Sitka Gold Corp. (TSXV:SIG) (FSE:1RF) (OTCQB:SITKF) has announced the recommencement of its previously announced 15,000-metre diamond drilling program at its road accessible RC Gold Project located in the Tombstone Gold Belt in the Yukon.

Cor Coe, Director and CEO of Sitka Gold Corp, commented in a press release: “Drilling currently underway is focused on continuing to expand the Blackjack deposit following up on the higher-grade gold mineralization discovered during the winter diamond drilling program outside of the current resource. Our updated geological model suggests this higher-grade gold zone continues south and we plan to investigate that possibility this summer along with follow-up on several other high-priority targets as we push to expand our rapidly growing gold resource and make additional discoveries across our one hundred percent owned, district-scale RC Gold Project.”

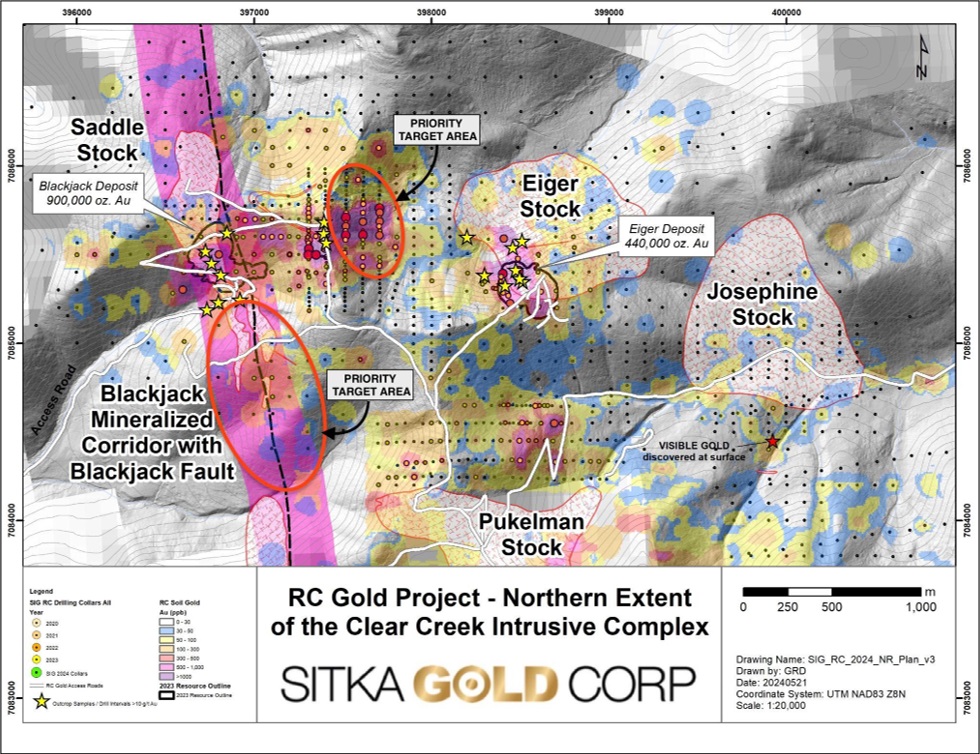

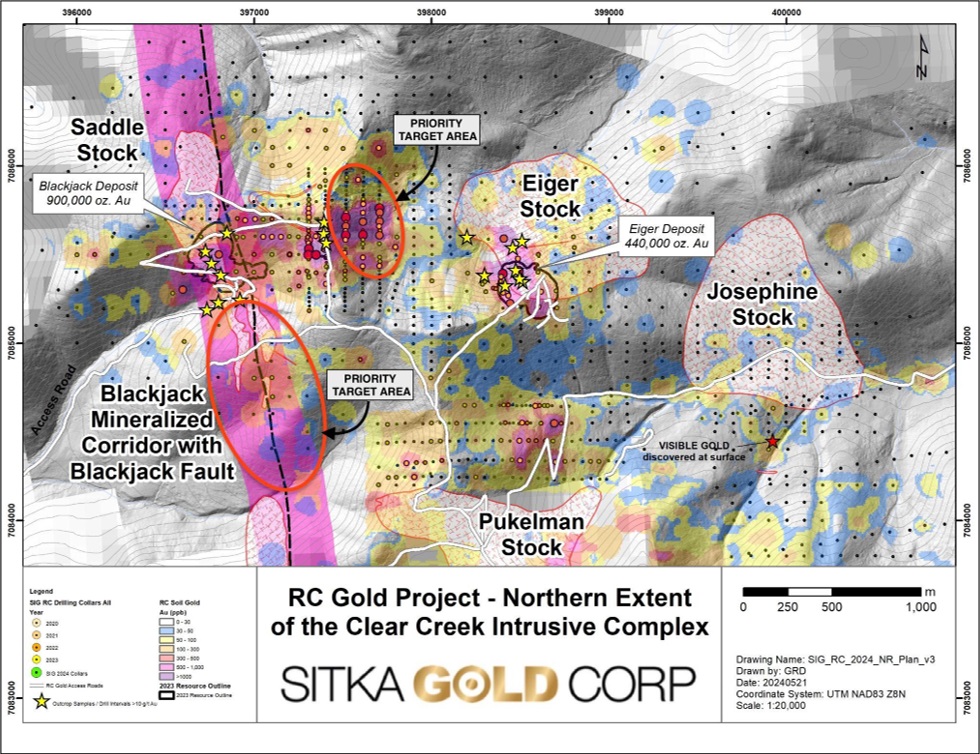

During the winter portion of this year’s drilling program, Sitka completed two diamond drill holes totaling 1085 metres to test the continuity of higher-grade gold mineralization south of the Blackjack gold deposit. Visible gold was observed in both drill holes, with assay results returning 191.0 m grading 1.16 g/t gold, including 11.0 m of 5.80 g/t gold within 89.0 m of 2.03 g/t gold in hole DDRCCC-24-057, and 154.0 m of 1.47 g/t gold, including 37.0 m of 3.07 g/t gold and 8.0 m of 4.61 g/t gold in hole DDRCCC-24-058.

The company’s objectives for the 2024 exploration season include further drilling of the Saddle East zone, Eiger Deposit, Josephine Stock, and investigation of nine known intrusions with associated gold mineralization discovered to date on the 386 square kilometre RC Project.

The RC Gold Project consists of a district-scale land package located in the heart of Yukon’s Tombstone Gold Belt, approximately 100 kilometres east of Dawson City. It is the largest consolidated land package positioned between Victoria Gold’s Eagle Gold Mine and former producing Brewery Creek Gold Mine.

In January 2023, Sitka Gold announced an Initial Mineral Resource Estimate for the RC Gold Property of 1,340,000 ounces of gold. The road accessible, pit constrained Mineral Resource is classified as inferred and is contained in the Blackjack and Eiger deposits. Both deposits are potentially open pit minable and amenable to heap leaching, with initial bottle roll tests indicating gold recoveries of up to 94% with minimal NaCN consumption.

Exploration on the property has mainly focused on identifying an intrusion-related gold system (IRGS), which is the prominent host to deposits within the Tintina Gold Province in Yukon and Alaska. Notable deposits from the belt include Fort Knox Mine, Eagle Gold Mine, Brewery Creek deposit, Florin Gold deposit, and the AurMac Project.

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan

Comments are closed.