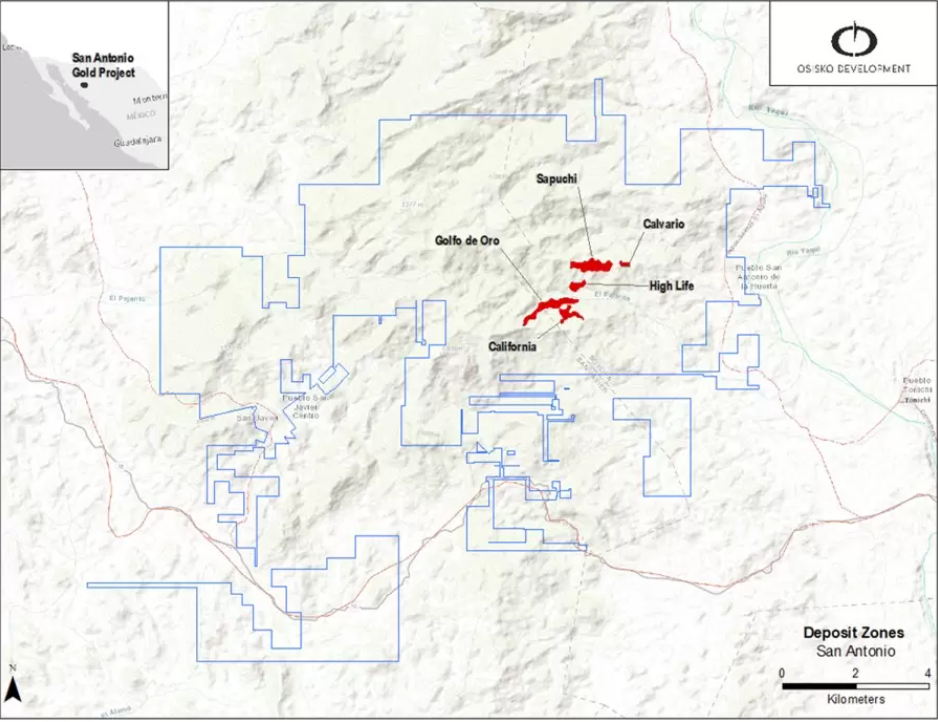

Osisko Development (TSXV:ODV) has announced that an initial open-pit resource estimate has been completed for the Sapuchi, California, Golfo de Oro, Calvario, and High Life deposits at the San Antonio project. The project is located in Sonora State, Mexico and is characterized by a hydrothermal breccia that forms an approximately 3000 metre-long east-northeast trending mineralization corridor with the Luz del Cobre copper deposit to the east.

Chris Lodder, President of Osisko Development commented in a press release: “The addition of this new resource further strengthens our portfolio for near term advancement and towards possible production. Osisko Development has made considerable progress at San Antonio in the past year with the construction of the leach pad, near term processing of the stockpile and completion of a drill program to generate this initial resource. The Company believes there is potential to add to the mineral resource through continued exploration and drilling on the property.”

Highlights from the mineral resource estimate are as follows:

- 576,000 oz of Au and 1.37 M oz Ag Indicated and

- 544,000 oz Au and 1.76 M oz of Ag Inferred

San Antonio Project Mineral Resource

- Indicated Mineral Resource of 576,000 ounces of gold and 1.37 million ounces of silver (14.9 million tonnes grading 1.2 g/t Au and 2.9 g/t Ag).

- Inferred Mineral Resource of 544,000 ounces of gold and 1.76 million ounces of silver (16.6 million tonnes grading 1.0 g/t Au and 3.3 g/t Ag).

- Mineral resource comprises oxide, transition and sulphide zones for each deposit using 0.27 g/t Au cut-off grade for oxide and 0.44 g/t Au cut-off grade for transition and sulphide and a 50-degree pit slope.

- The 2022 Mineral Resource Estimate (“MRE”) covers a portion of the Sapuchi – Cero Verde trend that encompasses five deposits: Sapuchi, Golfo de Oro, California, Calvario and High Life over approximately 2.8 km along strike, a maximum width of 600 metres (m) to a maximum depth of 300 m below surface.

- The MRE is based on 84,454 m of current and verified historic drilling in 579 holes, of which 27,870 m of drilling in 177 holes were drilled by the Company in 2021.

- Gold mineralization is hosted within altered hydrothermal breccia and sediments, as stockwork quartz veins and veinlets, adjacent to intrusions and fault structures and often associated with iron carbonate minerals.

- Resource summary and sensitivity tables are presented in the tables below.

The MRE incorporates five deposits, Sapuchi, California, Golfo de Oro, High Life and Calvario, as part of what comprises 2.8 km of the 10.0 km within the Sapuchi-Cero Verde trend of the San Antonio Project (Figure 1). The deposits are in the indicated and inferred categories listed in Table 1 and a further breakdown by deposit and oxide zone are listed in the Tables 2 and 4. Grade sensitivity is presented in Table 3. Potential mining scenarios indicate a strip ratio of 1.0 to 6.7. The MRE was conducted by Talisker Exploration Services Inc., under the supervision of Servicios Geológicos IMEx, S.C and Micon International Limited.

The deposits are constrained within a geologic model of the hydrothermal breccia, the main mineralization control known to date. Additional drill targets remain underexplored on the property and new exploration drilling is recommended to verify historic data and potentially add new resource. Further infill and exploration drilling is recommended on the Project.

Operational Update

The San Antonio Project gold mineralization is characterized by hydrothermal breccia that forms an approximately 3,000 m long east-northeast trending mineralization corridor with the Luz del Cobre copper deposit at the east. The gold mineralization is associated with intense chlorite and carbonate alteration and is intrusion related with host sedimentary rocks. The breccia has been defined to a vertical depth of 500 m and at an average depth of 250 m. Drilling has occurred within the three major zones at Sapuchi, Golfo de Oro and California, over a combined strike length of 1 km of the 3 km breccia trend.

Since Osisko Development’s acquisition of the San Antonio Project in November 2020, the Company has successfully achieved the following operational milestones

- The construction of a leach pad and carbon in column plant at the end of 2021 to process stockpiled mineralized material.

- The stockpile has a total of 1.1 M tonnes with an average grade of 0.57 g/t Au.

- The processing of the stockpile began in Q4 2021 and currently, 680,000 tonnes of mineralized material has been placed and processed.

Table 1: 2022 San Antonio Project Mineral Resource Estimate for an open pit scenario- all deposits indicated category

| INDICATED | ||||||

| Deposit | Weathering

Zone |

Tonnes

(Mt) |

Au

(g/t) |

Ag

(g/t) |

Au

Ounces (000) |

Ag

Ounces (000,000) |

| California | Oxide | 0.6 | 0.93 | 2.8 | 17 | 0.05 |

| Transition | 0.2 | 0.79 | 3.3 | 6 | 0.02 | |

| Sulphide | 3.1 | 1.31 | 2.4 | 130 | 0.23 | |

| Total | 3.9 | 1.22 | 2.5 | 153 | 0.31 | |

| Golfo de Oro | Oxide | 0.2 | 1.07 | 2.8 | 7 | 0.02 |

| Transition | 0.1 | 1.19 | 2.8 | 6 | 0.01 | |

| Sulphide | 5.3 | 1.46 | 2.5 | 249 | 0.42 | |

| Total | 5.7 | 1.44 | 2.5 | 262 | 0.46 | |

| Sapuchi | Oxide | 1.9 | 0.85 | 3.6 | 53 | 0.22 |

| Transition | 1.4 | 1.04 | 3.6 | 47 | 0.16 | |

| Sulphide | 2.1 | 0.94 | 3.4 | 62 | 0.22 | |

| Total | 5.4 | 0.93 | 3.5 | 162 | 0.61 | |

| Total | Oxide | 2.7 | 0.89 | 3.4 | 77 | 0.30 |

| Transition | 1.8 | 1.02 | 3.5 | 59 | 0.20 | |

| Sulphide | 10.4 | 1.31 | 2.6 | 441 | 0.88 | |

| Total | 14.9 | 1.20 | 2.9 | 576 | 1.37 | |

Table 2: 2022 San Antonio Project Mineral Resource Estimate for an open pit scenario- all deposits inferred category

| INFERRED | ||||||

| Deposit | Weathering

Zone |

Tonnes

(Mt) |

Au

(g/t) |

Ag

(g/t) |

Au

Ounces (000) |

Ag

Ounces (000,000) |

| California | Oxide | 0.4 | 0.68 | 2.1 | 8 | 0.02 |

| Transition | 0.1 | 0.85 | 2.6 | 4 | 0.01 | |

| Sulphide | 1.1 | 1.27 | 3.8 | 46 | 0.14 | |

| Total | 1.6 | 1.10 | 3.3 | 58 | 0.17 | |

| Golfo de Oro | Oxide | 0.5 | 0.80 | 3.0 | 12 | 0.04 |

| Transition | 0.2 | 0.93 | 3.4 | 5 | 0.02 | |

| Sulphide | 5.7 | 1.29 | 2.5 | 237 | 0.46 | |

| Total | 6.4 | 1.24 | 2.5 | 254 | 0.52 | |

| High Life | Oxide | 0.5 | 0.84 | 4.2 | 14 | 0.07 |

| Transition | 0.2 | 0.73 | 4.5 | 4 | 0.02 | |

| Sulphide | 0.1 | 0.90 | 8.3 | 4 | 0.04 | |

| Total | 0.8 | 0.83 | 4.9 | 22 | 0.13 | |

| Sapuchi | Oxide | 3.2 | 0.74 | 3.7 | 75 | 0.37 |

| Transition | 1.6 | 0.92 | 3.6 | 48 | 0.19 | |

| Sulphide | 2.8 | 0.92 | 4.1 | 84 | 0.37 | |

| Total | 7.6 | 0.85 | 3.8 | 208 | 0.94 | |

| Calvario | Oxide | 0.1 | 0.53 | 0.0 | 2 | 0.00 |

| Transition | 0.0 | 0.55 | 0.0 | 0.0 | 0.00 | |

| Sulphide | 0.0 | 0.0 | 0.0 | 0.0 | 0.00 | |

| Total | 0.1 | 0.53 | 0.0 | 2 | 0.00 | |

| Total | Oxide | 4.6 | 0.74 | 3.5 | 111 | 0.51 |

| Transition | 2.1 | 0.90 | 3.6 | 61 | 0.24 | |

| Sulphide | 9.8 | 1.18 | 3.2 | 371 | 1.00 | |

| Total | 16.6 | 1.02 | 3.3 | 544 | 1.76 | |

Table 3: San Antonio Project Mineral Resource Estimate for an open pit scenario, all deposits separated by oxide zone.

| Category | Zone | Tonnes

(Mt) |

Au

(g/t) |

Ag

(g/t) |

Au

Ounces (000) |

Ag

Ounces (000,000) |

| Indicated | Oxide | 2.7 | 0.89 | 3.4 | 77 | 0.30 |

| Transition | 1.8 | 1.02 | 3.5 | 59 | 0.20 | |

| Sulphide | 10.4 | 1.31 | 2.6 | 441 | 0.88 | |

| Total | 14.9 | 1.20 | 2.9 | 576 | 1.37 | |

| Inferred | Oxide | 4.6 | 0.74 | 3.5 | 111 | 0.51 |

| Transition | 2.1 | 0.90 | 3.6 | 61 | 0.24 | |

| Sulphide | 9.8 | 1.18 | 3.2 | 371 | 1.00 | |

| Total | 16.6 | 1.02 | 3.3 | 544 | 1.76 |

Table 4: San Antonio Project Cut-Off Gold Price Sensitivity Table (Base cases in Bold), Indicated Category

| Sensitivity to Gold Price INDICATED | |||||||

| Gold

Price US$/oz |

Cut-off

Grade (g/t) |

Weathering

Zone |

Tonnes

(Mt) |

Au

(g/t) |

Ag

(g/t) |

Au

Ounces (000) |

Ag

Ounces (000,000) |

| 1400 | 0.34 | Oxide | 2.6 | 0.90 | 3.4 | 76 | 0.29 |

| 0.55 | Transition | 1.6 | 1.07 | 3.6 | 55 | 0.18 | |

| 0.55 | Sulphide | 8.0 | 1.44 | 2.8 | 372 | 0.72 | |

| Total | 12.3 | 1.28 | 3.0 | 504 | 1.19 | ||

| 1450 | 0.33 | Oxide | 2.6 | 0.90 | 3.4 | 76 | 0.29 |

| 0.54 | Transition | 1.6 | 1.06 | 3.5 | 56 | 0.19 | |

| 0.54 | Sulphide | 8.2 | 1.43 | 2.8 | 377 | 0.73 | |

| Total | 12.5 | 1.27 | 3.0 | 510 | 1.21 | ||

| 1500 | 0.32 | Oxide | 2.7 | 0.90 | 3.4 | 77 | 0.29 |

| 0.52 | Transition | 1.7 | 1.05 | 3.5 | 57 | 0.19 | |

| 0.52 | Sulphide | 9.0 | 1.40 | 2.7 | 404 | 0.78 | |

| Total | 13.3 | 1.25 | 3.0 | 537 | 1.27 | ||

| 1550 | 0.31 | Oxide | 2.7 | 0.89 | 3.4 | 77 | 0.29 |

| 0.50 | Transition | 1.7 | 1.05 | 3.5 | 57 | 0.19 | |

| 0.50 | Sulphide | 9.3 | 1.38 | 2.7 | 411 | 0.80 | |

| Total | 13.6 | 1.24 | 2.9 | 545 | 1.29 | ||

| 1600 | 0.30 | Oxide | 2.7 | 0.89 | 3.4 | 77 | 0.29 |

| 0.48 | Transition | 1.7 | 1.04 | 3.5 | 58 | 0.20 | |

| 0.48 | Sulphide | 9.6 | 1.37 | 2.7 | 420 | 0.83 | |

| Total | 14.0 | 1.23 | 2.9 | 554 | 1.31 | ||

| 1650 | 0.29 | Oxide | 2.7 | 0.89 | 3.4 | 77 | 0.29 |

| 0.47 | Transition | 1.8 | 1.03 | 3.5 | 58 | 0.20 | |

| 0.47 | Sulphide | 9.8 | 1.35 | 2.7 | 426 | 0.84 | |

| Total | 14.3 | 1.22 | 2.9 | 561 | 1.33 | ||

| 1700 | 0.28 | Oxide | 2.7 | 0.89 | 3.4 | 77 | 0.29 |

| 0.46 | Transition | 1.8 | 1.02 | 3.5 | 58 | 0.20 | |

| 0.46 | Sulphide | 10.1 | 1.33 | 2.6 | 432 | 0.86 | |

| Total | 14.5 | 1.21 | 2.9 | 567 | 1.35 | ||

| 1750 | 0.27 | Oxide | 2.7 | 0.89 | 3.4 | 77 | 0.30 |

| 0.44 | Transition | 1.8 | 1.02 | 3.5 | 59 | 0.20 | |

| 0.44 | Sulphide | 10.4 | 1.31 | 2.6 | 441 | 0.88 | |

| Total | 14.9 | 1.20 | 2.9 | 576 | 1.37 | ||

| 1800 | 0.27 | Oxide | 2.7 | 0.89 | 3.4 | 77 | 0.30 |

| 0.43 | Transition | 1.8 | 1.02 | 3.5 | 59 | 0.20 | |

| 0.43 | Sulphide | 10.6 | 1.30 | 2.6 | 446 | 0.89 | |

| Total | 15.1 | 1.20 | 2.9 | 582 | 1.39 | ||

| 1850 | 0.26 | Oxide | 2.7 | 0.89 | 3.4 | 77 | 0.30 |

| 0.42 | Transition | 1.8 | 1.01 | 3.5 | 59 | 0.20 | |

| 0.42 | Sulphide | 10.9 | 1.30 | 2.6 | 455 | 0.91 | |

| Total | 15.4 | 1.19 | 2.8 | 591 | 1.41 | ||

| 1900 | 0.25 | Oxide | 2.7 | 0.89 | 3.4 | 77 | 0.30 |

| 0.41 | Transition | 1.8 | 1.01 | 3.5 | 59 | 0.20 | |

| 0.41 | Sulphide | 11.0 | 1.29 | 2.6 | 457 | 0.92 | |

| Total | 15.6 | 1.18 | 2.8 | 593 | 1.42 | ||

Table 5: San Antonio Project Cut-Off Gold Price Sensitivity Table (Base cases in Bold), Inferred Category

| Sensitivity to Gold Price INFERRED | |||||||

| Gold

Price US$/oz |

Cut-off

Grade (g/t) |

Weathering

Zone |

Tonnes

(Mt) |

Au

(g/t) |

Ag

(g/t) |

Au

Ounces (000) |

Ag

Ounces (000,000) |

| 1400 | 0.34 | Oxide | 3.9 | 0.81 | 3.7 | 103 | 0.47 |

| 0.55 | Transition | 1.6 | 1.00 | 3.9 | 52 | 0.20 | |

| 0.55 | Sulphide | 5.9 | 1.38 | 3.5 | 261 | 0.67 | |

| Total | 11.4 | 1.13 | 3.6 | 416 | 1.34 | ||

| 1450 | 0.33 | Oxide | 4.1 | 0.79 | 3.7 | 104 | 0.48 |

| 0.54 | Transition | 1.7 | 0.98 | 3.8 | 54 | 0.21 | |

| 0.54 | Sulphide | 6.7 | 1.33 | 3.5 | 286 | 0.75 | |

| Total | 12.5 | 1.11 | 3.6 | 444 | 1.44 | ||

| 1500 | 0.32 | Oxide | 4.2 | 0.78 | 3.6 | 105 | 0.48 |

| 0.52 | Transition | 1.8 | 0.96 | 3.7 | 56 | 0.22 | |

| 0.52 | Sulphide | 7.6 | 1.29 | 3.4 | 314 | 0.83 | |

| Total | 13.6 | 1.09 | 3.5 | 475 | 1.53 | ||

| 1550 | 0.31 | Oxide | 4.3 | 0.77 | 3.6 | 107 | 0.49 |

| 0.50 | Transition | 1.9 | 0.94 | 3.7 | 58 | 0.23 | |

| 0.50 | Sulphide | 8.1 | 1.26 | 3.3 | 330 | 0.87 | |

| Total | 14.3 | 1.07 | 3.5 | 494 | 1.59 | ||

| 1600 | 0.30 | Oxide | 4.4 | 0.76 | 3.5 | 109 | 0.50 |

| 0.48 | Transition | 2.0 | 0.93 | 3.7 | 59 | 0.23 | |

| 0.48 | Sulphide | 8.5 | 1.24 | 3.3 | 339 | 0.90 | |

| Total | 14.9 | 1.06 | 3.4 | 506 | 1.63 | ||

| 1650 | 0.29 | Oxide | 4.5 | 0.76 | 3.5 | 110 | 0.50 |

| 0.47 | Transition | 2.0 | 0.93 | 3.7 | 59 | 0.23 | |

| 0.47 | Sulphide | 8.9 | 1.22 | 3.3 | 348 | 0.93 | |

| Total | 15.4 | 1.10 | 3.3 | 517 | 1.67 | ||

| 1700 | 0.28 | Oxide | 4.6 | 0.75 | 3.4 | 111 | 0.51 |

| 0.46 | Transition | 2.0 | 0.91 | 3.6 | 60 | 0.24 | |

| 0.46 | Sulphide | 9.3 | 1.20 | 3.2 | 360 | 0.97 | |

| Total | 16.0 | 1.03 | 3.3 | 531 | 1.72 | ||

| 1750 | 0.27 | Oxide | 4.6 | 0.74 | 3.4 | 111 | 0.51 |

| 0.44 | Transition | 2.1 | 0.90 | 3.6 | 61 | 0.24 | |

| 0.44 | Sulphide | 9.8 | 1.18 | 3.2 | 371 | 1.00 | |

| Total | 16.6 | 1.02 | 3.3 | 544 | 1.76 | ||

| 1800 | 0.27 | Oxide | 4.8 | 0.73 | 3.3 | 114 | 0.52 |

| 0.43 | Transition | 2.2 | 0.89 | 3.6 | 62 | 0.25 | |

| 0.43 | Sulphide | 10.4 | 1.15 | 3.1 | 386 | 1.04 | |

| Total | 17.4 | 1.00 | 3.2 | 562 | 1.81 | ||

| 1850 | 0.26 | Oxide | 4.9 | 0.73 | 3.3 | 114 | 0.52 |

| 0.42 | Transition | 2.2 | 0.89 | 3.5 | 63 | 0.25 | |

| 0.42 | Sulphide | 10.9 | 1.13 | 3.1 | 395 | 1.07 | |

| Total | 18.0 | 0.99 | 3.2 | 572 | 1.85 | ||

| 1900 | 0.25 | Oxide | 5.0 | 0.72 | 3.3 | 115 | 0.52 |

| 0.41 | Transition | 2.3 | 0.88 | 3.5 | 64 | 0.26 | |

| 0.41 | Sulphide | 11.2 | 1.12 | 3.0 | 404 | 1.09 | |

| Total | 18.4 | 0.99 | 3.2 | 583 | 1.87 | ||

Mineral Resource Estimate Notes (For Tables 1, 2 and 3):

-

- Rodrigo Calles, of Servicios Geológicos IMEx, S.C., William Lewis and Alan S J San Martin, of Micon International Limited have reviewed and validated the mineral resource estimate for Sapuchi, Golfo de Oro, California, High Life and Calvario deposits. All are independent “Qualified Persons” (as defined in NI 43-101) responsible for the 2022 MRE. The effective date of the mineral resource estimate is June 24th, 2022.

- Specific extraction methods are used only to establish reasonable cut-off grades for various portions of the deposit. No Preliminary Economic Analysis, Pre-Feasibility Study or Feasibility Study has been completed to support economic viability and technical feasibility of exploiting any portion of the mineral resource, by any particular mining method.

- The mineral resources disclosed in this press release were estimated using the Canadian Institute of Mining, Metallurgy and Petroleum (“CIM”) standards on mineral resources and reserves definitions, and guidelines prepared by the CIM standing committee on reserve definitions and adopted by the CIM council.

- The calculated economic cut-off grade for the resource in: Oxides (70% recovery) is 0.27 g/t Au, Transition and sulphides (90% recovery) is 0.44 g/t Au

- Mineral resources are not mineral reserves and do not have demonstrated economic viability.

- Geologic modeling was completed by Osisko Development geologist Gilberto Moreno. The MRE was completed by Geologist Leonardo Souza, MAusIMM (CP) of Talisker Exploration Services, under the supervision of Rodrigo Calles, of Servicios Geológicos IMEx, S.C., William Lewis and Alan S. J. San Martin, of Micon International Limited

- The estimate is reported for a potential open pit scenario and with USD assumptions. The cut-off grades were calculated using a gold price of $1,750 per ounce, a CAD:USD exchange rate of 1.3; mining cost of $2.95/t; processing cost of $4/t for oxides and $13.0/t for transition and sulphides; and general and administration costs of $2.50/t. The cut-off grades should be re-evaluated in light of future prevailing market conditions (metal prices, exchange rate, mining cost, etc.).

- A density of 2.55 g/cm3 was established for all oxide zones, 2.69 g/cm3 for transition zones and 2.74g/cm3 for the sulphide zones.

- Resources for Sapuchi, Golfo de Oro, California, High Life and Calvario were estimated using Datamine Studio RM 1.3 software using hard boundaries on composited assays (3.0 m for all zones). Ordinary Kriging interpolation method was used in a with a parent block size = 10m x 10m x 5m.

- Results are presented in-situ. Ounce (troy) = metric tons x grade / 31.10348. Calculations used metric units (metres, tonnes, g/t). The number of metric tons was rounded to the nearest thousand. Any discrepancies in the totals are due to rounding effects; rounding followed the recommendations as per NI 43-101;

- Neither the Company, Servicios Geológicos IMEx, S.C., nor Micon International Limited. is aware of any known environmental, permitting, legal, title-related, taxation, socio-political, marketing or other relevant issue that could materially affect the mineral resource estimate other than disclosed in this press release.

Source: Osisko Development

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan

Comments are closed.