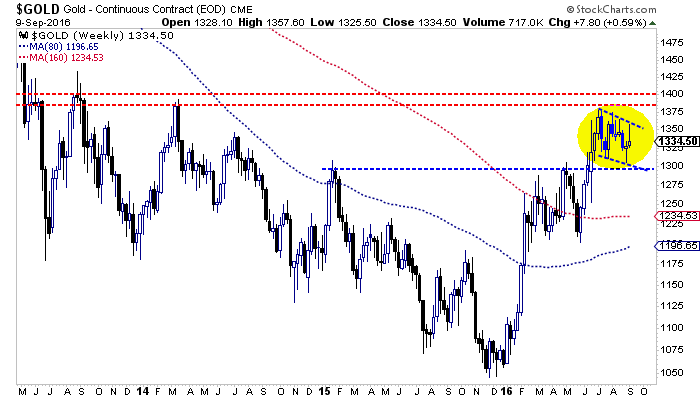

The failure of Gold and gold stocks to sustain recent gains coupled with a strong selloff to close the week dashes any hope that the correction ended last week. The charts and probabilities argue that the sector remains in a larger correction and perhaps has started the C portion of a typical A-B-C (down-up-down) correction.

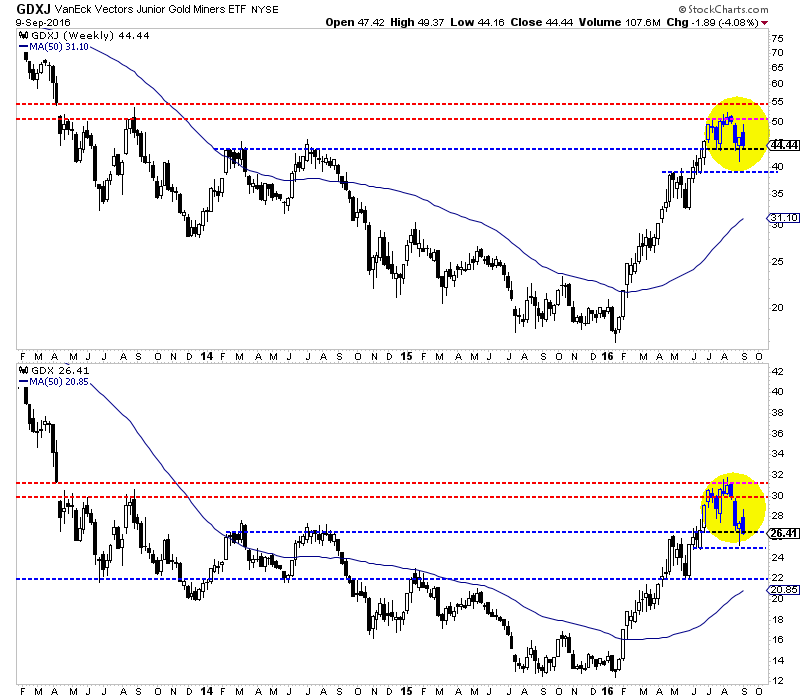

This week started out strong for the miners but that strength faded and was completely reversed with Friday’s selloff. GDX and GDXJ closed down 3%-4% for the week and left nasty bearish candles on the weekly charts. GDXJ, which made a low of $41 last week could test at least $39 while GDX, which tested a low of $25 last week has downside potential to $22.

Before I get to Gold, here is an important note on GDX. During bull market corrections, GDM, the parent index of GDX often found support at its 400-day exponential moving average. This happened seven times during 2002-2003, 2006 and 2009-2010. The 400-day exponential moving average for GDX is currently at $22 and rising slowly. Hence, I consider $22-$23 as a potential bottom for GDX.

Turning to Gold, we note that Gold failed at the $1355-$1360 resistance earlier in the week. That coupled with Friday’s decline increases the odds that Gold will head lower to the bottom of its channel near $1300. Gold closed at $1334. It has support at $1300-$1310 and $1275-$1280.

The negative reversal in miners and metals at the end of this week (and their failure to hold the rebound) signals that a larger and longer correction is playing out and more downside potential is directly ahead. GDX closed at $26.41. It has a very strong confluence of support around $22 which includes its 200-day moving average, its 400-day exponential moving average (noted above) and the 50% retracement of the entire rebound. Do not be surprised if this target is reached quickly, such as in days and not weeks. Remember that fishing line type declines (think of the trajectory of a fishing line) are a buying opportunity.

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan

Comments are closed.