Rhodium is a rare metal, and the silvery, corrosive resistant metal is most commonly used in catalytic converters for automobiles, where it competes with platinum, despite platinum production being 12 times larger than rhodium production. It is generally produced as a by-product of platinum and nickel mining; there are about 10 mines in the world that can produce it. As rhodium is so rare it cannot respond to changes in demand easily and therefore the price is driven by supply and demand factors.

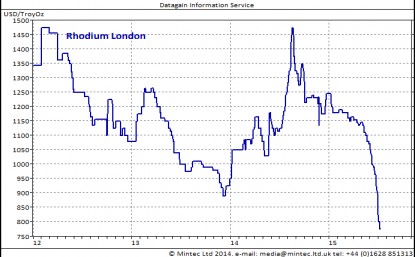

Most of the mines producing rhodium are in South Africa, 80% of global production; however it is also produced in Russia and North America in smaller quantities. The 5 month long platinum miner’s strike in South Africa last year reduced production of platinum and rhodium. The strike over pay ended in June 2014, and a year on, supply of rhodium has jumped to levels not seen for 3 years. Whereas platinum has been in a supply deficit for the past 3 years, rhodium is forecast to be in supply surplus in 2015. In addition, the mines need to sell their stocks quickly in order to increase cash flow to finance their operations and the raised pay of their workers. This has resulted in prices falling to the lowest level in 11 years.

The other factor influencing prices of rhodium is the weakness of the South African Rand (ZAR). The ZAR has been weakening steadily for 4 years and is now worth nearly 45% less than it did at the beginning of 2011. Part of this weakening has to do with the recent strength of the USD, and as metals are traded in dollars, this has resulted in the price of rhodium being under more downward pressure.

Global economy and vehicle demand

The global economy has also had an effect on the price of rhodium. As the global economy weakens; so does the demand for vehicles and therefore, the demand for rhodium. China has the fastest growing car market but their economic growth has slowed in the past few years and consequently so has the appetite for new cars. Even though the global production of new cars is increasing year on year, this increase has slowed to 2.5% y-o-y in 2015 from an increase of 2.9% in 2014. China is forecast to increase the number of motor vehicles produced by 6% in 2015 but that is down from a 7.4% increase in 2014. In Europe, the world’s 2nd largest car market, concern over Russia, the Greek crisis and poor economic growth has led to a similar slowing of growth in the production of new cars in 2015, down from a 5% increase in 2014 to a 3% increase in 2015. Although strong US economic data has led to an increase in consumer confidence resulting in the highest growth in car production since 2001, this has not been enough to pull global car production out of slowing growth. Consequently, global demand for the platinum and rhodium has fallen from 9.31m ounces in 2014 to 9.30m ounces in 2015, down 0.1% y-o-y.

Competition with platinum

As rhodium competes with platinum in the car market, the price differential between these will influence demand for rhodium. Platinum is more widely used by car manufacturers due to the wider availability, however recently rhodium has had a cost advantage. The price of rhodium was lower than platinum for all of 2012/13 and into 2014, but the strike in South Africa caused the prices of rhodium to rise and the price advantage that rhodium had enjoyed narrowed to virtually nothing. In fact, the price of rhodium has been higher than platinum at several points since August 2014. Consequently, whilst demand for platinum has fallen by 5,000 ounces in 2015, down 0.06% y-o-y, demand for rhodium has fallen by 8,000 ounces, down 0.8% y-o-y.

Supply surplus

Now that the South African platinum miners have been back at work for a year, rhodium supply has increased back to levels seen in 2012. In 2013, there was a supply deficit of 28,000 ounces rising to 72,000 ounces in 2014; whereas the forecast in 2015 is a surplus of 62,000 ounces. This would initially seem like a good thing for rhodium, but the supply deficit for platinum has fallen from1.1m ounces in 2014 to a deficit of 284,000 ounces in 2015. This has caused prices of both metals to fall, and rhodium has borne the brunt of this due to the surplus.

Russia

The final piece in the rhodium price weakness puzzle is Russia. Although Russian production accounts for just 11% of global production, it can still affect prices. Crude oil is a crucial part of the Russian economy as they are a major producer. The fall in price of crude oil resulted in a rouble than was weaker even than in the midst of the global financial crisis in 2008. Add in western sanctions and the country is having difficulties in attracting international investment. Any investment that is coming into the country is likely to be aimed at mines that produce metals that have not had such large drops in prices, such as gold. Rhodium production in Russia is forecast to fall to 80,000 ounces in 2015, down 8% y-o-y, however with the strong dollar and weak rouble, Russian mining companies can tolerate a lower dollar price.

All in all, there are many things driving down the price of rhodium. The biggest by far is a surplus in supply for the first time since 2011 and the slowing of car production growth. Unless there is a disruption to production or a much higher than expected increase in vehicle production, it seems unlikely that the price of rhodium will rise much in 2015.

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan

Comments are closed.