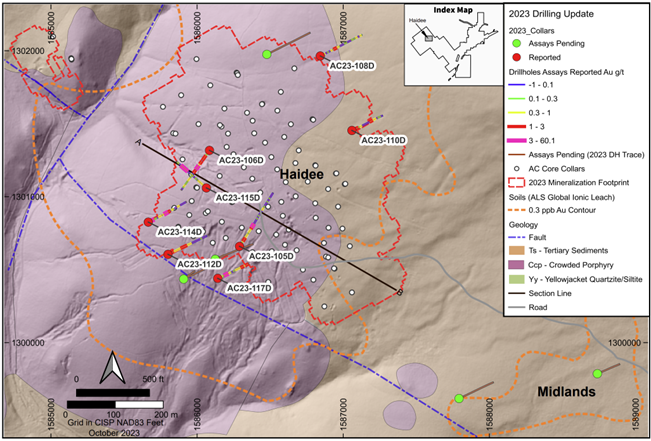

Revival Gold (TSXV:RVG) has announced the results of eight core drill holes as part of its 2023 exploration activities at the Beartrack-Arnett Gold Project in Idaho, USA. All eight holes are from the Haidee deposit area and showed near-surface oxide gold mineralization above the cut-off grade. The 2023 drilling at Haidee consisted of twelve core drill holes, which aimed to investigate various targets related to the existing Haidee Mineral Reserve.

Hugh Agro, President & CEO of Revival Gold, commented in a press release: “The confirmation of higher grade near-surface oxide gold mineralization beyond the current Mineral Reserve at Haidee is a significant development. The results validate our team’s exploration case for higher grade material and possible feeder structures at Haidee, and they demonstrate tangible potential to meaningfully expand Revival Gold’s proposed Haidee open pit and heap leach restart plans for Beartrack-Arnett. We look forward to releasing this year’s remaining drill results in the weeks ahead.”

In addition to Haidee, the company also completed drilling in three new target areas at Beartrack-Arnett: Roman’s Trench, Midlands, and Ridge. In total, 18 core drill holes covering 3,350 meters were completed in this year’s campaign. Results for two of the holes at Roman’s Trench were disclosed on September 27, 2023, and results for the remaining eight holes are anticipated to be released next month.

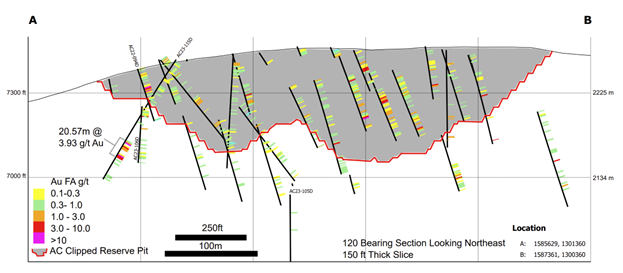

Two particular holes, AC23-106D and AC23-115D, were drilled to further investigate high-grade mineralization found in hole AC22-094D on the western side of the Haidee Mineral Reserve. Both holes revealed additional high-grade mineralization. Hole AC23-115D specifically showed mineralization in what is interpreted to be a feeder structure with a north-northeast strike and a moderate southeasterly dip. These findings confirm the presence of higher-grade mineralization outside the current reserve pit at Haidee, suggesting the potential for increasing Mineral Reserves in the area.

Apart from Haidee, Revival Gold reported outcomes from a channel sampling program at Roman’s Trench. This program was initiated to follow up on earlier chip sampling and involved cutting a continuous channel across an 11.9-meter outcrop to obtain a more representative sample set. Eight samples were taken at roughly 1.4-meter intervals along the channel, and five vertical crosscuts were also taken. Gold values varied from 0.04 g/t to 112 g/t, with two additional samples over 6 g/t. These results, although not reflecting the true width of the structure due to the sampling method, support the existence of high-grade oxide gold mineralization in the Roman’s Trench area, warranting further investigation.

Highlights from the results are as follows:

| Hole Number |

Area | Azimuth (deg.) |

Dip (deg.) |

From (m) |

To (m) |

Drilled Width1 (m) |

Fire Assay Gold Grade (g/t) |

| AC23-105D | Haidee-Deep | 34 | -67 | 30.9 | 45.1 | 14.3 | 0.47 |

| 53.3 | 57.7 | 4.4 | 0.33 | ||||

| 61.4 | 65.0 | 4.1 | 0.28 | ||||

| 109.2 | 125.3 | 16.1 | 0.55 | ||||

| Incl. | 120.1 | 125.3 | 5.2 | 1.15 | |||

| 131.7 | 132.3 | 0.6 | 4.77 | ||||

| AC23-106D2 | Haidee-AC23-094D offset | 215 | -50 | 11.9 | 16.2 | 4.3 | 0.32 |

| 23.1 | 35.1 | 12.0 | 0.47 | ||||

| 57.5 | 70.3 | 12.8 | 0.93 | ||||

| Incl. | 68.7 | 70.3 | 1.6 | 5.04 | |||

| 117.7 | 123.9 | 6.2 | 0.29 | ||||

| 147.1 | 155.3 | 8.3 | 0.27 | ||||

| AC23-108D | Haidee-Up-dip | 64 | -61 | 72.7 | 77.0 | 4.3 | 0.93 |

| 187.4 | 189.6 | 2.2 | 0.33 | ||||

| AC23-110D3 | Haidee-Up-Dip | 65 | -63 | 10.1 | 24.4 | 14.4 | 0.50 |

| Incl. | 11.4 | 13.0 | 1.5 | 2.92 | |||

| 43.4 | 46.2 | 2.8 | 0.40 | ||||

| 101.2 | 106.1 | 4.9 | 0.53 | ||||

| 113.1 | 116.7 | 3.7 | 0.38 | ||||

| 121.3 | 127.4 | 6.1 | 0.38 | ||||

| AC23-112D | Haidee-Down-Dip | 65 | -61 | 13.1 | 20.0 | 6.9 | 0.61 |

| Incl. | 18.5 | 20.0 | 1.5 | 2.25 | |||

| 48.0 | 50.6 | 2.6 | 0.42 | ||||

| 55.8 | 58.8 | 3.0 | 0.45 | ||||

| 64.9 | 69.5 | 4.6 | 0.80 | ||||

| 93.9 | 98.1 | 4.3 | 0.38 | ||||

| 106.1 | 112.2 | 6.1 | 0.34 | ||||

| AC23-114D4 | Haidee-Down-Dip | 64 | -61 | 12.3 | 18.0 | 5.7 | 1.44 |

| Incl. | 16.5 | 18.0 | 1.5 | 3.52 | |||

| 57.6 | 60.7 | 3.0 | 0.56 | ||||

| 73.3 | 75.3 | 2.0 | 0.39 | ||||

| 79.9 | 86.3 | 6.4 | 1.23 | ||||

| Incl. | 85.2 | 86.3 | 1.1 | 5.25 | |||

| 98.1 | 100.7 | 2.6 | 0.69 | ||||

| 117.0 | 120.1 | 3.0 | 0.45 | ||||

| 148.9 | 155.0 | 6.1 | 0.39 | ||||

| AC23-115D5 | Haidee-AC23-094D offset | 311 | -56 | 2.1 | 5.8 | 3.7 | 0.48 |

| 23.8 | 26.8 | 3.0 | 0.57 | ||||

| 34.4 | 39.0 | 4.6 | 0.25 | ||||

| 104.3 | 124.8 | 20.6 | 3.93 | ||||

| Incl. | 105.4 | 106.8 | 1.4 | 19.6 | |||

| Incl. | 120.6 | 124.8 | 4.3 | 9.15 | |||

| AC23-117D6 | Haidee-Down-Dip | 66 | -61 | 5.2 | 11.6 | 6.5 | 0.56 |

| 16.5 | 19.2 | 2.7 | 0.56 | ||||

| 39.8 | 46.6 | 6.8 | 1.20 | ||||

| Incl. | 39.8 | 41.4 | 1.6 | 3.55 | |||

| 54.1 | 63.4 | 9.3 | 0.43 | ||||

| 87.3 | 91.9 | 4.6 | 0.26 | ||||

| 122.8 | 127.4 | 4.6 | 0.75 | ||||

| 1 True width is estimated to be 50% to 70% of drilled width. | |||||||

| 2 AC23-106D: 40% recovery from 29.4 meters to 30.4 meters | |||||||

| 3 AC23-110D: No recovery from 13.0 meters to 15.8 meters and 22.3 meters to 23.5 meters. These intervals were included in grade calculations at 0 g/t gold. | |||||||

| 4 AC23-112D: 40% recovery from 13.1 meters to 14.6 meters; 50% recovery from 16.2 meters to 17.7 meters | |||||||

| 5 AC23-115D: 35% recovery from 3.4 meters to 4.0 meters. | |||||||

| 6 AC23-117D: 35% recovery from 5.2 meters to 5.8 meters and 25% recovery from 6.4 meters to 7.0 meters. | |||||||

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan

Comments are closed.