Arizona Sonoran Copper (TSX:ASCU) has announced a significant option to joint venture agreement with Nuton LLC, a subsidiary of the mining giant Rio Tinto. This agreement involves a strategic partnership focusing on the deployment of Nuton’s technologies at ASCU’s Cactus Mine and the Parks/Salyer Project in Arizona, USA.

Under this agreement, Nuton has been granted the exclusive option to acquire a 35% to 40% interest in ASCU’s Cactus Project. The agreement involves a total funding commitment of up to $33 million from Nuton, which includes an initial payment of $10 million and additional funding for various project costs.

George Ogilvie, President and CEO of ASCU commented in a press release: “We are delighted to announce this strategic joint venture transaction with Nuton. We welcome the expertise and financial support as we expand testing of Nuton’s heap leaching technologies, while concurrently advancing ASCU’s projects. Nuton’s column test results have demonstrated continued improvements in extraction rates from both the primary and enriched mineral resources, resulting in potentially more efficient operations. We look forward to advancing into Phase 2 testing, which includes an expanded understanding of the Nuton technologies’ economic benefits within a fully-integrated pre-feasibility study, anticipated by the end of 2024. The proposed heap leach and SXEW flowsheet utilizing Nuton is intended to build upon the strength of our standalone base case, utilizing the same infrastructure proving economies of scale. Nuton has indicated the potential to significantly increase copper cathode output from our current 45-50 ktpa target which could materially enhance project economics. Furthermore, we see this as a significant de-risking event for ASCU shareholders with up to US$33 million in non-dilutive near-term financing and the addition of a strong project partner for future financing and development.”

Adam Burley, CEO of Nuton LLC, also commented: “We are pleased to be advancing our strategic partnership with ASCU. Successful deployment of Nuton Technologies at Cactus and Park/Salyer has the potential to materially enhance the economic and environmental performance of the projects.”

ASCU, through its subsidiaries Arizona Sonoran Copper Company (USA) Inc. and Cactus 110 LLC, is set to collaborate with Nuton on a work program starting in the first quarter of 2024. This program aims to deliver a pre-feasibility study by the end of 2024, evaluating the integration of Nuton’s technologies into the Cactus Project.

A key aspect of this partnership is the formation of a Steering Committee, comprising representatives from both ASCU and Nuton. This committee will oversee the project’s execution scope. Additionally, Nuton will have the opportunity to nominate a member to ASCU’s Technical & Sustainability Committee and maintain observer rights based on a previous Investor Rights Agreement.

The agreement stipulates conditions under which Nuton can exercise its option to acquire a larger stake in the Cactus Project. These conditions include the project’s net present value (NPV) with Nuton technologies being significantly higher than without, and ASCU’s equity contribution to project capital costs remaining equal or lower compared to the standalone case.

Moreover, the agreement covers the potential incorporation of the Mainspring Property into the project. If this occurs and becomes material to ASCU, Nuton’s option to acquire a stake in the project would be adjusted accordingly, based on the comparative NPV of the project with and without the Mainspring Property.

In case Nuton exercises its option, it will pay the option exercise price, adjusted for any pre-payments and accrued interest, to ASCU’s subsidiary. The agreement also details the ownership percentages Nuton would hold based on the NPV multiples achieved.

Furthermore, the agreement includes provisions for the formation of a joint venture company and outlines scenarios in which Nuton can terminate the agreement or be repaid. This includes a clause that allows Nuton to convert certain payments into an exchangeable debenture, which can be settled in ASCU common shares, subject to stock exchange conditions and ownership limits.

ASCU will continue to act as the operator of the Cactus Project, maintaining the remaining equity interest in the joint venture corporation. This partnership marks a significant step in the advancement of ASCU’s Cactus Project, leveraging Nuton’s technologies to potentially enhance the project’s value and efficiency.

Highlights from the transaction are as follows:

- US$33 million in non-dilutive financing to ASCU

- Global Mining and Innovation Industry partner validates scalability of Cactus Project and Nuton’s confidence in enhancing project economics

Creating a Straightforward Mechanism for Significant Project Funding

- Endorses the Cactus Project through up to US$33 million in non-dilutive financing

- Creates a straightforward mechanism for significant project funding, designed to minimize ASCU’s future share of equity contributions to capital costs

- Commitment from Nuton to support the creation of a funding strategy for ASCU, which may include the provision of a completion guarantee for the Cactus Project or a performance guarantee related to the Nuton technologies

- Potential to improve per share returns to ASCU shareholders

Reduction of Execution Risks

- Establishes a framework for a joint-venture partnership with industry-leading technical and innovation leader to deliver value-enhancing project economics

- Potential to significantly increase attributable copper production per share

- Defines near-term project advancement strategy with the goal of delivering an Integrated Nuton Case PFS (defined below) by December 31, 2024

- Preserves long-term optionality for ASCU and outlines a clear path towards environmentally- friendly copper production in the USA, with a focus on Nuton’s positive impact pillars: water, energy, land, materials, and society

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

Arizona Sonoran Copper (TSX:ASCU) recently shared updates on their metallurgical testing from the Nuton Phase 1 column leach program at the Cactus copper porphyry project in Arizona. This testing forms part of the company’s evaluation of new technologies for copper extraction.

George Ogilvie, Arizona Sonoran Copper Company President and CEO commented in a press release: “We are encouraged by the extraction rates resulting from our primary and secondary sulphides using the Nuton™ technologies. These results demonstrate a continued extraction rate improvement from the columns reported in June. Nuton’s heap leaching technology is a potential solution to gain access to our currently stranded primary mineral resource while also incrementally improving the copper extraction rates from the enriched material. Particularly interesting to ASCU, is that Nuton’s flow sheet could be integrated into the planned Cactus heap leach and SXEW flow sheet. With a successfully negotiated Commercial Framework Agreement in place and a completed Phase 1 test program, we would seek to coordinate the improved extraction rates into an updated and expanded technical study, complementing the base case PFS anticipated in Q1 2024 and demonstrating economies of scale.”

The first phase of the program focused on assessing the efficiency of using Nuton’s proprietary additives in extracting copper from both primary and enriched sulphides at the Cactus site. The tests experimented with various operating conditions, such as temperature variations and different additive combinations. Following the Phase 1 results, ASCU and Nuton are considering moving to Phase 2, which aims to address the challenges and opportunities identified in the initial phase.

The Cactus deposit underwent 23 small-scale column leach tests, covering 10 different ore types and a Life of Asset (LoA) Blend. Early results suggest that Nuton additives, particularly at higher temperatures, could significantly improve chalcopyrite extraction in both the LoA blend and other primary sulphide ores. The highest copper extraction rate recorded for the LoA Blend was 80%. Efforts are ongoing to optimize conditions, especially temperature, to consistently exceed this extraction rate.

Acid consumption for processing primary sulfide ores varied widely, from 10 to 60 kilograms per tonne. For ores with higher acid consumption, adjusting the pH level showed mixed results, reducing acid use but also slowing down copper extraction. Nuton plans to continue its analysis, focusing on residue samples for additional insights. Extraction rates for secondary sulfide dominant ore types were notably high, ranging from 86% to 98%, attributed to the low reactive gangue content in these ores, making them net acid generators.

Highlights from the results are as follows:

- Phase 1: Indicative, interim results available at the end of November 2023, for first 15 small (3 ft | 1 m) columns completed:

- Targeting an average life of asset (“LoA”) copper extraction rate of 80% from the Cactus area material

- Primary sulphide as dominant material copper extractions at elevated temperatures range from 80% to 85%

- Secondary sulfide (“enriched”) as dominant material copper extraction at elevated temperatures range from 85% to +95%

- Phase 1: Next steps

- To conduct small column tests (3 ft | 1 m) on a Parks/Salyer primary blend and a mixed enriched blend sample

- Phase 2: Next Steps

- Metallurgical program contingent upon advancing a Commercial Framework agreement with Nuton

- To include tall column tests (30 ft | 10 m) on Cactus mineralized material to mitigate or test threats/opportunities identified under the Phase 1 test program

TABLE 1: Copper Extraction and Acid Consumption Estimates by Material Type

|

|

ASCU |

NUTON™ |

||||

|

|

Programs updated Feb 2022 and May 2023 |

Preliminary Column Data, updated November 2023 |

||||

|

Mineral Resource Location |

Net Copper Extraction (% Cu AS) |

Net Copper Extraction (% CuCN) |

Blended Extraction (%) |

Net Acid Consumption (kg/tonne) |

Extraction (%) |

Net Acid Consumption (kg/tonne) |

|

Oxides |

||||||

|

Stockpile |

90% 1 |

40% 1 |

81% |

81 |

n/a |

|

|

Cactus West |

92% 1 |

73% 1 |

88% |

81 |

|

|

|

Cactus East |

92% 1 |

73% 1 |

90% |

81 |

|

|

|

Parks Salyer |

|

|

|

|

|

|

|

Enriched (Secondary Sulphide) |

||||||

|

Cactus West |

92% 1 |

73% 1 |

78% |

(-) 5 |

86% – 98% |

-5 – 15 |

|

Cactus East |

92% 1 |

73% 1 |

76% |

(-) 5 |

86% – 98% |

-5 – 15 |

|

Parks Salyer |

|

|

80% |

(-) 5 |

80% |

-5 – 15 |

|

Primary Sulphides |

||||||

|

Flotation (ASCU) |

|

|

86% 2 |

(-) 5 |

n/a |

|

|

Leaching (Nuton) |

|

|

|

|

80% – 85% 3 |

10 – 45 |

|

Blended (Primary and Secondary Sulphide) |

||||||

|

Flotation (ASCU)/ |

|

|

91% 2 |

(-) 5 |

n/a |

|

|

Leaching (LoA) (Nuton) |

|

|

|

|

86% – 95% 4 |

25 – 404 |

|

1 As reported on February 23, 2022, Arizona Sonoran Updates on Metallurgical improvements at the Cactus Mine Project, acid consumption converted to kg/tonne from lbs/ton for comparison purposes |

||||||

|

2 Initial flotation results from 2022 testing program |

||||||

|

3 Excludes ASC 6 (ECW-011) that has anomalous high Biotite content (See Phase 2 workplan) |

||||||

|

4 Excludes column ASC 6 (ECW-011) that has anomalous high Biotite content and low temperature (See Phase 2 workplan) |

||||||

|

5 Net acid consumption is either nil or net generating |

||||||

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

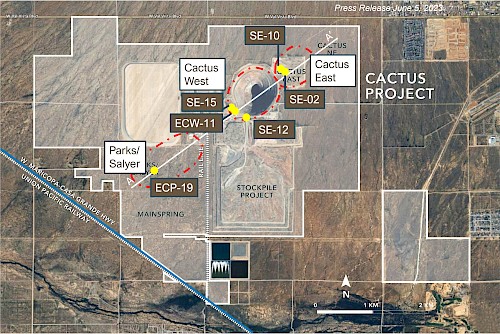

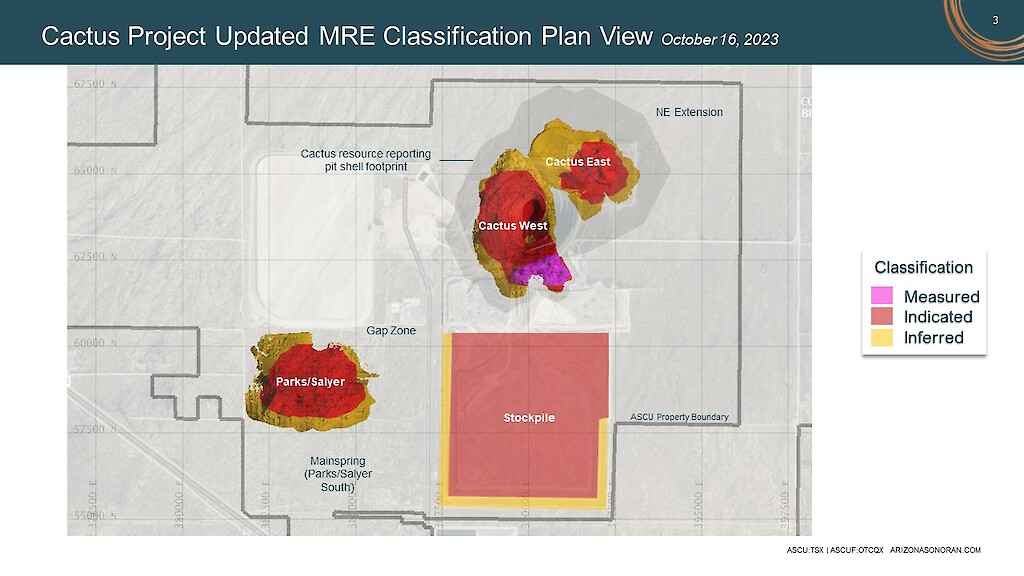

Arizona Sonoran Copper (TSX:ASCU) has reported its latest Mineral Resource Update (MRE) for its Cactus Project, a combined initiative that includes the Cactus, Stockpile, and Parks/Salyer deposits. Situated 45 miles south of Phoenix, Arizona, the Cactus Project is expected to be the focus of an upcoming Pre-Feasibility Study slated for release in the first quarter of 2024. The goal is to establish a copper cathode heap leach and SXEW operation that produces 45-50 thousand tons per annum (ktpa).

The Cactus Project is an entirely-owned brownfield project located on private land in Arizona. The site comes with approximately $30 million worth of existing infrastructure, an advanced stage of permitting, approved water rights, and ready access to water sources.

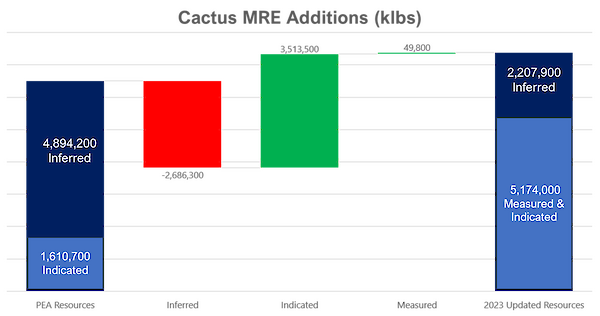

George Ogilvie, CEO of Arizona Sonoran Copper Company commented in a press release: “Our team has completed yet another key milestone in the process of reactivating the Cactus Mine. Driven through textbook infill drilling programs at Parks/Salyer and Cactus, our team readies an already significant copper asset in Arizona, USA for the next step in technical reporting; 3.6 billion pounds of Copper were added and converted to the M&I category for a new M&I mineral resource of 5.2 billion pounds. The leachable Copper M&I category now stands at 4.4 billion pounds of Copper and will act as the foundation for our upcoming PFS. The PFS remains on track and on budget for Q1 2024. I look forward to our team continuing to deliver on key objectives over the next year.”

The newly updated MRE is backed by extensive drilling programs concentrated on the northeastern portion of the Santa Cruz porphyry copper system, to which the company has access to around 3.5 miles. The drilling data has been categorized into Measured, Indicated, and Inferred resources based on the spacing between drilling points. Specifically, a total of 80,715 feet of new drilling into the Cactus deposits has been carried out since May 2021, and new Parks/Salyer drilling accumulated to 57,250 feet from July 2022 to March 2023. The company plans to continue drilling beyond April 2023 with the intention of releasing another mineral resource update in 2024.

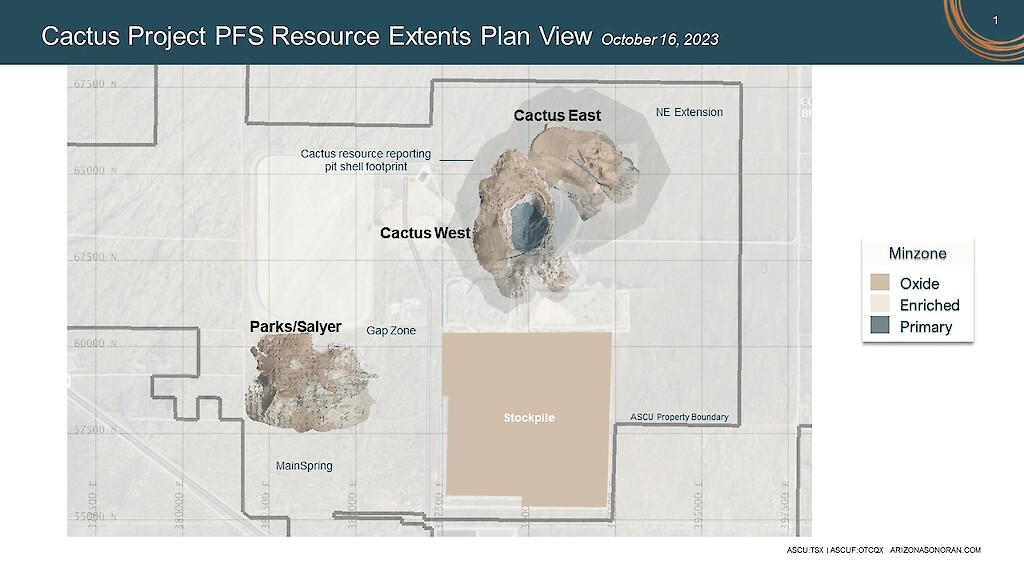

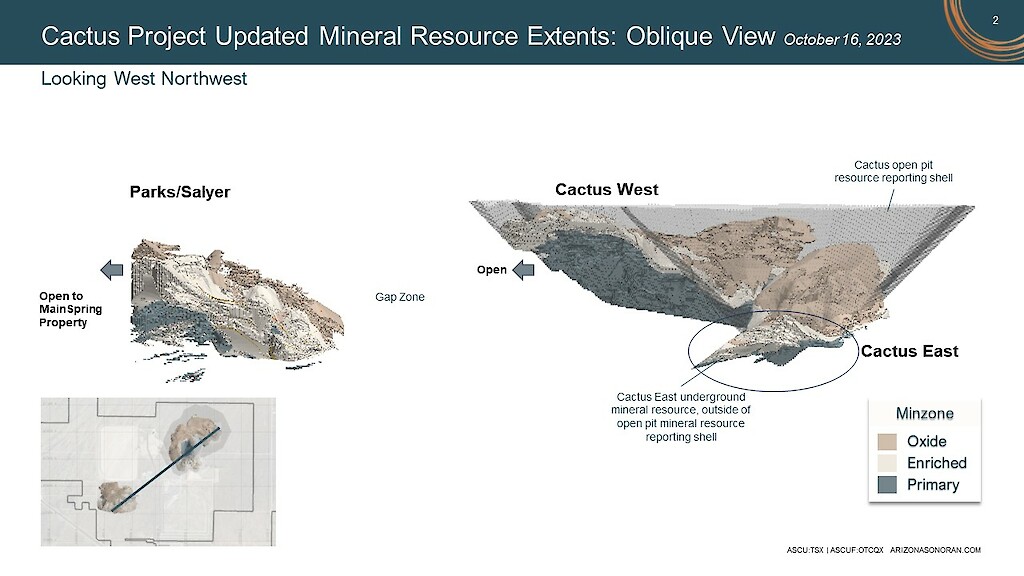

In terms of geology, the resource areas within the Cactus Project consist of fragmented parts of the larger Santa Cruz Porphyry System. The mineral deposits are hosted mainly in Precambrian Oracle granite and Laramide monzonite porphyry. The geology of the site is complex, with notable fracturing, faulting, and both pre-mineral and post-mineral brecciation. The resource areas also contain both oxide and enriched copper mineralization, lying above the primary sulphide mineralization. This geological complexity and the continuity of mineralization styles suggest that the resource areas might have once been interconnected, which assists in further exploration and modelling of the resources.

Cactus Project Resource Modelling

The resource modelling for the Cactus Project was carried out by Arizona Sonoran Copper Company Inc.’s (ASCU) resource team and Allan Schappert, a qualified individual as per the National Instrument 43-101 standards for mineral projects. The team utilized updated drilling data and interpretations to form the basis of the Mineral Resource model, which was developed in Vulcan software.

The data used for generating the mineral resources included a significant number of drill holes and measurements. Specifically, the Cactus Project involved 305 drill holes totalling 309,418.5 feet; Parks/Salyer had 77 drill holes with 172,166.3 feet; and the stockpile had 518 drill holes totalling 44,728.2 feet. This drilling data is backed by standard quality assurance and control programs, and the quality of the data has been deemed suitable for use in resource estimation.

When it comes to the mineralized domains, these align with what one would expect for porphyry copper systems. These domains represent varying rock types and copper mineral zones, which in turn are associated with weathering processes that lead to secondary copper enrichment. Several mineral zones including leached, oxide, enriched, and primary were identified through logging and sequential copper analyses.

Physical density measurements were also an integral part of the resource modelling. Both historical data from ASARCO and recent measurements by ASCU were included. For the Cactus and Parks/Salyer deposits, density was measured using the wet and dry weight method with thousands of samples considered for accurate assessment. For the stockpile, given its unconsolidated nature, density was calculated based on weight and volume measurements from four test holes.

Copper grades were estimated using a technique called Ordinary Kriging. A range of statistical and visual validation methods were employed, ensuring the reliability of these estimates. This included comparisons of statistical distribution, visual cross-checks against the drilling data, and other methods like change of support and swath plots.

Updates on Parks/Salyer and Cactus Deposits

Parks/Salyer showed a notable increase in its leachable Indicated mineral resource, rising from 2,461 million pounds (Mlbs) in the 2022 Preliminary Economic Assessment (PEA) to 2,677 Mlbs. This increase is attributed to successful infill drilling, the inclusion of mineral resources under a new Mineral Exploration Permit obtained in October 2024, and a slight natural extension of mineralization onto the MainSpring property.

In the case of the Cactus deposits, the focus of Measured and Indicated drilling programs was on upgrading the Inferred mineral resources from the PEA to support the upcoming Pre-Feasibility Study. The total leachable Measured and Indicated resources for Cactus were reported to be 156.3 million tons at a grade of 0.491% Cu TSol, distributed between open pit and underground mineral resources. The Cactus East sector notably contains 41.2 million tons at a much higher grade of 1.057% Cu TSol.

Stockpile Conversion and Classification

The Stockpile saw a significant shift from Inferred to Indicated classification. Previously categorized solely as Inferred, recent drilling efforts have converted 217 million pounds of copper at a grade of 0.153% Cu TSol into the Indicated category. Only 3 million pounds now remain in the Inferred category. This change does indicate a minor reduction in total pounds, but the grade increased, largely due to higher copper grades in the upper lift of the stockpile.

Highlights and results from the MRE are as follows:

| PREVIOUS MINERAL RESOURCE

(As of September 28, 2022) |

UPDATED MINERAL RESOURCE

(As of August 31, 2023) |

VARIANCE | |||||

| Tons | Grade | Pounds | Tons | Grade | Pounds | Cu Content | |

| kt | Cu%¹ | Cu Mlbs | kt | Cu%¹ | Cu Mlbs | % | |

| Total Measured |

N/A |

10,400 |

0.241 |

49.8 |

New |

||

| Leachable |

9,100 |

0.230¹ |

41.9 |

New |

|||

| Primary |

1,300 |

0.315 |

8.0 |

New |

|||

| Total Indicated |

151,800 |

0.531 |

1,610.7 |

435,300 |

0.589 |

5,124.2 |

+218% |

| Leachable |

73,900 |

0.723 |

1,065.2 |

348,500 |

0.629¹ |

4,387.2 |

+312% |

| Primary |

77,900 |

0.350 |

545.5 |

86,800 |

0.425 |

737.0 |

+35% |

| Total M&I |

151,800 |

0.531 |

1,610.7 |

445,700 |

0.580 |

5,174.0 |

+221% |

| Leachable |

73,900 |

0.723 |

1,065.2 |

357,600 |

0.619¹ |

4,429.0 |

+316% |

| Primary |

77,900 |

0.350 |

545.5 |

88,000 |

0.423 |

745.0 |

+37% |

| Total Inferred |

449,900 |

0.544 |

4,894.2 |

233,800 |

0.472 |

2,207.9 |

-55% |

| Leachable |

310,400 |

0.590 |

3,663.7 |

107,700 |

0.607¹ |

1,307.9 |

-64% |

| Primary |

139,500 |

0.441 |

1,230.5 |

126,200 |

0.357 |

900.0 |

-27% |

NOTES:

1. Leachable copper grades are reported using sequential assaying to calculate the soluble copper grade. Primary copper grades are reported as total copper, Total category grades reported as weighted average copper grades of soluble copper grades for leachable material and total copper grades for primary material. Tons are reported as short tons.

2. Stockpile resource estimates have an effective date of 1st March, 2022, Cactus resource estimates have an effective date of 29th April, 2022, Parks/Salyer resource estimates have an effective date of 19th May, 2023. All resources use a copper price of US$3.75/lb.

3. Technical and economic parameters defining resource pit shell: mining cost US$2.43/t; G&A US$0.55/t, 10% dilution, and 44°-46° pit slope angle.

4. Technical and economic parameters defining underground resource: mining cost US$27.62/t, G&A US$0.55/t, and 5% dilution,

5. Technical and economic parameters defining processing: Oxide heap leach (HL) processing cost of US$2.24/t assuming 86.3% recoveries, enriched HL processing cost of US$2.13/t assuming 90.5% recoveries, Primary mill processing cost of US$8.50/t assuming 92% recoveries. HL selling cost of US$0.27/lb; Mill selling cost of US$0.62/lb.

6. Royalties of 3.18% and 2.5% apply to the ASCU properties and stateland respectively. No royalties apply to the MainSpring (Parks/Salyer South) property.

7. For Cactus: Variable cutoff grades were reported depending on material type, potential mining method, and potential processing method. Oxide material within resource pit shell = 0.099% TSol; enriched material within resource pit shell = 0.092% TSol; primary material within resource pit shell = 0.226% CuT; oxide underground material outside resource pit shell = 0.549% TSol; enriched underground material outside resource pit shell = 0.522% TSol; primary underground material outside resource pit shell = 0.691% CuT.

8. For Parks/Salyer: Variable cut-off grades were reported depending on material type, associated potential processing method, and applicable royalties. For ASCU properties – Oxide underground material = 0.549% TSol; enriched underground material = 0.522% TSol; primary underground material = 0.691% CuT. For stateland property – Oxide underground material = 0.545% TSol; enriched underground material = 0.518% TSol; primary underground material = 0.686% CuT. For MainSpring (Parks/Salyer South) properties – Oxide underground material = 0.532% TSol; enriched underground material = 0.505% TSol; primary underground material = 0.669% CuT.

9. Mineral resources, which are not mineral reserves, do not have demonstrated economic viability. The estimate of mineral resources may be materially affected by environmental, permitting, legal, title, sociopolitical, marketing, or other relevant factors.

10. The quantity and grade of reported inferred mineral resources in this estimation are uncertain in nature and there is insufficient exploration to define these inferred mineral resources as an indicated or measured mineral resource; it is uncertain if further exploration will result in upgrading them to an indicated or measured classification.

11. Totals may not add up due to rounding.

- 221% increase of total Measured and Indicated (“M&I”) resources (including primary resources), and a 9% increase of grade, resulting in a 55% decrease of Inferred resources due to upgrading of material

- MRE including Primary Resource Opportunity

- M&I 445.7 Mt @ 0.58% Cu for 5.17 billion pounds of copper

- Inferred 233.8 Mt @ 0.47% Cu for 2.21 billion pounds of copper

- Leachable (Oxide and Enriched) Mineral Resource

- M&I category increases by 316%: 357.6 million tons (“Mt”) at 0.62% Soluble Copper (“Cu TSol”) for 4.43 billion lbs of copper

- Inferred Category decreases by 64%: 107.7 Mt at 0.61% Cu TSol for 1.31 billion lbs of copper due to upgrading of material

- Low discovery cost – $0.005 / lb per pound

- +1.0% Soluble Copper Grades – specifically, Parks/Salyer contains 130Mt @ 1.028% Cu Tsol and Cactus East contains 41.2Mt @ 1.057% Cu TSol within M&I resources reporting to underground resource cutoff grades.

- Continuity confirmed – total drill database includes 526,000 ft (160,420 m) of drilling in 900 holes, resulting in demonstrated consistency of mineralization overall and a significant upgrade of the Parks/Salyer Deposit from the last MRE

- High Quality – first declaration of Measured mineral resources and significant conversion of Inferred mineral resources to the Indicated category which have the potential to be used to declare first reserves in the pending Pre-Feasibility Study expected in Q1 2024

- Location Advantages – set within Casa Grande’s industrial park and connected to nationwide transportation (highway and railroad), a streamlined permitting process, access to Arizona Public Service power, and access to water

- Growth – ongoing drilling will focus on Parks/Salyer southern extensions (Parks/Salyer South property); exposure to a 4 km mine trend with pockets of mineralization known south of Parks/Sayler, in the Gap Zone and NE of Cactus East

- Next Steps – Continue decreasing drill spacings to 125 ft (38 m) for future studies; begin drilling at the MainSpring (Parks/Salyer South) property

TABLE 2: Parks/Salyer Deposit

| PREVIOUS MINERAL RESOURCE

(As of September 28, 2022) |

UPDATED MINERAL RESOURCE

(As of August 31, 2023) |

|||||

| Tons | Grade | Pounds | Tons | Grade | Pounds | |

| kt | Cu% * | Cu Mlbs | kt | Cu% * | Cu Mlbs | |

| Total Indicated | N/A | 143,900 | 1.009 | 2,906.1 | ||

| Total Leachable | 130,200 | 1.028* | 2,676.6 | |||

| Oxide | 10,000 | 0.921* | 183.7 | |||

| Enriched | 120,200 | 1.037* | 2,493.0 | |||

| Total Inferred | 143,600 | 1.015 | 2,915.4 | 48,400 | 0.967 | 936.1 |

| Total Leachable | 115,400 | 1.066* | 2,460.9 | 44,500 | 0.982* | 873.2 |

| Oxide | 14,100 | 0.827* | 233.7 | 8,700 | 0.925* | 161.7 |

| Enriched | 101,200 | 1.100* | 2,227.2 | 35,700 | 0.996* | 711.5 |

NOTES: refer to TABLE 1

*Denotes Cu TSol, generated using a sequential assaying technique to calculate the grade of the soluble copper.

TABLE 3: Cactus East, Underground Resource outside of Cactus Open Pit Resource

| PREVIOUS MINERAL RESOURCE

(As of September 28, 2022) |

UPDATED MINERAL RESOURCE

(As of August 31, 2023) |

|||||

| Tons | Grade | Pounds | Tons | Grade | Pounds | |

| kt | Cu% * | Cu Mlbs | kt | Cu% * | Cu Mlbs | |

| Total Indicated | 9,900 | 0.912 | 180.0 | 10,400 | 0.882 | 182.6 |

| Leachable | 7,700 | 0.954* | 146.2 | 9,000 | 0.891* | 161.0 |

| Total Inferred | 19,200 | 0.873 | 335.9 | 6,400 | 0.785 | 100.1 |

| Leachable | 17,900 | 0.881* | 315.7 | 4,600 | 0.767* | 69.9 |

NOTES: refer to TABLE 1

*Denotes Cu TSol, generated using a sequential assaying technique to calculate the grade of the soluble copper.

TABLE 4: Cactus Open Pit, inclusive of Cactus West and Cactus East

| PREVIOUS MINERAL RESOURCE

(As of September 28, 2022) |

UPDATED MINERAL RESOURCE

(As of August 31, 2023) |

|||||

| Tons | Grade | Pounds | Tons | Grade | Pounds | |

| kt | Cu% * | Cu Mlbs | kt | Cu% * | Cu Mlbs | |

| Total Measured | N/A | 10,400 | 0.241 | 49.8 | ||

| Leachable | 9,100 | 0.230* | 41.9 | |||

| Total Indicated | 141,900 | 0.505 | 1,431.6 | 209,900 | 0.433 | 1,818.1 |

| Leachable | 66,200 | 0.696* | 919.7 | 138,200 | 0.482* | 1,332.1 |

| Total M&I | 141,900 | 0.505 | 1,431.6 | 220,300 | 0.424 | 1,868.0 |

| Leachable | 66,200 | 0.696* | 919.7 | 147,300 | 0.466* | 1,374.0 |

| Total Inferred | 209,700 | 0.339 | 1,428.7 | 177,900 | 0.328 | 1,168.7 |

| Leachable | 99,700 | 0.334* | 672.1 | 57,500 | 0.315* | 361.8 |

NOTES: refer to TABLE 1

*Denotes Cu TSol, generated using a sequential assaying technique to calculate the grade of the soluble copper.

TABLE 5: Stockpile

| PREVIOUS MINERAL RESOURCE

(As of August 31, 2021) |

UPDATED MINERAL RESOURCE

(As of August 31, 2023) |

|||||

| Tons | Grade | Pounds | Tons | Grade | Pounds | |

| kt | Cu TSol% | Cu Mlbs | kt | Cu Tsol% | Cu Mlbs | |

| Indicated (Oxide) | N/A | 71,100 | 0.153 | 217.3 | ||

| Inferred (Oxide) | 77,400 | 0.144 | 223.5 | 1,200 | 0.127 | 3.0 |

NOTES: refer to TABLE 1

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

The City of Casa Grande has given the green light for the rezoning of the northern section of the MainSpring Property, known as “Parks/Salyer South,” to Industrial use for Arizona Sonoran Copper (TSX:ASCU). This approval paves the way for Arizona Sonoran Copper to kick off drilling activities. The company is currently in the process of developing an exploration plan. Meanwhile, the southern parcel of Parks/Salyer South is still undergoing rezoning and a General Plan Amendment with the City of Casa Grande.

Travis Snider, VP Sustainability and External Relations commented in a press release: “Our team is appreciative of the ongoing support from the city of Casa Grande and our Stakeholders in every step of redeveloping the Cactus Mine. Rezoning the north parcel continues to open up new land at Cactus for future operations, and adds the potential for incremental mineral resource growth.”

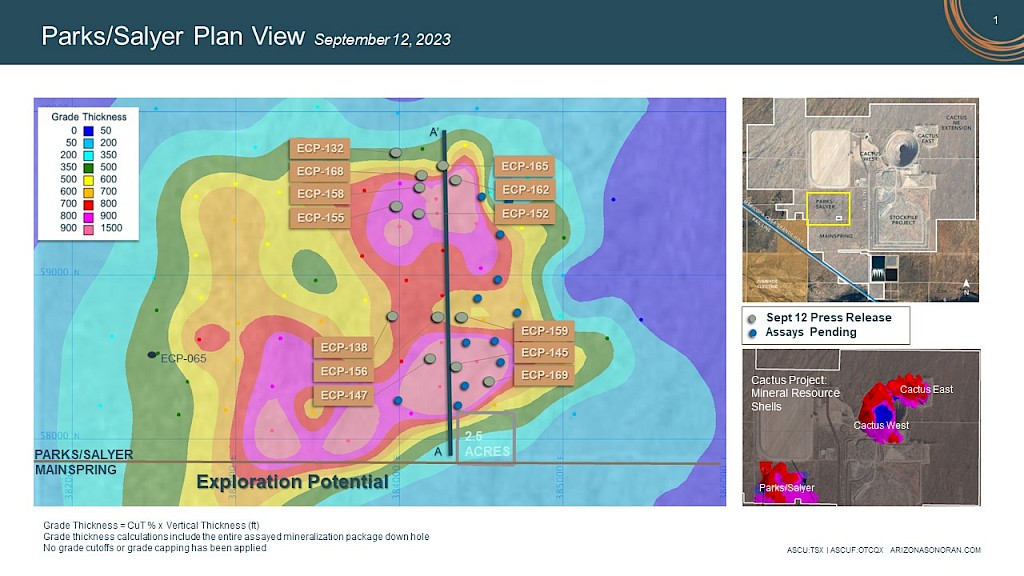

In addition to the rezoning, Arizona Sonoran Copper has secured a 2.5-acre Mineral Exploration Permit (MEP) within the Parks/Salyer deposit from Arizona State Lands. This acquisition will offer the company more operational flexibility and positions it for low-risk, high-impact exploration targets. The MEP is situated at the southern edge of the Parks/Salyer deposit and intersects with Parks/Salyer, Bronco-Creek, and Parks/Salyer South properties. The permit will also enhance accessibility to mineralized material and mitigate any potential setbacks in mine planning activities adjacent to this parcel.

For context, the Parks/Salyer mineral resource has an estimated 2.9 billion pounds of copper with a grade of 1.015%, categorized as inferred. The mineral resource is presently confined to the Parks/Salyer border. Arizona Sonoran Copper plans to release an updated mineral resource report for the entire Cactus Project, which includes Parks/Salyer, in the fourth quarter of 2023.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

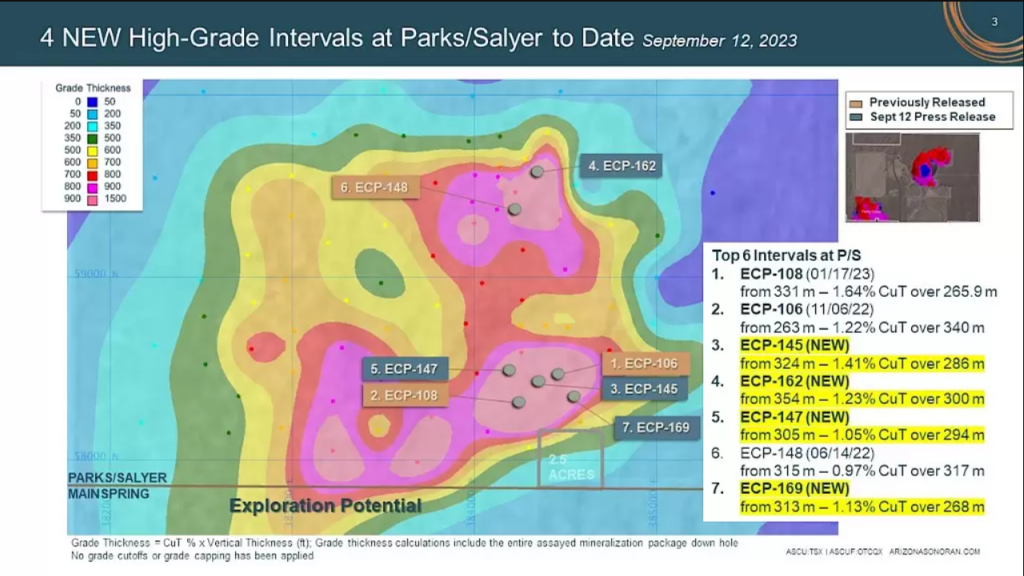

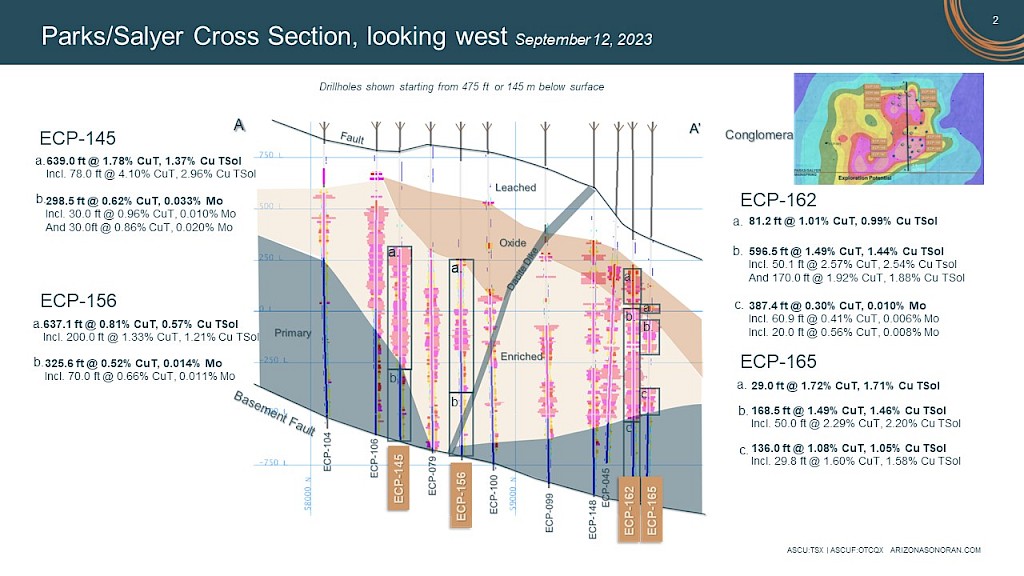

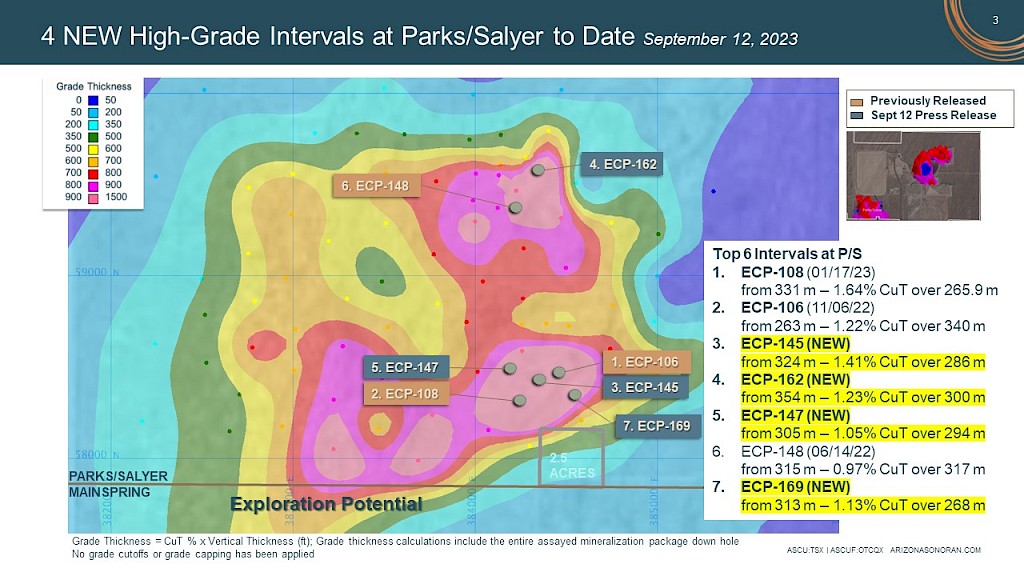

Arizona Sonoran Copper (TSX:ASCU) has successfully completed drilling of 13 infill holes at the Parks/Salyer deposit’s high-grade core, which displays consistency in both grade and mineralized widths at a 125 ft (38 m) drill spacing. Out of the total planned drilling for the Cactus Project deposits, 29,036 ft (8,850.2 m) has been covered, aiming to complete an overall 105,000 ft (32,000 m) by the end of the program. This extensive drill program seeks to improve the precision of the current mineral resources, setting the stage for a detailed feasibility study in 2024.

Since the beginning of April 2023, 26 out of a proposed 47-hole program have been drilled at 125 ft (38m) drill centres in the eastern section of the Parks/Salyer mineral resource area. The primary aim remains to pinpoint the high-grade core of the mineral resource, with the geological team noting steady intervals of mineralization. This effort is gearing up for a comprehensive feasibility study next year. Notably, holes ECP-145 and ECP-162 indicate a continuity of width and grade that aligns with expectations set by an earlier 250 ft (76m) drill program. This consistency is particularly evident in areas previously identified to have a thicker and higher-grade copper presence. As drilling progresses, forthcoming results are anticipated to provide more insights into the specific traits and boundaries of the two prominent high-grade mineralization centres.

George Ogilvie, Arizona Sonoran President and CEO commented in a press release: “The team continues to execute and deliver solid results as we advance our Cactus and Parks/Salyer projects. The proven continuity of the Parks/Salyer mineralization within the deposit continues to support our vision of a top tier asset within a tier 1 jurisdiction. Additionally, with the recent option of MainSpring, the Parks/Salyer southern extension, we see a tremendous opportunity to continue building the Parks/Salyer mineral resource beyond the current 2.9 billion pounds at 1.015% total copper inferred resource.”

Highlights from the results are as follows:

– Drilling replicating high-grade thicknesses from prior drill programs, including 5 new intervals in the top 10 grade thickness intervals at Parks/Salyer

– In July and August, 2 drill rigs focused in the eastern section, interpreted to be the high grade core of the deposit

– ECP-145: 937 ft (285.8 m) @ 1.41% CuT of continuous mineralization

- 639 ft (194.8 m) @ 1.78% CuT, 1.37% Cu TSol, 0.016% Mo (enriched)

- Incl 78 ft (23.8 m) @ 4.10% CuT, 2.96% Cu TSol, 0.013% Mo

– ECP-147: 1,023 ft (312 m) @ 1.05% CuT of continuous mineralization

- 935 ft (285.2 m) @ 1.02% CuT, 0.63% Cu TSol, 0.014% Mo (enriched)

- Incl 202 ft (61.6 m) @ 2.03% CuT, 1.28% Cu TSol, 0.016% Mo

– ECP-162: 1,132 ft (344.9 m) @ 1.23% CuT of continuous mineralization

- 597 ft (181.8 m) @ 1.49% CuT, 1.44% Cu TSol, 0.019% Mo (enriched)

- And 170 ft (51.8 m) @ 1.92% CuT, 1.88% Cu TSol, 0.023% Mo

– ECP-169: 880.2 ft (268.3 m) @ 1.13% CuT of continuous mineralization

- 519 ft (158.2 m) @ 1.49% CuT, 1.09% Cu TSol, 0.011% Mo (enriched)

- Incl 158ft (48.2m) @ 2.16% CuT, 2.10% Cu TSol, 0.004% Mo

– ECP-152: 1,011 ft (308.2 m) @ 0.78% CuT of continuous mineralization

- 674 ft (205.6 m) @ 1.0% CuT, 0.94% Cu TSol, 0.020% Mo (enriched)

- Incl 125 ft (38.3 m) @ 2.18% CuT, 2.13% Cu TSol, 0.017% Mo

TABLE 1

|

Hole Id |

Zone |

Feet |

Metres |

Grade |

||||||

|

From |

To |

Length |

From |

To |

Length |

CuT |

TSol |

Mo |

||

|

ECP-132 |

oxide |

1,535.5 |

1,586.9 |

51.4 |

468.0 |

483.7 |

15.7 |

0.95 |

0.94 |

0.011 |

|

enriched |

1,586.9 |

1,816.0 |

229.1 |

483.7 |

553.5 |

69.8 |

1.02 |

0.95 |

0.007 |

|

|

including |

1,586.9 |

1,634.7 |

47.8 |

483.7 |

498.3 |

14.6 |

1.52 |

1.45 |

0.012 |

|

|

and |

1,678.0 |

1,708.0 |

30.0 |

511.5 |

520.6 |

9.1 |

1.24 |

1.20 |

0.005 |

|

|

and |

1,752.6 |

1,804.0 |

51.4 |

534.2 |

549.9 |

15.7 |

1.17 |

1.03 |

0.005 |

|

|

primary |

1,816.0 |

2,246.0 |

430.0 |

553.5 |

684.6 |

131.1 |

0.21 |

0.02 |

0.004 |

|

|

including |

1,843.0 |

1,896.0 |

53.0 |

561.7 |

577.9 |

16.2 |

0.36 |

0.05 |

0.002 |

|

|

ECP-138 |

enriched |

1,041.4 |

1,159.0 |

117.6 |

317.4 |

353.3 |

35.8 |

1.58 |

1.54 |

0.010 |

|

including |

1,068.0 |

1,108.0 |

40.0 |

325.5 |

337.7 |

12.2 |

2.52 |

2.51 |

0.007 |

|

|

enriched |

1,268.0 |

1,313.3 |

45.3 |

386.5 |

400.3 |

13.8 |

0.96 |

0.93 |

0.028 |

|

|

enriched |

1,376.2 |

1,497.7 |

121.5 |

419.5 |

456.5 |

37.0 |

1.00 |

0.78 |

0.016 |

|

|

including |

1,386.0 |

1,451.0 |

65.0 |

422.5 |

442.3 |

19.8 |

1.39 |

1.30 |

0.016 |

|

|

primary |

1,497.7 |

2,115.8 |

618.1 |

456.5 |

644.9 |

188.4 |

0.49 |

0.05 |

0.013 |

|

|

including |

1,597.0 |

1,657.3 |

60.3 |

486.8 |

505.1 |

18.4 |

0.65 |

0.07 |

0.016 |

|

|

and |

1,798.5 |

2,008.3 |

209.8 |

548.2 |

612.1 |

63.9 |

0.69 |

0.05 |

0.020 |

|

|

ECP-145 |

enriched |

1,064.0 |

1,703.0 |

639.0 |

324.3 |

519.1 |

194.8 |

1.78 |

1.37 |

0.016 |

|

including |

1,074.0 |

1,152.0 |

78.0 |

327.4 |

351.1 |

23.8 |

4.10 |

2.96 |

0.013 |

|

|

primary |

1,703.0 |

2,001.5 |

298.5 |

519.1 |

610.1 |

91.0 |

0.62 |

0.05 |

0.033 |

|

|

including |

1,703.0 |

1,733.0 |

30.0 |

519.1 |

528.2 |

9.1 |

0.96 |

0.09 |

0.010 |

|

|

and |

1,852.0 |

1,882.0 |

30.0 |

564.5 |

573.6 |

9.1 |

0.86 |

0.07 |

0.020 |

|

|

ECP-147 |

enriched |

1,000.3 |

1,936.0 |

935.7 |

304.9 |

590.1 |

285.2 |

1.02 |

0.63 |

0.014 |

|

including |

1,145.0 |

1,347.0 |

202.0 |

349.0 |

410.6 |

61.6 |

2.03 |

1.28 |

0.016 |

|

|

and |

1,397.0 |

1,427.0 |

30.0 |

425.8 |

434.9 |

9.1 |

1.75 |

1.29 |

0.021 |

|

|

primary |

1,936.0 |

2,024.0 |

88.0 |

590.1 |

616.9 |

26.8 |

0.62 |

0.05 |

0.013 |

|

|

ECP-152 |

oxide |

1,042.0 |

1,062.3 |

20.3 |

317.6 |

323.8 |

6.2 |

1.00 |

0.97 |

0.018 |

|

enriched |

1,272.0 |

1,946.7 |

674.7 |

387.7 |

593.4 |

205.6 |

1.00 |

0.94 |

0.020 |

|

|

including |

1,293.4 |

1,419.0 |

125.6 |

394.2 |

432.5 |

38.3 |

2.18 |

2.13 |

0.017 |

|

|

and |

1,674.0 |

1,724.0 |

50.0 |

510.2 |

525.5 |

15.2 |

1.33 |

1.31 |

0.028 |

|

|

and |

1,892.0 |

1,916.0 |

24.0 |

576.7 |

584.0 |

7.3 |

1.68 |

1.65 |

0.032 |

|

|

primary |

1,946.7 |

2,283.0 |

336.3 |

593.4 |

695.9 |

102.5 |

0.35 |

0.04 |

0.016 |

|

|

including |

1,946.7 |

2,075.0 |

128.3 |

593.4 |

632.5 |

39.1 |

0.54 |

0.05 |

0.017 |

|

|

ECP-155 |

oxide |

1,072.0 |

1,140.0 |

68.0 |

326.7 |

347.5 |

20.7 |

0.72 |

0.70 |

0.018 |

|

oxide |

1,223.5 |

1,315.0 |

91.5 |

372.9 |

400.8 |

27.9 |

0.87 |

0.85 |

0.018 |

|

|

enriched |

1,315.0 |

1,887.6 |

572.6 |

400.8 |

575.3 |

174.5 |

1.04 |

0.92 |

0.023 |

|

|

including |

1,322.0 |

1,347.0 |

25.0 |

402.9 |

410.6 |

7.6 |

2.20 |

2.17 |

0.031 |

|

|

and |

1,510.0 |

1,620.0 |

110.0 |

460.2 |

493.8 |

33.5 |

1.29 |

1.06 |

0.028 |

|

|

and |

1,690.0 |

1,730.0 |

40.0 |

515.1 |

527.3 |

12.2 |

1.41 |

1.31 |

0.021 |

|

|

primary |

1,887.6 |

2,290.0 |

402.4 |

575.3 |

698.0 |

122.7 |

0.23 |

0.02 |

0.011 |

|

|

including |

1,988.0 |

2,017.0 |

29.0 |

605.9 |

614.8 |

8.8 |

0.87 |

0.06 |

0.017 |

|

|

ECP-156 |

enriched |

1,118.9 |

1,756.0 |

637.1 |

341.0 |

535.2 |

194.2 |

0.81 |

0.57 |

0.010 |

|

including |

1,366.0 |

1,566.0 |

200.0 |

416.4 |

477.3 |

61.0 |

1.33 |

1.21 |

0.009 |

|

|

primary |

1,756.0 |

2,081.6 |

325.6 |

535.2 |

634.5 |

99.2 |

0.52 |

0.05 |

0.014 |

|

|

including |

1,806.0 |

1,876.0 |

70.0 |

550.5 |

571.8 |

21.3 |

0.66 |

0.06 |

0.011 |

|

|

ECP-158 |

oxide |

1,256.0 |

1,336.7 |

80.7 |

382.8 |

407.4 |

24.6 |

1.70 |

1.69 |

0.020 |

|

enriched |

1,367.0 |

1,876.9 |

509.9 |

416.7 |

572.1 |

155.4 |

1.20 |

1.09 |

0.020 |

|

|

including |

1,382.0 |

1,432.0 |

50.0 |

421.2 |

436.5 |

15.2 |

2.79 |

2.13 |

0.032 |

|

|

and |

1,634.0 |

1,734.0 |

100.0 |

498.0 |

528.5 |

30.5 |

1.45 |

1.40 |

0.016 |

|

|

primary |

1,876.9 |

2,311.0 |

434.1 |

572.1 |

704.4 |

132.3 |

0.27 |

0.03 |

0.011 |

|

|

including |

1,897.0 |

1,969.4 |

72.4 |

578.2 |

600.3 |

22.1 |

0.42 |

0.04 |

0.009 |

|

|

and |

2,240.0 |

2,300.0 |

60.0 |

682.8 |

701.0 |

18.3 |

0.41 |

0.03 |

0.011 |

|

|

ECP-159 |

enriched |

1,493.0 |

1,823.2 |

330.2 |

455.1 |

555.7 |

100.6 |

1.27 |

0.77 |

0.015 |

|

including |

1,503.0 |

1,587.0 |

84.0 |

458.1 |

483.7 |

25.6 |

1.84 |

1.35 |

0.012 |

|

|

primary |

1,823.2 |

2,056.3 |

233.1 |

555.7 |

626.8 |

71.0 |

0.58 |

0.14 |

0.017 |

|

|

including |

1,833.0 |

1,903.5 |

70.5 |

558.7 |

580.2 |

21.5 |

0.70 |

0.09 |

0.017 |

|

|

ECP-162 |

oxide |

1,163.0 |

1,310.8 |

147.8 |

354.5 |

399.5 |

45.0 |

1.39 |

1.36 |

0.015 |

|

including |

1,212.7 |

1,280.7 |

68.0 |

369.6 |

390.4 |

20.7 |

2.09 |

2.05 |

0.017 |

|

|

enriched |

1,321.0 |

1,917.5 |

596.5 |

402.6 |

584.5 |

181.8 |

1.49 |

1.44 |

0.019 |

|

|

including |

1,367.9 |

1,418.0 |

50.1 |

416.9 |

432.2 |

15.3 |

2.57 |

2.54 |

0.016 |

|

|

and |

1,668.0 |

1,838.0 |

170.0 |

508.4 |

560.2 |

51.8 |

1.92 |

1.88 |

0.023 |

|

|

primary |

1,917.5 |

2,304.9 |

387.4 |

584.5 |

702.5 |

118.1 |

0.30 |

0.03 |

0.010 |

|

|

including |

1,917.5 |

1,978.4 |

60.9 |

584.5 |

603.0 |

18.6 |

0.41 |

0.05 |

0.006 |

|

|

and |

2,059.0 |

2,079.0 |

20.0 |

627.6 |

633.7 |

6.1 |

0.56 |

0.06 |

0.008 |

|

|

ECP-165 |

oxide |

1,357.0 |

1,386.0 |

29.0 |

413.6 |

422.5 |

8.8 |

1.72 |

1.71 |

0.033 |

|

enriched |

1,429.5 |

1,598.0 |

168.5 |

435.7 |

487.1 |

51.4 |

1.49 |

1.46 |

0.012 |

|

|

including |

1,437.0 |

1,487.0 |

50.0 |

438.0 |

453.2 |

15.2 |

2.29 |

2.20 |

0.013 |

|

|

enriched |

1,748.0 |

1,884.0 |

136.0 |

532.8 |

574.2 |

41.5 |

1.08 |

1.05 |

0.009 |

|

|

including |

1,758.2 |

1,788.0 |

29.8 |

535.9 |

545.0 |

9.1 |

1.60 |

1.58 |

0.010 |

|

|

primary |

1,884.0 |

2,327.0 |

443.0 |

574.2 |

709.3 |

135.0 |

0.28 |

0.03 |

0.011 |

|

|

including |

1,908.5 |

1,945.0 |

36.5 |

581.7 |

592.8 |

11.1 |

0.46 |

0.04 |

0.007 |

|

|

ECP-168 |

oxide |

1,282.0 |

1,385.5 |

103.5 |

390.8 |

422.3 |

31.5 |

0.97 |

0.97 |

0.027 |

|

including |

1,365.4 |

1,385.5 |

20.1 |

416.2 |

422.3 |

6.1 |

2.36 |

2.36 |

0.036 |

|

|

enriched |

1,405.0 |

1,570.5 |

165.5 |

428.2 |

478.7 |

50.4 |

1.28 |

1.22 |

0.016 |

|

|

including |

1,405.0 |

1,439.0 |

34.0 |

428.2 |

438.6 |

10.4 |

2.09 |

2.08 |

0.038 |

|

|

and |

1,518.0 |

1,548.0 |

30.0 |

462.7 |

471.8 |

9.1 |

1.63 |

1.62 |

0.010 |

|

|

enriched |

1,696.3 |

1,862.5 |

166.2 |

517.0 |

567.7 |

50.7 |

1.49 |

1.46 |

0.008 |

|

|

including |

1,730.0 |

1,800.0 |

70.0 |

527.3 |

548.6 |

21.3 |

1.93 |

0.35 |

0.006 |

|

|

primary |

1,862.5 |

2,300.4 |

437.9 |

567.7 |

701.2 |

133.5 |

0.25 |

0.03 |

0.010 |

|

|

including |

1,862.5 |

1,960.0 |

97.5 |

567.7 |

597.4 |

29.7 |

0.44 |

0.06 |

0.012 |

|

|

ECP-169 |

enriched |

693.3 |

730.0 |

36.7 |

211.3 |

222.5 |

11.2 |

0.79 |

0.79 |

0.007 |

|

enriched |

1,028.1 |

1,547.0 |

518.9 |

313.4 |

471.5 |

158.2 |

1.49 |

1.09 |

0.011 |

|

|

including |

1,036.0 |

1,194.0 |

158.0 |

315.8 |

363.9 |

48.2 |

2.16 |

2.10 |

0.004 |

|

|

primary |

1,547.0 |

1,908.3 |

361.3 |

471.5 |

581.6 |

110.1 |

0.61 |

0.05 |

0.017 |

|

|

including |

1,601.5 |

1,692.0 |

90.5 |

488.1 |

515.7 |

27.6 |

0.75 |

0.08 |

0.020 |

|

|

1. |

Intervals are presented in core length and are drilled with vertical, or steep dip angles. |

|

|

2. |

Drill assays assume a mineralized cut-off grade of 0.5% CuT reflecting the potential for heap leaching of underground material in the case of Oxide and Enriched or in the case of Primary material, 0.1% CuT, to provide typical average grades. Holes were terminated below the basement fault. |

|

|

3. |

Assay results are not capped. Intercepts are aggregated within geological confines of major mineral zones. |

|

|

4. |

True widths are not known. |

Table 2: Drilling details

|

Hole |

Easting (m) |

Northing (m) |

Elevation (ft) |

TD (ft) |

Azimuth |

Dip |

|

ECP-132 |

421884.8 |

3645378.0 |

1386.7 |

2430.0 |

235.0 |

-80.0 |

|

ECP-138 |

421775.2 |

3645055.4 |

1376.0 |

2248.0 |

115.0 |

-80.0 |

|

ECP-145 |

421948.2 |

3644932.1 |

1377.2 |

2011.6 |

0.0 |

-90.0 |

|

ECP-147 |

421897.2 |

3644937.9 |

1374.2 |

2219.9 |

0.0 |

-90.0 |

|

ECP-152 |

421876.6 |

3645214.3 |

1381.0 |

2315.0 |

0.0 |

-90.0 |

|

ECP-155 |

421843.8 |

3645229.5 |

1381.0 |

2315.4 |

0.0 |

-90.0 |

|

ECP-156 |

421919.7 |

3645022.2 |

1376.8 |

2103.0 |

0.0 |

-90.0 |

|

ECP-158 |

421876.6 |

3645251.8 |

1381.9 |

2347.2 |

0.0 |

-90.0 |

|

ECP-159 |

421960.0 |

3645022.5 |

1377.4 |

2077.0 |

0.0 |

-90.0 |

|

ECP-162 |

421945.2 |

3645277.4 |

1383.3 |

2323.0 |

0.0 |

-90.0 |

|

ECP-165 |

421921.3 |

3645307.7 |

1384.6 |

2373.0 |

0.0 |

-90.0 |

|

ECP-168 |

421884.6 |

3645283.8 |

1382.8 |

2360.1 |

0.0 |

-90.0 |

|

ECP-169 |

422007.8 |

3644902.1 |

1374.8 |

1912.8 |

0.0 |

-90.0 |

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

If you would like to receive our free newsletter via email, simply enter your email address below & click subscribe.

CONNECT WITH US

Tweets

Tweet with hash tag #miningfeeds or @miningfeeds and your tweets will be displayed across this site.

MOST ACTIVE MINING STOCKS

Daily Gainers

Highbank Resources Ltd. Highbank Resources Ltd. |

HBK.V | +50.00% |

|

ADD.V | +50.00% |

|

RG.V | +50.00% |

|

ERA.AX | +50.00% |

|

BCU.V | +40.00% |

|

PLY.V | +33.33% |

|

ERL.AX | +33.33% |

|

PLY.V | +33.33% |

|

HLX.AX | +33.33% |

|

MRQ.AX | +33.33% |

Articles

FOUND POSTS

Arras Minerals (TSXV:ARK) Updates on Elemes Drill Program in Kazakhstan

December 19, 2024

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan