Lithium Ionic (TSXV:LTH) has reported further assay results from the Galvani target, a component of the company’s nearly completed 30,000-metre delineation drill program. This project is anticipated to result in an initial NI 43-101 compliant mineral resource estimate for both the Bandeira and Galvani targets by the second quarter of 2023.

Blake Hylands, P.Geo., CEO of Lithium Ionic, commented in a press release: “These latest results further confirm the scale and continuity of the large spodumene-bearing pegmatite dykes at this target. The results from the initial drilling program at Galvani and Bandeira have been tremendously successful, and our team is confident that the upcoming mineral resource estimate will deliver scale and high-grade, that will form the basis for significant future growth.”

So far, Lithium Ionic has managed to carry out 28,400 metres of drilling at the Bandeira and Galvani sites and is now wrapping up the final drill holes before the data cut-off for inclusion in the mineral resource estimate.

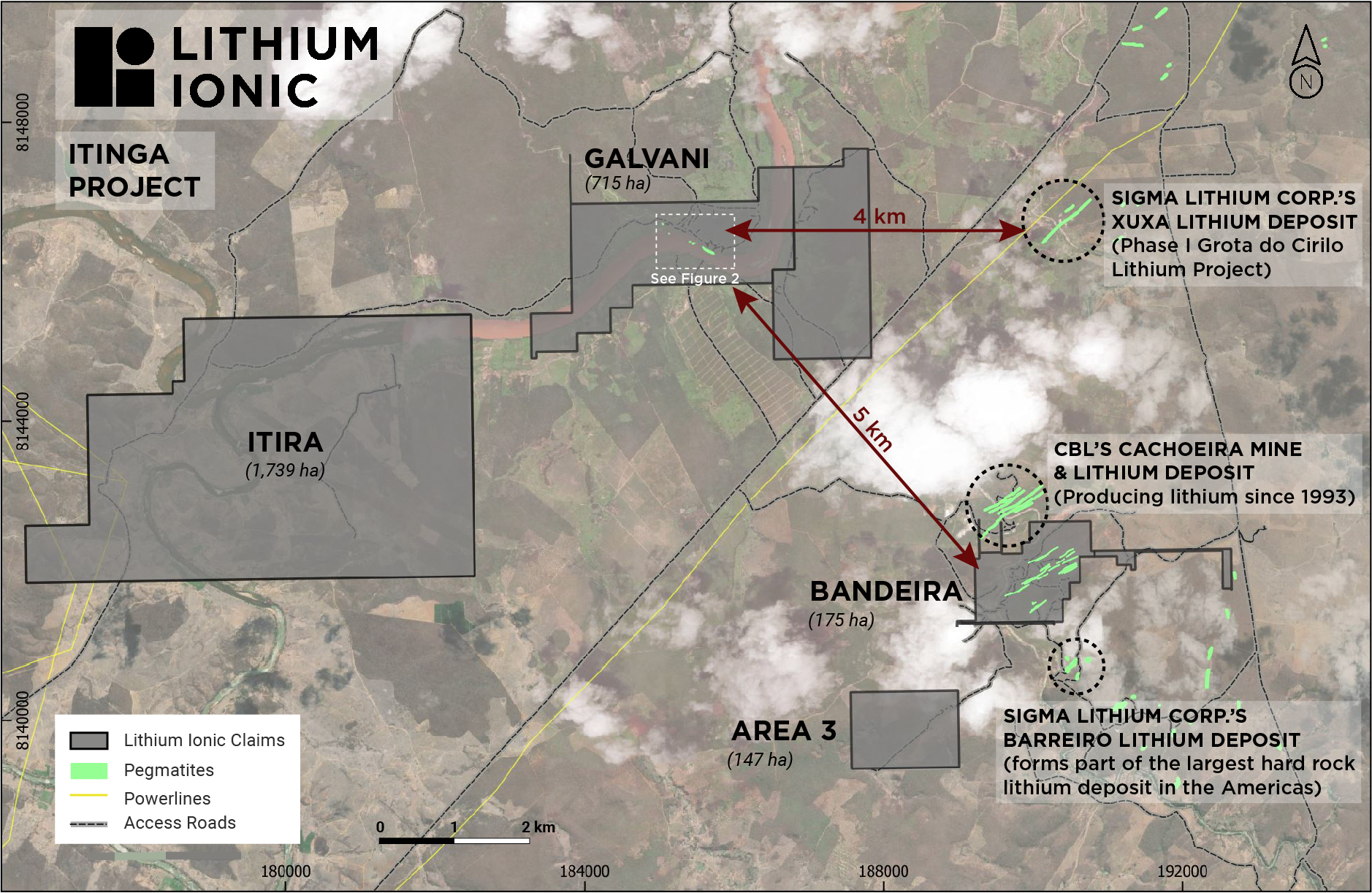

The Galvani claims are conveniently located around 5 kilometres to the northwest of Lithium Ionic’s Bandeira property and Companhia Brasileira de Lítio’s (CBL) Cachoeira lithium mine. They’re also approximately 4 kilometres west of Sigma Lithium’s large Xuxa lithium deposit (refer to Figure 1).

Currently, Lithium Ionic is the second-largest mineral rights holder in the area, with control over 14,182 hectares in this budding hard rock lithium production district. The Galvani and Bandeira properties, set to be the focus of the initial mineral resource estimate, cover only 872 hectares of this vast land package.

To complete the initial NI 43-101 mineral resource estimate, the company has partnered with SGS Canada (“SGS”), an internationally recognized firm with expertise in the estimation and modelling of mineral deposits. Notably, SGS has had firsthand experience with lithium deposits in the region, including those belonging to Sigma Lithium Corp.

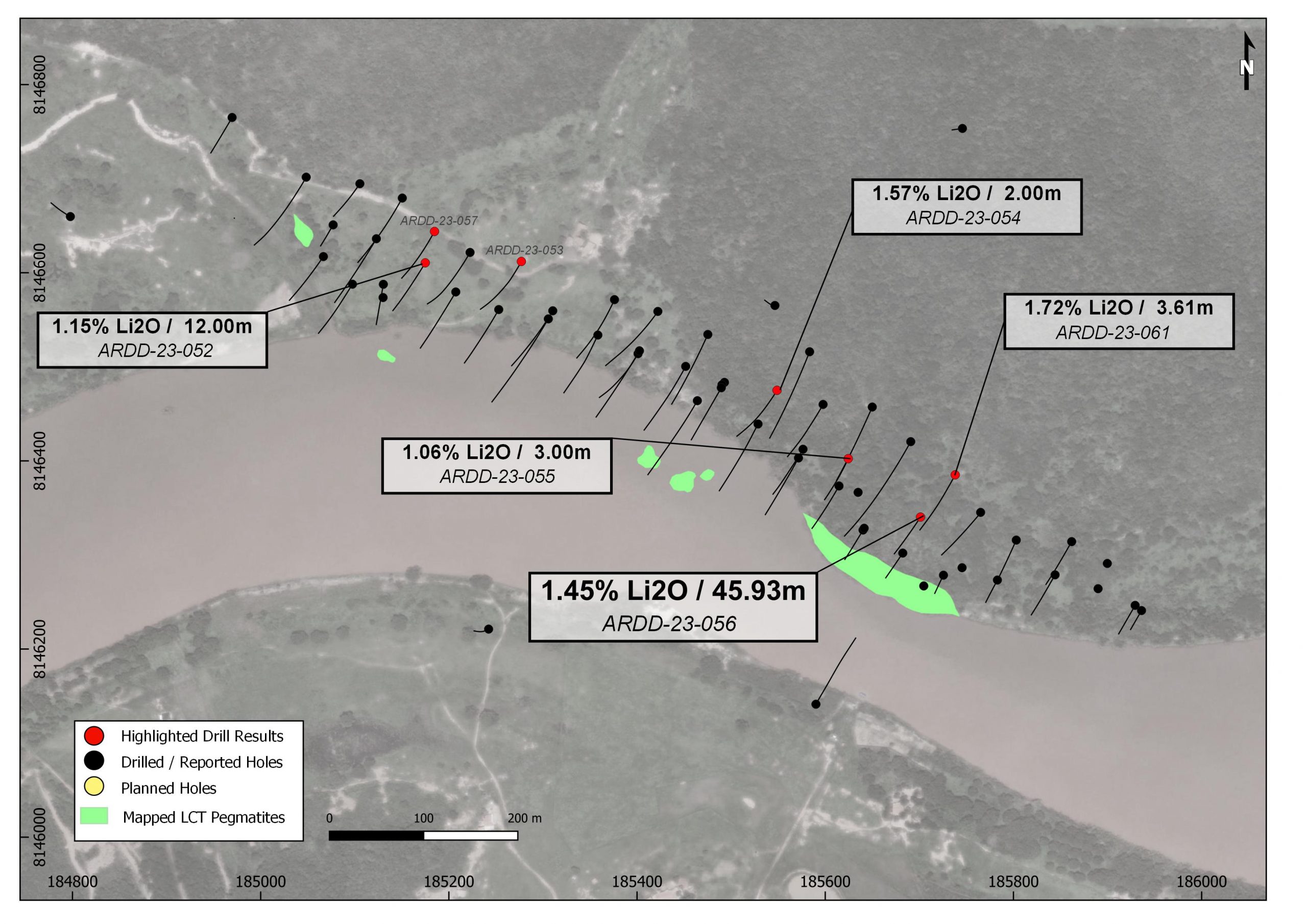

Table 1. Galvani Drill Results

| Hole ID | Az | Dip | From | To | Metres | Li2O (%) |

| ARDD-23-52 | 210 | -45 | 54.14 | 66.14 | 12.00 | 1.15 |

| ARDD-23-54 | 210 | -60 | 113.10 | 115.10 | 2.00 | 1.57 |

| ARDD-23-55 | 210 | -65 | 97.18 | 100.18 | 3.00 | 1.06 |

| ARDD-23-56 | 210 | -60 | 28.07 | 74.00 | 45.93 | 1.45 |

| ARDD-23-61 | 205 | -55 | 99.88 | 103.49 | 3.61 | 1.72 |

*Assays pending for ARDD-23-58 to ARDD-23-60;

No significant values in holes ARDD-23-53 and ARDD-23-57

Lithium Ionic also announced the formation of Valitar Participacoes S.A. (“Valitar”), a special purpose vehicle (“SPV”). Lithium Ionic, through Valitar, plans to acquire surface rights over its mining claims that it deems have high mining potential. As per Brazilian law, the owner of surface rights on a mining claim is entitled to 1% of the mineral net revenue from the mining of lithium on that claim.

Valitar is a Brazilian firm and Lithium Ionic, via its wholly-owned subsidiary, MGLIT Empreendimentos Ltda. (“MGLIT”), owns 100% of the preferred shares of Valitar. These Preferred Shares allow MGLIT to reap the economic benefits generated by Valitar.

MGLIT has signed a loan agreement with Valitar to supply Valitar with up to R$10 million (approximately USD$2 million) for the acquisition of the necessary surface rights over Lithium Ionic’s mining claims. This Loan, which has a three-year term, is unsecured and carries an annual interest rate of 1%. As per Brazilian law, rural land must be owned by a Brazilian resident, thus the common shares of Valitar are beneficially owned by an officer of Lithium Ionic who resides in Brazil. Consequently, the Loan is considered a “related party transaction” as per Multilateral Instrument 61-101 – Protection of Minority Security Holders in Special Transactions (“MI 61-101”). Lithium Ionic is relying on exemptions from the formal valuation requirements of MI 61-101 pursuant to section 5.5(a) and the minority shareholder approval requirements of MI 61-101 pursuant to section 5.7(1)(a), given that the fair market value of the Loan does not exceed 25% of the Company’s market capitalization.

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan

Comments are closed.