Roaring electric vehicle (EV) sales, battery production, and economic reopening continued to drive lithium prices higher in June. Most lithium producers are now working on ramping up further production during the expansion of a very favourable environment for them.

A Decade of Expansion

The coming decade could see a 1000% demand increase, at the current rate of expansion. To meet the global megafactory demand of 3,791 GWh by around 2030 may require lithium producers to step up to the plate faster than ever. This count is always shifting and could change by the time we get to the end of the decade, but there is no question that demand will continue to grow over the coming years, giving lithium miners more customers and profits.

More Price Runs

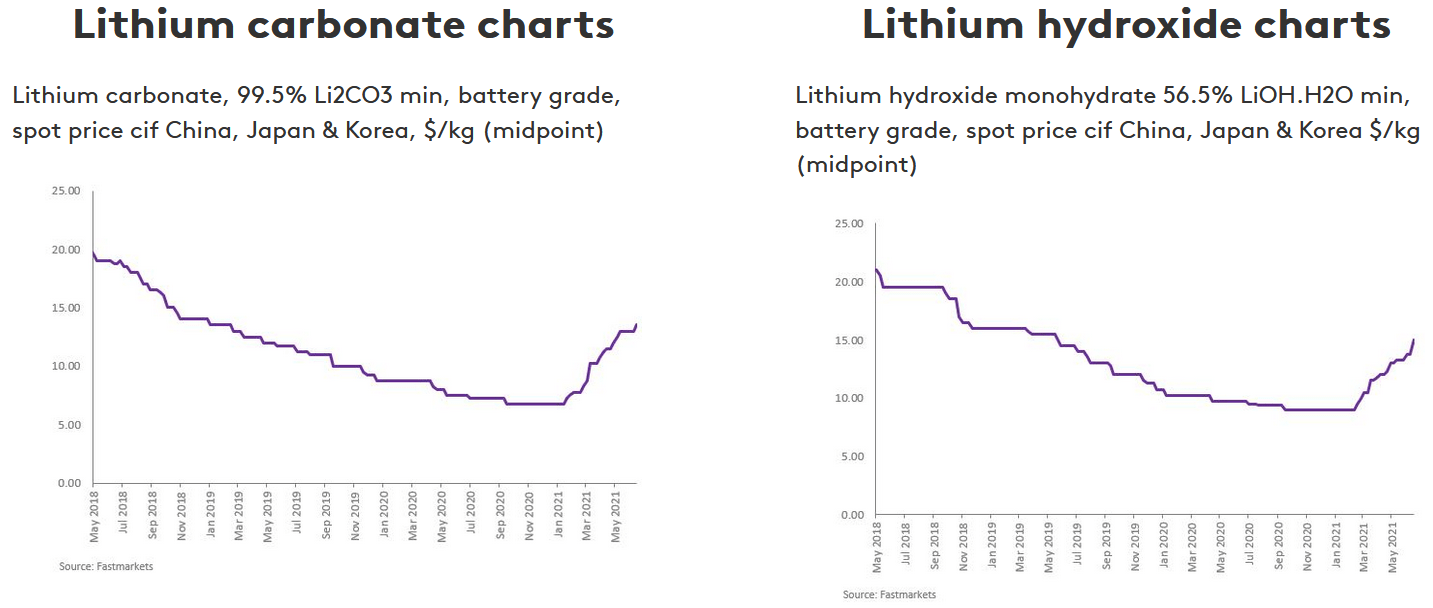

The past 30 days has see 99.5% lithium carbonate battery grade spot midpoint prices cif China, Japan and Korea at US$13.50/kg (US$13,500/t) and min 56.5% lithium hydroxide battery grade spot midpoint prices cif China, Japan and Korea at US$15.00/kg (US$150,000/t). The price charts for these look like they are bouncing off a trampoline with a heavy positive trend for May and June.

The main drivers for lithium (metal) demand are EVs and some of the high-tech sectors that require lithium for their products. EVs and energy storage make up the vast majority of demand for lithium, and this is where the bulk of the demand increases are expected to come in the future. Two of the fastest movers for this market are Europe, with 15% EV share, and China, with 10% EV share. A permissive and positive regulatory framework on top of stable and supported homegrown car manufacturers has given these two countries a leg up on accelerating their new EV sales timelines.

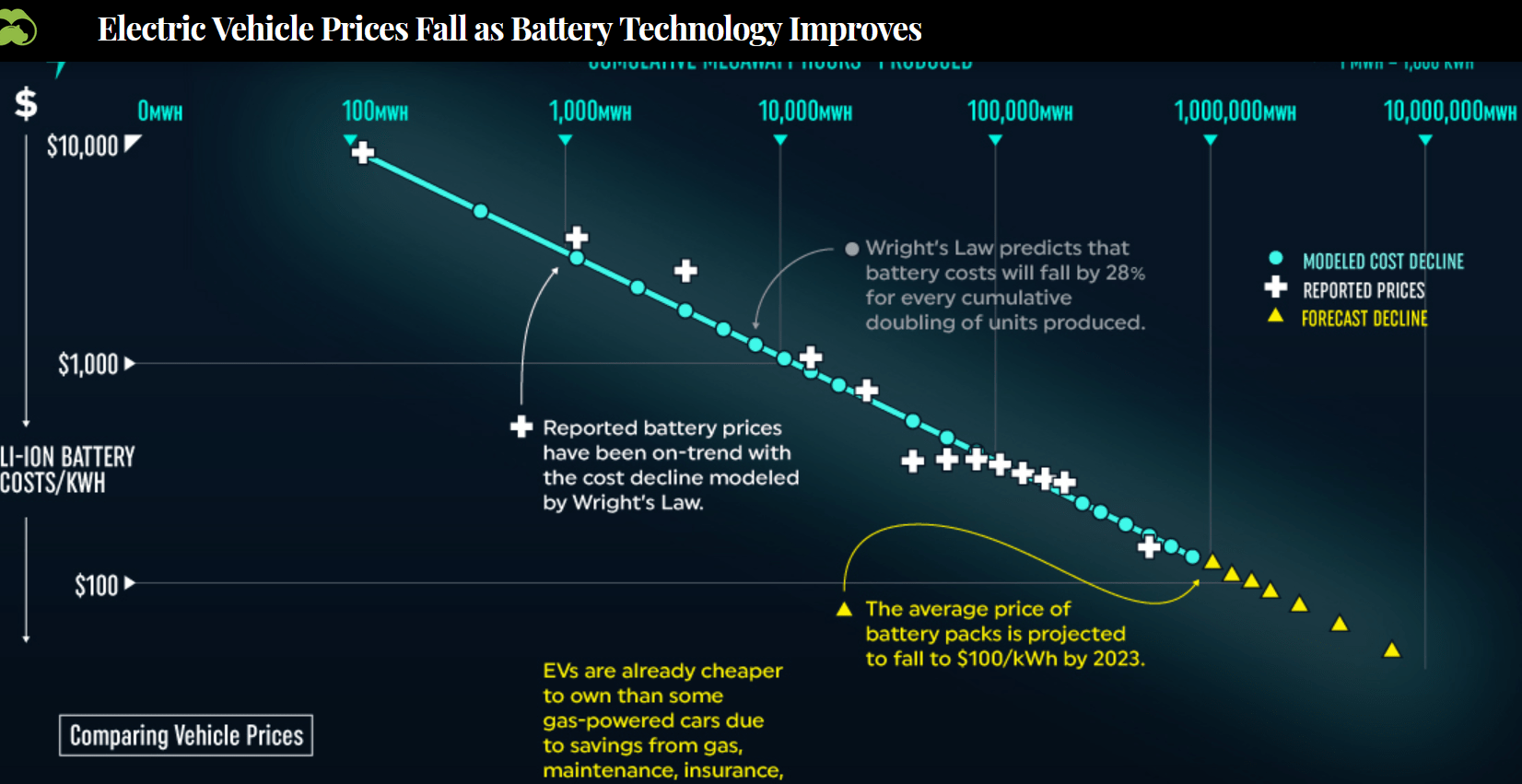

China in particular has pushed its domestic EV producers further with massive subsidies and government investment. As battery prices continue to fall, so do EV prices. In an article from Visual Capitalist, the linear correlation shows that the forecasted decline in Li-ion batteries could fall to around $100/kWh by 2023.

Miners Heading to the Moon

Some lithium mining companies are soaring on the backs of this news and their business models are in a great position.

Albemarle (NYSE:ALB)

Albemarle (NYSE:ALB) recently completed the sale of its fine chemistry services business to W.R. Grace and Co for about $570 million. The company is moving forward with its ESG goals for lithium mining as well, announcing on June 2 that “Albemarle releases sustainability report and environment target commitments.”

Orocobre (ASX:ORE) (TSX:ORL)

Orocobre (ASX:ORE) (TSX:ORL) announced that the “Olaroz Lithium Facility (Olaroz) operations increased the Gross Cash Margin more than $1,800/tonne with the sales price up more than 50%. Costs remained near all-time lows despite a much greater proportion of sales being battery grade material which has higher production costs…..Naraha Lithium Hydroxide Plant construction has continued throughout the period and is now approximately 94% complete.”

As the company continues to expand operations in time to fill the growing demand, investors could be more than happy to continue piling into the stock.

Galaxy Resources (ASX:GXY)

The company’s Mt Cattlin project is back to producing at full rate, with an acceleration of 2NW mining with the first phase of pre-strip to commence in H2 2021. The company joins many other miners in the race back to normal after the pandemic shut down some operations and forced mining companies to slow production. This was partly due to the pandemic itself, and the double-shock of the dropoff in demand from shutdowns.

Just the Beginning

We are likely just at the beginning of a long run of lithium prices continuing their steady growth. The U.S. has also unveiled its recent infrastructure plan which is set to require more lithium due to the massive needs coming from the electrification aspects of the plan. The plan will call for the superpower to start bringing in domestic and international supply for batteries, critical minerals (like lithium and copper) and semiconductors.

It also seems that there could be a cross-pollination within the tech, auto, mining, and energy industries. CATL and BYD (one of the key EV brands in China) is in talks with Apple for EV battery supply, as Apple is possibly aiming for a 2024 production start date for its own passenger vehicle. Volkswagen is also looking to “get actively involved in the raw materials business” according to a statement from the company.

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan

Comments are closed.