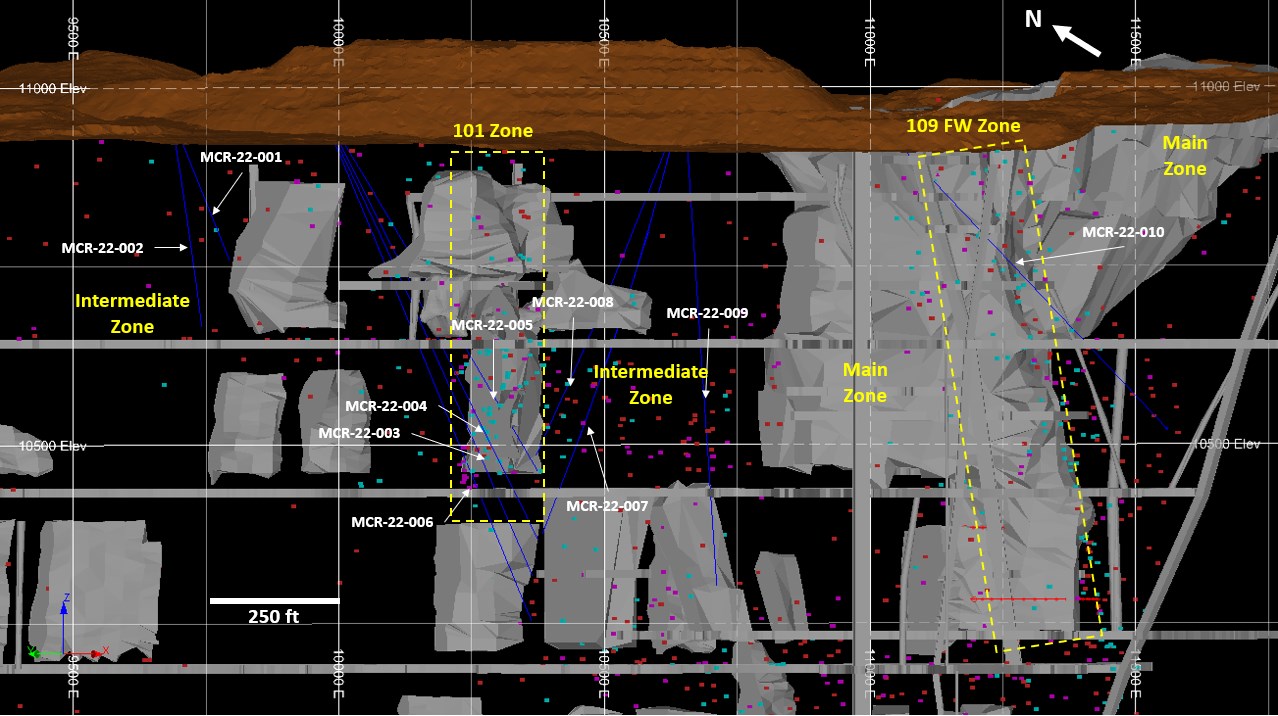

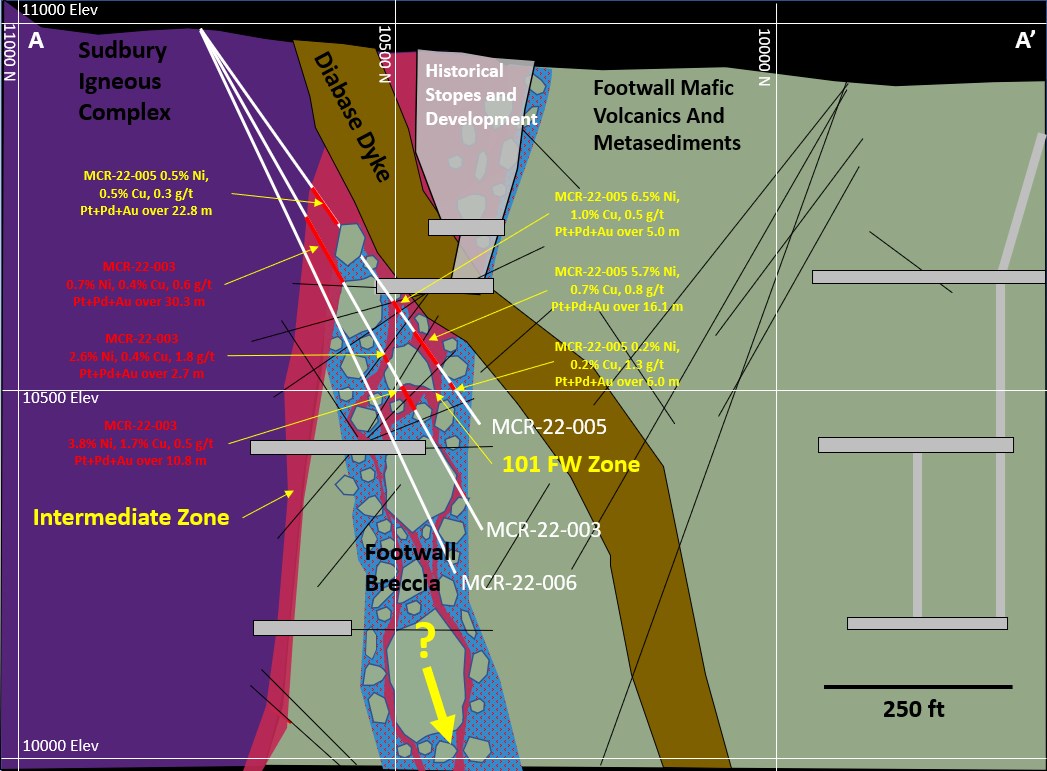

Magna Mining (TSXV:NICU) has announced it has received new assays from its November 2022 drill program a the Crean Hill Mine in Sudbury. Drillhole MCR-22-005 followed up on high grade nickel mineralization intersected in the 101 Footwall Zone from drillhole MCR-22-003. The resulting assay was as follows: Hole MCR-22-005 intersected mineralization grading 4.0 % Ni, 0.7 % Cu, 0.7 g/t Pt+Pd+Au over 31.1 metres, including two massive sulphide intervals grading 6.5 % Ni, 1.0 % Cu, 0.5 g/t Pt+Pd+Au over 5.0 metres, and 5.7 % Ni, 0.7 % Cu, 0.8 g/t Pt+Pd+Au over 16.1 metres.

The company plans to resume scheduled drilling at Crean hill or the 2023 drill program on January 9th. Magna has budgeted 15,000 metres of drilling for the year.

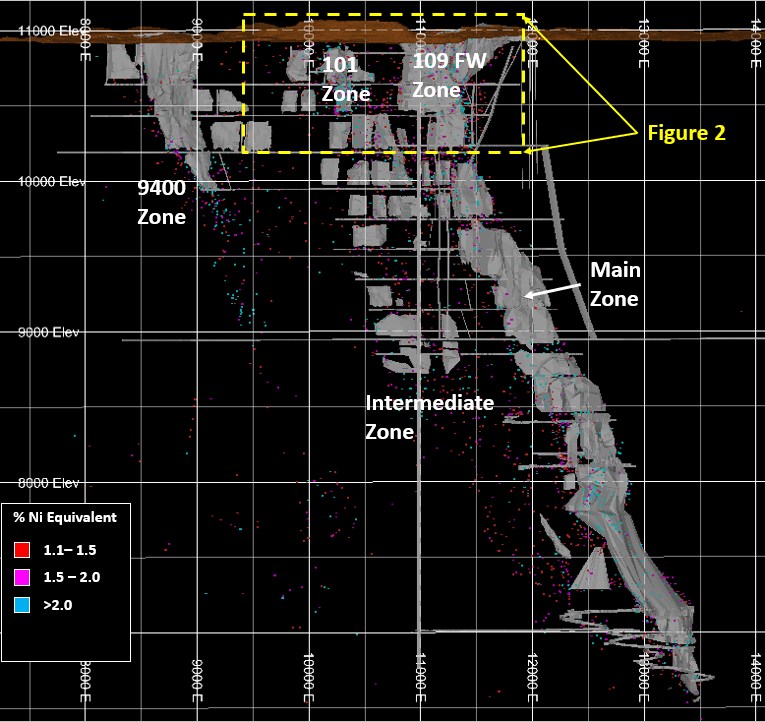

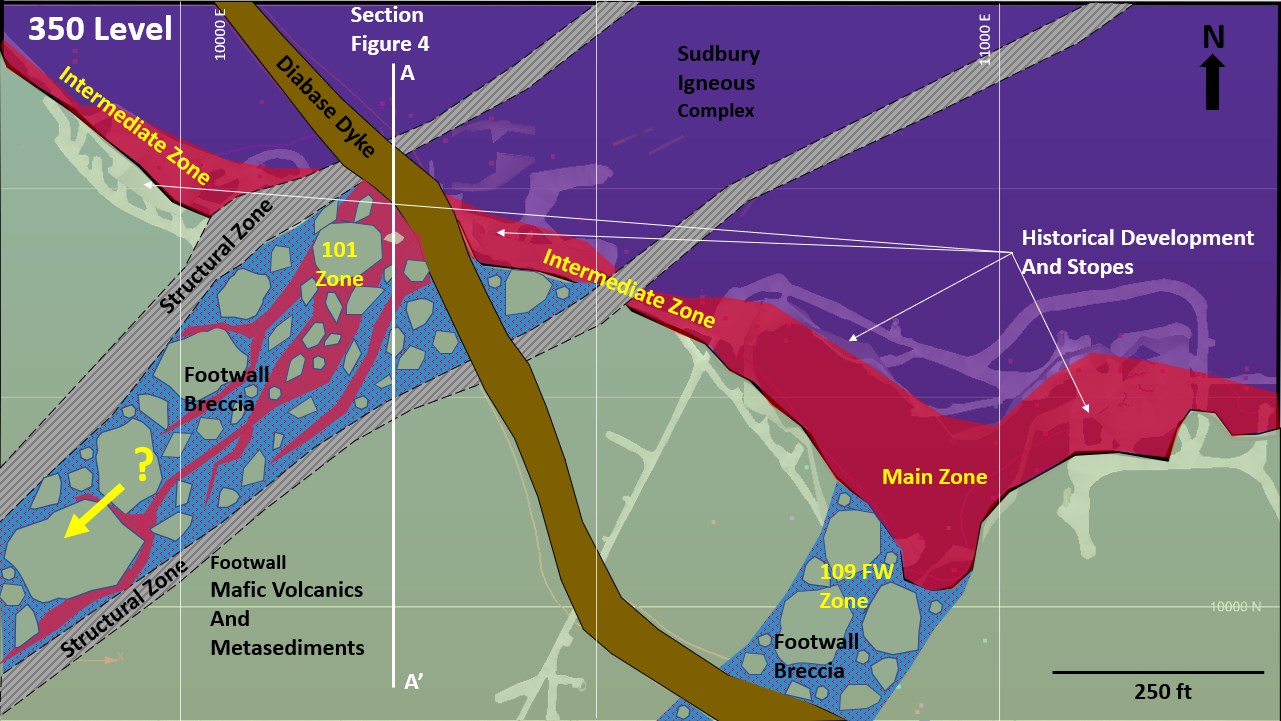

2022 saw four drillholes target the 101 FW zone below historical mining. Previously, Lonmin Canada did not focus on this area because it isn’t considered a low-sulphide, high PGE system. The zone consists of disseminated to locally massive sulphide, which is hosted in a footwall breccia system that extends southwest into the footwall of the intermediate Zone.

The footwall orebodies in Sudbury are normally hosted within breccia systems, and are known to be elevated in Ni, Cu, and PGE mineralization.

David King, Senior Vice President for Magna, commented in a press release: “We are excited to announce additional assay results from our current drilling at Crean Hill. These assay results from drillhole MCR-22-005 are the second set of assay results received from the 101 FW Zone, and they demonstrate the continuity of high grade, massive sulphide mineralization within the footwall breccia zone. The 2022 drilling has improved our geological understanding of the 101 FW Zone mineralization and these results will enable Magna to effectively explore along strike and down-dip of the known mineralization, as well as explore for additional, similar mineralization within the footwall environment at Crean Hill. Additional assay results are expected over the coming weeks and will be announced shortly thereafter.”

Highlights from the results are as follows:

- Drillhole MCR-22-005, intersected 4.0 % Ni, 0.7 % Cu, 0.7 g/t Pt+Pd+Au over 31.1 metres, Including 6.5 % Ni, 1.0 % Cu, 0.5 g/t Pt+Pd+Au over 5.0 metres, and 5.7 % Ni, 0.7 % Cu, 0.8 g/t Pt+Pd+Au over 16.1 metres in the 101 FW Zone

- The 101 FW Zone represents an area of high grade, massive sulphide mineralization over significant widths that was un-mined by prior operators

- 101 FW Zone mineralization is hosted within an approximately 70 metre wide footwall breccia package which remains open for exploration down-dip and along strike

Table 1 Summary of Assay Results Received to Date

| Drillhole | Zone | From (m) | To

(m) |

Length (m) | Ni % | Cu % | Co % | Pt g/t | Pd g/t | Au g/t | TPM g/t | NiEq | |

| MCR-22-001 | Assays Pending | ||||||||||||

| MCR-22-002 | Assays Pending | ||||||||||||

| MCR-22-003 | Intermediate | 75.83 | 105.06 | 30.23 | 0.68 | 0.43 | 0.02 | 0.36 | 0.13 | 0.11 | 0.60 | 0.99 | |

| including | 95.55 | 105.06 | 10.51 | 1.11 | 0.61 | 0.03 | 0.86 | 0.31 | 0.20 | 1.37 | 1.63 | ||

| 101 FW | 154.53 | 157.20 | 2.67 | 2.57 | 0.40 | 0.07 | 0.94 | 0.67 | 0.17 | 1.78 | 3.15 | ||

| 101 FW | 168.12 | 178.90 | 10.78 | 3.75 | 1.74 | 0.09 | 0.20 | 0.22 | 0.04 | 0.46 | 4.69 | ||

| including | 168.12 | 169.78 | 1.66 | 3.24 | 8.30 | 0.08 | 0.07 | 0.24 | 0.21 | 0.52 | 7.65 | ||

| and | 173.10 | 178.90 | 5.80 | 6.01 | 0.33 | 0.14 | 0.35 | 0.33 | 0.02 | 0.70 | 6.47 | ||

| 101 FW | 192.27 | 195.47 | 3.20 | 0.80 | 3.76 | 0.06 | 1.00 | 2.52 | 0.67 | 4.19 | 3.31 | ||

| 101 FW | 215.75 | 222.00 | 6.25 | 0.19 | 0.71 | 0.01 | 0.02 | 0.02 | 0.08 | 0.13 | 0.52 | ||

| MCR-22-004 | Assays Pending | ||||||||||||

| MCR-22-005 | Intermediate | 75.27 | 98.09 | 22.82 | 0.50 | 0.48 | 0.01 | 0.18 | 0.06 | 0.07 | 0.31 | 0.77 | |

| including | 88.17 | 92.23 | 4.06 | 0.88 | 0.97 | 0.02 | 0.45 | 0.16 | 0.14 | 0.75 | 1.44 | ||

| 101 FW | 138.39 | 169.44 | 31.06 | 4.04 | 0.69 | 0.10 | 0.36 | 0.25 | 0.07 | 0.67 | 4.58 | ||

| including | 138.39 | 143.42 | 5.03 | 6.50 | 1.03 | 0.17 | 0.28 | 0.17 | 0.03 | 0.48 | 7.26 | ||

| and | 153.08 | 169.44 | 16.07 | 5.68 | 0.69 | 0.13 | 0.43 | 0.29 | 0.05 | 0.78 | 6.29 | ||

| 101 FW | 178.70 | 184.74 | 6.04 | 0.19 | 0.22 | 0.01 | 0.38 | 0.54 | 0.42 | 1.33 | 0.55 | ||

| MCR-22-006 | Assays Pending | ||||||||||||

| MCR-22-007 | Assays Pending | ||||||||||||

| MCR-22-008 | Assays Pending | ||||||||||||

| MCR-22-009 | Assays Pending | ||||||||||||

| MCR-22-010 | Assays Pending | ||||||||||||

All lengths are downhole length. True width is estimated at 60-80% of downhole length.

NiEq % = ( (Ni% x 2204 x Ni Price $/lb) + (Cu% x Cu Recovery% x 2204 x Cu Price $/lb) + (Co% x Co Recovery % x 2204 x Co Price $/lb) + (Pt gpt x Pt Recovery % / 31.1035 x Pt $/oz) +(dt gpt x Pd Recovery % / 31.1035 x Pd $/oz) + (Au gpt x Au Recovery % / 31.1035 x Au $/oz))/2204 x Ni $/lb

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan

Comments are closed.