Solaris Resources (TSX:SLS) (NYSEAmerican:SLSR) has announced assay results from its ongoing 2024 drilling program at the Warintza Project in southeastern Ecuador. The results reveal high-grade mineralization near the surface, improving previously modeled grades and expanding the potential of the resource in several key areas of the site.

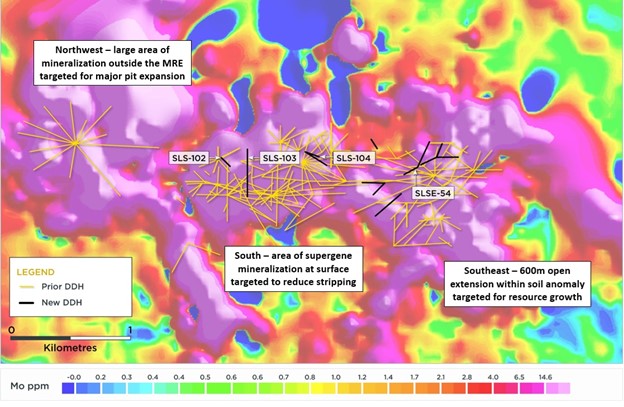

The company, which has drilled over 53,000 meters by the end of the third quarter of 2024, is aiming to exceed its 60,000-meter target for the year. The latest drill holes, SLS-103, SLSE-54, SLS-102, and SLSE-52, add significant mineralization in areas that had not been extensively drilled. Holes SLS-103 and SLSE-54, located in the northwest and northeast sectors, respectively, have intersected new high-grade mineralization at surface, with much of the mineralization falling outside the current Mineral Resource Estimate (MRE). This marks an important step in expanding the known resource, as these results indicate higher grades than previously modeled in these regions.

Key intercepts include 87 meters of 1.23% CuEq, 93 meters of 1.01% CuEq, and 84 meters of 1.00% CuEq. These findings bolster the company’s ongoing efforts to improve the quality of the resource, particularly in sparsely drilled zones within the northwest, north, and northeast areas of the project.

In addition to the resource expansion efforts, Solaris is conducting exploration drilling in an area featuring a large soil anomaly on the opposite side of a granodiorite formation, which shapes the northwestern pit wall. Assays from this exploration are expected in the coming weeks.

With high productivity on-site due to infrastructure investments, Solaris remains on track to exceed its 2024 drilling plan. Current efforts include drilling focused on expanding open extensions of the resource, infill drilling to upgrade existing resources, and further geotechnical and condemnation drilling.

Highlights from the results include:

Northwest, North and Northeast Sectors:

- SLS-102 (drilled northwest): 93m of 1.01% CuEq² within 156m of 0.74% CuEq² from surface

- SLS-103 (drilled north): 87m of 1.23% CuEq² within 528m of 0.59% CuEq² from surface

- SLS-104 (drilled southeast): 84m of 1.00% CuEq² within 485m of 0.77% CuEq² from surface

- SLSE-54 (drilled southwest): 258m of 0.52% CuEq² within 399m of 0.41% CuEq² from surface

Table 1 – Mineral Resource Extension, Infill and Condemnation Results

| Hole ID | Date Reported |

From (m) |

To (m) |

Interval (m) |

Cu (%) |

Mo (%) |

Au (g/t) |

CuEq² (%) |

Comments |

| SLS-104 | Oct 7, 2024 | 0 | 485 | 485 | 0.56 | 0.03 | 0.06 | 0.77 | Northern sector – infill |

| Including | 45 | 129 | 84 | 0.82 | 0.02 | 0.07 | 1.00 | ||

| Including | 45 | 255 | 210 | 0.69 | 0.03 | 0.07 | 0.90 | ||

| Including | 45 | 485 | 440 | 0.61 | 0.03 | 0.06 | 0.82 | ||

| SLS-103 | 0 | 528 | 528 | 0.26 | 0.05 | 0.04 | 0.59 | Northwest sector – infill and extensional | |

| Including | 21 | 108 | 87 | 1.00 | 0.03 | 0.11 | 1.23 | ||

| Including | 21 | 483 | 462 | 0.29 | 0.06 | 0.05 | 0.64 | ||

| Including | 240 | 345 | 105 | 0.28 | 0.08 | 0.02 | 0.72 | ||

| SLS-102 | 0 | 156 | 156 | 0.46 | 0.04 | 0.08 | 0.74 | Northwest sector – infill | |

| Including | 57 | 150 | 93 | 0.73 | 0.04 | 0.09 | 1.01 | ||

| SLS-101 | 0 | 307 | 307 | 0.06 | 0.01 | 0.02 | 0.14 | Northwest sector – condemnation | |

| SLSE-60 | 0 | 290 | 290 | 0.16 | 0.01 | 0.03 | 0.23 | Northeast sector – infill | |

| Including | 93 | 290 | 197 | 0.21 | 0.01 | 0.04 | 0.30 | ||

| Including | 141 | 290 | 149 | 0.24 | 0.01 | 0.05 | 0.35 | ||

| Including | 207 | 290 | 83 | 0.28 | 0.02 | 0.03 | 0.43 | ||

| SLSE-58 | 0 | 453 | 453 | 0.03 | 0.00 | 0.01 | 0.04 | Northeast sector – condemnation | |

| SLSE-57 | 0 | 660 | 660 | 0.22 | 0.01 | 0.05 | 0.30 | Southeast sector – extensional | |

| Including | 552 | 660 | 108 | 0.49 | 0.02 | 0.06 | 0.61 | ||

| SLSE-56 | 0 | 381 | 381 | 0.09 | 0.00 | 0.03 | 0.11 | Northeast sector – condemnation | |

| SLSE-55 | 0 | 473 | 473 | 0.12 | 0.00 | 0.02 | 0.16 | Northeast sector – condemnation | |

| SLSE-54 | 0 | 399 | 399 | 0.29 | 0.01 | 0.04 | 0.41 | Northeast sector – infill and extensional | |

| Including | 0 | 258 | 258 | 0.37 | 0.02 | 0.05 | 0.52 | ||

| Including | 81 | 231 | 150 | 0.43 | 0.02 | 0.05 | 0.60 | ||

| SLSE-53 | 0 | 455 | 455 | 0.04 | 0.00 | 0.02 | 0.07 | Northeast sector – condemnation | |

| SLSE-52 | 0 | 138 | 138 | 0.15 | 0.01 | 0.03 | 0.23 | Southeast sector – condemnation | |

| SLSE-51 | 0 | 257 | 257 | 0.15 | 0.01 | 0.03 | 0.20 | Southeast sector – condemnation |

Notes to Table 1: True widths are interpreted to be very close to drilled widths due to the bulk-porphyry style mineralized zones at Warintza.

Table 2 – Collar Locations

| Hole ID | Easting | Northing | Elevation (m) |

Depth (m) |

Azimuth (degrees) | Dip (degrees) |

| SLS-104 | 800383 | 9648303 | 1411 | 485 | 110 | -70 |

| SLS-103 | 799760 | 9648031 | 1575 | 528 | 360 | -56 |

| SLS-102 | 799568 | 9648147 | 1403 | 253 | 315 | -60 |

| SLS-101 | 799760 | 9648031 | 1575 | 307 | 180 | -45 |

| SLSE-60 | 801800 | 9648235 | 1102 | 290 | 243 | -54 |

| SLSE-58 | 801806 | 9648243 | 1098 | 454 | 90 | -58 |

| SLSE-57 | 801150 | 9647610 | 1396 | 660 | 45 | -60 |

| SLSE-56 | 801163 | 9648335 | 1309 | 382 | 326 | -71 |

| SLSE-55 | 801597 | 9648134 | 1155 | 473 | 25 | -50 |

| SLSE-54 | 801596 | 9648136 | 1154 | 481 | 240 | -70 |

| SLSE-53 | 801802 | 9648239 | 1100 | 455 | 23 | -68 |

| SLSE-52 | 801248 | 9647968 | 1252 | 354 | 270 | -46 |

| SLSE-51 | 801246 | 9647967 | 1252 | 257 | 225 | -45 |

Notes to Table 2: The coordinates are in WGS84 17S Datum.

Endnotes

- Refer to the technical report entitled “Mineral Resource Estimate Update – NI 43-101 Technical Report, Warintza Project, Ecuador” with an effective date of July 1, 2024 and available on SEDAR+ under the Company’s profile at www.sedarplus.ca and on the Company’s website.

- Copper-equivalence grade calculation for reporting assumes metal prices of US$4.00/lb Cu, US$20.00/lb Mo, and US$1,850/oz Au, and recoveries of 90% Cu, 85% Mo, and 70% Au based on preliminary metallurgical testwork. CuEq formula: CuEq (%) = Cu (%) + 5.604 × Mo (%) + 0.623 × Au (g/t).

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan

Comments are closed.