Nevada King Gold (TSXV:NKG) has announced that its Phase II resource expansion and definition drilling program at the 5,166-hectare Atlanta Gold Mine project will be increased. The project is located in the Battle Mountain Trend 264km northeast of Las Vegas, Nevada, and is 100%-owned by Nevada King Gold.

The company is the third largest mineral claim holder in the state, just behind Nevada Gold Mines (Barrick/Newmont) and Kinross. In 2016, the company began staking large project areas hosting significant historical exploration work along the Battle Mountain trend located close to current or former producing gold mines.

Initially, these areas were selected for their potential for hosting multi-million-ounce gold deposits and were then staked after a detailed geological evaluation. Projects in the company’s portfolio include the Atlanta Mine, the Lewis and Horse Mountain-Mill Creek projects, and the Iron point project. Nevada King Gold continues to be well funded with approximately $14.5 million in cash as of November 2022.

Exploration Manager Cal Herron, P.Geo., commented in a press release: “Since our last update two weeks ago, the drills have advanced down the west pit wall stepping closer to the high-grade zone hit in last year’s drilling along the pit floor. Expanding the program and running it into the winter months will allow us to maintain our current momentum targeting further definition and expansion of the high-grade gold mineralization targets defined so far which remain open in all directions, as well as to test target areas not drilled to date. We are continually surprised by the complicated faulting and rapidly changing alteration patterns revealed with each step-out exploration hole. When examined in detail, the Atlanta gold system is proving to be very complex and difficult to decipher, which in itself is a hallmark of many large deposits. We anticipate a flurry of assays to start arriving shortly, which will allow us to update our modelling and continue to fine tune the targeting in on-going drilling program leading to an updated resource estimate.”

Highlights from the update are as follows:

- On November 1, 2022, the Company announced a 20% expansion to its Atlanta Mine Phase II drill program, from the originally planned 13,100m (100 holes) to 16,000m of combined core and reverse-circulation (“RC“) drilling.

- Drilling productivity has exceeded expectations with the Company having now completed 16,450m (138 holes).

- Based on assay results received to date, drill hole logging and ongoing geological interpretation based on this work, target areas at Atlanta continue to grow and the Company has decided to again expand the Phase II program another 25% to 20,000m, and to extend the program into the winter months.

- A track-mounted RC drill capable of accessing and drilling in harder to reach areas is being added to the program, with this rig scheduled to arrive on site within the next two weeks. Utilizing equipment already on-site, including the recent addition of water tank heaters, infrastructure is now in place to keep the drill program running into the winter months, with at least two rigs active.

- To date, the Company has reported assays from 2,455m of drilling, while assay results from 13,995m of drilling are currently pending.

Phase II Drilling Highlights are as follows:

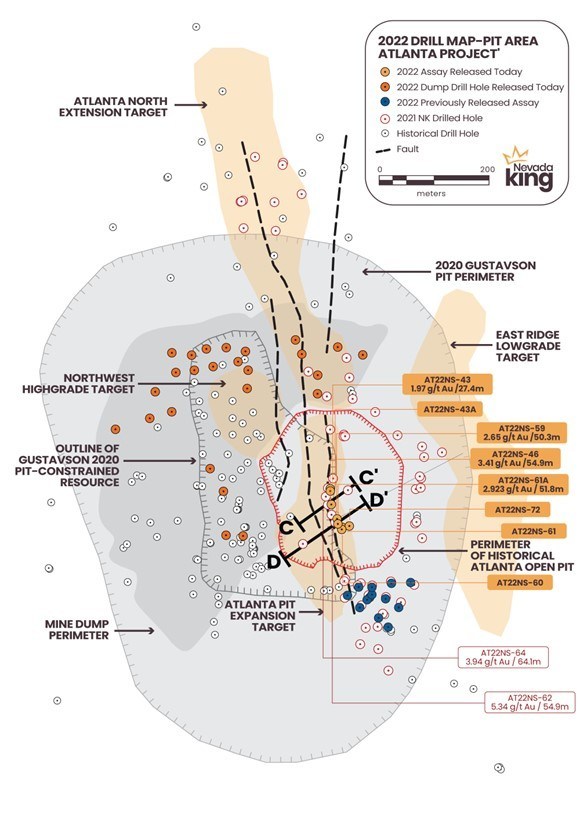

- The Company reported initial assay results on September 13, 2022 and October 18, 2022. The results included high-grade oxide-hosted intervals of 120.4m of 1.49 g/t Au and 57.9m of 1.38 g/t Au, located south and southeast of the Atlanta pit, and 54.9m of 3.41 g/t Au, 50.3m of 2.65 g/t Au, and 51.8m of 2.23 g/t Au, starting from surface at the bottom of the Atlanta pit.

- Drilling continues to target high-grade gold mineralization along the Atlanta Mine Fault Zone (“AMFZ“), westward and southwestward from last year’s drilling. Assays from these target areas returned high-grade intercepts including 41.2m of 3.94 g/t Au, 64m of 3.35 g/t Au, and 54.9m of 5.34 g/t Au, also starting at surface from within the Atlanta pit (see January 20, 2022, news release).

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan

Comments are closed.