ATAC Resources (TSXV:ATC) has commenced its maiden drill program at the Catch Property in Yukon, Canada, and has announced surface exploration results. The company has received prospecting, soil sampling, and Induced Polarization (IP) results from the 2022 Phase 1 exploration and commencement of a Phase 2 maiden drill program.

The results from the Catch Property have allowed ATAC to identify and define multiple drill-ready targets that can be included in the campaign. Additionally, there are numerous soil anomalies that the company has yet to follow up on, which indicate that Catch could be a significant new grassroots copper-gold discovery. Planned drilling for the campaign is expected to begin in the coming days.

Highlights from the initial exploration are as follows:

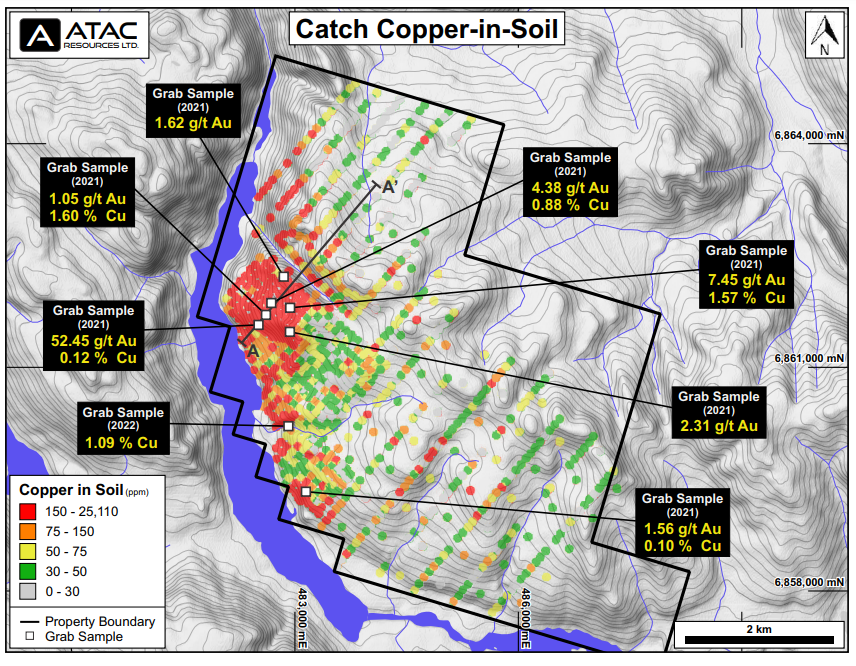

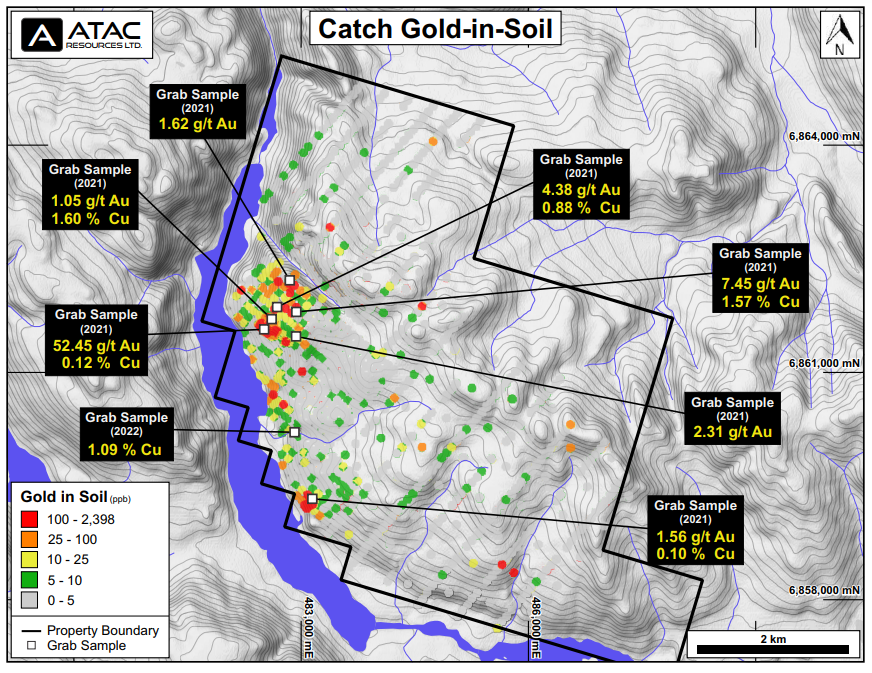

- Primary copper-in-soil anomaly extended by 1.5 km to total of 5 km x 500 m, with multiple additional target areas identified (figures 1 & 2);

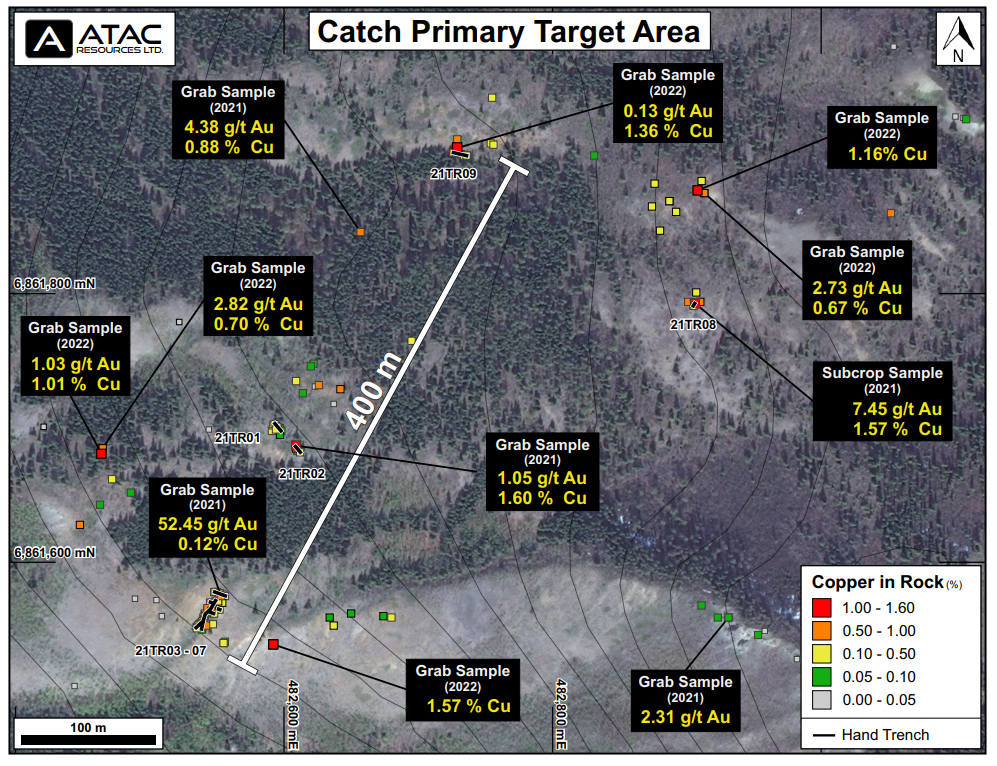

- Widespread copper mineralization observed at surface in the primary target area, with grab samples (figure 3) returning values including:

- 1.57% copper;

- 1.01% copper with 1.03 g/t gold; and

- 0.70% copper with 2.82 g/t gold;

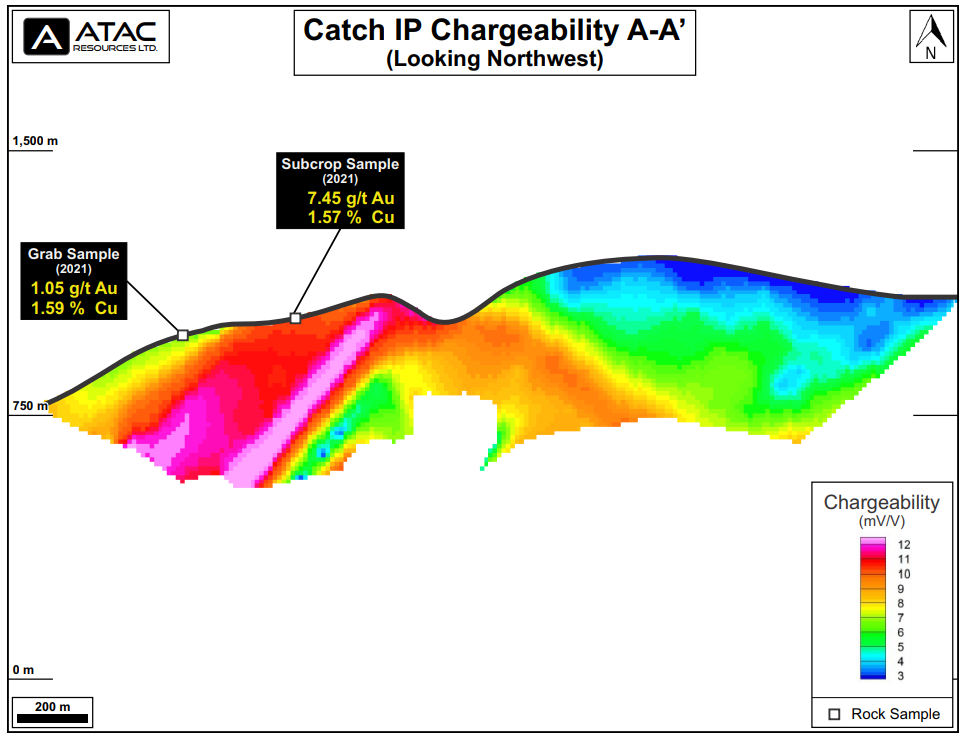

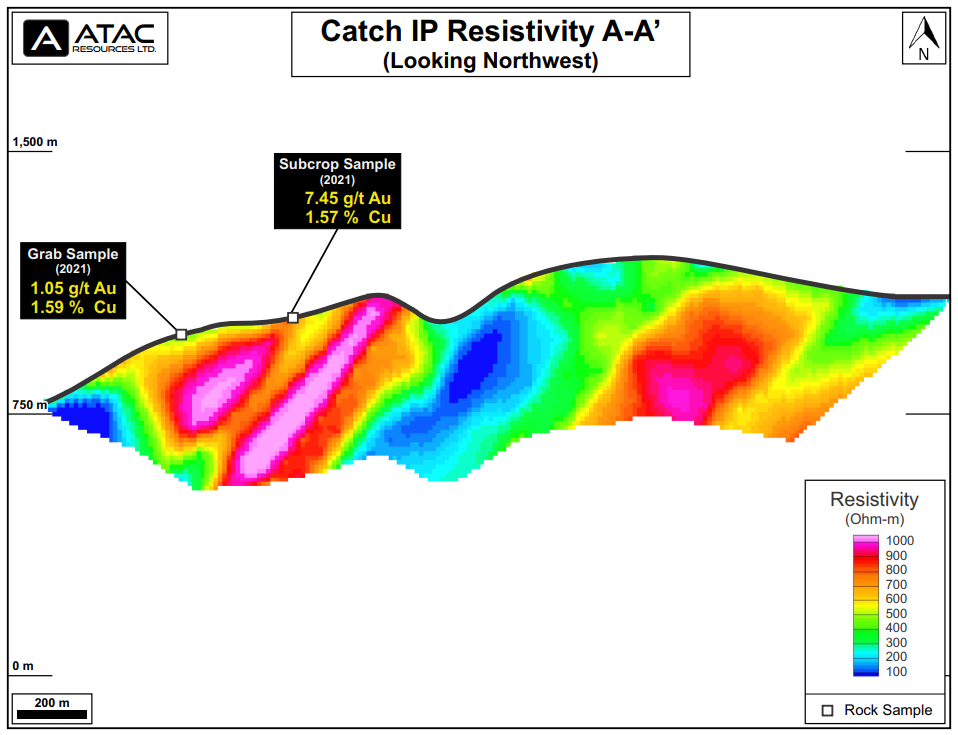

- IP surveys returned a 1,000 x 600 x 400 m chargeability and resistivity high coincident with high-grade surface samples (figures 4 & 5);

- Phase 2 maiden drill program at the Catch property has commenced, with up to 1,500 m of reverse circulation (“RC”) drilling to test priority coincident geochemical and geophysical targets; and

- Outcrop sampling 1.5 km south of the primary target area returned 1.09% copper in an area that has seen minimal sampling (figures 1 & 2).

Graham Downs, ATAC president and CEO, commented in a press release: “We are very impressed with the results we have seen from Catch so far. We’ve already defined multiple drill-ready targets, with numerous soil anomalies yet to be followed-up. This has all the hallmarks of a significant new grassroots copper-gold discovery, and we look forward to drilling the first ever holes on this property in the coming days.”

Exploration Summary

Phase 1 exploration at Catch consisted of prospecting, mapping, soil sampling and geophysical surveys. A total of 50 rock samples and 359 soil samples were collected. 10.1 line-km of IP and 49.3 line-km of ground magnetics and very low frequency surveys were completed.

Broad-spaced soil sampling (100 x 500 m) extended the primary copper-in-soil anomaly by 1.5 km to the north, to a total of 5 km x 500 m in size. Additional areas of anomalous copper-in-soil were identified outside the main target area and provide compelling targets for Phase 2 prospecting work.

Figure 1 – Catch Copper-in-soil

Rock sampling extended areas of known mineralization at surface. Hand pitting 100 m north of Trench 8 yielded a sample returning 1.16% copper. Follow-up sampling at Trench 9 yielded a sample returning 1.36% copper with 0.13 g/t gold. Sampling 135 m west of Trench 1 returned 1.01% copper with 1.03 g/t gold from a hand pit. Sampling 50 m east of Trench 7 returned 1.57% copper. Apart from the follow-up sampling at Trench 9, all of these samples are from new mineral occurrences within the main target area, significantly extending known mineralization at surface. The primary anomaly area remains underexplored and numerous additional targets will be evaluated in Phase 2 work.

A separate copper-in-soil anomaly located 1.5 km south of the trenching area returned 1.09% copper from outcrop in an area that remains underexplored. This area and additional soil anomalies located further south and east will be evaluated in Phase 2 and future work.

Figure 2 – Catch Gold-in-soil

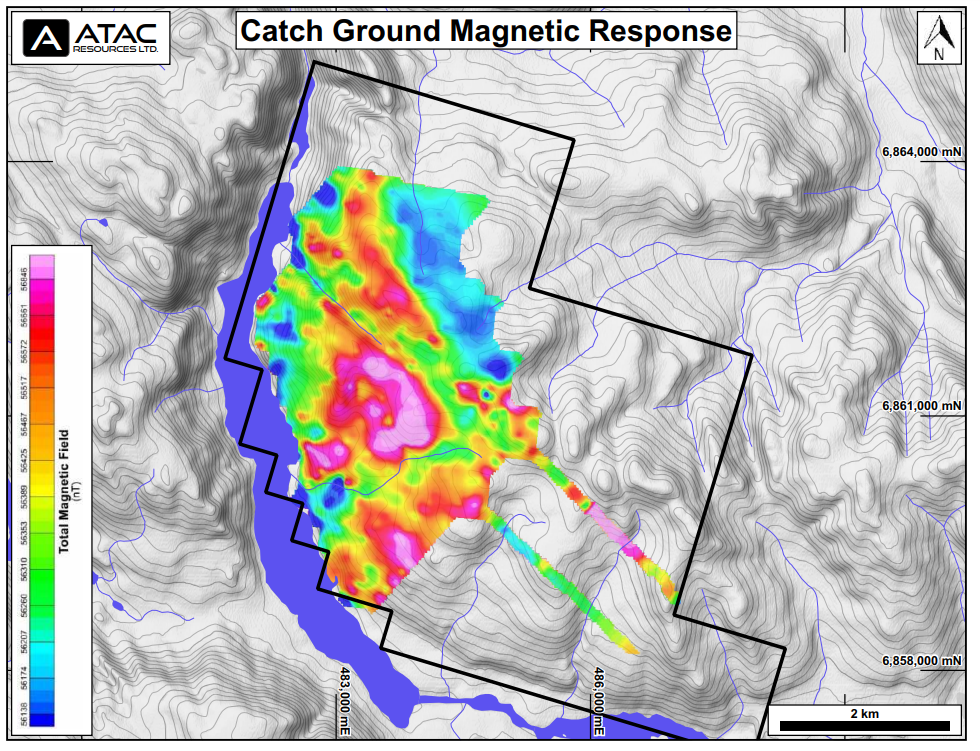

The IP survey returned an open ended (NW-SE), 1,000 x 600 x 400 m coincident chargeability and resistivity high coincident with the primary zone of copper-gold mineralization (figure 4 & 5). This area lies within a moderate magnetic high and is immediately adjacent to a 1.5 x 1.2 km circular magnetic high (figure 6).

Based on the highly encouraging results from this Phase 1 work, crews have recently returned to the Catch property to initiate a Phase 2 program, with additional prospecting, mapping and sampling underway. Crews and equipment are currently being mobilized to site for a maiden RC drill program, with drilling scheduled to begin in the coming days. This property has never been drilled, and all targets represent new grassroots discoveries.

Figure 3 – Catch Rock Highlights

Property Geology and Mineralization

The Property lies within the Quesnel Terrane and is juxtaposed against the Stikine Terrane by the 1,000+ km long, deep seated, crustal scale strike-slip Teslin-Thibert fault approximately 3 km west of the Property boundary. The Quesnel and Stikine Terranes are characterized by similar Late Triassic to early Jurassic volcanic-plutonic arc complexes that are well-endowed with copper-gold-molybdenum porphyries including the Mt. Milligan, KSM, Red Chris, Mt. Polley, Highland Valley Copper deposits.

Figure 4 – Catch IP Section Chargeability

The Property is underlain by augite phyric basalt of the Semenof Formation, centered on a 7 x 3 km regional magnetic high. Bedrock exhibits strong propylitic and sericitic alteration and intense localized oxidation, brecciation and malachite staining.

The geology, alteration and mineralization observed throughout the Property are all indicative of a nearby copper-gold±molybdenum bearing porphyry system.

The Property is under option from a Yukon prospector, and ATAC can earn up to a 100% interest in the Property. For more information, see ATAC news release dated January 25, 2022.

Figure 5 – Catch IP Section Resistivity

Figure 6 – Catch Ground Magnetics

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

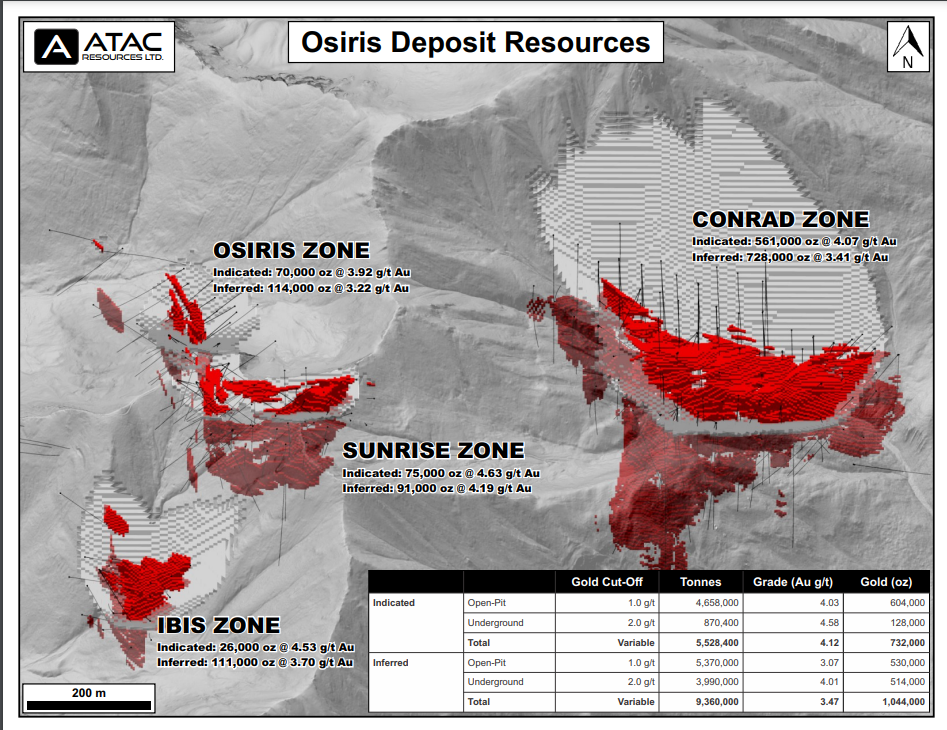

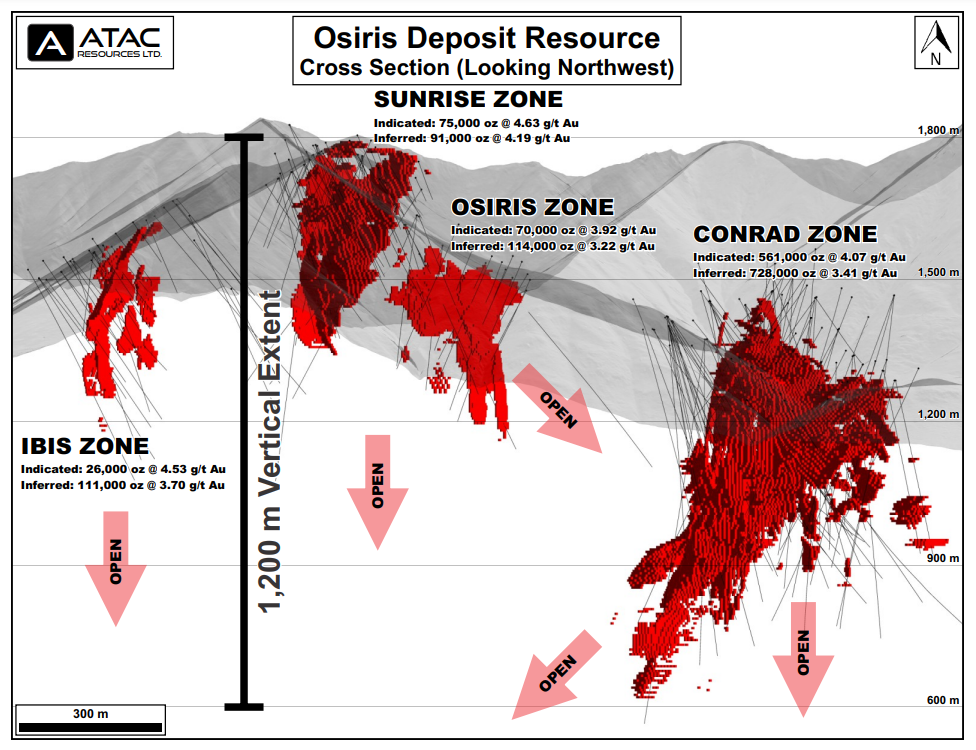

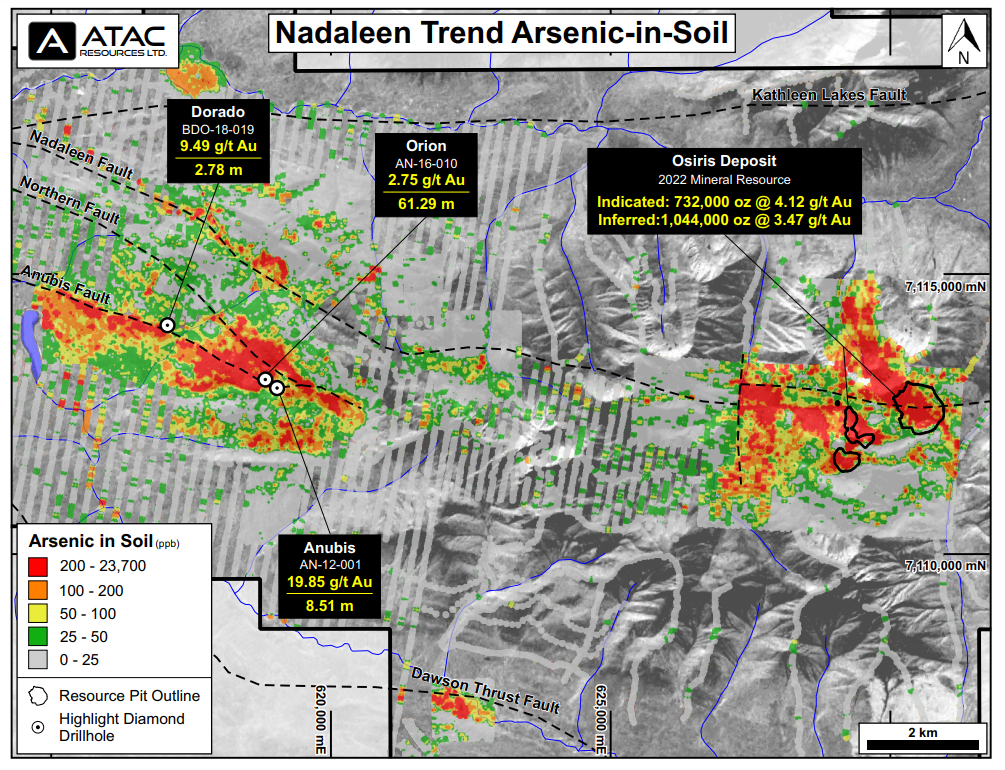

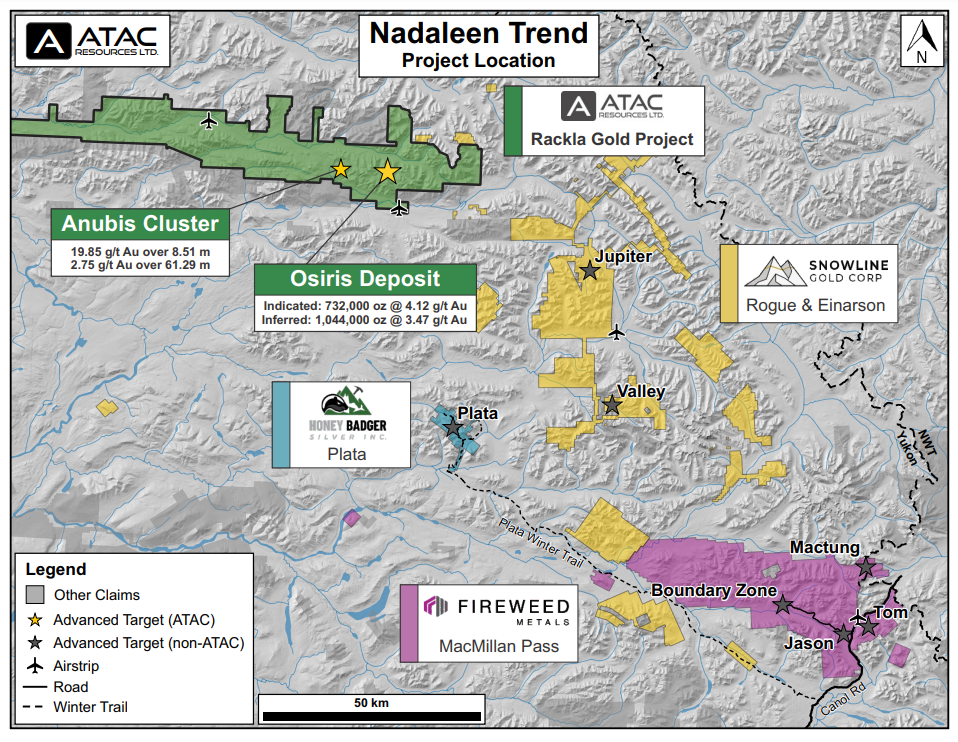

ATAC Resources (TSXV:ATC) has announced it has completed an updated mineral resource estimate at the Osiris Deposit at the Rackla Gold Property in Yukon, Canada. The 100%-owned property demonstrates a significant conversation of resources from the Inferred to Indicated category at the Osiris Deposit. This mineral resource estimate updates data from the previously released 2018 Osiris Resources. The company has since done additional geological modelling, geotechnical studies, and metallurgical test work since then. The cut-off grades for the deposit have also been modified to reflect current gold prices.

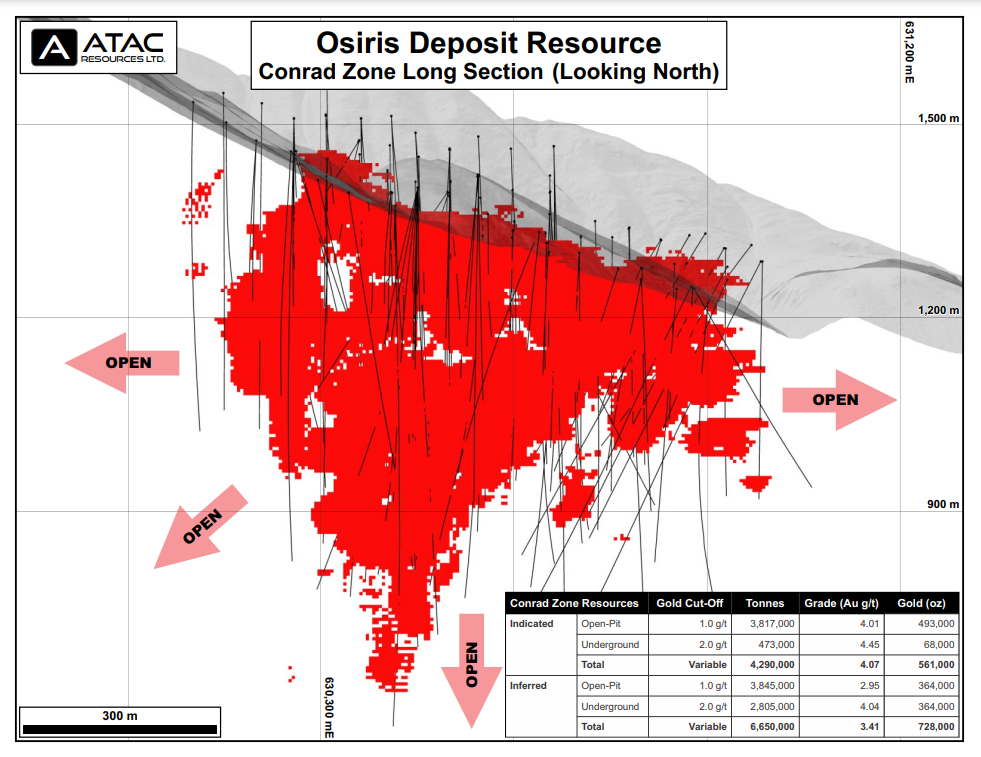

The Osiris Deposit is located at the eastern end of ATAC Resources’ Nadaleen Project. The deposit has four zones: Conrad, Sunrise, Osiris, and Ibis. All four of the zones remain open in multiple directions. The company also has additional targets at the pre-resource stage.

Graham Downs, President and CEO of ATAC Resources, commented in a press release: “We are very pleased to demonstrate significant conversion of resources from the Inferred to Indicated category at Osiris. This continues to demonstrate the confidence we have in this extensive, high-grade Carlin-style system that hosts some of the best gold intervals ever reported in Yukon. Work over the past two years has focused on technical studies and modeling, leading to growth of the deposit and improved classification of part of the resources at Osiris. We have recently completed 1,500 m of drilling stepping out on open near-surface parts of the resource and look forward to releasing those results when available.”

Highlights from the Deposit Resource Update include:

- Indicated Mineral Resource of 732,000 ounces gold at an average grade of 4.12 g/t (in 5.5 Mt), including pit-constrained resources of 604,000 ounces gold at 4.03 g/t (in 4.7 Mt);

- Inferred Mineral Resource of 1,044,000 ounces gold at an average grade of 3.47 g/t (in 9.4 Mt), including pit-constrained resources of 530,000 ounces gold at 3.07 g/t (in 5.4 Mt);

- Conversion of 43% of the 2018 maiden Inferred Resource (1,685,000 ounces at 4.23 g/t) to the Indicated category;

- All zones remain open to extension along strike and at depth; and

- Metallurgical testwork confirms >80% gold recoveries, and viable processing paths with flotation, pre-treatment by either pressure oxidation or roasting, and cyanide leaching.

Osiris Deposit – Mineral Resource Estimate Summary1,2,3

| Classification | Type | Gold Cut-off

(Au g/t) |

Tonnes | Grade

(Au g/t) |

Gold (ounces) |

| Indicated | Open-Pit3 | 1.0 | 4,658,000 | 4.03 | 604,000 |

| Underground | 2.0 | 870,400 | 4.58 | 128,000 | |

| Total | Variable | 5,528,400 | 4.12 | 732,000 | |

| Inferred | Open-Pit3 | 1.0 | 5,370,000 | 3.07 | 530,000 |

| Underground | 2.0 | 3,990,000 | 4.01 | 514,000 | |

| Total | Variable | 9,360,000 | 3.47 | 1,044,000 |

| 1. | CIM definition standards were used for the Mineral Resource. The Qualified Person is Steven Ristorcelli, C.P.G., associate of MDA. |

| 2. | Numbers may not add due to rounding. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. |

| 3. | Open-Pit material was constrained using a Whittle™ optimization at US$1,800/oz gold price. |

Figure 2 – Conrad Long Section

Figure 3 – Osiris Long Section

Figure 4 – Nadaleen Trend

Figure 5 – Nadaleen Project Location

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

If you would like to receive our free newsletter via email, simply enter your email address below & click subscribe.

CONNECT WITH US

Tweets

Tweet with hash tag #miningfeeds or @miningfeeds and your tweets will be displayed across this site.

MOST ACTIVE MINING STOCKS

Daily Gainers

Lincoln Minerals Limited Lincoln Minerals Limited |

LML.AX | +125.00% |

|

GCR.AX | +33.33% |

|

CASA.V | +30.00% |

|

AHN.AX | +22.22% |

|

ADD.AX | +22.22% |

|

AZM.V | +21.98% |

|

NSE.V | +21.05% |

|

DYG.V | +18.42% |

|

AAZ.V | +18.18% |

|

GLA.AX | +17.65% |

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan