The gold miners’ stocks have been slammed by a sharp gold pullback in recent weeks, spawning today’s bearish sentiment. Traders often get caught up in the emotional swings generated by this volatile sector. But once a quarter earnings season arrives, revealing gold mining’s hard fundamental realities which dispel the obscuring sentiment fogs. The major gold miners’ profitability actually just exploded higher in Q1!

Four times a year publicly-traded companies release treasure troves of valuable information in the form of quarterly reports. Companies trading in the States are required to file 10-Qs with the US Securities and Exchange Commission by 45 calendar days after quarter-ends. Canadian companies have similar requirements. Some companies in other countries with half-year reporting instead of quarterly even follow suit.

So the world’s major gold miners are just wrapping up their first-quarter earnings season. After spending decades intensely studying and actively trading this contrarian sector, there’s no gold-stock data I look forward to more than the miners’ quarterly financial and operational reports. They offer a true and clear snapshot of what’s really going on, shattering the misconceptions bred by the ever-shifting winds of sentiment.

The definitive list of major gold-mining stocks to analyze comes from the world’s most-popular gold-stock investment vehicle, the GDX VanEck Vectors Gold Miners ETF. Its composition and performance are similar to the benchmark HUI gold-stock index. GDX utterly dominates this sector, with no meaningful competition. This week GDX’s net assets are 36.2x larger than the next-biggest 1x-long major-gold-miners ETF!

Being included in GDX is the gold standard for gold miners, requiring deep analysis and vetting by elite analysts. And due to ETF investing eclipsing individual-stock investing, major-ETF inclusion is one of the most-important considerations for picking great gold stocks. As the vast pools of fund capital flow into leading ETFs, these ETFs in turn buy shares in their underlying companies bidding their stock prices higher.

This week GDX included a whopping 51 component “Gold Miners”. That term is used somewhat loosely, as this ETF also contains major silver miners, silver streamers, and gold royalty companies. Still, all the world’s great gold miners are GDX components. Due to time constraints, I limited my deep individual-company research to this ETF’s top 34 components, an arbitrary number that fits neatly into the tables below.

Collectively GDX’s 34 largest components now account for 91.1% of its total weighting, a commanding sample. While the vast majority of gold miners’ Q1’17 results have been released, a few are still coming due to later reporting. GDX includes major foreign gold miners trading in Australia, the UK, and South Africa. These companies report in half-year increments instead of quarterly, so their Q1 data is limited.

The importance of these top-GDX-component gold miners can’t be overstated. In Q1 they collectively produced nearly 9.7m ounces of gold, or 300.3 metric tons. According to the World Gold Council’s just-released Q1 Gold Demand Trends report, the definitive source on gold’s worldwide supply-and-demand fundamentals, total global mine production was 764.0t. GDX’s top miners alone accounted for nearly 4/10ths!

Every quarter I wade through a ton of data from these elite gold miners’ 10-Qs, and dump it into a big spreadsheet for analysis. Some made it into these tables. If a field is left blank, that usually means a company didn’t report it for Q1’17 as of this Wednesday. Some percentage changes are also left blank if they went from a negative to positive number, which was actually quite common in terms of profitability in Q1.

In these tables the first couple columns show each GDX component’s symbol and weighting within this ETF as of this week. While most of these gold stocks trade in the States, not all of them do. So if you can’t find one of these symbols, it’s a listing from a company’s primary foreign stock exchange. That’s followed by each company’s Q1’17 gold production in ounces, which is mostly reported in pure-gold terms.

Most gold miners also produce byproduct metals like silver and copper. These are valuable, as they are sold to offset some of the considerable costs of gold mining. Some companies report their quarterly gold production including silver, a construct called gold-equivalent ounces. I only included GEOs if no pure-gold numbers were reported. Financial and operational reporting varies greatly from company to company.

That’s followed by the quarter-on-quarter change, the absolute percentage difference between Q4’16 and Q1’17. This offers a more-granular read on gold miners’ ongoing performance trends than year-over-year comparisons. QoQ changes are also listed for the rest of this data, which includes cash costs per ounce of gold mined, all-in sustaining costs per ounce, operating cash flows generated, and GAAP accounting profits.

After spending lots of time digesting these elite gold miners’ latest quarterly reports, it’s fully apparent gold stocks’ recent sharp selloff wasn’t fundamentally-righteous at all! Gold-stock traders got scared because gold was sliding after gold-futures shorting attacks. That excessive herd fear pummeled this sector back down to fundamentally-absurd levels relative to prevailing gold prices, spawning incredible bargains.

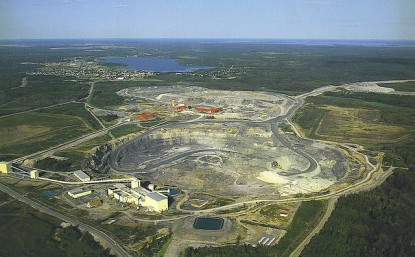

Gold miners are naturally in the business of wresting gold from the bowels of the Earth, so that’s where we’ll start. And as you can see from the sea of red in the QoQ-change column following gold production, it plunged among the top 34 GDX gold miners in Q1’17. The 9.7m ounces collectively mined collapsed by 8.5% from Q4’16’s 10.6m! Of the 33 of these companies reporting Q1 production, it fell QoQ in fully 29.

If you don’t follow this sector closely, this looks like a dire fundamental bloodbath. If the world’s biggest and best gold miners can’t maintain production, they must be in a world of hurt. How can they grow their profitability if their ounces mined are plunging? Interestingly, sharply-slowing first-quarter gold production has long been typical in this sector. The World Gold Council’s comprehensive global data proves this out.

According to its new Q1 GDT report, world mine production fell 9.6% QoQ in Q1’17. So the GDX majors actually fared better than their peers. In the first quarters of 2016, 2015, 2014, 2013, 2012, and 2011, world gold production dropped 6.3%, 10.3%, 11.4%, 8.1%, 6.9%, and 7.3% QoQ. That averages out to a precipitous 8.4% first-quarter plunge in recent years! So the top GDX miners’ -8.5% was right in line with precedent.

What drives this curious seasonal phenomenon? Why do gold miners, which should be producing their metal at constant rates, collectively see sharp first-quarter pullbacks? The reasons are both operational and psychological. On the mining front, gold deposits are far from homogenous. Ore bodies have richer and poorer areas in terms of gold content. Often lesser ore has to be mined first to dig down to better ore.

So geologists carefully analyze drilling data to construct mining plans. Some quarters ore with less gold must be mined and run through the fixed-capacity mills, resulting in lower gold production. This industry has often collectively decided to chew through its lower-grade ore on the way to better stuff in years’ first quarters. The reasons are likely new capital budgets in new years and managing investors’ expectations.

Near the end of each year, gold-mining companies allocate capital to expanding operations in the following year. That often includes opening up new areas of their deposits to mine, necessitating digging through lower-grade ore. I suspect managements like to take this quarterly-production hit in first quarters since it gives plenty of time to exceed expectations later in the year. That helps maximize their stock-based compensation.

So after this typical Q1 slump, gold production expands dramatically in Q2 and Q3. From 2010 to 2016, the WGC’s comprehensive data shows global Q2 gold mined ramped 6.6%, 7.6%, 6.2%, 7.1%, 5.8%, 7.3%, and 3.5% QoQ! That averages out to 6.3% quarterly gains in Q2, which I fully expect to see again this year. That surge continued in Q3s from 2010 to 2016, at 8.0%, 4.4%, 5.3%, 9.0%, 8.8%, 5.6%, and 6.7% QoQ.

So the usual first-quarter drop in gold production is followed by big surges in both the second and third quarters, it’s nothing to worry about. Gold mining is highly seasonal due to capital-allocation decisions on mining-plan timing, and managements trying to set themselves up for big expectations beats and thus higher stock prices later in the year. On a YoY basis, Q1’17’s global gold production was flat at -0.5% from Q1’16.

Lower gold production directly leads to higher per-ounce mining costs. Gold miners blast and haul big chunks of gold-bearing ore to mills. These are essentially giant rock grinders that break ore into smaller pieces, vastly increasing the surface area for chemicals to later leach the gold out. Mill capacity is fixed, with limits on ore tonnage throughput. So the same quarterly tonnage of lower-grade ore leads to fewer ounces.

But the costs of running mills, electricity, employees, and maintenance, are the same regardless of how rich the ore being run through. Lower-grade ore yields fewer ounces to spread these big fixed costs across, jacking up per-ounce costs. A 9% drop in quarterly gold production should lead to a 9% rise in per-ounce costs, inversely proportional. Thus the top GDX gold miners’ costs should’ve risen sharply in Q1.

But rather impressively, they didn’t! Q1’17’s gold-mining costs were essentially flat QoQ, which means the elite GDX gold miners are squeezing out major operational efficiencies. That portends exploding profitability in this year’s coming quarters as richer ore is once again fed into the mills to boost production. Stable costs on much-lower production is an incredibly-bullish fundamental omen for gold stocks!

There are two major ways to measure gold-mining costs, classic cash costs per ounce and the superior all-in sustaining costs per ounce. Both are useful metrics. Cash costs are the acid test of gold-miner survivability in lower-gold-price environments, revealing the worst-case gold levels necessary to keep the mines running. All-in sustaining costs show where gold needs to trade to maintain current mining tempos indefinitely.

Cash costs naturally encompass all cash expenses necessary to produce each ounce of gold, including all direct production costs, mine-level administration, smelting, refining, transport, regulatory, royalty, and tax expenses. In Q1’17, these top 34 GDX-component gold miners that reported cash costs averaged just $623 per ounce. That was actually 0.8% lower than Q4’16’s $628, despite that big 8.5% production drop!

Gold-stock traders are notoriously excitable. Literally everything scares them, the sky is always falling in their worlds. They collectively have little courage in their convictions, always looking for excuses to flee. If they want something real to fear, it’s gold falling below the cash costs of mining it. And at $623 in Q1, that true fundamental disaster isn’t in the cards. Gold miners face no meaningful threats at today’s gold prices!

Way more important than cash costs are the far-superior all-in sustaining costs. They were introduced by the World Gold Council in June 2013 to give investors a much-better understanding of what it really costs to maintain a gold mine as an ongoing concern. AISC include all direct cash costs, but then add on everything else that is necessary to maintain and replenish operations at current gold-production levels.

These additional expenses include exploration for new gold to mine to replace depleting deposits, mine-development and construction expenses, remediation, and mine reclamation. They also include the corporate-level administration expenses necessary to oversee gold mines. All-in sustaining costs are the most-important gold-mining cost metric by far for investors, revealing gold miners’ true operating profitability.

In Q1’17, these top 34 GDX components reporting AISC averaged a level of only $878 per ounce. That’s just 0.3% higher than Q4’16’s $875 despite sharply-lower production! The major gold miners are growing their operational efficiencies, which will lead to much-bigger profits growth in coming quarters as both gold prices and production levels mean revert higher. Stable AISC are super-bullish fundamentally for this sector.

Because of gold’s extreme post-election selloff on the equally-extreme Trumphoria stock-market surge, there’s a universal belief today that gold is faring poorly. Yet in Q1’17, gold rallied 8.5% which easily bested the leading S&P 500 stock index’s 5.5% gain! Gold averaged $1220 in Q1, up slightly from the $1218 in Q4. Comparing the major gold miners’ AISC with prevailing gold prices shows huge upside potential.

At $1220 gold and $878 AISC, the top GDX gold miners were earning $342 per ounce mined in Q1. That equates to big 28% profit margins, fat levels most other industries would die for. That is nearly identical to the $343 profits seen in Q4. The gold miners remain quite profitable today, despite the excessively-bearish psychology that recently hammered their stocks back down to fundamentally-absurd levels relative to gold.

The key fundamental reason gold stocks enjoy such massive upside is their profits leverage to gold. Gold-mining costs are essentially fixed during mine-planning stages, when engineers decide which ore bodies to mine, how to dig to them, and how to process that ore. Quarter after quarter, generally the same numbers of employees, haul trucks, excavators, and mills are used regardless of prevailing gold prices.

So higher gold prices flow right through to the bottom line, costs don’t rise with them. To average $1300 in 2017, gold would have to rally just 6.6% from Q1’s $1220 average. Yet with static AISC, such gold levels would lead to a big 23.4% surge in profitability. $1500 gold is only 22.9% higher from Q1’s average, and still way under 2012’s $1669 average before the Fed’s extreme QE3 stock-market levitation slammed gold.

At $1500 gold and $878 AISC, major gold miners’ profits would rocket 81.8% higher to $622 per ounce. If you believe gold is heading higher in the coming quarters as these overvalued stock markets inevitably roll over, the gold stocks are screaming buys today fundamentally. Their already-strong profitability will soar, really leveraging gold’s mean-reversion advance. Gold stocks’ great near-term upside potential is unequalled.

Another key measure of gold miners’ fundamental health is their cash flows generated from operations. The top 34 GDX components’ came in at $3.0b in Q1’17, down a sharp 15.8% QoQ from Q4’16’s $3.6b. But that’s to be expected with sharply-lower production. Naturally fewer ounces being mined and sold yields lower operating cash flows. OCF will surge sharply in coming quarters as gold prices and production recover.

The second big surprise in the major gold miners’ Q1’17 results after flat costs despite lower production was radically-higher profits! And we are talking hard GAAP earnings here, not the garbage adjusted fictions Wall Street is using to make stock-market valuations look less extreme than they actually are. As of the middle of this week, 26 of these top 34 GDX components had reported accounting net income for Q1.

That was the exact-same number I found in my updated Q4’16 analysis of gold miners’ fundamentals. Even with a flat average gold price and lower production, these major gold miners reported over $1.6b in profits in Q1’17. That was an enormous improvement from Q4’16’s $0.6b in collective losses. In a single quarter with flat gold and lower production, the major gold miners’ earnings swung $2.2b back into the black!

While much of Q4’s big accounting losses were driven by non-cash writedowns of gold-mining assets due to sharply-lower gold prices following the election, Q1’s massive profits jump is still impressive. It proves the gold miners are very profitable even at $1220 gold, the same level that has thrown the goofy gold-stock traders into tizzies in recent weeks. Their indiscriminate fleeing spawned a huge fundamental disconnect.

Just last week that leading HUI gold-stock index plunged to 181.6. The first time those levels were seen in gold’s current upleg in late December, gold was just cresting $1150. But that day it closed at $1229. To see the same gold-stock prices over 4 months later with gold about $79 higher is ludicrous! Traders aren’t thinking rationally, they are overcome with fear. When they snap out of it, gold stocks will surge.

Though this contrarian sector is widely despised today, it was the best-performing in all the stock markets last year despite that sharp post-election selloff in Q4. The HUI blasted 64.0% higher in 2016, trouncing the S&P 500’s mere 9.5% gain! Similar huge 50%+ gold-stock gains are highly likely again this year, as gold mean reverts higher on the coming stock-market selloff. The gold miners’ strong Q1 fundamentals prove this.

While investors and speculators alike can certainly play gold stocks’ coming rebound rally with the major ETFs like GDX, the best gains by far will be won in individual gold stocks with superior fundamentals. Their upside will far exceed the ETFs’, which are burdened by overdiversification with underperforming gold stocks. A carefully-handpicked portfolio of elite gold miners will generate much-greater wealth creation.

At Zeal we’ve literally spent tens of thousands of hours researching individual gold stocks and markets, so we can better decide what to trade and when. As of the end of Q1, this has resulted in 928 stock trades recommended in real-time to our newsletter subscribers since 2001. Fighting the crowd to buy low and sell high is very profitable, as all these trades averaged stellar annualized realized gains of +22.0%

The key to this success is staying informed and being contrarian. That means buying low when others are afraid. So we’ve been aggressively adding new trades in recent weeks’ selloff. An easy way to keep abreast is through our acclaimed weekly and monthly newsletters. They draw on our vast experience, knowledge, wisdom, and ongoing research to explain what’s going on in the markets, why, and how to trade them with specific stocks. For only $10 per issue, you can learn to think, trade, and thrive like a contrarian. Subscribe today and get deployed in great gold stocks before they surge far higher!

The bottom line is the major gold miners’ fundamentals were very strong in the just-reported first quarter. As usual seasonally, gold production fell sharply with lower-grade ore being run through the mills. But it was remarkable to see the miners still hold costs steady, evidencing big improvements in operational efficiencies. That will fuel sharply-higher profits growth in coming quarters as production mean reverts higher.

The major gold miners’ accounting earnings already exploded higher in Q1 without Q4’s big writedowns. That leaves the gold stocks wildly undervalued even at today’s prevailing gold prices, let alone where gold is heading in coming quarters. Sooner or later gold-stock traders will realize how irrational their latest bout of excessive fear was. Then they will flood back in with a vengeance, catapulting gold stocks far higher.

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan

Comments are closed.