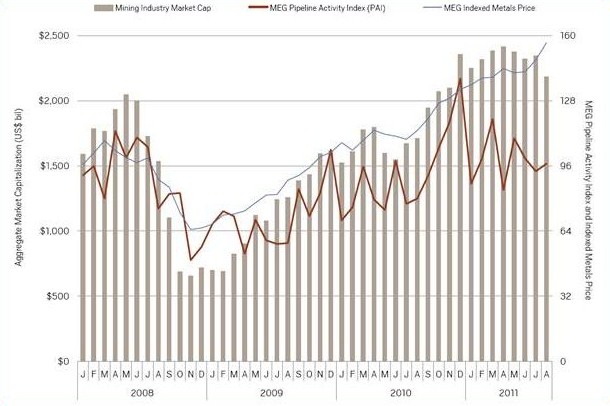

Pipeline Activity Index (PAI) decreased for the second consecutive month in July, then slightly improved in August on the back of a record number of significant drill results. Both months remained below the PAI’s 2011 year-to-date average and well short of the March 2011 high, as the increased exploration activity was not enough to counteract uneasy markets that are making capital raising difficult, particularly for base metals companies.

The industry’s aggregate market cap increased slightly to $2.35 billion in July, before fears of stagnant global economic growth and a potential double-dip recession dragged market caps down to $2.19 billion in August—the lowest level since November 2010.

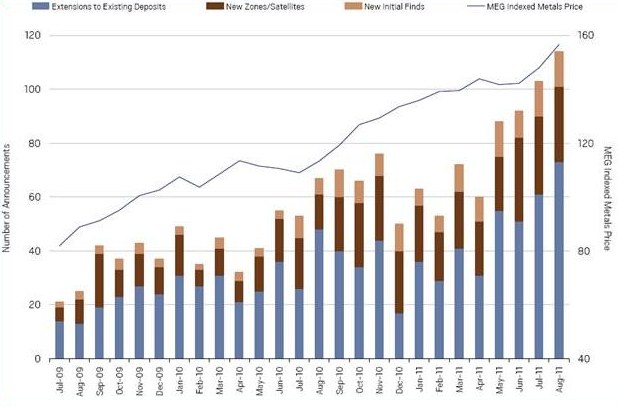

The number of significant drill results announced hit a record high in August, increasing for the fourth consecutive month. Gold explorers continue to be motivated by record-breaking bullion prices, while copper- and silver-focused exploration has helped drive the number of base metals results to their highest levels since before the 2008-09 recession. As has been the case throughout most of 2011, North America and Latin America continue to be the dominant regions for successful drilling, with Africa also contributing significantly to gold results and Australia-Pacific accounting for 25% of the base metals announcements in July and August.

The number of initial resource announcements made in July and August is the lowest two-month total since July-August 2010. This may be partly explained by seasonal factors, such as a focus on summertime exploration programs. Probe Mines’ (TSX-V: PRB) Borden Lake project in Ontario with 4.06 million oz of contained gold and Atacama Pacific Gold’s (TSX-V: ATM) Cerro Maricunga project in Chile with 3.56 million oz were the two largest initial resources announced in the period.

Significant Drill Results Announced

The number of significant financings (US$2 million minimum) completed remained relatively steady in July, before market tumult resulted in only 56 financings closing in August—the lowest one-month total in more than a year.

The two-month total was 10% higher than the May-June total, but included $438 million raised by Detour Gold (TSX:DGC) for development of its 20-million-oz Detour Lake gold project in Ontario. Difficult market conditions had an even stronger impact on base metals companies, as the amount raised in July-August failed to top $1 billion for the first time since January-February 2010.

The MEG Pipeline Activity Index (PAI) measures the level and direction of overall activity in the supply pipeline, incorporating significant drill results, initial resource announcements, project development milestones, and significant financings into a single comparable index. The PAI is featured in the MEG Industry Monitor—a series of comprehensive graphs and charts, with related commentary, illustrating MEG’s analysis of monthly changes and emerging trends in the base and precious metals pipeline. Using information only available from MEG through MineSearch, Exploration Activity Services, and Acquisitions Services, the Industry Monitor tracks developments based on announcements over the past 26 months of significant drill results, initial new resources, project development milestones, significant financings, and acquisitions.

From the article entitled, “Metals Economics Group Pipeline Activity Index, September 2011” by Metals Economics Group. Metals Economics Group (MEG) is a trusted source of global mining information and analysis. With three decades of comprehensive information and analysis, MEG has an unsurpassed level of experience and historical data. The information provided herein has been provided to MiningFeeds.com by the author and, as such, is subject to our disclaimer: CLICK HERE.

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan

Comments are closed.