The gold miners’ stocks have been climbing higher on balance, enjoying a solid upleg that is gathering steam. That’s fueling improving sentiment, driving more interest in this small contrarian sector. This gold-stock upleg is likely to grow in coming months, partially because of very-favorable spring seasonals. The gold stocks’ second-strongest seasonal rally of the year typically unfolds between mid-March to early June.

Seasonality is the tendency for prices to exhibit recurring patterns at certain times during the calendar year. While seasonality doesn’t drive price action, it quantifies annually-repeating behavior driven by sentiment, technicals, and fundamentals. We humans are creatures of habit and herd, which naturally colors our trading decisions. The calendar year’s passage affects the timing and intensity of buying and selling.

Gold stocks exhibit strong seasonality because their price action mirrors that of their dominant primary driver, gold. Gold’s seasonality generally isn’t driven by supply fluctuations like grown commodities experience, as its mined supply remains fairly steady year-round. Instead gold’s major seasonality is demand-driven, with global investment demand varying dramatically depending on the time in the calendar year.

This gold seasonality is fueled by well-known income-cycle and cultural drivers of outsized gold demand from around the world. The seasonal gold year starts in late July as Asian farmers begin reaping their harvests. They plow some of their surplus income into gold. That’s soon followed by the famous Indian wedding season in autumn, with its heavy gold buying for brides’ dowries during marriage-auspicious festivals.

After that comes the Western holiday season, where gold jewelry demand surges for Christmas gifts for wives, girlfriends, daughters, and mothers. Following year-end, Western investment demand balloons after bonuses and tax calculations as investors figure out how much surplus income the prior year generated for investment. Then after that Chinese New Year gold buying flares up heading into February.

These understandable cultural factors drive surges of outsized gold demand between late summer and late winter. But interestingly there is one more gold-demand spike in spring. Over the years I’ve seen a variety of theses explaining this mid-March-to-late-May gold rally, but nothing definitive like for the rest of the year’s seasonality. As silly as it sounds, I suspect spring itself is the reason for this demand surge.

Sentiment exceedingly influences investing, which requires optimism for the future. Investors won’t risk deploying their scarce capital unless they believe it will grow. And the glorious expanding sunshine and warming temperatures of spring naturally breed optimism. The vast majority of the world’s investors are far enough into the northern hemisphere that spring has a major psychological impact, buoying their spirits.

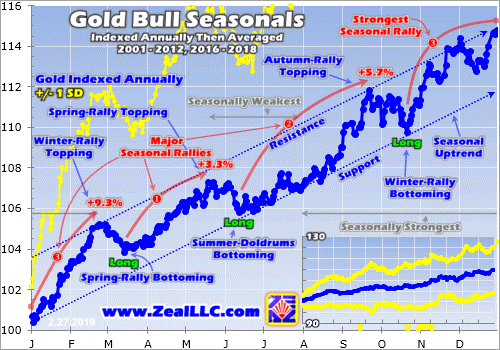

Since it is gold’s own demand-driven seasonality that fuels the gold stocks’ seasonality, that’s logically the best place to start to understand what’s likely coming. Price action is very different between bull and bear years, and gold remains in a young bull market. After being crushed to a 6.1-year secular low in mid-December 2015 on the Fed’s first rate hike of this cycle, gold blasted 29.9% higher over the next 6.7 months.

Crossing the +20% threshold in March 2016 confirmed a new bull market was underway. Gold corrected after that sharp initial upleg, but normal healthy selling was greatly exacerbated after Trump’s surprise election win. Investors fled gold to chase the taxphoria stock-market surge. Gold’s correction cascaded to mammoth proportions, hitting -17.3% in mid-December 2016. But that remained shy of a new bear’s -20%.

Gold’s last mighty bull market ran from April 2001 to August 2011, where it soared 638.2% higher! And while gold consolidated high in 2012, that was technically a bull year too since gold just slid 18.8% at worst from its bull-market peak. Gold didn’t enter formal bear-market territory at -20% until April 2013, thanks to the crazy stock-market levitation driven by extreme distortions from the Fed’s QE3 bond monetizations.

So the bull-market years for gold in modern history ran from 2001 to 2012, skipped the intervening bear-market years of 2013 to 2015, and resumed in 2016 to 2019. Thus these are the years most relevant to understanding gold’s typical seasonal performance throughout the calendar year. We’re interested in bull-market seasonality, because gold remains in its latest bull today and bear-market action is quite dissimilar.

Prevailing gold prices varied radically throughout these modern bull-market years, running between $257 when gold’s last secular bull was born to $1894 when it peaked a decade later. All these years along with gold’s current bull since 2016 have to first be rendered in like-percentage terms in order to make them perfectly comparable. Only then can they be averaged together to distill out gold’s bull-market seasonality.

That’s accomplished by individually indexing each calendar year’s gold price action to its final close of the preceding year, which is recast at 100. Then all gold price action of the following year is calculated off that common indexed baseline, normalizing all years regardless of price levels. So gold trading at an indexed level of 105 simply means it has rallied 5% from the prior year’s close, while 95 shows it’s down 5%.

This chart averages the individually-indexed full-year gold performances in those bull-market years from 2001 to 2012 and 2016 to 2018. 2019 isn’t included yet since it remains a work in progress. This bull-market-seasonality methodology reveals that gold’s spring rally is its last push higher before the summer doldrums arrive. While this is gold’s smallest seasonal rally of the year, the gold stocks greatly leverage it.

During these modern bull-market years from 2001 to 2012 and 2016 to 2018, gold’s spring rally tended to start in mid-March on average. From that major seasonal low following the winter rally, gold often starts grinding higher before its gains accelerate through April and much of May. This spring rally has generally run its course by late May. Across the 15 bull years in this study, gold averaged modest spring rallies of 3.3%.

This spring rally unfolds rapidly, with an average duration of just 2.2 months. That makes it the smallest and shortest of gold’s three major seasonal rallies, falling way behind the champion 9.3% winter rally that precedes it and the strong 5.7% autumn rally that follows the summer doldrums. Nevertheless, it is still well worth trading. 3.3% gains do really make a difference, and naturally about half of years exceed this mean.

On average gold’s spring-rally bottoming occurred on March’s 10th trading day, which will be the 14th this year. If today’s seasonals stay true to form, gold will slump in the first couple weeks of March. But that seasonal pullback between the winter and spring rallies is pretty modest, averaging just 1.3% over a few weeks at most. The resulting mid-March lull in gold prices spawns an excellent gold-stock buying opportunity.

Gold’s average seasonal performances in March, April, and May during these modern bull-market years ran -0.3%, +1.6%, and +0.6%. While even April is just gold’s 6th-best month of the year, it still has an outsized impact on gold-stock prices. This has to be sentiment-driven. Optimism runs high in the spring anyway, and plenty of bullish psychology lingers following gold stocks’ strong winter rally in preceding months.

This year’s spring gold rally has excellent potential to come in on the large side. Gold investment demand surged in Q4’18 as global stock markets crumbled. They are likely rolling over into a long-overdue major bear. When investors start worrying its next major downleg is brewing, they will again flood into gold to continue diversifying their stock-heavy portfolios. Surging gold investment demand propels gold strongly higher.

That may push gold to the verge of a major decisive breakout to new bull highs! At best in February, gold hit $1341 on close. Assuming a 1.3% early-March seasonal pullback before a typical 3.3% spring rally, gold would hit $1367. That’s just above its bull-to-date peak of $1365 seen way back in early July 2016. Investor and speculator interest in gold, and capital inflows into it, will explode as new bull highs are achieved.

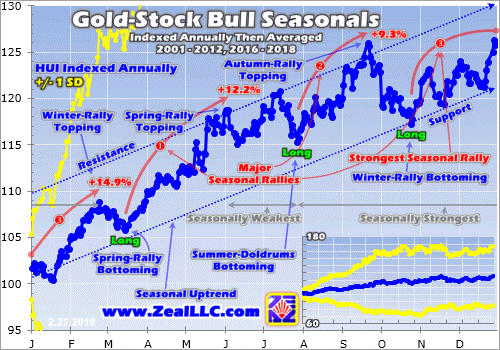

And as goes gold, so go gold stocks. Gold stocks also exhibit strong seasonality, which is of course the direct result of gold’s own seasonality. Since gold-mining costs are largely fixed when mines are being planned, fluctuations in gold’s price flow directly into amplified moves in gold-mining profits. Higher gold prices drive much-higher earnings for the gold miners, which attract in more investors to bid up stock prices.

The ironclad historical relationship between the price of gold, gold-mining profitability, and therefore gold-stock price levels is exceedingly important to understand. If you need to get up to speed, I wrote an essay looking at gold-stock price levels relative to gold early last month. Fundamentally gold stocks are leveraged plays on gold, and greatly outperform in the spring on gold’s seasonals and general optimism.

This next chart applies this same bull-market-seasonality methodology used on gold directly to the gold stocks. It looks at the average annual indexed performance in the flagship HUI NYSE Arca Gold BUGS Index in these same bull-market years of 2001 to 2012 and 2016 to 2018. Using the HUI is necessary because the popular GDX VanEck Vectors Gold Miners ETF was only born in May 2006, missing bull years.

That was halfway into the last secular gold-stock bull, which ran from November 2000 to September 2011. Over that long 10.8-year span, the HUI skyrocketed a life-changing 1664.4% higher on gold’s parallel 638.2% bull! Gold-stock prices naturally mirror and amplify gold action since it dominates gold-mining earnings. That’s true across entire secular bulls, within individual uplegs, and even in calendar-year seasons.

Gold stocks’ seasonal spring rally is much stronger than gold’s, buttressing that spring-optimism-drives-stock-buying thesis. Between mid-March and early June, the gold stocks have averaged hefty 12.2% rallies in these 15 modern bull-market years. That makes for exceptional 3.7x upside leverage to gold’s 3.3% seasonal spring rally! Interestingly this is gold stocks’ best seasonal leverage to gold’s gains by far.

While the HUI averaged 14.9% surges during gold’s winter rally, that only made for 1.6x upside leverage to gold’s big 9.3% gain. And the HUI’s 9.3% average gain during gold’s autumn rally also only amplified gold’s 5.7% gain by 1.6x. So while the gold-stock spring rally’s 12.2% average gains rank second out of these three seasonal rallies, it offers the most bang for the buck in gold-stock upside compared to gold!

Like gold, the gold miners’ stocks suffer a seasonal slump from late February to mid-March. That has averaged 2.7% in these modern bull-market years. So don’t be worried into selling if we see a typical early-March slump in this sector. That’s usually just a mild pullback before gold stocks’ strong spring rally gets underway. Any seasonal weakness is a great opportunity to add new gold-stock trades relatively low.

The gold stocks’ post-winter-rally pre-spring-rally lull tends to bottom on March’s 11th trading day, which will be the 15th this year. From there the HUI surges 12.2% higher on average over the next 2.7 months into early June. Interestingly the gold stocks tend to top a couple weeks after gold peaks in late May. That’s likely the result of momentum fueled by spring optimism and strong gains since the prior summer.

Assuming this year’s gold-stock seasonals conform to their bull-year precedent in coming months, some impressive levels are coming before summer. If the HUI first retreats 2.7% from its February peak into mid-March before powering 12.2% higher into early June, we are looking at 193.0 heading into this year’s summer doldrums. Those would be the best gold-stock levels since February 2018 on merely normal seasonals.

But this year’s spring seasonal rally has real potential to grow much larger than usual. Of course if gold’s own spring rally becomes outsized due to stock-market-selloff-driven surging gold investment demand, the gold miners’ stocks will leverage those gains. And the higher gold stocks climb, the more bullish their psychology. Speculators and investors alike love chasing momentum and piling into winning trades en masse.

More importantly this sector’s strengthening fundamentals should support bigger seasonal gains. Gold’s price averaged $1228 in Q4’18. While the gold miners are still finishing reporting their results for last quarter and full-year 2018, odds are their collective all-in sustaining costs will remain flat. Every quarter I wade through the latest results of the major gold miners of GDX, and usually publish the Q4 ones in mid-March.

Over the last four fully-reported quarters ending in Q3’18, the GDX gold miners averaged AISCs of $858, $884, $856, and $877. That makes for an $869 mean, but let’s round that to $875 for easier calculations. At Q4’s average gold price of $1228 and $875 AISCs, the major gold miners of GDX and the HUI likely earned profits near $353 per ounce last quarter. But so far in Q1, the average gold price has surged to $1305!

With AISCs this quarter likely to be stable too around that usual $875, the gold miners are likely earning profits of $430 per ounce so far in Q1. That is a massive 21.8% higher quarter-on-quarter! If investors expect Q1’19 earnings to come in this strong, there’s no way gold stocks will merely see a seasonally-average spring rally. Strong operational results in both Q4 and Q1 reporting should fuel a major gold-stock bid.

Seasonal spring rallies can balloon very large in rising-gold-price environments, which drive excellent fundamentals for the gold miners. The last example happened in spring 2016, when the HUI powered 32.3% higher within its normal spring-rally span! That was just a fraction of a monster 182.2% upleg that skyrocketed over just 6.5 months. Gold-stock buying is fast and furious when momentum fuels enthusiasm.

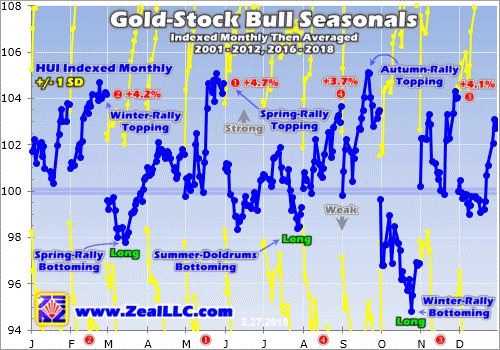

This last chart breaks down gold-stock seasonality into even-more-granular monthly form. Each calendar month between 2001 to 2012 and 2016 to 2018 is individually indexed to 100 as of the previous month’s final close, then all like calendar months’ indexes are averaged together. Slicing up seasonal tendencies this way shows May has actually averaged gold stocks’ strongest month of the year in modern bull-market years!

During the 15 Aprils in these modern gold bull-market years, the gold stocks as measured by the HUI saw average gains of 1.6%. But the lion’s share of the spring-rally gains came in May, where average gains nearly tripled to 4.7%! For decades if not longer, May has been one of the best and most-important months to be heavily long gold miners’ stocks. Only February and November have managed to rival it.

The key to gold stocks’ spring rally is to get your capital deployed by mid-March, when gold stocks swoon to their spring-rally bottoming. In intra-month terms the initial gains are often fast in late March as gold stocks rebound out of their seasonal lull. But then the spring rally tends to slow down in mid-April, which invariably discourages impatient and short-sighted traders. The real gains come in May, when gold stocks surge.

Of course the standard seasonality caveat applies that these are mere tendencies, not primary drivers of gold or gold stocks. Seasonal tailwinds can be easily drowned out by bearish sentiment, technicals, and fundamentals. Seasonality doesn’t always work, especially when it doesn’t align with the primary drivers of sentiment, technicals, and fundamentals in that order. Thankfully that certainly isn’t the case this year.

Gold-stock sentiment is growing increasingly bullish as this sector’s solid upleg gathers steam. Seeing higher lows and higher highs on balance further feeds into positive psychology, and traders love to chase momentum in rallying sectors. Mounting stock-market fears of a young bear getting underway should continue to push gold investment demand higher. The resulting higher gold prices really boost mining profits.

Outsized gold-stock gains during this spring-rally timeframe are fully justified fundamentally when gold itself is rallying. When sentiment, technicals, fundamentals, and seasonals all align behind gold stocks, they often surge dramatically higher. Unfortunately most speculators and investors won’t realize this until most of the spring-rally gains have already been won. Buy low in mid-March instead of buying high in early June!

While you can ride gold stocks’ spring rally higher in GDX, the major miners dominating it are struggling to grow their production. Far-better gains will be won in smaller mid-tier and junior gold miners with superior fundamentals. The best are increasing their output through new mine builds and expansions, which also lowers their costs further boosting their profits. Their upside potential utterly trounces that of the GDX majors.

The earlier you get deployed, the greater your gains will be. That’s why the trading books in our popular weekly and monthly newsletters are currently full of better gold and silver miners mostly added in recent months. The gains we won in 2016 were amazing the last time American stock investors returned to gold. Our newsletter stock trades that year averaged +111.0% and +89.7% annualized realized gains respectively!

The gold-stock gains should get really big as today’s young gold and gold-stock uplegs grow. The gold miners are the last undervalued sector in these still-expensive stock markets, and rally with gold during stock-market bears unlike anything else. To multiply your wealth in the stock markets you have to do your homework and stay abreast, which our newsletters really help. They explain what’s going on in the markets, why, and how to trade them with specific stocks. You can subscribe today for just $12 per issue!

The bottom line is gold stocks often experience a strong spring rally seasonally. This is driven by gold’s own seasonality, where outsized investment demand arises at certain times during the calendar year. Gold usually enjoys a solid spring rally likely driven by the universal optimism this season brings. And since gold drives gold miners’ profitability, their stock prices naturally follow it higher while amplifying its gains.

This year’s coming spring rally is due to start in mid-March, with great potential to grow much larger than normal. Gold-stock sentiment is slowly improving as this sector’s current upleg continues grinding higher on balance. And higher gold prices driven by renewed investment demand on stock-market-selloff fears is really boosting gold-mining earnings. All this with strong seasonal tailwinds should fuel an outsized spring rally.

Adam Hamilton, CPA

March 4, 2019

Copyright 2000 – 2019 Zeal LLC (www.ZealLLC.com)

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan

Comments are closed.