Faraday Copper (TSX:FDY) recently announced the results of gold assays from archived material from the Childs Aldwinkle breccia at their Copper Creek project in Arizona, USA. The samples, which had not been previously tested for gold, were analyzed to improve data coverage. The outcomes have reinforced the company’s position that the project holds extractable gold, adding another layer of value to the site.

Paul Harbidge, President and CEO, commented in a press release: “We are pleased to provide the first results of the gold program after completing analysis of the Childs Aldwinkle breccia. The results show near-surface gold mineralization in the current resource pit shell and demonstrate the potential to add a gold by-product, further enhancing the value of the project. The team has been able to advance our thesis of payable gold in the resource by utilizing the historical drill core and pulps that previous operators did not analyze for gold. With Childs Aldwinkle assay results now received, the Company is currently preparing samples from other high-priority breccias and we look forward to presenting results as they are available.”

In past results, the focus of sample analysis was largely on copper, with gold getting considerably less attention. Faraday Copper aims to increase the amount of gold data available for potential incorporation into future resource updates. Besides gold, the samples are also being reassessed for copper, silver, and molybdenum to cross-check historical findings. Childs Aldwinkle is the first breccia selected for this multi-elemental analysis.

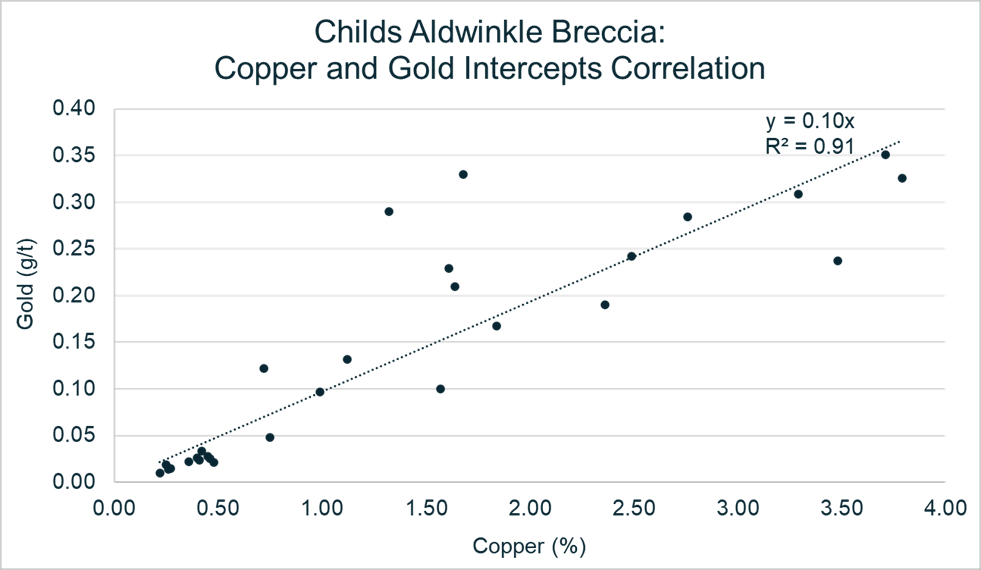

The results from Childs Aldwinkle indicated a robust correlation between gold and copper, observed as a 1:10 gold (g/t):copper (%) ratio. According to a technical report effective as of May 3, 2023, the breccia is estimated to contain about 3.3 million tonnes of mineralized material. This correlation suggests that the gold is mineralogically bound with copper and is expected to be included in copper concentrate. However, it’s important to note that this ratio and gold presence have not yet undergone a complete metallurgical or economic assessment, which means it is not yet classified as part of an official mineral resource.

Faraday Copper has initiated a metallurgical program to gather more information on the recoverability of gold. This will involve variability tests across multiple breccia domains to further understand how gold behaves in different settings.

Looking ahead, Faraday Copper plans to continue re-analyzing older samples, with an eye towards potentially including more gold data in future resource estimations. Additional areas under consideration for this gold program include the Copper Prince and Pole breccias, as well as the Keel underground zone. A new drilling program is set to kick off in October 2023, aiming to expand the Mineral Resource Estimate, better outline high-grade mineralized zones, and perform reconnaissance drilling on new targets.

The company is working towards releasing an updated technical report in the first half of 2025. This will include findings from their upcoming Phase II and III drilling programs, the ongoing gold program, and metallurgical studies.

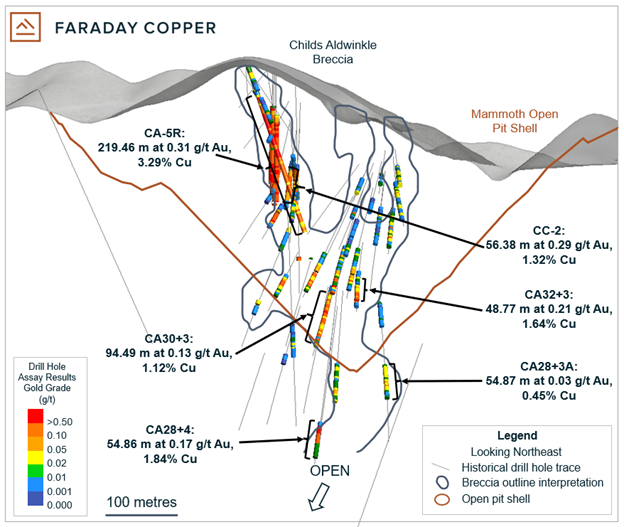

Highlights from the results are as follows:

- Significantly increased analytical coverage for gold at Childs Aldwinkle with 743 new gold assay results in addition to 120 historical gold results.

- Examples of intercepts with new gold assays and re-assayed copper include:

- 219.46 m (“metres”) at 3.29% copper and 0.31 g/t gold from 24.38 m in drill hole CA-5R;

- 94.49 m at 1.12% copper and 0.13 g/t gold from 341.38 m in drill hole CA30+3; and

- 56.38 m at 1.32% copper and 0.29 g/t gold from 150.88 m in drill hole CC-2.

- A weighted average of 0.16 g/t gold and 1.52% copper is calculated for mineralized intercepts for which gold analytical data is available1.

- Gold and copper are well-correlated on an intercept basis with an overall ratio of approximately 1:10 gold (g/t):copper (%) at Childs Aldwinkle.

- Historical metallurgical test work suggests high gold recoveries in the copper concentrate. The Company has initiated a metallurgical program to confirm gold recoveries.

- As part of the gold program, copper was re-assayed. These results confirm historical data, providing additional confidence in the database.

- Phase III drill program is expected to commence in October 2023.

Table 1: Intercept values at the Childs Aldwinkle breccia

| Drill Hole ID | From | To | Length | True width | Cu | Au | Ag | Mo |

| (m) | (m) | (m) | (m) | (%) | (g/t) | (g/t) | (%) | |

| CA-4R | 12.19 | 30.84 | 18.65 | N/A | 0.48 | 0.02 | 1.47 | 0.0042 |

| CA-4R | 64.01 | 82.30 | 18.29 | N/A | 0.36 | 0.02 | 0.82 | 0.0016 |

| CA-5R | 24.38 | 243.84 | 219.46 | N/A | 3.29 | 0.31 | 13.88 | 0.0770 |

| CA28+3A | 441.96 | 496.83 | 54.87 | 32 | 0.45 | 0.03 | 1.30 | 0.0004 |

| CA28+4 | 512.07 | 566.93 | 54.86 | 30 | 1.84 | 0.17 | 4.69 | 0.0320 |

| CA30+3 | 341.38 | 435.87 | 94.49 | 60 | 1.12 | 0.13 | 4.55 | 0.0230 |

| CA30+4 | 438.91 | 496.83 | 57.92 | 36 | 0.40 | 0.03 | 1.08 | 0.0006 |

| CA32+3 | 341.38 | 390.15 | 48.77 | 34 | 1.64 | 0.21 | 5.50 | 0.0320 |

| CA32+5 | 330.40 | 360.88 | 30.48 | 21 | 0.99 | 0.10 | 3.69 | 0.0800 |

| CA32+6 | 256.03 | 289.56 | 33.53 | 22 | 0.27 | 0.02 | 0.67 | 0.0031 |

| CA34+3 | 234.70 | 271.27 | 36.57 | 22 | 0.75 | 0.05 | 2.26 | 0.1106 |

| CA34+4 | 234.70 | 280.42 | 45.72 | 28 | 1.57 | 0.10 | 5.62 | 0.0285 |

| CA34+4A | 243.84 | 274.32 | 30.48 | 19 | 0.72 | 0.12 | 3.17 | 0.1007 |

| CA35.5+1 | 176.78 | 234.70 | 57.92 | 44 | 0.42 | 0.03 | 1.85 | 0.0130 |

| CA35.5+3 | 225.55 | 234.70 | 9.15 | 7 | 0.25 | 0.02 | 0.92 | 0.0016 |

| CA36+7 | 249.94 | 277.37 | 27.43 | 22 | 2.49 | 0.24 | 9.74 | 0.0867 |

| CA37.5+1 | 146.30 | 179.83 | 33.53 | 28 | 0.41 | 0.02 | 1.15 | 0.0113 |

| CA37.5+1A | 124.97 | 173.74 | 48.77 | 44 | 0.46 | 0.03 | 2.25 | 0.0746 |

| CA37.5+2 | 134.11 | 158.50 | 24.39 | 22 | 0.26 | 0.01 | 0.72 | 0.0601 |

| CA38+7 | 149.35 | 184.10 | 34.75 | 22 | 2.36 | 0.19 | 9.31 | 0.0179 |

| CA40+7 | 116.43 | 135.64 | 19.21 | 17 | 3.48 | 0.24 | 10.59 | 0.0649 |

| CC-2 | 150.88 | 207.26 | 56.38 | 36 | 1.32 | 0.29 | 5.53 | 0.0205 |

| MET-2CA | 45.72 | 169.16 | 123.44 | N/A | 3.79 | 0.33 | 11.57 | 0.0486 |

| MET-3CA | 45.72 | 152.40 | 106.68 | N/A | 3.71 | 0.35 | 11.27 | 0.0169 |

| FCD-23-023 | 184.72 | 230.61 | 45.89 | 35 | 1.68 | 0.33 | 5.55 | 0.0280 |

| FCD-23-027 | 390.72 | 408.98 | 18.26 | 9 | 0.22 | 0.01 | 1.58 | 0.0080 |

| CA-9R | 164.59 | 182.88 | 18.29 | N/A | 2.76 | 0.28 | 8.20 | 0.0206 |

| CATECH | 237.74 | 243.23 | 5.49 | N/A | 1.61 | 0.23 | 9.43 | 0.0014 |

| CA28+8 | No significant intercepts and incomplete gold data | |||||||

| CA30+6 | No significant intercepts | |||||||

| CA35.5+2 | No significant intercepts | |||||||

| CA36.5+2 | No significant intercepts | |||||||

| CA36.5+3 | No significant intercepts | |||||||

| CA36+8 | No significant intercepts | |||||||

Notes: Copper, silver and molybdenum columns indicate re-assayed metal values. Drill holes MET-2CA and MET-3CA were not re-assayed as part of this program. Drill holes CA40+7 and CC-2 are composite samples. For drill holes CA-9R and CATECH, gold data does not cover the entire mineralized intercept and lengths listed are for the portion for which gold data is available. True widths are approximate.

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan

Comments are closed.