Gold reversed hard last week after blasting higher for a month, leaving traders wondering why and what that portends. The answers are found in gold’s dominant short-term driver, speculators’ collective trading in gold futures. Their positioning has grown excessively bullish, they are essentially all-in betting on more gold upside. That spawned a massive and ominous gold-futures-selling overhang, which needs to be normalized.

Since gold-futures trading is so esoteric, most investors and speculators ignore it. That’s a big mistake, as gold’s near-term price action is overwhelmingly driven by what speculators are doing in gold futures. Their buying and selling heavily impacts gold, and those moves are amplified in both silver and the stocks of precious-metals miners. Trading anything in this realm without watching gold futures is like flying blind.

The reason gold, silver, and their miners’ stocks soared between early August to early September was heavy spec gold-futures buying. That exhausted these traders’ sizable-but-still-limited capital firepower, which is why gold’s powerful upleg stalled out last week. Then gold began falling as specs started to unwind some of their excessively-bullish bets. Gold’s recent action is largely a tale of spec futures trading.

Despite being relatively small compared to the broader gold market, gold futures exert disproportional outsized impacts on gold prices. Unfortunately the gold-futures tail usually wags the gold dog, mostly due to a couple key factors. Gold-futures trading allows extreme leverage far beyond anything seen in normal markets, and the resulting gold-futures price is gold’s global reference one that heavily influences sentiment.

Investors normally buy gold outright, so $1 of capital allocated exerts $1 of price pressure which makes for no leverage at 1.0x. Since 1974, the legal maximum allowed in the US stock markets has been 2.0x. So an investor using maximum margin could buy the world’s leading gold exchange-traded fund, the GLD SPDR Gold Shares, at 2.0x. That would effectively double the price impact of $1 of capital deployed to $2.

But gold futures are in an extreme league of their own for leverage. Each COMEX gold-futures contract controls 100 troy ounces of gold, which is worth $150,000 at $1500 gold. Yet this week the maintenance margin required to hold each contract is only $4,500. That’s all the cash traders are required to have in their accounts, enabling crazy maximum leverage as high as 33.3x! $1 of capital can exert $33 of price pressure.

Gold-futures speculators punch way above their weights in moving gold prices because the price impact of their trading is amplified by up to 33.3x! That juiced gold-futures capital radically outguns investors over short periods of time. Traders can choose to use less leverage, and many do. But even at 10x or 20x, significant spec gold-futures activity drowns out everything else. This has big negative side effects.

At 33.3x, traders can’t afford to be wrong for long or risk catastrophic losses. A mere 3.0% gold move against their bets would obliterate 100% of their capital deployed! That forces these guys into extreme myopia. Their gold outlook isn’t measured in weeks and months, but in hours and days. All they can care about bearing such ridiculous risks is piling on and riding gold’s immediate momentum. Nothing else matters.

The extreme leverage inherent in gold futures also enables gold-price-manipulation attempts. Relatively-small amounts of capital can be blitzed into gold futures at full amplification in very-short timeframes to artificially move gold prices. Often these huge buy and sell orders are rapidly placed then cancelled before they can be executed, which is known as spoofing. This fraud is finally leading to criminal convictions.

Gold prices would be far-less volatile, and vastly more reflective of underlying global supply and demand, without that 30x+ gold-futures capital bullying them around. Gold futures’ impact is multiplied even more since that COMEX gold-futures price is the world reference one. That is what investors and speculators watch around the globe, heavily influencing their own gold sentiment and outlooks which affects their trading.

So what speculators are doing in gold futures changes how investors perceive gold in real-time. They love chasing performance, tending to add gold positions on strength while selling on weakness. Thus heavy gold-futures selling amplified through extreme leverage hammering the gold price lower curtails investment buying and spawns selling. The psychological impact of that reference gold-futures price is sweeping!

There’s no doubt gold would be far better off without hyper-leveraged futures trading, which ought to be banned. These speculators should be bound by the same 2x that has served stock markets well for nearly a half-century. The crazy risks and perverse incentives of running 10x, 20x, 30x+ leverage are really contrary to the core mission of futures markets, which is enabling actual physical users to hedge prices.

But we must trade the markets we have, not the ones we want. And gold futures’ current wildly-outsized price impact on gold makes watching speculators’ trading activity essential for gaming gold’s near-term price action. Every week the collective spec trading in gold futures is summarized in the CFTC’s famous Commitments of Traders reports. They are current to Tuesdays closes, but not published until late Fridays.

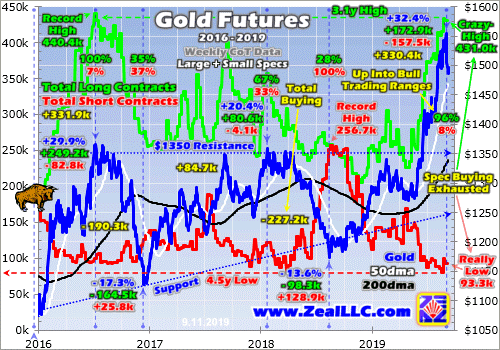

This chart superimposes the current gold bull over speculators’ total long and short positions in gold-futures contracts. The green long line shows their total upside bets each CoT week, while the red short one tracks their downside ones. Gold powers higher when these leveraged traders are buying, and falls when they are selling. Gold, silver, and their miners’ stocks can’t be successfully traded without following this.

This secular gold bull was born in mid-December 2015, and its maiden upleg was powerful and exciting. Gold soared 29.9% in just 6.7 months, a sea change after languishing in the prior bear market for years! Heavy spec gold-futures buying was the key driver of that mighty move. During that relatively-short span, speculators bought 249.2k gold-futures long contracts while buying to cover another 82.8k short ones.

That added up to a huge 331.9k contracts of total buying in largely the first half of 2016! That is the equivalent of 1032.3 metric tons of gold, or almost 2/3rds of the world’s total mined gold supply that half-year. The other primary driver of gold is investment demand, which was dominated by GLD in that upleg. But GLD’s holdings merely grew 352.6t in that same upleg span, just over a third of gold-futures buying.

The vertical blue lines divide this gold bull into its major uplegs and corrections. Note that uplegs require the green spec-gold-futures-longs line to rise and their red shorts line to fall. Gold can’t consistently rally when these guys aren’t buying. And when they are selling as evidenced by falling longs and rising shorts, gold heads lower in corrections. Speculators’ leveraged gold-futures trading dominates gold’s price action!

Fast-forward to today, where gold has powered 32.4% higher over 12.6 months in its biggest upleg of this bull so far. This move was largely driven by massive spec gold-futures long buying and short covering. This upleg was born last August when these traders were exceedingly bearish on gold. Their longs were relatively low, and their shorts had soared to an all-time-record high of 256.7k contracts. That was super-bullish!

I explained this at the time, writing an essay on specs’ record gold-futures shorts just over a year ago as gold traded under $1200. I concluded then “…gold and silver soon soared on short-covering buying following all past episodes of excessive and record short selling. There’s nothing more bullish for gold and silver than extreme shorts! … Record futures shorts are the best gold and silver buy signals available.”

Because of the extreme risks inherent in gold futures, the group of traders willing to bear these is always fairly small. The capital they collectively command is finite and relatively minor by market standards. So though their price-moving firepower is greatly amplified by radical leverage, their buying and selling soon exhausts itself. Once specs have bought or sold all the gold futures they are able to, gold is going to reverse.

All-time records in spec longs or shorts are easy to identify as extremes not likely to be sustainable for long. Spec longs hit their record high of 440.4k contracts in early July 2016, as this gold bull’s powerful maiden upleg peaked. Spec shorts crested at that 256.7k contracts in late August 2018, which is what birthed today’s strong upleg. But how can we decide what is relatively high or relatively low outside of records?

We want to aggressively buy gold and gold stocks when speculators’ gold-futures positioning grows too bearish, when their longs are low and shorts high. And we need to prepare to sell the resulting winning trades when their collective bets get excessively bullish, evidenced by high longs and low shorts. I’ve tried various approaches to analyzing this over the years, and finally developed a simple one that works.

Every week I game the near-term outlook in gold, silver, and their miners’ stocks by looking at how spec gold-futures longs and shorts are trading relative to their own bull-market-to-date trading ranges. These are expressed as percentages. When gold bottomed in mid-August 2018, total spec longs were 28% up into that range while total spec shorts were at 100% of their own. There was way more room to buy than sell.

The most-bullish-possible gold-futures positioning is specs being all-out, represented by 0% longs and 100% shorts. That means about all they can do is buy, both by adding new longs and buying to cover and close existing shorts. The lower spec longs and higher spec shorts, the more bullish gold’s near-term outlook and the bigger the coming gains as these traders buy to normalize their excessively-bearish positions.

Indeed gold’s latest upleg was driven by massive spec long buying and short covering over the past year or so. During that entire 12.6-month span ending last week where gold climbed 32.4%, total spec longs soared 172.9k contracts while total spec shorts collapsed 157.5k. That adds up to 330.4k contracts of gold-futures buying, the equivalent of 1027.7t. That’s nearly identical to the 331.9k bought in this bull’s first upleg!

Today’s upleg’s latest interim gold high of $1554 came last Wednesday September 4th. The latest weekly CoT report available before this essay was published was current to the previous day’s close. At that point before gold reversed hard and started falling, total spec longs were running 96.3% up into their gold-bull-market trading range since mid-December 2015. Total spec shorts were just 7.6% up into their own range.

The most-bearish-possible gold-futures positioning is specs being all-in, which happens at 100% longs and 0% shorts. Their capital firepower is exhausted, they are tapped out and just can’t materially add to their excessively-bullish bets any more. At that point all they can do is sell, beginning to normalize their lopsided positioning. And gold-futures selling quickly cascades due to the extreme leverage in these trades.

Last Tuesday as gold exuberance mounted, total spec longs ran 431.0k contracts. That was the third-highest on record, after the prior CoT week’s 433.0k and early July 2016’s 440.4k! There wasn’t much room for material new buying with longs so excessive. No matter how excited traders get after a strong gold run, the ranks of gold-futures speculators won’t swell much since the risks they bear are so extreme.

Gold not only faced virtually no more spec long buying last week, but little potential short-covering buying. The total spec shorts of 93.3k contracts weren’t much above their lowest levels seen in this gold bull just a couple CoT weeks earlier. Spec shorts never go to zero, there’s always a floor no matter how big and fast gold rallies. In this bull that has run around 90k or so. This upleg’s huge short covering was out of steam.

When gold-futures speculators’ potential buying exhausts itself, gold has to stall and top out. There’s just no more high-octane leveraged fuel to keep driving it higher. And at that point with specs essentially all-in longs and all-out shorts, it’s only a matter of time until some catalyst sparks selling. Early last Thursday it happened to be news the US-China trade talks are back on and better-than-expected US private-sector jobs.

Neither headline would’ve moved gold much had spec gold-futures positioning not been so extreme. But the only thing these traders could do was sell, and that soon snowballed. Again at 33.3x leverage, gold only has to move 3.0% against speculators’ bets to wipe out 100% of their capital risked. So they have to sell fast or risk ruin. And the more they sell the quicker gold falls, triggering still more selling by other traders.

Now that this gold-futures selling is underway, the extreme gold-futures-selling overhang that led into it has to be largely wiped out. That is likely to take at least a couple months coming from such near-record extremes. That portends a major correction in gold as specs dump their excessive longs and ramp up their barely-existent shorts. This gold bull’s own precedent is certainly ugly, as we saw after its maiden upleg.

In early July 2016 after gold soared 29.9% in 6.7 months, total spec longs and shorts were running 100% and 7% up into their bull trading ranges. By the time the necessary gold-futures selling to rebalance those positions ran its course, gold plunged 17.3% over the next 5.3 months! Just last week specs’ total longs and shorts stretched a similar 96% and 8% up into their bull-market trading ranges, which is menacing.

While gold is in for a major correction, thankfully it isn’t likely to challenge that H2’16 extreme. That was really exacerbated by an exceptional one-off anomaly. Trump’s surprise election win goosed the stock markets on hopes for big tax cuts soon, leading to extraordinary gold selling. Before Trump won, gold had decisively bottomed down just 8.3% before rallying again for weeks. That’s about what’s probable this time.

Speculators’ gold-futures positioning is so important to follow that I always discuss it in our weekly and monthly newsletters for subscribers. Since they graciously fund our business, they get this critical data and analysis well before I consider writing essays on it. I warned about all this in our new September newsletter published early on August 31st. That was before gold cracked on the inevitable gold-futures selling.

My conclusion then was “Gold is overextended, due for a healthy bull-market correction over the near-term. Its technicals are way too overbought, and its sentiment way too greedy. Too many buyers have flooded in too quickly, exhausting gold’s near-term upside potential. My best guess is a 6%-to-12% gold selloff, which the major gold stocks will leverage like usual by 2x to 3x.” That works out to 12% to 36%.

Gold-futures-selling overhangs can’t be taken lightly, as extreme spec positioning never lasts for long. The resulting gold corrections are very healthy for bulls, restoring balance to sentiment and technicals. But there’s no need to get trapped in them and see big prior-upleg gains in gold stocks just evaporate. When gold stocks are very overbought like last week, stop losses should be tightened to protect gains.

To multiply your capital in the markets, you have to trade like a contrarian. That means buying low when few others are willing, so you can later sell high when few others can. In the first half of 2019 well before gold’s breakout, we recommended buying many fundamentally-superior gold and silver miners in our popular weekly and monthly newsletters. We’ve recently realized big gains including 109.7%, 105.8%, and 103.0%!

To profitably trade great gold stocks, you need to stay informed about speculators’ positioning in gold futures which drives gold. Our newsletters are a great way, easy to read and affordable. They draw on my vast experience, knowledge, wisdom, and ongoing research to explain what’s going on in the markets, why, and how to trade them with specific stocks. Subscribe today and take advantage of our 20%-off sale! Get onboard now so you can mirror our coming trades for gold’s next upleg after this correction.

The bottom line is gold stalled and reversed hard because speculators’ leveraged gold-futures bets had grown too excessively bullish. Their longs were way up just under all-time-record highs, and their shorts were way down just over bull-market lows. These gold-dominating traders were effectively all-in longs and all-out shorts, leaving them little room to keep buying but vast room to sell on the right catalyst hitting.

Such gold-futures-selling overhangs resulting from specs waxing too bullish need to be normalized before gold bulls can resume. That only happens through heavy selling, both jettisoning exaggerated longs and ramping up meager shorts. This forces gold into major corrections, which are both necessary and healthy between major bull-market uplegs. They lead to the best buying opportunities seen within ongoing bulls.

Adam Hamilton, CPA

September 16, 2019

Copyright 2000 – 2019 Zeal LLC (www.ZealLLC.com)

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan

Comments are closed.