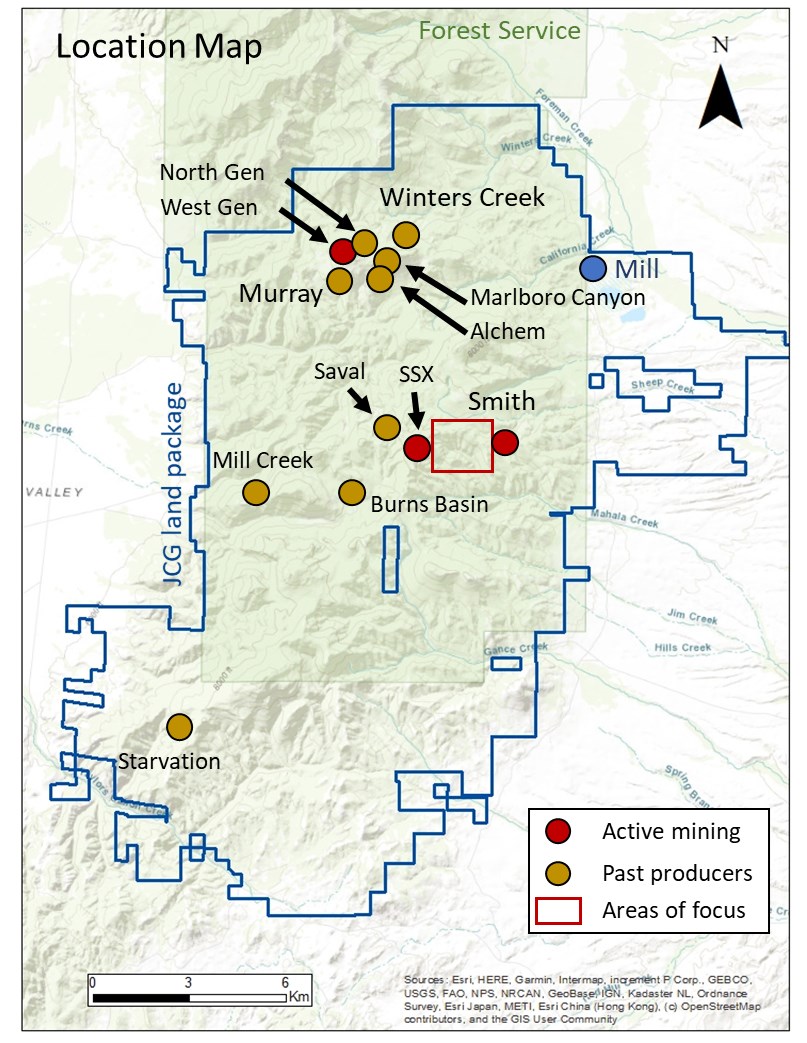

First Majestic Silver (TSX:FR) announced this morning new drill results from the ongoing exploration program at the Jerritt Canyon Gold Mine in Nevada. Roughly 120,000m of drilling is planned at Jerritt Canyon in 2022. Drilling will focus on the Smith and SSX mines, Winters Creek, Murray, Wheeler, and Waterpipe areas. The campaign is focused on short-term underground core drilling testing extensions for known ore controls. These are near active mining.

Other mid-term focused drilling is focused on validating and testing the presence of mineralized volumes near historic workings. Finally, the long-term drilling of the program will aim to make new gold discoveries in this important district.

Keith Neumeyer, President and CEO of First Majestic, commented in a press release: “Today’s exploration results continue to validate our thesis that the area between the operating SSX and Smith mines is favourable for new, near-mine gold discoveries. Hole-1102 intersected what looks like a new high-grade area on the north side of the SSX/Smith connection drift. Nine follow up drill holes are being planned to further define this potential new zone. In addition, follow up drilling at Zone 10 in the Smith mine has confirmed the presence of a high-grade pod of gold mineralization approximately 90 metres southeast from the connection drift. Over the past few months, we advanced the mine development towards this high-grade pod in anticipation of initial ore extraction in early October. Furthermore, ore production from the West Gen mine is also planned to begin in October and expected to increase the amount of fresh ore production at Jerritt to over 3,000 tonnes per day by the end of 2022.”

Highlights from the Company’s ongoing exploration program are as follows:

Drilling at Smith Zone 10:

- Follow up drilling to hole SMI-LX-1112 (8.39 grams of gold per tonne (g/t Au) over 29.7m, reported May 2022) delineated a new gold mineral zone located above the water table, approximately 90m southeast of the new connection drift between the SSX and Smith mines. Geologic interpretation and modeling of the drilling results determined that the gold zone is flat-lying, similar to nearby deposits. Results from Smith Zone 10 include:

- SMI-LX-1067: 6.98 g/t Au over 17.6m

- SMI-LX-1068: 8.61 g/t Au over 12.8m

- SMI-LX-1069: 8.61 g/t Au over 24.4m

- SMI-LX-1071: 14.60 g/t Au over 13.2m

Drilling from the SSX/Smith Mine connection drift:

- SMI-LX-1102: 19.35 g/t Au over 23.2m: the intercept is approximately 75m north and 40m above the connection drift (above the current water table). The geometry of the mineralization appears to be sub-horizontal with the drilling intersecting at a low angle.

- SSX-SR-612: 10.27 g/t Au over 14.7m and 9.53 g/t Au over 13.7m: the intercepts are approximately 300m SE and 75m below the connection drift. The drill hole likely intercepted the mineralization at a low angle and may be correlated to results from hole SSX-SR-608 reported in May 2022.

Drilling at Smith:

- SMI-LX-799: 32 g/t Au over 13.7m: identified gold mineralization approximately 150m north and 15m below active mine workings. Geologic interpretation suggests that this intercept is stratigraphically controlled (sub-horizontal) and drilling has intersected it at a low angle.

Drilling at SSX Zone 5:

- Intersected mineralization approximately 100m from active mining and above the water table. The geometry of the mineralization is not yet known, a combination of sub horizontal controls along stratigraphy (for low angle intersects) and vertical controls are under investigation.

- SSX-SR-486: 6.53 g/t Au over 11.3m

- SSX-SR-490: 11.22 g/t over 35.3m

Table 1: Summary of Significant Gold Intercepts:

| Drillhole | Target | Drill type | Intercept | |||

| From (m) | To (m) | Length (m) | Au (g/t) | |||

| SMI-LX-1067 | Smith | DDH | 126.6 | 138.0 | 11.4 | 5.30 |

| SMI-LX-1067 (2) | Smith | DDH | 149.4 | 167.0 | 17.6 | 6.98 |

| SMI-LX-1068 | Smith | DDH | 127.1 | 134.7 | 7.6 | 9.13 |

| SMI-LX-1068 (2) | Smith | DDH | 151.5 | 164.3 | 12.8 | 8.61 |

| SMI-LX-1069 | Smith | DDH | 120.7 | 145.1 | 24.4 | 8.61 |

| SMI-LX-1071 | Smith | DDH | 93.3 | 106.5 | 13.2 | 13.76 |

| SMI-LX-1071 (2) | Smith | DDH | 110.0 | 116.1 | 6.1 | 3.60 |

| SMI-LX-1071 (3) | Smith | DDH | 119.2 | 132.9 | 13.7 | 14.60 |

| SMI-LX-1071 (4) | Smith | DDH | 137.5 | 143.7 | 6.2 | 8.88 |

| SMI-LX-1102 | Smith | DDH | 91.7 | 114.9 | 23.2 | 19.35 |

| SMI-LX-799 | Smith | DDH | 171.3 | 185.0 | 13.7 | 32.00 |

| SSX-SR-486 | SSX | DDH | 116.7 | 128.0 | 11.3 | 6.53 |

| SSX-SR-490 | SSX | DDH | 81.7 | 90.8 | 9.1 | 13.03 |

| SSX-SR-490 (2) | SSX | DDH | 98.5 | 133.8 | 35.3 | 11.22 |

| SSX-SR-612 | SSX | DDH | 266.6 | 281.3 | 14.7 | 10.27 |

| SSX-SR-612 (2) | SSX | DDH | 284.5 | 298.2 | 13.7 | 9.53 |

DDH is abbreviation for Diamond Drill Hole;

From, To and Length indicated in metres, true width of the mineralized intercepts is unknown at this time.

Source: First Majestic Silver

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan

Comments are closed.