Solaris Resources (TSX:SLS) has had the highest insider buying for its industry group, leading all issuers in the TSX materials sector, and that rate continues to climb. The company has announced that it received about C$30.4 million from the exercise of common share purchase warrants. The company is now fully funded through to mid-2023 for its drill program at the Warintza Project in Ecuador.

Mr. Daniel Earle, President & CEO, commented in a press release: “With last year’s intensive resource drilling program at Warintza Central having established a voluminous mineral resource estimate and robust starter pit, we are now directing our efforts to immediate high-impact drilling aimed at expanding the starter pit in open extensions of near surface, high-grade mineralization at Warintza Central, expanding the minimally-drilled Warintza East discovery, and testing the potential of the nearby Warintza West discovery.”

The total insider buying has now crossed $170 million dollars in the past 24 months, as a portion of the warrants has been exercised by Solaris management. Executive Chairman Richard Warke is the main shareholder exercising the most warrants. In the second half of 2022 and the first half of 2023, more warrant expires will occur. Should holders choose to exercise all of them, the company would bring in another C$54.1 million, with approximately 63% of the still outstanding warrants held by management.

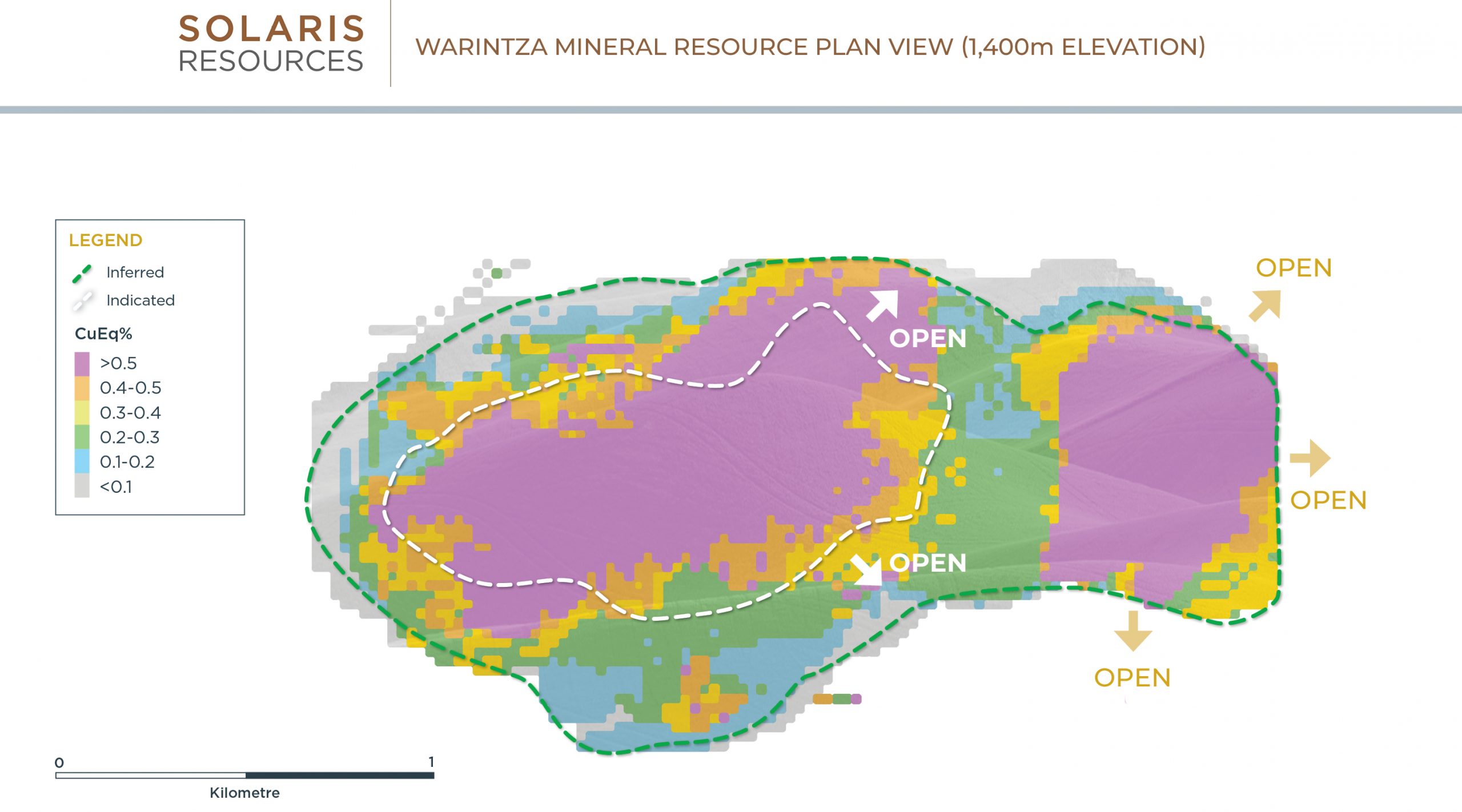

A recent mineral resource update for Warintza Central showed in-pit resources of 579 Mt at 0.59% CuEq (Ind) and 887 Mt at 0.47% CuEq (Inf). This also includes an ‘indicative starter pit’ of 180 Mt at 0.82% CuEq (Ind) & 107 Mt at 0.73% CuEq (Inf). Additionally, the company is now targeting high-grade extensions and major growth in cluster. Warintza East and Warintza West will now become the focus for the company as it advances its flagship project.

Highlights from the Warintza Central mineral resource update are as follows:

- In-Pit Indicated mineral resources of 579 million tonnes (“Mt”) at 0.59% copper equivalent¹ (“CuEq”) and Inferred mineral resources of 887 Mt at 0.47% CuEq¹ above a 0.3% CuEq cut-off grade

- Includes ‘Indicative Starter Pit’ comprised of Indicated mineral resources of 180 Mt at 0.82% CuEq² and Inferred mineral resources of 107 Mt at 0.73% CuEq² above 0.6% CuEq cut-off grade

- High Quality – Expected low strip ratio ‘Indicative Starter Pit’ and ultimate pit, zoned from high-grade at surface to low grade at depth, consistent, clean sulphide mineralogy free of deleterious elements

- High-Grade Growth – Ongoing drilling focused on open extensions of near surface, high-grade mineralization to the northeast and southeast of Warintza Central

- ‘Super Pit’ Growth – Warintza Central pit shell includes overlapping portion of Warintza East, discovered mid-2021, a target wide open for major growth potential within a shared pit

- Cluster Potential – Warintza Central forms part of a 7km x 5km cluster of porphyry deposits, where in addition to East, recent discoveries at West and South offer major growth potential

- Structural Advantages – Set within mining district featuring access to highway, abundant and low-cost hydroelectric power, fresh water, labour and low elevation

Source: Solaris Resources

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan

Comments are closed.