New Pacific Metals (TSX:NUAG) has announced new assay results for another seven drill holes from its 2022 drill program at the Carangas Silver-Gold Project in Bolivia in conjunction with its local Bolivian partner. The results continue to expand silver and gold mineralization at the project. Near surface silver horizons are stacked over a broad bulk gold mineralization, presenting multiple opportunities for the company.

21,980 metres across 43 drill holes have been completed to-date, with assay results for the twelve drill holes as part of the 2022 drill program being received and released. The results from the first five drill holes were released on July 13, 2022, with 7 more added on August 8. There are 31 drill holes with results still pending, with five drill rigs turning as part of the program.

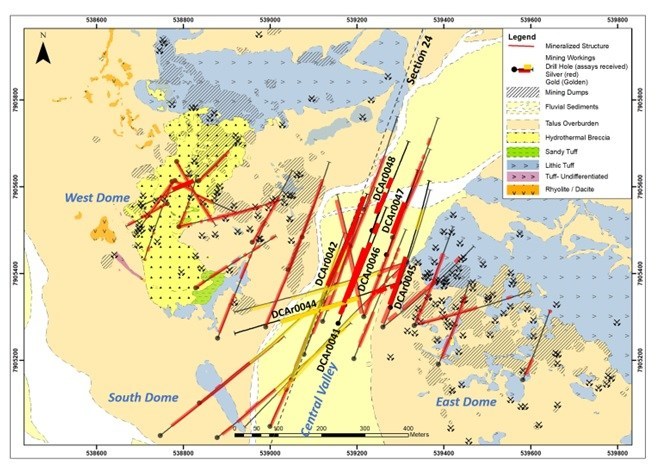

Most importantly, the company intersected 514m grading 1.1 grams per tonne gold from the 6th drilled in the emerging Gold Zone (Deep Hole DCAr0044). There are six holes remaining for this zone, all of them being relatively shallow that targeted near-surface mineralization in the northern portion of the Central Valley of the zone.

Highlights from the results are as follows:

- Gold Hole DCAr0044: 514.85 m interval (from 266.35 m to 781.2 m) grading 1.10 g/t Au and 6 g/t silver (“Ag”), including higher grade intervals of 14.15 m (from 436.2 m to 450.35 m) grading 3.8 g/t Au, 11g/t Ag and 0.12% copper (“Cu”); 87.51 m interval (from 472.4 m to 559.91 m) grading 2.57 g/t Au, 9 g/t Ag and 0.12% Cu.

- Silver Hole DCAr0041: 78.68 m interval (from 37.8 m to 116.48 m) grading 75 g/t Ag, 0.71% Pb and 0.69% Zn.

- Silver Hole DCAr0042: 79.2 m interval (from 53 m to 132.2 m) grading 77 g/t Ag, 0.73% Pb and 1.43% Zn.

- Silver Hole DCAr0045: 170.64 m interval (from 8.36 m to 179 m) grading 88 g/t Ag, 0.38% Pb and 0.61% Zn, including 72.17 m interval grading 150 g/t Ag.

- Silver Hole DCAr0046: 74.67 m interval (from 7.68 m to 82.35 m) grading 102 g/t Ag, 0.9% Pb and 0.36% Zn.

- Silver Hole DCAr0047: 19.95 m interval (from 77.5 m to 97.45 m) grading 163 g/t Ag, 0.41% Pb and 1.31% Zn.

- Silver Hole DCAr0048: 33.96 m interval (from 142.5 m to 176.46 m) grading 104 g/t Ag, 0.42% Pb and 0.68% Zn.

Hole DCAr0044 intersected a silver interval of 25.12 m (from 33.88 m to 59.0 m) grading 64 g/t Ag, 0.22% Pb, 0.11% Zn and a silver interval of 61.66 m (from 84.83 m to 146.49 m) grading 24 g/t Ag, 0.32% Pb and 0.89% Zn. From 266.35 m to 781.2 m, a broad gold interval of 514.85 m interval grading 1.10 g/t Au and 6 g/t Ag was intersected, including higher grade subintervals of 14.15 m grading 3.8 g/t Au, 11g/t Ag and 0.12% copper (“Cu”) from 436.2 m to 450.35 m, 87.51 m grading 2.57 g/t Au, 9 g/t Ag and 0.12% Cu from 472.4 m to 559.91 m. These two higher grade intervals are hosted in strongly argillic-sericite altered ignimbrite with dissemination and crosscutting veins of pyrite and chalcopyrite. A third higher grade interval of 29.89 m grading 2.46 g/t Au. 5 g/t Ag and 0.14% Cu intersected from 717.07 m to 746.96 m, is hosted in mineralized flow-banded rhyodacite intrusive with dissemination and crosscutting veins of pyrite and chalcopyrite.

This hole was drilled across the Central Valley about 50 m to the south of and parallel to the hole DCAr0039 which intersected a 535 m interval grading 1 g/t gold (please refer to the Company’s news release on July 13, 2022).

Hole DCAr0041 intersected a 266.99 m (from 30.06 m to 297.05 m) silver zone grading 31 g/t Ag, 0.52% Pb and 0.95% Zn, including a 78.68 m interval grading 75 g/t Ag, 0.71% Pb and 0.69% Zn. This hole was drilled on grid at an angle of -45 to test the continuity of silver mineralization at a shallow level.

Hole DCAr0042 intersected 332.7 m interval (from 53.0 m to 385.7 m) grading 25 g/t Ag, 0.45% Pb and 0.95% Zn, including 79.2 m interval grading 77 g/t Ag, 0.73% Pb and 1.43% Zn. This hole was drilled on grid at an angle of -45 to test the continuity of silver mineralization at a shallow level.

Hole DCAr0045 intercepted 170.64 m grading 88 g/t Ag, 0.38% Pb and 0.61% Zn (from depth 8.36 m to 179 m), including a 72.17 m interval grading 150 g/t Ag. This hole was drilled on grid at an angle of -45 to test the continuity of silver mineralization at a shallow level.

Hole DCAr0046 intersected 195.65 m (from 7.68 m to 203.33 m) grading 48 g/t Ag, 0.57% Pb and 0.82% Zn, including 74.67 m interval (from 7.68 m to 82.35 m) grading 102 g/t Ag, 0.9% Pb and 0.36% Zn. This hole was drilled on grid at a dip angle of -45 to test the continuity of silver mineralization at a shallow level.

Hole DCAr0047 intersected 109.02 m (from 72.05 m to 181.07 m) grading 57 g/t Ag, 0.24% Pb and 0.68% Zn. This hole was drilled on grid at an angle of -45 to test the continuity of silver mineralization at a shallow level.

Hole DCAr0048 intersected a silver interval of 62.31 m (from 65.0 m to 127.31 m) grading 55 g/t Ag, 0.36% Pb and 0.73% Zn, and a silver interval of 33.96 m (from 142.5 m to 176.46 m) grading 104 g/t Ag, 0.42% Pb and 0.68% Zn. This hole was drilled on grid at a dip angle of -45 to test the continuity of silver mineralization at a shallow level.

| Table 1 Summary of Drill Intercepts | ||||||||||

| Hole_ID | Depth_from | Depth_to | Interval_m | Ag_g/t | Au_g/t | Pb_% | Zn_% | Cu_% | AgEq_g/t | |

| DCAr0041 | 30.06 | 297.05 | 266.99 | 31 | 0.06 | 0.52 | 0.95 | 0.03 | 85 | |

| incl. | 37.80 | 116.48 | 78.68 | 75 | 0.00 | 0.71 | 0.69 | 0.02 | 120 | |

| 333.38 | 371.45 | 38.07 | 6 | 0.37 | 0.41 | 0.71 | 0.02 | 71 | ||

| DCAr0042 | 53.00 | 385.70 | 332.70 | 25 | 0.03 | 0.45 | 0.95 | 0.02 | 71 | |

| incl. | 53.00 | 132.20 | 79.20 | 77 | 0.00 | 0.73 | 1.43 | 0.01 | 148 | |

| DCAr0044 | 33.88 | 59.00 | 25.12 | 64 | 0.00 | 0.22 | 0.11 | 0.00 | 75 | |

| 84.83 | 146.49 | 61.66 | 24 | 0.01 | 0.32 | 0.89 | 0.00 | 64 | ||

| 156.80 | 174.10 | 17.30 | 3 | 0.02 | 0.35 | 1.08 | 0.01 | 52 | ||

| 266.35 | 781.20 | 514.85 | 6 | 1.10 | 0.02 | 0.04 | 0.07 | 94 | ||

| incl. | 436.20 | 450.35 | 14.15 | 11 | 3.80 | 0.05 | 0.02 | 0.12 | 296 | |

| incl. | 472.40 | 559.91 | 87.51 | 9 | 2.57 | 0.04 | 0.03 | 0.12 | 207 | |

| incl. | 717.07 | 746.96 | 29.89 | 5 | 2.46 | 0.01 | 0.01 | 0.14 | 195 | |

| DCAr0045 | 8.36 | 179.00 | 170.64 | 88 | 0.0 | 0.38 | 0.61 | 0.02 | 121 | |

| incl. | 8.36 | 80.53 | 72.17 | 150 | 0.0 | 0.39 | 0.21 | 0.02 | 170 | |

| DCAr0046 | 7.68 | 203.33 | 195.65 | 48 | n/a | 0.57 | 0.82 | 0.01 | 93 | |

| incl. | 7.68 | 82.35 | 74.67 | 102 | n/a | 0.90 | 0.36 | 0.01 | 141 | |

| 327.78 | 365.17 | 37.39 | 4 | n/a | 0.49 | 0.75 | 0.00 | 44 | ||

| DCAr0047 | 72.05 | 181.07 | 109.02 | 57 | n/a | 0.24 | 0.68 | 0.01 | 88 | |

| Incl. | 77.50 | 97.45 | 19.95 | 163 | n/a | 0.41 | 1.31 | 0.02 | 220 | |

| DCAr0048 | 65.00 | 127.31 | 62.31 | 55 | n/a | 0.36 | 0.73 | 0.01 | 92 | |

| 142.50 | 176.46 | 33.96 | 104 | n/a | 0.42 | 0.68 | 0.03 | 142 | ||

| Notes: | |

| 1. | Drill location, altitude, azimuth, and dip of drill holes are provided in Table 2 |

| 2. | Drill intercept is core length, and grade is length weighted. True width of mineralization is unknown due to early stage of exploration without adequate drill data. |

| 3. | Calculation of silver equivalent (“AgEq”) is based on the long-term median of the August 2021 Street Consensus Commodity Price Forecasts, which are US$22.50/oz for Ag, US$0.95/lb for Pb, US$1.10/lb for Zn, US$3.40/lb for Cu, and US$1,600/oz for Au. The formula used for the AgEq calculation is as follows: AgEq = Ag g/t + Pb g/t * 0.0029 + Zn g/t * 0.00335 + Cu g/t * 0.01036 + Au g/t * 71.1111. This calculation assumes 100% recovery. Due to the early stage of the Project, the Company has not yet completed metallurgical test work on the mineralization encountered to date. |

| 4. | A cut-off of 20 g/t AgEq is applied to calculate the length-weighted intercept. At times, samples lower than 20 g/t AgEq may be included in the calculation of consolidation of mineralized intercepts. |

| 5. | n/a stands for no fire assay of gold was carried out. |

| Table 2 Summary of Drill Holes of Discovery Drill Program of the Carangas Project | |||||||||

| Hole_id | Easting | Northing | Altitude | Depth_m | Azimuth (°) | Dip (°) | Date_start | Date_complete | Target |

| DCAr0041 | 539155.52 | 7905285.54 | 3906.91 | 437.00 | 20 | -45 | 3/8/2022 | 3/13/2022 | C. Valley |

| DCAr0042 | 539121.24 | 7905335.45 | 3907.65 | 400.00 | 20 | -45 | 3/15/2022 | 3/21/2022 | C. Valley |

| DCAr0044 | 539297.60 | 7905378.46 | 3909.11 | 1083.30 | 254 | -66 | 3/23/2022 | 4/19/2022 | C. Valley |

| DCAr0045 | 539273.97 | 7905323.23 | 3908.27 | 450.00 | 20 | -45 | 3/24/2022 | 4/2/2022 | C. Valley |

| DCAr0046 | 539171.12 | 7905329.49 | 3907.10 | 400.00 | 20 | -45 | 4/2/2022 | 4/9/2022 | C. Valley |

| DCAr0047 | 539267.05 | 7905445.11 | 3908.45 | 300.00 | 20 | -45 | 4/9/2022 | 4/15/2022 | C. Valley |

| DCAr0048 | 539231.41 | 7905496.81 | 3908.35 | 300.00 | 20 | -45 | 4/16/2022 | 4/22/2022 | C. Valley |

| Notes: | |

| 1. | Drill collar coordinate system is WGS1984 UTM Zone 19S. |

| 2. | Coordinate of drill collar is picked with Real Time Kinematics (RTK) GPS except for hole DCAr0036 which is by handheld GPS. |

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan

Comments are closed.