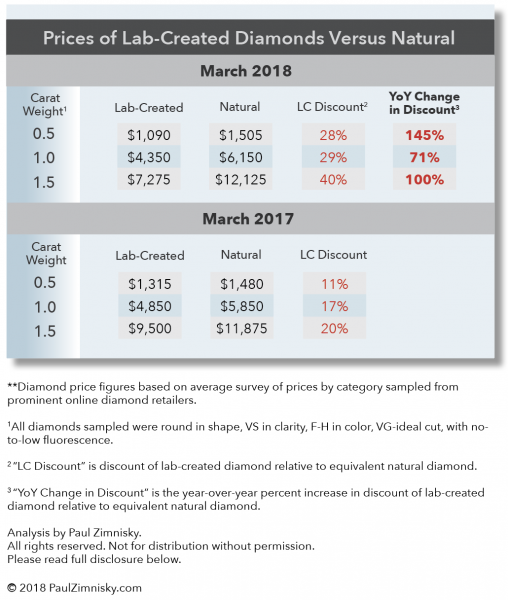

The discount of gem-quality lab-created diamonds, manufactured for use in jewelry, relative to natural diamonds has doubled from 11-20% a year ago to 28-40% today, according to a survey of prices.

For example, a white, 1-carat round diamond that is VS (very-slightly included) in clarity, F-H (near-colorless to colorless) in color, VG-ideal cut, with no-to-low florescence was selling for approximately $4,850 in March 2017 but is now $4,350 in March 2018, a 10% decline.

However, over the same period of time the price of an equivalent natural diamond went from $5,850 to $6,150, representing about a 5% increase. Thus, the discount of the lab-created diamond relative to the natural equivalent was approximately a 17% in March 2017, but is now about 29%, a 71% year-over-year increase.

See table below for more examples:

Lab-created diamonds are becoming less expensive relative to natural equivalents as investment in lab-diamond production technology has rapidly improved production economics in just the last few years. This has led to rapid relative supply growth and an environment that is more price competitive for lab-diamond manufacturers.

Lab-created diamonds are becoming less expensive relative to natural equivalents as investment in lab-diamond production technology has rapidly improved production economics in just the last few years. This has led to rapid relative supply growth and an environment that is more price competitive for lab-diamond manufacturers.

However, actually gauging lab-diamond supply growth is difficult. The global proliferation of lab-diamond production facilities in recent years, from China to Russia to the U.S., has made tracking production figures challenging, especially given that the companies involved are private and proprietary in nature. Further complicating the process is the range in quality and scale at which lab-diamonds are being produced.

Natural diamond production quality can be segmented as approximately 40% gem-quality, 20% near-gem-quality, and 40% industrial-grade. Gem-diamonds are used in jewelry, industrial-grade diamonds are used for abrasive and other industrial application, and near-gem diamonds are used for both jewelry and more-specialized industrial application, with the split of use dependent on market prices and demand.

It is important to note that natural industrial-grade diamonds are simply seen as a by-product, as the presence of gem-quality diamonds in a deposit are what drive the economics behind natural diamond production decisions.

In the case of lab-diamonds, the ability to create higher-quality gem-diamond product economically is a relatively recent development –within the last decade. Even with the recent developments in technology, current lab-created production of true gem-diamonds only represents <10% of global output, estimated at <5M carats, which compares to natural gem-quality output of ~60M carats (based on 40% of an estimated total natural production of 147M carats in 2018).

The business of manufacturing lab-created diamonds for industrial application (typically referred to as synthetic diamond) has been around for decades, and the industry currently supplies >99% of global industrial diamond supply for use as abrasives (production is in the billions-of-carats for context).

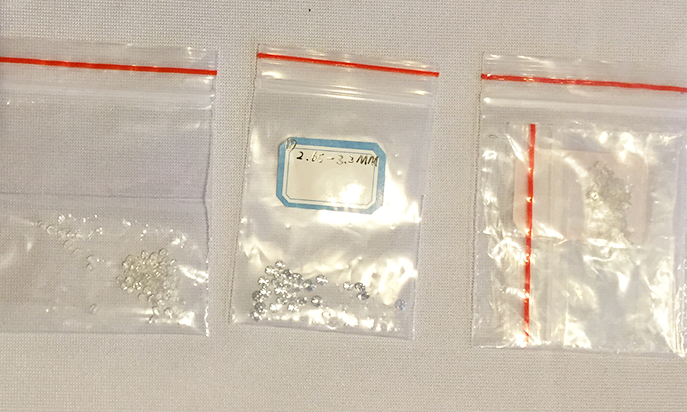

Lab-production of near-gem-quality diamonds is where supply analysis gets especially challenging. Producers of synthetic industrial-quality diamonds have been advancing their production capability through improved technology which has enabled them to increase the quality of their product from industrial to near-gem quality. Given that billions-of-carats of industrial-quality diamonds are produced each year, it becomes apparent that lab-created near-gem production could be in the hundreds-of-millions of carats; and some of this product is being passed off for use in jewelry –which is primarily used to embellish larger-stones and for use in pavé settings.

The natural diamond industry has been proactively developing affordable screening technology so that lab-created diamonds of all quality and sizes used in jewelry can be properly disclosed and sold as such.

As lab-diamond production continues to accelerate, it seems inevitable that the price spread between lab-created and natural diamonds across all sizes and qualities will continue to widen, especially in the case of generic lab-diamonds, those that are not supported by a manufacturer or retailer’s brand.

Medium-to-longer-term expect the dialog surrounding lab-created diamonds to shift from jewelry to application in high-tech developments such as processing chips, optics, laser devices, and thermal conductivity equipment. The unique properties of diamond make the application potential exciting and wide, and the scientific and tech community has just begun to scratch the surface of its potential.

The high-tech industry enthusiastically awaits economically available mass-produced high-quality diamond, the lab-diamond manufacturers know this and most are just using jewelry as a stepping stone.

—

For more on lab-created diamonds see: Lab-created Diamonds: Where to Go from Here?

Paul Zimnisky is an independent diamond industry analyst, author of the Zimnisky Global Rough Diamond Price Index and publisher of the subscription-based State of The Diamond Market monthly industry report. On May 9th, 2018 he will be speaking at the Mines and Money investor conference in New York City. Paul can be reached at paul@paulzimnisky.com and followed on Twitter @paulzimnisky.

by: Paul Zimnisky

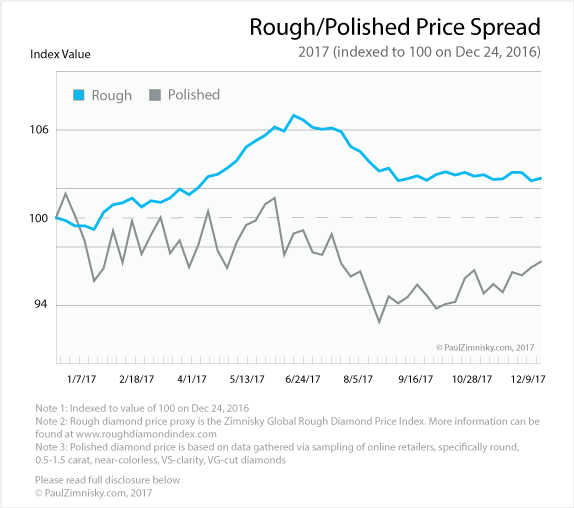

Through mid-December 2017, rough diamond prices are up 2.7%* year-to-date, while polished prices are down 3.5%**. However, despite shrinking manufacturer margins, the midstream segment of the industry still bought $5.3B worth of diamonds from De Beers this year, including $450M at the final sight which was 7% over the comparable sight last year and 81% over 2015.

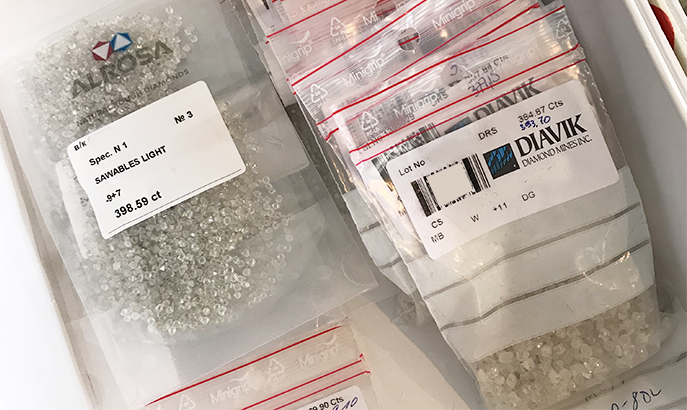

De Beers’ full-year sales were -5% relative to last year and +53% over 2015. Russian-major, ALROSA (MICEX: ALRS), is on pace to sell $4.4B of diamonds in 2017, which would be in line with 2016 and 27% over 2015.

2017 has been a year of excess inventory shifting from the upstream segment of the diamond industry to the mid-stream segment. For instance, industry leaders De Beers and ALROSA have both see their inventories decrease by an estimated 1.6M and 2.3M carats, respectively, through Q3 2017, this despite both producers also increasing production this year.

World-wide natural diamond production is estimated to rise to approximately 148M carats in 2017 which would be a 7% increase in volume over last year. The increase mostly due to the commencement of production at three new mines, the ramping-up of production at previously curtailed operations and expansion projects at legacy mines.

Despite various operating setbacks and political challenges that have disrupted production at multiple mines this year, including an accident that has since halted production at ALROSA’s Mir mine, most major miners are still on pace to produce towards the higher end of guidance ranges.

Most industry participants would agree that the first half of 2017 was strong, however, the second half relatively disappointing. Demand for rough returned aggressively in early-2017 as manufacturers in India recovered from the late-2016 liquidity crisis caused by the government’s demonetization of high denomination bank notes.

However, by mid-year, new polished entering the market compounded an already overstocked global polished inventory and manufacturers noticeably pulled back operating activity punctuated with longer-than usual Diwali factory closures in the fall.

In recent weeks manufacturer activity has begun ramping up again, as the industry prepares to replenish Christmas and Indian wedding season stock and deliver for Chinese New Year demand.

The U.S. consumer market is currently supported by a relatively strong economy. With the stock market regularly making new all-time highs and with most employment figures at favorable levels, consumer sentiment is positive. Pending tax reform and the recent appointment of a new Fed chairman that favors continued dovish policy has supported this trend.

America’s largest jeweler, Signet Jewelers (NYSE: SIG), had a challenging 2017, however most of underperformance can be attributed side effects associated with the company restructuring, and not necessarily the appetite of the U.S. consumer. In fact, globally-diversified Tiffany & Co. (NYSE: TIF) recently noted the U.S. market as one of its strongest.

Tiffany also noted particular strength in the company’s Mainland Chinese market. Recent results from leading Greater China jeweler, Chow Tai Fook (HK: 1929), supports this as the company has seen same-store-sales growth for four consecutive quarters in its Mainland market and three consecutive quarters in Hong Kong/Maccu.

Luk Fook (HK: 0590), which has a greater exposure to Hong Kong than Chow Tai Fook (which is more Mainland focused), had same-store-sales growth of over 11% in the six-months ending September 30, which stands out against three prior comparable years of decline.

On November 21, Chow Tai Fook described the current market as a “turning point…given the nascent jewelry market recovery” and Luk Fook has recently described the climate as “improved.”

The U.S. is still by far the largest end-consumer market for diamonds at about 50%. Greater China, which includes Mainland China, Hong Kong, Macau and Taiwan, and India represent the industry’s fastest growing large markets.

Global diamond supply is estimated to marginally decrease about 1.5% in 2018 to 146M carats and global polished diamond wholesale demand is estimated to hit $26.6B next year, which would be a 3.8% increase over 2017.

Heading into 2018, here are some possible diamond industry catalysts to watch for:

- Indian billionaire Anil Agarwal who has a fond interest in diamonds and is now the largest shareholder of De Beers’ parent Anglo American (LSE: AAL) after accumulating shares throughout 2017, could make a move to gain control of the company in 2018

- Next year ALROSA will decide whether to rebuild or close the Mir mine after it sustained a flooding accident in August 2017; a decision to permanently close the mine would be supportive of global supply/demand dynamics, e.g. the loss of Mir production would offset the combined new supply from Renard and Liqhobong (two of the three mines that commenced production this year)

- In December Tiffany & Co. stock rallied to just shy of an all-time high in part due to takeover speculation, an event that could possibly play out in 2018 as favor for international luxury returns

- Lucara Diamond Corp (TSX: LUC) is back to mining fresh South Lobe ore, the portion of the Karowe ore body that produced the Lesedi La Rona and Constellation diamonds; with a new advanced large-stone recovery system in place, Lucara has the potential to produce more newsworthy diamonds in 2018

- Signet Jewelers could recover after a disappointing 2017 as company-wide restricting plays out, including selling its customer credit portfolio, closing underperforming mall-based stores, expanding at off-mall locations, integrating web and digital into sales strategies, and executive level change

- Zimbabwe’s government-run ZMDC (private) has commenced conglomerate mining at the Marange fields with $30M of new equipment which could increase production in 2018 to an estimated 3.5M carats from just over 2.0M carats in 2017

- De Beers’ Voorspoed mine in South Africa, Gem Diamond’s (LSE: GEMD) Ghaghoo mine in Botswana, and previous-Rio Tinto (LSE: RIO) diamond project, Bunder, are all up for sale and could have new owners in 2018

- As production at De Beers’ and Mountain Province Diamonds’ (TSX: MPVD) Gahcho Kué mine approaches deeper depths in 2018, more production could come from center-lobe ore which is expected to be of lower grade but host higher-quality diamonds

- Kennady Diamonds (TSX-V: KDI) and Peregrine Diamonds (TSX: PGD) both disclosed that they had been in discussions with potential strategic partners in 2017, an indication of possible deals in 2018

- Stornoway Diamonds’ (TSX: SWY) waste sorting circuit which is being installed to alleviate diamond breakage during processing could prove effective when it goes live in Q2 2018, the likely result being a higher average diamond price achieved for Stornoway’s Renard goods

- Following a disappointing 2017, mining of lower grade areas at Firestone Diamonds’ (LSE: FDI) Liqhobong mine nears completion and production is expected to move to areas of the open pit that host higher quality diamonds in 2018

- A review of the proposed South African Mining Charter will take place in mid-February 2018, which could have implications on ownership and operations of diamond companies in the country including De Beers and Petra Diamonds (LSE: PDL)

- Further work at Luaxe in 2018, arguably the most important undeveloped diamond project in the world, could provide further clarity on resource and production details and a production start date, which is now anticipated for some time after 2020

- A continued weaker U.S. dollar in 2018 could support momentum in global consumer luxury demand, while a shift in trajectory could have an adverse effect

- An updated feasibility study on Shore Gold’s (TSX: SGF) Star-Orion South project in Saskatchewan Canada, is anticipated in 2018, which could change the economics of the project by reducing an almost $2B pre-production capex

- North Arrow Minerals (TSX-V: NAR) is expected to set up an exploration camp and drill its Mel property in 2018, the site of Canada’s newest diamond discovery, which could further indicate the significance of the discovery

- Lab-created diamond production expected to continue to increase in 2018, however wider-consumer appetite for the product is still unclear and production of larger gem-quality stones is still just a fraction of the natural equivalent production

- Dunnedin Ventures (TSX-V: DVI) has plans to conduct the company’s first drill program in 2018 at its Kahuna project in Canada’s Nunavut territory which could result in a new discovery near Agnico Eagle’s (TSX: AEM) Meliadine gold mine currently in development

- Lucapa Diamond (ASX: LOM) expects to commence production at Mothae in Lesotho in the second half of 2018, a mine with the potential to produce diamonds worth in excess of $1,000/ct on average

- The Diamond Producers Association, established by the diamond industry to return generic marketing to diamonds, could impact consumer demand following the launch of a second U.S. campaign and first Indian campaign in November 2017 and first Chinese campaign in April 2018

- Five Star Diamonds (TSX-V: STAR) plans to continue progressing exploration and development on over 20 kimberlite projects in Brazil in 2018, which could lead to Brazil eventually becoming a more important contributor to global diamond supply

- U.S.-based lab-created diamond producer, Diamond Foundry (private), plans to build a “MegaCarat foundry” in Washington state, with first reactors expected to be deployed by Q2 2018, which would add to the company’s current annual production estimated at approximately 100k carats

—

*Rough diamond price based on the Zimnisky Global Rough Diamond Price Index. More information can be found at www.roughdiamondindex.com. **Polished diamond price based on data gathered via sampling of online retailers, specifically round, 0.5-1.5 carat, near-colorless, VS-clarity, VG-cut diamonds.

All figures in U.S. dollars unless otherwise noted.

De Beers is 85% owned by Anglo American plc and 15% owned by the Government of the Republic of Botswana.

At the time of writing the author held a long position in Lucara Diamond Corp, Stornoway Diamond Corp, Mountain Province Diamonds Inc, Kennady Diamonds Inc, Tsodilo Resources Ltd, North Arrow Minerals Inc, Signet Jewelers Ltd and Peregrine Diamonds Ltd. Please read full disclosure below.

Paul Zimnisky is an independent diamond industry analyst, author of the Zimnisky Global Rough Diamond Price Index and publisher of the subscription-based State of The Diamond Market monthly industry newsletter. In 2018, he will be speaking at Mining Indaba in Cape Town, South Africa on February 6, and Mines and Money in New York on May 9. Paul can be reached at paul@paulzimnisky.com and followed on Twitter @paulzimnisky.

by Linus Booker

It is said that the most valuable commodity in Sierra Leone is diamonds. But in my experience, one commodity is priceless: trust. Contracts move, governments are ousted and money changes hands all the time, but the one thing you cannot buy in Sierra Leone is trust.

I’ve been based in Geneva from most of this year, but have been on a project in Freetown for the last 10 weeks. The talk of the town is all about how the creditors attached to one of the biggest foreign-owned mining investors here may be about to discover the value of trust the hard way. But if this blows up, knowing where to place the blame may raise as many questions about creative accounting as it does about management.

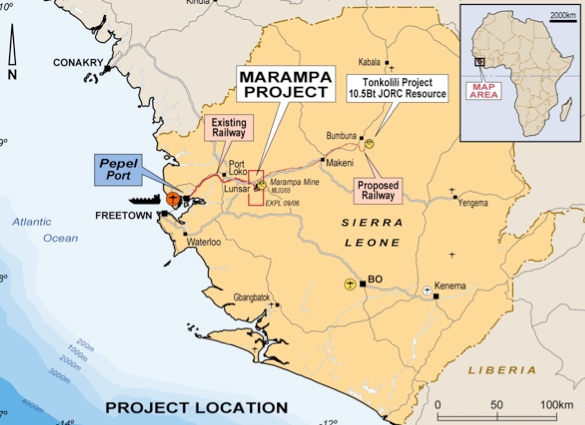

First, some context: there is a vast iron ore mine in the east of Sierra Leone that has the potential for 40 years of mining. The Marampa mine was first developed by London Mining, the erstwhile giant of African mining, before being snapped up and developed by one of Frank Timis’s companies when London Mining went bust. After the iron-ore price crashed in 2014, things went very quiet at Marampa before ownership quietly transferred to company called ‘SL Mining’ owned by Connecticut-based Gerald Metals. The iron ore price has since recovered, but production is yet to resume at Marampa. What’s more, lingering concerns over how Gerald secured the Marampa licence in the first place has meant that scrutiny on the ground is mounting by the day.

Since mid-November there have been concerns voiced in the local newspapers in Sierra Leone about Gerald Metals. Articles have variously claimed that Gerald Metals is under serious pressure from the government over its dismal performance, or claimed that Gerald Metals is about to lose its mining licence. Wednesday’s news from Freetown tells us Gerald Metals has some support of the government, but for many observers this too will raise more questions than it answers.

Since Gerald Metals first acquired the licence at Marampa, rumours of foul-play have surrounded the company. Their near-overnight acquisition of the mine in March this year did not go unnoticed by newspapers here in Sierra Leone, with the kindest criticism being raised over inexperience of the new management. Given the problems restarting production at Marampa, it does seem fair to ask what faith should be placed in Gerald’s CEO, Craig Dean, who trained as a forensic accountant at Deloitte, not in metals trading, not even in mining.

For creditors, keeping an eye on the Deloitte connection may be sensible. Deloitte currently represents Gerald Metals. The accountancy firm has enough trouble on the African continent already, and by all accounts, the scandal surrounding the Steinhoff empire is yet to run its full course. Newspapers are already suggesting that an investigation into Deloitte’s compliance with international audit standards is around the corner.

And those checks may come sooner rather than later. Why? Well, according to reports online, Gerald’s credit lines for Marampa are up for review.[1] Banks like BNP Paribas, Credit Suisse, Deutsche Bank and Credit Agricole will be weighing the merits of renewing the $225m float currently attached to Marampa. Presumably in response to mismanagement of Marampa, the creditors have already decreased their exposure following an initial float of $300m for Gerald in 2014. So, any news of accounting irregularities, added to the fact that production at Marampa remains dormant, could spell real trouble for Gerald’s credit lines. With BNP Paribas still smarting from the $8.9 billion fine it received for its ties with Cuba, Iran and Sudan, this is no time for their compliance teams to risk another scandal on the books.

So, Gerald may have been given a stay of execution from the Government of Sierra Leone, but it remains to be seen if their creditors will be so merciful.

[1] http://www.tfreview.com/news/

Linus Booker is principal consultant with Chavenage Mining Consultants, an independent practice he established in 2005. Previously a contractor with a number of blue-chip extractive firms, Linus has worked in Zambia, Russia and Sierra Leone, and is currently based between London and Zurich. He is married with three children.

On November 1st, De Beers said that it will be closing its nearly depleted Victor diamond mine in northern Ontario in early 2019. Victor is the first in a line of legacy diamond mines world-wide that will be closing over the next 5-years.

Most notably, Rio Tinto’s illustrious Argyle mine in Australia is expected to shut operations in 2021. At peak production, in the mid-90’s, Argyle produced over 40M carats annually. To put that into perspective, total 2017 global diamond output is estimated at less than 150M carats.

De Beers Voorspoed mine in Botswana is on pace to reach end-of-life by the end of the decade, and a slew of the company’s alluvial mines in Namibia are planned to be phased out by 2022.

With global diamond demand forecast to grow at approximately 3.5% annually over the next five years, driven by middle class consumers in Mainland China and India, the industry’s fastest growing large markets, a supply gap down the line seems inevitable if forecasts hold.

Globally there only two new diamond projects in the works with annual production potential of in excess of 1M carats, one in Angola, the other in Russia. Further, new diamond project exploration has been limited by challenges in the upstream diamond industry’s primary jurisdictions.

Greenfields diamond exploration in South Africa is at multi-decade lows due to delays in granting of prospecting licenses and perceived risks of a new Mining Charter, and this year there was a production disruption at the Williamson diamond mine in Tanzania related to government changes in mining legislation.

In Botswana, home to De Beers’ primary asset base, the country has been heavily explored and most major diamond discoveries are assumed to already have been made. In Russia, most major diamond production in is controlled by government entities.

This makes Canada, already the third largest diamond producing nation in the world by value (see chart above), arguably the most prospective diamond exploration jurisdiction in the world. In May of this year, Canada’s leading diamond producer, Dominion Diamond (private), pledged to spend C$50M on exploration over next 5 years, the company’s first major greenfields exploration since 2007.

After being acquired for US$1.2B in July by private-held the Washington Companies (at a 44% premium to where the stock was trading the day before initial indication of interest was made), on November 1st Dominion reiterated plans of “reinvigorating” exploration programs in Canada.

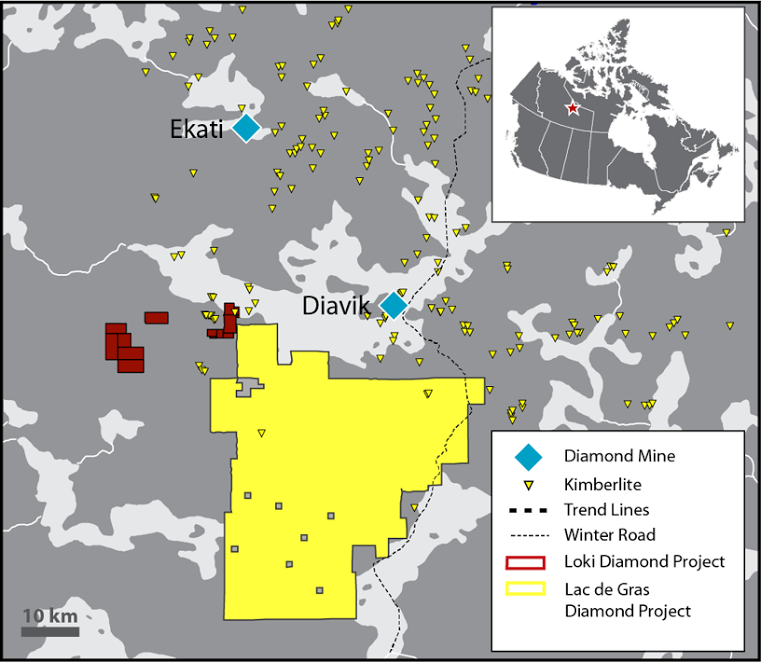

Dominion is partnered with North Arrow Minerals (TSX-V: NAR) on the prospective “Lac de Gras” property, which is located within a diamondiferous kimberlite field in the Northwest Territories that is the source to some of the richest diamond deposits in the world, including Dominion’s two world-class mines, Ekati and Diavik.

Dominion’s partner is known for making 2 of the only 5 kimberlite discoveries made in Canada over the last 5 years, and both of North Arrow’s discoveries were diamond bearing. Just last month North Arrow announced a discovery at the company’s 100%-owned Mel project in in the Nunavut territory of Canada. The company has plans to set up an exploration camp and drill the property next year.

Mel is approximately 200km northeast of the North Arrow’s 100%-owned Naujaat property which already has an inferred resource of over 26M carats and contains fancy yellow and orangey-yellow diamonds. In September, the company completed a C$2M drilling and mini-bulk sampling program at the property with results expected in the coming months. North Arrow also has pending results from a till sampling program at its Pikoo project, a 100%-owned diamond bearing kimberlite project in Saskatchewan that was discovered by North Arrow in 2013.

This coming March, Dominion will lead a drill program at the aforementioned Lac de Gras joint-venture (69% Dominion/31% North Arrow) in hopes of discovering new diamondiferous kimberlites. At around the same time North Arrow will also be drilling at its 100% owned Loki project, also in the Northwest Territories, and approximately only 30-40km away from both Ekati and Diavik.

With active programs across multiple worthy projects in Canada’s premier diamond territories, North Arrow appears well positioned to add to previous success and maintain its status as Canada’s leading publicly-traded stand-alone diamond explorer.

Disclosure: Paul Zimnisky has been compensated by North Arrow Minerals to produce the above content. The content includes views that are based on observations and opinions. The author has made every effort to ensure the accuracy of information provided, however, accuracy cannot be guaranteed. The above content is strictly for informational purposes and should not be considered investment advice. Consult your investment professional before making any investment decisions. None of the parties involved accept culpability for losses and/or damages arising from the use of content above.

The November 1991 discovery of diamonds in the Northwest Territories by Chuck Fipke and Stu Blusson put Canada on the global diamond map. It also triggered one of the largest staking rushes in the world, as hundreds of companies hurried north to find treasure.

A few years later, many had retreated to warmer climes. One company that remained in the hunt was Gren Thomas’s Aber Resources, with a large land package staked by Thomas and partners at Lac de Gras near the Fipke find. In the spring of 1994, an Aber exploration crew led by Thomas’s geologist daughter, Eira Thomas, raced the spring melt to drill through the ice in search of kimberlite — the rock that sometimes hosts valuable diamonds.

It was a longshot. Since the Fipke find, the great Canadian diamond hunt had virtually ground to a halt — despite the millions of dollars spent in search of the glittery stones. But the drill core from that final spring hole had a two-carat diamond embedded in it. The Diavik discovery meant it was game on for Aber — and Canada’s nascent diamond industry.

DIAMOND POWER PLAYER

A quarter century after that fateful hole was punched through melting ice, Canada punches above its weight in the world of diamonds. Measured by value, the country is the third largest producer of diamonds by value globally. And the valuable diamonds that continue to be unearthed at the Diavik mine discovered by Aber are a big reason why.

The discovery unleashed a wave of shareholder value. The shares of Aber and its successor companies went from pennies to more than $50 as the quality of the diamonds and the asset became known. Dominion Diamond Corp., as Aber is now known and which owns the Ekati mine and 40% of Diavik, is Canada’s premiere diamond company. Diavik is expected to produce about 7.4 million carats this year, making it among the world’s largest diamond operations.

The team behind the Diavik discovery has also created a fair amount of shareholder value in the years since, led by Eira Thomas. She has co-founded two diamond players, Stornoway Diamond Corp. and Lucara Diamond Corp., and remains a director of the latter Lundin Group company. Her most recent gig, as CEO of Kaminak Gold, ended rather well — Goldcorp bought the company for $520 million last year.

Thomas is also an advisor to North Arrow Minerals (NAR-V), a cashed-up junior company at the forefront of Canadian diamond exploration. Aber’s Gren Thomas is North Arrow’s chairman and the CEO is Ken Armstrong, a former Aber and Rio Tinto geologist. North Arrow recently raised $5 million to explore its portfolio of projects and a drill program is underway at its advanced-stage Naujaat project, which hosts a population of valuable fancy orangey yellow diamonds.

In a space with few new discoveries or development projects, Canada is home to two of the world’s new diamond mines. Stornoway’s Renard mine in Quebec and Gahcho Kue, a De Beers-Mountain Province joint venture in the Northwest Territories, have both recently begun commercial production.

Globally, the diamond industry has faced headwinds, including India’s demonetization and choppy rough stone prices. But diamonds remain a money maker for some of the world’s largest mining companies, including Rio Tinto (60% owner of Diavik) and Anglo American. Incoming Rio boss Jean-Sebastien Jacques identified diamonds as a “priority area” last year in a Bloomberg interview: “I would love to have more diamonds, to be very explicit.” The company recently backed up those words by signing a three-year, $18.5-million option on Shore Gold’s Star-Orion South diamond project in northern Saskatchewan.

And Anglo’s De Beers division remains a reliable profit generator. In 2016, rough diamond sales surged for both Anglo American (up 36%) and Russian producer Alrosa (up 26%), according to The Diamond Loupe. A recent hostile takeover bid for Dominion Diamond reflects the demand for well-run diamond mines, which are powerful profit machines.

EXPLORATION DEFICIT

The picture is less promising on the exploration front. Budgets dried up during the mining slump that began in 2011, and little grassroots exploration work is being done. It’s particularly problematic for supply because diamond mines take longer to discover, evaluate and build. The new Canadian mines will help fill the gap, but it won’t be enough. Economic diamond discoveries have simply not kept pace with mine depletion, globally.

“There are definitely a lack of new projects, at least new projects that are close to infrastructure,” said Paul Zimnisky, a New York-based independent diamond analyst. “There really is not much at all in the global diamond production pipeline.”

Economic, world-class diamond projects are few and far between, and most exploration companies looking for them have failed, Zimnisky explained. That has resulted in wariness and declining interest among investors: “In general, shareholders have not done well in diamonds.”

The looming supply deficit is particularly acute for rare coloured diamonds, which fetch higher prices. Australia’s Ellendale mine produced an estimated 50% of the world’s fancy yellow diamonds before closing in 2015. The Argyle mine, also in Australia, is one of the world’s biggest mines and a source of valuable coloured diamonds, including extremely rare pinks. It, too, is slated to close in the coming years, after decades of production.

North Arrow’s Naujaat could help fill the void. The project hosts a population of fancy orangey yellow diamonds that are more valuable because of their rarity. Naujaat is on tidewater, which dramatically reduces costs, and hosts a very large diamondiferous kimberlite, Q1-4, that outcrops on surface.

It’s the focus of this year’s $3.2-million program, which will see North Arrow drill 4,500 metres and collect a 200-tonne mini bulk sample. The goal is to extend the Inferred resource to a depth of at least 300 metres below surface and better define the diamond population. The sample will be shipped south in late August and processed in the fall.

“There is excellent potential to extend the Q1-4 kimberlite at depth, beyond the reach of past drilling efforts,” said North Arrow CEO Ken Armstrong. “It’s the first drilling in more than 12 years. The work will help us confirm and update the size of Q1-4 and improve our understanding of the deposit’s internal geology and diamond distribution.”

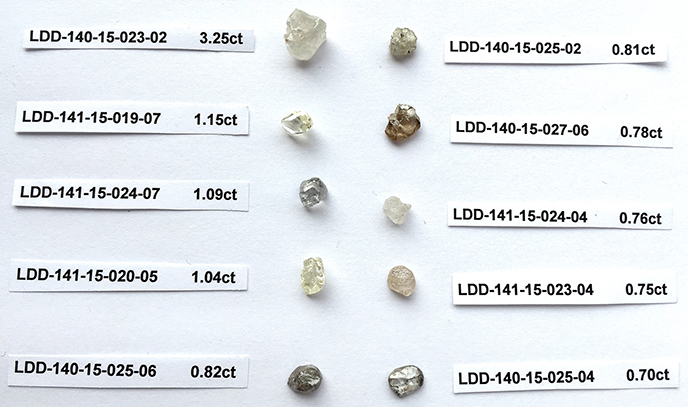

In 2014 and 2015, North Arrow collected a small bulk sample at Naujaat (formerly known as Qilalugaq) with the goal of gauging diamond values. But the carat values on the small 384-carat package came in significantly below expectations. North Arrow shares were relegated to the market penalty box and the company has been largely under the radar since, despite important background work that set the stage for this year’s program.

RISK AND OPPORTUNITY

Contrarian investing and the ability to time cycles can lead to fortunes in the junior mining sector. Vancouver investor Ross Beaty has proven it, time and again. In the early 2000s, with copper trading for under US$1 a pound, his team assembled a portfolio of unwanted copper assets in a bear market. He developed and sold those projects during bull markets, turning $170 million in invested capital into shareholder returns of $1.87 billion. His latest win was a large bear-market investment in Kaminak Gold, later bought out by Goldcorp.

Beaty’s latest contrarian bet is on North Arrow, through a $2-million investment that was part of the recent $5-million private placement financing. Other investors included the New York-based Electrum Strategic Opportunities Fund ($2 million) and company management and directors. The money will fund an aggressive program at Naujaat including drilling and a bulk sample, as well as exploration at North Arrow’s Mel, Loki and Pikoo projects.

North Arrow also has exposure to drilling through the LDG (Lac de Gras) joint venture with Dominion Diamond Corp. That project borders on the mineral leases where Diavik is located. Ekati is 40 kilometres to the northwest. Dominion plans to drill several targets later this summer as part of a $2.8-million exploration program. North Arrow will have a 30% interest in the JV.

With a target on its back, Dominion is highly motivated to enhance shareholder value. And that extends beyond mine operations to exploration and new discoveries. In May, Dominion announced a “renewed strategic focus on exploration” and a $50-million, five-year exploration budget.

A FANCY EDGE

As for Naujaat, North Arrow is revisiting the project after a polishing exercise yielded fancy yellow diamonds that turned some heads in the industry. Several were certified “fancy vivid” diamonds, a coveted designation in the coloured diamond world. The quality of the polished stones suggests the fancy orangey yellow diamonds at Naujaat are considerably more valuable than the June 2015 valuation of the roughs indicated.

The primary conclusion of the diamond evaluators was that the 384-carat parcel of Naujaat diamonds was too small to properly evaluate. North Arrow plans to remedy that, in part, by collecting a 200-tonne bulk sample that should yield another 80 to 100 carats. The sample will be taken from the kimberlite’s highest-grade zone, A61. Lab results are expected in early 2018.

Another complicating factor at Naujaat is the presence of two distinct diamond populations of different ages, including a population of rare fancy yellow diamonds. It’s a consideration that was not factored into the prior carat valuation. It will be next time. Diamonds are a rarity play, and diamonds that occur less frequently — such as coloured diamonds and large diamonds — are more valuable. Yellow diamonds made up only 9% of the 2015 Naujaat sample by stone count, but more than 21% by carat weight.

The drilling at Naujaat is targeting kimberlite between 200 and 300 metres in order to bring material designated target for future exploration (TFFE) into the Inferred category. That drilling, plus the mini bulk sample, should help North Arrow better evaluate the diamond deposit on the path to a future Preliminary Economic Assessment. The Q1-4 kimberlite has a horseshoe shape that makes it amenable to open-pit mining and a low strip ratio. A larger bulk sample is planned for 2018.

COLOURED CARATS

Fancy yellow diamonds were thrust into the spotlight earlier this month when Dominion unveiled the striking 30.54-carat Arctic Sun, a fancy vivid yellow diamond cut from a 65.93-carat stone unearthed at Ekati. Dominion also played up coloured diamonds in their latest corporate presentation — specifically, the sweetener effect of high-value fancy yellow and orange diamonds at Misery.

The potential emergence of Canadian coloured diamonds could help solidify Canada’s position on the world diamond stage, according to analyst Zimnisky. On the branding and marketing side, Canadian diamonds continue to have strong appeal because of their high quality and ethical sourcing.

And the two recent Canadian mine openings are a bright spot for the global industry, despite early growing pains at both Gahcho Kue (lower-than-expected values) and Renard (breakage), he pointed out.

“There is absolutely an opportunity to sell Canadian diamonds at a premium, especially in North America,” Zimnisky said. The United States remains the world’s largest diamond market, despite the growth in demand from China and India.

Important hurdles remain before any mine is built at Naujaat, but the strength of North Arrow’s management team bodes well for success, according to Zimnisky.

“North Arrow is looking for something world-class and it’s high-risk, high-reward,” said Zimnisky, who has seen the company’s cut and polished fancy yellow diamonds: “They’re beautiful.”

The appetite for fancy yellow and other coloured diamonds remains strong, despite the closure or pending closure of two of the mines that produce many of them. Last year a De Beers store opened on Madison Avenue in New York, Zimnisky said, and the feature diamond on opening day was a diamond necklace with a very large fancy yellow stone of more than 100 carats.

DISCOVERY POTENTIAL

Further north of Naujaat on Nunavut’s Melville Peninsula is another North Arrow project with a good shot at a kimberlite discovery. At the Mel property, 210 kilometres north of Naujaat, North Arrow geologists have narrowed down and defined three kimberlite indicator mineral (KIM) trains through systematic soil sampling over several seasons. Last year’s till sampling defined where the KIM train is cut off, suggesting the bedrock kimberlite source is nearby.

The discovery of a new kimberlite field this season is possible, since kimberlites in the region outcrop at surface. “It’s a first look, but there’s potential for discovery without drilling,” says CEO Ken Armstrong.

As for the Lac de Gras joint venture, the US$1.1-billion hostile takeover bid for Dominion unveiled by the private Washington Corp. earlier this year may work in North Arrow’s favour. In addition to spurring a stock surge, the bid forced the diamond miner to crystallize its focus on creating shareholder value. And a key strategy for Dominion, with its two aging mines, is a renewed exploration push.

Finding new diamondiferous kimberlites in proximity to its existing operations would be a big boost for Dominion. One of its best shots is through the joint venture with North Arrow, which covers 147,200 hectares south of Ekati and Diavik. Dominion is spending $2.8 million on the project this season, including a planned drill program in the fall. North Arrow is well-positioned to capture the value of any Dominion kimberlite discoveries made.

North Arrow also plans to drill two or three promising kimberlite targets at its nearby 100% owned Loki project, dovetailing with the completion of the LDG drilling. The company has received a $170,000 grant from the Northwest Territories government to drill Loki. North Arrow will also conduct till sampling in the fall at Pikoo, its Saskatchewan diamond discovery, in advance of a potential early 2018 drill program.

Disclosure: Author owns shares of North Arrow Minerals. North Arrow is one of three company sponsors of Resource Opportunities, helping keep subscription prices low for the subscriber-supported newsletter. North Arrow Minerals is a high-risk junior exploration company. This article is for informational purposes only and all investors need to do their own research and due diligence.

Immortalized in film by screen siren Marilyn Monroe, it’s a well known fact that diamonds are a girl’s best friend. But are diamonds an investor’s best friend? In the mid-1990s they certainly were when there was a bona fide “diamond rush” in Canada after diamonds were discovered by Dia Met Minerals in Canada’s north. Dia Met Minerals, and its share in the coveted Ekati diamond mine, were later taken-over by BHP Billiton in 2001 for $21 per share. At the time of the buy-out Dia Met Minerals controlled 28% of the Ekati mine and the deal was valued at $687 million. The Ekati mine became Canada’s first diamond-producing mine when it came into production in 1998.

With the success of Dia Met Minerals in the mid-1990s many junior mining companies were launched on the TSX-V Exchange including none other than Diamond Fields Resources, which, although they never found diamonds in Canada, did manage to discover one of the largest Nickel deposits on the planet while they were prospecting in Labrador, Newfoundland. Diamond Fields’ Voisey’s Bay nickel discovery, although somewhat happenstance, is arguably the most significant mineral discovery in Canada in the past 40 years.

But today, the lustre of diamonds has faded and the mining market is dominated by the resurgence of the precious metals, base metals and tech metals. In memory of what once was, we take a trip down nostalgia lane with Marilyn Monroe.

The MiningFeeds.com

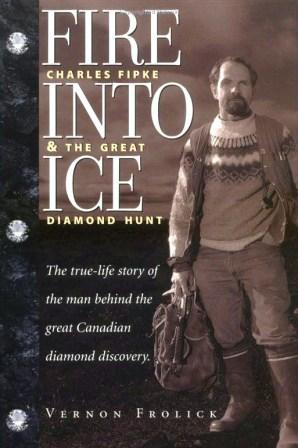

In 1969, while working in the Yukon, a geologist named Chuck Fipke needed to be rescued from a mountainside in the Mackenzie mountain range where he had been stranded for close to a week. Stewart Blusson, his boss at the time, sent in the helicopter that saved him. From then on, Fipke and Blusson became friends and prospecting partners. Between them, they changed the landscape of Canadian mining when they co-discovered the Ekati diamond mine in Canada’s arctic.

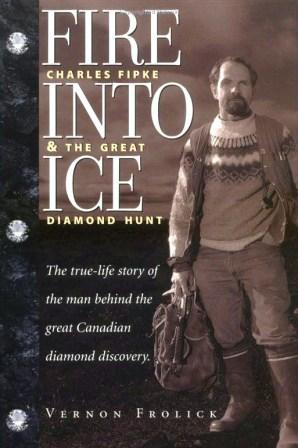

In 1981, Blusson and Fipke began searching for diamonds in the Northwest Territories, concentrating their search on indicator minerals commonly associated with kimberlite, a host rock for diamond. They found kimberlitic indicator minerals near Lac de Gras in the Northwest Territories in 1985, and their first kimberlite at Point Lake in 1991 which contained diamonds. Seven years later, in 1998, the Ekati mine opened as a joint venture between BHP Diamonds Inc. (51%), Dia Met Minerals (29%), Fipke (10%), and Blusson (10%) and the rest is, how shall we say, history. A book entitled, Fire and Ice, marks the story of Charles Fipke and the great Canadian diamond discovery.

Since 1998, the mine has produced over 50 million carats (8,888 kg / 19,595 lb) of diamonds out of six open pits. And as a result, Fipke and Blusson are now among Canada’s richest businessmen and both are active philanthropists. Stewart Blusson has earned the distinction as one of the most generous philanthropists in Canadian history with donations of more than $100 million to fund Canadian medical research and education.

In a telephone interview, MiningFeeds asked Stewart Blusson for his take on the diamond sector today – here’s what he had to say. “Most junior diamond exploration companies have stalled due to the success of other commodities. But what many people may not understand is diamond mining is so much more profitable than other mining. A rich diamond bearing pipe is the most valuable real estate on earth.” Mr. Blusson also pointed out, “Today the supply of diamonds is winding down because diamonds are not expandable like other commodities. They occur in the earth’s surface in one particular way and, by 2050, there may be nothing left to mine.”

1. Peregrine Diamonds Ltd. (TSX:PGD)

During the height of the financial crisis in November 2008, BHP Billiton elected to exercise its earn-in rights for the Chidliak diamond project. The price? $22.3-million in exploration over a two year period entitled the mining giant to a 51% interest in Peregrine Diamond’s biggest project. This marked a significant milestone in the company’s history and set the stage for a huge rally in the company’s share price from the $0.75 range to over $4.50. Since then, shares of Peregrine Diamonds have, over a three year period, trended back to the $1.00 mark.

Raymond Goldie, a senior mining analyst at Salman Partners, states in a report, “We note that BHP rarely enters into joint ventures with juniors, especially joint ventures in which the junior is, as is the case with Peregrine, the operator. BHP’s decision should not only increase the market’s confidence in the prospects of the Chidliak project, it should also increase the market’s confidence that the project can obtain financing through to production.”

A stable funding partner is a key part of the equation for a junior exploration and development diamond company since the average time frame from discovery to production is around 10 years and the costs are significant.

Is it time to revisit Peregrine Diamonds as an investor? We connected with Eric Friedland, younger brother to well-known mining venture capitalist Robert Friedland and CEO of Peregrine Diamonds, to find out what’s in store for the company – CLICK HERE – for the interview.

2. Stornoway Diamond Corp. (TSX:SWY)

A day late and a dollar short. Shareholders are hopeful the age-old idiom does not apply to Stornoway Diamond.

Stornoway’s flagship asset is the Renard Diamond Project which the company has been working on for 10 years in pursuit of becoming Québec’s first diamond mine. Current NI 43-101 compliant Indicated and Inferred Mineral Resources stand at 23.8 and 17.5 million carats respectively, with a further 23.5 to 48.5 million carats classified in the non-resource category. As Stornoway’s President & CEO, Matt Manson, pointed out during an interview with BNN on April, 2011, “Renard for us is the big value driver and big story.” During the interview, Mr. Manson also confirmed the Renard Feasibility Study was do for completion by the end of the third quarter, 2011 (September, 30th).

On September 20th, 2011, Stornoway reported their long awaited Renard Feasibility Study, which is to include an operating plan, mine plan, production schedule and cost estimates, was “nearing completion”. The company stated that, over the next several weeks, management would complete a final due diligence review in advance of its approval by the Board of Directors prior to its public release. That was seven weeks ago and still no word. And, based on some of the discussions taking place on internet message boards, investors are getting impatient. As one poster states, “Whats goin on here?…couldn’t imagine when (Stornoway) was 2.40 $ that it could go…to this level.” The company’s shares are currently trading at $1.49, down almost a $1.00 over the past four months.

With the company’s stock trading just above 52 week lows, there is another age-old idiom that shareholders of Stornoway Diamonds are very likely placing credence in – patience is a virtue.

For 5 Diamond Stocks to Watch – Part 2 – CLICK HERE.

3. Lucara Diamond Corp. (TSX:LUC)

In March 2011, Lucara Diamond confirmed it was in talks with several companies in the diamond sector, including Gem Diamonds as it was evaluating merger alternatives. At the time, Gem Diamonds issued a somewhat prophetic statement, “These discussions are at a very early stage and there can be no certainty the contemplated merger will occur or of the timing or terms of any such transaction.”

At the time of the statement Cormark Securities analyst Matthew O’Keefe said, “I would take their press release at face value. This is a small space, everybody knows everybody else and they talk all the time.” By May, 2011 Gem Diamonds confirmed in a statement that discussions between the two companies had ended.

Lucara Diamonds is part of Lukas Lundin’s mining empire. The company has two key assets, specifically, the AK6 diamond mine in Botswana and the Mothae diamond mine in Lesotho. The 100% owned AK6 project is in the construction stage with mine, originally scheduled for commissioning to commence in the fourth quarter of 2011, now delayed until early 2012. The 75% owned Mothae mine is currently in the trial mining stage. Lucara also has a 49% interest in the Kavango diamond project in Namibia through it’s subsidiary Motapa.

In January earlier this year, Lukas Lundin, chairman of Lucara Diamond bought 215,000 shares in the public market between the prices of $1.05 and $1.10. He added to his position following the news of diamond sales from the company’s Mothae mine in Lesotho. Then on March 29 and 30, he bought one million shares in the public market at $1.20. We also note that in late February, chief executive officer William Lamb, the company’s President & CEO exercised 100,000 options and did not subsequently sell any shares. And a quick check on Canadian Insider shows more recent purchases at lower prices. Today, Lucara’s shares are trading just above 52 week lows at $0.83 resulting in a moderate paper-loss for the company’s Chairman.

I guess Mr. Lundin has been reading Suze Orman who writes, “By using the dollar-cost averaging technique, even if you’re investing for the long run (ten years or more), in the end you’ll be a winner.” Should we send Suze an email reminding her that not every stock goes up?

4. Mountain Province Diamonds Inc. (TSX:MPV)

On September 24th, 2010 Mountain Province Diamonds announced the results of the Feasibility Study on the Gahcho Kué diamond project located in Canada’s Northwest Territories. The study confirmed an operating mine life of 11 years based on an average annual production of approximately 4.5 million carats and initial capital costs in the range of $550 to $650 million. Thereafter, the company promptly raised $23 million at $5 per share providing the Mountain province with sufficient funds for its 2011 operating budget and a required $10 million payment to De Beers.

In partnership with De Beers, Mountain Province is developing, according to the company, the world’s largest and richest new diamond mine. And after 17 long years of development, the company is moving closer and closer towards production. De Beers is the world’s leader in diamond discover, development and mining. De Beers has been active in Canada since the early 1960s and is currently working on several exploration projects ranging from grassroots exploration to feasibility studies. De Beers Canada now has two established mines – the Snap Lake Mine and Victor Mine. Both mines were officially opened in July, 2008.

The Snap Lake Mine, De Beers’ first diamond mine outside of Africa, is built on the shore of Snap Lake 220 kilometres northeast of Yellowknife. The mine is Canada’s first completely underground diamond mine. While the Victor Mine is located in the James Bay Lowlands of Northern Ontario, approximately 90 kilometers west of the coastal community of Attawapiskat. Like Snap Lake, Gahcho Kué is located in Canada’s arctic.

Cathie Bolstad, spokesperson for De Beers Canada points out, different physical profiles of Snap Lake and Gahcho Kué will require different mining approaches. Whereas Snap Lake is a fully underground mine, Gahcho Kué is more reminiscent of the Ekati and Diavik diamond mines, which began their lives as traditional open-pit operations.

MiningFeeds.com recently connected with Patrick Evans, President & CEO of Mountian Province Diamonds, to discuss the company’s relationship with De Beers and their corporate development plans – CLICK HERE – to read more.

5. Shore Gold Inc. (TSX:SGF)

The Fort à la Corne area of Saskatchewan hosts an extensive kimberlite field and is the site of Shore Gold’s Star diamond project. Over 70 kimberlites exist in the Fort à la Corne forest and over 70 percent of these have been shown to contain diamonds. To date, NI 43-101 compliant Mineral Resource estimate for the explored portion of the Star Kimberlite is 20.5 million indicated carats and 3.1 million inferred carats. Total probable mine reserves of estimated at 34.4 million carats.

The past decade has been a wild ride for shareholders of Shore Gold. 10 years ago the company’s stock traded at $0.50 and, if I remember correctly, I purchased a private placement in the company at about that price. Five years later, when I was no longer a shareholder, shares of Shore Gold hit $8 a share. And now today, five years later, the company’s shares are again at $0.50. But as the quotable Baseball Hall of Fame catcher Yogi Berra once said, “It’s tough to make predictions, especially about the future.”

Predictions difficult? Barry Allan, senior analyst with Mackie Research would probably agree. Mr. Allan noted, “When Shore Gold originally discovered the kimberlites in the Fort a la Corne region… there were considerable question marks about whether there was potential for an economic diamond mine in Saskatchewan. The reason for that is these are somewhat different kinds of kimberlite or diamond inference kimberlite occurrences in the world — in the sense that they’re very different from what you find in other regions of Canada. They are very large, but relatively lower grade, compared to diamond deposits in Northern Canada, so the economic approach to exploiting these kinds of deposits is quite different.”

But after many years and many naysayers, Shore Gold released its Feasibility Study for the Star diamond project on July 14, 2011 confirming a NPV of $2.1 billion. But the massive scale and supporting economics may also be the biggest hurdle for the company when considering the up-front capital cost is expected to reach approximately $2 billion. For a company with a market cap of just over $100 million, accessing that amount of capital may prove somewhat challenging.

“It will take someone like Newmont Mining or (another) major mining company… someone like a BHP, Tech Cominco, or Rio Tinto to really have the horsepower. It will not be Shore Gold by itself,” said Mr. Allan. The Mackie Research analyst has a target price of $2 per share on the company’s stock assuming a “moneyed up, major mining company” steps in to help carry the ball across the goal line.

For 5 Diamond Stocks to Watch – Part 1 – CLICK HERE.

During the height of the financial crisis in November 2008, BHP Billiton elected to exercise its earn-in rights for the Chidliak diamond project. The price? $22.3-million in exploration over a two year period entitled the mining giant to a 51% interest in Peregrine Diamond’s biggest project. This marked a significant milestone in the company’s history and set the stage for a huge rally in the company’s share price from the $0.75 range to over $4.50. Since then, shares of Peregrine Diamonds have, over a three year period, trended back to the $1.00 mark.

Raymond Goldie, a senior mining analyst at Salman Partners, states in a report, “We note that BHP rarely enters into joint ventures with juniors, especially joint ventures in which the junior is, as is the case with Peregrine, the operator. BHP’s decision should not only increase the market’s confidence in the prospects of the Chidliak project, it should also increase the market’s confidence that the project can obtain financing through to production.”

A stable funding partner is a key part of the equation for a junior exploration and development diamond company since the average time frame from discovery to production is around 10 years and the costs are significant.

Is it time to revisit Peregrine Diamonds as an investor? We connected with Eric Friedland, younger brother to well-known mining venture capitalist Robert Friedland and CEO of Peregrine Diamonds, to find out what’s in store for the company.

Peregrine Diamonds was part of a bigger picture in 2005. Please talk about the genesis of the company and some of your major accomplishments to date.

In 2005, we bought the Altar copper and gold porphyry project in Argentina from Rio Tinto. Recognition of the significant potential value represented by Altar led to the spin-out of Peregrine Metals from Peregrine Diamonds, just prior to the Peregrine Diamonds IPO. Peregrine Metals conducted exploration throughout South America and advanced the Altar project as a private company until it went public in March, 2010. Peregrine Metals was subsequently sold in October, 2011 to Stillwater Mining.

Our diamond company went public in 2006. The exploration focus of Peregrine Diamonds started in the Northwest Territories and gradually shifted east to the Chidliak project on Baffin Island, Nunavut. Now, with the discovery in just four years of 59 kimberlites, seven of those with economic potential, and significant exploration upside, Chidliak is one of the most important diamond discoveries in the past two decades. A preliminary assessment of diamond value through bulk sampling next year and another year of exploration will help us gauge where it sits on a scale relative to the existing Canadian diamond mines.

You mention your sister company was recently purchased by Stillwater Mining in a transaction valued at US$487 million. Please tell our readers about the acquisition and what ancillary benefits, if any, have resulted from the sale.

In the spring, Stillwater conducted extensive legal and technical due diligence on the Altar project. They understood the value of the large copper-gold resource that had been identified and the significant upside offered by both the copper and gold exploration potential. Altar is a very big porphyry system that was only first drilled in 2003. There are very few large porphyry copper-gold systems in the world that are 100% controlled by junior exploration companies, especially at the Preliminary Economic Assessment stage. In May, Stillwater approached Peregrine Metals with a friendly acquisition proposal and a deal was finalized in June. The transaction was based on a value for the copper in the ground at Altar that was in-line with other recent transactions in the copper industry.

Peregrine Metals shareholders were supportive of the transaction. Many of those shareholders are also shareholders of Peregrine Diamonds. A number of directors, officers and employees of Peregrine Metals also hold positions with Peregrine Diamonds and are now fully focussed on adding significant value to Peregrine Diamonds.

Diamonds are generally considered to be a luxury item but, at the same time, they are very much a part of everyday life. What is your take on the diamond markets over the near term and what factors are expected to drive demand?

The long term fundamentals for diamonds are excellent, with demand rising while supply is diminishing. Of particular impact is the increase in demand in China and India as those countries continue their economic expansion. Diamonds are luxury items, but they are also working their way into the fabric of day to day living in the emerging economies. About 50% of weddings in China now feature diamond engagement rings, and it is as high as 80% in the major cities. In comparison, in 1989 it was difficult to buy diamond jewelry in China. When the economy falters, people may choose to delay large purchases and commitments, such as weddings, but life still goes on and this pent-up demand eventually gets satisfied. This is why the price of diamonds ran up so rapidly in the years following the global economic crisis.

We do not see any major mines the size of EKATI or Diavik (+ 100 million carats) coming onstream in the near future. Several of the world’s largest diamond mines are moving to underground operations in the coming year, in order to extend their mine life. All these factors point to supply constraint and higher prices in the coming years. Chidliak is very important because it comes at a time when there are very few diamond projects in the world ready for development. Since the discovery of Chidliak in 2008, there have been no new discoveries of diamond districts anywhere in the world that we know of.

Peregrine’s properties are located in the Canadian Arctic. What are some of the benefits and drawbacks associated with doing business in the deep north?

There are definitely challenges that need to be considered when you mine in the Arctic. This is where the experience of our joint venture partner, BHP Billiton, will be invaluable. BHP Billiton owns 80% and operates the EKATI Diamond Mine in the Northwest Territories, in a similar Arctic environment to Chidliak. We believe the setting at Chidliak on south Baffin Island would be quite complimentary to a diamond mining operation. The land where most of our kimberlites with economic potential have been discovered is relatively flat with far fewer lakes than in the Lac de Gras region of the NWT. Chidliak is located only 100 km from Iqaluit, Nunavut’s capital. A year-round or seasonal road from the capital to the project is a real possibility. Supplies can be shipped to Iqaluit by sea, a cost-effective form of transportation.

I believe it is recognized in the far north that mining offers great opportunities for significant economic gains in the region. The economic data from the three diamond mines in the Northwest Territories makes that clear. The local population and political leadership in Nunavut are keen to see economic benefits similar to those experienced by their neighbours to the west.

What is the nature of your relationship with BHP Billiton and do you plan on expanding or developing additional industry relationships going forward?

We have an excellent relationship with BHP Billiton, and our project will continue to benefit from their technical, Arctic mining and diamond marketing expertise which was derived from exploring, developing and operating one of the world’s most important diamond mines, EKATI. BHP has a 51% participating interest in the Chidliak joint venture with Peregrine owning the remaining 49%. The fact that BHP Billiton has allowed Peregrine to continue to be the operator at Chidliak speaks volumes about the strength of this relationship and the quality of our operational personnel. Peregrine has full marketing rights to its share of diamond production which would allow us to establish a fully integrated diamond company, taking diamonds from the mine to the consumer.

Overall, we are very satisfied with our relationship with BHP Billiton and with five joint venture partners we have on other exploration projects. Joint venture and business relationships can be very beneficial, especially with the inherent risks of diamond exploration, and as we grow and evolve, we are always open to establishing new relationships that we think could benefit our shareholders.

What major milestones are on the horizon for Peregrine as we head into 2012?

The 2011 drilling of over 5,500 metres on six kimberlites with economic potential, and extensive logistical planning and arrangements, have set the stage for bulk sampling of select kimberlites by way of large diameter reverse circulation drilling, which is scheduled to commence in the first quarter of 2012. Equipment, supplies and fuel are have been shipped to Iqaluit by sealift and bulk sample site layouts and access trails have been mapped, The bulk sampling program aims to extract roughly 200-carat diamond parcels from at least three kimberlites to allow the first diamond valuations at Chidliak, a crucial step towards confirming the economic viability of the project.

The 2012 bulk sampling program is an important step along the development path at Chidliak and it will allow Peregrine to continue to unlock the value at this exciting diamond project. Our goal is to deliver the first diamond mine on Baffin Island. We will work to achieve this goal by rapidly advancing the known kimberlites with economic potential as well as continuing to explore for additional diamondiferous pipes. Unresolved kimberlite indicator mineral trains and the presence of kimberlite float at multiple localities not currently linked to sources give us confidence that more kimberlites will be discovered next season.

Concurrent with advancing Chidliak, Peregrine will continue to explore its other properties in the north. These include Cumberland and Qilaq, near Chidliak on south Baffin Island, Nanuq and Nanuq North, 850 kilometres west of Chidliak in Nunavut, and our highly prospective Lac de Gras region land package in the Northwest Territories, near the Diavik and EKATI diamond mines, which includes our 73% owned, nine hectare DO-27 kimberlite pipe that has a diamond resource of 18.2 million carats plus a potential mineral deposit of 6.5 to 8.5 million tonnes of kimberlite. We are looking forward to a very busy and fruitful 2012.

This interview was featured in the article 5 Diamond Stocks to Watch – Part 1 – CLICK HERE to read more.

On September 24th, 2010 Mountain Province Diamonds announced the results of the Feasibility Study on the Gahcho Kué diamond project located in Canada’s Northwest Territories. The study confirmed an operating mine life of 11 years based on an average annual production of approximately 4.5 million carats and initial capital costs in the range of $550 to $650 million. Thereafter, the company promptly raised $23 million at $5 per share providing the Mountain province with sufficient funds for its 2011 operating budget and a required $10 million payment to De Beers.

In partnership with De Beers, Mountain Province is developing, according to the company, the world’s largest and richest new diamond mine. And after 17 long years of development, the company is moving closer and closer towards production. De Beers is the world’s leader in diamond discovery, development and mining. De Beers has been active in Canada since the early 1960s and is currently working on several exploration projects ranging from grassroots exploration to feasibility studies. De Beers Canada now has two established mines – the Snap Lake Mine and Victor Mine. Both mines were officially opened in July, 2008.

The Snap Lake Mine, De Beers’ first diamond mine outside of Africa, is built on the shore of Snap Lake 220 kilometres northeast of Yellowknife. The mine is Canada’s first completely underground diamond mine. While the Victor Mine is located in the James Bay Lowlands of Northern Ontario, approximately 90 kilometers west of the coastal community of Attawapiskat. Like Snap Lake, Gahcho Kué is located in Canada’s arctic.

Cathie Bolstad, spokesperson for De Beers Canada points out, different physical profiles of Snap Lake and Gahcho Kué will require different mining approaches. Whereas Snap Lake is a fully underground mine, Gahcho Kué is more reminiscent of the Ekati and Diavik diamond mines, which began their lives as traditional open-pit operations.

MiningFeeds.com recently connected with Patrick Evans, President & CEO of Mountain Province Diamonds, to discuss the company’s relationship with De Beers and their corporate development plans.

Thanks for joining us Patrick, please tell our readers, in general terms, about Mountain Province and the structure of the company.

Mountain Province Diamonds controls 49 percent of the world’s largest and richest new diamond development project at Kennady Lake in the diamond fields of Canada’s Northwest Territories. Partnered with De Beers, the leading global diamond company, the joint venture is permitting a first mine that will produce approximately 4.5 million carats per year from open-pit for an initial 11 years. Gahcho Kué (“Place of Big Rabbits”) will be Canada’s fifth diamond mine and the fourth in the Northwest Territories.

Mountain Province originally discovered diamond-bearing kimberlite in the mid-1990s when there was a “diamond rush” in Canada. Please talk about those exciting times in comparison to where the company is at today.

Mountain Province staked the properties at Kennady Lake during Canada’s diamond rush 20 years ago and discovered the first kimberlite – 5034 – in 1994. This was a remarkable achievement. It’s about ten times more difficult to find a diamond mine than it is to find a gold mine. Also, only 1 percent of diamond discoveries have the grade to support a diamond mine. Today, the 5034 kimberlite has a reserve grade of nearly 2 carats per tonne and contains more than 23 million carats for an in-situ value of over $4.2 billion.

Does having a majority partner, albeit a world-class partner in De beers, limit the company in any way?

Mountain Province entered into a JV with De Beers in 1995 under which it could earned a 51 percent interest in Gahcho Kué. De Beers discovered a further six kimberlites, three of which (5034, Hearne and Tuzo) have a Probable Reserve of 31.2 million tonnes with a fully diluted mining grade of 1.57 carats per tonne for a total reserve of 49 million carats. At April 2011 actual diamond prices of $185 per carat, this represents in-situ value of more than $9 billion!

Mountain Province is De Beers’ largest commercial mining partner. Although it’s a 49/51 JV, all material decisions require the approval of both partners, so it effectively operates as a 50/50 JV. Each partner will market its own share of the diamond production, which gives Mountain Province control over the marketing of more than 2 million carats a year. Based on April 2011 diamond prices of $185 per carat, Mountain Province will have control of revenue of more than $370 million a year. With operating costs projected at approximately $30 per carat, this represents an operating margin of over 80 percent. And the company’s current market cap is a mere $350 million.

You recently announced two major exploration programs at Kennady Lake – the planned Kennady North airborne gravity survey and the Tuzo Deep drill program. What are the key points associated with each program?

De Beers and Mountain Province have just completed an airborne gravity survey over both Gahcho Kué as well as Mountain Province’s 100%-controlled Kennady North Project, which is immediately to the north and west of Gahcho Kué and more than three times the surface area. With the preliminary results expected before the end of November, it’s expected that additional kimberlites will be identified which will be the subject of further exploration to increase the size of what’s already the world’s largest new diamond development project.

In addition, the Joint Venture is currently drilling the six-hole Tuzo Deep program designed to define an underground resource from 350 (the base of the current 21 million carat Tuzo resource) to 750 metres. If successful, the Tuzo Deep program has the potential to add materially to both the Gahcho Kué resource as well as the projected mine life. The Tuzo Deep drill program is expected to be completed in early 2012 and thereafter the results will be announced.

It is no secret that you’ve been in discussions with third parties who are interested in Mountain Province. However, you elected to cease discussions before the results of these exploration programs have been announced. If you read between the lines one can assume that the board is open to an acquisition – is that a fair assumption?

Given the size and quality of the Gahcho Kué asset, as well as the potential to materially increase the resource of what’s already the world’s largest and richest new diamond mine development, it’s hardly surprising that Mountain Province has attracted the attention of the leading diamond producers seeking to add to their rapidly diminishing resources. Despite this unsolicited attention, Mountain Province is determined to remain in control of its destiny at least until the full value of its assets has been established. Accordingly, Mountain Province unilaterally suspended discussions with third parties pending the results of the Tuzo Deep program and the airborne gravity survey. Once the results of these programs are in the public domain and shareholders have a better idea of the value of the company’s assets, Mountain Province will re-engage with third parties to explore value-enhancing opportunities.

For investors looking at investing in this sector for the first time, what are some of the key factors to consider and what sets Mountain Province apart for other companies?

While economic diamonds deposits are undoubtedly the most difficult to discover, they offer amongst the highest margins of any commodity. Despite more than 20 years of exploration costing hundreds of millions of dollars, Gahcho Kué was the last major diamond discovery. No discovery since then can compete with the size and quality of Gahcho Kué. Growing demand, particularly in India and China, has driven the industry into a supply deficit which has resulted in annual double-digit price increases. Given that it takes on average ten years from discovery to production from a new diamond mine, the supply deficit is likely to grow and provide strong price support for Gahcho Kué future diamond production.

This interview was featured in the article 5 Diamond Stocks to Watch – Part 2 – CLICK HERE to read more.

If you would like to receive our free newsletter via email, simply enter your email address below & click subscribe.

CONNECT WITH US

Tweets

Tweet with hash tag #miningfeeds or @miningfeeds and your tweets will be displayed across this site.

MOST ACTIVE MINING STOCKS

Daily Gainers

|

ADE.V | +100.00% |

|

CCD.V | +50.00% |

|

WGF.V | +33.33% |

|

RUG.V | +33.33% |

|

ROX.V | +33.33% |

|

DMI.V | +33.33% |

|

IZN.V | +33.33% |

|

CASA.V | +30.00% |

|

SMN.V | +27.27% |

|

PEX.V | +25.00% |

Articles

FOUND POSTS

Orosur Mining (TSXV:AIM) Provides Update on Exploration at Anzá Project

December 31, 2024