Arras Minerals (TSXV:ARK)(OTCQB:ARRKF) has provided an update on its core drilling program at the Elemes Project in Kazakhstan. The company confirmed that the program, which began in September, remains on schedule and is expected to conclude by the end of December.

Tim Barry, CEO of Arras Minerals, commented in a press release: “We are very pleased with the progress of the core drilling program at Elemes over the past three months. This Phase 1 campaign is testing new target areas developed through our recent fieldwork, and we are encouraged by the early indications we’ve seen so far that Elemes is indeed a large epithermal-porphyry system that has yet to be explored with modern techniques.”

The Phase 1 diamond drilling program covers approximately 4,000 metres and focuses on several key targets: Berezski Central, Berezski East, Q-Gorka, and K-Ozek. These targets were selected following two exploration seasons at the Elemes Project, which included airborne magnetic surveys, Pole-Dipole Induced Polarization geophysical surveys, as well as soil sampling and mapping.

In addition to recent exploration efforts, historical drill holes at Berezski East and Q-Gorka were re-assayed earlier this year. The re-assays were previously detailed in Arras Minerals’ news releases issued on January 8 and January 22, 2024.

Arras Minerals acknowledged delays in receiving assay results for drill samples collected in September and October. The company cited longer-than-expected processing and verification times. However, Arras now anticipates announcing the initial assay results by early January 2025, with subsequent results to be released as they become available.

The Elemes Project has been a key focus for the company’s exploration activities. The drill program aims to test areas identified through prior exploration data to determine the potential for mineralized systems in the region.

The Elemes Project is one of Arras Minerals’ key assets as the company continues its exploration efforts in Kazakhstan. Arras has focused on ensuring rigorous quality assurance and quality control processes throughout the program.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

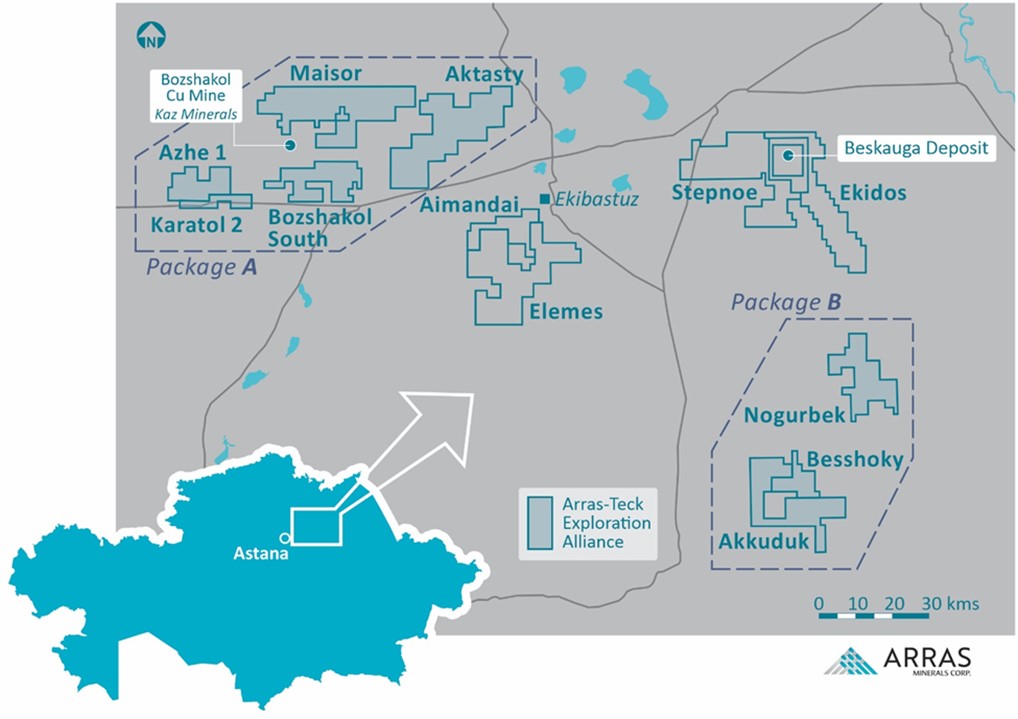

Arras Minerals (TSXV:ARK) has announced the start of a regional field program across its 3,300 square-kilometer license package in Pavlodar, Kazakhstan. The exploration area is within the Bozshakol-Chingiz metallogenic belt, known for containing the Bozshakol Mine and the Beskauga copper-gold-silver deposit.

Tim Barry, CEO of Arras, commented on the upcoming 2024 Field Program in a press release: “We are very much looking forward to starting the 2024 field program. This will be our third exploration season in Kazakhstan. Over the previous couple of seasons, we have assembled an excellent team of young local geologists, gained hard won experience on how to effectively explore in Kazakhstan, and put in place robust systems which allows us to quickly assess projects and move them to the next stage. Furthermore in 2024, we are very pleased to also have our partner, Teck, working with us. They will provide invaluable additional support via their technical specialists. We are also excited to follow up on our Elemes and Tay prospects and expect to drill them later in the season after refining the targets with additional mapping and geophysics.

The 2024 field program has the potential to be transformative for Arras. We expect to drill at least three new porphyry prospects this year, which when combined with the Beskauga Project which we have under an option to purchase, means we potentially have at least four porphyry prospects controlled by the company. The project portfolio is close to incredible infrastructure and the country is quickly becoming a tier-one destination for copper and gold exploration globally as demonstrated by many of the copper and gold majors establishing a presence in Kazakhstan over the past 6-12 months.”

The program includes work under the Teck Strategic Alliance, focusing on two license packages covering 1,736 square kilometers. Activities planned for 2024 include airborne and ground geophysics, followed by mapping, soil sampling, and targeted drilling.

Additionally, the program will explore the Elemes Project, specifically the Berezski and Aimandai targets. The Berezski Target is an 8.8-kilometer-long copper anomaly with historical drilling showing promising results. The Aimandai Target is a 14-kilometer x 3.2-kilometer copper anomaly that has not yet been drilled. Both targets will undergo detailed mapping and ground geophysics to define drill targets for upcoming diamond drilling.

The Tay Project, specifically the Tay IP Target, will also be explored. This target is a 6.5-kilometer x 2.1-kilometer chargeability anomaly located 28 kilometers north of the Bozshakol mine. The prospect is covered with unconsolidated cover and has not been systematically explored using modern methods. The plan includes a KGK drill program to understand the geology, followed by diamond drilling to test the chargeability high.

The project area benefits from existing infrastructure, including a paved highway, power lines, and rail, all within close proximity to the targets.

Highlights from the results are as follows:

- The 2024 Exploration program will target licences associated with the Teck Strategic Alliance, and Arras’s 100% owned Elemes and Tay projects.

- An extensive airborne and ground geophysics program, followed by a mapping, soil sampling and drill program over the Package A and Package B Licences under the Strategic Alliance with Teck Resources Limited (“Teck”).

- A geophysics and detailed mapping program followed an initial diamond drill program targeting the Berezski and Aimandai copper targets located within the Elemes Project.

- An initial scout KGK program followed by an initial diamond drill program on the Tay Project, targeting the 6.5-kilometre x 2.1-kilometre Induced Polarization (“IP”) chargeability anomaly.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

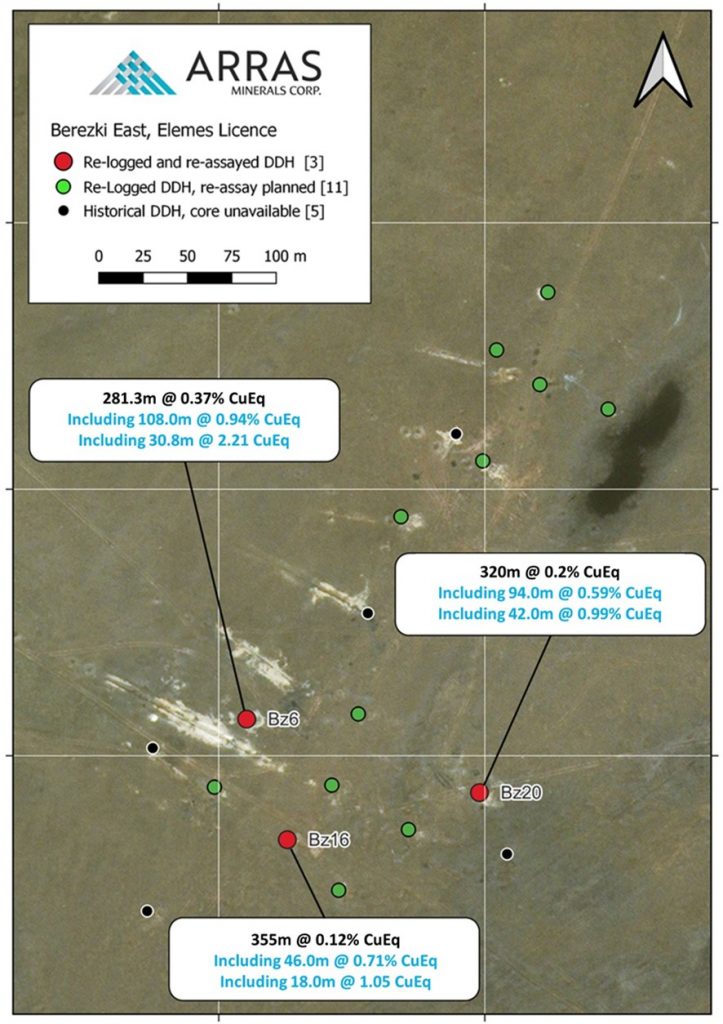

Arras Minerals (TSXV:ARK) has announced promising results from the re-analysis of samples from three historic diamond drill holes from the Berezski East project located within the Company’s Elemes exploration licence in northeastern Kazakhstan. The 425 square kilometre Elemes mineral exploration license, which hosts the Berezski East project, is located approximately 80 kilometres east of Arras Minerals’ flagship Beskauga copper-gold deposit and is not included in the Teck-Arras Strategic Exploration Alliance.

Tim Barry, CEO of Arras Minerals, commented in a press release: “The recent re-analysis program at Berezski East and Quartzite-Gorka has underscored the promising mineralizing system developing within our Elemes Licence. Our efforts over the past year have revealed a significant at-surface zone of mineralization, extending across a 5-kilometre strike, with potential expansions in every direction. To date, key areas of interest include “porphyry style” mineralization found at the Berezski East, Berezski Central, and Quartzite Gorka prospects, and “epithermal style” mineralization found at the Karagandy-Ozek prospect. Re-logging and re-assay of historic drill holes has verified intercepts of high-grade of mineralization often exceeding 100 meters in thickness and often starting from surface. It is also important to note that many of historical drill holes end in mineralization as most of the drilling was quite shallow, averaging between 200-300 meters in depth.”

The Elemes licence is situated within the highly productive Bozshakol-Chingiz metallogenic belt in northeastern Kazakhstan that also hosts KAZ Minerals’ large Bozshakol porphyry copper-gold mine located roughly 60 kilometers northwest of Berezski East. The Elemes license benefits from excellent infrastructure, including close proximity to Arras Minerals’ operational base in the nearby city of Ekibastuz. A paved highway and heavy rail lines lie within 15 kilometers of Berezski East, while 1100 KVA power lines run within 1 kilometer of the project area.

Between 2007 and 2010, the previous operators at Berezski East completed 19 diamond drill holes totaling 5,695 metres, with an average depth of 299.7 meters per hole. Mineralization at Berezski East remains open along strike and at depth based on the results of the historical drilling. Arras Minerals has acquired all available drill core and coarse rejects from the previous operators’ drilling campaigns and has relocated the materials to the Company’s core storage facility in Ekibastuz for detailed re-logging and analysis.

Arras Minerals’ technical team has re-logged the available historical drill core from Berezski East in order to systematically document lithology, structure, alteration, and mineralization characteristics. These core re-logging results, combined with the encouraging re-assaying of coarse rejects from historical drilling, have provided valuable insights into the geology and metallogenesis of the Berezski East mineral system.

The style of mineralization identified at Berezski East is interpreted by Arras geologists to represent part of a larger gold-rich porphyry copper-gold district within the Elemes licence area. Additional prospects identified to date on the Elemes property include Berezski Central, Quartzite Gorka, and Karagandy-Ozek.

The re-analysis work by Arras of coarse rejects from three historical drill holes at Berezski East confirms the presence of high-grade gold, copper and silver mineralization. Individual sample assays returned up to 18.0 grams per tonne (g/t) gold (Au), 1.01% copper (Cu) and 47.7 g/t silver (Ag).

The gold-rich mineralization at Berezski East consists of sheeted and stockwork quartz-magnetite-chalcopyrite-bornite veins with associated potassic alteration halos. Additional vein types identified include magnetite-only and quartz-chalcopyrite veins. Disseminated chalcopyrite, bornite and pyrite are also locally present. Late anhydrite and epidote-carbonate veins crosscut the earlier porphyry-style veins.

The Ordovician-aged host diorite intrusion is fine-grained, equigranular and typically highly magnetic. Pervasive potassic alteration (K-feldspar+quartz+magnetite+biotite) affects the diorite locally, overprinted by intermediate argillic alteration (illite+chlorite). An upper oxidized zone exhibits intense kaolinite-iron oxide alteration with minor supergene copper enrichment.

Results from a detailed high-resolution airborne magnetic survey by Arras, along with 3D inversion modeling of the magnetic data, reveal that the known mineralization at Berezski East lies on the margin of a strong northwest-trending magnetic high. This magnetic feature extends towards and links up with the Karagandy-Ozek epithermal gold prospect where Soviet-era exploration reportedly discovered high-grade gold mineralization in trenches. The airborne magnetic survey has greatly improved Arras’ understanding of the structural setting of Berezski East mineralization and has generated compelling new drill targets near known zones of porphyry and epithermal Au-Cu mineralization.

Arras is highly encouraged by the re-analysis results and new geologic insights from its comprehensive re-logging program on the historical drill core from the Berezski East project within the Company’s 100% owned Elemes license. The Company will incorporate these positive developments into upcoming exploration plans for the Elemes property. Arras’ technical team believes Berezski East and the broader Elemes license represent a major new gold-rich porphyry copper-gold district opportunity in northeastern Kazakhstan. Further drilling and exploration work is warranted based on the re-interpretation of the historic Berezski East data and the additional targets defined by the recent airborne magnetic survey. With its close proximity to excellent infrastructure, Berezski East highlights the untapped discovery potential remaining within Arras’ prospective project portfolio in this prolific but under-explored mineral belt.

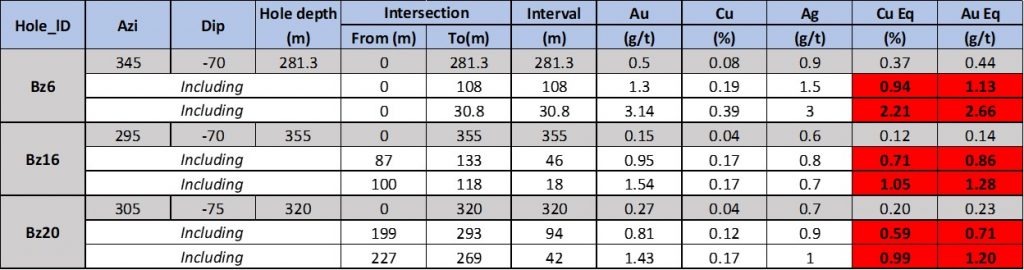

- Bz6 – 108.0 meters (“m”) of mineralization grading 0.94 % CuEq or 1.33 /t AuEq (1.30 g/t gold (“Au”), 0.19 % copper (“Cu”) and 1.5 g/t silver (“Ag”)) starting at surface.

- Including 30.8 m grading 2.21 % CuEq or 2.66 g/t AuEq (3.14 g/t Au, 0.39 % Cu and 3.0 g/t Ag) starting at surface.

- Bz16 – 46.0 m of mineralization grading 0.71 % CuEq or 0.86 g/t AuEq (0.95 g/t Au, 0.17 % Cu and 0.8 g/t Ag) starting at 87.0 m depth down-hole.

- Including 18.0 m grading 1.05 % CuEq or 1.28 g/t AuEq (1.54 g/t Au, 0.17 % Cu and 0.7 g/t Ag) from 102.0 m depth down-hole.

- Bz20 – 94.0 m of mineralization grading 0.59 % CuEq or 0.71 g/t AuEq (0.81 g/t Au, 0.12 % Cu and 0.9 g/t Ag) starting at 199.0 m depth down-hole.

- Including 42.0 m grading 0.99 % CuEq or 1.20 g/t AuEq (1.43 g/t Au, 0.17 % Cu and 1.0 g/t Ag) from 227.0 m depth down-hole.

Notes: Copper Equivalent (“CuEq”) grades reported for the drill holes at Berezski East were calculated using the following formula: CuEq % = Copper (%) + (Gold (g/t) x 0.8264) + (Silver (g/t) x 0.0107). Gold Equivalent (“AuEq”) grades reported for the drill holes at Berezski were calculated using the following formula: AuEq g/t = Gold (g/t) + (Copper (%) x 1.2100) + (Silver (g/t) x 0.0129). Assumptions used for the copper and gold equivalent calculations were metal prices of US$3.00/lb. Copper, US$1,700/oz Gold, US$22/oz Silver, and metallurgical recoveries were assumed to be 90% for Cu and Au and 50% for Ag and Mo. Intervals are core-length and original core recovery is estimated to be > 90 %. Source: Arras Minerals

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

If you would like to receive our free newsletter via email, simply enter your email address below & click subscribe.

CONNECT WITH US

Tweets

Tweet with hash tag #miningfeeds or @miningfeeds and your tweets will be displayed across this site.

MOST ACTIVE MINING STOCKS

Daily Gainers

Ratel Group Ltd. Ratel Group Ltd. |

RTG.TO | +60.00% |

|

CZN.AX | +50.00% |

|

AFR.V | +33.33% |

|

GCX.V | +33.33% |

|

CRB.AX | +33.33% |

|

RUG.V | +33.33% |

|

CASA.V | +30.00% |

|

BSK.V | +25.00% |

|

PGC.V | +25.00% |

|

GZD.V | +25.00% |

Articles

FOUND POSTS

Arras Minerals (TSXV:ARK) Updates on Elemes Drill Program in Kazakhstan

December 19, 2024

Potential Trump Tariffs Could Reshape Copper Market Dynamics in 2025

December 17, 2024

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan