A new lithium processing plant is in the works according to Albemarle (NYSE:ALB), in a plan to create a plant that would end up producing as much lithium as the company produces today. Electric vehicles use lithium in their batteries, and with the rise in sales of these types of vehicles, it’s no wonder that Albemarle is taking this step. The move signals Albemarle’s strategy to be a key player in an all-electric economy.

The United States requires lithium to be imported in order to meet the demands of electric vehicle production. However, with this new processing plant, Albemarle would be able to provide all the lithium that is needed for these vehicles. This is a huge shift and one that could have a big impact on the economy and environment.

With this expansion, Albemarle aims to be part of the US supply chain in a major way, handling mine development, process, and manufacturing for the critical metal that is used to make EV batteries.

The advantages of having a local source of lithium are many. It would create jobs, reduce the country’s reliance on imports and be more environmentally friendly than current mining practices.

Albemarle is taking on this project because of the past few quarters seeing a rise in the number of announced EV manufacturing plants. These announcements and further construction of the plants could fuel a huge demand surge that the United States would struggle to keep up with at current production rates.

At the Fastmarkets Lithium Supply and Battery Raw Materials conference in Phoenix Arizona, Eric, Norris, head of Albemarle’s lithium division said, “There isn’t enough (lithium) supply yet to supply the ambitions of the US. This (processing plant) will be essential for our success in the future.”

The new processing plant would have 100,000 tonnes of annual capacity and might be located somewhere in the southeastern United States where there could be rail access to a major port. This will contribute to the company’s goal of boosting its lithium production capacity to 500,000 tonnes per year by 2030.

The company is already in talks with automakers to secure deals for the facility. Automakers and Albemarle are discussing buying supply from the facility. Currently, Albemarle supplies Tesla, among some other major automakers.

The US plant would be similar to one the company opened in Kemerton, Western Australia. However, the plant needs to cost less than the one in Kemerton since the costs ultimately grew past the initial goal of $1.2 billion. And while Albemarle is planning to fund the US plant itself, it could also apply for US Department of Energy loans for the project.

To supply the processing plant, the Kings Mountain mine in North Carolina could be reopened, possibly by 2027 to prepare for the opening of the new plant.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

Elon Musk has made public appeals to boost mining in the past, most notably for nickel. Most recently, the Tesla (NASDAQ:TSLA) boss made it clear that he is looking for more lithium for electric vehicles (EVs). One of the problems the company faces right now, is that very few places can supply lithium consistently right now.

Tesla CEO Elon Musk has repeatedly said that the company would begin mining lithium following years of comments indicating it would do so. He first stated this nearly two years ago although steps have not yet been taken.

While demand for the commodity is set to rise in the coming years, the necessity to have a steady supply of it has become all the more pressing. Major producers such as Albemarle Corp. (NYSE:ALB) are increasing capacity and launching new projects, but growth in supply is still insufficient owing to a lack of investment following the lithium boom-bust from 2017 to 2019.

For the present, lithium production is concentrated in a few nations, with Chile and Australia accounting for 81% of global output. Few suppliers imply greater uncertainty about delivery, and often price volatility.

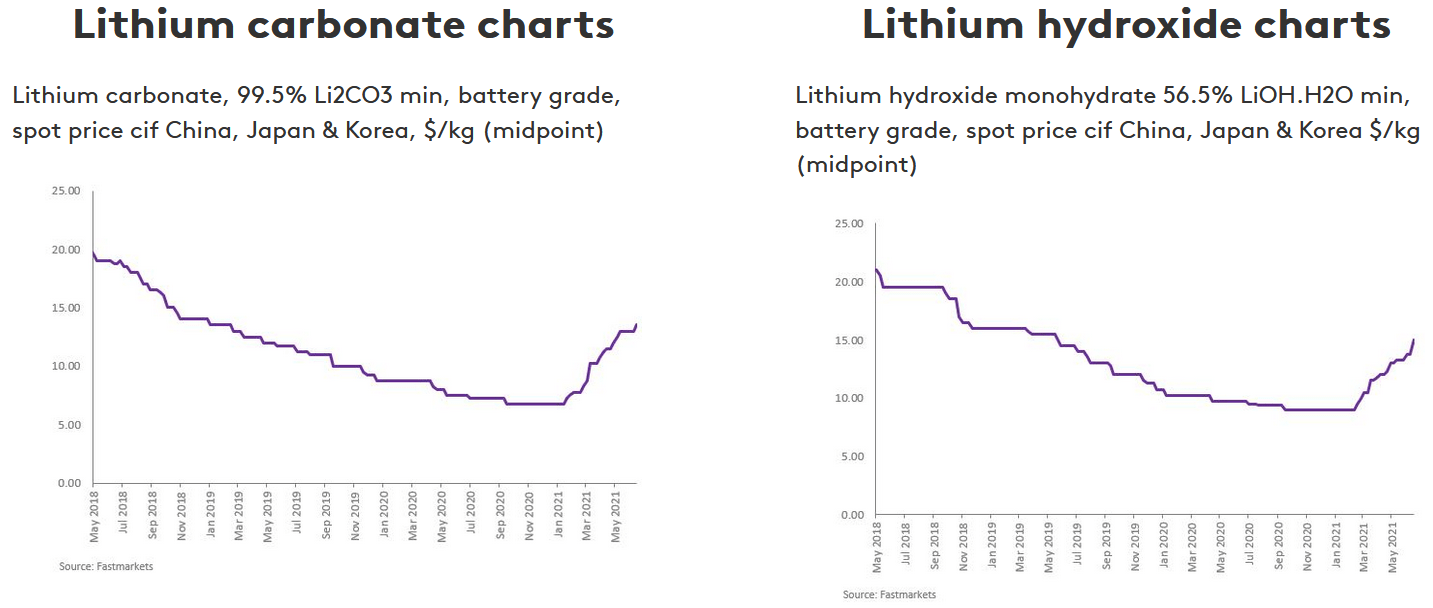

Recent Price Moves

In April, rising lithium carbonate and hydroxide prices in China slowed their rise, according to Benchmark Mineral Intelligence, but for chemical processors and battery manufacturers trying to keep up with price increases so far in 2022, the lull is unlikely to last. The first half of April has seen lithium hydroxide prices (the kind used in batteries with nickel cathodes) rise further though. This is the particular kind of lithium that Tesla requires for its vehicles.

A Dry Spell and Price Slump

For some time, there was a price slump for lithium as the market was still deciding what the demand might be from the coming changes in the auto and energy industries. Now that it is clear that the direction toward clean energies is certain, prices have been more bullish.

At the time of the pause, a lot of lithium capacity was being built, driven by the electric vehicle craze when Tesla and non-hybrid vehicles arrived five years ago. Now, prices have caught up to the reality of the demand and expected demand growth in the coming decade.

There is an industry of startups and junior miners attempting to tackle the challenge of developing new lithium projects. However, the process of going from exploration to production takes several years, which has contributed to today’s undersupply. None have been able to achieve commercial scale yet either. For now, Tesla has relied on and will continue to rely on traditional lithium mining countries like Australia and Chile.

Mexico Nationalizes Its Lithium Industry

In other lithium news, the Mexican government has nationalized the country’s lithium industry after the Senate passed a mining reform bill proposed by President Andres Manuel Lopez Obrador. The president now has 90 days to establish a new, decentralized organization to deal with all aspects of lithium in the country.

The president declared that his administration will conduct an audit of all lithium contracts, casting a cloud over projects already in development, and all but assuring a lack of new projects in the near future. The law may also likely deter foreign investment not just for lithium mining but for other mining as investors weigh the risks of the populist government proposing similar changes to other areas of the industry.

The law, according to reports, would violate the United States-Mexico-Canada Agreement (USMCA) and jeopardize trade frictions with Mexico’s northern neighbours. Most of the world’s current lithium production is stashed away in long-term deals because downstream chemicals producers, battery manufacturers, and electric vehicle makers are all trying to lock down future supply. While the law will change the industry within Mexico, it may not change much for the lithium mining industry globally.

According to data from the US Geological Survey, Mexico’s lithium reserves place it in just 10th place among the world’s top producers.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

Investors in the mining sector are preparing for what should be another strong year for the industry by adding a total of $86.3 billion of market capital to the top mining companies in the Top 50 ranking in 2021.

The overall value of the Top 50 ended 2021 at just under $1.4 trillion after peaking a little above that. This amount represents an increase of about $100 billion since the beginning of the year and double the market capitalization they had during March and April 2020, i.e., the peak of the pandemic.

Coal Doesn’t Go Cold

With no exposure to iron ore other than trading, Glencore (OTC:GLNCY) and its investors bucked the trend by closing the year with $25 billion.

The Swiss multinational company, Glencore, a commodity trading and production company, has not abandoned coal mining. Like its peers, its coal, gas and oil trading arm is benefiting from rising energy prices.

The performance of coal miners in 2021, especially in China, is the clearest evidence of the volatility of commodity markets. Although only a short time ago, towards the end of the year coal miners and their coal divisions in the diversifieds were threatening to drop out of the ranking altogether.

The rest of the three remaining coal companies (the ranking excludes power companies that operate their own mines such as Shenhua Energy) rose and Coal India halted its decline. The world’s largest coal miner, Coal India was number 4 in the rankings four years ago.

Lithium on the Rise

The high demand for electric cars has caused lithium prices, used for the motors and battery technology, to remain high, and their rebound has been prolonged. At the moment, the top three lithium producers, listed in the Top 50 ranking, have a global value of more than $66 billion.

Tianqi Lithium briefly dropped its position in the rankings in 2019, due to its market value being below $5 billion. However, China’s Shenzhen-listed Lithium producer is now ranked in the top 20 of the majors, with a value of about $25 billion surpassing SQM.

For its part, Albemarle (NYSE:ALB), the world’s number one producer, has risen 59% since the year began which made its investors $10 billion richer. Charlotte, North Carolina-based Albemarle announced that it intends to buy, with the aim of expanding downstream, a Chinese lithium producer.

Ganfeng, the leading manufacturer of lithium chemicals (a company not ranked as mining is not a major part of its business) is striving to secure investment in that sector of production. For its part, copper producer Codelco is advancing work on its lithium project. However, concessions in Chile could become scarce or disappear altogether in the decades to come.

Pilbara Minerals is currently ranked 54th but Pilbara is expected to enter the top 50 mining rankings very soon, as the company continues to post record highs and operations at the Pilgangoora project are ramping up to supply the huge demand for spodumene for Chinese transformers.

Rio Tinto’s (ASX:RIO) Jadar project is not off to a good start in Serbia. The Anglo-Australian company’s lithium business is likely to start to look up in the rankings in the next few years as well as Sibanye’s entry into battery metal with an acquisition in Nevada.

Iron Ore, and More

Falling iron ore prices and the decline of copper in the market in the last months of 2021 affected the ranking position of the big three companies, BHP (NYSE:BHP), Rio Tinto (ASX:RIO) and Vale (NYSE:VALE). Over the course of last year, they lost a total of $56 billion.

Last year, BHP had a valuation of almost $200 billion being worth slightly more than oil company Royal Dutch Shell for some time. This made it the most valuable stock in the UK.

A sign of the belief investors have in the effect on mining for the green energy transition is the fact that BHP has lost almost $50 billion despite activating the search for nickel for battery manufacturing. Rio Tinto, for its part, has lost $43 billion since its peak. These losses are indicators that iron ore mining remains central to the sector.

The fall in iron ore caused South Africa’s Kumba Iron Ore to have its worst valuation of the year, plummeting 30%. Australia’s Fortescue Metals, the world’s fourth largest iron ore producer, plunged by $13 billion over the year. While its ranking fell six places as its trading arm, Fortescue Future Industries, got off to a slow start.

CSN Mineração, one of the biggest mining IPOs since Glencore’s in 2011, dropped out of the 50 ranking in its first quarter debut. But thanks to last year’s 87% rise, the Cleveland-Cliffs company is ranked in the top 50 after spending years in obscurity.

Uranium

For the first time after many years, the value of uranium producers is once again ranked in the top 50.

Kazakhstan’s Kazatomprom expanded its stock exchange listing beyond Almaty. As a result, the company has doubled in value this year. Kazakhstan, responsible for about 40% of uranium production, despite the turmoil in the country, has not affected the fortunes of the state-controlled company.

AngloGold Ashanti, Cameco’s main rival, has been overtaken by Cameco leaving Cameco out of the rankings at the end of the year. However, the stock’s performance since the Dec. 31 close would see the Saskatoon-based company move back up the rankings in the hope that it can take advantage of the revival of uranium mining and the problems in Kazakhstan.

A Banner Year

Overall, the mining industry had a banner year with record investor inflows. The bullishness of 2021 is likely to continue as the pandemic recedes and producers get back to normal with production targets as well as a more balanced and predictable supply chain.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

Lithium is a fundamental building block for the future of the world. As an essential component that drives green technologies and an essential element for the manufacture of energy storage systems, it has become indispensable for life on earth. This has led to its demand growing exponentially globally.

In order to boost the lithium market, promote sustainable production and increase competitiveness in the industry, the Chilean government has invited national and international companies to participate in a public search process for strategic partners to begin the exploration, exploitation and commercialization of new lithium deposits in the country.

With this call, 57 companies have expressed interest in new contracts in Chile to explore and produce lithium.

Chile will open tenders for the exploration and production of 400,000 tons of lithium to meet the high demand, the Ministry of Mining confirmed in a statement. These are special operating contracts with private and foreign companies until 2050 to sell lithium as raw material in the form of lithium carbonate or lithium hydroxide.

The Process

According to government information, the bidding process is in an initial phase, it is expected to have more information on the contracts by the end of this year, before the change of government.

The national and international call for bids will be made through a public, competitive and transparent process in order to tender and award contracts to produce a total of 400,000 tons of marketable metallic lithium, divided in five installments of 80,000 tons each, without a specific geographic location, detailed by the Ministry of Mining.

Participating companies may bid for 1 or 2 quotas, requesting each one, individually or through consortiums or related companies, to be awarded a maximum of 2 quotas for a total of 160,000 tons, in any area of the national territory.

The awards will be for a term of seven years, extendable for another two years to carry out the geological exploration, studies and development of the project in general, to which will be added another 20 years of production.

“It looks promising,” mentioned the minister of Energy and Mining Juan Carlos Jobet in an interview.

Chilean Lithium

After Australia, Chile is the largest lithium producer with 29% of the world’s supply but its market share has been compromised in recent years. Due to high demand for electric vehicles, Chile has decided to open up more of its huge reserves with the promise that this demand will keep lithium supplies tight for the next few years. The benchmark lithium index has doubled this year, as have prices in China.

Global lithium demand is expected to quadruple by 2030, reaching 1.8 million tons of lithium carbonate, according to ministry projections.

A Confluence of Events Creates Mild Uncertainty

Potential bidders are taking a high political risk in Chile as the whole process is taking place on the eve of presidential and parliamentary elections. In addition, Chilean President Sebastián Piñera has been impeached following revelations from the Panama Papers leak.

At least one opposition senator has accused the center-right government of trying to rush through the new contracts at a time when the country is reviewing its stance on natural resources while a new constitution is being drafted.

Albemarle Corp. (NYSE:ALB), one of only two existing producers in Chile, has purchased the bidding documents, but said that part of its due diligence is to evaluate the next government’s stance on the process.

Currently, the Chilean company and the US company Albemarle SQM operate in Chile at the Salar de Atacama, one of the richest lithium deposits in the world. Before the companies can develop their projects, they will have to carry out exploration work and process the necessary permits to produce up to 80,000 metric tons each for 20 years, the U.S. Geological Survey said.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

Chile holds the largest known lithium reserves, and miners have been clamoring for tenders consistently since the first discoveries and mapping were conducted. Now, the Latin American nation is opening a tender for the exploration and production of 400,000 tonnes of lithium.

This move by the Chilean government is an effort to reclaim market share from competitors like the Democratic Republic of Congo, Australia, and China, and fill some of the growing demand for lithium due to its use in electric vehicles and technology. Up until 2018, Chile was the world’s top lithium producer.

However, Australia displaced Chile, and China is fast approaching the point where it will be the second-largest lithium producer with a projected timeline of the end of this decade. For example, China’s Ganfeng Lithium is a majority shareholder in Argentina’s plant Cauchari-Olaroz. Production is scheduled to begin in mid-2022 and become one of the world’s leading lithium production mines.

Chile still produced approximately 29% of the world supply. No small feat for the smaller nation competing on the international stage. The government has ambitions set much higher though, and it looks to double production to 250,000 tonnes of lithium carbonate equivalent (LCE) by 2025.

Chile’s mining ministry projects show that global demand for lithium could quadruple by 2030 – a total of 1.8 million tonnes. Even if Chile doubles it production and new lithium projects come online, available supply is projected to be 1.5 tonnes, a significant deficit. This will likely drive prices higher and create a further wave of new projects and new tenders becoming available.

The tender is being prepared with rules that will make it available to local firms and foreign firms alike. The tender will split the 400,000 tonnes into five quotas of 80,000 tonnes each. Winning permits will mean companies have seven years to explore and develop projects. This is extendable by two years if needed. Following development, the tender will allow permit 20 years of production, according to the mining ministry.

Right now, there are two major lithium miners that dominate the market: Albemarle (NYSE:ALB) and SQM (NYSE:SQM). Their primary and most profitable location for extraction is in Chile’s Atacama Desert. The desert is one of the driest places on earth and creates ideal conditions for lithium extraction. The extraction process requires pumping brine from beneath surface and then concentrating the brine using evaporation pools.

They pump the brine from the vast salt plain of Salar de Atacama in Chile to 80 km2 basins. The salt flats and surrounding mountains have allowed rainfall to accumulate over millions of years, forming a salty brine that has become trapped in underground reservoirs. Lithium extraction in Chile is currently taking place in the Atacama Plain, but the Maricunga Plain is believed to hold the largest lithium reserves in the country.

The upcoming tender is designed to shift the dynamics of the global lithium market and help Chile compete with its global competitors. With the rise of China’s lithium mining giant, and the two dominant miners continuing to expand their footprints, Chile will open up the tender in the hopes of creating some of the biggest lithium projects of the next decade. This is all aimed at the mission of doubling production.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

The world’s top lithium producer is about to get even bigger, as Albemarle (NYSE:ALB) is buying Chinese company Guangxi Tianyuan New Energy Materials. The $200 million dollar deal will further cement Albemarle’s position as the number one lithium producer in the world and increase production.

Albemarle is getting an important asset at a very critical time. Lithium is becoming more important than ever with the rise of battery technology at the forefront of the economy. Founded in 2017, Guangxi Tianyuan New Energy Materials has a recently constructed lithium processing plant in Guangxi. The plant is close to the port of Qinzhou, making it strategically accessible for the company to export its product.

The project is not operational yet, but it is in the commissioning stage. Albemarle said it hopes to bring the project online for commercial production in the first half of next year. The plant has a capacity o f25,000 tonnes of lithium carbonate equivalent (LCE) and can produce the battery-grade lithium carbonate and lithium hydroxide that is so valuable in today’s modern economy.

Plants like these will form a strategic part of Albemarle’s strategy going forward as it strengthens its position in this particular corner of the market.

At the same time, the company is increasing the production of the critical material for which prices are rising rapidly. Earlier in September, lithium prices skyrocketed to their highest level in the pat three years. Optimism about EVs and record electric vehicle sales around the world have depleted lithium stocks in China, which is the top consumer of the material.

According to a report by Benchmark Mineral Intelligence (BMI) demand for lithium could jump 26.1% in just five years from approximately 100,000 tonnes of LCE to 450,000 LCE, creating a production deficit of 10,000 tonnes in the process. That is a very short timeline for this shift, and companies are scrambling to keep up.

Albemarle, as the leader in production, produced lithium from salt brine deposits in Chile and the United States and has hard rock joint venture mines in Australia. A deal like this one will surely further cement the company’s position as a critical lithium producer.

A Second Challenge to Face

The lithium market will also need to adapt to new environmental standards, as recycling for materials and batteries generally becomes more widely adopted.

As electric vehicles become more widespread, the market for battery recycling will grow. Most components of lithium-ion batteries can be recycled but the cost of material recovery remains a problem for the industry. The US Department of Energy supports the Lithium-Ion Battery Recycling Award to find solutions for the collection, separation, storing, transportation, dispensing, and discarding of lithium-ion batteries for subsequent recycling.

American battery technology companies in Nevada that mine and process lithium use it in their own production processes and sell the other materials. Brunp Reycling, a subsidiary of CATL, the world’s largest manufacturer of electric batteries, operates a dozen hydrometallurgical recycling plants in China. The company says it recycles 120,000 tonnes of old batteries a year, which is half of China’s current annual battery recycling capacity.

Lithium stocks are riding a wave of demand for the metal, drowning in a deluge of new offerings coming onto the market. Worldwide battery capacity is currently around 455 GWh with the average lithium-ion battery system at 79 GWh.3 Battery manufacturers are planning massive capacity expansions in the next decade, with an estimated production of 2,450 GWh by 2029 enough to supply 49 million electric vehicles annually.4 Looking ahead, 49 million cars will account for 65% of global automotive sales in 2019.

How Does it Work?

Lithium is the main active material in rechargeable batteries for electric cars. It occurs in rocks and clay deposits as a solid mineral that dissolves into brine.

Tesla drew attention to the raw materials needed to produce batteries for electric vehicles by signing a sales contract with Piedmont Lithium to secure a third startup production for 10 years even though its mines are not yet in operation.

The key type of new battery technology will be solid-state lithium batteries, which companies like Albemarle produce lithium for. Solid-state lithium batteries use a solid material instead of combustible gels.

Natalie Scott Gray, the senior metals analyst at the StoneX Financial Services firm, said the market for rechargeable batteries had increased fivefold in the past 20 years. The lithium market is still relatively small, said Andrew Miller, product director at Benchmark Mineral Intelligence, a price-awareness agency that specializes in the lithium-ion battery market.

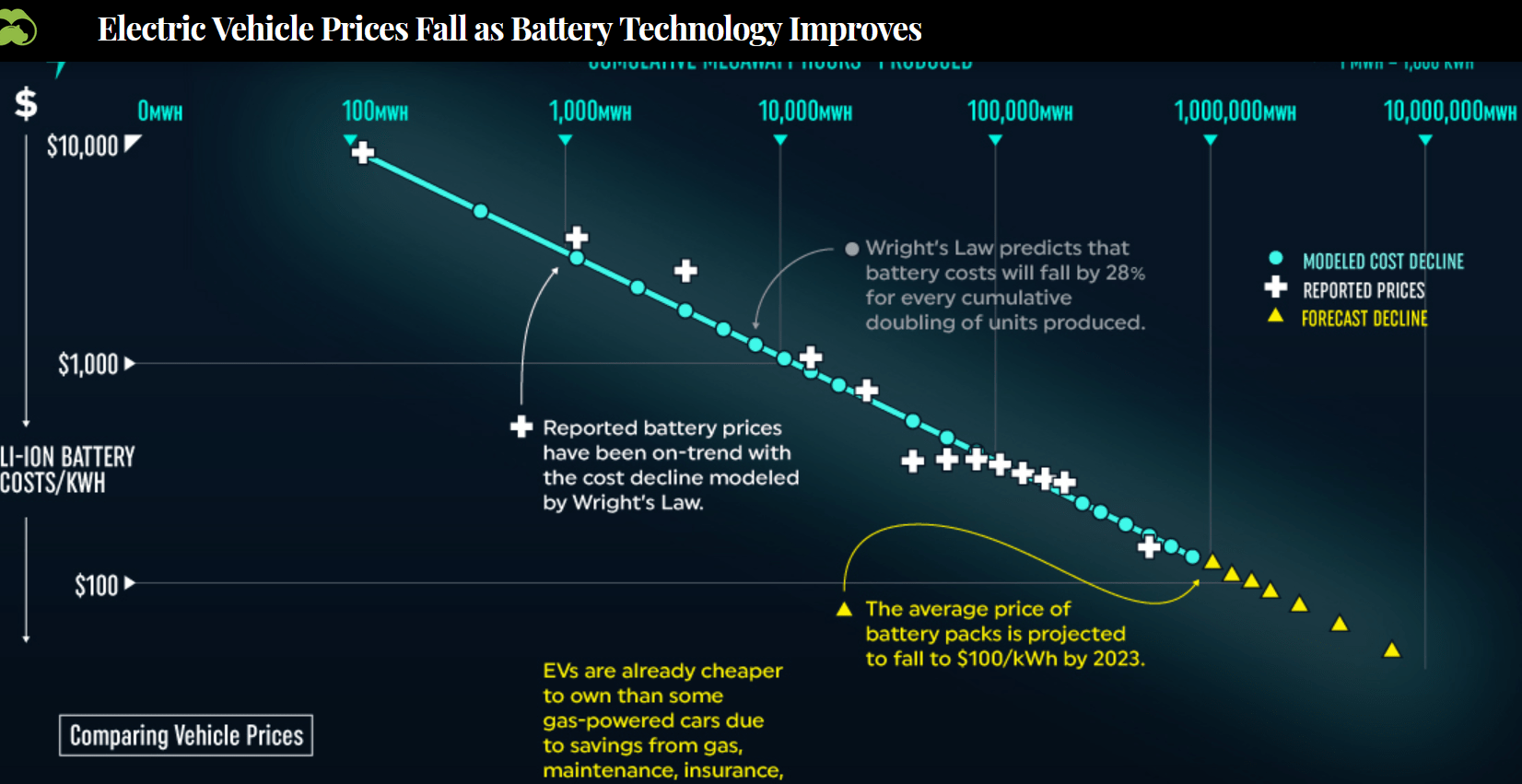

Before the Turn of the Millenium

The revolution in lithium-ion batteries began in the early 1990s when Sony and several other companies started commercial versions of lithium-ion batteries. Lithium-ion batteries are now the standard choice for most household electronic devices and appliances and electric cars because of their higher energy density than other technologies. Industry analysts expect the price of electric vehicles (EVs) to be equal to combustion engine vehicles by 2025, with convergent costs for batteries to fall even further.

With millions of electric vehicles already driving on roads and an increasing number of countries around the world focused on the growing volume of electric vehicle sales, we can expect strong growth in demand for lithium-ion batteries. Since lithium-ion batteries are the dominant choice for many applications, especially electric vehicles, the question of the global supply of lithium is timely and important for investors.

Lithium-ion batteries are used in most portable consumer electronics as well, such as mobile phones and laptops because they contain high energy per mass unit compared to other electrical energy storage devices.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

Roaring electric vehicle (EV) sales, battery production, and economic reopening continued to drive lithium prices higher in June. Most lithium producers are now working on ramping up further production during the expansion of a very favourable environment for them.

A Decade of Expansion

The coming decade could see a 1000% demand increase, at the current rate of expansion. To meet the global megafactory demand of 3,791 GWh by around 2030 may require lithium producers to step up to the plate faster than ever. This count is always shifting and could change by the time we get to the end of the decade, but there is no question that demand will continue to grow over the coming years, giving lithium miners more customers and profits.

More Price Runs

The past 30 days has see 99.5% lithium carbonate battery grade spot midpoint prices cif China, Japan and Korea at US$13.50/kg (US$13,500/t) and min 56.5% lithium hydroxide battery grade spot midpoint prices cif China, Japan and Korea at US$15.00/kg (US$150,000/t). The price charts for these look like they are bouncing off a trampoline with a heavy positive trend for May and June.

The main drivers for lithium (metal) demand are EVs and some of the high-tech sectors that require lithium for their products. EVs and energy storage make up the vast majority of demand for lithium, and this is where the bulk of the demand increases are expected to come in the future. Two of the fastest movers for this market are Europe, with 15% EV share, and China, with 10% EV share. A permissive and positive regulatory framework on top of stable and supported homegrown car manufacturers has given these two countries a leg up on accelerating their new EV sales timelines.

China in particular has pushed its domestic EV producers further with massive subsidies and government investment. As battery prices continue to fall, so do EV prices. In an article from Visual Capitalist, the linear correlation shows that the forecasted decline in Li-ion batteries could fall to around $100/kWh by 2023.

Miners Heading to the Moon

Some lithium mining companies are soaring on the backs of this news and their business models are in a great position.

Albemarle (NYSE:ALB)

Albemarle (NYSE:ALB) recently completed the sale of its fine chemistry services business to W.R. Grace and Co for about $570 million. The company is moving forward with its ESG goals for lithium mining as well, announcing on June 2 that “Albemarle releases sustainability report and environment target commitments.”

Orocobre (ASX:ORE) (TSX:ORL)

Orocobre (ASX:ORE) (TSX:ORL) announced that the “Olaroz Lithium Facility (Olaroz) operations increased the Gross Cash Margin more than $1,800/tonne with the sales price up more than 50%. Costs remained near all-time lows despite a much greater proportion of sales being battery grade material which has higher production costs…..Naraha Lithium Hydroxide Plant construction has continued throughout the period and is now approximately 94% complete.”

As the company continues to expand operations in time to fill the growing demand, investors could be more than happy to continue piling into the stock.

Galaxy Resources (ASX:GXY)

The company’s Mt Cattlin project is back to producing at full rate, with an acceleration of 2NW mining with the first phase of pre-strip to commence in H2 2021. The company joins many other miners in the race back to normal after the pandemic shut down some operations and forced mining companies to slow production. This was partly due to the pandemic itself, and the double-shock of the dropoff in demand from shutdowns.

Just the Beginning

We are likely just at the beginning of a long run of lithium prices continuing their steady growth. The U.S. has also unveiled its recent infrastructure plan which is set to require more lithium due to the massive needs coming from the electrification aspects of the plan. The plan will call for the superpower to start bringing in domestic and international supply for batteries, critical minerals (like lithium and copper) and semiconductors.

It also seems that there could be a cross-pollination within the tech, auto, mining, and energy industries. CATL and BYD (one of the key EV brands in China) is in talks with Apple for EV battery supply, as Apple is possibly aiming for a 2024 production start date for its own passenger vehicle. Volkswagen is also looking to “get actively involved in the raw materials business” according to a statement from the company.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

If you would like to receive our free newsletter via email, simply enter your email address below & click subscribe.

CONNECT WITH US

Tweets

Tweet with hash tag #miningfeeds or @miningfeeds and your tweets will be displayed across this site.

MOST ACTIVE MINING STOCKS

Daily Gainers

Ratel Group Ltd. Ratel Group Ltd. |

RTG.TO | +60.00% |

|

ERL.AX | +50.00% |

|

MRQ.AX | +50.00% |

|

AFR.V | +33.33% |

|

CRB.AX | +33.33% |

|

GCX.V | +33.33% |

|

RUG.V | +33.33% |

|

CASA.V | +30.00% |

|

BSK.V | +25.00% |

|

GQ.V | +25.00% |

Articles

FOUND POSTS

Arras Minerals (TSXV:ARK) Updates on Elemes Drill Program in Kazakhstan

December 19, 2024

Potential Trump Tariffs Could Reshape Copper Market Dynamics in 2025

December 17, 2024

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan