Gold Royalty Corp (NYSE:GROY) is down over 9% YTD, significantly underperforming GDXJ. The poor performance could be attributed to arbitrage shorts and sentiment that the premium being offered for Elemental (OTCQX:ELEMF) is too high.

The high premium and aggressive M&A posture of Gold Royalty can be viewed in light of CEO David Garafelo’s thesis that there will be strong investor appetite for a mid-cap in the space.

Elemental’s superior cash position

Gold Royalty announced its intent to acquire Elemental on Dec. 20, 2021. The offer of 0.27 GROY per share of Elemental was a 37% premium at the time. Since the value of GROY has fallen, the current premium is closer to 28%.

Elemental’s Board rejected the offer as “opportunistic”, stating it “substantially undervalues the company’s portfolio of revenue-generating royalties”. Gold Royalty is taking the offer directly to shareholders in a hostile bid.

The initial offer would value Elemental at just over $100 million with a P/NAV of about 1.4, well above the average for small-cap peers, which is closer to 1.0x. The transaction rationale highlights Elemental’s cash flowing assets. Elemental had revenue over $4 million for the first three quarters of 2021 versus Gold Royalty’s $192,000 (despite GRC having ~6 times the market cap). Also notable is Elemental’s relatively favourable cash position of $5.6 million (Q3 2021) versus $9.9 million for Gold Royalty.

As CEO David Garofalo states, “one of the key factors that drew us to Elemental is its attractive mix of cash flowing and near-term development assets”.

Seeking a Re-Rate

Despite negative market reaction, the bid is consistent with Garofalo’s capitalization strategy.

Garofalo reiterates the common value proposition in the space: the macro outlook for gold is positive; operating cost inflation and the need for capital investment on the part of miners will mean that royalty companies are a better leverage on the price of the metal.

However, investors face a market saturated with small-cap players who have entered the space anticipating the need for producers to use their strong cash positions to invest back into the ground. For Garofalo, the question is one of scale, where “the bigger you are, the more liquid you are, the higher valuation you get in the marketplace”.

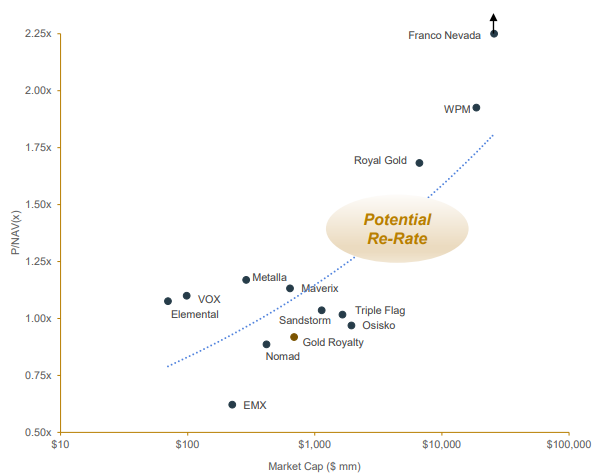

There is a large gulf between the few large, $20-30 billion players (e.g. Wheaton, Franco Nevada) trading above NAV 2x, and the plethora of sub $1-2B small-caps trading closer to 1x. Gold Royalty sees re-rate opportunity somewhere in between: a $4-5 billion market cap that gets a 1.5x NAV valuation. Garofalo is anticipating that fundamentals will mean a larger pool of investors will be attracted to a NYSE listed gold royalty company with the liquidity and cash flow that small-caps don’t have, while maintaining a growth rate that exceeds the large caps. Part of this strategy is adding a dividend, which would explain why Elemental’s cash position would be attractive even though it does not add much breath to Gold Royalty’s portfolio.

The Canadian Malartic mine is a potential company building asset for Gold Royalty that could get it into the mid-cap category, but it is still at least 5 years from cash flowing. Meanwhile, Gold Royalty is walking a line between adding shareholder value or diluting it in the pursuit of growth.

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan

Comments are closed.