Tanzania has become one of the fastest emerging gold producers in Africa, and is now the continent’s third largest gold producing country after South Africa and Ghana. Tanzania has proven gold reserves in excess of 36 million ounces and each year since 1998, a new gold mine has been opened in Tanzania. Majors mining gold in Tanzania include South Africa’s AngloGold Ashanti (NYSE: AU) and Barrick Gold (TSX: ABX) through its subsidiary African Barrick Gold (LSE: ABG).

Today, Reuters reported that the Tanzanian government is considering a “super profit” tax on earnings from miners in order to fund the development of their nation. President Jakaya Kikwete said on Tuesday, “Revenue from the mineral resources will be one of the important sources of financing the medium-term plan. Considering the increasing trend in mineral prices, it is optimal to introduce a super profit tax on the windfall earnings from the mineral sector.”

Gold exports from Tanzania account for 7% of the country’s gross domestic product. Annual sales of gold have grown from $500 million to $1.5 billion over the past five years while the government revenue from sales of the metal has remained at $100 million from a report issued by the East African nation’s planning commission.

Most mining contracts in Africa were negotiated in the 1980s and 1990s when commodity prices were low and political risks were high which discouraged foreign investments in Africa’s mining sector. Festus Mogae, the former president of Botswana, one of Africa’s most successful mineral exporters, stated that previously African countries had to entice investors by granting incentives such as extensive tax and royalty exemptions. Consequently, many countries earned very little from such contracts. “That is why it is necessary to renegotiate some of them,” he said at a meeting of the Africa Development Bank.

Tanzanian Royalty Exploration Corporation (TSX: TNX) is a junior miner with gold exploration projects in the Lake Victoria Goldfields of Tanzania. The company is developing the projects independently and in association with third parties. James Sinclair, the company’s President & CEO issued a statement on the company’s website refuting the reports on the proposed super tax as erroneous. Mr. Sinclair wrote, “Rumours of a supertax on minerals production in Tanzania are totally without merit and based upon a recommendation by a Uganda-based non-governmental organization that is not connected to the Tanzanian government in any way. It is the company’s understanding that no such supertax has been proposed in the latest budget tabled by the Tanzanian government.”

Tanzanian Minerals (TSX-V: TZM), Canaco Resources (TSX-V: CAN), and Currie Rose Resources (TSX-V: CUI) are three juniors listed on the TSX Venture Exchange with exploration activities in the East African nation of Tanzania. All of which may, or may not, be affected by the rumoured super tax.

Eritrea, a funnel shaped country that borders The Red Sea, was, because of its unstable political history, a bit of a mystery to the international mining community. But an unprecedented era of peace and stability is changing things quickly.

Eritrean society is ethnically heterogeneous. The Tigrinya people and the Tigre people together make up about 80% of the country’s total population. The rest of the country consists of various other Afro-Asiatic groups. Like its demographic makeup, mining deposits in Eritrea are also heterogeneous; since the Eritrean government embraced mining development in the 1990’s a number of unique deposits have been found in the country that consist of a combination of gold, silver, copper and zinc.

Eritrea’s government, however, is a stark counterpoint to the country’s diversity. Eritrea is a single-party state. The government is run by the People’s Front for Democracy and Justice (PFDJ). No other political groups are currently allowed to organize, although the Constitution of 1997, which has not been implemented, provides for the existence of multi-party politics. In 2008, the government of Eritrea made it more attractive for foreign companies to prospect and develop projects when they set their stake at 10 percent with an option to buy a further 30 percent. Industry analysts consider this to be a relatively small claim compared to other countries in North Africa like Egypt which mandates a 50 percent stake or Sudan at 60 percent. And as a result, some industry experts predicted an impending mining boom in Eritrea.

A video released in 2009 focusing on the Eritrean mining industry provides an excellent overview of the country and its approach to mining:

The bottom line for international miners? The Eritrean government is proactive and pro-mining. The Ministry of Energy and Mines carried out modern technology-backed study and exploration activities in 2010 with a view to reinforcing the ongoing mining endeavors in the country. Alem Kibreab, director general of the Mining Department, explains the mineral resources in the country are owned by the people themselves and that the Government shoulders the responsibility of their management. Since the 2008 policy that encourages mining investment in Eritrea, Mr. Kibreab notes that twenty foreign companies are now engaged in studying, exploring and mining in the country.

Eritrea’s most advanced project is the Bisha mine operated by Nevsun Resources (TSX:NSU). Its 27 million tonnes of ore reportedly contain 1 million ounces of gold, 11.9 million ounces of silver, 800 million pounds of copper and over 1 billion pounds of zinc. The Bisha mine went into full commercial production in February of this year and Nevsun recently reported the mine produced 105,000 ounces of gold from January to April. Within the deposit, gold and silver is found in the top 35 meters and will be mined over the first two years. During last week’s sell-off in commodities shares of Nevsun faired extremely well and were actually up $0.08 on the week closing at $5.25.

Another company developing gold, silver, copper and zinc projects in Eritrea is Sunridge Gold (TSX-V:SGC). Sunridge has four projects with a combined NI 43-101 resource of 1.05 million ounces of gold, 31.8 million ounces of silver, 1.28 billion pounds of copper and 2.05 billion pounds of zinc. The company’s Debarwa deposit has similar geology to Nevsun’s Bisha mine. The company has been relatively quite of late on the news front but drill results are expected soon from Emba Derho (one of the company’s three northern deposits); and, an updated resource calculation is expected this month from their flagship Debarwa deposit factoring in drill programs conducted in 2009 and 2011. Sunridge Gold also survived the recent correction unscathed closing the week unchanged at $0.95.

NGEx Resources (TSX:NGQ), a diversified international mining company that boasts Lukas Lundin as its Chairman, also has a foothold in Eritrea. NGEx’s Hambok project is located near the Bisha mine and in January, 2009 the company reported a NI 43-101 indicated resources estimated of 231 million pounds of copper, 530 million pounds of zinc, 2.3 million ounces of silver and 68,000 ounces of gold. The mini-mining meltdown was less kind to NGEx Resources, shares of the company were down $0.13 to close the week at $3.36.

In what has become a near daily occurrence, civil unrest erupted in another developing African nation today. The Ivory Coast is in the news once again. On Saturday, the Red Cross said that at least 800 civilians were killed in inter-ethnic violence in the city of Duekoue by fighters supporting UN-recognized president Alassane Ouattara.

With unprecedented demand for mining commodities, junior mining companies have braved international geopolitical risks in exchange for NI 43-101 resource estimates. Over the past ten years, the Ivory Coast has faced its share of political uncertainty. But this issue has had no perceivable affect on mining; a number of juniors operate there. So how can investors in junior mining stocks price in the level of political risk associated with the Ivory Coast? The answer, curiously, might be by carefully watching the price of cocoa.

In 1960, the Ivory Coast gained independence from France which was then French West Africa’s most prosperous country, contributing over 40% of the region’s total exports, including much of the world supply of cocoa. For the two decades that followed independence, the economy maintained an annual growth rate of nearly ten per cent, the highest of Africa’s non-oil-exporting countries. As the new millennium approached it brought political instability to the Ivory Coast. In late 1999, a group of dissatisfied officers staged a military coup that put General Robert Guéï in power. Former President Henri Konan Bédié fled in exile to France. General Guéï was quickly replaced, in the year 2000, with the election of Laurent Ghagbo. Ghagbo was welcomed into office by a brief civil war in 2001 that lead to a “government of national unity” between rebel leaders and Ghagbo’s administration.

As a result of the instability, the presidential elections scheduled for 2005 were postponed and, finally, held in November 2010. The preliminary results announced by the Electoral Commission showed a loss for Gbagbo in favour of former prime minister Alassane Ouattara. Gbagbo contested the results before the Constitutional Council charging massive fraud in the northern departments which were controlled by the rebels. In response, the African Union sent former South African President Thabo Mbeki to mediate the conflict.

The contested election results raised fears of yet another civil war and thousands of refugees have fled the country. Eventually, the U.N. Security Council adopted a common resolution recognizing Alassane Ouattara as winner of the elections, based on the position of the Economic Community of West Africa States. But Gbagbo has not yet stepped aside. In January, 2011 it was reported that West African military commanders were preparing a contingency plan to remove Ivory Coast President Laurent Gbagbo by force if he failed to peacefully transfer power to Alassane Ouattara.

Because the country is the world’s largest supplier of cocoa, recent tensions in the Ivory Coast have resulted in a steady upward move in the price, from $2,874 per tonne in September, 2010 to just under $3,500 last month. In March, however, the price of cocoa fell as many believed that recent actions indicated the situation was finally coming to a head. Bloomberg reported that the Republican Forces who are seeking to oust incumbent leader Laurant Gbagbo are likely behind the latest attacks outside of Abidjan.

So is the declining price of cocoa a bullish indicator for miners operating in the Ivory Coast? Some do expect that an end to the Ghagbo situation will bring political stability to the country and could positively impact junior miners doing business there.

Sama Resources (TSXV:SME) primary project is the Samapleau Nickel/Copper project in the Ivory Coast. On January 15th, 2009, a Memorandum of Agreement between La Société pour le Développement Minier de la Côte d’Ivoire (SODEMI) and Sama Nickel Corporation was signed to undertake exploration under Exploration Permit No. 123. With Ghagabo under pressure, investors appear to be viewing the events in a positive light – the company’s shares were up $0.05 this past week to close at $0.38.

Perseus Mining Limited (TSX:PRU) a gold mining junior interlisted on the Australian and TSX Exchanges is drilling their secondary project (Tengrela Gold Project) in the politically charged nation. But Perseus’s flag ship project is the Central Ashanti Gold Project, located in neighbouring Ghana, so tensions in the Ivory Coast have not impacted the company to any large degree. Shares of Perseus have traded in a narrow range this year; between $3.20 and $2.60. Shares closed Friday at $3.14, down just a penny on the day.

La Mancha Resources (TSX:LMA) is producing gold at their Ity mine in western Ivory Coast. On December 17th, 2010 the company reported activities were actually suspended due to the country’s political situation, but operations resumed in February. Dominique Delorme, President & CEO noted: “We expect that the situation will continue to rapidly evolve in the area surrounding the mine for the time to come. Luckily, our ability to quickly suspend and restart activities at the Ity mine gives us the flexibility to adapt ourselves to the evolution of the political situation.” The Ity mine accounts for 15% of the company’s annual gold production. La Mancha is also conducting exploration on other properties in central and eastern Ivory Coast. Shares of the company have been almost as volatile as the political action in the Ivory Coast. In the past two months shares have seen a high of $2.75 and a low of $1.70. The closing price on Friday, April 1st, was $2.32 up $0.05.

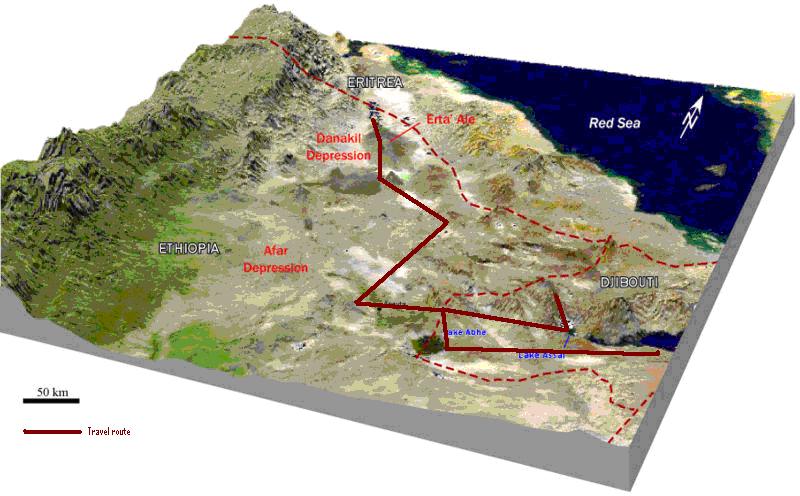

The Danakil Depression is a geological depression in the Horn of Africa that includes three areas: the Afar Triple Junction; part of the Great Rift Valley where it overlaps Eritrea; and, the Afar Region of Ethiopia and Djibouti. About 1200 km² (463 sq mi) of the Danakil is covered by salt, and salt mining is a major source of income for many of the area’s local tribes. But it is not salt that has attracted the attention of the international mining community – it is potash.

The Dallol Desert is the lowest point within the greater Danakil Depression and the hottest place in the entire world at 100 meters below sea level. Potash was discovered there many years ago and production began in 1918 after a railway was completed from the port of Mersa Fatma in Eritrea to an area 28 km outside of Dallol. Potash production ended after World War I when large-scale supplies from Germany, USA, and USSR came to market. Activity in the region sat dormant until just a few years ago when a number of licenses were granted by both Etiopia and Eritrea governments.

In 2007 one of India’s largest mining companies Sainik Coal Mining was awarded a mining license to begin potash extraction in the Danakil Depression – the largest project in the region (estimated at 160 million tonnes). Sainik plans to invest $1.1 billion in the project.

Then on July 18, 2008 Bloomberg reported that the Ethiopia government granted a 17,000 square kilometre permit to BHP Billiton. In the same report, the Mines Ministry also confirmed that three Canadian companies were granted potash exploration licenses in the area.

In neighbouring Eritrea, South Boulder Mines, a company listed on the Australian Stock Exchange (ASX: STB), announced in July, 2009 that it was granted the Colluli Potash Project exploration licence by the Eritrean Ministry of Energy and Mines. Then it became more interesting when it was reported in March, 2010 that China Investment Corp and their $300 billion Sovereign Wealth Fund was looking at Allana Potash (TSXV: AAA) and their Dallol potash project.

And it’s not cooling down yet, yesterday Ethiopian Potash (TSXV: FED) emerged as the latest entrant on the scene and staked its claim on the area with the reverse takeover of G & B Central African Resources. Shares of Ethiopian Potash hit the market with a fervour trading seven million shares closing at $0.75 up nearly $0.60 on the day.

It is clear that the Horn of Africa is open for business. Gebre Egziabher the director of mineral operations for Ethiopia’s Mines Ministry recently stated, “The sector has seen a dramatic change, seven years ago, the West didn’t know about our mineral resources.” Ethiopia’s government is aiming to license 50 mineral-exploration projects every year and more than double exports from the industry to $1 billion in five years.

If you would like to receive our free newsletter via email, simply enter your email address below & click subscribe.

CONNECT WITH US

Tweets

Tweet with hash tag #miningfeeds or @miningfeeds and your tweets will be displayed across this site.

MOST ACTIVE MINING STOCKS

Daily Gainers

Highbank Resources Ltd. Highbank Resources Ltd. |

HBK.V | +50.00% |

|

ADD.V | +50.00% |

|

RG.V | +50.00% |

|

ERA.AX | +50.00% |

|

BCU.V | +40.00% |

|

PLY.V | +33.33% |

|

ERL.AX | +33.33% |

|

PLY.V | +33.33% |

|

HLX.AX | +33.33% |

|

MRQ.AX | +33.33% |

Articles

FOUND POSTS

Arras Minerals (TSXV:ARK) Updates on Elemes Drill Program in Kazakhstan

December 19, 2024

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan