Amarc Resources (TSXV:AHR) has reported all assay findings from its groundbreaking Phase 1 core drilling program. The program took place at the DUKE porphyry Cu-Au district, located in central British Columbia, and is fully owned by the company.

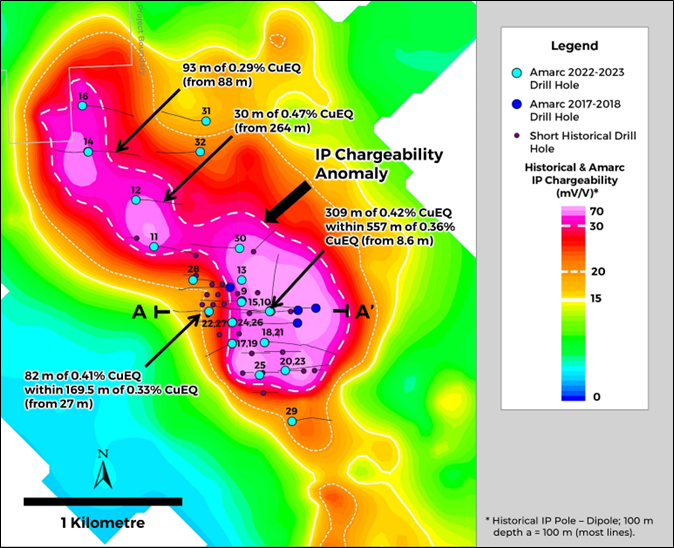

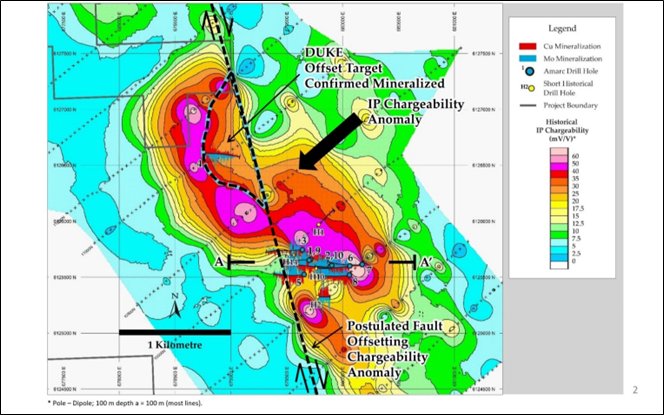

Between the early days of December 2022 and mid-March 2023, Amarc successfully executed 24 core drill holes, summing up to an impressive 11,086 metres, within a meticulously planned 80-drill-day schedule. This extensive operation was carried out using two high-precision drill rigs dedicated to clarifying the geological nuances of the DUKE Cu-Mo-Ag-Au Deposit. Simultaneously, a third rig was put into action to investigate the overburden-rich, and strong 4.7 km2 Induced Polarization anomaly wrapping the DUKE Deposit. The anomaly suggests the presence of a comprehensive mineralized system.

An early snow melt in mid-May made way for teams to return on-site. Amarc has kept the momentum going with a recently concluded District-wide airborne magnetics survey. Concurrently, a multitude of ground geological, geophysics, and geochemical surveys are in progress with an expert team of over 35 technical and logistics crew members active on-site. These surveys will scrutinize 16 prioritized porphyry Cu-Au targets scattered across the DUKE District in preparation for the planned winter 2023-2024 drill testing.

As part of the 2023 agenda, Amarc has dedicated $10 million in exploration expenditures at the DUKE District. This exploration cost is covered in full under the Mineral Property Earn-in Agreement with Boliden Mineral Canada Ltd., also referred to as Boliden, as per the details released in the Amarc news release dated November 22, 2022. Amarc is maintaining full control over the project’s operation.

The Impact of DUKE Deposit Drilling Program

In the recently concluded Phase 1 drilling program, of the 24 holes drilled, 16 were widely-dispersed drill holes amassing 7,552 metres. These were completed to contribute to the understanding and delimitation of the DUKE Deposit. The explorative endeavours have not only amplified the extent of the DUKE Deposit porphyry Cu-Mo-Ag-Au system but have also bolstered Amarc’s grasp on the factors influencing mineralization within the DUKE District. The company has successfully crafted an exploration template to effectively sift and promote the additional 16 priority exploration targets within the expansive 678 km2 DUKE District tenure. This swift headway in understanding the mineralization control at the DUKE Deposit allows for an increased likelihood of success in the upcoming regional target areas.

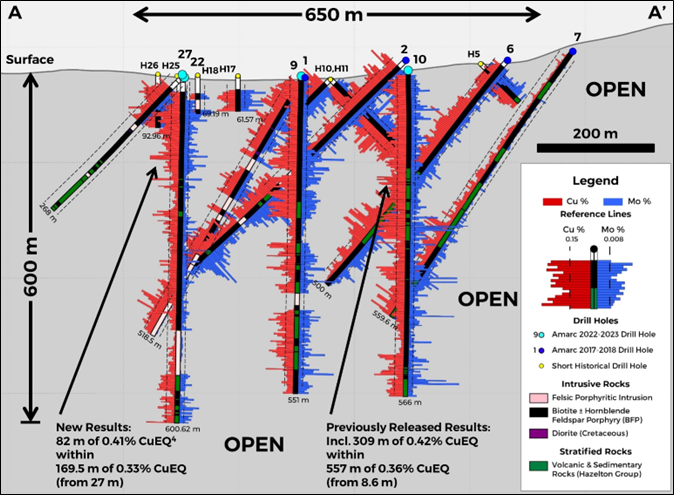

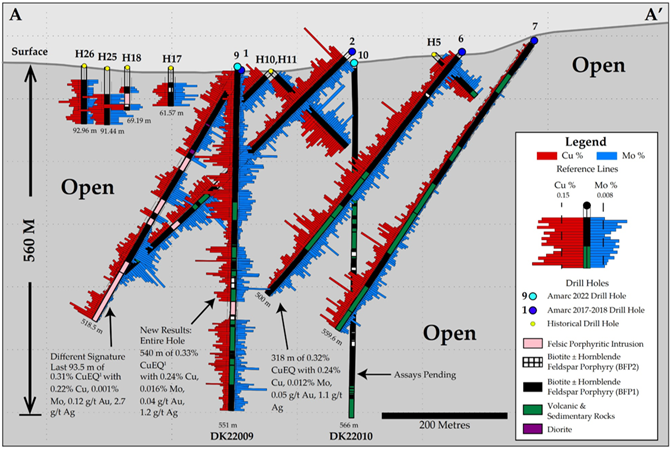

In the DUKE Deposit, drill holes were placed on an approximate 200-metre grid, a strategic step-out from Amarc’s prior drilling. This effort validated that the DUKE Deposit extends to a depth of a minimum 600 metres and widened the deposit footprint laterally to over 650 metres north-south and 800 metres east-west. Additionally, detailed geological interpretation and modelling suggest a solid potential for further lateral expansion of the deposit, specifically to the east. One key characteristic of the porphyry Cu-Mo-Ag-Au mineralization in these extensive holes is the existence of zones of higher-grade mineralization enclosed within broader envelopes of comparatively average grade. Notably, with further drilling, significant potential arises for defining internal higher-grade zones.

The DUKE Deposit comprises a sequence of Babine porphyry intrusions positioned within volcanic and sedimentary rocks. These junction zones are marked by heightened Cu-Mo grades, often spanning tens of metres in width, within both the intrusions and the neighbouring volcanic and sedimentary rocks. This significant Cu-Mo mineralization extension from the intrusions into the surrounding volcanic and sedimentary rocks extensively augments the DUKE Deposit volume potential.

Testing of the Broad Mineralized System Encasing the DUKE Deposit

Aside from the work at the DUKE Deposit, Amarc also successfully completed eight Phase 1 core holes, aggregating 3,534 metres, within the robust mineralized system demarcated by a 4.7 km2 IP chargeability anomaly. These distributed drill holes (300 to 500 metres apart) scrutinized a range of geophysical and geological targets. Notably, drill hole DK23012, situated 500 metres northwest of the DUKE Deposit, returned an important 30-metre intercept of 0.47% CuEQ, providing an essential target for subsequent drilling. Amarc’s ongoing data interpretation and modelling efforts are oriented towards vectoring outward from the DUKE Deposit to this target, and other zones of mineralization nestled within the broader mineralized system.

Exploration Program in the DUKE District

Amarc has just wrapped up an expansive 5,759 line-kilometre, helicopter-assisted high-resolution aeromagnetic survey, covering an area surpassing 500 km2 over the DUKE District. The results from this survey, which expand on previous Amarc and historical aeromagnetic coverage, are being integrated into the comprehensive District-wide exploration program. The mission of this program is to clearly define multiple porphyry Cu-Au deposit drill targets.

A broad surface exploration program has also been initiated, complete with a logistics team, and a trio each of geological mapping, geophysical and geochemical sampling crews, already working on-site. The aim of these surveys is to establish well-defined drill targets for the winter 2023-2024 drilling. Initially, 16 prospective deposit target areas have been chosen based on a comprehensive compilation of government and historical data encompassing the entire District. The compilation underscores the surprisingly low exploration maturity of the productive Babine porphyry Cu-Au region and offers a new interpretation of its geological, geochemical and geophysical characteristics. Furthermore, Amarc’s 2022-2023 drilling at the DUKE Deposit has yielded valuable insights about porphyry deposit exploration footprints in the region.

Highlights from the results are as follows:

- 183 m of 0.43% CuEQ* (0.31% Cu, 0.019% Mo, 0.07 g/t Au,1.5 g/t Ag) in hole DK22009**

- 217 m of 0.45% CuEQ (0.33% Cu, 0.018% Mo, 0.08 g/t Au, 1.5 g/t Ag) in hole DK22010**

- 30 m of 0.47% CuEQ (0.36 % Cu, 0.015% Mo, 0.06 g/t Au, 3.2 g/t Ag) in hole DK23012

- 30 m of 0.43% CuEQ (0.31% Cu, 0.014% Mo, 0.09 g/t Au, 1.6 g/t Ag), and

33 m of 0.44% CuEQ (0.20% Cu, 0.053% Mo, 0.06 g/t Au, 1.3 g/t Ag) in hole DK23015 - 82 m of 0.41% CuEQ (0.30% Cu, 0.017% Mo, 0.06 g/t Au, 1.1 g/t Ag) in hole DK23022

- 36 m of 0.47% CuEQ (0.34% Cu, 0.024% Mo, 0.06 g/t Au, 1.5 g/t Ag) in hole DK23024

- 33 m of 0.40% CuEQ (0.30% Cu, 0.017% Mo, 0.05 g/t Au, 1.5 g/t Ag) in hole DK23026

* Copper equivalent (CuEQ) calculations use metal prices of: Cu US$4.00/lb, Mo US$15.00/lb, Au US$1,800.00/oz and Ag US$24.00/oz and conceptual recoveries of: Cu 85%, Mo 82%, Au 72% and 67% Ag.

** Holes DK22009 and DK22010 were previously reported in Amarc releases dated January 26, 2023 and February 15, 2023, respectively

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

Amarc Resources (TSXV: AHR) has announced new assay results from the ongoing 2022-2023 drilling program at the DUKE deposit in the 100%-owned DUKE porphyry Cu-Au district in British Columbia. The results from the first drill hole are part of the first phase program funded under the Mineral Property Earn-in Agreement with Boliden Mineral Canada.

The results are for Hole DK22009 and are the first results from one of two holes completed in December 2022. Drilling was done in the central area of the DUKE deposit to test the geometry and depth potential of the mineralization there. The hole was drilled in the vicinity of previous Amarc drill holes (including DK17001 and DK17002, listed as “1” and “2” on Figures 1 and 2; see also December 19, 2017 and June 12, 2018 news releases). The hole intercepted significant Cu-Mo-Au-Ag mineralization from the bedrock surface to the bottom of hole, including several sub-intervals of a higher grade. The results are of good tenor and continuity and indicate that the DUKE Deposit extends to a significantly greater depth than previously known (seen in Figure 1).

Amarc President and CEO Diane Nicolson commented in a press release: “With the release of these initial encouraging results, we are pleased with the excellent progress has already been made in our first work program with partner Boliden. Our teams are excited about DUKE’s tremendous potential, and are looking forward to further expanding and delineating the mineralization at DUKE while also testing the multiple other targets within the DUKE District.”

Highlights from the results are as follows:

- 542 m of 0.33% CuEQ* (0.24% Cu, 0.016% Mo, 0.04 g/t Au and 1.2 g/t Ag) from 9.4 m

- Including 183 m of 0.43% CuEQ (0.31% Cu, 0.019% Mo, 0.07 g/t Au and 1.5 g/t Ag) from 65 m

- Including 126 m of 0.52% CuEQ (0.38% Cu, 0.024% Mo, 0.08 g/t Au and 1.8 g/t Ag) from 122 m

* Copper Equivalent (CuEQ) and other details are provided below with Table 1

Table 1: Drill Hole DK22009 Assay Results

| Drill Hole ID1 | Azim (°) | Dip (°) | EOH (m) | Incl. | From (m) | To (m) | Int.2,3,4 (m) | CuEQ5 (%) | Cu (%) | Mo (%) | Au (g/t) | Ag (g/t) |

| DK22009 | 0 | -90 | 551 | 9.40 | 551.00 | 541.60 | 0.33 | 0.24 | 0.016 | 0.04 | 1.2 | |

| Incl. | 9.40 | 247.62 | 238.22 | 0.39 | 0.29 | 0.016 | 0.06 | 1.4 | ||||

| and | 65.00 | 247.62 | 182.62 | 0.43 | 0.31 | 0.019 | 0.07 | 1.5 | ||||

| and | 122.00 | 247.62 | 125.62 | 0.52 | 0.38 | 0.024 | 0.08 | 1.8 | ||||

| and | 128.00 | 161.00 | 33.00 | 0.59 | 0.42 | 0.028 | 0.10 | 1.8 | ||||

| and | 176.00 | 245.00 | 69.00 | 0.57 | 0.42 | 0.023 | 0.09 | 2.1 | ||||

| Incl. | 289.88 | 376.90 | 87.02 | 0.36 | 0.25 | 0.020 | 0.05 | 1.5 | ||||

| and | 289.88 | 336.87 | 46.99 | 0.43 | 0.31 | 0.022 | 0.06 | 1.7 | ||||

| Incl. | 406.12 | 551.00 | 144.88 | 0.31 | 0.22 | 0.018 | 0.03 | 1.1 | ||||

| and | 412.00 | 488.00 | 76.00 | 0.38 | 0.28 | 0.018 | 0.04 | 1.4 | ||||

| and | 412.00 | 434.00 | 22.00 | 0.42 | 0.31 | 0.022 | 0.04 | 1.5 | ||||

| and | 459.54 | 488.00 | 28.46 | 0.41 | 0.30 | 0.018 | 0.05 | 1.5 |

- DK22009 is collared at UTM NAD83, Zone 9, Easting 679708, Northing 6125648.

- Widths reported are drill widths, such that true thicknesses are unknown.

- All assay intervals represent length-weighted averages.

- Some figures may not sum exactly due to rounding.

- Copper equivalent (CuEQ) calculations use metal prices of: Cu US$4.00/lb, Mo US$15.00/lb, Au US$1,800.00/oz, Ag US$24.00/oz and and conceptual recoveries of: Cu 85%, Mo 82%, Au 72% and 67% Ag. Conversion of metals to an equivalent copper grade based on these metal prices is relative to the copper price per unit mass factored by conceptual recoveries for those metals normalized to the conceptualized copper recovery. The metal equivalencies for each metal are added to the copper grade. The general formula for this is: CuEQ % = Cu% + (Au g/t * (Au recovery / Cu recovery) * (Au $ per oz/ 31.1034768) / (Cu $ per lb* 22.04623)) + (Ag g/t * (Ag recovery / Cu recovery) * (Ag $ per oz/ 31.1034768) / (Cu $ per lb* 22.04623)+ (Mo% * (Mo recovery / Cu recovery) * (Mo $ per lb / Cu $ per lb)).

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

If you would like to receive our free newsletter via email, simply enter your email address below & click subscribe.

CONNECT WITH US

Tweets

Tweet with hash tag #miningfeeds or @miningfeeds and your tweets will be displayed across this site.

MOST ACTIVE MINING STOCKS

Daily Gainers

|

CMB.V | +900.00% |

|

CCD.V | +100.00% |

|

CASA.V | +30.00% |

|

AAZ.V | +25.00% |

|

RMI.AX | +25.00% |

|

POS.AX | +25.00% |

|

KGC.V | +20.00% |

|

GDX.V | +20.00% |

|

LPK.V | +16.67% |

|

CCE.V | +16.67% |

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan