The gold miners’ stocks have slumped in January, tilting sentiment back to bearish. This sector’s strong December upward momentum was checked by gold’s own upleg stalling out. Gold investment demand growth slowed on the blistering stock-market rally. But uplegs always flow and ebb, and this young gold-stock upleg merely paused. The gold miners’ gains will likely resume soon, rekindling bullish psychology.

Most investors and analysts track the gold-mining sector with its leading ETF, the GDX VanEck Vectors Gold Miners ETF. GDX was this sector’s pioneering ETF birthed in May 2006, creating a huge first-mover advantage that is insurmountable. This week GDX’s net assets of $9.9b were an incredible 56.7x larger than the next-biggest 1x-long major-gold-miners ETF! GDX dominates this space with little competition.

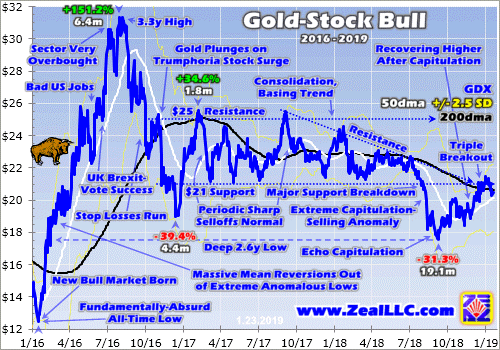

Back in early September, the gold stocks plunged to a major 2.6-year secular low per GDX. This sector suffered a brutal forced capitulation on cascading stop-loss selling, devastating sentiment. The triggering catalyst was gold getting pounded to its own major lows in mid-August on record futures short selling. At worst GDX fell to $17.57 on close, which was down an ugly 24.4% year-to-date. Most traders fled in disgust.

But major new uplegs are born in peak despair, and that was it. The gold stocks started recovering out of those fundamentally-absurd levels, gradually carving a solid upleg. By early January GDX had rallied 22.3% higher in 3.7 months, fueling more-optimistic sector sentiment. Plenty of speculators and investors including me were comparing 2019’s setup for gold stocks to the first half of 2016, a wildly-lucrative stretch.

That was just after today’s gold bull ignited, and its maiden upleg surged 29.9% higher in just 6.7 months. Such gold strength ignited a flood of capital into the gold miners, catapulting GDX an enormous 151.2% higher in essentially that same span! This year when GDX’s latest closing upleg high of $21.48 was achieved on January 3rd, traders were salivating at the prospects of another mighty H1’16-like gold-stock upleg.

But instead of powering higher, the gold stocks stalled and started drifting lower. By last Friday the 18th, GDX had slumped 5.4% over a couple of weeks or so to $20.31. That really discouraged the gold-stock traders, torpedoing the nascent bullishness driven by GDX’s powerful 10.5% December rally. I’ve been getting lots of e-mails from discouraged traders moping, and often convinced this gold-stock upleg fizzled.

Sentiment has really deteriorated in recent weeks as gold-stock prices retreated. One manifestation of this resurgent bearishness is apparent in how individual gold miners’ stocks are reacting to company-specific news. Early in new quarters, many gold miners report their prior quarter’s production. And early in new years, plenty also give guidance for new full-year production. Traders are selling hard on this news.

Even though these production reports and outlooks have generally been flat to good, they are being used as excuses to sell. When traders wax bearish, all news is considered bad. So when pessimism reigns early in new quarters, it’s not unusual to see traders flee. Conversely when gold stocks are rallying nicely early in new quarters, this news is typically bought. Gold stocks’ reaction to news is a sentiment indicator.

Interestingly selling on full-year production guidance is usually a poor decision. Gold-miner managers try to maximize their compensation which is heavily driven by their stock’s price. So they tend to lowball their production estimates early in new years, leaving room to beat them later in those years. Then when they exceed their own expectations, their stocks catch strong bids into year-ends maximizing their personal earnings.

Plenty of traders have written me worrying that January 2019 is nothing like January 2016, arguing that a major new gold-stock upleg isn’t underway. They are dead wrong, everyone forgets the gold stocks also fell in much of that pivotal month. In the first couple weeks of January 2016, GDX actually dropped 9.1% despite a parallel 2.5% gold surge! Then like now, emotional gold-stock traders were irrationally scared.

That monster H1’16 gold-stock upleg didn’t start until January 20th that year, which was that month’s 12th trading day. That was after most of the post-quarter and new-year news releases. This year’s slump is actually better, not worse. GDX was only down 3.7% month-to-date on this month’s 13th trading day, on gold’s slight 0.1% drift lower over that span. Early-year weakness doesn’t preclude major uplegs brewing!

While most traders want to assume otherwise, gold stocks’ young upleg remains very much alive and well. This chart is updated from my essay several weeks ago heralding GDX’s major upside triple breakout, a super-bullish technical event. While GDX did slump in recent weeks after achieving that, its upleg is still rock-solid. All uplegs meander higher in fits and starts, taking two steps forward before one step back.

I’m not going to rehash this chart after analyzing it in depth just a few weeks ago. But scared gold-stock traders can take solace in some brief observations. First note the early-January-2019 pullback in GDX is far less severe than the early-January-2016 one. While that month birthed a monster upleg, it wasn’t all rainbows and unicorns until the very end. Weak-handed excitable traders had to be shaken out before the surge.

Second look at GDX’s solid upleg since early September 2018, which again rallied 22.3% at best over 3.7 months as of January 3rd. Uplegs are simply series of higher lows and higher highs often unfolding in a defined uptrend channel. All that still perfectly applies to GDX, its technicals remain very bullish. Both its upleg lows and highs are gradually marching higher, revealing zero technical strain on this young upleg.

Once again this upleg was born at GDX’s deep 2.6-year low of $17.57 on September 11th. Over the next few weeks into early October, GDX surged 8.4% to $19.05. Then it quickly pulled back to $18.39, which was still 4.7% above upleg-start levels. From there GDX powered up another 9.3% over the next couple weeks to $20.10 in late October. Then it suffered a bigger retreat to $18.42 by mid-November, still a higher low.

GDX rebounded strongly from there, surging another 16.6% to $21.48 by early January. And after such a strong run it slumped again to $20.31 last Friday. While it remains to be seen if that proves the latest upleg low, the higher lows so far have run $18.39, $18.42, and $20.31. And the higher highs clocked in at $19.05, $20.10, and $21.48. This is a textbook-perfect gold-stock upleg so far, offering nothing to worry about.

These higher lows and higher highs have formed an excellent uptrend channel for this upleg. Connecting these lows and highs creates parallel lower-support and upper-resistance lines. I didn’t draw them in this chart because they’d be difficult to see at this scale, but they are really well-defined. As of this week the support line extends near $19.50. So even if GDX slumped that low, its uptrend channel would remain intact.

Resistance now projects near $21.75, which would be another new upleg high. Odds are GDX will head back up there to challenge it in the coming few weeks or so. GDX may have started bouncing from last Friday’s level a bit under its 200-day moving average, which is now running $20.65. It could head a little lower first to its 50dma which is down near $20.14. And maybe it will even drop to $19.50 lower support.

It’s important to realize that as long as GDX remains above that uptrend-channel support line, its upleg is just fine. Any action over that is merely upleg noise that isn’t worth worrying about technically. It is normal for pullbacks within uplegs to bleed away bullishness and rekindle bearishness. That’s actually essential for uplegs’ health and longevity, keeping sentiment balanced so uplegs don’t prematurely burn out.

All the upside triple-breakout analysis and bullishness I discussed in early January remains valid and in force today. This gold-stock upleg has just paused, which is par for the course. All uplegs flow and ebb, gradually meandering higher on balance. None shoot up in straight lines, not even that monster one in H1’16. That was riddled with multiple strong selloffs, with one even hitting support below GDX’s 50dma.

The reason this young gold-stock upleg paused in recent weeks was gold’s own upleg stalled out. Gold miners’ stocks are ultimately just leveraged plays on gold. Their profits really amplify changes in gold’s price, which lets major gold miners’ stocks leverage gold’s underlying moves by 2x to 3x. Gold’s own young upleg that is driving gold stocks’ one hit its latest high near $1294 in early January the same day as GDX.

At that point gold had rallied 10.2% upleg-to-date, which GDX’s 22.3% upleg leveraged by a normal 2.2x in a similar span. Gold had bottomed a few weeks before the gold stocks, in mid-August instead of early September. Gold stocks’ performance relative to gold in this upleg has been normal. That leverage is often on the low side of its range early in young uplegs, then climbs to the high side later as momentum mounts.

At worst since its own January 3rd high, gold had slumped 1.0% to $1280 on last Friday. It is certainly no coincidence that is the exact span of gold stocks’ latest pullback. GDX’s young upleg will resume as soon as gold catches a bid again. That is dependent on gold investment demand resuming. It was strong in Q4, but faded significantly in January. This next chart looks at the leading proxy for gold investment demand.

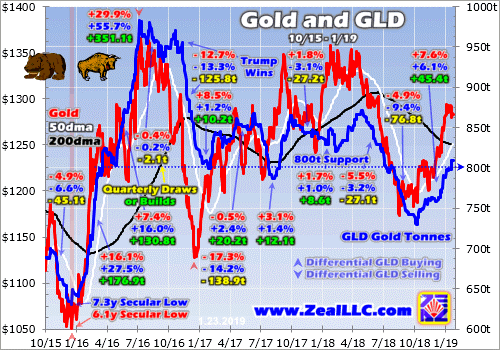

That is the physical bullion holdings the dominant GLD SPDR Gold Shares gold ETF holds in trust for its shareholders. They are reported daily, a far-higher-resolution read than the quarterly supply-and-demand data from the World Gold Council. In last week’s essay I explained this chart in depth, analyzing why the capital flows into and out of GLD alone by American stock investors overwhelmingly drive the global gold price.

It superimposes GLD’s bullion holdings in blue over the gold price in red. Rising GLD holdings show that American stock-market capital is moving into gold via the conduit of this leading gold ETF. In Q4 and especially December gold surged higher on heavy differential buying of GLD shares. But in January that GLD buying has moderated. That’s why gold’s advance stalled out, which in turn drove gold stocks’ pause.

Again I discussed this chart just last week, so there’s no need for more comprehensive analysis. For our purposes today, note how GLD’s holdings climbed modestly in October and November after they had fallen to a deep 2.6-year secular low of their own in early October. GLD had suffered 5 consecutive monthly draws of 24.2 metric tons, 28.0t, 18.8t, 45.0t, and 12.9t between May and September, an ugly streak.

But that trend of American stock-market investors selling gold via GLD shares ended in early October. GLD enjoyed its first big build the very day the US stock markets suffered their first sharp plunge! That snowballed into an 11.8t build in October and 7.7t in November. That investment buying fueled modest gold rallies of 2.1% and 0.5% those months. Then in December that GLD-share buying really accelerated.

Last month enjoyed a sizable 25.9t build in GLD’s holdings, the biggest since September 2017. Those capital inflows fueled a much-larger 4.9% gold rally in December. When investment capital is flowing into gold, its price naturally climbs. And that in turn drives the gold miners’ stocks higher. Gold’s 2.1%, 0.5%, and 4.9% gains in the last several months drove parallel 2.2%, 0.8%, and 10.5% monthly rallies in GDX.

On the surface January has looked good too, with GLD’s holdings surging another 22.1t month-to-date as of the middle of this week. But nearly 9/10ths of that build came on only 2 trading days, January 2nd and 18th. Out of 15 trading days so far, January has seen 4 GLD-holdings build days, 3 draw days, and fully 8 unchanged. American stock investors’ differential GLD-share buying hasn’t been consistent this month.

That’s enabled gold-futures speculators to push gold modestly lower. Unfortunately we can’t know how much selling they’ve done, or whether it was exiting longs or adding new shorts, because of the federal-government partial shutdown. The weekly Commitments of Traders reports usually published by the CFTC haven’t been released since mid-December, so there is no data on gold-futures speculators’ trading.

But gold drifting lower this month despite a solid GLD build on balance proves they have to be selling. A sharp bounce in the US Dollar Index is a major factor driving those gold-futures sales. But the main one is the surging US stock markets. They are really retarding gold investment demand, making investors forget the wisdom of prudently diversifying their stock-heavy portfolios with gold. That has paused gold stocks.

The flagship U.S. S&P 500 broad-market stock index (SPX) plunged 19.8% over 3.1 months between late September and late December, a severe correction nearly entering bear-market territory. It was that SPX drop that reignited gold investment demand and fueled gold’s latest young upleg. Last week’s essay dug into this critical relationship between the SPX and gold. The SPX’s sharp rebound since weighed on gold demand.

Between the SPX’s Christmas Eve near-bear low and last Friday, this leading index rocketed up 13.6% in just several weeks! That violent bounce that looked and felt exactly like a bear-market rally nearly erased 4/7ths of the preceding correction. That has reignited widespread greed and complacency in the stock markets, the exact mission of bear rallies which are the biggest and fastest seen in all of stock-market history.

Gold stalled out in January because the SPX is surging so fiercely, retarding the impetus to diversify with gold. And the gold-stock upleg paused because gold stopped advancing. So this probable bear rally in the stock markets is to blame for gold stocks’ early-year weakness. But once these overbought U.S. stock markets roll over decisively again, gold psychology will flip back to favorable and big investment buying will resume.

When gold starts powering higher again, gold stocks will be off to the races. That portends big gains still coming in GDX, and even larger ones in its little brother GDXJ. It is effectively a mid-tier gold miners ETF these days, and its upleg gains during recent years’ bull market have outpaced GDX’s by about 1.4x on average. GDXJ simply has a better mix of gold miners than GDX, with fewer problems expanding production.

Yet the best gains by far won’t be won in the ETFs, but in the smaller mid-tier and junior gold miners with superior fundamentals. GDXJ still has deadweight in its top holdings, miners struggling with declining production and rising costs. The better gold miners are growing their output through new mine builds and expansions, generating greater gains. Finding and owning these better gold-mining stocks is essential.

The earlier you get deployed, the greater your gains will be. That’s why the trading books in our popular weekly and monthly newsletters are currently full of better gold and silver miners mostly added in recent months. The gains we won in 2016 were amazing the last time American stock investors returned to gold. Our newsletter stock trades that year averaged +111.0% and +89.7% annualized realized gains respectively!

The gold-stock gains should be similarly huge in this next major gold upleg. The gold miners are the last undervalued sector in these still-very-expensive stock markets, and rally with gold during stock-market bears unlike anything else. To multiply your wealth in the stock markets you have to do your homework and stay abreast, which our newsletters really help. They explain what’s going on in the markets, why, and how to trade them with specific stocks. You can subscribe today for just $12 per issue!

The bottom line is this young gold-stock upleg is just paused. The current technicals certainly don’t justify increasingly-bearish sentiment. This sector’s leading benchmark GDX is carving higher lows and higher highs, climbing on balance in a well-defined uptrend channel. Uplegs don’t shoot higher in straight lines, pullbacks within them are normal and expected. They serve to rebalance sentiment keeping uplegs healthy.

Gold stocks’ pullback this month was driven by gold’s own young upleg stalling. Strong gold investment demand fueled by recent months’ serious stock-market selloff moderated after stocks screamed higher in a violent bear-market-rally-like bounce. The resulting rekindled bullish psychology overshadowed gold again. But once stock-market selling resumes, so will the young uplegs in gold and its miners’ stocks.

Adam Hamilton, CPA

January 29, 2019

Copyright 2000 – 2019 Zeal LLC (www.ZealLLC.com)

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan

Comments are closed.