Solaris Resources Inc. (TSX:SLS) (OTCQB:SLSSF) has recently reported its assay results from a sequence of drillings focused on expanding the ‘Indicative Starter Pit’ within the Warintza Central zone at the Warintza Project, located in southeastern Ecuador. The goal of the drilling is to enlarge the near-surface, high-grade mineralization estimated at 180 Mt at 0.82% CuEq (Indicated) and 107 Mt at 0.73% CuEq¹ (Inferred) in the Warintza Mineral Resource Estimate.

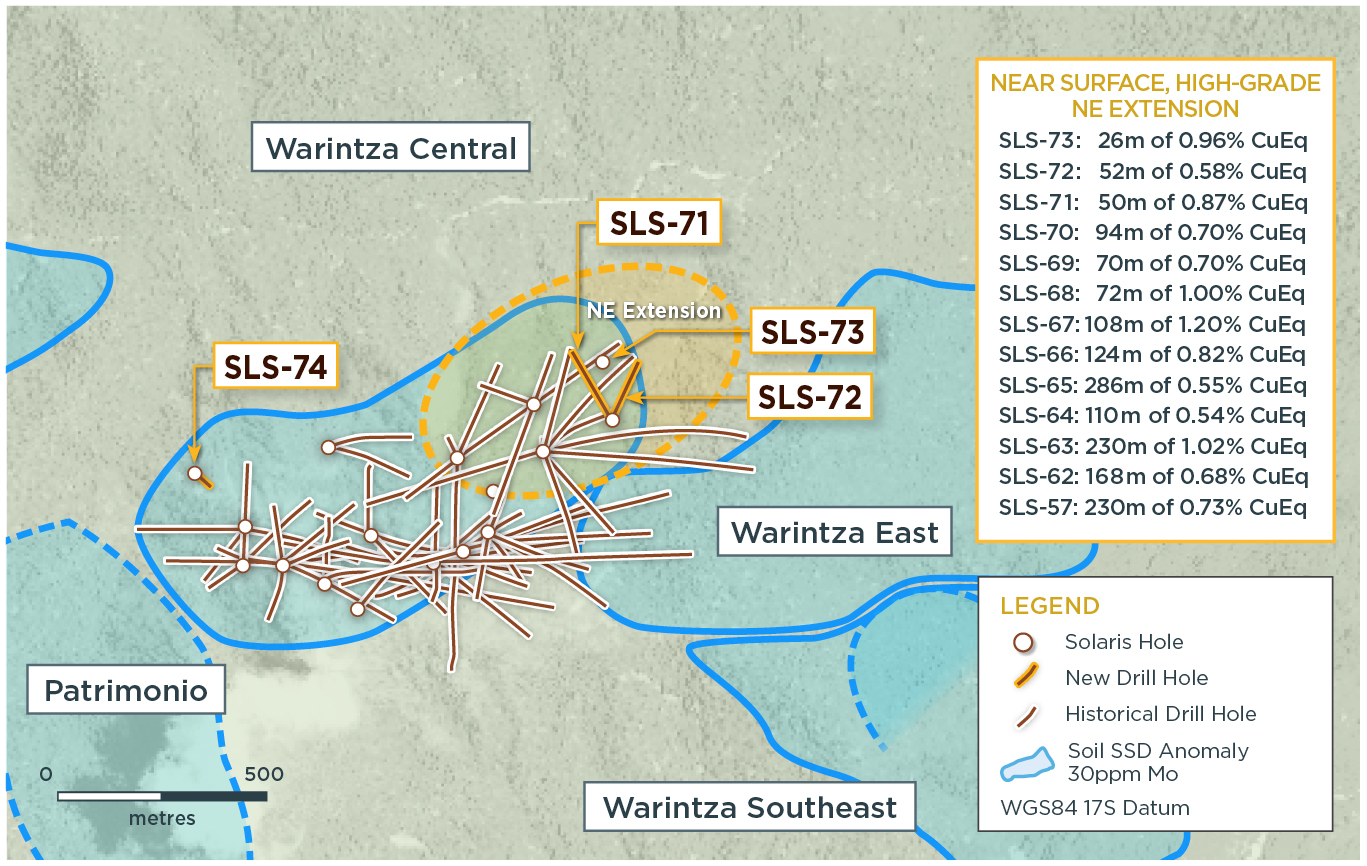

The results show that recent drilling has successfully expanded the Northeast Extension zone to the north-northeast. Future plans include more step-out drilling in this direction. Meanwhile, a considerable step-out of 250 meters on the opposite side of Warintza Central has increased the zone towards the northwest, unveiling new potential areas for mineral resource growth. Drilling to expand the ‘Indicative Starter Pit’ is still ongoing, with the company aiming to further increase the mineral resource potential of the site.

Highlights from the results are as follows:

- SLS-72 was collared from a newly-constructed step out platform 200m to the northeast, returning 268m of 0.60% CuEq¹ within a broader interval of 830m averaging 0.50% CuEq¹ from 48m depth, extending the zone to the northeast where it remains open

- SLS-71 was collared from the same platform within the northeast extension zone and drilled northwest into a partially open volume, returning 212m of 0.60% CuEq¹, including 50m of 0.87% CuEq¹, within a broader interval of 494m of 0.42% CuEq¹ from near surface

- SLS-73 was collared from another newly-constructed step out platform 250m to the north, returning 26m of 0.96% CuEq¹ from near surface and 128m of 0.60% CuEq¹ within a broader interval, extending the zone to the northeast where it remains open

- These three holes expand the Northeast Extension zone to the east and northeast where two additional 200m step-out platforms have been planned for construction to test the potential extension of the zone beneath shallow saprolitic cover

- On the opposite side of Warintza Central, SLS-74 was collared from a newly-constructed platform stepping out 250m to the northwest of the existing drill grid to test the potential extension of high grade, near surface mineralization – it returned 54m of 0.80% CuEq¹ from surface within a broader interval of 224m of 0.41% CuEq¹

- SLS-74 includes lower grade mineralization within a porphyritic granodiorite modelled as the northwestern contact of Warintza Central – ongoing mapping and sampling aims to assess the potential for better-developed mineralization higher up in this intrusive phase in the 700m gap to Warintza West

- Additional assays are expected soon from drilling targeting further growth at Warintza East, follow-up drilling at the recent high-grade Warintza Southeast discovery and the new Patrimonio discovery

Table 1 – Assay Results

| Hole ID | Date Reported | From (m) | To (m) | Interval (m) | Cu (%) | Mo (%) | Au (g/t) | CuEq¹ (%) |

| SLS-74 | June 28, 2023 | 6 | 230 | 224 | 0.28 | 0.03 | 0.04 | 0.41 |

| Including | 6 | 60 | 54 | 0.59 | 0.05 | 0.07 | 0.80 | |

| Including | 120 | 230 | 110 | 0.22 | 0.03 | 0.03 | 0.38 | |

| SLS-73 | 12 | 228 | 216 | 0.40 | 0.02 | 0.11 | 0.53 | |

| Including | 26 | 52 | 26 | 0.83 | 0.01 | 0.13 | 0.96 | |

| Including | 100 | 228 | 128 | 0.45 | 0.02 | 0.12 | 0.60 | |

| SLS-72 | 48 | 878 | 830 | 0.39 | 0.02 | 0.08 | 0.50 | |

| Including | 48 | 100 | 52 | 0.50 | 0.01 | 0.08 | 0.58 | |

| Including | 610 | 878 | 268 | 0.47 | 0.02 | 0.08 | 0.60 | |

| SLS-71 | 30 | 524 | 494 | 0.33 | 0.01 | 0.08 | 0.42 | |

| Including | 54 | 266 | 212 | 0.47 | 0.02 | 0.09 | 0.60 | |

| Including | 54 | 104 | 50 | 0.76 | 0.02 | 0.10 | 0.87 |

Notes to table: True widths of the mineralized zone are not known at this time.

Table 2 – Collar Location

| Hole ID | Easting | Northing | Elevation (m) | Depth (m) | Azimuth (degrees) | Dip (degrees) |

| SLS-74 | 799558 | 9648247 | 1325 | 236 | 130 | -80 |

| SLS-73 | 800531 | 9648518 | 1262 | 294 | 0 | -90 |

| SLS-72 | 800552 | 9648378 | 1358 | 878 | 25 | -80 |

| SLS-71 | 800552 | 9648378 | 1358 | 568 | 330 | -70 |

| Notes to table: The coordinates are in WGS84 17S Datum. | ||||||

Endnotes

- Copper-equivalence calculated as: CuEq (%) = Cu (%) + 4.0476 × Mo (%) + 0.487 × Au (g/t), utilizing metal prices of US$3.50/lb Cu, US$15.00/lb Mo, and US$1,500/oz Au, and assumes recoveries of 90% Cu, 85% Mo, and 70% Au based on preliminary metallurgical test work. The ‘Indicative Starter Pit’ is based on the same assumptions as the MRE except utilized metal prices of US$1.00/lb Cu, US$7.50/lb Mo, and US$750/oz Au. The ‘Indicative Starter Pit’ is comprised of Indicated mineral resources of 180 Mt at 0.82% CuEq (0.67% Cu, 0.03% Mo, 0.07 g/t Au) and Inferred mineral resources of 107 Mt at 0.73% CuEq (0.64% Cu, 0.02% Mo, 0.05 g/t Au) above a 0.6% CuEq cut-off grade. No economic analysis has been completed by the Company and there is no guarantee an ‘Indicative Starter Pit’ will be realized or prove to be economic.

- Refer to Solaris’ technical report titled, “NI 43-101 Technical Report for the Warintza Project, Ecuador” with an effective date of April 1, 2022, prepared by Mario E. Rossi and filed on the Company’s SEDAR profile at www.sedar.com.

- For additional details on “Near Surface, High-Grade, NE Extension” intervals, refer to press release dated May 26, 2022 for SLS-57: 230m of 0.73% CuEq (0.59% Cu, 0.03% Mo, 0.08 g/t Au), refer to press release dated July 20, 2022 for SLS-62: 168m of 0.68% CuEq (0.51% Cu, 0.03% Mo, 0.07 g/t Au) and SLS-63: 230m of 1.02% CuEq (0.87% Cu, 0.02% Mo, 0.12 g/t Au), refer to press release dated September 7, 2022 for SLS-64: 110m of 0.54% CuEq (0.38% Cu, 0.04% Mo, 0.03 g/t Au) and SLS-66: 124m of 0.82% CuEq (0.71% Cu, 0.02% Mo, 0.09 g/t Au) and SLS-67: 108m of 1.20% CuEq (1.06% Cu, 0.03% Mo, 0.09 g/t Au), refer to press release dated December 5, 2022 for SLS-65: 286m of 0.55% CuEq (0.38% Cu, 0.04% Mo, 0.06 g/t Au) and SLS-68: 72m of 1.00% CuEq (0.88% Cu, 0.02% Mo, 0.06 g/t Au), refer to press release dated Mar 13, 2023 for SLS-69: 70m of 0.70% CuEq (0.56% Cu, 0.03% Mo, 0.06 g/t Au) and SLS-70: 94m of 0.70% CuEq (0.53% Cu, 0.03% Mo, 0.11 g/t Au).

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan

Comments are closed.