Twenty kilometres from a major four lane highway lies one of the largest undeveloped silver assets with an established resource of 115 million ounces of silver and 1.5 billion pounds of zinc, Golden Tag Minerals’ (TSX-V: GOG) wholly owned San Diego Silver Project.

Golden Tag has been preparing for stronger silver prices since 2019 in order to follow up on a resource outlined by a 2013 resource estimate. A new team at Golden Tag is accelerating its plans to appreciate and expand the large silver-zinc-lead deposit left lying in the desert for seven years.

The company recently announced a $5.6-million financing with Eric Sprott, his third financing in the company in under a year, in order to grow and define the known resources.

The San Diego Silver Project is located in the Velardeña Mining District in the Mexican State of Durango. The 92-hectare property lies 75 kilometres southwest of the city Torreon in sight of Golden Minerals (TSX: AUMN) San Juana Mine and 14 kilometres from Peñoles’ (BMV: PE & OLES) Santa Maria Mine.

A 2013 resource estimate concluded that there is potential to increase the size of the resource. The mineralization at the property is hinting at something bigger at depth and the company has sought the guidance of a geologist who has a knack for discovery at depth.

After seven years, the story of the San Diego Silver project continues, but with every good story, it is best to revisit the beginning.

History Lesson

In 2005, Golden Tag entered into a joint-venture agreement with ECU Silver Mining, now Golden Minerals, to earn a 50-per-cent interest in the San Diego Property. Golden Tag earned the 50-per-cent interest by 2008. The company acquired the remaining 50 percent in July 2016, a 2-per-cent net smelter return remains on the property payable to Golden Minerals.

Golden Tag acquired an established resource of 115 million ounces of silver and 1.5 billion pounds of zinc. There are two primary types of silver-lead-zinc mineralization at San Diego: veins and bulk zones.

- Veins: a thin sheet of mineralized rock that is one to two meters thick which typically contains higher-grade ore. There are over 20 veins of interest at the San Diego property.

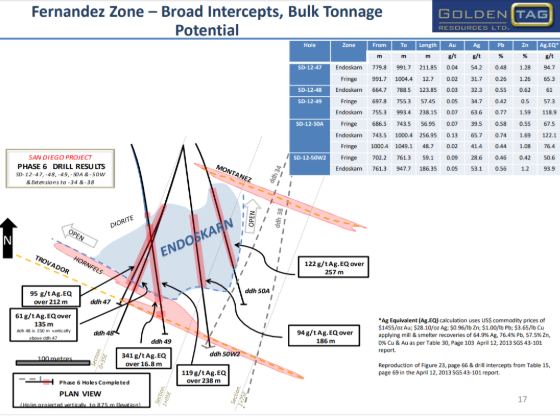

- Bulk Zones: a large area containing mineralization. These types of zones contain lower grade material consistent over a large area. Mining costs are lower than for narrow veins. There is one bulk zone on the property – the Fernandez Zone.

The San Diego property was identified by narrow high-grade silver veins at a surface outcrop and shallow historic underground workings on oxidized veins. Early exploration drilling showed these veins extended beneath the oxide zones with several high-grade Ag-Pb-Zn sulfide veins at depths greater than 400 metres.

Drilling in 2011 and 2012 revealed widening vein zones below 500 metres, in some cases to more than 20 metres. This drilling also identified broader mineralized zones.

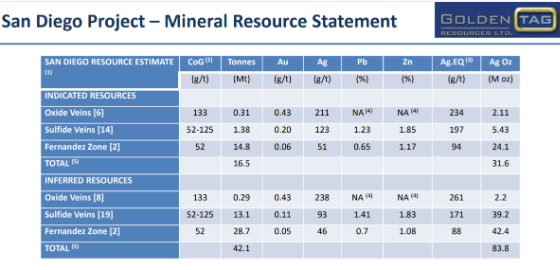

The 2013 resource estimate was completed by SGS using 59 drill holes amounting to 32,96 metres and reported over 115 million ounces of silver and 1.5 billion pounds of zinc in the resource estimate.

Table 1: Estimated Indicated Mineral Resources, San Diego Project, SGS March 2013

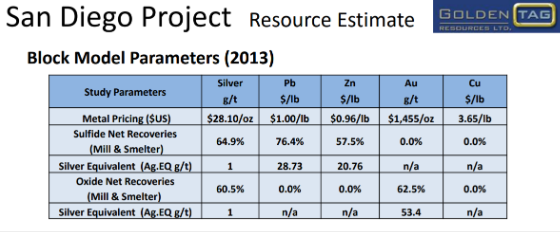

In addition to having a historical resource in place, San Diego already has estimated recovery rates. Most juniors do not complete these types of studies but it was roughly calculated using assumptions from the Valaradeña mine 12 kilometres away.

These recoveries are not representative of the geology at the San Diego site. Every poly-metallic operation is unique and any metallurgical work should be tailored to the specific project. Golden Tag could reconsider these recoveries as more drill core comes out of the ground.

After the 2013 Resource the company was put on care and maintenance, and not another drill program was proposed until 2019.

Recognizing Opportunity: Golden Tag’s Team Reigniting San Diego

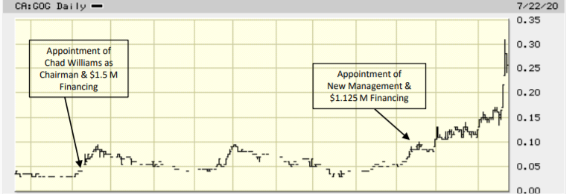

In September of 2019, Chad Williams became chairman of the board. Mr. Williams is the founder of Red Cloud Klondike Strike, a brokerage specializing in the junior mining sector. It was only nine days later that the company raised $1.5-million with participation from Eric Sprott.

The company then signed a five-year agreement with Ejudi San Diego, a Mexican communal governance committee, to conduct exploration work at San Diego.

The company completed an environmental impact assessment and filed an application for a permit with Mexico’s environmental agency, SEMARNAT, to drill up to 21 holes. The permit was approved on March 13, 2020 and granted two and a half years to complete the work.

Soon after this, another financing of $1.125 million with Sprott’s participation was closed on June 18, 2020, followed by another one of $5.6 million on July 28.

The company has built a strong foundation on past results and since September 2019 it has seen its share price rise.

The story of San Diego is restarting and drill results are just around the corner. Golden Tag Resources is fully permitted, fully funded with a proven resource ready for more exploration, and should be finally appreciated.

An initial 2,000-meter drill program comprising eight holes has been planned to test the near-surface continuity of mineralization encountered during prior drill programs in two target areas, the Trovador and Arroyo zones. However, the improved market conditions and increased financing should support a larger exploration program.

One key appointment that will help provide exploration insight is David Rigg. Mr. Rigg was the former President of Alexis Minerals now QMX Gold Corp. (TSX-V: QMX) and Exploration Manager for Agnico Eagle (TSX: AEM). He contributed to the discovery of the Musselwhite Mine in Ontario, Goldex, LaRonde and Lac Herbin Mines in Québec and was part of the original San Diego Deposit in Mexico.

Growing A Resource: Exploration Potential

According to the 2013 resource estimate by SGS Canada – resources could potentially be expanded by 20 to 50 million tonnes grading from 100 to 150 g/t Aq.Eq. from existing structures, as well as lateral and depth extensions.

The bulk of the resources in the mineral resource estimate come from the Fernandez zone, showing room to add significant ounces but there are other targets on the property that show the potential for high grade headline results.

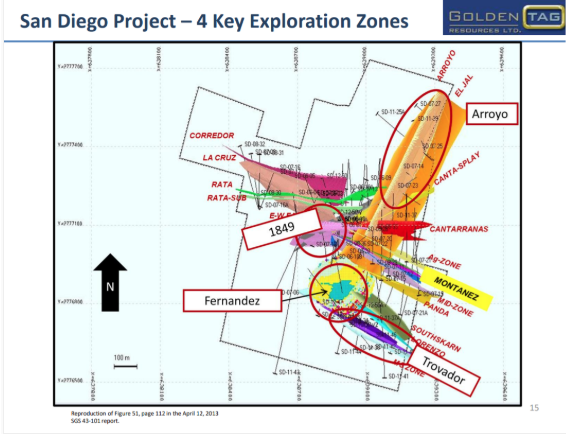

There are four primary zones that show the greatest potential and make the most sense as exploration targets on the San Diego Property.

4 Key Exploration Zones:

Fernandez

The Fernandez Zone offers a way to add more ounces to the resource. Drill results indicate bulk mining potential and it opens up to the west, which needs to be defined with more exploration.

The top of this was interpreted by SGS in 2013 at a vertical depth of 450 meters below surface, but no drilling has been conducted in this area to verify the upward extent of the zone. As a result, potential exists in extending known mineralization in the zone upwards from the interpreted 450 m vertical depth towards the surface.

This zone represents the core value underlying the San Diego Property. The authors of the 2013 Resource Estimate recommended that a Preliminary Economic Assessment “PEA” be completed to measure the economic impact along with the higher grade veins.

Travador

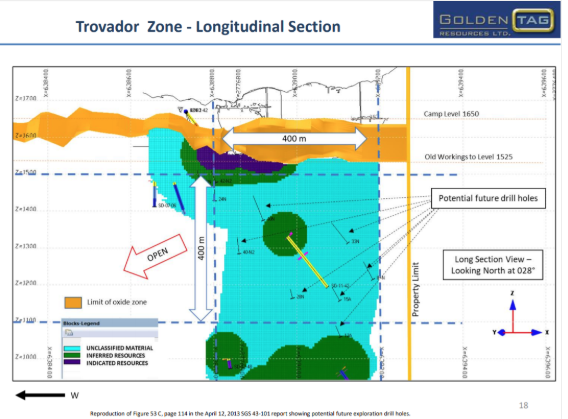

The Trovador Zone target lies in a 400 x 400 meter area between indicated resources located 150 metres below surface close to the historical workings, and above inferred resources estimated in 2013 at depth.

Potential exists to test this zone over 400 meters, down to a vertical range of 400 meters through drilling targeted between the historical mine workings at the 1525 Level and the inferred resources estimated by SGS in 2013 at 1100 Level, 550 m below surface.

There is a large amount of material defined as unclassified which typically means there is evidence of mineralization but there has not been sufficient work to make it compliant with modern reporting standards.

1849

The 1849 Target lies at the intersection of the East-West Fault Zone and Western Contact Zone. The target area lies within the 250 vertical meters between holes SD-12-49 and SD-07-18 and along the 350 meter up-dip extension to the surface. Further drilling will be required to confirm the potential for a “chimney” type structure at the intersection of these two sub-vertical zones.

Arroyo

Discovered in 2007 in hole SD-07-27 (166 g/t Ag over 4.60 m, including 776 g/t Ag over 0.6 m with 1.55% Cu), the Arroyo Zone has been traced over a strike length of 525 meters from the surface to shallow depths with few, widely spaced drill holes from previous programs. It contains near surface, higher-grade Ag dominant oxide and sulfide mineralization. The presence of this oxide zone right below surface should be further tested.

In Summary:

- Existing large silver resource

- One ounce of silver per share pre-financing

- Excellent shareholder base with Eric Sprott

- New management team & board of directors:

- Previous team had the company dormant for 7 years

- Well situated in Mexico within a prolific mining camp, continuously for 100 plus years

- Ample exploration potential with numerous targets indicating additional resources and potential for high grade results

About Golden Tag Resources:

Golden Tag Resources Ltd. is a junior exploration company exploring for high-grade silver deposits. The Company holds a 100% interest, subject to a 2% NSR, in the San Diego property in Durango State, Mexico. The San Diego property is located within the prolific Velardeña Mining District, the site of several mines having produced silver, zinc, lead, and gold over the past century. For more information regarding the San Diego property please visit our website at www.goldentag.ca. Golden Tag has no debt and cash balances of approximately $2.1 million.

Disclaimer:

*The author of this article was compensated for the creation of this article in cash, no options. The author picked up shares in the public market, ranging from prices of 29 cents to 30 cents on July 30, 2020. This article is meant to serve informational and marketing purposes only and not a technical report and does not constitute a buy recommendation. As always, please do your own diligence.

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan

Comments are closed.