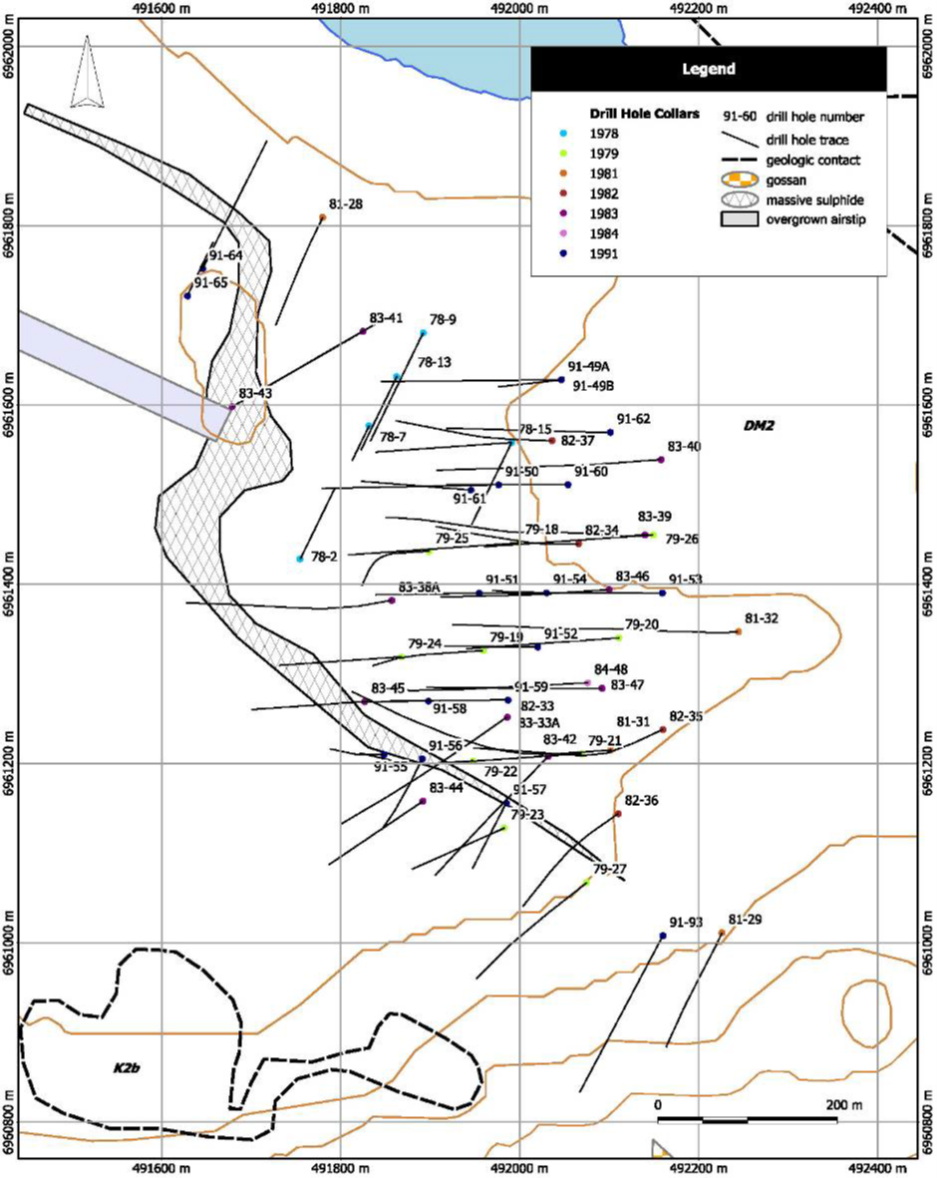

Honey Badger Silver Inc. (TSXV:TUF) announced on Tuesday, March 29 that it had acquired a 100% interest in the Clear Lake deposit in the Whitehorse Mining District of the Yukon.

The transaction is subject to a 1% net smelter return royalty on all metals except silver. The Clear Lake deposit is known to be an important source of zinc and lead but holds mostly silver. With the acquisition Honey Badger Silver Inc. is becoming the owner of a historic resource of 5.5 million ounces of silver.

Honey Badger Chairman Chad Williams said: *The Clear Lake acquisition represents a milestone as we acquire, on an extremely value-accretive basis, a quality asset with in-situ silver resources in one of the best mining jurisdictions in the world, where we are currently active at our higher-grade Plata silver project. This acquisition demonstrates our stated strategy of identifying and executing highly accretive targeted silver acquisitions. Clear Lake not only provides our shareholders with exposure to silver resources but also offers the possibility of unlocking value from the significant zinc and lead endowment, which is not of primary interest to Honey Badger, in a royalty/stream spin-off or even potentially other innovative instruments, such as a commodity-linked non-fungible token (“NFT”) – watch for more news on this front.”

This acquisition represents an important step in fulfilling the company’s strategy of entering more silver properties at different stages of production that will allow it to offer investors high exposure to silver prices. As part of the strategy. Honey Badger continues to conduct asset evaluations.

The historical resources were reported in a NI-43-101 technical report dated February 23, 2010 and were 43-101 compliant at the time the agreement was signed.

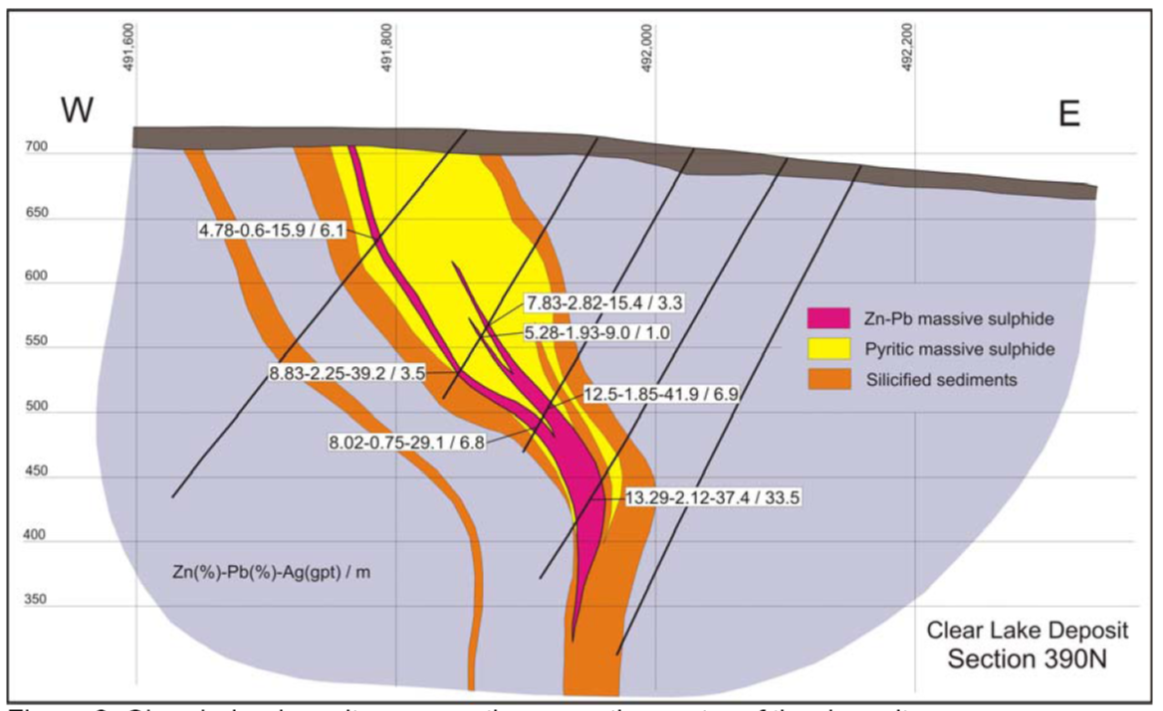

Inferred historical resource prepared by SRK Consulting in 2010 in accordance with National Instrument 43-101 (“NI 43-101”) of 5.5 million ounces of silver at 22 grams per tonne, plus 1.3 billion pounds of zinc grading 7.6% zinc and 185 million pounds of lead grade 1.08%(A)(B);

Figure 2: Cross-Section of Clear Lake Deposit, SRK Technical Report, 2010(A)

Being a silver deposit but also a zinc and lead deposit, the company is exploring different options to make the best use of the historic Clear Lake resource.

The Clear Lake deposit includes 1.3 billion pounds of zinc and 185 million pounds of lead so Honey Badger is considering the possible sale of royalties on the zinc and lead or other means. It also presents potential to gradually expand existing resources and discover additional mineralization on the property.

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan

Comments are closed.