Investing in high quality companies can bring you gains in any segment of the market cycle. But, when you’re buying a high quality company at the bottom of a commodity cycle, the result can be truly spectacular.

When I bought the best junior gold companies in 2014 and 2015, near the bottom of the last bear cycle, it turned out to be a fantastic contrarian decision, giving me incredible gains in 2016 as sentiment changed.

Today, I feel the same could be said for investing in the nickel market, which, up until 2016, has been decimated by over-supply. This change in the supply dynamic is just one of the reasons why I’m bullish on nickel. In August of this year (2017), I wrote a two-part series on the nickel market and why I’m bullish on its future. For those who would like a closer look at my analysis, check out my series on nickel, Part 1 and Part 2.

So, how do I look to profit from my bullish nickel thesis? For me, the key is FPX Nickel Corp. FPX is the 100% owner of its flagship Decar Nickel District, which is located in central British Columbia, just 80 km west of the Mount Milligan open-pit Cu-Au mine.

Let’s take a look.

FPX Nickel Corp (FPX: TSX-V)

MCAP – $13.4 million (at the time of writing)

As of November, 2017

Shares – 133,770,339

Fully Diluted – 141,920,339 (no warrants outstanding)

Management & Directors – 19.3%

Cash – $750K

FPX Nickel’s People

If you have invested in the resource sector long enough, you have most likely heard the adage that people are the most important part of a company. It’s absolutely true. The fact is, however, like everything else in life, most people fall within the average moniker. Besides being average, you, of course, have the bottom feeders – the people you really want to avoid – and conversely, you have the cream of the crop at the top. Without a doubt, you want to be invested with the best people, as they give you the best chance of being right in the mining sector.

Peter Bradshaw is the co-founder and Chairman of the Board of FPX Nickel and, to me, is one of those outliers at the top of the industry . Bradshaw was inducted into the Canadian Mining Hall of Fame in 2015 for his achievements in what has been, thus far, a 40+ year career.

Bradshaw is best known for his involvement with Placer Development and their discovery of the high-grade zone VII at Porgera in Papua New Guinea, as well as co-founding the Mineral Deposit Research Unit (MDRU) at the University of British Columbia. Bradshaw has also worked or contributed to a few other companies, such as Barringer Research and Orvana Minerals. Today, he is Chairman of the Board for FPX and a Director with Aquila Resources.

Here’s a list of Bradshaw’s key discoveries and projects: Porgera Gold Mine, Kidston Gold Mine, Misima Gold Mine, Big Bell Gold Mine, Omai Gold Mine and Decar Nickel Project. As you can see, Bradshaw is a minefinder, and I think Decar will be his next mine. Here’s a link to Bradshaw’s must-see Canadian Mining Hall of Fame Tribute Video.

FPX is led by President and CEO, Martin Turenne. Turenne, a Chartered Accountant by trade, has worked in the commodities industry for over 15 years. Five of those years have been spent with FPX, where he was first the CFO from 2012 to 2015.

I have spoken to Turenne on a few occasions and am always impressed by his knowledge of the nickel market and, of course, the level of detail with which he answers my questions regarding FPX. Turenne is a major reason why I’m confident in investing in FPX and believe that their future is very bright given the quality of his leadership and vision.

FPX’s team is rounded out by consulting geologist and formerly FPX’s (formerly, First Point Minerals) VP of exploration, Trevor Rabb. Rabb has been busy this summer with FPX’s step-out drill program, which tested the southeast extension of the Baptiste deposit at Decar.

Last, but not least, is FPX’s CFO, J. Christopher Mitchell, who has more than 40 years of experience in the mineral industry. Mitchell has held senior roles with Viceroy Resource Corp. and Orvana Minerals Corp.

Board of Directors

Over the last few months, FPX has added two key pieces to its Board of Directors, with the appointment of Robert Pease and Peter Marshall. For those who aren’t familiar, both Pease and Marshall have extensive experience within the mining industry, more specifically, with the development and construction of mining projects in central British Columbia.

Both Pease and Marshall were a part of Terrane Metals; Pease as the founder and Marshall as the Senior VP of Project Development. Terrane owned the Mt. Milligan copper-gold project, which they developed from the PEA stage through to final feasibility and the commencement of project construction. To note, Terrane was later acquired by Thompson Creek Metals Company Inc. for $650 million in 2010.

Clearly, both Pease and Marshall have great knowledge and experience to draw on as they move toward the development of Decar with the rest of the FPX team.

Turenne’s comments with regards to his Board of Directors and how FPX will conduct themselves, moving forward;

Turenne: “We have begun to assemble a team of world-class mine builders and operators. The recent additions of Peter Marshall and Rob Pease are very important, as they have significant experience in developing and building mines in our region in central British Columbia.

Peter and Rob were the team behind Terrane Metals, which developed the similar scale, open-pit, bulk-tonnage Mt. Milligan project from the resource stage to construction in five years before selling the company for $650 million.

One of our other board members is Bill Myckatyn, who has built and operated several large-scale base metal mines in his career, most notably as the CEO of Quadra-FNX (acquired by KGHM for $3 billion in 2011). We will continue to add new team members with deep experience in mine development, construction and operation. This is a major company-style asset; our ongoing development of Decar will continue to be performed to major-company standards.”

The Decar Nickel District

Central British Columbia

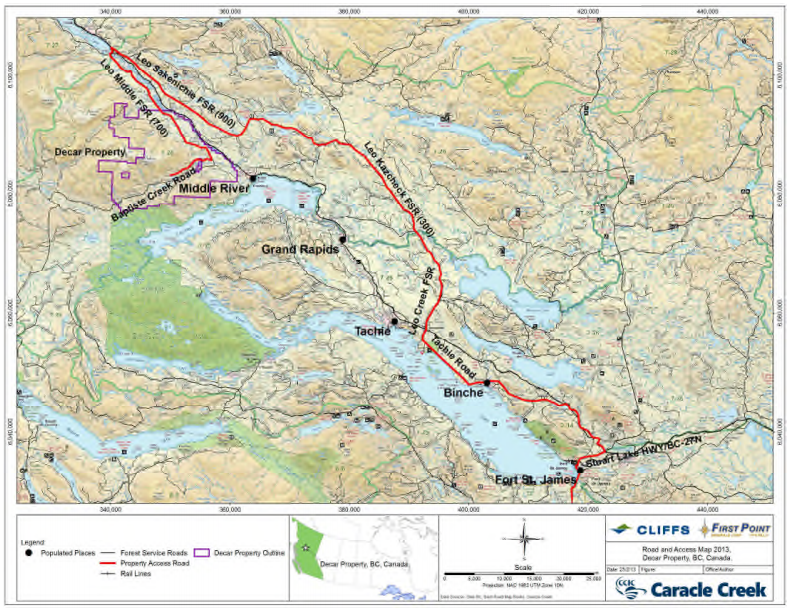

The Decar Nickel District consists of 4 main targets, Baptiste (the focus of the 2013 PEA), Van, Sid and Target B. They total 60 mineral claims and encompass a total area over 245 square kilometres. The Decar Nickel District is located in central BC within 5 km of an existing railroad and is accessible by 4WD on logging roads.Decar sits roughly 90 km northwest of the town of Fort St. James, which is well equipped with most services, including accommodation, stores, private airbase, a bank and medical services.

Decar is expected to require 106 MW of power for its production, which can be accessed via a connection to BC Hydro’s Glenannan Substation (GLN). Accessibility and power are two of the major needs for a developing mine.

BC and its NDP Provincial Government

I have written about BC’s NDP government in a previous article, so I won’t take up space repeating myself here. The long and short of it is that while I believe there is risk with any political party, I feel the most risk comes from the far left, which, in Canada’s political world, is represented by the NDP.

I had a great discussion about the BC political situation with Turenne. Here’s what he had to say;

“British Columbia has a long history as one of the most mining-friendly jurisdictions in the world. In fact, in a 2017 ranking of safest places to invest resource capital, the Mining Journal rated British Columbia as the second-most attractive jurisdiction in the world, second only to Saskatchewan. An Executive Summary of the report can be accessed on the Mining Journal website.

During this year’s election campaign and since taking office, the NDP government has expressed its support for safe and responsible mining in B.C. Mining will remain a key driver of economic growth in the province, regardless of changes in the governing party. As with most jurisdictions, there are some profound regional differences in the ability to develop mining projects in B.C.; in the case of our Decar nickel project, it’s located in north-central British Columbia, which has several active mines and projects. For example, Decar sits just 80 km from Mt. Milligan, a similar-scale operation which was permitted and put into production in the last five years, demonstrating that north-central B.C. is an attractive setting for bulk-tonnage, open-pit mining operations like Decar.“

In the end, besides the political risk, BC has one of the richest mineral endowments in the world, let alone Canada. Whether it be gold exploration in the Golden Triangle or the copper mines throughout the north and central part of the province, BC is a top tier destination for mining and exploration.

While I do see risk in the NDP, when I have the chance to invest in what I believe is a great company, like FPX Nickel Corp., I think it’s worth the associated risk and have been a buyer since the summer of 2017.

History of Decar District Ownership

In a 2009 option agreement, what was then First Point Minerals (now FPX) granted Cliffs Natural Resources Exploration Inc. the option to acquire a 75% interest in the Decar property contingent on a number of criteria being met over the coming years.

From 2010 to 2013, Cliffs went on to spend roughly $22 million USD leading up to the completion of a PEA in 2013, giving them a 60% ownership of the project. In August of 2014, however, following a proxy battle, Cliffs’ Board of Directors and management were replaced, and the new management initiated a fire sale of all of the company’s non-core assets, including Decar.

In September of 2015, FPX purchased Cliffs’ 60% ownership of Decar for $4.75 million USD, giving FPX 100% ownership of the project.

Decar Nickel-Iron Alloy Project PEA 2013

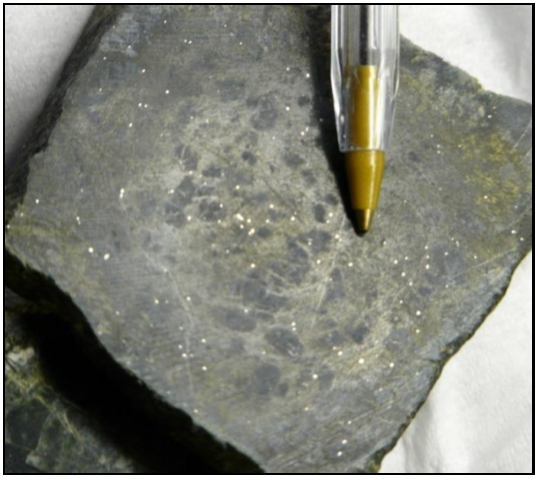

Decar’s nickel is found in a mineral called Awaruite. Awaruite is a dense and highly magnetic nickel-iron alloy, Ni₃Fe, which is commonly referred to as a ‘ naturally occurring stainless steel.’ Awaruite’s physical properties make it perfect for conventional processing and extraction techniques such as grinding, magnetic separation and gravity concentration.

Additionally, in the case of the Baptise Deposit mineralization, there are little to no sulphides present, meaning that both the host rock and tailings are non-acid generating, which is a huge plus when it comes time to permit the project.

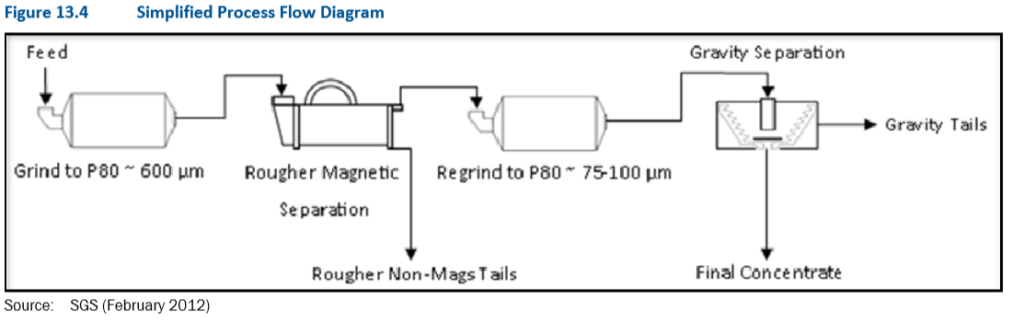

Mineral Processing and Metallurgical Testing

In 2012, SGS Minerals Services conducted “A Bench-Scale Investigation into the Recovery of Nickel from the Decar Awaruite Deposit.” From their tests, SGS selected a process which uses a grind size of 600 µm for the magnetic concentration stage, and 70 µm for the gravity concentration stage. This process results in an 84.7% recovery of DTR nickel, resulting in a concentrate with a grade between 12% and 15% total nickel.

The concentrate produced by FPX should be highly desirable in the stainless steel market, as steel producers, particularly in China, shift toward using higher grade sources of feedstock to supply their steel making operations. For your information, lower grade concentrates or pellets have higher amounts of impurities, which, if not properly captured by a Bag House (essentially a massive vacuum), are exhausted into the atmosphere.

For those who aren’t familiar, nickel pig iron (“NPI”) is a major additive in the stainless steel making process, as it contains both nickel and iron, two of the main constituents in stainless steel. The FPX concentrate or pellet, as mentioned earlier, will have a nickel grade of around 13.5% and iron content around 50%, which compares favourably to the specs of high-grade NPI.

I had the chance to ask Turenne about the metallurgy of the Decar Project and the outlook for the concentrate. Here’s what he had to say;

Turenne: “Decar will produce a premium nickel-iron product in the form of either a concentrate or a pellet with a nickel grade in the range of 12-15% and containing 40-50% iron. The closest market analogues to the Decar pellet are high-grade Chinese nickel pig iron (which typically grades 10-12% nickel with iron making up the balance) and ferronickel (grading 30% nickel, 70% iron). The significant iron content in ferronickel and Chinese NPI makes these products highly desirable for the production of stainless steel, which requires nickel and iron as key inputs; these products, therefore, attract premium pricing in the range of 102 to 110% of the LME nickel per contained nickel unit, as compared to typical nickel sulphide concentrate, which yields 70-75% of the LME nickel price when it is sold to a smelter.

In 2014, FPX conducted market testing of Decar product samples with six of the largest ferronickel and stainless steel producers in the world. The results of this program confirmed the potential for Decar product to bypass smelting and be injected as direct feed for the production of either ferronickel or stainless steel. The commercial feedback provided by the market test participants indicated that Decar product may achieve payability up to 95% or more of the LME nickel price, which is a material improvement over the 75% payability assumed in the 2013 Decar PEA. This improvement will be a key driver underpinning potentially robust economics in an upcoming updated PEA.”

From Turenne’s comments, I think the comment about the potential difference in payability, 20%, is a big deal and should be realized in an updated PEA in the future.

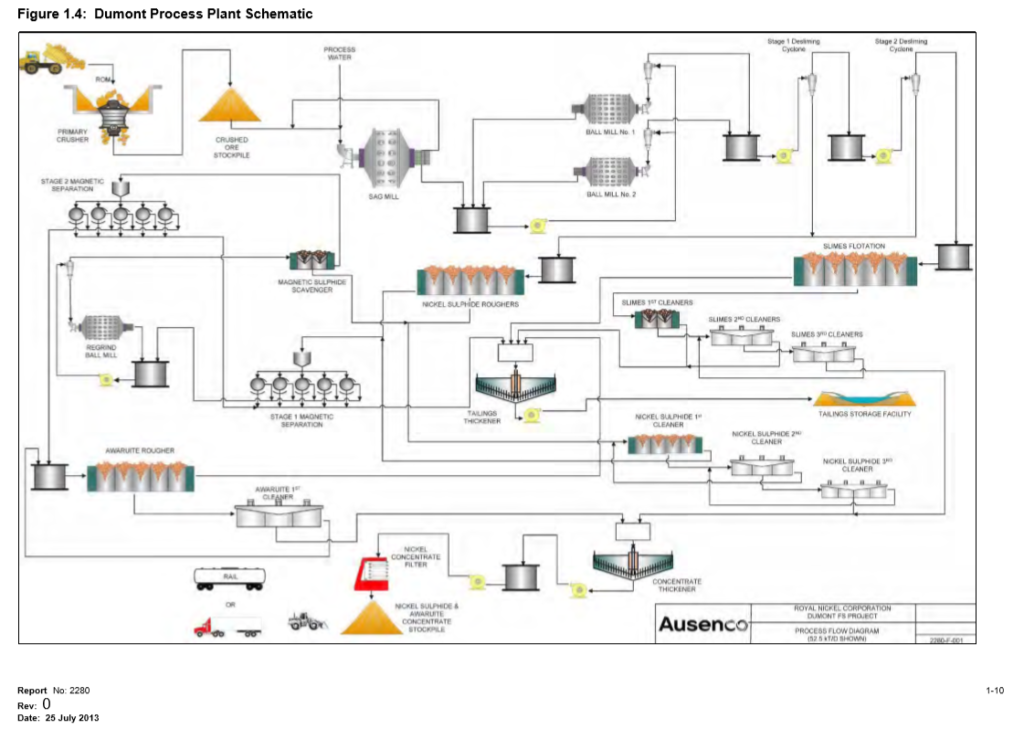

Metallurgical Comparison to RNC Nickel

For a better perspective of FPX’s metallurgical advantage, I have a comparison of Process Plant Schematic’s or Flow Sheets of RNC Nickel and FPX. First, let’s take a look at RNC Nickel’s Dumont Feasibility Study Technical Report, which shows the following flowsheet for the Dumont nickel sulphide deposit:

Source: RNC Nickel’s Dumont Feasibility Study Technical Report – pg.1-10

Source: RNC Nickel’s Dumont Feasibility Study Technical Report – pg.1-10

I am not showing RNC’s flow sheet to be critical of their process, but more to point out its complexity versus FPX’s flow sheet. FPX’s process is simple and widely used in the iron ore industry, and, in my opinion, presents fewer risks for economic production in the future.

Source: FPX Nickel’s Decar PEA Technical Report – pg.13-12

Source: FPX Nickel’s Decar PEA Technical Report – pg.13-12

You be the judge. In my mind, metallurgical processing is arguably the most important part of a mine and, therefore, for me, FPX is clearly the better place for my investment dollars.

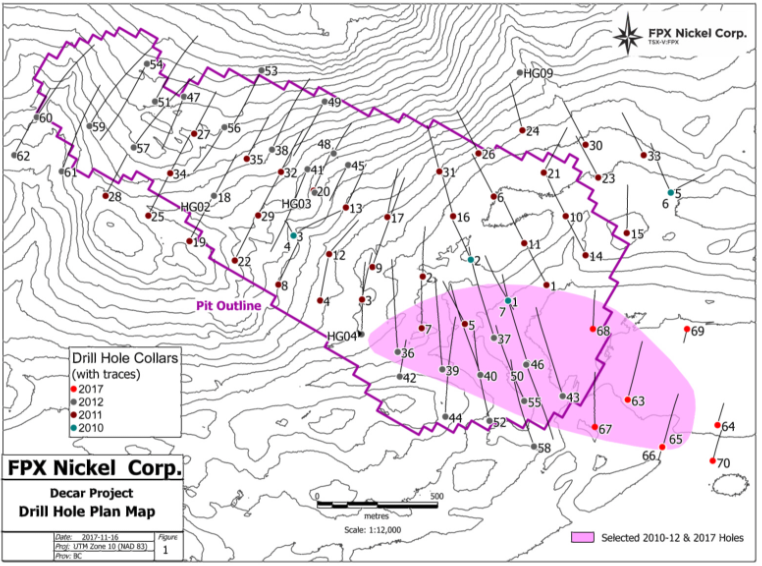

Summer Step-Out Drill Program

On September 25th , FPX completed their step-out drill program on the Baptiste Deposit. Eight diamond drill holes were completed, totalling 1,917 metres. The drill program area was 500 metres along strike from historical drilling, and covered a width of 500 metres.

On October 18 and November 20th, the results of the 8 hole program were released. The highlights from the program are as follows:

- Hole 63 had an interval containing 104 m of 0.163% Davis Tube magnetically-recovered (DTR) nickel at a vertical depth of 66 metres below surface.

- Hole 65 had an interval containing 132 m of 0.147% DTR nickel at a vertical depth of 32 m below surface.

- Hole 67 had an interval containing 96 m of 0.167% DTR nickel at a vertical depth of 42 m below surface.

- Hole 68 had an interval containing 124 m of 0.133% DTR nickel at a vertical depth of 20m below surface.

In my opinion, these results are excellent. To understand, let’s put it into perspective; the Baptiste deposit’s indicated DTR nickel resource estimate has a grade of 0.124%, and its inferred DTR nickel resource estimate has a grade of 0.125%.

The highlighted drill results are significantly higher-grade than the existing indicated and inferred resource estimate grades, they are large intervals and they are shallow. These are very positive signs that an updated PEA on the project should have better economics.

The question is how much of an impact can the step-out drill results have on the project’s economics? Well, the historically identified strike length totals 2.5 km in length, the summer drill program stepped out a further 500 m or a roughly 25% extension of the strike length. Given that the mineralization is shallow and higher grade than the existing resource estimates, I think this is going to have a very positive effect on the PEA update.

2013 PEA Results

The Baptiste Deposit will be mined via an open pit which is estimated to contain an Indicated Resource of 1.1 billion tonnes of 0.124% DTR Ni, and an Inferred Resource of 0.87 billion tonnes of 0.125% DTR Ni. Based on this, Tetra Tech calculated the following 2013 PEA results:

- Post-Tax NPV @8% – $579 million CAD

- Post –Tax IRR – 12.8%

- Pre-Production CAPEX Cost – $1.3 billion CAD

- Total CAPEX Cost over life-of-mine –k $2.1 billion CAD

- Post-Tax Payback – 6.4 years

- Nickel Price – $9.39 USD/lb.

- Mining Rate – 114,000 t/day or roughly 40 million t/year

- Exchange Rate – $0.97 CAD/ USD

Nickel Price Assumption

As you can see, the Decar project has some robust economics, with a post-tax NPV @8% of $579 million and an IRR of 12.8%. The downside to these numbers is that they were calculated using a nickel price of $9.39 USD/lbs.

For those who have been following the nickel price, you will know that nickel currently trades at roughly $5.50 USD/lbs, with most industry experts using $7.50 USD/lbs as their long-term target price.

At face value, the nickel price assumption is a troubling aspect of the 2013 PEA. A lot, however, has changed in the last 4 years, since the PEA was conducted.

- Firstly, as outlined in the previous section of the report, FPX’s 2017 step-out drill program, completed this past fall, intercepted large intervals of shallow, high-grade DTR nickel, which appears to have extended the existing deposit by another 500 metres or roughly 25%.

- Secondly, as outlined in the metallurgical section of this report, the PEA considered a conservative concentrate payback of 75%. However, FPX’s latest market testing suggests that a payback of 85 to 95% is more realistic due to the product’s high quality.

- Thirdly, the CAD to USD exchange rate was almost 1 for 1 back in 2013. Today, in 2017, according to the Bank of Canada website, for every Canadian dollar we would receive 0.7911 American dollars, making the difference between the two exchange rates almost 20%.

It is my contention that given the 3 outlined changes since the original PEA was conducted, that a new PEA at a lower nickel price will again show robust economics.

CAPEX Cost

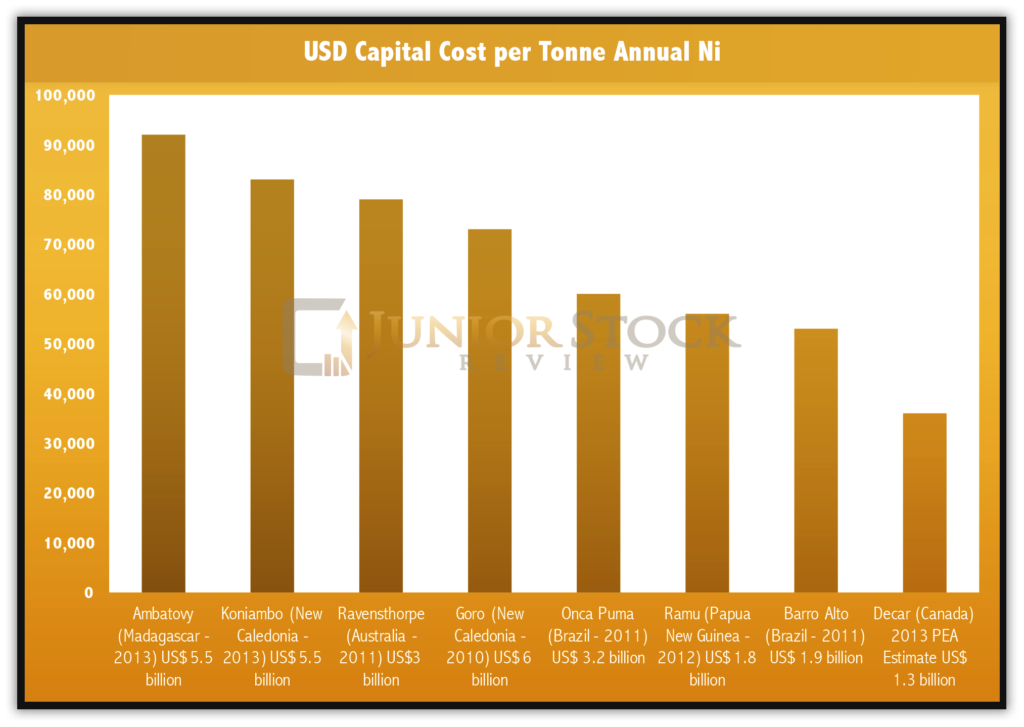

With a pre-production CAPEX cost of roughly $1.3 billion CAD, you may be thinking, ‘how are they going to pay for this?’ Well, in actuality, for those who aren’t familiar with base metals project development costs, US$1.3 billion is relatively cheap.

FPX’s most current corporate presentation, on slide 23, has a great graph depicting the capital cost (USD) per tonne annual nickel production of the largest nickel mines built around the world since 2010.

As you can see, Decar has the lowest capital cost (USD) per tonne of annual nickel production of all the listed nickel mines. The key take away from this graph, in my opinion, is two-fold; First, CAPEX costs in the billions of dollars won’t be the reason why this project isn’t developed. As you can see, the average CAPEX cost of the listed comparisons is close to $4 billion, making Decar’s current US$1.3 billion look quite low. Second, if FPX were to complete an updated PEA on Decar, they could potentially lower the throughput rate, which would have an effecton the overall CAPEX value.

As you can see, Decar has the lowest capital cost (USD) per tonne of annual nickel production of all the listed nickel mines. The key take away from this graph, in my opinion, is two-fold; First, CAPEX costs in the billions of dollars won’t be the reason why this project isn’t developed. As you can see, the average CAPEX cost of the listed comparisons is close to $4 billion, making Decar’s current US$1.3 billion look quite low. Second, if FPX were to complete an updated PEA on Decar, they could potentially lower the throughput rate, which would have an effecton the overall CAPEX value.

Here are Turenne’s comments surrounding the $1.3 billion pre-production CAPEX cost;

Turenne: “The estimated pre-production capital cost in the 2013 PEA was C$1.3 billion for a 114,000 tonne-per-day operation, or approximately US$1.1 million at today’s exchange rate. We are looking at a potential smaller-scale operation, which could potentially reduce capital costs.

We believe that Decar is the most attractive undeveloped nickel asset in the world, truly a tier-1 asset due to the size of the ore body (supporting a top-15 annual nickel producer over a 25+ year mine life) and bottom-quartile operating costs (C$3.23 on-site operating costs in the 2013 PEA).

Due largely to the somewhat depressed state of the nickel market, and due to the modest headline economics in the 2013 PEA (resulting mostly from the low assumed nickel payability and high Canadian dollar assumption), FPX’s current valuation is absurdly low. Our strategy is to continue to demonstrate the technical and economic feasibility of the project, and to commence the permitting process, so that as the nickel price continues to rise, the market will begin to value us more appropriately. As and when this occurs, this will give us a better basis on which to raise funds to advance the project on our own, or to advance the asset with a senior partner. “

FPX’s Plans for 2018

In my opinion, it’s important to have a long-term outlook when it comes to your investment within the resource sector, as it gives you the best chance for your thesis to be right and helps you manage the ebbs and flows of a volatile sector.

In saying this, I asked Turenne about 2018 and what they had planned. Here’s what he had to say;

Turenne: “We will continue to advance the Decar project, likely with the release of an updated resource estimate for the Baptiste deposit which will incorporate the results of our very successful 2017 step-out drilling program. The 2017 drilling defined the Southeast Zone, which is the highest-grading portion of Baptiste.

There are a couple of key features of the Southeast Zone: first, it’s a very large zone measuring 1,000 metres long east-west and up to 600 metres north-south; second, long, near-surface drill intercepts in the Southeast Zone have returned grades in a range between 0.14% to 0.16% Davis Tube recoverable nickel. These results compare very favourably with the undiluted head grade in the first five years of the 2013 PEA mine plan, which ranged from 0.105% to 0.116% DTR nickel. The incorporation of this near-surface, higher-grade tonnage in the early years of a new mine plan has the potential to significantly improve project economics.

Once we have completed an updated Baptiste resource estimate, the next major step is the completion of an updated PEA. Since early 2017, we have been evaluating a number of parameters to optimize project economics, including the development of an optimized mine schedule and process flowsheet, an evaluation of various alternatives for minimizingupfront capital, and incorporation of the results of market testing on payability for our nickel product.

The point on payability is particularly important to understand the upside in a new PEA. We have conducted market testing of Decar nickel product with some of the largest ferronickel and stainless steel producers in the world to confirm the technical and commercial viability of Decar product. The response received from those potential offtakers have demonstrated the potential to achieve nickel payability in the range of 85% to 95% of the LME nickel price, as compared to the 75% LME payability assumed in the 2013 PEA. This implies a significant potential for increased revenue over the life-of-mine, with obvious positive implications for overall project economics.”

Nickel Company Comparables

For perspective on the value of FPX, I have put together a comparison with another junior nickel company which has a development project in BC.

Giga Metals

MCAP – $27.4 million (at the time of writing) based on the current share price of $0.70/share, with 41.4 million shares and 26 million warrants outstanding at exercise prices ranging from $0.07 to $0.70/share

Giga Metals owns the Turnagain Nickel-Cobalt Project in northern BC. Turnagain is a large, low-grade sulphide deposit containing nickel and cobalt-bearing pentlandite and pyrrhotite. The project’s main economic value is found in its nickel, with a much smaller portion being derived from its cobalt credits.

As you will see below, many of Giga’s Turnagain Project economic valuations are very similar to FPX’s Baptiste Deposit. However, I see some areas in which, I believe, FPX is stronger than Giga – let’s take a look:

- Metallurgy – Complex mineralization, which, if successfully processed into a concentrate, will not fetch a premium price in the market, meaning payability of 75% of the LME price, at best. Please read the section of the PEA regarding metallurgy.

- Location – remote location in northern BC with higher hydro power access and concentrate shipment costs

- Limited Upside – The 2012 PEA has a high nickel price assumption ($8.50/lb.) and GIGA has not defined a clear path to making Turnagain an economic project below $8.50 USD/lb nickel.

- Share structure – while the shares outstanding is lower than FPX, this is only after a couple of recent share roll backs, and keep in mind that GIGA’s share count will almost double if all the outstanding warrants and options are exercised.

Here are a few of the highlights from the PEA:

- Measured and Indicated Resource – 865 Mt @0.21% Ni and 0.013% Co and an Inferred Resource – 976 Mt @0.20% and 0.013% Co.

Giga’s Results:

- Post-Tax NPV @8% – $724 million

- Post-Tax IRR – 13.5%

- Initial CAPEX – $1.357 billion

- Year 5 Expansion CAPEX – $492 million

- Total CAPEX Cost over life-of-mine – $1.849 billion

- Post-Tax Payback – 7.3 years

- Nickel Price – $8.50 USD/lb. and Cobalt Price – $14.00 USD/lb.

- Mining Rate – 28.1 Mt/year (average LOM)

- Exchange Rate – $0.95 USD/CAD

Currently, Giga Metals trades more than double the MCAP of FPX, which I don’t think is justified. Giga’s Turnagain has a lot of positive aspects, however, when it comes down to valuations, I don’t believe it’s more valuable than FPX’s Decar Nickel District, given the reasons I outlined.

Concluding Remarks

I’m very bullish on the future of nickel and am investing my money into what, I believe, are the best investments to capitalize on a rising nickel price.

Even if you agree with my bullish nickel outlook, you may have a different risk tolerance when it comes to investing. For me, I prefer the junior portion of the resource sector, as I believe it gives the investor the best risk to reward ratio.

In saying this, I will continue to buy shares in FPX Nickel Corp. because, in my opinion, their Decar Nickel District is among the best undeveloped nickel projects in the world.

As I outlined in the report, there’s some risk associated with FPX, mainly in the nickel price assumption from its 2013 PEA and the NDP political party which currently leads the BC provincial government. I do believe, however, that given the step-out drill results, the expected 85-95% payability on the concentrate and a change in the exchange rate, the Decar Nickel District will be economic at sub $8 USD/lb. nickel.

In my opinion, there’s more upside potential than downside, especially at its current MCAP. Here’s a list of the reasons I’m investing in FPX Nickel:

- Great leadership from CEO, Martin Turenne, and a group of proven mine builders, beginning with Peter Bradshaw and Board members, Robert Pease, Peter Marshall and Bill Myckatyn. This team is being assembled with the successful development of Decar in mind.

- A desirable concentrate or pellet which is made via a simple metallurgical process. Market research carried out by FPX suggests that the concentrate could sell for around 85-95% of the LME price, which is 20% higher than the 75% used in the 2013 PEA.

- The Baptise Deposit mineralization has little to no sulphides present, meaning that both the host rock and tailings are non-acid generating, which is a huge plus when it comes time to permit the project.

- Low Pre-Production CAPEX cost of $1.3 billion – World-class nickel projects come with large price tags, making Decar look very reasonable, if not cheap.

- Low on-site operating costs of C$3.23/lb, which would position Decar in the lowest quartile of the nickel industry cost curve.

- Given the PEA nickel production rate of 82 million lbs. per year, at today’s nickel price of US$5.75/lb, Decar would yield around US$250 million in annual pre-tax operating cash flows.

- Large resource containing over 5.5 billion pounds of nickel in the combined indicated and inferred categories, making Decar one of the five-largest undeveloped nickel deposits in the world

- Successful step-out drill program results from the Southeast Zone, which has increased the strike length by 500 metres or roughly 25%.

- PUSH – An update to the Baptiste Deposit’s resource estimate should come in 2018, setting the stage for an updated PEA.

- FPX is trading for less than half (in terms of MCAP) the value of a comparable junior nickel company which, I believe, doesn’t have as high quality an asset as FPX.

In my opinion, all of these points make a great investment proposition. One that I think will be very hard for a major mining company to ignore in the future. With the completion of an updated PEA, a rising nickel price, and the overall lack of comparably great projects in the world, I believe FPX is HIGHLY undervalued and am looking forward to its re-rating in the market.

Don’t want to miss a new investment idea, interview or financial product review? Become a Junior Stock Review VIP now – it’s FREE!

Until next time,

Brian Leni P.Eng

Founder – Junior Stock Review

Disclaimer: All statements in this report, other than statements of historical fact should be considered forward-looking statements. These statements relate to future events or future performance. Forward-looking statements are often, but not always identified by the use of words such as “seek”, “anticipate”, “plan”, “continue”, “estimate”, “expect”, “may”, “will”, “project”, “predict”, “potential”, “targeting”, “intend”, “could”, “might”, “should”, “believe” and similar expressions. Much of this report is comprised of statements of projection. These statements involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such forward-looking statements. Risks and uncertainties respecting mineral exploration companies are generally disclosed in the annual financial or other filing documents of those and similar companies as filed with the relevant securities commissions, and should be reviewed by any reader of this newsletter.

Brian Leni is an online financial newsletter writer. He is focused on researching and marketing resource and other public companies. Nothing in this article should be construed as a solicitation to buy or sell any securities mentioned anywhere in this newsletter. This article is intended for informational and entertainment purposes only!

Be advised, Brian Leni is not a registered broker-dealer or financial advisor. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer.

Never, ever, make an investment based solely on what you read in an online newsletter, including Junior Stock Review, especially if the investment involves a small, thinly-traded company that isn’t well known.

Brian Leni’s past performance is not indicative of future results and should not be used as a reason to purchase any stocks mentioned in his newsletters or on this website.

In many cases Brian Leni owns shares in the companies he features. For those reasons, please be aware that Brian Leni can be considered extremely biased in regards to the companies he writes about and features in his newsletters. You should conduct extensive due diligence as well as seek the advice of your financial advisor and a registered broker-dealer before investing in any securities. Brian Leni may buy or sell at any time without notice to anyone, including readers of this newsletter.

Brian Leni shall not be liable for any damages, losses, or costs of any kind or type arising out of or in any way connected with the use of this newsletter. You should independently investigate and fully understand all risks before investing. When investing in speculative stocks, it is possible to lose your entire investment.

Any decision to purchase or sell as a result of the opinions expressed in this report will be the full responsibility of the person authorizing such transaction, and should only be made after such person has consulted a registered financial advisor and conducted thorough due diligence. Information in this report has been obtained from sources considered to be reliable, but we do not guarantee that they are accurate or complete. Our views and opinions in this newsletter are our own views and are based on information that we have received, which we assumed to be reliable. We do not guarantee that any of the companies mentioned in this newsletter will perform as we expect, and any comparisons we have made to other companies may not be valid or come into effect.

Junior Stock Review does NOT have any business relationship with FPX Nickel Corp.

Junior Stock Review does not undertake any obligation to publicly update or revise any statements made in this newsletter.

Brian Leni does own shares in FPX Nickel Corp.

Tax loss season is upon us, and with it comes discounts on some of the best companies in the junior resource sector. In particular, Marathon Gold stood out for me; it just released a great update to its NI 43-101 resource estimate, moving a portion of its inferred gold ounces to the measured and indicated categories and increasing its gold resource by roughly 30% overall. The market reaction? “Yawn,” or basically no movement in the stock. This is music to my ears – I bought another tranche.

What’s my point? Sometimes, the market doesn’t see or understand the value proposition, especially when the sector for the given company isn’t in favour.

Today, I’m sharing my research on a copper company which is set to (very soon) finalize their acquisition of a major copper project in northern British Columbia (BC). I think this should result in a re-rating in their share price, as their current MCAP is around 3 times less than the acquisition cost of the project. This company is Desert Star Resources.

Let’s take a closer look.

Desert Star Resources (DSR:TSXV)

MCAP – $8.5 million (at the time of writing)

Shares – 18,947,901

Fully Diluted – 26,169,901

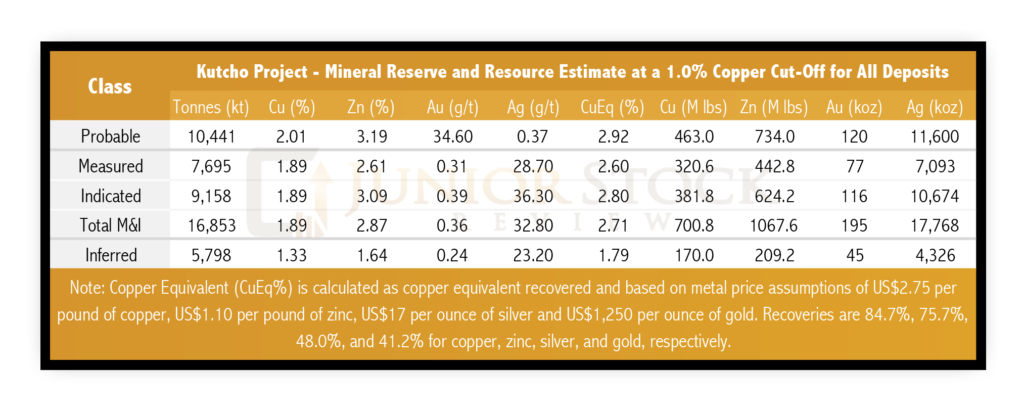

Kutcho High Grade Copper-Zinc-Gold-Silver Project

On June 15th, 2017 Desert Star announced it had signed a definitive agreement to acquire 100% of the Kutcho high grade copper-zinc-gold-silver project from Capstone Mining Corporation. The deal was comprised of cash, $28.8 million CAD and, upon completion of the acquisition and concurrent financing, 9.9% of the issued and outstanding shares of Desert Star.

Wheaton Precious Metals

On August 10, 2017, the purchase of Kutcho got a huge boost with the announcement that Desert Star had agreed to terms on a non-binding Early Deposit Precious Metals Purchase Agreement with Wheaton Precious Metals Corporation. The agreement will see Wheaton pay Desert Star $65 million USD for up to 100% of the payable silver production, and up to 100% of the payable gold production produced from the Kutcho Project.

Additionally, and in line with management’s goal for the project, if the processing capacity of the mine increases to 4,500 tpd or more within 5 years of attaining commercial production, a further $20 million USD will be payable to Desert Star.

Furthermore, on October 31, 2017, Desert Star announced it had entered into a non-binding Term Sheet for a $20 million CAD Subordinated Secured Convertible Term Debt Loan with Wheaton Precious Metals. Bringing the total financing package to over $100 million CAD.

In my view, an investment by Wheaton Precious Metals speaks volumes about the quality of the people and the project. The Wheaton Precious Metals team, while not infallible, has a great track record for finding projects that are future mines. In saying this, be mindful that a stream on the project, while helping early on with the funding of the mine, does remove some of the potential future value. In the case of the Kutcho Project, the precious metals only account for 8% of the revenue, making it a small part of the overall Kutcho Project value.

Desert Star’s People – Built for Success

The acquisition of the Kutcho Project from Capstone and management’s ability to secure over $100 million CAD in funding via Wheaton Precious Metals, in my mind, speaks volumes about CEO and Director, Vince Sorace’s, ability to lead the company. Sorace has over 25 years of experience in international business and capital markets, and has held senior leadership roles in a number of other companies.

Sorace’s COO, Rob Duncan, has over 26 years of experience in mineral exploration and held senior leadership roles for a number of other mining companies. In particular, he has extensive technical experience with VMS systems such as Kudz Ze Kayah and Wolverine in the Yukon’s Finlayson District and Izok Lake in Nunavut.

Rory Kutluoglu, a professional geologist, has 10 years experience in the mining industry. His most recent success was with Kaminak Gold Corp., where he was the exploration manager and played an instrumental role in the Coffee Gold Project’s development, which was acquired by Goldcorp in 2016. Kutluoglu is Desert Star’s VP of Exploration and will be focusing on expanding Kutcho resources.

Also, Allison Rippin-Armstrong, formerly with Kaminak Gold Corp, brings her 20 years of experience in permitting, regulatory processes and environmental compliance for resource companies to the Desert Star management team. Rippin-Armstrong will play an invaluable role as she leads relations with the First Nations Tahltan Central Government (TCG) and aids the company in the permitting process.

To note, there is one particular addition to Desert Star’s Board of Directors that I think will be an x-factor for the company as they develop Kutcho. The appointment of Bill Bennett, BC’s former Mining Minister, to the Board of Directors should pay major dividends, as he helps the company navigate the permitting process.

Additionally, on the Board of Directors, is Stephen Quinn and Jay Sujir. Also, Desert Star has three advisors; Peter Meredith, former Chairman of Ivanhoe Mines; Rob Carpenter, former CEO of Kaminak Gold; and Stuart Angus, former Chairman of Nevsun Resources. This advisory board is another huge plus for this junior company, as each of these men have been successful in the mining industry.

Northern British Columbia

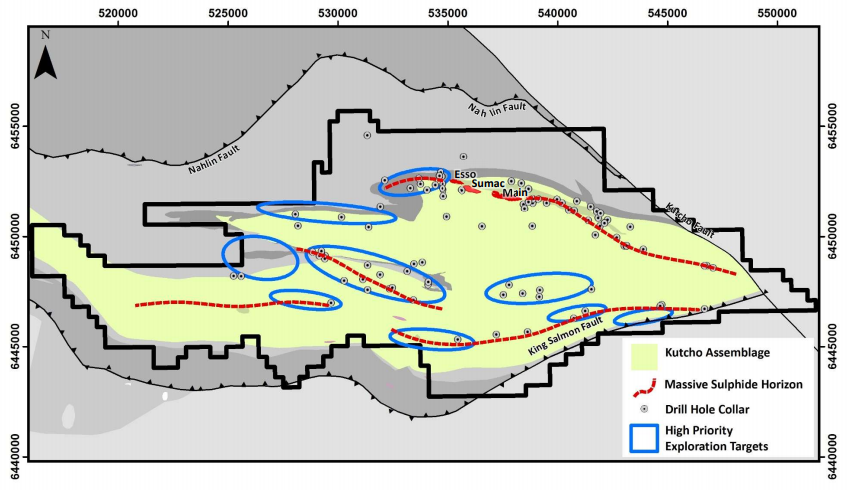

The Kutcho Project is made up of 46 mineral exploration claims encompassing 17, 060 hectares, and is located in northern British Columbia.

Source: Prefeasibility Study Technical Report on the Kutcho Project

As you can see on the map, Dease Lake is the largest community near Kutcho, sitting roughly 100 km west, and is cited as having a population of 335 people in the technical report. As well, Dease Lake is about 400 km north of the Port of Stewart and 600 km north of Smithers.

Access to Kutcho is via a seasonal road from HWY 37 or gravel airstrip, which is located on the property at the junction of Kutcho and Andrea creeks.

Tahltan Territory

On October 26, 2017, Desert Star announced a communications agreement with the Tahltan Central Government (TCG). The TCG is the governing body of the Tahltan Nation, which works to protect the Aboriginal rights and title, ecosystem and natural resources of the Tahltan community.

Tahltan territory encompasses 93,500 square kilometres in northwestern BC, running parallel to the Alaskan/Canadian border. Their three main communities are Telegraph Creek, Dease Lake and Iskut.

A good relationship with the TCG is integral to the future development of the Kutcho Project into an operating mine.

BC and its NDP Provincial Leadership

This past May, BC’s provincial election turned out the way many rural and business people had hoped, with the Liberals retaining control of the provincial government. This minority win, however, didn’t last long, as the NDP, the Liberals’ closet provincial leadership competitor, and the Green Party combined forces to displace the Liberals and took control of the province.

The NDP have a reputation of being bad for business – and with good cause. I cite Ontario in the 90s and, most recently, the NDP’s current control of what was formerly Canada’s richest province, Alberta. From a number of perspectives, but most importantly from a business perspective, these examples show the potential downside of the NDP ideology.

In saying this, however, it isn’t a done deal that all business is doomed because the NDP has taken over, just a higher probability, in my opinion. Further, I would be remiss if I didn’t point out that the Liberals and Conservatives aren’t without fault when it comes to bad policy decisions that have negatively affected business.

So what do I think about investing in mining in BC? Currently, I do see risk in investing in BC given the current political leadership. However, as I mentioned in the beginning of this article, investing in quality companies is the key to success in the junior resource sector. Therefore, if I’m able to find a quality company at the right price, I’m willing to take on more political risk.

In the case of Desert Star, I think that the Kutcho Project is quality and worth the associated jurisdictional risk. Bill Bennett and Allison Rippin Armstrong will prove invaluable as they help the company navigate the permitting process to ensure that this project has the best chance of being approved in a timely manner.

Updated Prefeasibility Study

Upon signing the definitive agreement with Capstone to acquire the Kutcho Project, Desert Star approached JDS Energy and Mining Inc. to update their 2011 PFS on the Project. The update to the PFS is intended to show the project’s economics based on current costs, metal prices, exchange rates, mineral resources and metallurgical interpretations.

Source: Prefeasibility Study Technical Report on the Kutcho Project

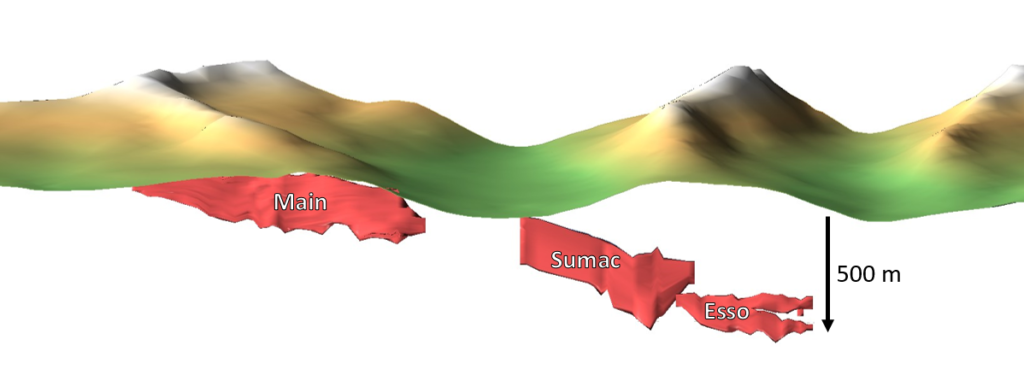

The Kutcho Project is made up of 3 mineralized zones: Main, Esso and Sumac. These 3 zones are Kuroko-type volcanogenic massive sulphide (VMS) deposits and are aligned in a westerly plunging linear trend. The PFS mine planning and economics only consider the Main and Esso zones, as the Sumac Zone only has inferred resources.

Source: Kutcho Project’s 3 Mineralized Zones

Currently, the mine plan calls for a starter pit to be constructed on the Main Zone, which will be used to mine roughly 0.4 Mt of preliminary mill feed. The pit will then give way to an underground portal which will be used to access the rest of the deposit.

As you can see in the image above, the Main Zone deposit is at surface, has a strike length of about 1.5 km, and extends approximately 260 m down dip. The Esso Zone sits about 1.5 km away from the Main Zone, and is located roughly 400 m below surface, extending 240 m down dip, and has a strike length of 640 m.

The PFS estimates the mine to have the following production and economic statistics:

- Production Rate – 2,500 tpd

- Mine Life – 12 years

- Average Annual Copper Production – 33 Mlbs

- Average Annual Zinc Production – 42 Mlbs

- After-tax NPV@8% – $265 million CAD

- After-IRR – 27.6%

- After-tax Payback – 3.5 years

- Initial CAPEX Cost – $220.7 million

Kutcho Metallurgy

The biggest question mark surrounding the Kutcho Project, in my opinion, is its metallurgy. JDS remarks,

“The mineralogy of the Kutcho deposits is complex and requires a similarly complex approach to produce copper and zinc concentrates at reasonable recoveries and concentrate grades.” ~ PFS 1-3

The PFS economic case is based off of a 84.7% copper recovery with a saleable concentrate grade of 27.6% copper, zinc content of 7.3%, gold content of 2.5 g/ton, and a silver content of 268.6 g/ton. The zinc recovery is expected to be 75.7%, with a concentrate grade of 55.1% zinc and 1.2% copper.

Deviations from the expected recoveries or further use of reagents and increased power consumption are concerns due to the complex nature of the mineralization. Further metallurgical work on the Project is scheduled for Q3 and Q4 of 2018, and will provide the company with a good chance to optimize the metallurgical process, which could have a positive impact on Kutcho’s economics.

Kutcho Expansion and Exploration Potential

The company has outlined a few scenarios for Kutcho’s upside growth potential, which are: Existing Resource Conversion, Down Dip Extension and project expansion through exploration. Let’s go through each one briefly:

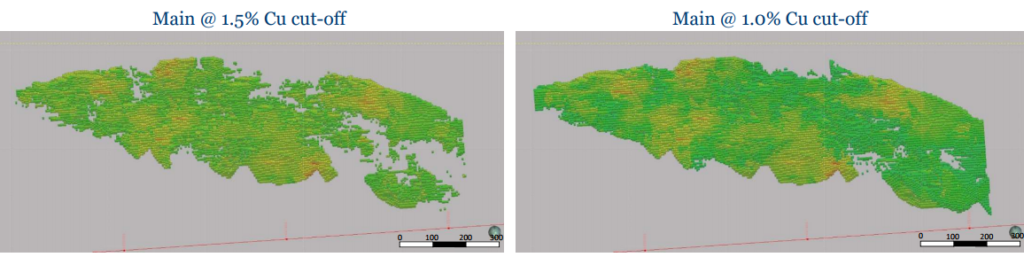

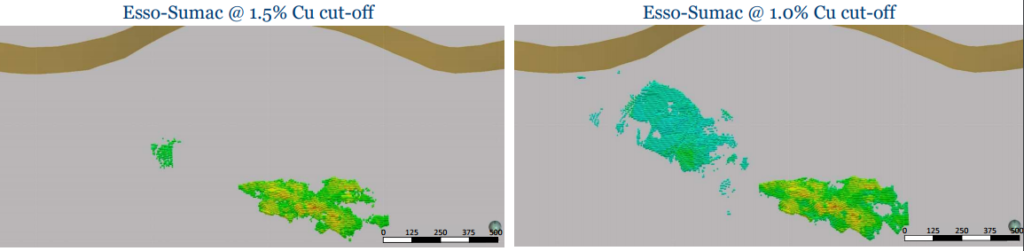

- First, by lowering the cut-off grade from 1.5% to 1.0% copper, the reserve tonnage could grow roughly by 5.0 Mt. Secondly, with further infill drilling, the current inferred resource of 5.8 Mt @ 1.79% CuEq could potentially be moved into the measured and indicated resource category and, thus, be included in the economics of the project.

PUSH: Watch for infill drilling results on the deposit, which is scheduled to occur in Q2 and Q3 of 2018. Drill results showing continuity should be a sign that this deposit is going to get bigger.

PUSH: A resource update will follow the infill drilling and should be completed by the end of 2018 or the first quarter of 2019.

Main Zone Block Model Cut-off Comparison

Esso-Sumac Zone Block Model Cut-off Comparison

- Secondly, the Main and Esso Zones are open at depth and along strike. Desert Star estimates 60% of the Main Zone and 50% of the Esso Zone’s strike length is open down dip, with the potential to add 1 to 3 Mt in the Main Zone and 300 to 600 Kt in the Esso Zone.

- Finally, the Kutcho Project has a large land package with multiple repeated VMS sulphide horizons that haven’t seen extensive exploration. In the image below, you can see the high priority targets outlined in blue. Currently, exploration drilling is set to occur in Q4 of 2018.

Kutcho Project Exploration Targets

Concluding Remarks

There isn’t a mining project in the world that doesn’t have at least a couple of question marks. In Desert Star’s case, I see two main areas of risk; first, the metallurgical complexity of the mineralization, and second, BC’s NDP government. The company, however, has taken steps to address both of these risks. First, with further metallurgical work scheduled for Q3 and Q4 in 2018, and for the jurisdictional risk, they have appointed Bill Bennett, to the Board and Allison Rippin-Armstrong to the management team, whose combined experience in navigating the permitting process should prove to be invaluable.

For me, the investment case for Desert Star Resources is straightforward, and I have summarized what I think are the company’s strengths and, ultimately, the reasons I think Kutcho has the potential to become BC’s next producing copper mine in the years ahead.

- Good management team and Board of Directors – In particular, Bennett has x-factor type experience and influence to move Kutcho to production in a timely manner.

- Advisory Board which includes Peter Meredith, former Chairman of Ivanhoe Mines; Rob Carpenter, former CEO of Kaminak Gold; and Stuart Angus, former Chairman of Nevsun Resources.

- Over $100 million CAD in funding via an agreement with Wheaton Precious Metals, paving the way to the final investment decision in 2020.

- After-tax NPV @8% of $265 million CAD and after-tax IRR of 27.6% – Desert Star’s Kutcho high grade Cu-Zn-Au-Ag Project has an updated PFS which shows positive economics at current metal prices and exchange rates- $2.75 USD/lbs Cu, $1.10 USD/lbs Zn, $1250 USD/oz, $17 USD/oz.

- Deposit growth potential through the reduction in the resource cut-off grade, which could see the reserve tonnage grow by roughly 5.0 Mt and the measured and indicated resource tonnage by roughly 5.8 Mt

- The Main and Esso Zones are open at depth and along strike – If the continuity of the deposit continues, Desert Star estimates that the Main Zone could grow between 1 to 3 Mt, and Esso Zone could grow between 300 and 600 Kt.

- Kutcho’s district scale land package could yield further mineralization via a few high priority targets that have been identified on the property.

Don’t want to miss a new investment idea, interview or financial product review? Become a Junior Stock Review VIP now – it’s FREE!

Until next time,

Brian Leni , P.Eng

Founder – Junior Stock Review

Disclaimer: All statements in this report, other than statements of historical fact should be considered forward-looking statements. These statements relate to future events or future performance. Forward-looking statements are often, but not always identified by the use of words such as “seek”, “anticipate”, “plan”, “continue”, “estimate”, “expect”, “may”, “will”, “project”, “predict”, “potential”, “targeting”, “intend”, “could”, “might”, “should”, “believe” and similar expressions. Much of this report is comprised of statements of projection. These statements involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such forward-looking statements. Risks and uncertainties respecting mineral exploration companies are generally disclosed in the annual financial or other filing documents of those and similar companies as filed with the relevant securities commissions, and should be reviewed by any reader of this newsletter.

Brian Leni is an online financial newsletter writer. He is focused on researching and marketing resource and other public companies. Nothing in this article should be construed as a solicitation to buy or sell any securities mentioned anywhere in this newsletter. This article is intended for informational and entertainment purposes only!

Be advised, Brian Leni is not a registered broker-dealer or financial advisor. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer.

Never, ever, make an investment based solely on what you read in an online newsletter, including Brian Leni’s online newsletter, especially if the investment involves a small, thinly-traded company that isn’t well known.

Brian Leni’s past performance is not indicative of future results and should not be used as a reason to purchase any stocks mentioned in his newsletters or on this website.

In many cases Brian Leni owns shares in the companies he features. For those reasons, please be aware that Brian Leni can be considered extremely biased in regards to the companies he writes about and features in his newsletters. You should conduct extensive due diligence as well as seek the advice of your financial advisor and a registered broker-dealer before investing in any securities. Brian Leni may buy or sell at any time without notice to anyone, including readers of this newsletter.

Brian Leni shall not be liable for any damages, losses, or costs of any kind or type arising out of or in any way connected with the use of this newsletter. You should independently investigate and fully understand all risks before investing. When investing in speculative stocks, it is possible to lose your entire investment.

Any decision to purchase or sell as a result of the opinions expressed in this report will be the full responsibility of the person authorizing such transaction, and should only be made after such person has consulted a registered financial advisor and conducted thorough due diligence. Information in this report has been obtained from sources considered to be reliable, but we do not guarantee that they are accurate or complete. Our views and opinions in this newsletter are our own views and are based on information that we have received, which we assumed to be reliable. We do not guarantee that any of the companies mentioned in this newsletter will perform as we expect, and any comparisons we have made to other companies may not be valid or come into effect.

Brian Leni does not undertake any obligation to publicly update or revise any statements made in this newsletter.

Desert Star is a Sponsor of Junior Stock Review. Brian Leni does not own shares in Desert Star Resources.

The Province of British Columbia, Canada is experiencing a mining renaissance. What’s happening in the province, in regards to mining, should be on every investors radar screen.

Vancouver is undoubtedly one of the greatest mining centers in the world and British Columbia should be a mining powerhouse when one considers the province has favourable characteristics:

- Excellent geology – British Columbia is mineral rich and hugely underexplored.

- Good transportation system.

- Reasonable mining regulations.

- Competitive tax rates.

- Strategic location with respect to Asian markets. Two modern ports, Vancouver – Canada’s largest and the Port of Prince Rupert which is the closest of any of North America’s West Coast ports to Asia – up to 58 hours of sailing time shorter.

- High quality and easily accessible geological data.

- Mining friendly provincial government.

- Communities receptive to resource extraction as a livelihood.

- Attractive exploration incentives.

- BC is the third largest generator of hydro electricity in Canada – one of the lowest power costs in North America. Natural gas is plentiful, cheap and resources are growing.

- Some of the most modern education and telecommunications infrastructure in the world.

Land claims of the First Nations remain a stumbling block in many areas – perhaps in part because so many claims overlap – but First Nations are now coming to understand and embrace resource development as a way to generate training, jobs and financial security for their people and their communities. While things are not always as smooth, dialogue is taking place and things are getting done – projects are moving forward.

About the sector, Gavin C. Dirom President and CEO of the Association of Mineral Exploration B.C., recently stated, “BC-based mineral explorers and developers appreciate the key measures that were announced in today’s federal budget. Maintaining the Mineral Exploration Tax Credit and reducing red tape will help sustain Canada’s mineral exploration and mining sector, encourage capital investment and ultimately benefit all Canadians well into the future.”

BC is taking the lead in regulatory reform – the largest cut in red tape could come from dropping the duplication of process in regards to environmental assessments. B.C. has taken the position that the province’s own process already takes into account the responsibilities of the federal government and that doing a second duplicate federal review forces a company to spend more money and time on needless duplication of process.

The process does work – three major mines are being constructed, six major mines are in advanced development, and over eighteen mining projects are in earlier stages of environmental assessment. In addition, there’s a very real trend by major mining companies towards making deals with junior resource companies that presently own copper-gold porphyry projects in BC:

- Tiex/Newmont.

- Novagold/Teck Resources.

- Cariboo Rose/Gold Fields.

- Terrane Metals/Goldcorp.

- Kiska Metals (formerly Rimfire Metals)/Xstrata.

- Serengeti/Freeport.

- Strongbow/Xstrata.

- Copper Mountain/Mitsubishi.

Copper-gold porphyries can offer both size and profitability. These kinds of deposits are one of the few deposit types containing gold that have both the scale and the potential for decent economics that a major mining company can feel comfortable going after to replace and add to their gold reserves.

On May 8th, 2011, just two days after the federal government gave the environmental thumbs-up on the Northwest Transmission Line (NTL), two B.C. First Nations say they will join forces to fight against the major power line.

The NTL is slated to run through seven different First Nations territories, four of which have yet to sign agreements with B.C. Hydro. About one-third of the line would pass through territory belonging to the Gitanyow and Lax Kw’alaams, who claim that B.C. Hydro has been inflexible in negotiations about their participation and compensation. The bands, subsequently, are threatening blockades. The Chiefs of the respective bands have said they will not accept B.C. Hydro’s one-time cash offer, comparing the offer to “beads” in exchange for land.

On April 11th, after over a year of attempting to negotiate with BC Hydro regarding the proposed NTL to be constructed through Gitanyow Territory, the Gitanyow Chiefs received a “No” from BC Hydro’s representatives concerning the outstanding issue of revenue sharing. This response was delivered to the Gitanyow First Nations despite the directive from the BC Utilities Commission to BC Hydro in early February 2011 to engage in revenue sharing discussions with Aboriginal Nations whose rights will be impacted by transmission line projects.

In 2008, The Mining Association of BC commissioned a study that evaluated the economic benefits of establishing a high-voltage transmission line in northwest British Columbia. According to the study, the NTL would result in at least $15 billion in new investment in mining and power generation for the remote region. The study said the NTL has the potential to create more than 10,000 new jobs, allow new green power projects to link to the provincial transmission grid, and generate $300 million in new tax revenue annually.

Last year, the Northwest Powerline Coalition released a video highlighting the various benefits associated with the Northwest Transmission Line:

A number of mining companies have been patiently waiting for power in the region. Imperial Metals (TSX:III) is developing the Red Chris copper/gold project and the operation is dependent upon completion of the Northwest Transmission Line. Red Chris anticipates being able to connect to the NTL’s Bob Quinn hydro station approximately 120 km from the proposed mine site.

At least two other junior miners are also relying on the development of the Northwest Transmission Line. Copper Fox Metals (TSXV:CUU) and Hard Creek Nickel (TSX:HNC) are also very much dependent on the project. In a recent interview with MiningFeeds.com, Copper Fox President & CEO Elmer Stewart noted, “The NTL is fundamental to the development of the large copper deposits located in northern British Columbia including Schaft Creek. Without this supply of electricity, the capital and operating costs would increase which directly impacts the economics of these deposits.” And Mark Jarvis, President of Hard Creek Nickel, said the NTL was “the key infrastructure element we need to advance our Turnagain Nickel project to a reality.”

You’ve probably heard or peak oil but have you heard of peak copper? The difference between peak oil and peak copper is that copper is recycled and reused. It has been estimated that at least 80% of all copper ever mined is still available above ground. Peak copper, in theory, is the point in time when the maximum global copper production rate is reached. Since copper is a finite resource, at some point in the future new production from the earth will diminish. When this will occur is very much a matter under dispute but, lately, the debate over peak copper has been adding fuel to the copper frenzy. One Canadian listed company that plans on adding to the global supply of copper is Copper Fox Metals.

Copper Fox listed on the TSX Venture Exchange in June 2004 to explore the potential of the Schaft Creek deposit in Northern British Columbia, Canada. Schaft Creek deposit is an undeveloped copper-gold-molybdenum-silver that was owned by Teck-Cominico (now Teck Resources) that was optioned by Guillermo Salazar, the company’s founding president and CEO, in 2002. Pursuant to the option agreement, Copper Fox can earn a 78% interest (23.4 % of the deposit) in Liard Copper Mines Limited by completing a “positive” feasibility study. Teck maintains certain earn-back rights on receipt of a “positive” bankable feasibility study.

The recent approval of the Northwest Power Line by B.C.’s Provincial government was always considered a key component of the projects viability. BC Hydro performed technical studies on the project for years and advocated the new line would provide a reliable supply of clean power to potential industrial developments in the area. But, as is often the case with such mega-projects, environmental opponents were vocal.

Finally, on February 23rd, 2011 the BC Environmental Assessment Office announced that the Northwest Transmission Line was finally granted an Environmental Assessment Certificate. Copper Fox put out a press release applauding the decision and the company’s shares made a dramatic move from $.96 cents on February 11th to $2.70 a few months later. Shares of Copper Fox have subsequently pulled back from their April highs to the $2.00 range. MiningFeeds.com connected with Copper Fox boss Elmer Stewart recently to discuss the significance of the Northwest Power Line and the company’s future.

You joined Copper Fox as Chief Executive in 2009, when you were doing your own due dilligence what was it about the Schaft Creek project that caught your attention?

I joined Copper Fox as President and CEO in July 2009. Prior to that I was a director of the Company and non-executive Chairman of the Board. I have always been excited about the size of the resource, its polymetallic nature, metallurgical recoveries and the general setting of the deposit. The reported low grade nature of the Schaft Creek deposit was clearly a function of the low cut-off used to report the resource which I saw as a positive. Using a higher cut-off grade clearly reduced the resource, but provides higher average metal grades. The ability to balance average grades and resources is fundamental in mine development. Another aspect was that developing mines and specifically open pit mines in mountainous terrain depends on the ability to have space for the infrastructure and waste piles associated with mine development. Schaft Creek possessed all these features.

In February the British Columbia government approved the “Northwest Transmission Line” which, when completed, will provide you with the power reguired for the project – tell us a bit about what this means to Copper Fox?

The NTL is fundamental to the development of the large copper deposits located in northern British Columbia including Schaft Creek. Without this supply of electricity, the capital and operating costs would increase which directly impacts the economics of these deposits. The NTL is also good for the residents of northern British Columbia in that it brings environmentally friendly energy to the region and opens the area up to development for other business enterprises as well.

The company has a relationship with Teck, Canada’s largest diversified mining company, can you explain the significance of this relationship to our readers?

Teck has an earn-back right pursuant to the Option agreement entered into in 2002. We have been working with the senior technical people from Teck since early 2010 when we announced that we were proceeding to complete a feasibility study on Schaft Creek. The purpose of engaging Teck early on in the process of completing the feasibility study was to have their input into the feasibility study that is required to allow Teck to make their decision as to their participation in the Schaft Creek project. Teck’s experience in operating open pit mines of the size of that contemplated at Schaft Creek is valuable information that helps makes the feasibility study a realistic and practical study in the contexts of developing the deposit.

In terms of comparables, are there other projects in Canada that compare to the Schaft Creek project in terms of size, grade and composition?

Schaft Creek is a very large project and possibly the largest one in Canada that is undergoing a feasibility study. The work completed in 2010 suggests that a substantial portion of the Schaft Creek deposit has not been tested by drilling. In addition the nature of porphyry deposits suggests that there should be other similar deposits within the same general area. The two large zones of copper mineralization exposed on surface and the large untested chargeability anomaly may represent one or more deposits. Of course exploration will need to be completed to confirm this interpretation. At this time, we do not know what the ultimate resource could be at the Schaft Creek property so it is difficult to make a comparisson with other deposits. But given the geophysical and geological information, I suspect that Schaft Creek may be much larger than the our resource estimation completed in late 2006 suggests.

With a deposit containing copper, gold, molybdenum and silver, please comment of the econimic associated with the project?

The preliminary feasibility study completed in September 2008 showed a -$0.32 to produce a pound of copper net of the sale of the gold-molybdenum-silver credits. This was based on metal prices of $3.12/pound copper, $692/oz gold, $33.00/pound molybdenum and $13.09/ozs silver. The current metal prices for three of the four metals are substantially higher than those used in the 2008 calculations and this increase/decrease will be included in the feasibility study currently underway. The sale of four metals from each tonne of rock processed show the economic impact on the cost to produce a pound of copper which substantially impacts the overall economic performance of Schaft Creek.

What major milestones is Copper Fox working towards completing in 2011?

Our near term major milestones are; to complete the updated resource estimation which is expected to be completed shortly, commence the 2011 program at Schaft Creek before the end of May and complete the balance of the work required to complete the feasibility study as soon as possible. A substantial amount of work has already been completed on the feasibility study to date. Due to the large amount of technical data and studies that need to be performed it’s not easy for the independent contractors working on the feasibility study to give Copper Fox a specific date on which the study would be completed. One of our main objectives at Schaft Creek in 2011 is to test the three targets identified above – any one of which we believe could be another previously undiscovered deposit.

This interview appeared in 10 Base Metal Stocks to Watch – Part 4 – CLICK HERE – for the article.

What does an experimental electronic music band from the UK called The Shamen have to do with Copper Mountain? Admittedly, that is a very difficult question. The Shamen’s first (and only) top 40 hit in the U.S. was released during the summer of 1991 and could very well be the perfect theme song for Copper Mountain. That song was “Move Any Mountain” and that’s what Copper Mountain is about to do – all the way to Japan.

The company owns 75% of the Copper Mountain mine, and their Japanese partner, Mitsubishi Materials Corporation, owns the other 25%. The 18,000 acre mine site is located 20 km south of the town of Princeton in southern British Columbia. The mine has a resource of approximately 5 billion pounds of copper and the project is fully financed and nearing completion. Pre production mining activities are underway and the mine is set to enter production next month to produce approximately 100 million pounds of copper each year. Shares of Copper Mountain have performed well over the past 12 months moving from $2.70 last May to $6.78 per share today.

The mine will utilize conventional crushing, grinding and flotation processes and equipment. Once the copper concentrate is produced, it will be shipped to one of Mitsubishi Materials’ existing copper smelters in Japan: first, by rail to the port of Vancouver, and then by ship across the Pacific Ocean. B.C. Minister of Transportation and infrastructure Shirley Bond recently stated, “This really shows how the Pacific Gateway is the best transportation route for Asian businesses.” And, “Mitsubishi Materials Corporation invests in the B.C. Copper Mountain Mine to get the copper concentrate they need, knowing that the best way to ship it is through the Port of Vancouver.”

MiningFeeds.com connected with Jim O’Rourke, Copper Mountain’s President & CEO and 2005 recipient of the Edgar A. Scholz Medal for Excellence In Mine Development in British Columbia and the Yukon to find out more about the company as it nears production.

After years of development you are quickly approaching your June target to have the mine in production. What does the production schedule look like?

The commissioning of processing equipment is progressing well. The primary crusher and conveyor system to the coarse ore stock pile has been tested and is also operating well. The commissioning team is currently active in the concentrator building and the start up is on schedule for production in June.

Preproduction mining is advancing well with major equipment fully operational and stock piling ore for the concentrator start up in May. We are currently mining at a rate of 100,000 tonnes per day with the planned mining rate to increase to 160,000 tonnes per day.

Once the copper concentrate is produced you plan on shipping it to your partner Mitsubishi’s smelting operations in Japan – how does one go about shipping 100s of millions of tonnes of ore half way around the world?

Copper and precious metals are contained in a concentrate which are produced at the mine for shipping to Mitsubishi. The 185,000 (annual) tonnes of concentrate is trucked to the port of Vancouver at a rate of approximately 500 tonnes per day. The concentrate is then stored at the Vancouver Port and shipped in approximately 12,000 tonne lots to the smelters in Japan.

Have you determined the costs per pound of copper associated with shipping the concentrate?

Total offside cost for moving concentrate to the smelters in Japan is approx. $110 per 1 metric tonne of concentrate which equates to about $0.18 per pound of Copper.

What are your overall costs factoring in the silver and gold net precious metal credits?

Our published cost is estimated at $1.30 per pound of copper, net of precious metal credits which vary depending on metal prices and foreign exchange rates.

In what month will Copper Mountain see cash flow from operations?

Because of our favourable agreement with Mitsubishi Materials Corporation, we expect to have a shipment in late June or early July and receive a provisional payment for 90% of the concentrate shipped.

After you put your first and only project into production, what’s next on the horizon for Copper Mountain?

We continuously take an entrepreneurial approach to evaluate other potential projects, companies, and mergers and acquisitions that may add shareholder value.

This interview appeared in 10 Base Metal Stocks to Watch- Part 3 – CLICK HERE – for the article.

Zinc, the fourth most used metal on the planet trailing only iron, aluminum and copper, has a worldwide annual production of roughly ten million tonnes. Zinc’s primary use is in the galvanizing process of steel and in making alloys including brass and bronze. Although zinc doesn’t get anywhere near the same amount of attention as its sexier cousin copper, that may begin to change. China’s refined copper imports fell 43 percent in March year over year due to high stock piles and strong international prices while their Zinc imports surged 108 percent over last year.

In November 2006, Zinc prices hit a record high of US$4,580 tonne. At the time, analysts cited that the growing demand for zinc in China could increase by 56% by 2010 which certainly helped fuel the fire. China became a net importer of zinc in 2004. With the onset of the “Great Recession” in 2008 the price of zinc declined dramatically to just above $1,000 per tonne, far below the bullish projections a few years earlier. But in the first quarter of 2009, as marginal zinc mines were being shut down all over the world, zinc began a swift and steady recovery, reaching US$2,560 per tonne by the end of the same year, just slightly higher than where it trades today.

Today, China produces about a quarter of the world’s zinc and consumes a third of it. And overall, Zinc consumption in China has tripled since 2000 – China consumes more zinc than USA, Japan, India, Germany, Italy and Belgium combined. Some analysts, however, believe this time China’s demand for zinc will continue unabated. This, coupled with demand from other emerging nations around the world is expected to push consumption to 15.5 million tonnes per year by 2020.

Peeyush Varshney, President and CEO of TSX-V listed Canada Zinc Metals is solidly in this camp. In August, 2005 Canada Zinc Metals entered an earn-in option agreement for 65% of its Akie property. A few years later, in 2007, the company acquired 100% of the Akie property and their entire claim package pursuant to a takeover. The next year the company completed its first NI 43-101 report on the Akie property. Soon after, China came calling in the form of Tongling Nonferrous Metals Group which subsequently made a substantial investment in Canada Zinc Metals. MiningFeeds.com sat down with Peeyush Varshney, President & CEO of Canada Zinc Metals to find out more about the company’s Chinese shareholder and what else is in store for 2011.

Your main project is the Akie zinc-lead-silver deposit in B.C., Canada. Could you give us an overview on the region?

The Akie deposit, and in fact all of our property holdings, are located in the highly prospective Kechika Trough which is the southern-most portion of the Selwyn Basin. This basin is host to several of the world’s largest zinc-lead deposits and is one of the most prolific zinc-lead districts on the planet.

What is the existing infrastructure in the region and how might this benefit the company down the road?

The infrastructure around our Akie deposit is relatively advanced. Akie is situated just above B.C.’s largest lake, Williston Lake, home to the largest hydro-power plant in the province. In 2008, we completed the construction of a road to the deposit. The roads connect to the town of Mackenzie (260 km to the south) where there is an existing rail line which could be utilized to haul concentrate. From Mackenzie we could transport the concentrate to Trail, British Columbia, where Teck Resources has a zinc smelter; or, transport the concentrate to the deep sea port of Prince Rupert on the west coast of B.C. From there, the concentrate could be loaded on to ships and transported to smelters in Asia.

You finished your NI 43-101 resource estimate in 2008, what is the resource estimate on the project and do you see further exploration upside?

Using a conservative 5% zinc cut-off grade, the deposit has an inferred resource of 23.6 million tonnes of 9.1 % combined zinc + lead (7.6% zinc, 1.5% lead) and 13 grams per tonne silver, this equates to 3.95 billion pounds of zinc, 780 million pounds of lead and 8.95 million ounces of silver. The resource calculation from 2008 only includes the drilling we did until the end of 2007. It does not include the drilling done in 2008 or 2010. The Akie deposit remains open in all directions so the resource could certainly be much larger than our current 43-101 calculation.

You have some notable shareholders in the company, could you tell us about them and what it means to the company?

Tongling Nonferrous Metals Group currently owns approximately 35% of the Company. Based in Tongling, Anhui Province, Tongling is a state-owned company and one of China’s largest copper smelting companies. Tongling is involved in exploration, mining, ore processing, smelting and refining; and, processing of copper, lead, zinc, gold, silver and other non-ferrous and rare metals. We were contacted by Tongling in the summer of 2008, they visited the Akie deposit and made an investment in the Company.

Lundin Mining is also a strategic shareholder of the Company – they have participated in several of our private placements and hold approximately a 5% equity interest.

Along with the Akie deposit, our significant prospective land package in the Kechika Trough represents a potential long-term development opportunity for both Canada Zinc Metals and major mining companies. Our properties could potentially provide zinc-lead concentrate for several decades to come.

What are your plans for the remainder of 2011?

Our primary objective this year is to continue doing the work required to advance the project to the completion of a preliminary economic assessment and pre-feasibility study. Currently, a geotechnical drilling program is taking place on the Akie property. From this information, we will submit an application to the government to allow us to proceed with an underground exploration program. We also anticipate a new surface drill program to test some very high priority targets elsewhere on the Akie property.

On a corporate level, we are continuing discussions with several large base metal mining companies that have shown interest in our Company and our extensive property holdings.

This interview was featured in 10 Base Metal Stocks to Watch – Part 1 – CLICK HERE for the article.

Disclosure: at publication Canada Zinc Metals is a client of MiningFeeds.com.