Executive Chairman Ivan Bebek and his team at Auryn Resources have already built and sold two successful exploration companies. But now they are convinced that they are on the cusp of two potential world-class discoveries that will far exceed their previous successes. In this interview, Ivan shares how Auryn assembled a top-notch technical and management team who have been able to locate and now pursue what they believe could turn out to be massive discoveries at their Committee Bay project in the Arctic and at their Sombrero property in Peru. Ivan discusses in detail not only the prospective nature of these projects, but also how he plans to fund up to four years of aggressive exploration with no shareholder dilution. Auryn Resources will see steady news flow throughout 2019, so this is an exploration story worth following.

Bill: Welcome back, and thanks for tuning into another Mining Stock Education episode. I’m Bill Powers your host. Joining me today is Ivan Bebek, executive chairman of Auryn Resources. Auryn is currently looking at numerous potential catalysts in 2019, so this is a story that you’ll definitely want to pay attention to. Auryn trades on the TSX and NYSE American under the ticker AUG. Fully diluted the company has under 97 million shares out with a current market cap of a little under US$100 million. So with that being said, Ivan, welcome to the podcast.

Ivan: Thank you so much. Pleasure to be here.

Bill: Ivan, as you know, we were able to meet in person at Minds and Money Toronto last October and we talked, it was supposed to be for 25 minutes, we ended up speaking for an hour and 15 minutes. And during the course of that conversation, we talked about one of your key projects, Sombrero, and you really got me excited by just the confidence and the belief that you’re onto something world class here. You’ve already built and sold two successful mining companies. I’d like to start off with you sharing regarding the anatomy of making a world class discovery. What does it take? You’ve done it twice, but this one seems to be even bigger with Auryn right now. What does it take to put together a team that can really pursue a world class discovery?

Ivan: Well thank you very much for having me on here, it was nice to meet you back in Toronto. So the anatomy of a team, it sounds easy once it’s done, but it’s actually not. We’ve been working together as a group for 13 years. My partner Shawn Wallace and myself, we started Keegan, we found 5 million ounces of gold in Ghana, West Africa that’s producing 10 million ounce gold mine. We did that with a really small team and we did that as our inaugural company to prove ourselves. We evolved as we went along, as you would, and I would say the main ingredient of creating a great team is success. And so finding 5 million ounces of gold was the first success.

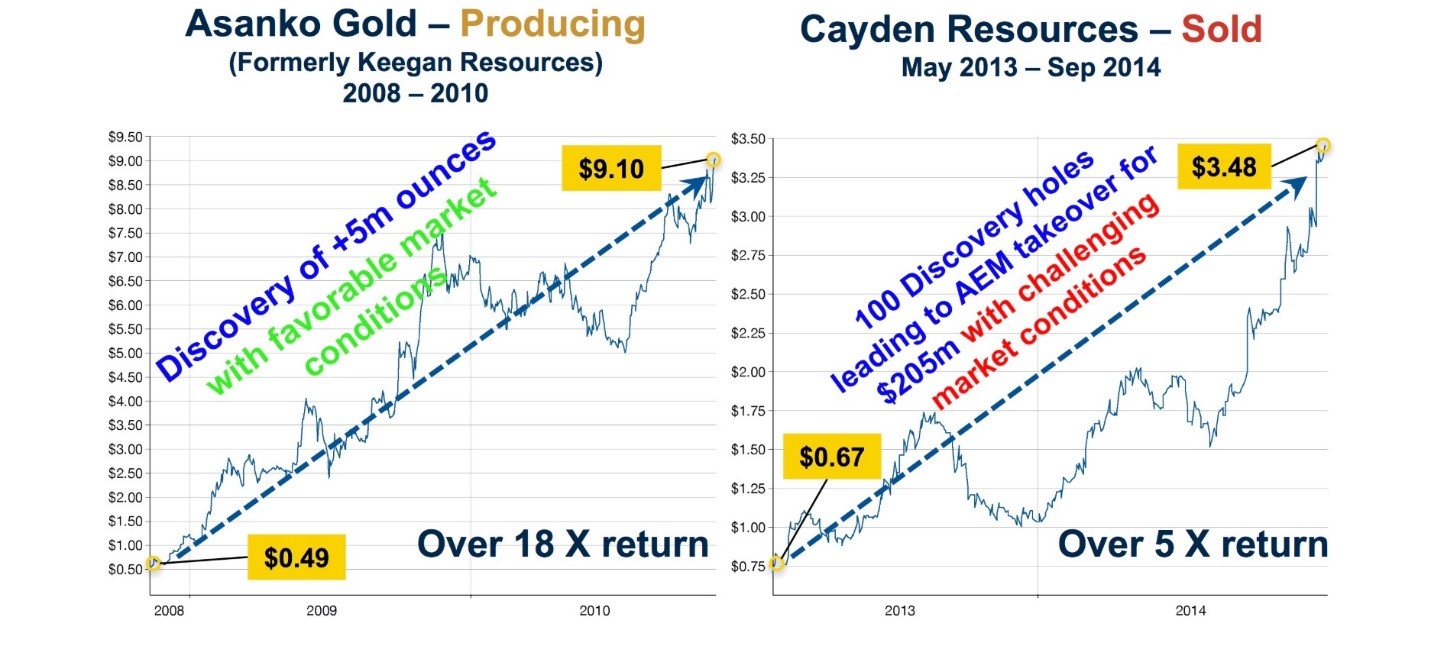

We then poured into another exploration opportunity and we tried to improve on what we did with Keegan and expand that team and that’s where we came up with Cayden and where we sold it to Agnico Eagle for $205 million in 2014. Both share prices performed extremely well for shareholders. The first company went from $.49 to $9 per share. The second one went from $.67 a year before the takeout, to a $3.50 takeout share price, which doubled if you held shares Agnico for 14 months later.

So not only did we attract a lot of these really high-quality geologists, Dan McCoy, who is our key geologists that brought us into Keegan and Cayden’s assets, he’s the gentleman who recruited these Newmont gentlemen, Michael Hendrickson and Dave Smithson and are leading the charge for Auryn. So we had technical success. We impressed our own geologists with our financial capabilities and then we had market success, which gave us the ability to raise a lot of money which being over $600 million since 2005 in combined good and bad markets, which is a fairly impressive number if you followed the last decade of mining stocks and whatnot.

So that comes down to how we came together with Auryn and how this anatomy of going after these major world-class discovery exists. And this is where we took him,. The gentlemen Dave Smithson and Michael Hendrickson, both from Newmont, Michael Hendrickson was a former structural geologist, Dave was the former global mapper. They were imperative on the Cayden sale. These gentlemen brought a bunch of world experts from Newmont, including the former chief geologist of Newmont, Antonio Arribas, who’s on our board, Antonio was also the VP of Geosciences for BHP, a $140 billion base metal company today. Anyway, these guys brought in some of these world experts; about six in particular, They all have different expertise, different backgrounds. So it’s not one geologist that’s doing every element of the science is each guy has done his own science as an expert and they work together as a team.

They found several million ounces for Newmont. They were imperative in our success and Cayden. And when we assembled Auryn we went out and said, “Hey guys, we want to do something bigger than we’ve done before. Five million ounces is great. It made people a lot of money, but we want to have a 10, 20 million ounce discovery or two on our belt and let’s go shopping. Let’s go do this. We have a lot of wind behind our back from Cayden and we’ve made a lot of people money, our ability to raise money is incredible.” And then we had went out and we built a seven project portfolio in Auryn. So first major part of the anatomy is technical team. We earned that through our successes of our first two companies.

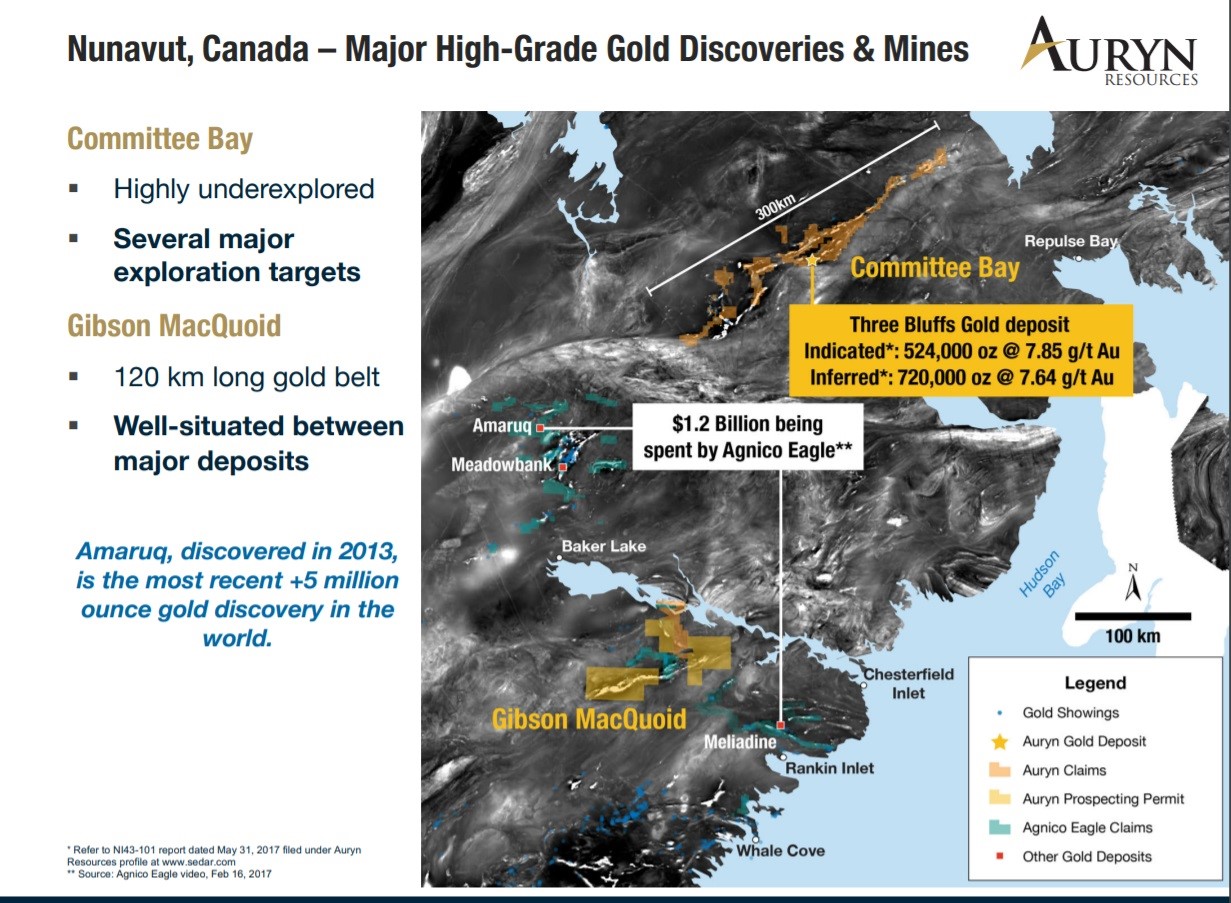

Second major part is the portfolio project and if you remember 2014 when we put Auryn together and started to assemble the company, we went out and acquired stuff that was worth pennies on the dollar. We bought Committee Bay for $18 million. It cost us 13 million shares. That company used to trade at a $200 million valuation as North Country Gold in the last bull market. So these are the kinds of asset buys we were doing and we were buying major district opportunities, large scale, that’s a 300 kilometer long gold belt. And then in that process we met a guy named Miguel Cardozo. Miguel Cardozo is part of our team. He runs our Peruvian operations. Miguel’s credited with the discovery of Yanacocha as a gold deposit when he worked with Newmont in Peru. That’s a 60 million ounce epithermal discovery in Peru that he made where he led the charge of.

So this is kind of the people we got to work with. This is kind of the outlook we went and took on and what we internally described ourselves as intelligently as a junior exploration company with a majors’ exploration team and a majors’ exploration appetite. And so fast forward a few years, we’ve obviously raised quite a bit of money for Auryn, about $100 million to date. Along that path we met Goldcorp and Goldcorp recognized the scale of some of these gold projects and copper gold now with Sombrero coming online, and they came in and gave us $36 million dollars, which was the largest investment by a major into a junior in the entire market I think in the last 20 years as initial investment. So that was a tremendous validation to what we’ve assembled, and we’re now at the pinnacle of two massive discoveries. One being potentially at Committee Bay and the other one down being at Sombrero. And the way I’ve been describing this for the investing audience is I believe as an investor and as an executive with bias because it’s our company, but I’m still looking for something on the planet that rivals the exploration potential both in Sombrero and Committee Bay and I have not found it yet. So I think categorically these are two of the biggest exploration swings you can take as an investors, as an executive right now in the business.

Bill: So you’ve been in this business for 20 years, would you say that Sombrero ranks right at the top?

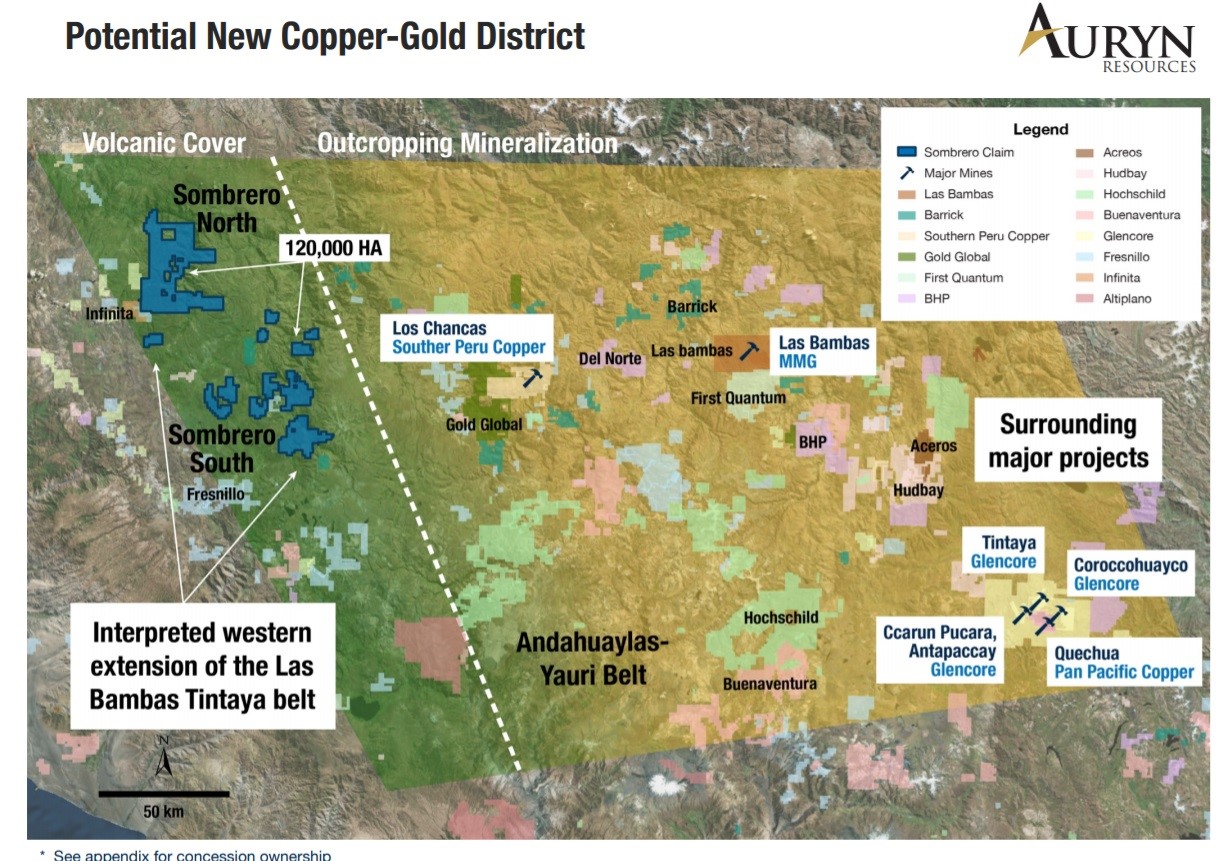

Ivan: I’d say by far, I’ve seen things as an investor, I got to be a shareholder an Aurelian, that was a tremendous discovery in Ecuador. I was a shareholder in Red Back mining, which was the discovery in Mauritania, that 30 million ounce deposit over in Africa. Looking at Sombrero pre drilling, we’re comparing it as an analog and the video on our website does a very good job of doing that to a mine called Las Bambas. Las Bambas is about equivalent of 50 million ounces of gold or $60 billion of metal. It’s copper-moly, we’re copper-gold, and that’s obviously a better factor for us, but the scale of what we’re exploring there it rivals the Las Bambas deposit in size and the more we look, and the more layers of data we take, the more confidence we have that we might be onto a big system like that. And it’s never been drilled before, the evidence is really, really strong and we’re continually signing (confidentiality agreements) on it, something I haven’t talked too much about, but several of the major mining companies around the world have come to us to sign confidentiality agreements so they could get a really close look at this before we start drilling it later this summer.

Bill: An astute investor is going to listen to us talk about the potential and they might ask themselves, well, if the potential is so great, how did MMG or BHP and some others in the region miss this opportunity? And what would be your response to such an investor?

Ivan: Well, my response would be the facts. I think about six different major companies, including the ones you have mentioned have walked on this property before and have taken a look. The first miss, and everyone’s recognizing this across that crowd because all of them have come back to sign confidentiality agreements and there’s obviously dialogue about why they missed it. The government actually mapped the volcanic rocks which cover most of the outcropping mineralizations covered by volcanic rocks. It was mapped at a very young age, that a lot of people didn’t believe would host the deposits next door, people were in a box in this part of Peru, there’s not just Las Bambas, there’s about five major copper-moly porphyries next door within 50 to 200 kilometers away, this major belt. We believe this is the extension of the belt, we believe it was missed because there’s volcanic rocks that cover a lot of the potential mineralization. People thought it was young.

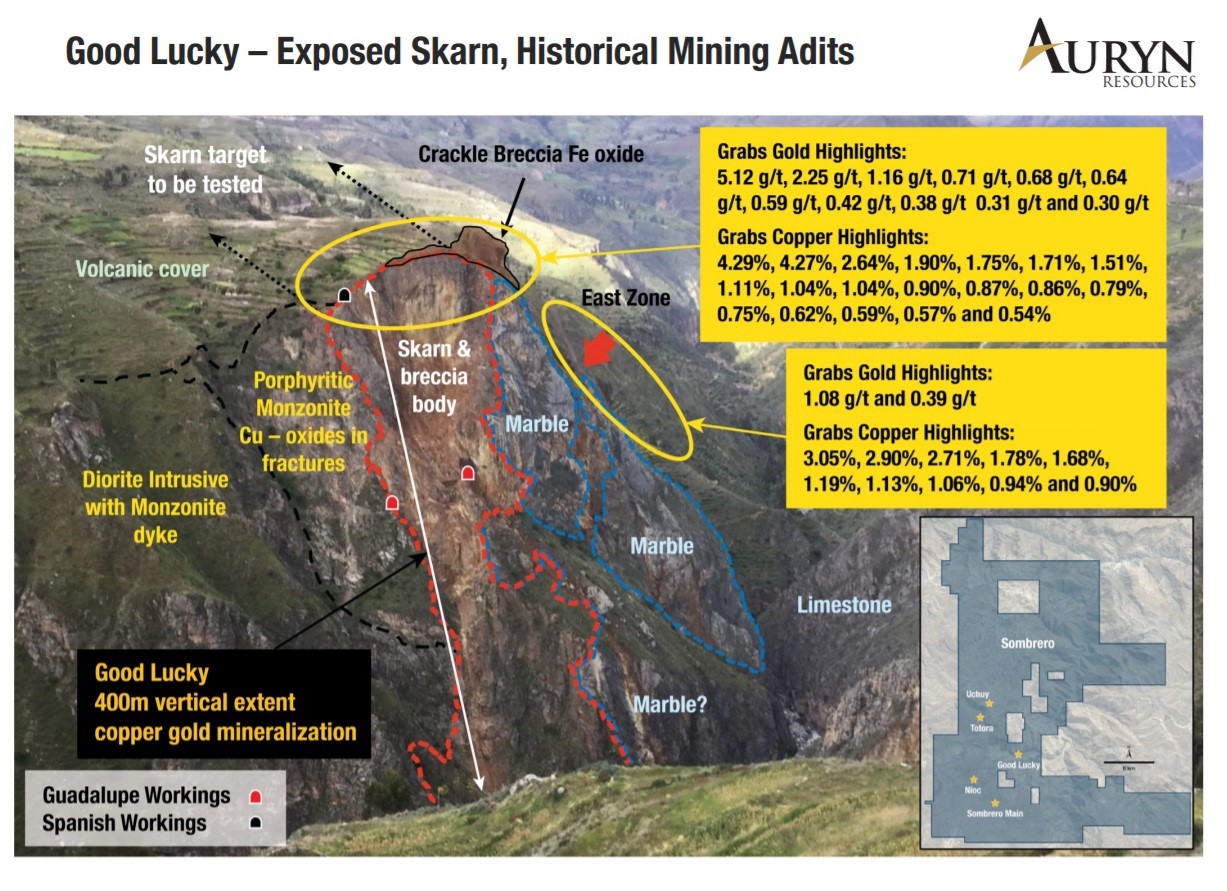

We are the first ever people to pull trenches on Sombrero. We got to pull back the cover, we got to pull back the gravels and we got to sample, one of those trenches ran 109 meters of .7% CuEq. That trench has gaps in it and we just gave ourselves zero in that calculation because we couldn’t sample the whole entire trench, but part of the trench ran 30 meters of 1.93% copper, which is spectacular. What’s even more impressive about that is that we’re trenching in the world of copper, gold porphyries, high grade copper-gold over 100 plus meters width. And that’s truly spectacular. So the guy’s like possibly MMG or BHP or any of the others that have missed this, had they seen these trenches that we’ve been pulling, we’ve got another 150 meters of a half a percent copper gold in another area. We got gold grades on surface up to a 193 grams per ton. We have copper up to 16%. There’s a tremendous metal budget here, there’s plus hundred meter widths of really, really high grade copper and gold being sampled by us. Nobody would have ignored any of this and that’s why everyone’s come to sign CA’s.

The crowd has definitely shifted and our geologists said we went outside the box and I’m going to quote Dave Smithson in here actually, his comment was, “We first came here and nobody liked it because they saw gold but they were looking for copper and we saw hill side on our second visit called “Good Lucky”. You could see on our website or in our presentation a really beautiful section of a hill where river cut a canyon and you could see mining at it in the side of the hill where they were mining high grade copper halfway down a 400 meter cliff. And then we went down to the bottom, we see bornite, which is high grade copper, huge metal for high grade copper if you know the copper world. But people were looking for copper and they were focusing on this project, considering it to possibly be a gold rich project, and obviously that changed dramatically for us and it’s been basically every visit we’ve done on the property since things have gotten better, we found more outcropping mineralization, we found sampled more high grade and a lot of other elements that are really giving us a strong indication this could be a major copper gold system.

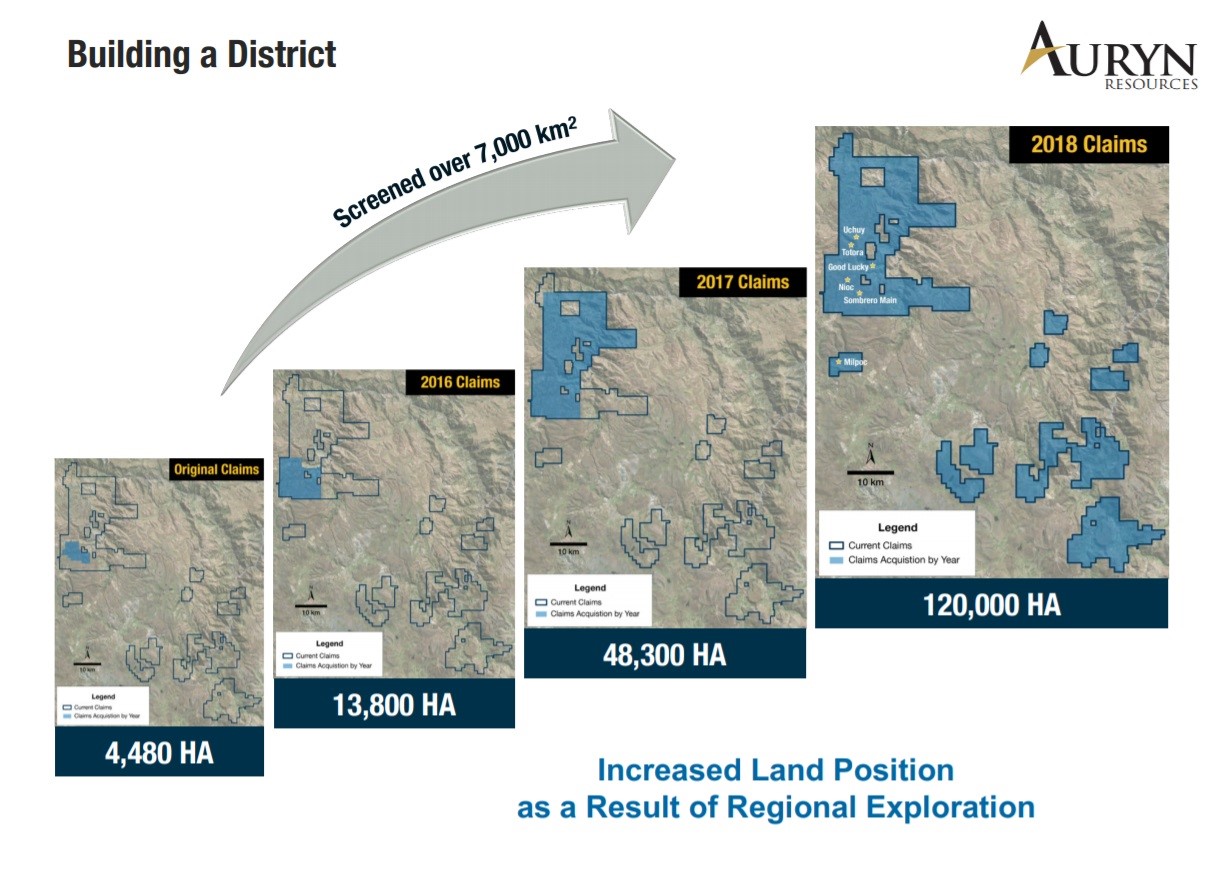

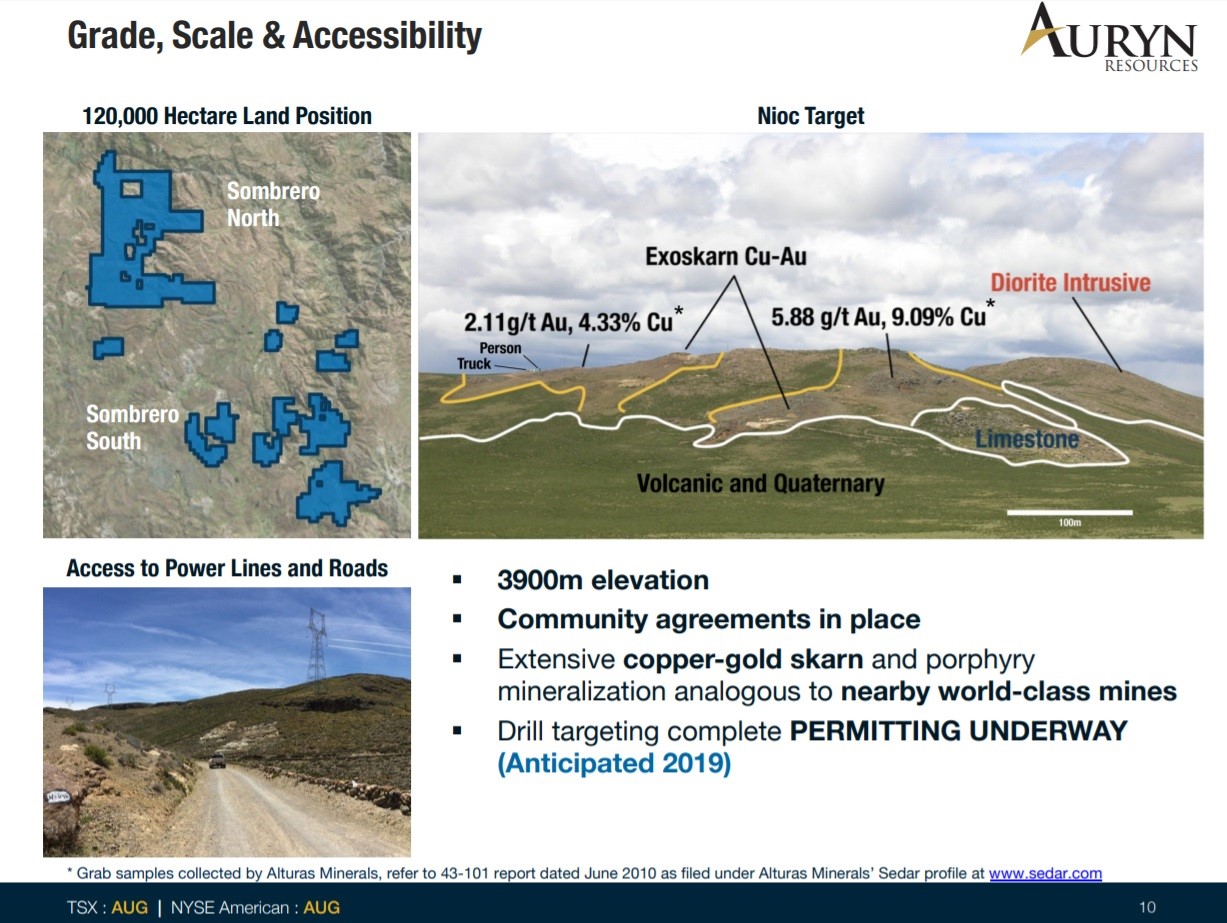

Bill: And after you discovered a lot of these excellent surface results, then you massively increased your land package. Can you talk about that?

Ivan: Yes. So we started with about 5,000 hectors, we got the project from Miguel Cardozo, the gentleman who found Yanacocha as a gold deposit. And we quickly got excited about it because we found copper gold at the edges of our property boundary. So we did what any smart, intelligent, aggressive junior would do, and we start staking ground all around us. We got to about 40,000 hectare land position through the staking. And then our guys, Michael Hendrickson and Dave Smithson, they turned and said, “Hey guys we have this very special way of sampling streams at the bottom of canyons to determine if there’s gold or copper or other metals running off the rocks that are predominantly covered. Can we go screen 8,000 square kilometers?

Jaw drops, that first 8,000 square kilometers, that’s a lot of screening. How much is this going to cost? It costs us about probably about US$700,000 to do this. Obviously we were well financed when we chose to do this, and then we increased our land position to 120,000 hectors. We did this for two reasons, one, first and foremost, because if we got Sombrero right and if this belt continues, that host some of the world’s largest copper porphyry deposits, we want to have as much of that as possible. And the second reason why we did it was we knew when we got on Sombero, everyone’s going to come if we start pulling hundred meter plus trenches of mineralization, which is exactly what’s happened as of now. So we wanted to be first. We were. We wanted to be greedy and we wanted to have the potential, not for one Las Bambas or Tintaya, we wanted multiple of those type of discoveries to be in our land position for the next decade of discoveries. And I believe we’d given ourselves the perfect shot. We got everything we wanted and now we’re comfortable to sign CA’s and let the big guys come in and take a look.

Bill: What is it going to cost to drill this project this year? Can you talk any more about the targets you have and the timeline that investors should look to this year?

Ivan: Yeah. So a couple things, right now we’re in the permitting phase, we’ve applied for 40 drill pads, which gives you a lot more room than the typical 20 you get in an initial permit, it takes a couple more months to get this permit but like I said, we’re in process, we are well on the way, we expect it June/July of this year. It can take a month or two longer, you never know. But right now we’re on track. We don’t see any foreseeable delays.

We’re going to drill 15,000 meters, is our plan on our first path, that will cost us about $5 million Canadian to do that first path of drilling, not a huge cost, we don’t have to worry about having money for that until we get permits later this summer. We’re about to resume trenching, we’ve only trenched and sampled one of five major centers that could be standalone flagship company making assets. So we’re about to get our trenching resuming to go on trench number two, number three, number four, number five, so by the time we’re actually drilling, we will have had five major centers all sampled, ready for permitting and drilling.

And so we’ve got our hands full, we’re going to have a lot of news for the market in terms of trenching these new areas. You kind of have to listen to the punchline, we’re comparing ourselves to Las Bambas and were saying that this thing could be as big as Las Bambas and we’re only on the first of five major targets, so we’re going to be following that up here quite shortly with trenching to show a bunch more things that could also be big discoveries like that. So perfect case from an exploration investor’s perspective, you’re waiting for drill permits while you keep adding more huge targets to the equation.

Bill: What about your relationship with the indigenous people and is there any infrastructure nearby?

Ivan: Yes. So a couple of things there. The local communities we took our time with them, we are under the guidance of Peruvians, Miguel Cardozo’s managing them. Instead of rushing, trying to get the drill bit out, we built really strong relations, took us about a year for the first major community agreement and that one’s been working out really well since we’ve done that. The second one has taken us just over two years and we’re just collecting signatures now, so it’s in the phase of being complete.

I’ll say one comment about Peru and communities, this is one of the major risks that can come up for any company that’s operating there, we came into Peru with a different project and the first thing we did before we took any samples off the ground was bringing a million dollar water program to bring water and irrigation to their fields. We spend about $240,000 over four years and then we brought in an NGO to come in and pick up the balance to do that. So what I heard when we first got to Peru and what we heard as a team was the people who came in the last bull market came and gave everybody money, but they left and there was no sustainability factor. Money was spent and communities, we’re a little bit upset in some areas of Peru.

So our theme as a group, as action before words. So we come in there and we started doing things for the communities before we start talking and making promises and stuff like that along the lines of what we will do. And so we’ve covered that part incredibly well. The second part of your question was asking me about the infrastructure. Since we’ve had the Sombrero project, and we like to think the government was foreshadowing the discovery because they built high tension power lines over the edge of our property. We have power for a major mine at our project. There are roads right into the project. There are two towns with about 800 people peripheral to the project, not on top of it, nobody has to be moved but nearby where we’d have a local workforce. We’re only at 3,900 meters elevation. People mine up to 5,500 meters elevation in the Andes. And so it’s reasonable an elevation, you have a road to the project, you have a power source which generally is a major cost factor.

So we have to think about, when I say all of those things, to answer your question, it’s profitability. Couldn’t be a better scenario. The only thing that could improve this would be a railway and if you go and google “Las Bambas railway”, you see there’s a lot of talk about one that’s nearly approved to be built from Las Bambas and all these other major nearby mines to the coast, which would be a tremendous add onto us. It’d be perfect infrastructure from all aspects.

Bill: You had told me back in October that you plan to aggressively pursue Sombrero as well as Committee Bay, which we haven’t spoken about yet, but how do you expect to fund this program?

Ivan: Yeah. So were we had $2 million in January last month, is how we started the year. That will take us into May before we need any more money. If you listen to me or any of my colleagues on the road right now, we’re not looking money, we’re going to be marketing our company to create awareness about the opportunity. And sharing the trenching and about the Committee Bay, which we’ll talk about in a minute. But we’re not looking for money because we have seven projects, two of them we’ve been very public about, are ones we’d consider selling if we got the right prices for them. And one of them is two years into the negotiation, the other one’s about a year and a half, so we’re at very mature stages of potentially one of these two things happening before we have to say the word “financing” again.

Conservatively, one of them would give us one year of drilling and working capital, is what we anticipate. If we sell the other one, we might end up with a combination of about four years of aggressive drilling and working capital to go out there and not have to say the word “financing” for four years would truly be spectacular for us with these kind of big projects on the deck.

Bill: If you were to sell both of them in the near term, what do you think that would do to your market capitalization?

Ivan: Oh, well, 90 million shares out issued and outstanding, the price I would speculate we net would probably be about 70 or eighty cents per share in cash, which can give you about $40 million for two of the biggest exploration swings globally, Committee Bay and Sombrero. I think there’d be a dramatic re rate on us, there’s a value to speculation about what you might drill. We saw a market cap of $250 million twice before we went to drill Committee Bay, which we haven’t even talked about yet. Now we have Sombrero online as well. Multiple projects takes away the risk, the obvious nature of the mineralization at Sombrero is going to allow people to speculate pretty aggressively. What would you pay in terms of share price as an investor to have a seat at a table where you’re taking a $60 billion swing? Finding a ball of metal in the ground with tons of indicators, big company signing CA’s, third party validations all over the place. What would you be wanting to pay if you might find something worth that much money?

Las Bambas was sold for $8 billion back in 2014, the same year we sold Cayden so middle of the bear market. I believe $6 billion was the metal content of a $60 billion ball of metal in the ground. So we have 90 million shares out, we have about $100 million market cap, we’re looking to raise about $60 to $70 million net of taxes from asset sales. I think you’d see much more than a double before we went drilling. That would be my speculation with the ability to drill for three or four years without saying the word “financing” in a rising commodity market, it would be spectacular

Bill: And if the sales didn’t go through, I know there’s a newsletter writer that I follow and he recommends your company just for the fact that you’re able to raise money easily.

Ivan: Yeah. So we’ve raised $600 million. As an insider in the public markets, I’ve bought 3.2 million dollars of Auryn shares in the last three and a half years, as high as $3.70 Canadian per share and as low as a $1.15 per share Canadian. My point there is not only do we have the ability to write a check into our own company and we’ve obviously done that, we have a tremendous following with investors. We’ve made a lot of money over the years. The money we need for one year of drilling both projects and working capital is probably around $15 million Canadian and we could get that this week if we wanted it. But we are extremely anti-dilutive. We are a very large shareholders, we own 15 percent of our company and we treat our company as investors would want to treat their own company in terms of dilution and financing.

So in that equation, with the ability to write our own checks into our own company, gives us a tremendous opportunity here to really deliver a very robust share price return by staying away from the market, from financings. If those assets sales take longer, that’s the consequence I think, not happening but they’ll happen eventually, then we would likely do a really small funding, a non-brokered private placement for $5 million which would cover trenching in Peru and G&A so that we could wait for better metal prices to get more out of those transactions. But to be honest, we’re sitting here in February, I’m marketing all month, we’re going to PDAC, we’re marketing in Europe and everything we’re doing, it doesn’t have the word “financing” attached to it. It’s just creating awareness on the opportunities that Sombrero and round five up at Committee Bay.

Bill: I was watching your share price movement and right after the Vancouver conferences in January, you saw a nice spike.

Ivan: Yeah, that’s just the crowds, we had just started talking about Sombrero. Vancouver two weeks ago was week one, we were just in California for a week, we’re in Florida next week, we are going to go through our global network and being around this business and as a group for about 13 years, we have a lot of investors to show how big the opportunities are at Sombrero and how mature we’re getting with the potential discovery at Committee Bay, underpinned with two potential asset sales that are nearly imminent to take place. So that’s what we’re excited about, that’s why we’re going out there and truly out of everything I’ve seen in 20 years, Sombrero is number one on my list and I’m going to tell the whole world about it because everybody should, who has ever bought an exploration stock should be watching the story.

Bill: Your other flagship project is Committee Bay, you’ve been at that project for four years and you’ve spent $50 million on it. What can we expect in 2019 with this project?

Ivan: So great question came up to me the other day and the question actually was you’ve been there for four years, you spent over $50 million dollars, I believe we’ve drilled over 250 holes on the project, we’ve taken over 400,000 till samples along a 300 kilometer long belt, which has gold shedding on one side to the other. And so that all being said, that’s a lot of work, where is the deposit? And you guys have the Newmont exploration team, how come you’ve spent all this money and haven’t found it? In the middle of the belt, there is a deposit, 1.3 million ounces of about eight grams per ton, but the belt is covered 95 percent by till, the whole belt is covered by till meaning there’s five to 40 meters of dirt on top of the rocks and you’re up in the Arctic, so glaciers have moved over these rocks or the dirt on the rocks. It’s not easy to find these things or we would have never been able to acquire it ourselves.

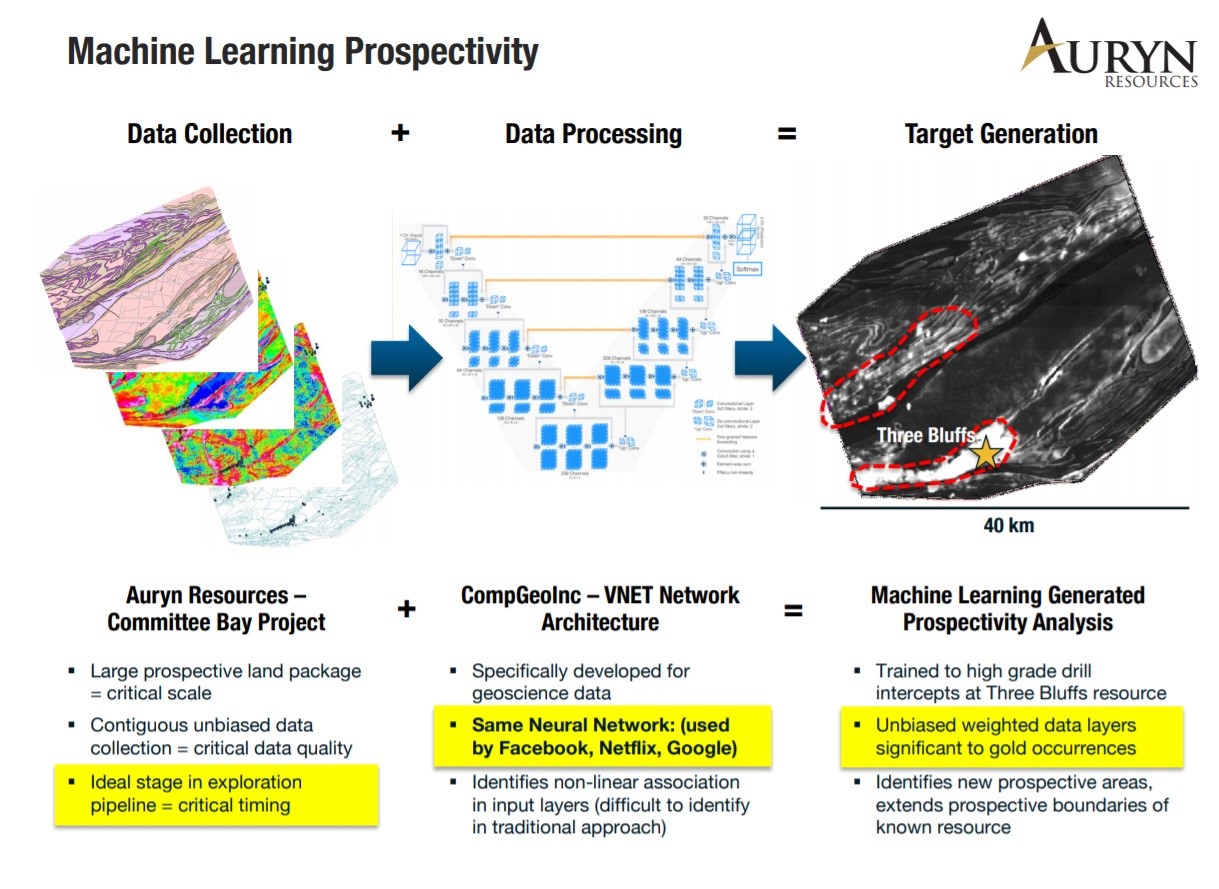

The comment I got was when you guys walk away from this project, and most certainly wouldn’t do it for another five or ten years because you have 18 targets along this big belt to go test, which is going to take time. Where the guys are at now is they’ve brought in machine learning to process all that data on the entire belt. And one of our Newmont geologists has met up or partnered up with a technical specialists, we’ve had a press release about this and it’s truly amazing what they’ve done. And first of all, the data inputs are extremely high quality of the way we take samples, the way we assay samples, the world experts formerly with Newmont that are inputting the data. So data in data out is obviously a major contributor.

The neural networks these guys are using is the same one google uses as Amazon, Facebook. And if you ever had the experience where you’re on their website, you’re looking at boats or something or tennis rackets or whatever sport you play, or you say it even out loud now you don’t even have to go look at it, and then you get some random marketing email that shows you a bunch of product for sale that you were thinking about or talking about. So imagine that exact same neural network which has been used by google, now you’re putting in geoscientific data. We took three bluffs the deposit, we gave it one third of the high grade at three bluffs and we taught it how to find in that. And then we challenge it to find the other two thirds. And it came out with about a 99 percent accuracy finding the other two thirds.

So in my opinion, it works. In about three weeks, the end of this month, end of February we’re going to have the results of the learning, which is gonna show targets that we’re going to drill this to Committee Bay alongside targets that our geologists have found. But truly the future of major discoveries is either hidden deposits or it is things like Sombrero that were overlooked or it’s contentious land owners that wouldn’t sell to an exploration company prior that finally sell. And I think if you listen to Barrick, Teck and Goldcorp and a lot of these big companies, everyone’s talking about AI platforms coming into mining and the true reason why is the computer that we’re using are the neural network and the ability for it to process data is about a thousand times the capacity of the human brain. So you’re basically saving 20 years of crunching numbers by doing it through a computer in a period of three to six months, and that’s the opportunity there.

The last comment I’ll make on Committee Bay, and this is for all the Committee Bay shareholders that have owned us, that have sold us, that have speculated with us and that can’t get enough of risking their money for Committee Bay discovery, we’ve only physically been on the ground at Committee Bay for about eight and a half months, and so we’ve drilled 250 holes, we’ve taken 400,000 till samples in eight and a half months of physically being on a property and in comparison to Sombrero where we’d been on the ground physically for about 11 months, you have to take that into context of how little time we’ve actually spent at Committee Bay.

And the reason why is we spent about two months at windows of exploration each summer, we’re not exploring through the winter, you could in the right environment of a discovery, you could drill year round. Agnico Eagle’s doing it on this major mine they found next door called Amaruq, but for us, we’ve only been on the ground for about eight and a half months since we’ve had it. We’ve collected all this data and the real discoveries are going to come out of Committee Bay, we think this season. Not only because we’ve learned so much about these deposits we’ve been going after and we feel we’re on the edge of some major discoveries, but we brought in the computer to process all that data that I’ve told you that we’ve just collected.

It’s going to be one of the most exciting drill programs that I’ve been part of with Committee Bay, but also to go test the computer learning, if it’s right, the whole belt opens up again, you have 300 kilometers of gold shedding off a belt. It becomes one of the phenomes in the world to go find major gold deposits and to quantify how hard these deposits are to find too, in those four years that we’ve been going up there so far, nobody else has found a 5 million ounce or better gold deposit. The last major mine in the world found that’s over 5 million ounces of gold is Amaruq, 6 million ounces of six grams per ton, which was found by Agnico Eagle right next to us at that Committee Bay. Nobody has found anything since 2013 of consequences in the gold side of the business that’s being explored. We’re not the only ones, but I’d liked to argue we have some of the best real estate for high grade gold in Canada and a massive copper-gold discovery in potentially in Peru.

Bill: Yeah. And it balances the portfolio, there’s going to be news flow constantly in the years to come.

Ivan: Yeah. So news flow is a main catalyst for all juniors and what we’re looking at for news flow here is the releasing of the AI targeting, Committee Bay targeting, as well as the resuming of trenching in Peru. Those would be two main drivers that drive a lot of speculation towards the summer, but you might see the first asset sale in the coming weeks or month or two. And the second one might be right behind it or they might happen both at the same time.

If you see the gold price performing, expect the asset sales to happen probably a lot quicker. If the gold price goes down, they might take longer, that’s the only way I would say you can wager how long these things might take. But, again, we’re in the very mature discussions of these asset sales and we’re confident that one or both could happen this year.

Bill: Ivan, Rick Rule always teaches speculators that they need to know at least three things that could go wrong with a gold speculative company that’s pursuing a discovery. So the question posed to you as the executive chairman would be, what would keep you up at night? When you look at the company and you look at your projects, what are some things that could go wrong?

Ivan: That’s a really great question, and I’ve had the chance to meet Rick in 2003 and get to know him for the last 15, 16 years. The first answer to that question would be communities in Peru, that’s the obvious one, that’s the easy one. We have a really good handle on that as I’ve been quite elaborate about that and I don’t think there’s any serious risks there at all, but that’s one of the big red flags that someone could throw out and lose little sleep at night.

Second one would be metal prices. We don’t need higher metal prices than today, but if the metal prices go into a massive tailspin, then that would obviously slow us down and we would be conservative with our spend and we wouldn’t get to go drill as quickly as we wanted to because we wouldn’t want to dilute ourselves in that process.

And thirdly, you’ve asked me for three, I’d have to go onto personnel. You don’t want to lose any geologists to something tragic or something else. We have incredible people on our team and I think if we lost part of our technical team somehow that would be something we could recover and repair, but it would be the other thing I don’t want anything to happen to anybody on a personal basis. There’s no danger in where we’re working, but life is interesting enough in itself, there’s airplanes, there’s all kinds of things that can happen. It was such a remarkable feat for us to put together this group of people as a team. It was such a remarkable feat to put together this portfolio of projects and we don’t want to lose anyone, so those are my three

Bill: Auryn trades under the ticker AUG, you can go on the website. It’s www.aurynresources.com. There you can listen to a Ivan’s lead geologist describing in detail in about a 17-minute youtube video, why they chose a specific targets at Sombrero, it’s very easy to understand for the non-technically trained person to understand the excitement regarding this project. There you can also view the most recent presentation that is up there to see the prospective nature of also Committee Bay, not just Sombrero. Ivan, as we conclude, is there anything else you’d like to share with the listeners?

Ivan: If you’re not going to own us, you most certainly should follow us because I think we have a chance to find the world’s biggest on two different projects.

Bill: Well, I appreciate the conversation. It was a pleasure meeting you in person. And we’ll be talking to you again throughout 2019.

Ivan: Thank you so much. Appreciate it.

by Bill Powers

ABOUT THE AUTHOR:

Bill Powers is the host of the Mining Stock Education podcast which interviews many of the top names in the natural resource sector and profiles quality mining investment opportunities. Bill is an avid resource investor with an entrepreneurial background in sales, management, and small business development. His latest interviews can be found at MiningStockEducation.com.

If you would like to receive our free newsletter via email, simply enter your email address below & click subscribe.

CONNECT WITH US

Tweets

Tweet with hash tag #miningfeeds or @miningfeeds and your tweets will be displayed across this site.

MOST ACTIVE MINING STOCKS

Daily Gainers

Arctic Star Exploration Corp. Arctic Star Exploration Corp. |

ADD.V | +100.00% |

|

ADD.AX | +50.00% |

|

GGL.V | +33.33% |

|

CASA.V | +30.00% |

|

MTB.AX | +20.00% |

|

TAS.AX | +20.00% |

|

BEA.V | +20.00% |

|

SXL.V | +16.67% |

|

PGM.AX | +16.67% |

|

SGU.V | +16.67% |

Articles

FOUND POSTS

Chile’s Year-End Copper Windfall Signals Mining Recovery

January 10, 2025

Oman Resumes Copper Exports After Historic 30-Year Gap

January 7, 2025

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan