AbraSilver Resource (TSXV:ABRA) has reported assay results from the final set of drill holes conducted under its Phase III drilling program at its wholly-owned Diablillos property in Salta Province, Argentina. The drill holes were aimed at defining the scope of the JAC zone ahead of an upcoming Mineral Resource Estimate (MRE) and Pre-Feasibility Study (PFS) on the Diablillos project.

John Miniotis, President and CEO, commented in a press release: “We are delighted with the results of our highly successful Phase III drill campaign. The consistent, high-grade drill results encountered throughout the past year clearly demonstrate the large-scale silver-gold mineralization potential at our flagship Diablillos project. The completion of this drill campaign represents another major milestone for the Company and reinforces our belief in the tremendous value remaining to be unlocked through our ongoing exploration efforts.”

Drill holes DDH 23-066 to DDH 23-070 focused on mapping the northwestern edge of the JAC zone and consistently showed signs of silver mineralization. Notably, hole DDH 23-070 recorded a 64-meter intercept grading 148 grams per tonne (g/t) of silver at a downhole depth of 41 meters. Further, holes DDH 23-071 to DDH 23-075 were drilled to explore the northeastern edge of the JAC zone and also revealed varying degrees of silver mineralization. For example, hole DDH 23-075 intersected 15 meters grading 93 g/t of silver and 0.78 g/t of gold.

Results from DDH 23-075 were particularly noteworthy for demonstrating a continuity of mineralization between the JAC zone and the main Oculto deposit, raising the possibility of a combined open pit. Meanwhile, hole DDH 23-065 was drilled into the recently discovered JAC North zone, situated beyond the northwestern edge of the JAC zone. The hole intersected a near-surface layer of 7 meters grading 119 g/t of silver and 0.14 g/t of gold at a downhole depth of 85 meters, confirming a new significant mineralized structure in the area.

As of August 9, 2023, the JAC North zone is located over 900 meters beyond the conceptual open pit’s current Mineral Resource estimate at Oculto and approximately 100 meters northwest of the high-grade JAC zone. The company has also drilled six additional holes at nearby exploration targets, including JAC North, Alpaca, and Fantasma, the results of which are expected in the coming weeks.

With the successful completion of the Phase III drill program, AbraSilver Resource Corp. is now preparing an updated MRE, scheduled for completion within the next few weeks. This will be followed by a PFS on the Diablillos project. The Phase III program aimed to systematically grid drill the silver-dominant mineralization at the JAC zone, delineate its margins, and conduct necessary geotechnical drilling for a conceptual open-pit design. It also included reconnaissance drilling at other targets on the Diablillos land package.

The next phase of drilling, Phase IV, will prioritize targets based on a range of factors including distance from the probable porphyry progenitor beneath Oculto and structural trends revealed in magnetic surveys. Targets in the area west of Oculto such as JAC North, Alpaca, and Fantasma are currently the focus, with additional targets being developed to the east and north of Oculto.

Highlights from the results are as follows:

Table 1 – Summary of Diablillos Drill Results

| Drill Hole | Area | From (m) | To (m) | Type | Interval (m) | Ag g/t | Au g/t | ||||||

| DDH-23-065 | JAC North | 85.0 | 92.0 | Oxides | 7.0 | 119.1 | 0.14 | ||||||

| DDH-23-065 | 101.0 | 117.0 | Oxides | 16.0 | 63.4 | – | |||||||

| DDH-23-066 | JAC | 140.0 | 159.0 | Oxides | 19.0 | 68.9 | – | ||||||

| DDH-23-068 | JAC | 36.0 | 44.0 | Oxides | 8.0 | 175.4 | – | ||||||

| DDH-23-068 | 62.0 | 91.0 | Oxides | 29.0 | 69.6 | – | |||||||

| DDH-23-069 | JAC | 39.0 | 42.0 | Oxides | 3.0 | 58.4 | – | ||||||

| DDH-23-069 | 46.0 | 50.0 | Oxides | 4.0 | 36.4 | – | |||||||

| DDH-23-070 | JAC | 41.0 | 105.0 | Oxides | 64.0 | 148.1 | – | ||||||

| DDH-23-070 | 135.0 | 139.0 | Oxides | 4.0 | 93.9 | – | |||||||

| DDH-23-071 | JAC | 72.0 | 76.0 | Oxides | 4.0 | 32.2 | – | ||||||

| DDH-23-072 | JAC | 90.0 | 96.0 | Oxides | 6.0 | 56.1 | – | ||||||

| DDH-23-073 | JAC | 94.5 | 112.0 | Oxides | 17.5 | 68.9 | 0.20 | ||||||

| DDH-23-074 | JAC | 163.0 | 165.0 | Oxides | 2.0 | 41.8 | – | ||||||

| DDH-23-075 | JAC/Oculto | 94.5 | 102.0 | Oxides | 7.5 | 42.7 | – | ||||||

| DDH-23-075 | 112.0 | 127.0 | Oxides | 15.0 | 93.1 | 0.78 | |||||||

Note: All results in this news release are rounded. Assays are uncut and undiluted. Widths are drilled widths, not true widths. True widths are estimated to be approximately 80% of the interval widths for oxides.

Table 2 – Highlights of Phase III High-Grade Intercepts at JAC Zone

| Drill Hole | From (m) | To (m) | Type | Interval (m) | Ag (g/t) | Au (g/t) | AgEq1 (g/t) |

| DDH-22-019 | 89.0 | 176.0 | Oxides | 87.0 | 346.0 | 0.15 | 356.5 |

| DDH-22-044 | 121.0 | 179.0 | Oxides | 58.0 | 208.8 | 0.20 | 222.8 |

| DDH-22-046 | 123.0 | 165.5 | Oxides | 42.5 | 400.5 | 0.11 | 408.2 |

| DDH-22-052 | 139.5 | 164.5 | Oxides | 25.0 | 754.4 | 0.12 | 764.2 |

| DDH-22-053 | 140.5 | 168.5 | Oxides | 28.0 | 266.4 | 0.64 | 318.8 |

| DDH-22-056 | 110.0 | 167.5 | Oxides | 57.5 | 141.4 | 0.27 | 163.5 |

| DDH-22-057 | 144.0 | 164.0 | Oxides | 20.0 | 498.6 | 0.10 | 506.8 |

| DDH-22-060 | 114.0 | 154.0 | Oxides | 40.0 | 203.4 | – | 203.4 |

| DDH-22-061 | 65.0 | 168.0 | Oxides | 103.0 | 138.7 | – | 138.7 |

| DDH-22-062 | 119.0 | 170.0 | Oxides | 51.0 | 169.4 | 0.20 | 185.8 |

| DDH-22-063 | 56.0 | 85.0 | Oxides | 33.0 | 143.4 | – | 143.4 |

| DDH-22-063 | 135.0 | 169.0 | Oxides | 34.0 | 118.6 | 0.08 | 125.2 |

| DDH-22-067 | 143.0 | 179.0 | Oxides | 36.0 | 463.3 | 0.71 | 521.5 |

| DDH-22-067 | 179.0 | 206.0 | Sulphides | 27.0 | 745.0 | 1.54 | 871.1 |

| DDH-22-075 | 151.0 | 167.0 | Oxides | 16.0 | 604.4 | 0.82 | 671.5 |

| DDH-22-076 | 147.0 | 169.0 | Oxides | 22.0 | 476.8 | 0.20 | 493.2 |

| DDH-22-076 | 169.0 | 177.5 | Oxides | 8.5 | 1,952.8 | 6.66 | 2,498.3 |

| DDH-22-077 | 60.0 | 92.0 | Oxides | 32.0 | 121.9 | – | 121.9 |

| DDH-22-078 | 58.0 | 99.0 | Oxides | 41.0 | 103.5 | – | 103.5 |

| DDH-22-079 | 144.0 | 179.0 | Oxides | 35.0 | 199.2 | 0.36 | 228.7 |

| DDH-22-080 | 50.0 | 102.0 | Oxides | 52.0 | 125.1 | – | 125.1 |

| DDH-22-081 | 128.0 | 165.0 | Oxides | 37.0 | 179.3 | – | 179.3 |

| DDH-22-082 | 154.5 | 181.0 | Transition | 26.5 | 311.4 | 0.43 | 346.6 |

| DDH-22-083 | 159.0 | 184.0 | Transition | 25.0 | 773.8 | 0.28 | 796.7 |

| DDH-22-086 | 158.0 | 167.0 | Sulphides | 9.0 | 342.3 | – | 342.3 |

| DDH-23-002 | 148.0 | 165.0 | Transition | 17.0 | 288.6 | 0.14 | 300.1 |

| DDH-23-003 | 155.8 | 161.5 | Sulphides | 5.8 | 502.2 | – | 502.2 |

| DDH-23-004 | 136.0 | 150.0 | Oxides | 14.0 | 3,024.5 | 0.21 | 3,041.7 |

| DDH-23-007 | 115.0 | 119.0 | Oxides | 4.0 | 2,320.0 | – | 2,320.0 |

| DDH-23-009 | 161.0 | 169.5 | Oxides | 8.5 | 479.2 | 0.15 | 491.5 |

| DDH-23-010 | 132.0 | 177.5 | Oxides | 45.5 | 233.4 | – | 233.4 |

| DDH-23-014 | 127.0 | 173.5 | Oxides | 46.5 | 185.0 | 0.50 | 226.0 |

| DDH-23-017 | 92.0 | 104.0 | Oxides | 12.0 | 876.1 | – | 876.1 |

| DDH-23-021 | 161.5 | 193.5 | Oxides | 32.0 | 530.8 | 0.60 | 579.9 |

| DDH-23-024 | 144.0 | 161.0 | Oxides | 17.0 | 828.9 | – | 828.9 |

| DDH-23-025 | 100.0 | 179.0 | Oxides | 79.0 | 237.6 | 0.15 | 249.9 |

| DDH-23-036 | 140.0 | 150.0 | Oxides | 10.0 | 520.0 | 0.04 | 523.3 |

| DDH-23-039 | 105.0 | 124.0 | Oxides | 19.0 | 253.4 | – | 253.4 |

| DDH-23-046 | 157.0 | 160.0 | Oxides | 3.0 | 2,070.0 | 0.27 | 2,092.1 |

| DDH-23-061 | 134.0 | 153.5 | Oxides | 19.5 | 272.8 | – | 272.8 |

| DDH-23-070 | 41.0 | 105.0 | Oxides | 64.0 | 148.1 | – | 148.1 |

Note: All results are rounded. Assays are uncut and undiluted. Widths are drilled widths, not true widths. True widths are estimated to be approximately 80% of the interval widths.

1 AgEq based on 81.9(Ag):1(Au) calculated using long-term prices of US$25.00/oz Ag and US$1,750/oz Au, and 73.5% process recovery for Ag, and 86.0% process recovery for Au as demonstrated in the Company’s PEA in respect of Diablillos dated January 13, 2022, using formula: AgEq g/t = Ag g/t + Au g/t x (Gold Price/Silver Price) x (Gold Recovery/Silver Recovery).

Collar Data

| Hole Number | UTM Coordinates | Elevation | Azimuth | Dip | Depth (m) | |

| DDH 23-065 | E719351 | N7198699 | 4,141 | 0 | -60 | 152 |

| DDH 23-066 | E719425 | N7198702 | 4,147 | 0 | -60 | 182 |

| DDH 23-067 | E719526 | N7198780 | 4,155 | 0 | -60 | 155 |

| DDH 23-068 | E719599 | N7198852 | 4,162 | 0 | -60 | 170 |

| DDH 23-069 | E719625 | N7198879 | 4,164 | 0 | -60 | 152 |

| DDH 23-070 | E719625 | N7198840 | 4,165 | 0 | -60 | 191 |

| DDH 23-071 | E719728 | N7198918 | 4,173 | 0 | -60 | 175 |

| DDH 23-072 | E719250 | N7198710 | 4,135 | 0 | -60 | 173 |

| DDH 23-073 | E719800 | N7198941 | 4,178 | 0 | -60 | 170 |

| DDH 23-074 | E719850 | N7198928 | 4,182 | 0 | -60 | 176 |

| DDH 23-075 | E719849 | N7198982 | 4,182 | 0 | -60 | 179 |

About Diablillos

The 80 km2 Diablillos property is located in the Argentine Puna region – the southern extension of the Altiplano of southern Peru, Bolivia, and northern Chile – and was acquired from SSR Mining Inc. by the Company in 2016. There are several known mineral zones on the Diablillos property, with the Oculto zone being the most advanced with over 120,000 metres drilled to date. Oculto is a high-sulphidation epithermal silver-gold deposit derived from remnant hot springs activity following Tertiarty-age local magmatic and volcanic activity. Comparatively nearby examples of high sulphidation epithermal deposits include: Yanacocha (Peru); El Indio (Chile); Lagunas Nortes/Alto Chicama (Peru) Veladero (Argentina); and Filo del Sol (Argentina).

The most recent Mineral Resource estimate for the Oculto Deposit is shown in Table 3:

Table 3 – Oculto Mineral Resource Estimate – As of October 31, 2022

| Category | Tonnage (000 t) | Ag (g/t) | Au (g/t) | Contained Ag (000 oz Ag) | Contained Au (000 oz Au) |

| Measured | 19,336 | 98 | 0.88 | 60,634 | 544 |

| Indicated | 31,978 | 47 | 0.73 | 48,737 | 752 |

| Measured & Indicated | 51,314 | 66 | 0.79 | 109,370 | 1,297 |

| Inferred | 2,216 | 30 | 0.51 | 2,114 | 37 |

Notes: Effective October 31, 2022. Mineral Resources are not Mineral Reserves and have not demonstrated economic viability. The Mineral Resource estimate is N.I. 43-101 compliant and was prepared by Luis Rodrigo Peralta, B.Sc., FAusIMM CP(Geo), Independent Consultant. The mineralization estimated in the Mineral Resource is sub-horizontal with sub-vertical feeders and a reasonable prospect for eventual economic extraction by open pit methods.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

AbraSilver (TSXV:ABRA) has announced promising diamond drill assay results from its ongoing Phase III exploration program at its fully-owned Diablillos project in Salta Province, Argentina. The drilling at the JAC zone continues to reveal high-grade silver oxide mineralization at shallow depths, accompanied by gold and underlying copper and silver mineralization in sulphides.

John Miniotis, President and CEO, commented in a press release: “Our drill results continue to encounter multiple thick intercepts of oxide silver in virtually every hole as we increase confidence and extend the size of the new high-grade JAC discovery. The JAC zone features a highly attractive combination of scale, grade and continuity, which is expected to significantly increase the economics of our Diablillos project. We look forward to additional drill results and incorporating all the data into an updated Mineral Resource estimate later this year.”

Dave O’Connor, Chief Geologist, also commented: “Today’s drill results further define and expand the high-grade core area of the new JAC zone. Additionally, the contact zone between the oxides and underlying sulphides continues to show substantial potential for an extensive zone of high-grade silver dominant mineralisation at the base of the oxide zone as well as for significant underlying copper sulphide mineralisation with associated precious metal content.”

Significant findings from the recent JAC zone drilling include:

- DDH 23-017, designed to examine the JAC zone’s southwest extension, discovered several silver mineralization zones in oxides, including a 12.0-meter section with 876.1 g/t Ag at a 92.0-meter downhole depth.

- DDH 23-020, aimed at the JAC zone’s northern margin, intersected multiple silver and gold mineralization zones in oxides, such as a 19-meter section with 149.5 g/t Ag and 0.78 g/t Au at a 127.0-meter downhole depth.

- DDH 23-021, located in the southeastern drill target area, encountered high-grade silver mineralization in oxides, including a 32.0-meter section with 530.8 g/t Ag and 0.60 g/t Au at a 161.5-meter downhole depth.

To date, AbraSilver has drilled around 20,000 meters in 85 holes, as part of the 22,000-meter Phase III program, mainly targeting the JAC zone. The exploration findings will form the basis for an updated Mineral Resource Estimate (MRE) and will be included in a Pre-Feasibility Study on the Diablillos project, expected to be completed in the second half of 2023.

Additional exploration targets southwest of the Oculto MRE have been identified based on the recently completed detailed ground magnetic survey. Some of these targets, including the Fantasma and Alpaca targets, are expected to be drilled following the systematic drilling of the JAC zone.

The La Coipita project saw the completion of a deep hole reaching 1,242 meters. The company has finalized core splitting and sent final sample shipments to the lab. Assay results are anticipated around late June and will be reported upon receipt and interpretation.

The 80 km2 Diablillos property, acquired by AbraSilver from SSR Mining Inc. in 2016, is situated in the Argentine Puna region. The property hosts several known mineral zones, with the most advanced being the Oculto zone, where over 120,000 meters have been drilled to date.

Table 1 – Diablillos Drill Result Highlights in JAC Zone (Intercepts greater than 2,000 gram-metres AgEq shown in bold text):

| Drill Hole | From (m) |

To (m) |

Type | Interval (m) |

Ag g/t | Au g/t | Cu % | AgEq1 g/t | ||

| DDH-23-015 | 103.0 | 118.0 | Oxides | 15.0 | 84.1 | – | – | 84.1 | ||

| DDH-23-016 | 61.0 | 88.0 | Oxides | 27.0 | 46.2 | 0.01 | – | 47.0 | ||

| DDH-23-017 | 92.0 | 104.0 | Oxides | 12.0 | 876.1 | – | – | 876.1 | ||

| DDH-23-017 | Includes | 94.0 | 96.0 | Oxides | 2.0 | 4,968.4 | 0.14 | – | 4,979.9 | |

| DDH-23-017 | 110.0 | 113.0 | Oxides | 3.0 | 72.4 | – | – | 72.4 | ||

| DDH-23-017 | 132.0 | 134.0 | Oxides | 2.0 | 77.0 | – | – | 77.0 | ||

| DDH-23-018 | 108.0 | 130.0 | Oxides | 22.0 | 51.8 | – | 51.8 | |||

| DDH-23-018 | 151.0 | 160.5 | Sulphides | 9.5 | 47.2 | – | 0.67 | 47.2 | ||

| DDH-23-018 | 171.0 | 175.5 | Sulphides | 4.5 | 65.8 | – | 0.46 | 65.8 | ||

| DDH-23-020 | 79.5 | 89.5 | Oxides | 10.0 | 161.5 | – | – | 161.5 | ||

| DDH-23-020 | 92.5 | 99.0 | Oxides | 6.5 | 47.2 | 0.02 | – | 48.8 | ||

| DDH-23-020 | 104.0 | 122.0 | Oxides | 18.0 | 66.7 | 0.12 | – | 76.5 | ||

| DDH-23-020 | 127.0 | 146.0 | Oxides | 19.0 | 149.5 | 0.78 | – | 213.4 | ||

| DDH-23-020 | 148.0 | 151.0 | Oxides | 3.0 | 79.7 | 0.13 | – | 90.3 | ||

| DDH-23-021 | 137.0 | 143.0 | Oxides | 6.0 | 63.1 | 0.03 | – | 65.6 | ||

| DDH-23-021 | 156.0 | 157.0 | Oxides | 1.0 | 49.2 | 0.82 | – | 116.4 | ||

| DDH-23-021 | 161.5 | 193.5 | Oxides | 32.0 | 530.8 | 0.60 | – | 579.9 | ||

| DDH-23-021 | 193.5 | 199.5 | Sulphides | 6.0 | 52.6 | – | 1.32 | 52.6 | ||

| DDH-23-022 | 53.5 | 79.0 | Oxides | 25.5 | 58.6 | 0.01 | – | 59.4 | ||

| DDH-23-023 | 50.5 | 110.0 | Oxides | 59.5 | 103.4 | 0.05 | – | 107.5 | ||

| DDH-23-023 | 143.0 | 147.0 | Oxides | 4.0 | 86.8 | – | – | 86.8 | ||

Note: All results in this news release are rounded. Assays are uncut and undiluted. Widths are drilled widths, not true widths. True widths are estimated to be approximately 80% of the interval widths.

1AgEq based on 81.9(Ag):1(Au) calculated using long-term prices of US$25.00/oz Ag and US$1,750/oz Au, and 73.5% process recovery for Ag, and 86.0% process recovery for Au as demonstrated in the Company’s Preliminary Economic Assessment in respect of Diablillos dated January 13, 2022, using formula: AgEq g/t = Ag g/t + Au g/t x (Gold Price/Silver Price) x (Gold Recovery/Silver Recovery).

Collar Data

| Hole Number | UTM Coordinates | Elevation | Azimuth | Dip | Depth (m) | |

| DDH 23-015 | E719591 | N7198755 | 4,159 | 315 | -60 | 179 |

| DDH 23-016 | E719552 | N7198754 | 4,156 | 315 | -60 | 170 |

| DDH 23-017 | E719505 | N7198680 | 4,151 | 0 | -60 | 170 |

| DDH 23-018 | E719427 | N7198634 | 4,145 | 315 | -60 | 203 |

| DDH 23-020 | E719705 | N7198845 | 4,169 | 0 | -60 | 211 |

| DDH 23-021 | E719765 | N7198755 | 4,175 | 0 | -60 | 215 |

| DDH 23-022 | E719570 | N7198766 | 4,160 | 0 | -60 | 161 |

| DDH 23-023 | E719686 | N7198866 | 4,168 | 315 | -60 | 170 |

Table 2 – Oculto Mineral Resource Estimate – As of October 31, 2022

| Category | Tonnage (000 t) |

Ag (g/t) | Au (g/t) | Contained Ag (000 oz Ag) |

Contained Au (000 oz Au) |

| Measured | 19,336 | 98 | 0.88 | 60,634 | 544 |

| Indicated | 31,978 | 47 | 0.73 | 48,737 | 752 |

| Measured & Indicated | 51,314 | 66 | 0.79 | 109,370 | 1,297 |

| Inferred | 2,216 | 30 | 0.51 | 2,114 | 37 |

Notes: Effective October 31, 2022. Mineral Resources are not Mineral Reserves and have not demonstrated economic viability. The Mineral Resource estimate is N.I. 43-101 compliant and was prepared by Luis Rodrigo Peralta, B.Sc., FAusIMM CP(Geo), Independent Consultant. The mineralization estimated in the Mineral Resource is sub-horizontal with sub-vertical feeders and a reasonable prospect for eventual economic extraction by open pit methods. For additional information please see Technical Report on the Diablillos Project, Salta Province, Argentina, dated November 28, 2022, completed by Mining Plus, and available on www.SEDAR.com.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

AbraSilver Resource (TSXV:ABRA) has announced new assay results from the ongoing Phase III drill program at the Diablillos property in Salta Province, Argentina. The results come from four additional diamond drill holes at the company’s 100%-owned property with significant results from the New JAC Zone.

John Miniotis, President and CEO, commented in a press release: “We continue to encounter very impressive drill results, in practically every drill hole, in the new JAC zone. We are also very pleased that the Company remains well-funded to complete the recently expanded drill campaign and deliver on its next set of upcoming milestones including: additional drill results from JAC and other targets, drill results from the La Copita project, an updated Mineral Resource Estimate and a Pre-Feasibility Study at Diablillos before the end of the year. With multiple significant catalysts on the horizon and ongoing exploration drilling, we expect investors will ultimately recognize AbraSilver’s significant value proposition.”

Highlights from the results are as follows:

- DDH 22-083 intersected a broad zone of high-grade silver mineralization in mixed oxides and sulphides, with 25.0 metres at 774 g/t Ag, 0.28 g/t Au and 1.36% Cu starting from a down-hole depth of 159 metres. The interval contained high-grade copper with associated silver mineralization in sulphide bearing feeder structures near the base of the hole.

- DDH 22-086 encountered high-grade silver and copper in sulphides containing 9.0 metres at 342 g/t Ag and 1.55% Cu, directly beneath an oxide zone of 5.0 metres grading 282 g/t Ag

- DDH 23-002 intersected high-grade silver mineralization in an oxide/sulphide transition zone, with 17.0 metres at 289 g/t Ag, including bonanza grades of 2,029 g/t Ag and 2.09 g/t Au over 1.0 metre.

- DDH 23-083 encountered multiple zones of silver mineralization in oxides, and 5.8 meters at 502 g/t Ag and 0.26% Cu in sulphides starting at 156 metres down-hole.

The latest assay result highlights are summarized in Table 1 below.

Table 1 – Diablillos Drill Result Highlights in JAC Zone

(Intercepts greater than 2,000 gram-metres AgEq shown in bold text):

| Drill Hole | From (m) | To (m) | Type | Interval (m) | Ag g/t | Au g/t | Cu % | AgEq1 g/t | |||

| DDH-22-083 | 152.5 | 155.5 | Oxides | 3.0 | 188.9 | 0.11 | – | 197.9 | |||

| DDH-22-083 | 159.0 | 184.0 | Transition | 25.0 | 773.8 | 0.28 | 1.36 | 796.7 | |||

| DDH-22-083 | Includes | 162.5 | 171.0 | Sulphides | 8.5 | 694.7 | 0.10 | 3.36 | 702.9 | ||

| DDH-22-086 | 72.0 | 87.0 | Oxides | 15.0 | 56.9 | – | – | 56.9 | |||

| DDH-22-086 | 153.0 | 158.0 | Oxides | 5.0 | 282.2 | – | – | 282.2 | |||

| DDH-22-086 | 158.0 | 167.0 | Sulphides | 9.0 | 342.3 | – | 1.55 | 342.3 | |||

| DDH-23-002 | 148.0 | 165.0 | Transition | 17.0 | 288.6 | 0.14 | – | 300.1 | |||

| DDH-23-002 | Includes | 155.0 | 165.0 | Transition | 10.0 | 463.1 | 0.23 | – | 481.9 | ||

| DDH-23-002 | Includes | 160.0 | 161.0 | Sulphides | 1.0 | 2,029.0 | 2.09 | – | 2,200.2 | ||

| DDH-23-003 | 87.5 | 110.0 | Oxides | 22.5 | 32.4 | – | – | 32.4 | |||

| DDH-23-003 | 115.0 | 119.0 | Oxides | 4.0 | 84.6 | – | – | 84.6 | |||

| DDH-23-003 | 133.0 | 141.0 | Oxides | 8.0 | 79.3 | – | – | 79.3 | |||

| DDH-23-003 | 155.8 | 161.5 | Sulphides | 5.8 | 502.2 | – | 0.26 | 502.2 | |||

Note: All results in this news release are rounded. Assays are uncut and undiluted. Widths are drilled widths, not true widths. True widths are estimated to be approximately 80% of the interval widths.

1AgEq based on 81.9(Ag):1(Au) calculated using long-term prices of US$25.00/oz Ag and US$1,750/oz Au, and 73.5% process recovery for Ag, and 86.0% process recovery for Au as demonstrated in the Company’s Preliminary Economic Assessment in respect of Diablillos dated January 13, 2022, using formula: AgEq g/t = Ag g/t + Au g/t x (Gold Price/Silver Price) x (Gold Recovery/Silver Recovery). No value is ascribed to copper grades in the AgEq calculations.

Exploration Update

Drilling activity at Diablillos remains focused on the recently discovered JAC zone which is located several hundred metres southwest of the conceptual open pit that constrains the current Mineral Resource estimate (“MRE”) on the main Oculto deposit (M&I MRE containing 1.3 Moz gold and 109 Moz silver – Table 2).

To date, the Company has completed approximately 12,900 metres of drilling, in 65 holes, as part of the 22,000-metre Phase III program. Drilling results to date, combined with interpretation of magnetics, suggest that the new JAC zone remains open in multiple directions.

At the La Copita project, drilling is progressing with the hole currently at a down-hole depth of approximately 130 metres. The deep hole is targeting the anticipated higher-grade zone of the porphyry system intercepted in hole DDHC 22-002.

Collar Data

| Hole Number | UTM Coordinates | Elevation | Azimuth | Dip | Depth (m) | |

| DDH 22-083 | E719676 | N7198689 | 4,165 | 0 | -60 | 200 |

| DDH 22-086 | E719550 | N7198700 | 4,156 | 0 | -60 | 173 |

| DDH 23-002 | E719625 | N7198665 | 4,161 | 0 | -60 | 182 |

| DDH 23-003 | E719551 | N7198611 | 4,156 | 0 | -60 | 168 |

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

AbraSilver Resource Corp. (TSXV:ABRA) has announced new assay results from three of its new diamond drill holes at the Phase II drill program at the company’s Diablillos property in Salta Province, Argentina. The near-surface intercept includes silver grades of 1,423 g/t AgEq (20.3 g/t AuEq) over 4 metres.

The 80 km2 Diablillos property is in the Puna region of Argentina, and was originally acquired from SSR Mining in 2016. The property is located in the southern extension of the Altiplano of southern Peru, Bolivia, and northern Chile, a notable silver mining region. The Oculto mineral zone is the most advanced on the property with over 100,000 metres drilled to date.

John Miniotis, President and CEO, commented in a press release: “We are very encouraged by the numerous near-surface, high-grade silver results intersected in the Northeast zone by these latest drill holes, as well as the underlying high-grade gold intercepts. These results will be included in the updated Mineral Resource estimate which will be announced later this year. It is evident that the multiple zones of mineralisation being encountered in the Northeast zone should add substantially to our overall Mineral Resource estimate which continues to grow rapidly.”

Dave O’Connor, Chief Geologist, also commented: “These new results, drilled in the Oculto Northeast zone, help clearly demonstrate the continuity of numerous mineralized breccia zones in this highly prospective area. What is particularly encouraging is the newly discovered shallow, high-grade silver mineralization encountered in holes 21 and 24, which is expected to allow for a substantial expansion of the conceptual open pit towards the northeast.

Highlights from the results are as follows:

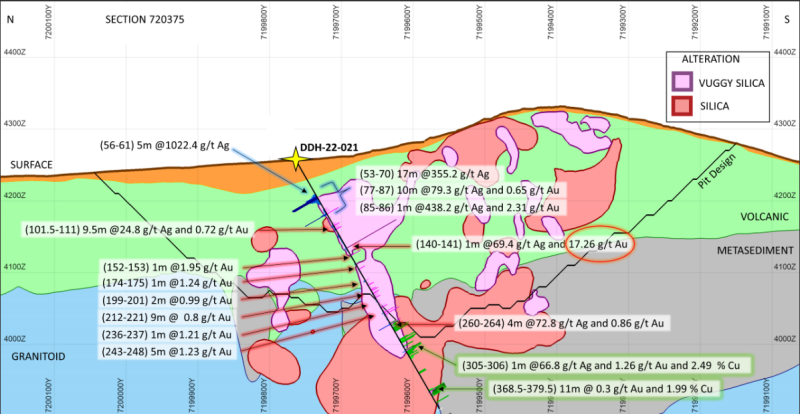

- DDH 22-021 intersected a near-surface, high-grade silver interval of 17m at 365 g/t AgEq (5.2 g/t AuEq – comprised of 355 g/t Ag and 0.14 g/t Au) in oxides starting at a down-hole depth of only 53 metresThis included a bonanza-grade 5m interval of 1,037 g/t AgEq (14.8 g/t AuEq – comprised of 1,022 g/t Ag 0.21 g/t Au);

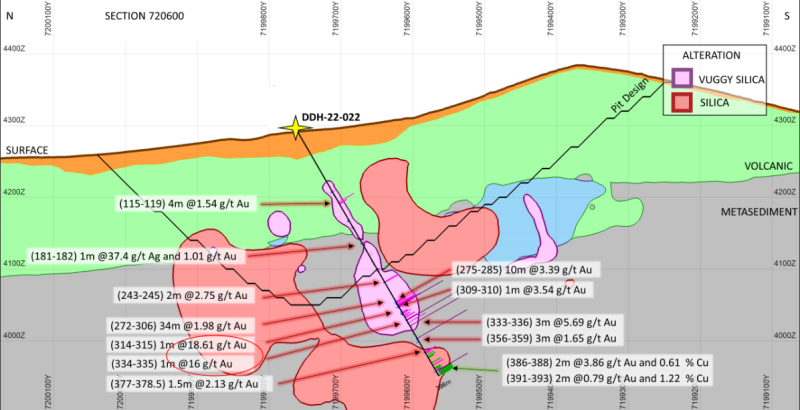

- DDH 22-022 intersected multiple zones of high-grade gold mineralization, including a broad intercept of 34m at 156 g/t AgEq (2.2 g/t AuEq – comprised of 18 g/t Ag and 1.98 g/t Au);

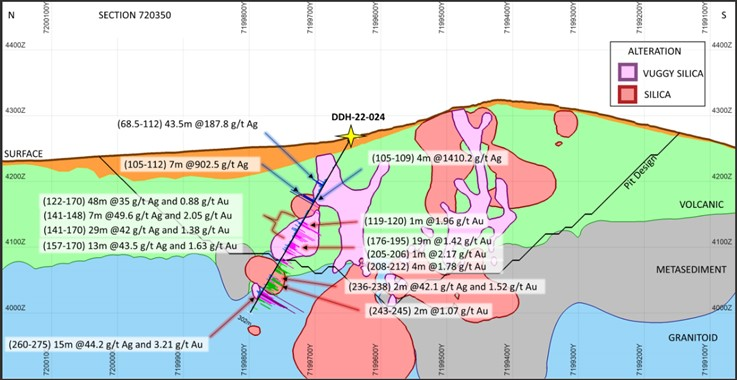

- DDH 22-024 intersected near-surface, high-grade silver mineralization including a broad intercept of 43.5m grading 196 g/t AgEq (2.8 g/t AuEq – comprised of 188 g/t Ag and 0.11 g/t Au) in oxides starting at a down-hole depth of only 68.5 metres. The hole included a bonanza-grade interval of 4m at 1,423 g/t AgEq (20.3 g/t AuEq – comprised of 1,410 g/t Ag 0.18 g/t Au);

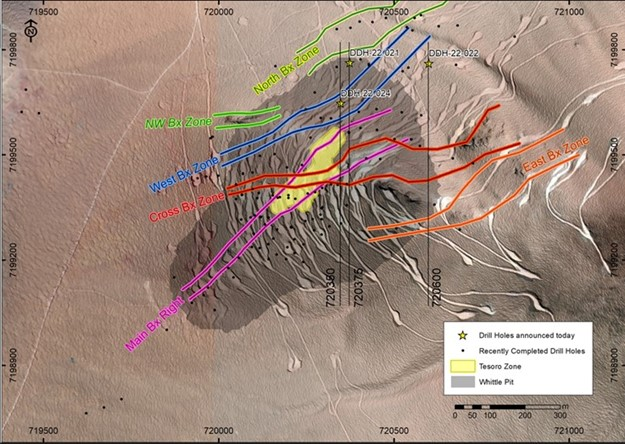

Figure 1 – Plan View of Drill Results

Table 1 – Diablillos Drill Result Highlights

(Intercepts greater than 2,000 gram-metres AgEq shown in bold text):

| Drill Hole | From (m) | To (m) | Type | Interval (m) | Ag

g/t |

Au g/t | Cu % | AgEq1 g/t | AuEq1 g/t | ||

| DDH-22-021 | 53 | 70 | Oxides | 17.0 | 355.2 | 0.14 | – | 365.0 | 5.21 | ||

| DDH-22-021 | Includes | 56 | 61 | Oxides | 5.0 | 1,022.4 | 0.21 | – | 1,037.1 | 14.82 | |

| DDH-22-021 | 77 | 87 | Oxides | 10.0 | 79.3 | 0.65 | – | 124.8 | 1.78 | ||

| DDH-22-021 | Includes | 85 | 86 | Oxides | 1.0 | 438.2 | 2.31 | – | 599.9 | 8.57 | |

| DDH-22-021 | 101.5 | 111 | Oxides | 9.5 | 24.8 | 0.72 | – | 75.2 | 1.07 | ||

| DDH-22-021 | 119 | 131 | Oxides | 12.0 | 24.0 | 0.10 | – | 31.0 | 0.44 | ||

| DDH-22-021 | 140 | 141 | Oxides | 1.0 | 69.4 | 17.26 | – | 1,277.6 | 18.25 | ||

| DDH-22-021 | 212 | 221 | Oxides | 9.0 | 11.0 | 0.80 | – | 67.0 | 0.96 | ||

| DDH-22-021 | 243 | 248 | Oxides | 5.0 | 20.4 | 1.23 | – | 106.5 | 1.52 | ||

| DDH-22-021 | 260 | 264 | Oxides | 4.0 | 72.8 | 0.86 | – | 133.0 | 1.90 | ||

| DDH-22-021 | 305 | 306 | Sulphides | 1.0 | 66.8 | 1.26 | 2.49 | 359.9 | 5.14 | ||

| DDH-22-022 | 115 | 119 | Oxides | 4.0 | 5.4 | 1.54 | – | 113.2 | 1.62 | ||

| DDH-22-022 | 243 | 245 | Oxides | 2.0 | 26.1 | 2.75 | – | 218.6 | 3.12 | ||

| DDH-22-022 | 272 | 306 | Oxides | 34.0 | 17.5 | 1.98 | – | 156.1 | 2.23 | ||

| DDH-22-022 | Includes | 275 | 285 | Oxides | 10.0 | 26.1 | 3.39 | – | 263.4 | 3.76 | |

| DDH-22-022 | 309 | 310 | Oxides | 1.0 | 23.0 | 3.54 | – | 270.8 | 3.87 | ||

| DDH-22-022 | 314 | 315 | Oxides | 1.0 | 5.6 | 18.61 | – | 1,308.3 | 18.69 | ||

| DDH-22-022 | 333 | 336 | Oxides | 3.0 | 17.8 | 5.69 | – | 416.1 | 5.94 | ||

| DDH-22-022 | Includes | 334 | 335 | Oxides | 1.0 | 17.5 | 16.00 | – | 1,137.5 | 16.25 | |

| DDH-22-022 | 356 | 359 | Oxides | 3.0 | 17.0 | 1.65 | – | 132.5 | 1.89 | ||

| DDH-22-022 | 377 | 378.5 | Oxides | 1.5 | 0.9 | 2.13 | – | 150.0 | 2.14 | ||

| DDH-22-022 | 386 | 388 | Sulphides | 2.0 | 24.4 | 3.86 | 0.61 | 344.8 | 4.93 | ||

| DDH-22-022 | 391 | 393 | Sulphides | 2.0 | 8.4 | 0.79 | 1.22 | 164.1 | 2.34 | ||

| DDH-22-024 | 68.5 | 112 | Oxides | 43.5 | 187.8 | 0.11 | – | 195.5 | 2.79 | ||

| DDH-22-024 | Includes | 105 | 112 | Oxides | 7.0 | 902.5 | 0.31 | – | 924.2 | 13.20 | |

| DDH-22-024 | Includes | 105 | 109 | Oxides | 4.0 | 1,410.2 | 0.18 | – | 1,422.8 | 20.33 | |

| DDH-22-024 | 122 | 170 | Oxides | 48.0 | 35.0 | 0.88 | – | 96.6 | 1.38 | ||

| DDH-22-024 | Includes | 141 | 170 | Oxides | 29.0 | 42.0 | 1.38 | – | 138.6 | 1.98 | |

| DDH-22-024 | 176 | 195 | Oxides | 19.0 | 31.8 | 1.42 | – | 131.2 | 1.87 | ||

| DDH-22-024 | 208 | 212 | Oxides | 4.0 | 29.8 | 1.78 | – | 154.4 | 2.21 | ||

| DDH-22-024 | 236 | 238 | Oxides | 2.0 | 42.1 | 1.52 | – | 148.5 | 2.12 | ||

| DDH-22-024 | 243 | 245 | Oxides | 2.0 | 32.8 | 1.07 | – | 107.7 | 1.54 | ||

| DDH-22-024 | 260 | 275 | Oxides | 15.0 | 44.2 | 3.21 | – | 268.9 | 3.84 | ||

Note: All results in this news release are rounded. Assays are uncut and undiluted. Widths are drilled widths, not true widths. True widths are estimated to be approximately 80% of the interval widths.

1AgEq & AuEq calculations for reported drill results are based on USD $1,750/oz, $25.00/oz Ag & $3.00/lb Cu. The calculations assume 100% metallurgical recovery and are indicative of gross in-situ metal value at the indicated metal prices.

Source: AbraSilver Resource Corp.

Figure 2 – Cross Section (Looking Northeast) with Highlighted Intercepts in Hole DDH 22-021

Figure 3 – Cross Section (Looking Northeast) with Highlighted Intercepts in Hole DDH 22-022

Figure 4 – Cross Section (Looking Northeast) with Highlighted Intercepts in Hole DDH 22-024

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

If you would like to receive our free newsletter via email, simply enter your email address below & click subscribe.

CONNECT WITH US

Tweets

Tweet with hash tag #miningfeeds or @miningfeeds and your tweets will be displayed across this site.

MOST ACTIVE MINING STOCKS

Daily Gainers

Ratel Group Ltd. Ratel Group Ltd. |

RTG.TO | +60.00% |

|

ERL.AX | +50.00% |

|

MRQ.AX | +50.00% |

|

AFR.V | +33.33% |

|

CRB.AX | +33.33% |

|

GCX.V | +33.33% |

|

RUG.V | +33.33% |

|

CASA.V | +30.00% |

|

BSK.V | +25.00% |

|

PGC.V | +25.00% |

Articles

FOUND POSTS

Arras Minerals (TSXV:ARK) Updates on Elemes Drill Program in Kazakhstan

December 19, 2024

Potential Trump Tariffs Could Reshape Copper Market Dynamics in 2025

December 17, 2024

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan