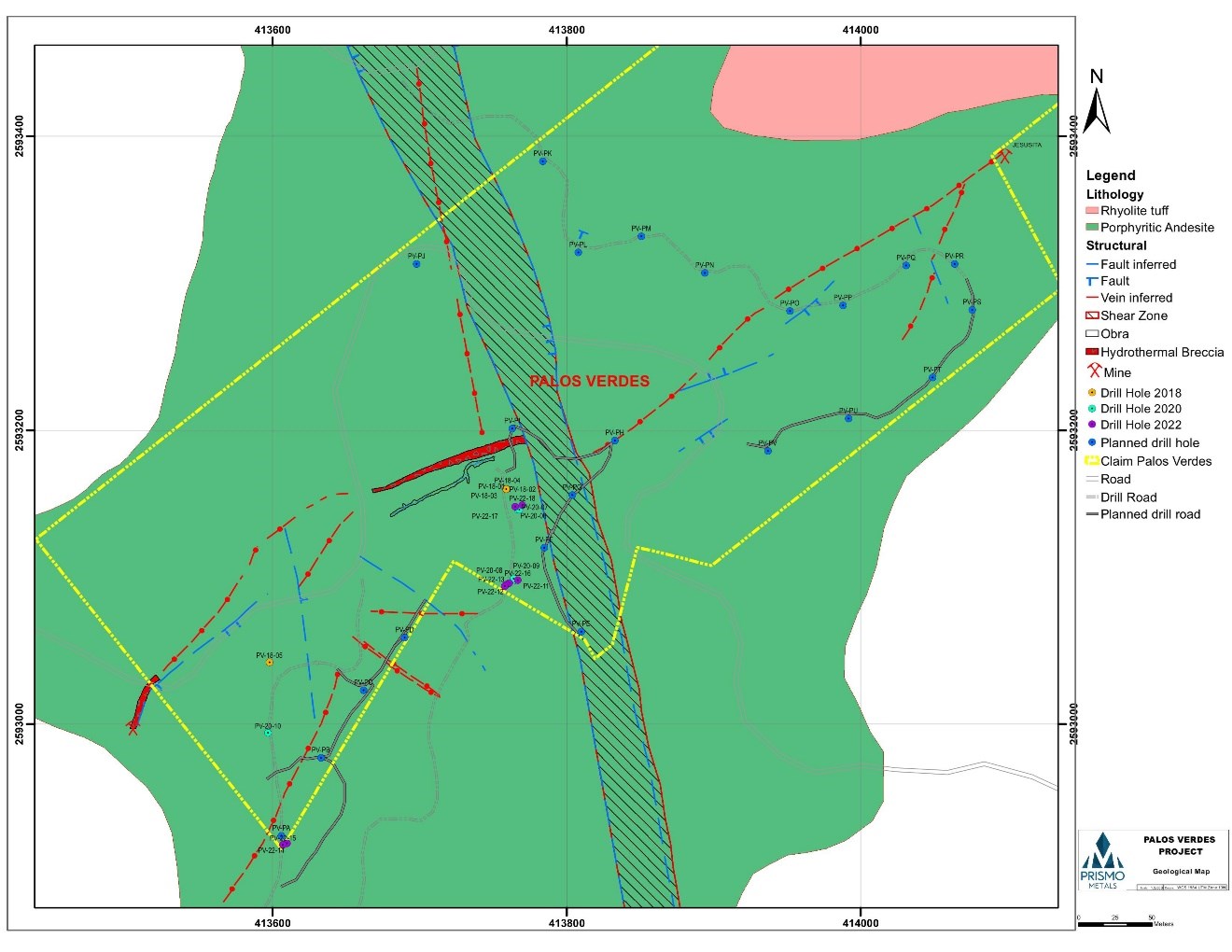

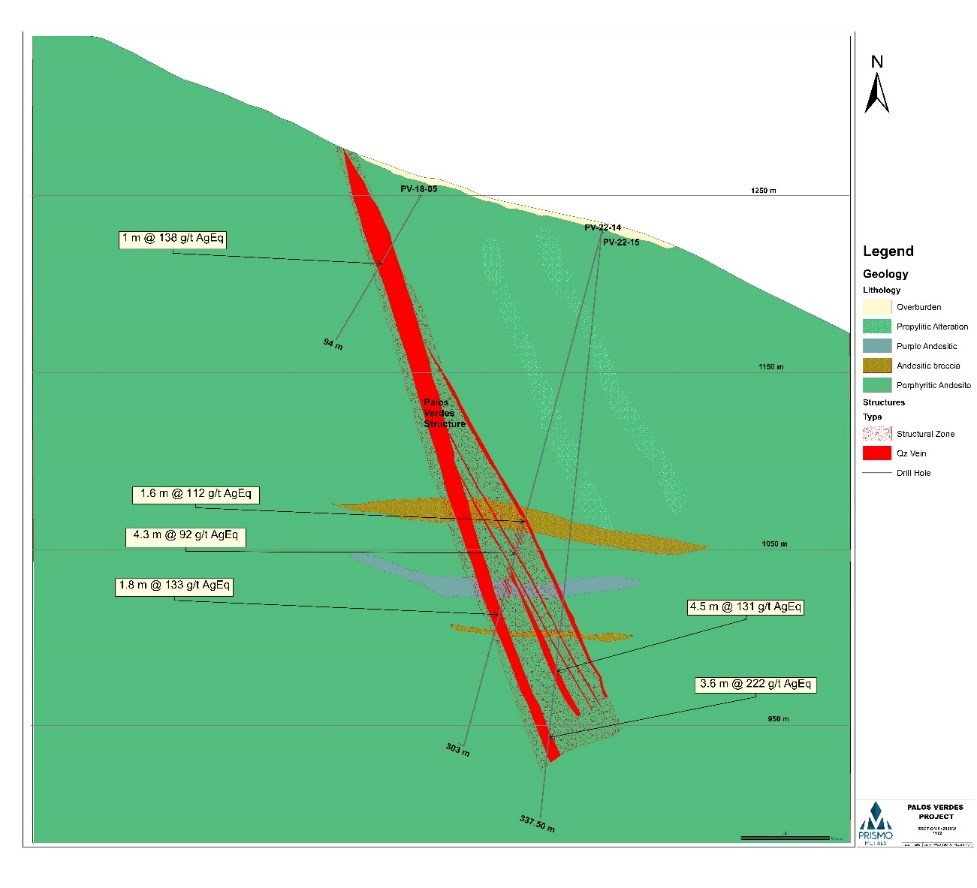

Prismo Metals (CSE:PRIZ) has announced new assay results for its first five holes from the drill program at the Palos Verdes project. The company still expects assays for the last three holes of the 2022 campaign to arrive before the end of December. Located in the Panuco-Copala district of the state of Sinaloa, Mexico, the Palos Verdes concession covers 700 metres of strike length in the Palos Verdes vein.

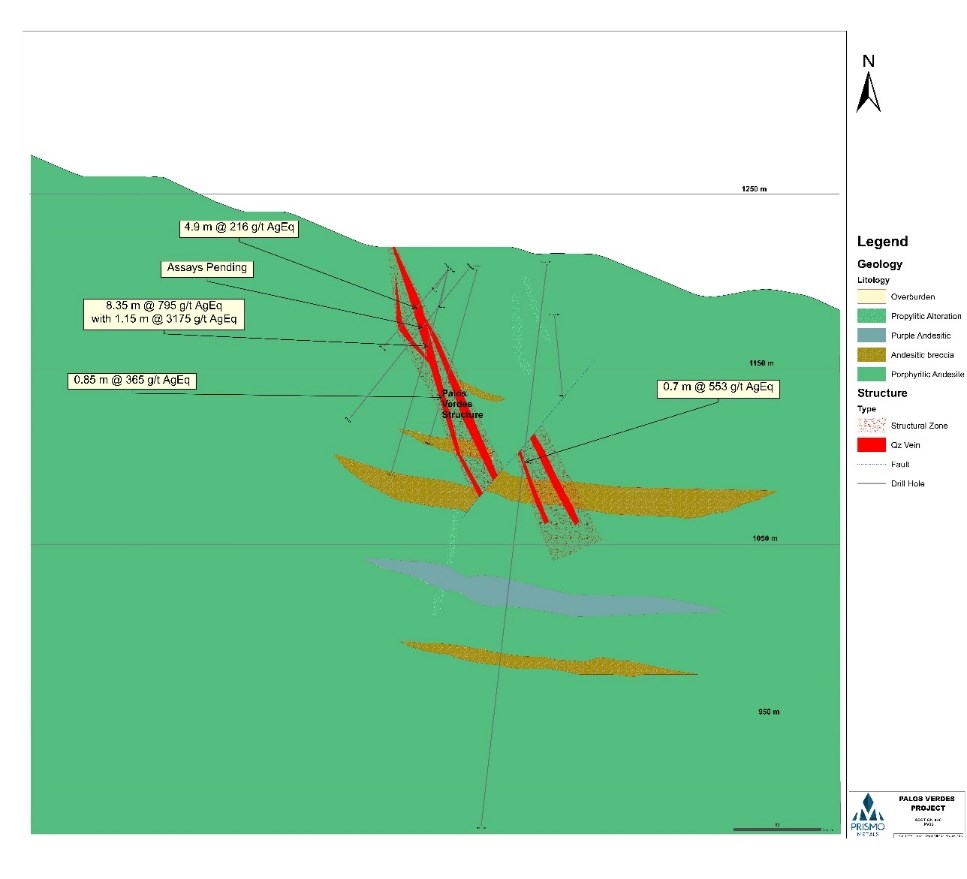

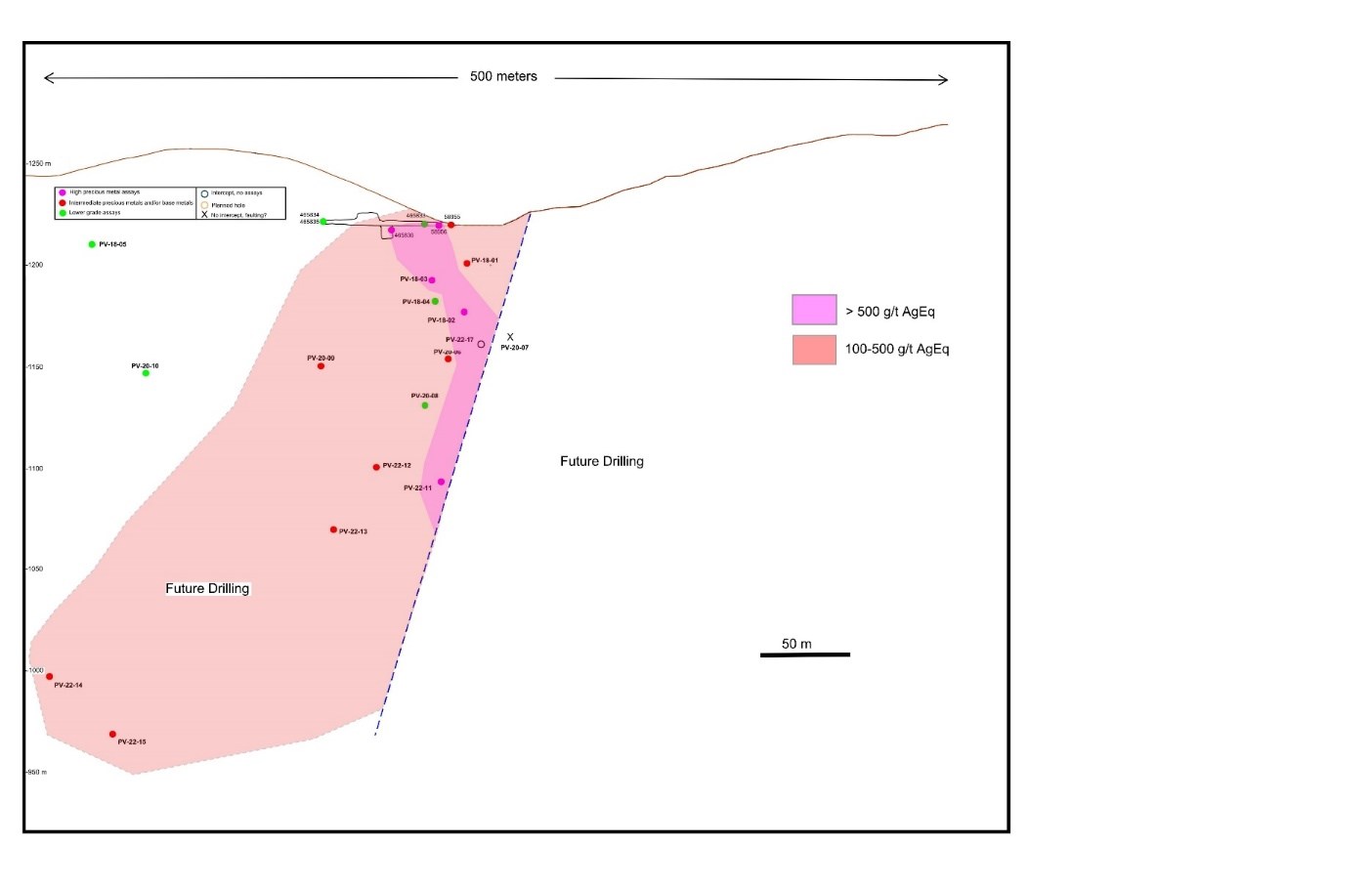

The first drill hole of the season, PV-22-11, cut 0.7 meters downhole length with 553g/t AgEq or 4.18 g/t gold and 207 g/t silver. All five holes reported here cut significant mineralization, and in general intercepts were relatively gold and base-metal rich (Table 1). The company has completed the current drill program with almost 2,100 meters drilled in eight holes as shown in Table 2.

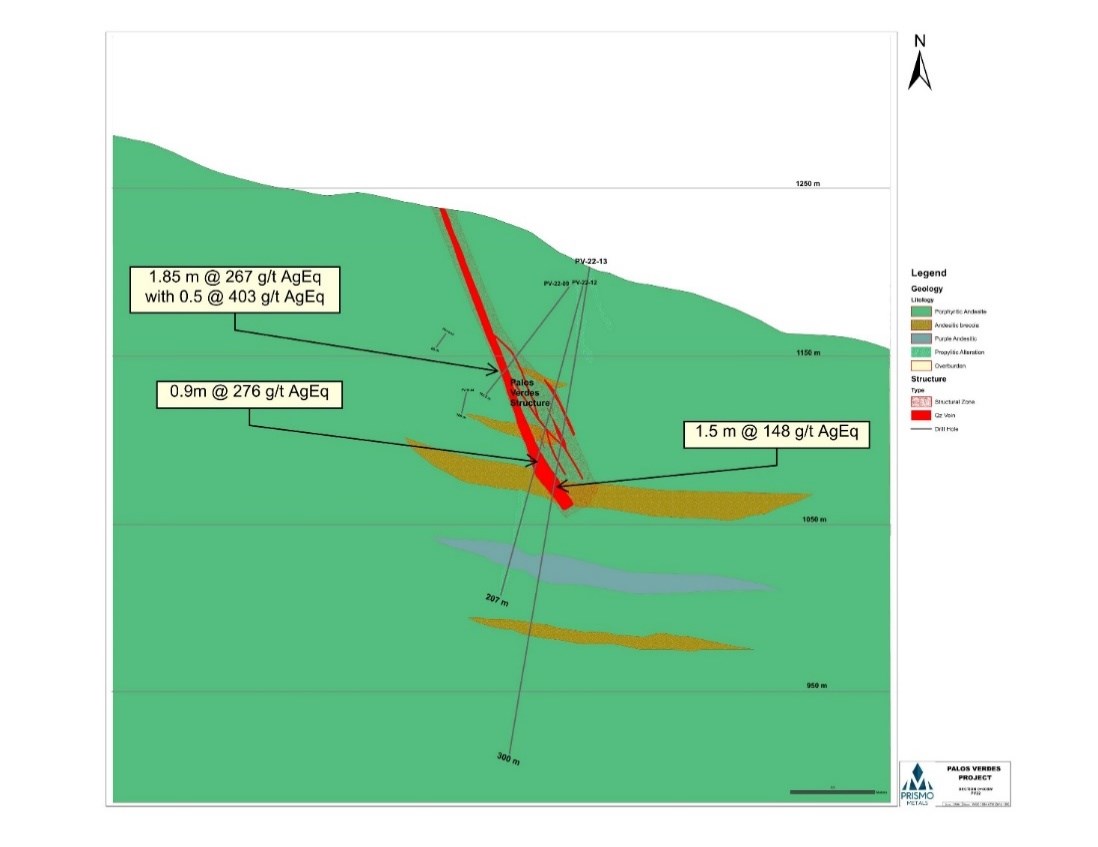

Several holes cut wide zones of mineralization, including nine meters downhole in hole PV-22-15 that averaged 187 g/t AgEq or 1.02 g/t Au with 1.1 % Pb and 1.4 % Zn. These intercepts shown in table 3 range from 50 to 150 meters below previous shallow drilling that had several high-grade intercepts. Table 3 shows the intercepts from the historic drilling with silver equivalent values shown for comparison purposes, with the best being 3,175 g/t AgEq over a true width estimated at 0.8 meters within a larger mineralized interval with 795 g/t AgEq over a true width of 5.5 meters.

Craig Gibson, President and CEO of Prismo Metals, commented in a press release: “The drill program was successful in extending the mineralization to depth below the shallow drill holes completed previously and provided important information on the distribution of metal values. Under the current environmental permit, we had access to limited drill sites, which leaves ample room to significantly extend the higher-grade zones in the mineralized ore shoot along strike.

“Approximately 70% of the strike length of the Palos Verdes vein remains untested, including the central portion of the southwestern segment of the vein, and all of the northeastern extension. In April of this year, we applied for an expanded environmental permit which we anticipate obtaining before our next phase of drilling planned for January 2023. Upon receipt of the expanded environmental permit, we will immediately initiate further drilling to the northeast to be funded by the announced strategic investment from Vizsla Silver Corp. Also, once this agreement with Vizsla is finalized, we will be able access the central portion of the southern segment of the Palos Verdes vein from roads on their adjacent concession, thereby further expanding our ability to explore the Palos Verdes property.”

Further results and a corporate update as provided by Prismo Metals include:

Prismo also provided an update on its short-term corporate priorities.

Prismo is currently working on finalizing the announced strategic investment by Vizsla Silver Corp. The strategic investment will provide for a cash injection to Prismo of $500,000 and issuance to Prismo of $1.5 million in Vizsla shares which will provide Prismo shareholders further exposure to the district via equity ownership position in Vizsla Silver.

The companies will also form a joint technical committee to allow for the pursuit of district-scale exploration of Panuco silver-gold district. This transaction is expected to be finalized by December 16, 2022. The next phase of drilling at Palos Verdes, expected in January 2023, will be reviewed by the technical committee to be formed as part of the agreement with Vizsla Silver.

At the Los Pavitos project, the surface mapping and sampling program begun early in 2022 continues, with completion of the initial mapping and sampling program over the concession slated for December. Preparation of the environmental permit application is in progress, field work has been completed and the application will be submitted shortly, with drilling planned in the first quarter of 2023.

No drilling has been completed to the northeast of the fault. Source: Prismo Metals

Table 1. Assays for drill holes in the current program.

| Hole | From

(m) |

To

(m) |

Width

(m) |

Est True

Width (m) |

Au

(g/t) |

Ag

(g/t) |

Cu

(%) |

Pb

(%) |

Zn

(%) |

Ag eq

(g/t) |

| PV-11 | 114.85 | 115.55 | 0.7 | 0.42 | 4.18 | 207 | 0.02 | 0.02 | 0.02 | 553 |

| PV-12 | 117.9 | 118.8 | 0.9 | 0.54 | 3.18 | 13 | 0.01 | – | – | 276 |

| PV-13 | 118.5 | 120.0 | 1.5 | 0.9 | 0.66 | 93 | – | – | – | 148 |

| PV-14 | 165.0 | 172.2 | 7.2 | 4.3 | 0.06 | 21 | 0.08 | 0.49 | 0.85 | 77 |

| incl | 169.4 | 171.0 | 1.6 | 2.5 | 0.07 | 28 | 0.12 | 0.52 | 1.01 | 88 |

| 179.9 | 184.2 | 4.3 | 2.6 | 0.03 | 27 | 0.41 | 0.81 | 1.01 | 92 | |

| 193.0 | 195.9 | 2.9 | 1.7 | 0.05 | 12 | 0.27 | 0.14 | 1.88 | 93 | |

| incl | 194.1 | 195.9 | 1.8 | 1.1 | 0.07 | 14 | 0.36 | 0.13 | 2.80 | 133 |

| PV-15 | 238.5 | 243.0 | 4.5 | 2.7 | 0.18 | 43 | 0.29 | 0.36 | 1.60 | 131 |

| 263.5 | 272.5 | 9 | 5.4 | 1.02 | 16 | 0.23 | 1.10 | 1.41 | 187 | |

| incl | 266.45 | 272.5 | 6.05 | 3.6 | 0.91 | 22 | 0.33 | 1.61 | 2.04 | 222 |

Silver equivalent values are calculated using the following metals prices: Au, US$1,750/oz, Ag, $21.24/oz, Pb, $0.97/lb and Zn, $1.34/lb. Cu was not used in the calculation, and metallurgical recoveries were not considered as there is no data available.

Table 2. Drill hole data for holes from the current program.

| Hole | Easting | Northing | Elev | Azim | Incl | Depth (m) | |

| PV-22-11 | 413,761 | 2,593,096 | 1,209 | 355 | -82 | 393.00 | |

| PV-22-12 | 413,759 | 2,593,095 | 1,209 | 325 | -75 | 207.00 | |

| PV-22-13 | 413,758 | 2,593,094 | 1,209 | 300 | -80 | 300.00 | |

| PV-22-14 | 413,610 | 2,529,919 | 1,230 | 330 | -75 | 303.00 | |

| PV-22-15 | 413,607 | 2,529,918 | 1,230 | 15 | -80 | 337.50 | |

| PV-22-16 | 413,767 | 2,593,098 | 1,209 | 70 | -60 | 288.00 | |

| PV-22-17 | 413,765 | 2,593,148 | 1,205 | 340 | -50 | 115.00 | |

| PV-22-18 | 413,770 | 2,593,149 | 1,205 | 40 | -50 | 156.00 | |

Coordinates in UTM WGS84 using handheld Garmin GPS.

Table 3. Drill results for all previously released drill holes at the Palos Verdes Project

| Hole | From

(m) |

To

(m) |

width

(m) |

Est True

width (m) |

Au

(g/t) |

Ag (g/t) | Cu

(%) |

Pb

(%) |

Zn

(%) |

Ag eq

(g/t) |

| PV-01 | 23.90 | 28.80 | 4.90 | 4.2 | 0.89 | 31 | 0.21 | 0.30 | 2.63 | 216 |

| PV-02 | 40.35 | 48.70 | 8.35 | 5.5 | 1.69 | 474 | 0.54 | 1.09 | 3.84 | 795 |

| incl. | 45.25 | 48.70 | 3.45 | 2.3 | 3.75 | 1098 | 0.67 | 1.99 | 3.00 | 1581 |

| incl. | 46.55 | 47.70 | 1.15 | 0.8 | 8.42 | 2336 | 0.27 | 1.72 | 2.46 | 3175 |

| PV-03 | 31.30 | 40.65 | 9.35 | 7.0 | 1.45 | 15 | 0.05 | 0.11 | 1.04 | 178 |

| incl. | 39.55 | 40.65 | 1.10 | 0.8 | 12.15 | 50 | 0.26 | 0.53 | 5.01 | 1263 |

| PV-04 | 55.45 | 59.00 | 3.55 | 3.0 | 0.12 | 37 | 0.31 | 0.12 | 0.74 | 121 |

| PV-05 | 54.25 | 57.40 | 3.15 | 2.0 | 0.25 | 23 | 0.06 | 0.32 | 0.62 | 77 |

| incl. | 56.40 | 57.40 | 1 | 0.42 | 30 | 0.12 | 0.83 | 1.27 | 138 | |

| PV-06 | 70.55 | 75.85 | 5.3 | 3.2 | 0.13 | 69 | 0.14 | 0.12 | 0.29 | 220 |

| 75.00 | 75.85 | 0.85 | 0.5 | 0.46 | 317 | 0.12 | 0.09 | 0.21 | 365 | |

| PV-07 | 32.40 | 34.20 | 1.8 | ? | 0.01 | 9 | 0.35 | 0.24 | 0.47 | 36 |

| PV-08 | 92.70 | 96.05 | 3.35 | 2.5 | 0.24 | 17 | 0.09 | 0.19 | 0.58 | 65 |

| 92.70 | 93.65 | 0.95 | 0.7 | 0.55 | 37 | 0.24 | 0.61 | 1.21 | 147 | |

| PV-09 | 87.10 | 88.95 | 1.85 | 1.3 | 0.73 | 38 | 0.19 | 0.61 | 3.89 | 267 |

| incl. | 87.10 | 87.60 | 0.5 | 0.3 | 1.63 | 44 | 0.27 | 0.79 | 5.15 | 403 |

| PV-10 | 125.30 | 126.50 | 1.20 | 0.9 | 0.03 | 6 | 0.06 | 0.03 | 1.4 | 71 |

Partial data for holes PV-01 to PV-10 were included in previous news releases, of September 30, 2020 and December 20, 2020 True width of the intercept in hole PV-07 is unknown.

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan

Comments are closed.