With change comes risk and disruption, and the mining industry is no exception. The coming changes in the green revolution sweeping the global economy will disrupt the balance of demand for metals and materials around the world. A new report published by Fitch Solutions forecasts some of the most significant changes to the energy and mining environment since the industrial revolution.

Miners and investors should be paying attention because the change is here, now. Major companies such as Equinor (NYSE:EQNR), Shell (AMS:RDSA), Total (NYSE:TOT), Repsol (BME:REP), ENI (BIT:ENI), and BP (NYSE:BP) have begun to shift their focus to the most in-demand metals and materials of the coming green revolution in technology, transportation, batteries, energy storage, and manufacturing.

Big Winners

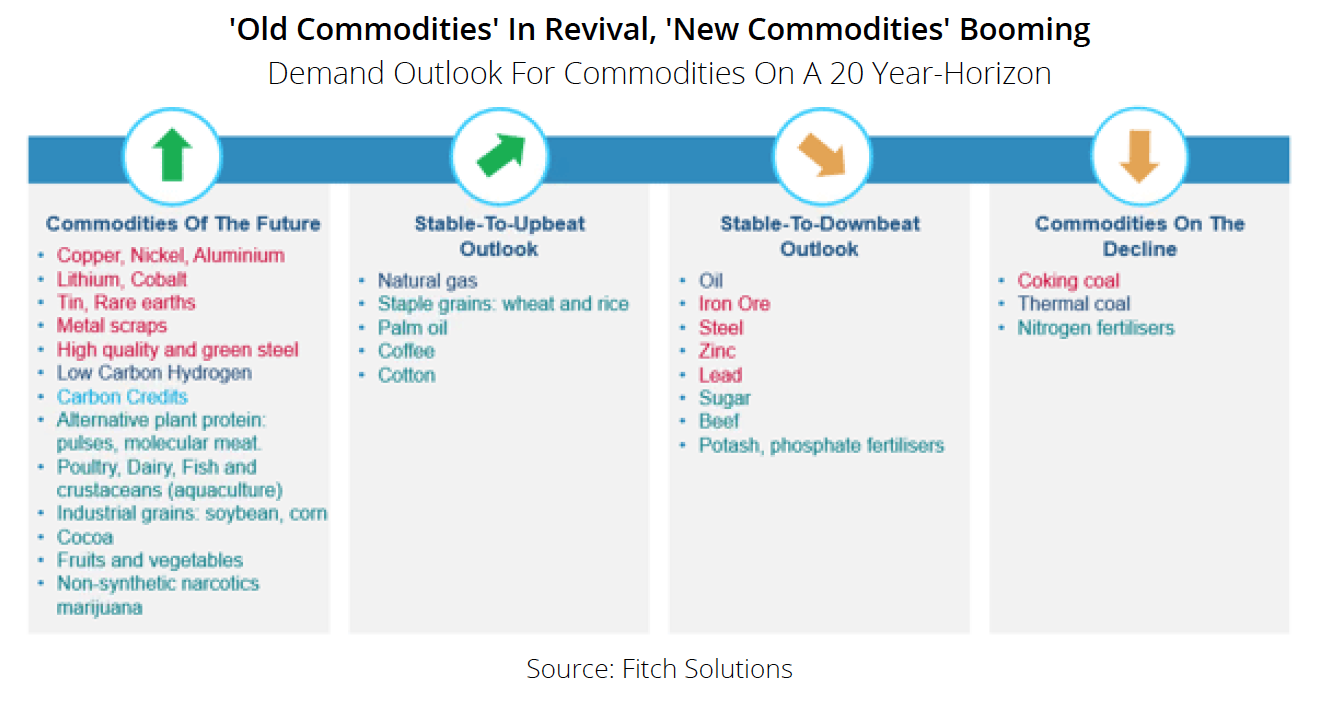

Copper, tin, nickel, aluminum, and rare earths, together with lithium and cobalt, stand to benefit the most as a massive demand surge over the coming decades is driven by batteries, energy storage, and the general electrification of the global economy will drive prices and demand through the roof.

Traditional base metals like copper, nickel, tin, and aluminum will continue to be in demand, but the growth or decline for lithium and cobalt will be most acute. The next 20 years, in particular, will likely see the largest amount of growth, according to the report. Some conventional commodities should get an added boost over the next 20 years, as they take centre stage in the green and digital transitions.

While the coming demand growth will be spread widely across a variety of metals and materials, some are still at risk for a fall in demand. Coking coal thermal coal and nitrogen fertilizers, in particular, have a more downbeat outlook with risk of decline on the horizon. Coal has fallen out of favour for most energy producers now, as clean energy becomes the priority. There is also a PR issue for producers as the public image of coal has become that of an antiquated and dirty energy source.

Nitrogen fertilizers are effective, but they are not safe for the environment and do not have the right image for the coming green revolutions. Some other older commodities that might struggle over the coming decades include oil, iron, steel, zinc, lead, sugar, beef, and potash/phosphate fertilizers, according to the report.

These elements are essential to much of the global economy. Still, they may see a decline as shifting consumer tastes and an economy moving toward a greener image and processes moves away from the high demand for these metals.

Efficiency, Cost, and Sustainability

The commodities of the future, according to Fitch Solutions, include copper, nickel aluminum, lithium, cobalt, tin, rare earths, and even metal scraps due to the increase in recycling and high-quality green steel. As mentioned, steel is at risk of a decline in demand, but if producers can clean up steel mining and processing, it may be possible to keep it circulating along with recycled scrap metals. This will form part of the foundation of the construction and infrastructure economy.

The keys over the coming decades will be efficiency, cost, and sustainability for batteries, which will require Innovation and development in the types of battery chemistries being used. One of the materials at risk of a drop-off in demand for batteries is cobalt. Many companies along the battery supply chain want to reduce or entirely phase out cobalt from batteries. Because of the issues with sustainability and environmental, social, and governmental risks associated with it, it is beginning to lose some of its shine.

Mining conditions for cobalt are in dire straits in some parts of the world, with child labour and underpaid workforces being used in the Democratic Republic of Congo. The recycling process for Cobalt is so complicated that it ends up polluting rivers and streams, as well as natural ecological areas. The metal could also experience some supply vulnerabilities due to a concentration in production and geopolitical hotspots or sustainability issues. Investors will struggle to attract and retain Capital if cobalt is not able to clean up its process and image.

What Will Happen to Steel?

Digitalisation and modernization initiatives for infrastructure as well as the commercial economy, along with the decarbonization of the manufacturing sector, will require higher quality, lighter, and lower carbon steel.

Demand for high-quality and green steel is expected to be strong amid the likely multiplication of decarbonization policies in the next 10 to 20 years; steel and iron ore demand, as well as zinc demand, is expected to slow as a result. These two critical materials will likely record the most subdued growth among all of the metals. Consumption is highest in countries like China experiencing construction growth. Any reduced consumption would likely be caused by China recording more lackluster growth or any rise in efficiency in the steel sector.

Carbon credits will be a large part of driving the transition and will reduce risk and disruption for the industry. Carbon credits are not a commodity in the traditional sense, but in the Fitch report, they are treated as such because they have some similarities with commodities markets. The carbon trading mechanisms currently in place multiply with accelerated decarbonization strategies by both States and corporations. As this accelerates and grows, it is forecasted that this will become a booming and robust market.

First-Mover Advantage for the EU

The EU, with its emission trading schemes directive phase 4 set to be implemented over 2021-2030, is seen as the leader of such growth. The European Union will be a large driver of the carbon swap market. Carbon swaps and trading as a commodity in the future is likely, the report reads, and this shift in thinking has already had a large impact on the power sector. Analysts believe this will continue to be a core driver of the energy transition in the region.

“We, therefore, expect the European Union ETS Market is actually likely to see a sharp increase in EUA trading volumes and prices as existing and new industries compete in a shrinking pool,” the report reads. “China is introducing its own ETS in 2021, and its remit will grow significantly in the coming years.”

Hydrogen’s Place in the Family

Another unlikely addition to the commodity story is hydrogen. Fitch expects green hydrogen, which comes from renewable resources, to become more prominent in the power industry and production to rise from less than 1% of the current global market supply to 10% by 2030. This will likely be at the expense of traditional fossil fuels or even gray hydrogen.

Green hydrogen’s acceleration is happening on the coattails of declining renewable costs, broad geographical scope, shorter development times, and its completely zero carbon footprint. One of the effects of this is that natural gas-based or blue hydrogen production growth will remain highly focused in several key markets, and market share gains will be slower due to long development times. Resource dependency and high levels of capital investment require a highly developed market.

Highly developed markets such as the US, China, Western Europe, and Canada will be the focus of markets for green hydrogen demand, which will be most concentrated in these areas because there is enough investment capital and state support to push projects along. Green hydrogen should be expected to not only power operations across the economy and reduce emissions, but could create massive opportunities for revenue streams in the mining, energy, and metal sectors.

Big Names Are Leading the Charge

Major companies such as Equinor (NYSE:EQNR), Shell (AMS:RDSA), Total (NYSE:TOT), Repsol (BME:REP), ENI (BIT:ENI), and BP (NYSE:BP) are already driving the support for low-carbon hydrogen, particularly blue hydrogen, and aim to be major producers and suppliers in the market.

No matter what path the mining industry takes, things will likely shake out the same. Cleaner, more environmentally, socially, and governmentally (ESG) friendly metals and materials will gain market share, and demand will outstrip supply for years to come. The major miners with a foothold in those sectors will benefit the most. Still, there are numerous opportunities for junior miners and even brokers to take advantage of the favourable climate.

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan

Comments are closed.