The mining sector has put itself in a difficult position, underinvesting in new copper projects when copper demand is rising. The good news for those looking for a copper investment is that there are still a number of new copper projects in the works.

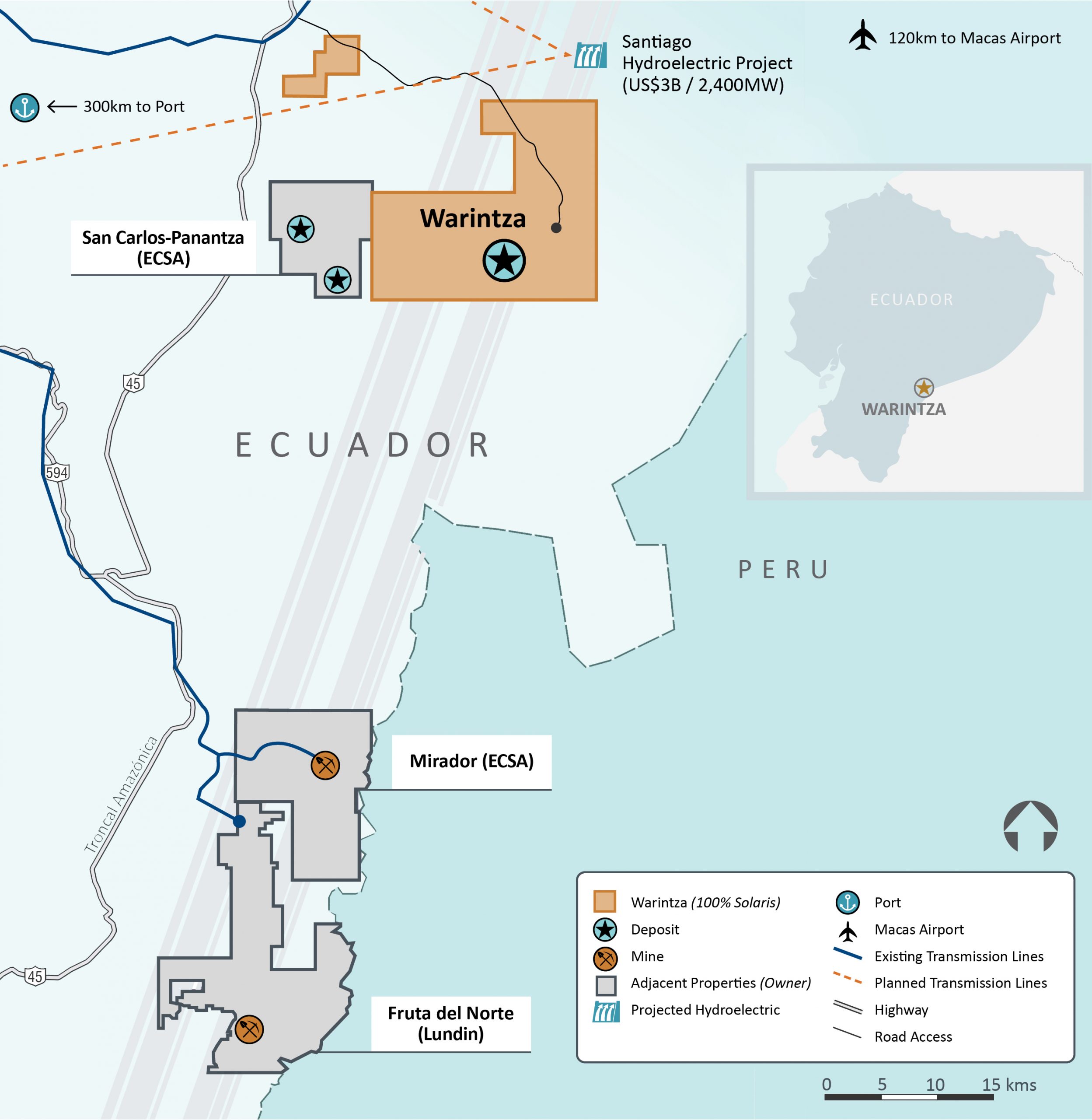

One of these projects is the Warintza copper project in southeastern Ecuador. Warintza is a world-class large-scale resource with expansion and discovery potential. There have been four major discoveries since the project started and the Mineral Resource Estimate at the project has been expanded from earlier in 2022. Most recently, Canadian mining company Solaris Resources (TSX:SLS) (OTCQB:SLSSF), which owns Warintza, reported new assay results from a series of holes aimed at delineating resources at the Warintza East discovery.

Highlights from the results are as follows:

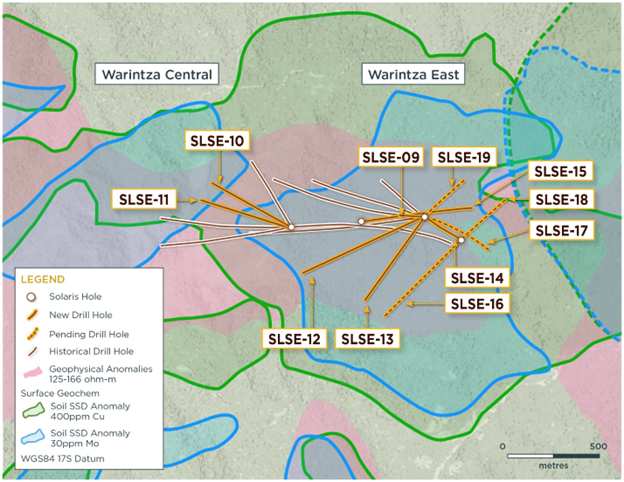

Warintza East was discovered in July 2021, with eight holes covering the overlapping periphery included in the Warintza Central Mineral Resource Estimate (“MRE”)¹ in April 2022. These follow-up drilling results significantly expand the drilled dimensions of the Warintza East footprint to the east and southwest, with the deposit remaining entirely open towards strong soil anomalism to the northeast and southeast.

- SLSE-15 was collared in the middle of the Warintza East grid and drilled east into a partially open volume, returning 204m of 0.60% CuEq² within a broader interval of 910m of 0.40% CuEq² from near surface, extending mineralization to the east where it remains open

- SLSE-14, stepped out approximately 250m from the eastern limit of the grid and drilled northwest into an open volume, returning 292m of 0.50% CuEq² within a broader interval of 694m of 0.40% CuEq² from near surface, extending mineralization in this direction where it remains open

- SLSE-12 was collared at the eastern limit of the grid and drilled southwest into an open volume, returning 48m of 0.53% CuEq² within a broader interval of 508m of 0.40% CuEq² from surface, extending mineralization in this direction

- SLSE-13 was collared from the same platform and drilled southwest into an open volume, returning 104m of 0.45% CuEq² within a broader interval of 618m of 0.29% CuEq² from surface, expanding the footprint to the south where it remains open

- SLSE-10 and SLSE-11 were collared in the overlapping portion with Warintza Central and drilled northwest into partially open volumes, returning 282m of 0.53% CuEq² and 270m of 0.55% CuEq², respectively, within broader intervals from near surface

- Drilling to date confirms Warintza East as a significant porphyry deposit which remains open for expansion in multiple areas, with assays pending from a series of extensional holes to the northeast, east and south

Warintza stands out in an environment where under-investment in new copper mines and exploration is jeopardizing the metal-intensive energy transition. Massive amounts of copper will be needed for everything from electric vehicles to renewable energy infrastructure.

Companies have instead focused on expanding mines with stronger guarantees of shareholder returns, playing it safe, but in turn, neglecting to invest in new projects. This focus on short-term shareholder returns and paying out dividends or using cash for share buybacks has left the discoveries to junior mining companies that are developing some of the most promising projects in the world. New copper mines take decades to achieve commercial production, and only exploration being done at projects right now has a chance of coming online in time for it to make a difference for future production levels.

Additionally, new discoveries have typically been of lower grades, making the Warintza Project an exceptional outlier in an environment when alarms are sounding for supply and demand dynamics. Lower grades ultimately make the copper more expensive to extract, but the potential for the high-grade “superpit” at Warintza is exactly what companies are looking for.

The future of copper is bright, but only if we see more investments in new projects like Warintza. Solaris Resources is one of the few mining companies that is making such investments, and the prospects for the Warintza project look very promising.

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan

Comments are closed.