Recent channel sampling results announced by Collective Mining (TSXV:CNL) from its Guayabales Project in Colombia gave the company a promising confirmation of the work they are doing at the site. Located in a deposit-rich area, the project is situated contiguous, immediately along strike, and to the northwest of Aris Gold’s Marmato gold mine, which contains proven and probable reserves of 2.0 million ounces gold and 4.35 million ounces silver.

Collective Mining holds the option to earn up to a 100% interest in the Guayabales project, making it a critical site for the company. If the results bear out what initial exploration efforts have hinted at, then this could be a fantastic investment opportunity for a buyout or developer looking for their next site.

Much of the excitement around Guayabales also comes from its proximity to the Marmato mine from Aris Gold. The mine is located in the Marmato gold district in the Caldas department, a mountainous region approximately 80 kilometres south of Medellin, Colombia. The mine has excellent infrastructure, is located near the Pan American Highway, and has access to the national electricity grid running near the property.

For Collective Mining, the Marmato mine is a strong hint at what may be possible at Guayabales. The mineralization in the Lower Mine at Marmato includes wide porphyry mineralization, and the mineralizations in the Upper Mine is characterized by narrow veins where an existing operation mines material using conventional cut-and-fill stope methods.

The potential for Guayabales to return results similar to or even better than the Marmato mine is not lost on the company or investors. As results continue to come in from drilling, Collective Mining (TSXV:CNL)will be looking to realize the many promises of the district, which has been mined since pre-Colonial times by the Quimbaya people.

On June 21, Collective Mining released results from its project from geological mapping, soil and rock sampling programs, and the completion of a high-resolution, airborne geophysical survey. The interpretation of that data points in the direction of a series of copper-gold-molybdenum porphyry intrusions, as indicated by the previous metal mineralization encountered throughout the property.

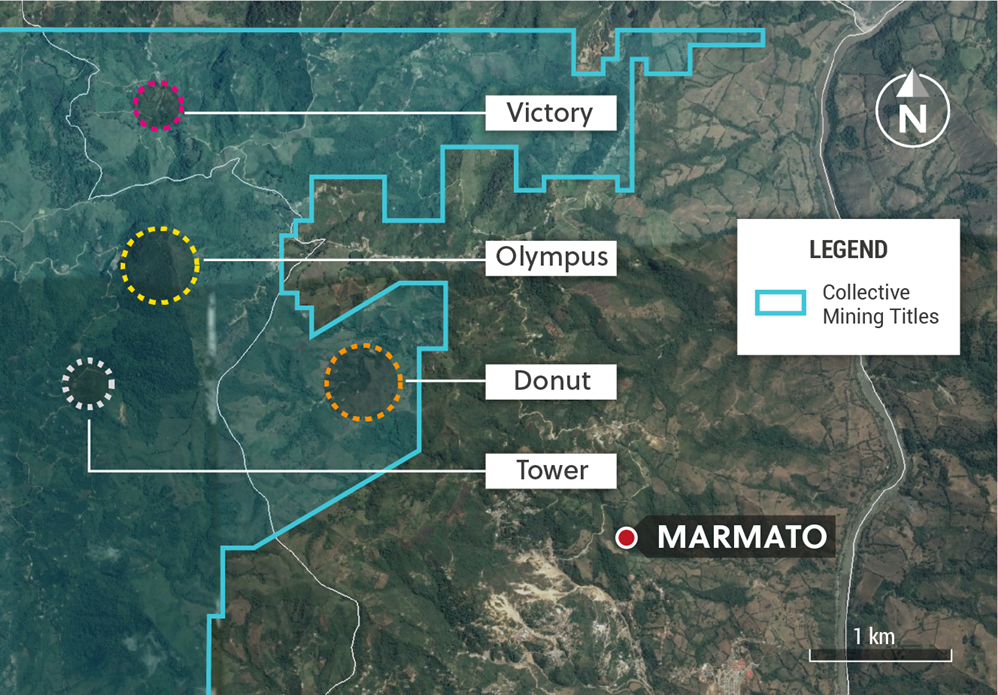

While current surface exploration activity has covered only less than 20% of the project area, four initial targets have been identified. These targets lie along a NW-trending and mineralized structural corridor that incorporate both porphyry-style copper-gold-molybdenum mineralization and associated high-grade gold-silver (base metal) vein systems.

Lying immediately along strike and at a higher elevation to Marmato, the Guayabales project has the potential to be the next significant discovery in the region. If the company finds what the latest results seem to hint at, then the drill program could bring Collective Mining (TSXV:CNL) much closer to a sale or deal with an established producer for a profitable deal.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

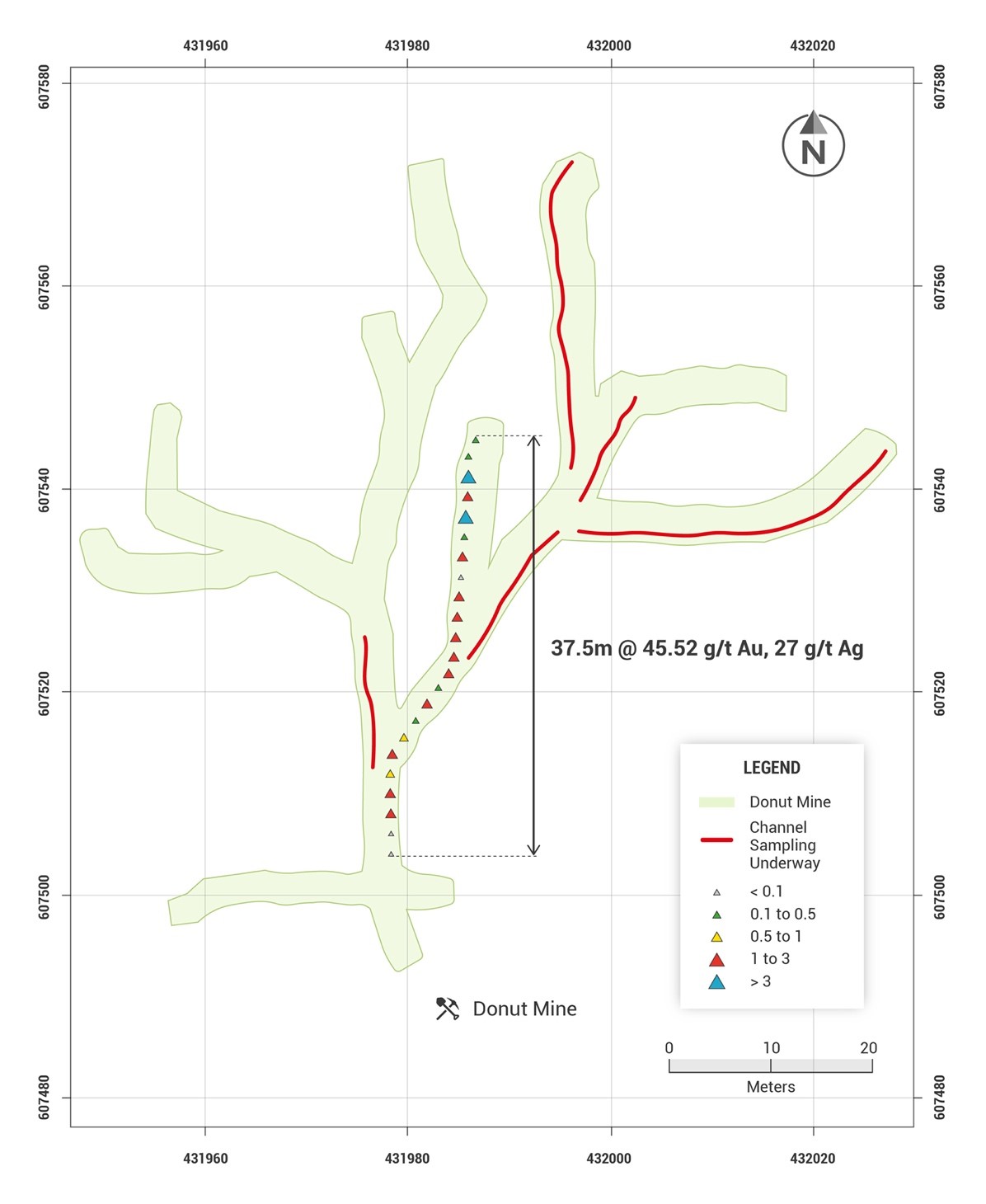

Collective Mining (TSXV:CNL) has provided an update on its flagship Guayabales Project this morning, announcing new channel samples 45.52g/t gold and 27 g/t silver along 37.5 metres in the underground development. The Guayabales project is a key focus for the company, with Collective (TSXV:CNL) interpreting the abundant precious metal mineralization encountered throughout to be related to a series of copper-gold porphyry intrusions hosted within the project tenements.

The Guayabales project is situated contiguous, immediately along strike and to the northwest of Aris Gold’s Marmato gold mine, for which Collective believes could be at least partially responsible for the rich mineral endowment of the Guayabales Project.

This is an important step for Collective Mining which is advancing on its Guayabales and San Antonio projects in Colombia. The company is looking to initiate its first-ever drill program in late August 2021, giving investors something to watch out for going forward. Collective will continue with channel sampling now to cover all underground workings and the target currently remains open to the north, north-west, east, and at depth.

“We are off to a very exciting start at the Guayabales project. The robust and continuous high-grade channel sampling results validate our geological model for the property. We look forward to initiating a first-ever drill program at the Donut target,” commented Ari Sussman, Executive Chairman.

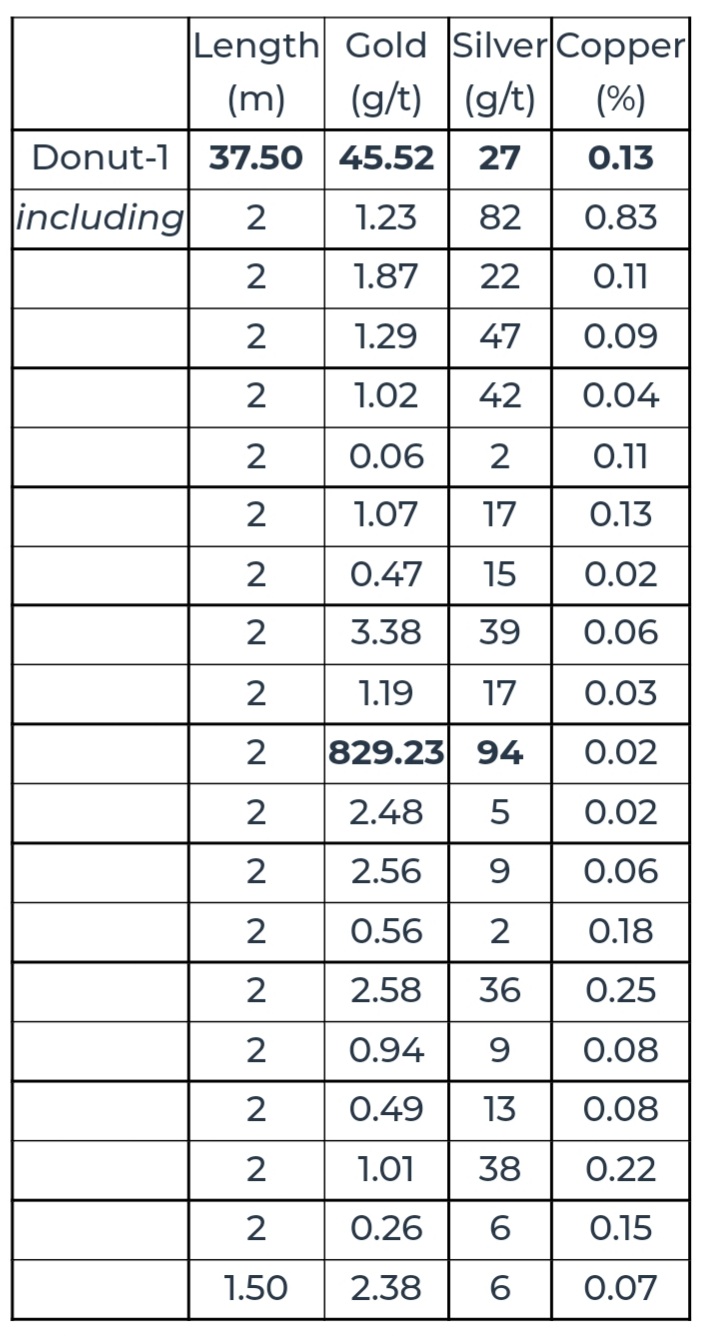

Highlights From the Results (Table 1 and Figures 1-3)

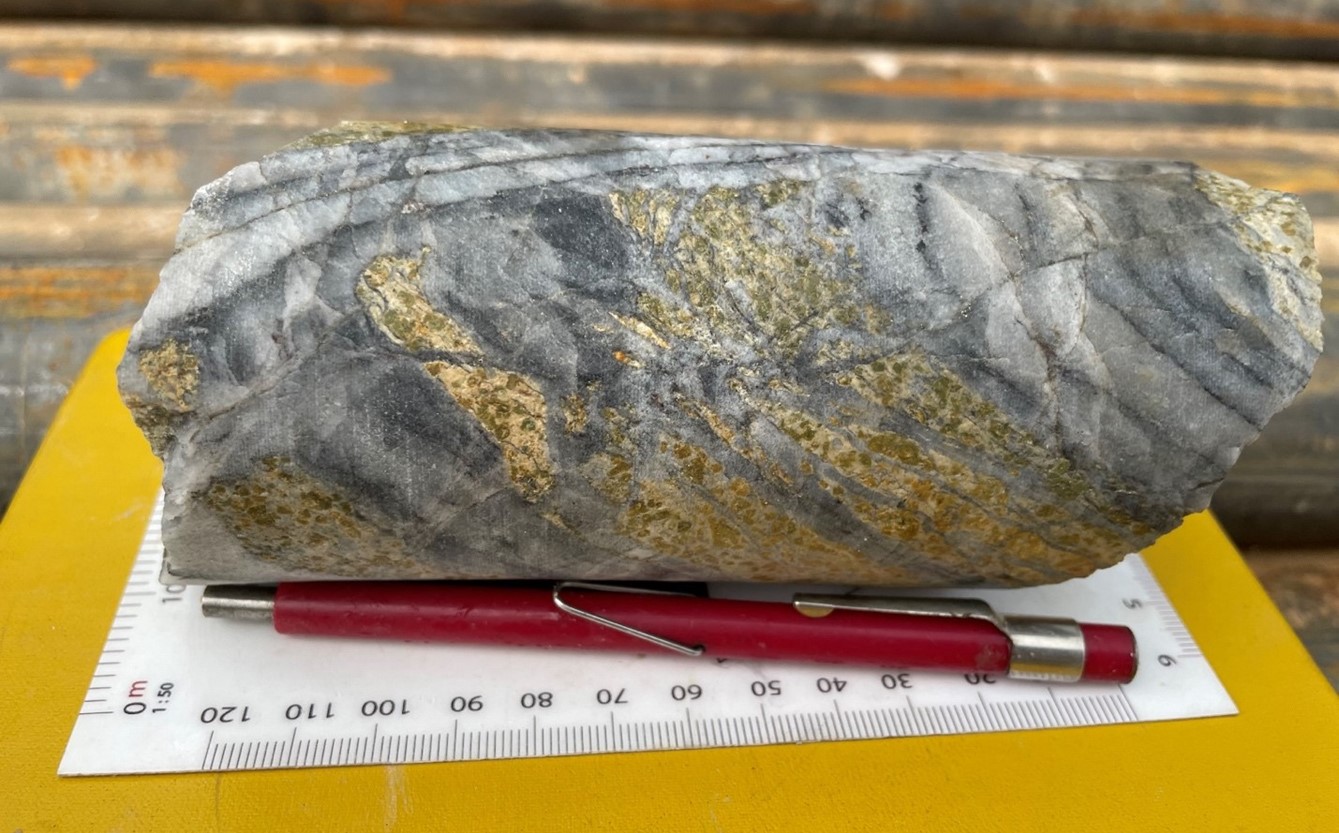

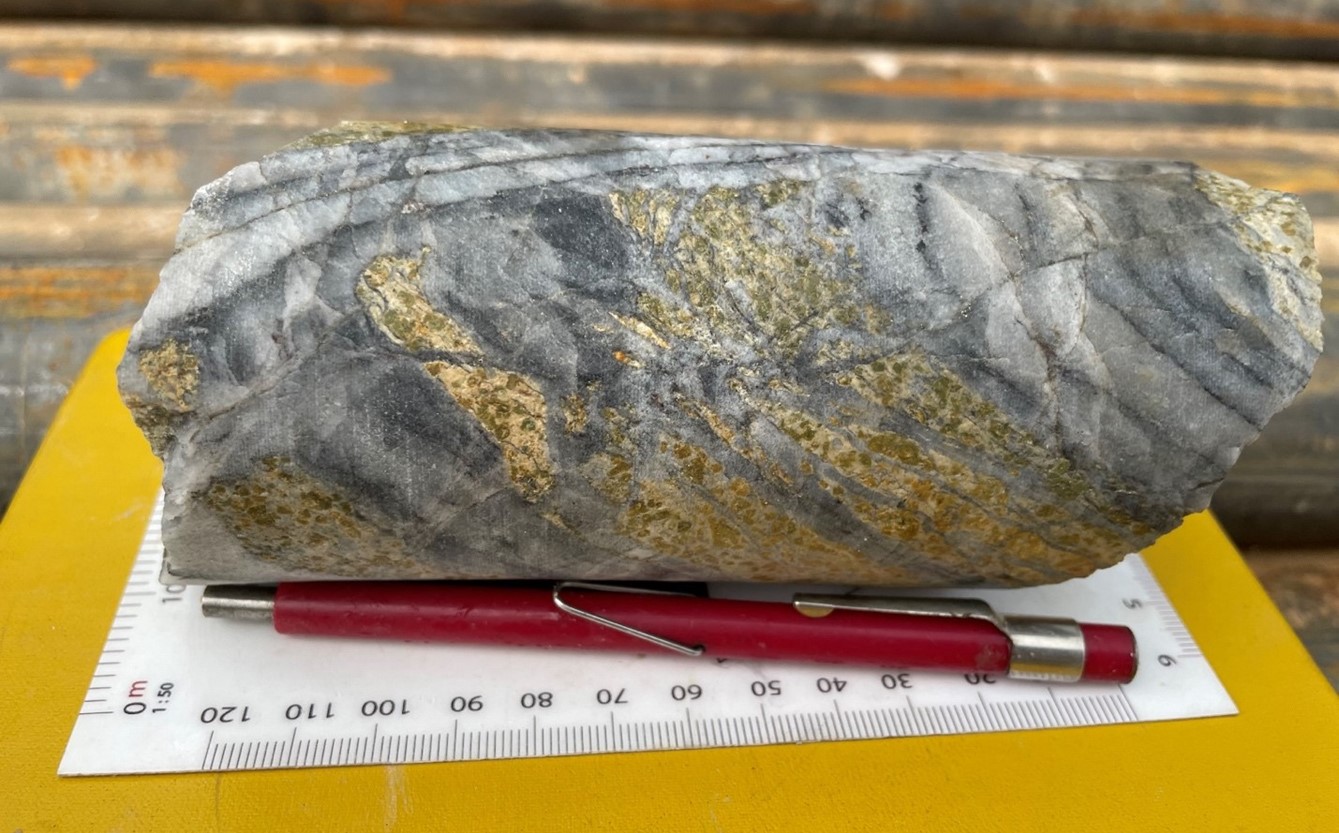

The Company’s initial channel sampling campaign at the Donut taget (“Donut”) within the Guayabales Project has returned high-grade gold and silver assay results from a shallow underground tunnel. Mapping of this tunnet has exposed a gold-copper porphyry stockwork of veinlets with overprinting polymetallic vein systems. Additionally, the mineralized zone outlined by channel sampling results announced herein displays excellent grade continuity with results as follows:

Table 1: Channel Sampling Results*

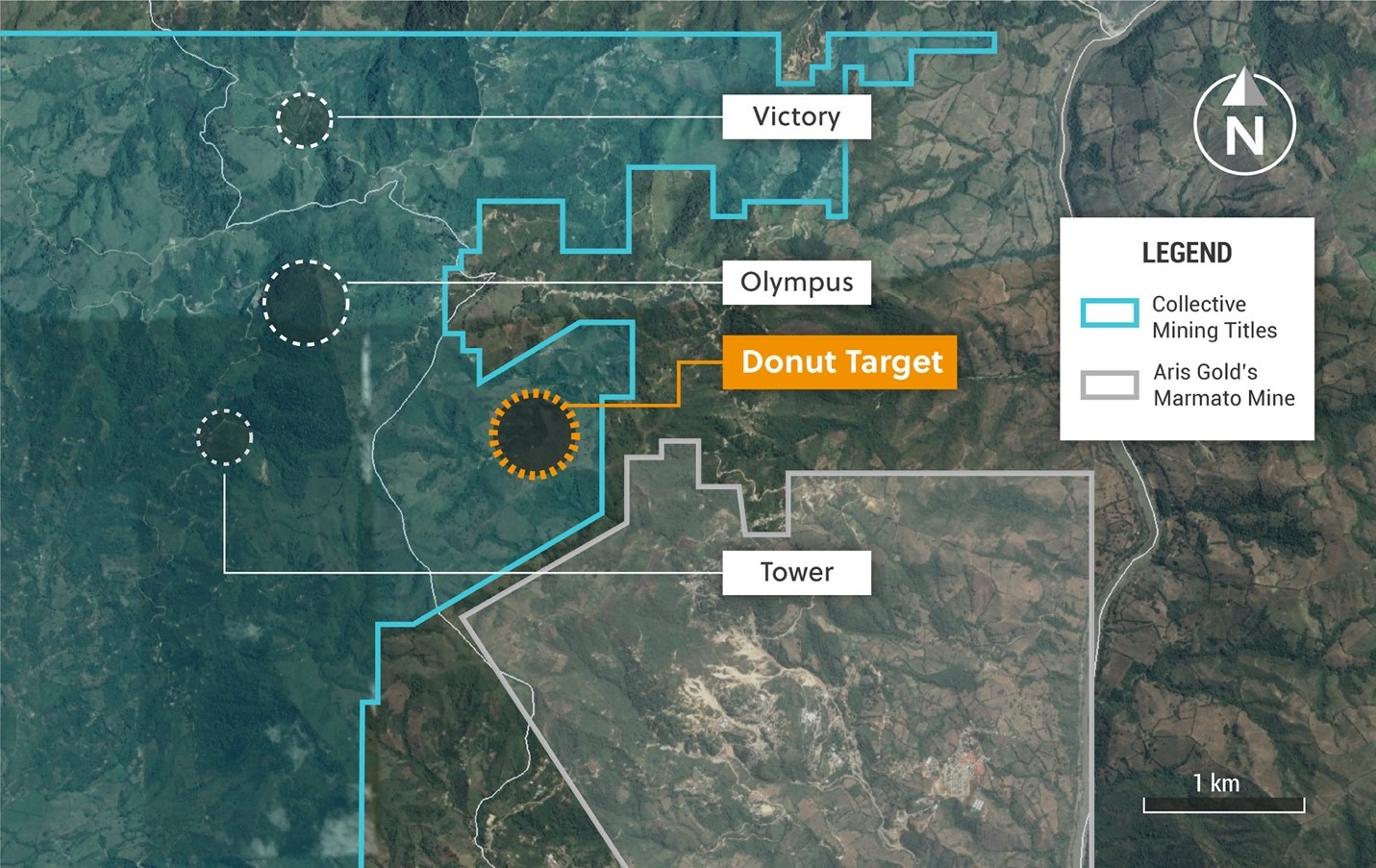

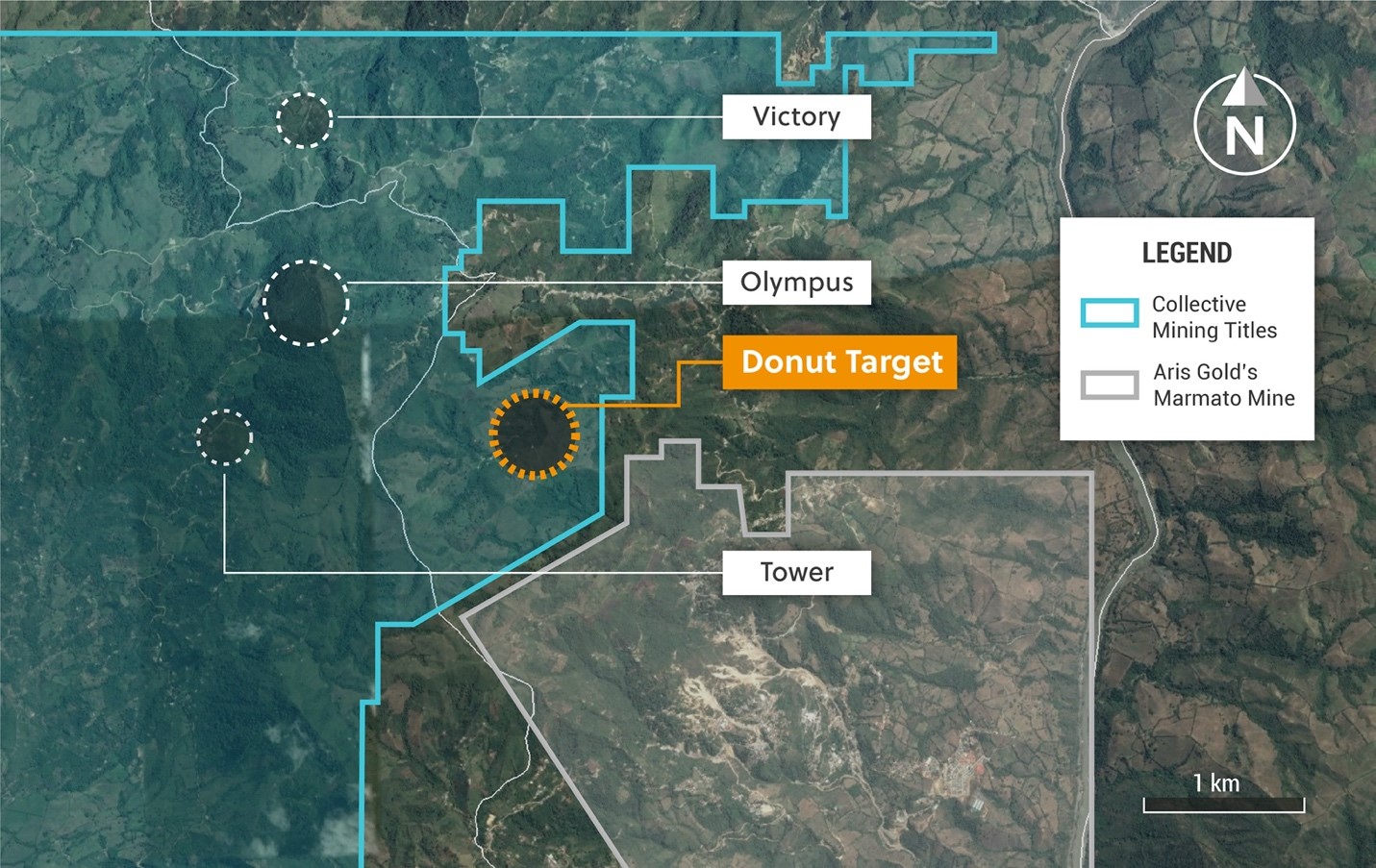

Figure 1: Plan View of the Guayabales Project and the Donut Target

Figure 2: Plan View of the Donut Mine Showing the Grade Ranges for Channel Sampling Assay Results

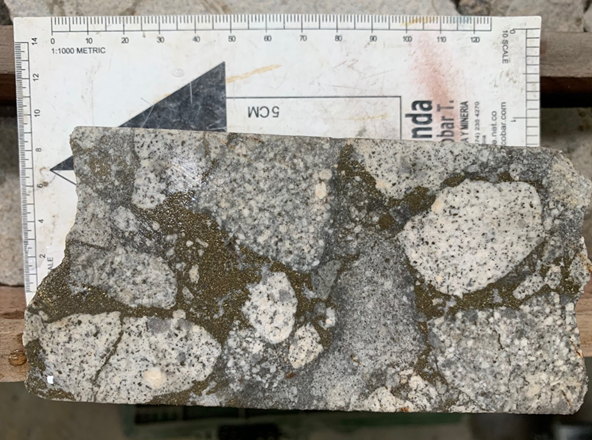

Figure 3: Donut Target porphyry style mineralization in underground workings showing abundant copper mineralization.

Figure 4: Donut Target porphyry style mineralization in underground workings showing abundant copper mineralization.

Source: Collective Mining

Source: Collective Mining

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

Collective Mining’s Guayabales project is making headway with the company identifying a new cluster of mineralized porphyries and associated gold-silver vein systems at the site in Cladas, Colombia. Situation contiguous and immediately along strike to the northwest from Aris Gold’s Marmato Gold Mine which contains proven and probable reserves of 2 million ounces gold, 4.35 million ounces silver, the Guayables project is rapidly advancing with intense geological mapping, soil and rock sampling programs, and has completed a high resolution, airborne geophysical survey.

Breaking New Ground

Collective is fortunate to be the first company to ever consolidate the prospective land package along strike to the northwest and adjacent to Marmato. The company is capitalizing on a significant section and the Guayabales project is a major leap forward for the company and the area.

The company’s interpretations of the survey and project is that the precious metal mineralization is related to a series of copper-gold-molybdenum porphyry intrusion, like at least partially responsible for the mineral endowment of the area. Current surface exploration has covered only 20% of the project area, but has identified four initial targets referred to as Donut, Tower, Olympus, and Victory.

Details provided by Collective Mining:

- The Donut target is part of a northwest trending and outcropping cluster of mineralized copper-gold-molybdenum porphyry intrusions. Shallow underground workings have exposed large zones of porphyry veining hosting various copper sulfides including chalcopyrite, chalcocite and lesser bornite with molybdenite and abundant pyrite. The Donut target displays intense zones of both potassic alteration and overprinting vein and stockwork systems. The porphyry zone is enveloped by a large scale (+1.5 km) and continuous anomalous zone of in-situ and coincidental gold, copper and molybdenum soil anomalism. Assay results are anticipated within the next 30 days from preliminary channel sampling program performed in existing underground workings and a maiden drill program is planned for September 2021.

- The Tower target, located in the western portion of the project area at the deformed contact between graphitic schists and diorite intrusives, incorporates a similar geological setting to the prominent Marmato gold-silver orebodies that are immediately to the south-east of this zone along strike. The north-south trending contact zone, recently exposed by a landslide, has exposed a 50 m x 50 m area of intense sericite-silica alteration with disseminated sulfides. This structure is exposed in old artisanal working located more than 1 kilometre to the NNW of the Tower outcrop. Detailed mapping and soil auger sampling of the entire target area is in progress to determine the dimensions of the target. Assays results from an extensive channel sampling campaign are expected within the next 30 days and will be followed shortly thereafter by a maiden drill program.

- The Olympus target hosts a large-scale sheeted vein and breccia, quartz-(carbonate) sulfide system, currently measuring over 400 metre true-width with an interpreted strike length of greater than 1 kilometre that trends to the Donut target. These late-stage porphyry-associated NW structures overprint a larger-scale porphyry style stockwork veinlet system within potassic altered quartz diorite porphyries and country rocks. Numerous artisanal workings have followed individual vein and breccia structures for +400 metres in strike length and reconnaissance grab samples have returned values of up to 72.4 g/t gold and 1,098 g/t silver. The exploration team is currently undertaking geological mapping and systematic soil and channel sampling in order to define the overall size of the target. A maiden drill program to test the Olympus target is anticipated to ensue in Q4, 2021.

- The Victory target is located in the north of the project area and consists of a stockwork of porphyry magnetite veinlets with disseminated sulfides hosted within altered diorite intrusive host-rocks. The large target area is outlined well by the airborne magnetics which illustrates a horseshoe shaped zone of high magnetic bodies enveloping a magnetic low. Multiple phases of altered and unaltered diorite intrusive were observed during reconnaissance fieldwork. Soil sampling mapping and rock channel sampling is in progress in this area with drilling planned for Q1, 2022.

Ari Sussman, Executive Chairman of Collective Mining stated, “This is the first time that any mining company has consolidated a commanding land package encompassing the northwest projection of the historically significant Marmato mine, which has been in continuous production for more than 500 years. Results to date from our Guayabales project are astounding, with multiple styles of precious and base-metal mineralization having been discovered covering more than 5 kilometres. The potential for discovering overprinting high-grade and bulk tonnage mineralized systems is excellent.”

Source: Collective Mining

The Guayabales Project

An initial 5,000 metre drill program has begun at the project with initial assay results projected for Q3 2021. The project is located in the Caldas region of Colombia, where Collective Mining works closely with the local Municipality and agriculture groups to invest in infrastructure, water access, and support for the coffee industry.

Collective Mining’s ESG approach to mining along with a focus on benefiting stakeholders at every step of the projects they work on has piqued investors’ interest in the company. The first day of trading saw Collective shares pop 205%, and the stock has moved higher since then.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

Collective Mining (TSXV:CNL) is a strong partner for the communities in Colombia in which it operates. With ESG principles woven into the fabric of the company’s founding principles, Collective’s commitment to creating opportunities for all stakeholders solidifies the company’s position as a responsible miner.

Mining and Agriculture Integral to Stakeholder Success

Collective Mining’s (TSXV:CNL) strategic alliance with the Coffee Growers Committee of Caldas and the Municipality of Supia is based on the foundation that mining and agriculture work effectively together to create positive growth and development in Colombia. The Committee is part of the National Federation of Coffee Growers of Colombia (FNC), an influential and important institution in the agricultural industry. The coffee industry being one of Colombia’s most important industries alongside mining, the institution oversees the development of the coffee sector and ensures it remains healthy and profitable for everyone.

The company was awarded a notable recognition from the Municipality of Supia as a direct result of its work and contributions toward the improvement and development of the municipality’s infrastructure. Omar Ossma, CEO and President of Collective commented that, “Coffee is one of the main drivers of this region and this alliance is a very important step to promote sustainable coexistence of different economic activities with mining. We are honored to have received this recognition.”

Agricultural and mining ventures are integral to the South-American country, which has a long track record of positive gains in these areas. For Collective, supporting the Coffee Growers Committee of Caldas is a key component of the company’s 2021 ESG initiatives in Caldas. Caldas is well known for its rich coffee culture and is the second largest coffee producing department in the country. With 32,000 families in the department, the coffee industry is an integral part of the local economy and community.

An Alliance For Everyone

Members of the strategic alliance have invested in the development of local road infrastructure, improving access to water for local communities and supporting the municipality’s coffee producers. The total commitment from members of the alliance is $530,000 for 2021. 1,286 coffee growers covering 1,489 hectares of farmland in the Municipality of Supia will directly benefit as a result of the initiatives put forth by the alliance.

Collective’s (TSXV:CNL) alliance with the Committee and Supia has strengthened its bond with all stakeholders in the region, with Marco Antonio Londono Zuluaga, Mayor of Supia stating, “These are investments that will go directly to our small farmers and rural communities. We are pleased to have the support of Collective Mining in this initiative. It is key to work together and it is key to work as a team. This project demonstrates that responsible mining is possible.”

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

With trading recently begun on the TSX Venture Exchange, Collective Mining (TSXV:CNL) continues to hit one success after another. The company’s San Antonio project, located 70 km south of Medellin, Colombia, is now advancing with a maiden 5,000 metre drill program. The 100% owned project in Caldas aims to determine the near surface geometry of three targets. Once they have been defined, Collective will begin testing for potential multiple, concealed, mineralized porphyry and breccia bodies. The testing area measures approximately 2 X 1 kilometres. The company expects assay results to be available early in the fourth quarter of 2021, giving investors yet another project update to look forward to.

The San Antonio Project

Located within the Middle Cauca Belt – a 250+ km, north-south trending gold and base-metal belt which hosts multiple porphyry and epithermal discoveries, the San Antonio project covers an area of 3,780 hectares. The

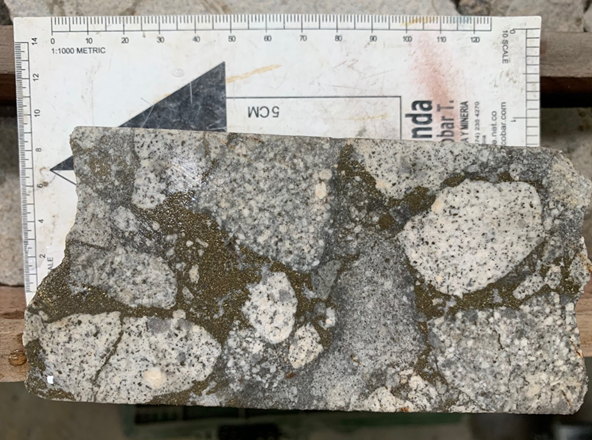

The project incorporates porphyry Cu-Au-Mo mineralization and associated hydrothermal alteration over that wide grid. Porphyry mineralization is now exposed over large areas because of the presence of both sheeted and stockwork vein systems and breccias associated with the multi-kilometre scale Au-Mo-Cu soil anomalies and associated hydrothermal alteration.

The Only Company to Realize the Project’s Potential

Collective (TSXV:CNL) is finally unlocking what other operators of the project could not. Past operators didn’t drill those main porphyry occurrences and instead only targeted high-grade vein style mineralization. That mineralization was located peripheral to the porphyry intrusive centers, but never realized significant results. Collective Mining has now begun drilling on the most promising section of the project, bringing the San Antonio project ever closer to the company’s goals.

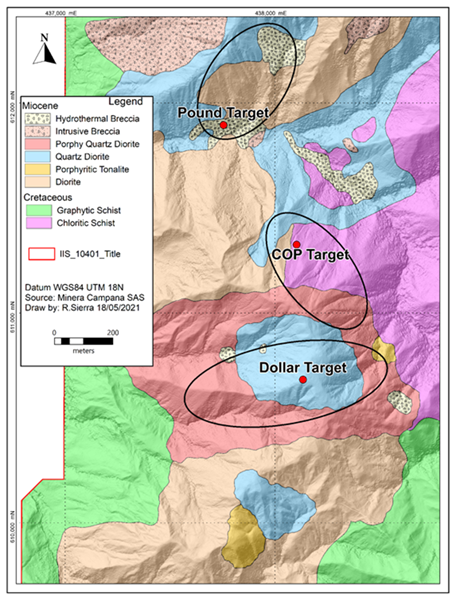

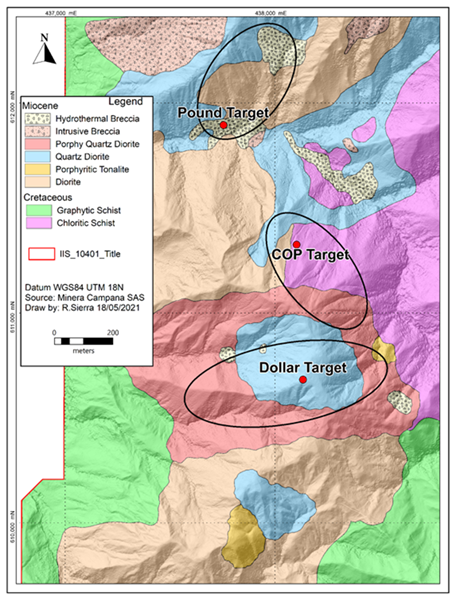

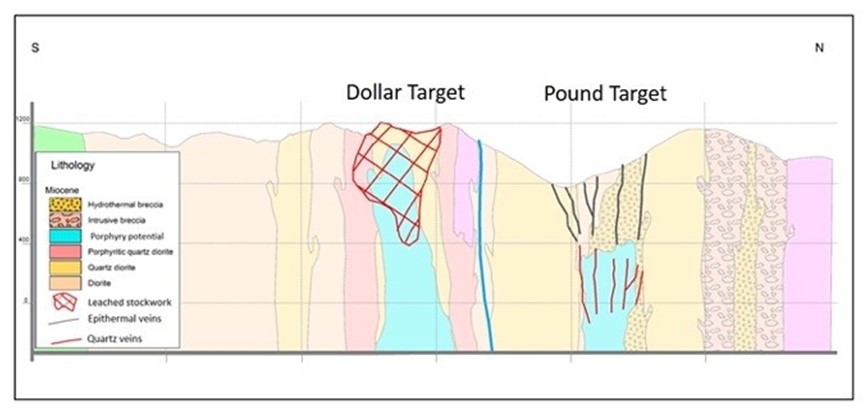

Details of the maiden drilling program are as follows (Referenced in Figures 1-4):

- Three specific grassroots exploration targets have been outlined by surface mapping, sampling, soil geochemistry, geophysical modelling and shallow scout drilling. These are referred to as the Dollar, COP and Pound targets.

- Two diamond drill rigs are operating at the project. To date, 1,857 metres of scout drilling, to define the geometry of the Dollar target, has been completed. Two deeper penetrating drill-holes to test for the potential metalliferous portions of the Dollar and Pound targets are currently in progress.

- The San Antonio project benefits from favorable topography with approximately 600 vertical metres of elevation change from the mountain peaks to the various flat lying valleys. Additionally, the topography is not overly steep, lending itself to multiple potential infrastructure development scenarios should an economic deposit be discovered in the future.

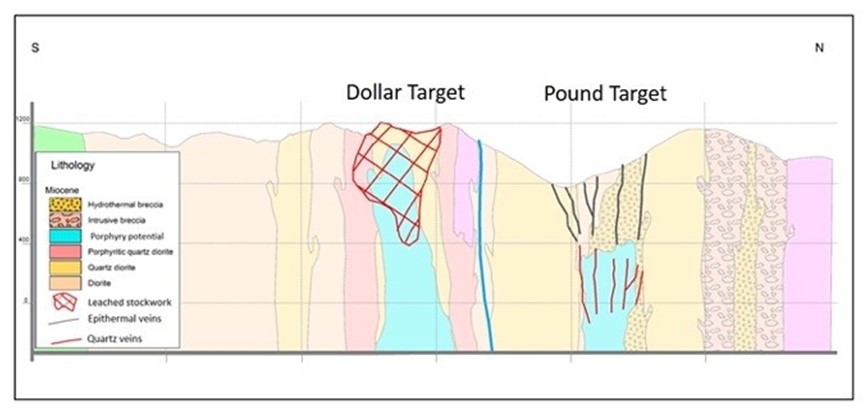

- The Dollar target is defined by outcrops of quartz-magnetite stockwork and sheeted veins emplaced within quartz diorite porphyry bodies in an area of 500 x 500 metres. The vein systems are associated with sericitic alteration. Shallow scout drilling has just been completed to define the geometry of the stockwork bearing porphyry and identified a strong overprint of yellow clay alteration, probably responsible for partial metal leaching. This accounts for the sporadic gold and molybdenum values encountered in surface outcrops. Deeper drilling is now in progress from a high elevation at a local mountain peak to test the porphyry system at 600 metres vertically below surface. This hole is expected to intersect a strong magnetic anomaly outlined by geophysical modelling, interpreted as being part of the potassic metal bearing porphyry centre.

- The Pound target, located 1.2 km north of Dollar, is defined by hydrothermal breccias and polymetallic veins hosted within diorite intrusive over an area of 600 x 350 metres. Outcrop exposures on the southern border of this target area include epithermal vein systems within a preserved lithocap of advanced argillic alteration which is superimposed on hydrothermal breccia bodies. These rocks are interpreted to reflect preservation of the shallow levels of the porphyry system. Additionally, a strong circular magnetic anomaly (MVI) is located approximately 600-900 metres below surface and is interpreted to be the potential porphyry source for the hydrothermal breccias located directly above. The initial drill hole, currently coring into Pound, will test the potential of both the hydrothermal breccias and the porphyry at depth.

- The COP target is located 400 metres north-northwest of Dollar and is defined by highly anomalous molybdenum (8ppm to 108ppm) and gold (up to 2.74 g/t) in soils in association with altered diorite porphyry and quartz veinlets over an area of 650 x 350 metres. The surface expression of the COP target is coincident with geophysical anomalies at 200-300 metres depth which include a positive magnetic anomaly and IP chargeability and resistivity highs. COP has not been tested, other than a single historical borehole drilled just south of the target area, returned an intercept of 99 metres at 0.42 g/t gold and 4.9 g/t silver within unmineralized country rocks partially intruded by mineralized porphyry quartz veins at a depth of 608 metre downhole. The mineralization encountered in the drill-hole is interpreted to be leakage from the COP target directly to the north.

Source: Collective Mining

Source: Collective Mining

From Strength to Strength

Having recently debuted on the TSX Venture Exchange, Collective Mining (TSXV:CNL) is off to a strong start. The first day of trading saw the stock pop 205%, proving that investors are bullish on the management’s direction and the strength of the team leading the charge on both the San Antonio project, and the Guayabales project in the same region (Caldas, Colombia).

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

Collective Mining (TSXV:CNL) had a big day last Friday, May 28, with a blockbuster IPO that saw the stock pop 205% on the first day of trading. The company’s common shares began trading at the market open on May 28, on the TSX Venture Exchange under the symbol CNL.

As part of its reverse takeover of shell company POCML5, Collective Mining (TSXV:CNL) had raised C$15 million at $1 per subscription receipt. With the share price hitting $3.05 on Friday, the company saw a valuation of C$30.9 million.

Collective’s executive chairman Ari Sussman said, “With the funds from our $15 million subscription receipt financing now released from escrow, we are embarking on an aggressive exploration programme and are excited to unlock the potential of our project over the next 12 months.” The exploration and development company is currently focused on exploring prospective gold projects in South America.

Colombia’s mines minister stated that it was great news to have a new Colombian-focused company listed on the TSX Venture Exchange. The high-level strong support from Colombia is a promising sign of the exciting times to come for Collective, with the minister saying in a joint statement that, “This is yet another endorsement of investors’ trust in the Colombia mining sector.”

Collective’s main directive is to realize its ability to earn a 100% interest in two projects located in Colombia (San Antonio, and Guayabales). With an assembly of superstar management with a track record of successfully selling Continental Gold to Zijin Mining for C$1.4 billion, the company is focused on bulk tonnage porphyry-related systems as opposed to high-grade gold.

This new approach to exploration is not the only change for the group. Collective Mining was founded with environmental, social, and governmental (ESG) principles embedded in the fabric of the company’s guiding philosophy and operational standards. The name of the company is a strong indication of the company’s commitment to collaborative and inclusive management, and a collective commitment to the values that investors prioritize for both stakeholders and investors.

Colombia’s mining sector is well-developed, with strong ancillary mining services, agriculture, and tourism industries helping form a well-rounded economy. As Collective builds strong and profitable porphyry gold projects, the economy and country stand to benefit from the strategic alliance across a myriad of industries.

Collective Mining’s (TSXV:CNL) management track record puts it in a good position to grow over the coming years. As the stock follows suit, investors will likely continue to add more of it to their portfolios as they look for ESG-compliant and focused mining companies. The fact that Collective’s team had such a massive success with the past buyout of Continental Gold also raises the possibility that the company could see a huge payday in the future as it develops it’s projects and revenue streams.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

If you would like to receive our free newsletter via email, simply enter your email address below & click subscribe.

CONNECT WITH US

Tweets

Tweet with hash tag #miningfeeds or @miningfeeds and your tweets will be displayed across this site.

MOST ACTIVE MINING STOCKS

Daily Gainers

|

RTG.TO | +60.00% |

|

ERL.AX | +50.00% |

|

MRQ.AX | +50.00% |

|

AFR.V | +33.33% |

|

CRB.AX | +33.33% |

|

GCX.V | +33.33% |

|

RUG.V | +33.33% |

|

CASA.V | +30.00% |

|

BSK.V | +25.00% |

|

PGC.V | +25.00% |

Articles

FOUND POSTS

Arras Minerals (TSXV:ARK) Updates on Elemes Drill Program in Kazakhstan

December 19, 2024

Potential Trump Tariffs Could Reshape Copper Market Dynamics in 2025

December 17, 2024