I recently returned from a hectic trip to Toronto for an annual mining industry investment conference known as PDAC. I met with 28 companies and spoke to dozens of investors. I expected to talk a lot about Lithium & Cobalt— how the sell-off in those sectors could be close to over, how demand forecasts keep rising in the face of uncertain long-term supply, etc.

Although there were plenty of discussions on the, “battery metals,” I was surprised by the universal excitement over a metal that’s old school, but also indispensable to the future of electric vehicles & renewable energies…. A metal that needs no further introduction…. #Copper.

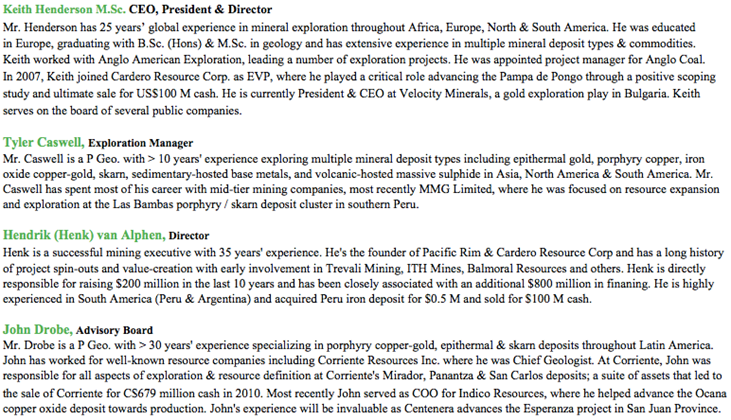

One of the best stories I heard at PDAC was an update from Keith Henderson M.Sc., CEO & Director of Centenera Mining Corp. [TSX-V: CT / OTC: CTMIF], an Argentina-focused company with attractive Copper (“Cu”) & Gold (“Au”) exploration projects. Upon a positive change in Argentina’s government in 2015, Centenera was quick to move more actively into the country.

Drilling is underway at the Company’s flagship project, and management believes that it’s going quite well. The first assay is expected around the end of March.

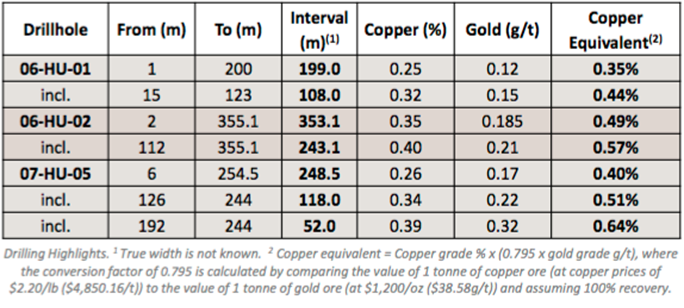

The crown jewel asset and primary focus of Centenera this year is the 100% controlled, near-surface Esperanza copper-gold project — (formerly known as the Huachi project) — an outcropping Cu–Au porphyry system with a blockbuster discovery that included a drill hole intersection of 353 meters grading 0.49% Cu Eq., (incl. 243 m at 0.57% Cu Eq. & 88 m at 0.69% Cu Eq.). Mineralization outlined at surface and found in shallow drilling is open in all directions and at depth. {see Corporate Presentation}

Assays from the discovery drill campaign included:

Esperanza is in San Juan province in northwestern Argentina, sitting at an elevation of between 2,800 and 3,250 meters. That’s relatively low compared to work being done in the high Andes. The project is 35 km from existing power lines. Proximity to key infrastructure is absolutely critical for mining bulk tonnage porphyry deposits.

Exploration can be performed year-round in San Juan, ranked in the 2017 Fraser Institute of Mining Survey as the #1 province in Argentina, and 3rd best mining jurisdiction in all of South America. Despite well-known players like Barrick (Veladero mine in San Juan) & Yamana Gold (Gualcamayo mine in San Juan) being active in the Province, the Esperanza project remains remarkably under-explored. Only 7 drill holes (2,011 m) have tested this extensive, outcropping copper-gold porphyry system.

After several weeks of delay due to unseasonal storms and flash flooding across multiple northern provinces, drilling is well underway at Esperanza. Interestingly, while repairing road access to site, new mineralization was exposed at surface in an area thought to be barren. Mineralization is now interpreted to extend significantly further to the southeast than previously known. Some of the best mineralization to date has been intersected in this area.

The Phase I drill program is investigating the potential for a bulk-tonnage copper-gold porphyry-style deposit. Management is currently drilling 4 step-out holes, ~2,000 m in total, of at least 100 m away from historical holes, aiming to reach deeper, (500 – 600 m), than prior efforts. Deeper drilling was called for because several assays from 2006-7 showed grade increasing at depth.

Some drill core from the first hole is about to be sent out for assay. I’m told that upon visual inspection, the technical team felt that the core looked really good, but readers will have to wait along with management until the end of March for lab results.

Upon success in Phase I, a Phase II program would include 4 additional step-outs of 100 – 150 m, plus 2 IP targets 500 m to the east, for a total of 6 holes.

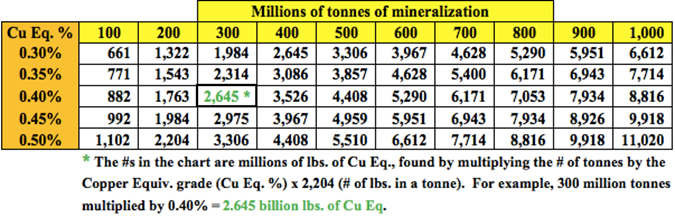

Based on exploration to date, the significant grade, and thickness of reported intervals, management believes there could be hundred(s) of millions of metric tonnes of mineralization. The area of interest is already 1,400 m by 850 m. If strong grade and wide intervals continue to be found, the deposit could host billion(s) of Copper Equivalent (“Cu Eq.“) pounds. Make no mistake, it’s still early days, but there’s a real possibility for substantial scale to be unearthed here.

It’s worth reminding readers that McEwen Mining’s (NYSE: MUX) Los Azules project is also in San Juan province. McEwen’s website describes Los Azules as follows; 962 million tonnes containing 10.2 billion pounds Cu in the Indicated category, plus 2.666 billion tonnes containing 19.3 billion pounds Cu Inferred, with (Cu only) grades of 0.48% & 0.33%, respectively. That’s a combined 3.6 billion tonnes of mineralization, containing 29.6 billion pounds Indicated & Inferred Cu, at an average grade of 0.37%.

Delineating hundred(s) of millions of tonnes is not a sure thing, and it won’t necessarily come in the maiden mineral resource estimate. However, historical exploration, combined with the current drill program, could provide further evidence of grade, scale & continuity that attracts considerable attention.

Centenera has a tremendous management, Board & technical team for a company its size {72.4 M shares outstanding x C$0.165 = C$12.0 M = US$9.3 M market cap}.

Centenera Mining Corp. [TSX-V: CT / OTC: CTMIF] is sitting on what could be a major copper-gold asset in San Juan, with important drill results coming out soon. It also holds a portfolio of promising projects, also in Argentina, including a high sulphidation epithermal gold mineralization project and a hard rock lithium play, both in Salta province.

Centenera Mining Corp. [TSX-V: CT / OTC: CTMIF] is sitting on what could be a major copper-gold asset in San Juan, with important drill results coming out soon. It also holds a portfolio of promising projects, also in Argentina, including a high sulphidation epithermal gold mineralization project and a hard rock lithium play, both in Salta province.

Here’s a very good 4-minute video clip of CEO Henderson from PDAC in early March.

Readers would benefit from reading the March 2017 Esperanza Technical Report

Recent press release: February 21, 2018 Website Twitter Corporate Presentation

Disclosures: The content of this article is for information purposes only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein, about Centenera Mining, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is to be considered, in any way whatsoever, implicit or explicit investment advice. Further, nothing contained herein is a recommendation or solicitation to buy, hold or sell any security. The content contained herein is not directed at any individual or group. Peter Epstein and Epstein Research [ER] are not responsible, under any circumstances whatsoever, for investment actions taken by the reader. Peter Epstein and [ER] have never been, and are not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and they do not perform market making activities. Peter Epstein and [ER] are not directly employed by any company, group, organization, party or person. The shares of Centenera Mining are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this article was posted, Peter Epstein owned shares and stock options of Centenera Mining and the Company was a sponsor of Epstein Research. Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. Mr. Epstein & [ER] are not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. Mr. Epstein & [ER] are not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. Mr. Epstein and [ER] are not experts in any company, industry sector or investment topic.

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan

Comments are closed.