SolGold (TSX:SOLG) has announced a joint declaration with the Government of Ecuador, paving the way for the execution of the Complementary Investment Protection Agreement (IPA) for the Cascabel copper-gold project in Ecuador. The signing took place at the Prospectors and Developers Association of Canada (PDAC) convention in Toronto, marking a significant milestone in SolGold’s commitment to the project and its partnership with the Ecuadorian government.

The Complementary IPA, signed by the Minister of Production, Foreign Trade, Investments and Fisheries, Ms. Sonsoles García, and Scott Caldwell, CEO of SolGold, represents a total investment of US $3.2 billion over the coming years in activities related to the Cascabel mining concession. This investment is in addition to the US$311 million already addressed by the current IPA, showcasing the immense scale and importance of the project for both SolGold and the Ecuadorian mining sector.

SolGold’s CEO and President of SolGold Ecuador, Scott Caldwell, commented in a press release: “The Complementary Investment Protection Agreement not only reinforces the protections for our key investment in Ecuador but also symbolizes a deepening of our relationship with the Ecuadorian State. President Noboa’s attendance and insightful speech at the PDAC convention were warmly welcomed by the mining community and underscores the significant support of his administration for responsible mining in Ecuador.“

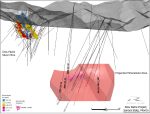

The Cascabel project, SolGold’s flagship venture, has been the focus of the company’s efforts to unlock its potential as a multi-generational asset. A recent pre-feasibility study (PFS) released in February revealed that the company had managed to reduce upfront costs significantly, with pre-production capital for initial mine development, the first process plant module, and infrastructure now estimated at $1.55 billion, down from $2.75 billion in the April 2022 PFS.

Despite the project’s potential, investors have expressed concerns about SolGold management’s ability to deliver the project to its full potential. The company’s share price has halved over the past year, and SolGold has had to cut spending to stay afloat, leading to a strategic review of its assets.

The size of the entire resource at Cascabel indicates the mine’s potential to be one of the 20 largest copper-gold mines in South America, with mine construction set to commence in 2025. The Complementary IPA, representing the largest mining investment in Ecuadorian history, underscores the significance of the project and SolGold’s commitment to its development.

As SolGold continues to navigate some of the remaining challenges of bringing the Cascabel project to production, the investment from the Ecuadorian government and the potential for the mine to become a major producing mine in South America will be the driving force for the company and its stakeholders.

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan

Comments are closed.