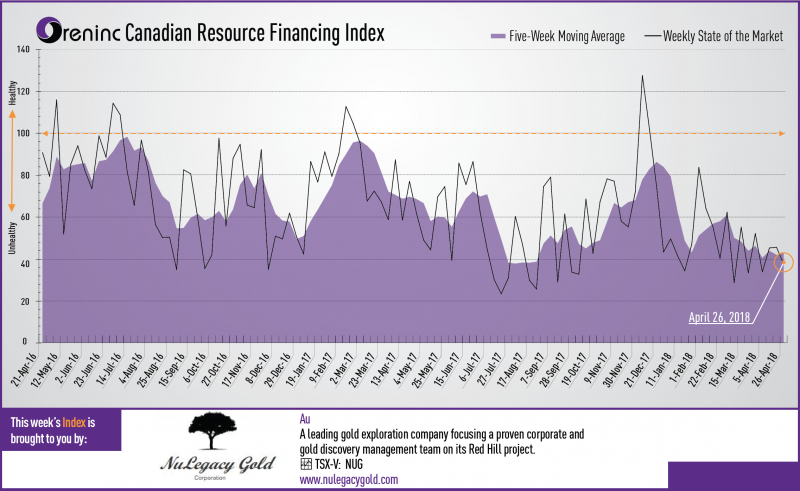

Last week index score: 45.59 (updated)

This week: 37.75

Oreninc: Interview Session with Mickey Fulp – Episode 22 now live

The Oreninc Index fell in the week ending April 27th, 2018 to 37.75 from an updated 45.59 a week ago as the number of deals fell despite some broker action returning.

A calmer and less volatile week all round with the presidents of North and South Korea meeting for the first time in decades, thawing tensions over the north’s nuclear ambitions, whilst in the US, president Donald Trump eased his position on sanctions against Russian aluminium producer Rusal. Maybe spring is in the air and the world is feeling more positive.

Another range-bound week for gold, this time ending in negative territory as the US dollar strengthened, although there are signs that gold stocks are starting to strengthen.

On to the money: total fund raises announced more than quadrupled to C$96.3 million, a four-week high, which included one brokered financing, a four-week low, and one bought deal financing, also a four-week low. The average offer size also more than quadrupled to C$4.8 million, a four-week high. However, the number of financings decreased to 20, a four-week low.

Gold closed down at US$1,324/oz from US$1,336/oz a week ago. Gold is now up 1.63% this year. Meanwhile, the US dollar index continued to strengthen and closed up at 91.54 from 90.31 a week ago. The van Eck managed GDXJ gave up ground and closed down at US$33.03 from US$33.49 last week. The index is down 3.22% so far in 2018. The US Global Go Gold ETF also fell to close down at US$12.99 from US$13.04 a week ago. It is down 0.12% so far in 2018. The HUI Arca Gold BUGS Index closed down at 182.04 from 184.18 last week. The SPDR GLD ETF saw a growth week as its inventory grew to 871.20 from 865.89 tonnes where it had been for nine-days straight.

In other commodities, silver’s recent growth spurt deflated and closed down at US$16.51/oz from US$17.11/oz a week ago. Copper also gave up a lot of ground as it closed down at US$3.06/lb from US$3.15/lb last week. Oil consolidated despite a slight loss on the week to close down at US$68.10 a barrel from US$68.40 a barrel a week ago.

The Dow Jones Industrial Average lost some ground and closed down at 24,311 from 24,462 last week. Canada’s S&P/TSX Composite Index put in a strong growth week as mining stocks showed growth to close at 15,668 from 15,484 the previous week. The S&P/TSX Venture Composite Index closed down at 783.76 from 804.96 last week.

Summary:

- Number of financings decreased to 20, a three-week low.

- One brokered financing was announced this week for C$15m a three-week low.

- One bought-deal financing was announced this week for C$15m, a three-week low.

- Total dollars nearly doubled to C$96.3m, a three-week high.

- Average offer size grew to C$4.8m, a three-week high.

Financing Highlights

SilverCrest Metals (TSX-V: SIL) announced a C$15 million bought deal financing

Syndicate of underwriters led by PI Financial and Cormark Securities for 7.1 million shares @ C$2.10.

- 15% over-allotment Option.

- Net proceeds will be used to continue exploration and drilling to deliver an updated resource estimate and maiden Preliminary Economic Assessment for the Las Chispas project in Sonora. Mexico.

Major Financing Openings:

- Africa Energy (TSX-V: AFE) opened a C$57.98 million offering on a best efforts basis. The deal is expected to close on or about May 4, 2018.

- Silvercrest Metals (TSX-V: SIL) opened a C$15 million offering underwritten by a syndicate led by PI Financial on a bought deal basis. The deal is expected to close on or about May 18, 2018.

- Pacton Gold (TSX-V: PAC) opened a C$4 million offering on a best efforts basis. Each unit includes a warrant that expires in 36 months. The deal is expected to close on or about May 22, 2018.

- Max Resource (TSX-V: MXR) opened a C$3.75 million offering on a best efforts basis. Each unit includes half a warrant that expires in 24 months.

Major Financing Closings:

- Nemaska Lithium (TSX-V: NMX) closed a C$99.08 million offering on a best efforts basis.

- Trilogy Metals (TSX-V: TMQ) closed a C$31.48 million offering underwritten by a syndicate led by Cantor Fitzgerald Canada on a bought deal basis.

- Stina Resources (TSX-V: SQA) closed a C$12.5 million offering on a best efforts basis. Each unit included half a warrant that expires in 36 months.

- Ashanti Gold (TSX-V: AGZ) closed a C$2.64 million offering on a best efforts basis.

Company News

Prospero Silver (TSX-V: PSL) provide an update on planned exploration work on its Mexican projects for 2018.

- The key objective is to complete first-pass, proof-of-concept drill testing of three projects in the Altiplano belt of northern Mexico: Bermudez, Buenavista and Trias. Neither Trias or Bermudez have been drilled before.

- About 6,000m of diamond drilling is planned.

- A 4th hole for Pachuca SE project may be drilled once drilling is complete at the projects above.

Analysis

Having recently announced a fund raise, the work plan shows that Prospero will continue to drill test the targets it has identified via its geological hypothesis for discovering large, blind silver deposits. Whilst the news release did not explicitly state that its strategic partner Fortuna Silver (TSX:FVI) would co-fund this exploration program, that seems likely given the technical success of the 2017 exploration program and that Fortuna has yet to select a project to joint-venture under its strategic agreement with Prospero.

ORENINC MINING DEAL CLUB

Access to high-quality, pre-vetted financing opportunities

www.miningdealclub.com

MEET US AT THE INTERNATIONAL MINING INVESTMENT CONFERENCE

MAY 15-16, 2018, VANCOUVER, CANADA

Oreninc Presentation: Tuesday, May 15th, 1:00 – 1:20pm

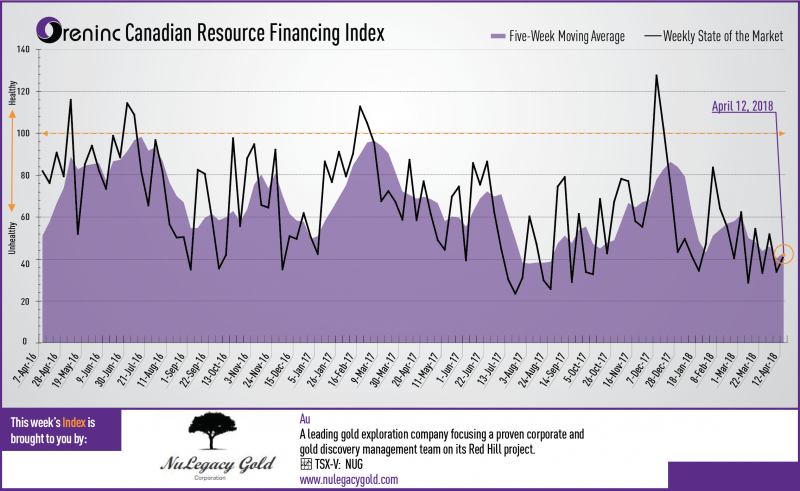

Last week index score: 33.86

This week: 41.32

Zinc One Resources (TSXV:Z) announces the final drill results from the Bongarita mineralized zone at its Bongará zinc mine project in north-central Peru.

We recently uploaded 43 CEO Elevator pitches to our Youtube channel! We also uploaded two videos of Brent Cook of Exploration Insights walking the floor of PDAC talking rocks with Morgan Poliquin of Almadex Minerals and Kevin Heather of Regulus Resources – go check them out!

The Oreninc Index rose in the week ending April 13th, 2018 to 41.32 from 33.86 a week ago as brokered action returned to the market.

Market volatility experienced another twist as tensions in Syria notched up, this time due to an alleged chemical weapons attack by the ruling regime of Bashar al Assad on the rebel-held town of Douma and the promise of pending punitive action by US president Donald Trump who warned that “missiles will be coming” (that subsequently occurred in the early hours of Saturday morning).

As a result, there was safe haven precious metals buying.

On to the money: total fund raises announced almost fell by half to C$166.0 million, a three-week low, which included three brokered financings for C$12.2 million, a two-week high, and one bought deal financing for C$5.0 million, a four-week high. The average offer size dropped to C$2.4 million, a three-week low.

Another volatile week for gold which saw the yellow metal close up at US$1,346/oz from US$1,333/oz a week ago with a mid-week high of US$1,353/oz. Gold is now up 3.33% this year. Meanwhile, the US dollar index closed down at 89.80 from 90.10 a week ago. The van Eck managed GDXJ gained more than a dollar to close up at US$33.49 from US$32.39 last week. The index is down 1.88% so far in 2018. The US Global Go Gold ETF also saw strong growth to close up at US$12.81 from US$12.51 a week ago. It is down 1.54% so far in 2018. The HUI Arca Gold BUGS Index closed up at 184.32 from 177.59 last week. The SPDR GLD ETF continued to see buying action and closed up at 865.89 tonnes from 859.99 tonnes a week ago.

In other commodities, silver closed up at US$16.65/oz from US$16.38/oz a week ago. Copper showed a slight increase to close at US$3.07/lb from US$3.05/lb last week, a week that saw the CRU World Copper Conference in Santiago, Chile and various presenters talk about the shortage of new copper mine projects coming through. Oil saw strong gains to close up at US$67.39 a barrel from US$62.06 a barrel a week ago.

The Dow Jones Industrial Average closed up at 24,360 from 23,932 last week. Likewise, Canada’s S&P/TSX Composite Index grew to 15,273 from 15,207 the previous week. The S&P/TSX Venture Composite Index closed up at 795.94 from 769.15 last week.

Summary:

- Number of financings increased to 28, a four-week high.

- Three brokered financings were announced this week for C$12.2m, a two-week high.

- One bought-deal financing was announced this week for C$5.0m, a four-week high.

- Total dollars dropped to C$66.0m, a three-week low.

- Average offer size also dropped to C$2.4m, a three-week low.

Financing Highlights

Maya Gold & Silver (TSXV: MYA) announced a non-brokered private placement of C$25.0 million through the issuance of 7.6 million shares @ C$3.30.

- No warrants will be issued.

- The net proceeds will be used to continue the development and expansion of the Zgounder silver mine in Morocco. Maya plans to begin building a second mine at Zgounder that will increase production capacity to 2,000 tpd by 2021.

Major Financing Openings:

- Maya Gold & Silver (TSX-V: MYA) opened a C$25-million offering on a best efforts basis. The deal is expected to close on or about April 13th.

- Critical Elements (TSX-V: CRE) opened a C$5-million offering underwritten by a syndicate led by Canaccord Genuity on a bought deal basis. Each unit includes half a warrant that expires in 24 months. The deal is expected to close on or about May 1st.

- Avino Silver & Gold Mines (TSX: ASM) opened a C$5-million offering underwritten by a syndicate led by Fitzgerald Canada on a best efforts basis. The deal is expected to close on or about April 27th.

- Noront Resources (TSX-V: NOT) opened a C$4.2-million offering on a best efforts basis.

Major Financing Closings:

- Orezone Gold (TSX: ORE) closed a C$44.92-million offering on a best efforts basis.

- Amarillo Gold (TSX-V: AGC) closed a C$5.16-million offering on a best efforts basis. Each unit included half a warrant that expires in 24 months.

- Aguia Resources (TSX-V: AGRL) closed a C$5-million offering underwritten by a syndicate led by Echelon Wealth Partners on a bought deal basis. Each unit included half a warrant that expires in 36 months.

- Noront Resources (TSX-V: NOT) closed a C$4.2-million offering on a best efforts basis.

Company News

Zinc One Resources (TSX-V: Z) announces the final drill results from the Bongarita mineralized zone at its Bongará zinc mine project in north-central Peru.

- 36 holes for 583m were drilled at Bongarita. Very fine-grained zinc mineralization, mostly as silicates exclusively hosted by soils, has been delineated over about 7,500m2.

- Two portable rigs continue to drill at Mina Chica and Mina Grande Sur.

- Highlights included 2.4m @ 42.8% Zn

- Zinc One also announced its first ever drill results that confirmed a high-grade zinc mineralized zone at Mina Chica, about 200m east of Bongarita.

- Highlights included 16.5m @ 35.6% Zn.

Analysis

The drilling at Bongarita has confirmed that the amount of mineralized soils should be similar in size and grade to the historical resource. The company believes that drill data along with the previous pit and channel sampling data, will provide enough data to delineate a resource. Combined with the positive first results from Mina Chica, the Bongarita project is shaping up to have significant zinc potential from surface, which bodes well for the possibility of a mine being developed in the future.

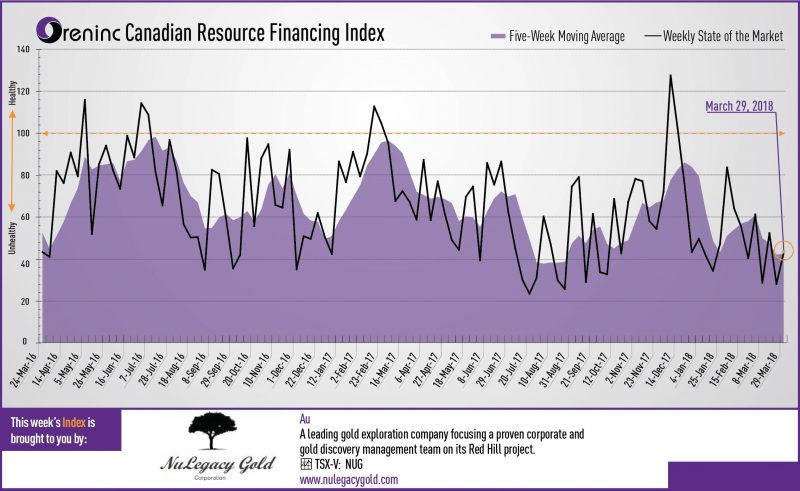

Last week index score: 28.01 (updated)

This week: 42.63

Zinc One Resources (TSXV:Z) received the first results from drilling at its Bongará zinc mine project in north-central Peru.

NuLegacy Gold (TSXV: NUG) said late winter storms deposited as much as three feet of snow on parts of its Red Hill property in the Cortez gold trend of Nevada, USA.

Prospero Silver (TSXV: PSL) announced the results of the third hole of a three-hole drill program at the Pachuca SE project in Hidalgo, Mexico.

Avrupa Minerals (TSXV: AVU) closed a private placement and raised C$550,000.

The Oreninc Index increased in the week ending March 30th, 2018 to 42.63 from an updated 28.01 a week ago as brokered and bought deal financings returned, even though it was a short week due to the Easter break.

Another swinging volatile week for gold as its recent fear trade boost subsided as US president Donald Trump deflated some of his trade tariff rhetoric. However, market analysts increasingly expect a gold breakout to occur, with the latest portent being that the gold/silver price ratio has gone past 80:1. This is the fifth time in the past 23 years that this has happened and on each previous occasion gold and silver equities exploded to the upside starting between 30-60 days later.

On to the money: total fund raises announced tripled to C$96.1 million, a four-week high, which included three brokered financings for C$13.3m, a two-week high, and two bought-deal financings for C$3.0 million, also a two-week high. The average offer size almost tripled to C$3.7 million, a four-week high.

Another range-bound volatile week for gold during which the yellow metal closed down at US$1,325/oz from US$1,347/oz a week ago despite hitting a mid-week high of US$1,353/oz. Gold is now up 1.74% this year. Meanwhile, the US dollar index closed up at 89.97 from 89.44 a week ago. The van Eck managed GDXJ also closed down at US$32.15 from US$32.78 last week. The index is down 5.80% so far in 2018. The US Global Go Gold ETF manged to hold its ground, dipping slightly to close down at US$12.71 from US$12.74 a week ago. It is down 2.31% so far in 2018. The HUI Arca Gold BUGS Index closed down at 175.41 from 176.86 last week. The SPDR GLD ETF saw some selling to close down at 846.12 tonnes from 850.54 tonnes a week ago.

In other commodities, the silver closed down at US$16.36/oz from US$16.56/oz a week ago. Copper recovered from its recent fall below the US$3.00/lb level to close up at US$3.02/lb from US$2.99/lb last week. Oil put in a losing week and closed down at US$64.94 a barrel from US$65.88 a barrel a week ago.

The Dow Jones Industrial Average showed signs of recovering from the trade-war potential resulting from Trump’s China tariffs announcement, to close up at 24,103 from 23,533 last week. Likewise, Canada’s S&P/TSX Composite Index got on the road to recovery to close up at 15,367 from 15,223 the previous week. The S&P/TSX Venture Composite Index closed down at 796.67 from 817.80 last week.

Summary:

- Number of financings grew to 26, a two-week high.

- Three brokered financings were announced this week for C$13.3m, a two-week high.

- Two bought-deal financings were announced this week for C$3.0, a two-week high.

- Total dollars jumped up to C$96.1m, a four-week high.

- Average offer size also grew to C$3.7m, a four-week high.

Financing Highlights

Asanko Gold (TSX: AKG) opened a US$17.6 million (C$22.79 million) offering on a strategic deal basis with Gold Fields, which will purchase 22.4 million shares @ US$0.79, a 9.9% interest.

- Asanko also entered into a JV with Gold Fields under which it will receive US$185 million for a 50% interest in its Asanko gold mine.

- Asanko will use the proceeds to repay US$164 million of debt with Red Kite.

Serabi Gold (TSX: SBI) announced a US$15 million strategic private placement with Greenstone Resources.

- 297.8 million @ 0.5 pence, a 29.82% interest.

- Funds will be used to undertake drilling to delineate additional resources and expand the life of mine at the Palito and Sao Chico projects, and advance the recently acquired Coringa project, all in Brazil.

- Serabi also opened a private placement for a minimum of US$8.0 million @ 3.6 pence undertaken by Peel Hunt.

Major Financing Openings:

- Asanko Gold (TSX:AKG) opened a C$22.79 million offering on a strategic deal basis.

- Serabi Gold (TSX:SBI) opened a C$18.46 million offering on a strategic deal basis.

- North American Nickel (TSXV:NAN) opened a C$15 million offering on a best efforts basis. Each unit includes half a warrant that expires in two years.

- Serabi Gold (TSX:SBI) opened a C$10.32 million offering underwritten by a syndicate led by Peel Hunt on a best efforts basis.

Major Financing Closings:

- Serabi Gold (TSX:SBI) closed a C$11.53 million offering underwritten by a syndicate led by Peel Hunt on a best efforts basis.

- Auryn Resources (TSXV:AUG) closed a C$10.08 million offering underwritten by a syndicate led by Cantor Fitzgerald Canada on a bought deal basis.

- Skeena Resources (TSXV:SKE) closed a C$8.46 million offering underwritten by a syndicate led by PI Financial on a best efforts basis. Each unit included half a warrant that expires in two years.

- Chakana Copper (TSXV:PERU) closed an C$8 million offering underwritten by a syndicate led by Eventus Capital on a best efforts basis.

Company News

Zinc One Resources (TSXV: Z) received the first results from drilling at its Bongará zinc mine project in north-central Peru. Drilling commenced at the Mina Grande Sur and Bongarita zones where two portable drill rigs are currently operating. At Mina Grande Sur, 543m were completed in 33 holes with highlights including 5.5m @ 26.1% Zn in hole MGS18001. At Bongarita, 587m were completed in 36 holes with highlights including 11.5m @ 16.0% Zn in hole BO18005.

Analysis

The initial results are very optimistic and demonstrate the potential of the project by confirming its high-grade nature, particularly given that many intercepts start at or near surface. The results will contribute to the upcoming resource estimate and PEA planned for 2018.

NuLegacy Gold (TSXV: NUG) said late winter storms deposited as much as three feet of snow on parts of its Red Hill property in the Cortez gold trend of Nevada, USA making access to selected drill target areas difficult and dangerous. As a consequence, the company had to release a reverse circulation drill rig it contracted to begin drilling in late March and replaced it with a drill scheduled to arrive late April. Drilling will initially focus on following up on the 2017 success in the Serena and Avocado zones in areas with broad intervals of intense alteration, silicification and decalcification seen in several of the drill holes in this large exploration area.

Analysis

Freak weather can happen, but this event should only delay the company by a month.

Prospero Silver (TSXV: PSL) announced the results of the third hole of a three-hole drill program at the Pachuca SE project in Hidalgo, Mexico. Drilling confirmed the presence of highly anomalous silver values hosted by blind epithermal veining in three widely separated zones hosted by 7km of structures on the property. Hole 3 cut multiple zones of anomalous silver including 1.5m @ 121.3g/t Ag & 0.37g/t Au.

Analysis

Drilling of the Pachuca targets continues drilling the third of three initial projects funded by Fortuna Silver (TSX: FVI) in early stage proof of concept programs. The program successfully demonstrated that Pachua SE hosts blind epithermal veins with silver and gold mineralization. The next step will be to agree additional drilling to define the extent of mineralization in the veins.

Avrupa Minerals (TSXV: AVU) closed a private placement and raised C$550,000 and issued 6.9 million units @ C$0.08. Each unit consists of one share and one warrant exercisable @ C$0.12 for two years. The funds will be used for exploration mainly in Portugal and Kosovo.

About Oreinc.com:

Oreninc.com is North America’s leading provider of relevant financing information in the junior commodities space. Since 2011, the company has been keeping track of financings in the junior mining as well as oil and gas space. Logging all relevant deal and company information into its proprietary database, called the Oreninc Deal Log, Oreninc quickly became the go-to website in the mining financing space for investors, analysts, fund managers and company executives alike.

The Oreninc Deal Log keeps track of over 1,400 companies, bringing transparency to an otherwise impenetrable jungle of information. The goal is to increase the visibility of transactions and to show financings activity in a digestible format. Through its daily logging activities, Oreninc is in a position to pinpoint momentum changes in the markets, identify which commodities are trending and which projects are currently receiving funding.

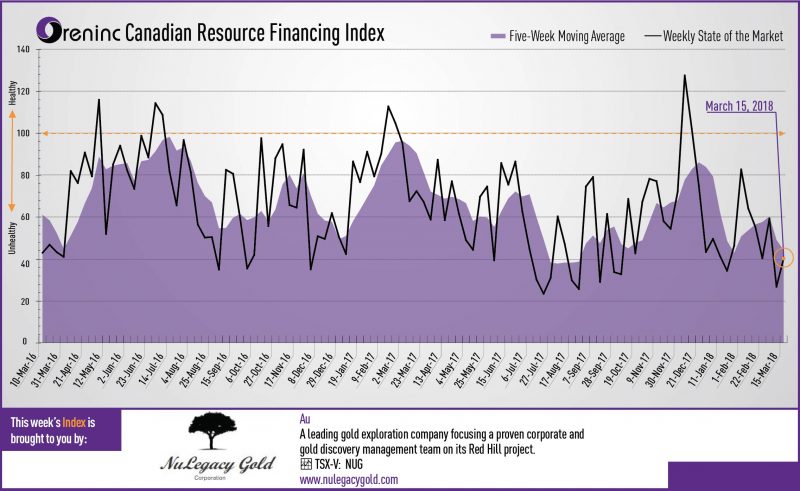

ORENINC INDEX – Monday, March 19th 2018

Last week index score: 26.73

This week: 40.03

Prospero Silver (TSXV:PSL) discovered a new gold & silver-bearing epithermal vein system during a three-hole drill program at the Pachuca SE project in Hidalgo, Mexico.

Avrupa Minerals (TSXV:AVU) said its C$500,000 private placement financing is fully subscribed.

The Oreninc Index surged in the week ending March 16th, 2018, with the index increasing to 40.03 from 26.73 a week ago as financings, particularly brokered deals, began flowing again.

Despite strong fundamentals for precious and base metals, stocks continue to chart with insouciance. Certainly, cryptocurrencies and marijuana stocks have occupied some of the investor attention that would formerly have been doted on them.

A relatively quiet week on the geopolitical front, with a diplomatic spat arising between the UK and Russia over the poisoning of a former spy and his daughter in the UK. The UK has expelled Russian diplomats and Russia has returned the favour.

Gold experienced rolling punches throughout the week as rising inflation in the US could transpose into multiple interest rate rises throughout the year. The US CPI Index rose 0.2% in February following from a 0.5% increase in January, higher than expectations. Whilst a 25-basis point interest rate increase is widely expected at the Federal Reserve monetary policy meeting this week all ears will be on the tone of its comments about the potential for additional rises later this year.

On to the money: total fund raises announced increased to C$85.6 million, a two-week high, which included seven brokered financing for C$25.3m, a two-week high, and two bought-deal financings for C$15.7 million, a two-week low. The average offer size more than doubled to C$2.6 million, a two-week high.

A less volatile but deflationary week for gold saw the yellow metal close down at US$1,314/oz from US$1,323/oz a week ago. The van Eck managed GDXJ also closed down slightly at US$31.41 from US$31.72 last week. The index is down 7.97% so far in 2018. The US Global Go Gold ETF fared slightly better to close up on the week at US$12.44 from US$12.43 a week ago. It is down 4.37% so far in 2018. The HUI Arca Gold BUGS Index continued to fall and closed down at 171.16 from 172.92 last week. This index features 15 companies involved in gold mining and is an indication of how well gold companies perform relating to the gold price. The SPDR GLD ETF saw gains in the week to close at 840.22 tonnes from 833.73 tonnes a week ago.

In other commodities, the silver sell-off continued as it closed down at US$16.33/oz from US$16.58/oz a week ago. Copper also had a negative week and closed slightly down at US$3.10/lb from US$3.13/lb last week. Meanwhile, oil closed slightly up at US$62.34 a barrel from US$62.04 a barrel a week ago.

The Dow Jones Industrial Average pulled back in the week to close down at 24,946 from 25,335 last week. Conversely, Canada’s S&P/TSX Composite Index closed up at 15,711 from 15,577 the previous week. The S&P/TSX Venture Composite Index also put in gains and closed at 833.67 from 828.90 last week.

Summary:

- Number of financings tripled to 33, a six-week high.

- Seven brokered financings were announced this week for C$25.3m, a two-week high.

- Two bought-deal financings were announced this week for C$15.7m, a two-week high.

- Total dollars shot up to C$85.6m, a two-week high.

- Average offer size more than doubled to C$2.6m, a two-week high.

Financing Highlights

International Tower Hill Mines (TSX:ITH) opened a C$15.6 million offering on a best efforts basis.

- Non-brokered private placement of 24.0 million shares @ US $0.50 per share for aggregate gross proceeds of US$12 million (C$15.6 million).

- Proceeds to be used for the continuation of optimization studies in efforts to further improve and de-risk the Livengood gold project, required environmental baseline studies and general working capital purposes.

- New strategic investor Electrum Strategic Opportunities Fund acquired 19.9 million shares (10.7%). Paulson & Co acquired 4.1 million shares to increase its ownership to 32.0%.

Major Financing Openings:

- International Tower Hill Mines (TSX:ITH) opened a C$15.6 million offering on a best efforts basis.

- Auryn Resources (TSXV:AUG) opened a C$8.76 million offering underwritten by a syndicate led by Cantor Fitzgerald Canada on a bought deal basis. The deal is expected to close on or about March 23rd.

- Tinka Resources (TSXV:TK) opened a C$7.01 million offering underwritten by a syndicate led by GMP Securities on a bought deal basis. Each unit includes half a warrant that expires in 12 months. The deal is expected to close on or about April 4th.

- Tinka Resources (TSXV:TK) opened a C$6 million offering on a best efforts basis.

Major Financing Closings:

- Millennial Lithium (TSXV:ML) closed a C$24.15 million offering underwritten by a syndicate led by Canaccord Genuity on a bought deal basis. Each unit included half a warrant that expires in 24 months.

- International Tower Hill Mines (TSX:ITH) closed a C$15.6 million offering on a best efforts basis.

- Millennial Lithium (TSXV:ML) closed a C$6.38 million offering on a strategic deal basis. Each unit included half a warrant that expires in 24 months.

- Stina Resources (TSXV:SQA) closed a C$3 million offering on a best efforts basis.

Company News

Prospero Silver (TSXV:PSL) discovered a new gold & silver-bearing epithermal vein system during a three-hole drill program at the Pachuca SE project in Hidalgo, Mexico.

- An 1,800m drill program tested three targets with deep, angled holes with intercepts including 1.35m @ 227Ag demonstrating that the negligible Ag and Au anomalies we noted in the surface alteration are related to a potentially significant epithermal vein system at depth.

- The Pachuca drilling completes proof of concept drilling of three initial targets funded by Fortuna Silver (TSX:FVI).

Analysis

Prospero cut new vein systems within 25km of one of the world’s great silver-gold districts that produced over 1.2Boz of silver. Hitting multi-ounce and multi-gram silver and gold grades during scout drilling bodes well for future follow-up drilling on the 6-7km of linear, structurally-controlled alteration at surface on its concession. Following completion of the proof-of-concept drilling, Fortuna now has the option to enter into a JV on one of the targets tested.

Avrupa Minerals (TSXV:AVU) said its C$500,000 private placement financing is fully subscribed.

- 6.25 million units @ C0.08. Each unit is comprised of one share and a warrant exercisable @ C$0.12 for two years.

- Proceeds will be used for working capital and exploration in Portugal and Kosovo.

About Oreinc.com:

Oreninc.com is North America’s leading provider of relevant financing information in the junior commodities space. Since 2011, the company has been keeping track of financings in the junior mining as well as oil and gas space. Logging all relevant deal and company information into its proprietary database, called the Oreninc Deal Log, Oreninc quickly became the go-to website in the mining financing space for investors, analysts, fund managers and company executives alike.

The Oreninc Deal Log keeps track of over 1,400 companies, bringing transparency to an otherwise impenetrable jungle of information. The goal is to increase the visibility of transactions and to show financings activity in a digestible format. Through its daily logging activities, Oreninc is in a position to pinpoint momentum changes in the markets, identify which commodities are trending and which projects are currently receiving funding.

Website: www.oreninc.com

If you would like to receive our free newsletter via email, simply enter your email address below & click subscribe.

CONNECT WITH US

Tweets

Tweet with hash tag #miningfeeds or @miningfeeds and your tweets will be displayed across this site.

MOST ACTIVE MINING STOCKS

Daily Gainers

Taranis Resources Inc. Taranis Resources Inc. |

TRO.V | +52.17% |

|

RG.V | +50.00% |

|

AFR.V | +50.00% |

|

AAZ.V | +50.00% |

|

RDS.AX | +50.00% |

|

NTM.AX | +50.00% |

|

AUK.AX | +50.00% |

|

TAS.AX | +33.33% |

|

IZN.V | +33.33% |

|

CASA.V | +30.00% |

Articles

FOUND POSTS

Filo (TSX:FIL) Expands Aurora Zone as Buyout Talks Progress

November 27, 2024

Rio Tinto-Backed Lithium Startup ElectraLith Pursues Major Funding

November 26, 2024

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan