would like to receive our free newsletter via email, simply enter your email address below & click subscribe.

CONNECT WITH US

Tweets

Tweet with hash tag #miningfeeds or @miningfeeds and your tweets will be displayed across this site.

MOST ACTIVE MINING STOCKS

Daily Gainers

Ratel Group Ltd. Ratel Group Ltd. |

RTG.TO | +60.00% |

|

ERL.AX | +50.00% |

|

MRQ.AX | +50.00% |

|

AFR.V | +33.33% |

|

CRB.AX | +33.33% |

|

GCX.V | +33.33% |

|

RUG.V | +33.33% |

|

CASA.V | +30.00% |

|

BSK.V | +25.00% |

|

PGC.V | +25.00% |

Articles

FOUND POSTS

Arras Minerals (TSXV:ARK) Updates on Elemes Drill Program in Kazakhstan

December 19, 2024

Potential Trump Tariffs Could Reshape Copper Market Dynamics in 2025

December 17, 2024

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan