Q4 production challenges have meant Kinross investors missed out on recent strength in gold mining equities. Kinross (TSX:K) (NYSE:KGC) has underperformed the Gold Miners ETF (GDX) by ~15% YTD.

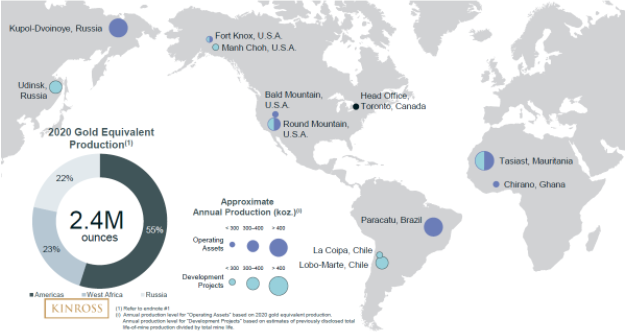

Geopolitics and sanctions may also be near-term headwinds given that Russian operations accounted for 20% of 2021 production. However, 2022 performance is more likely to be driven by their ability to deliver on broader production and capital strategies.

Production interruptions in Q4

Earlier this month, Kinross announced it would book a Q4 loss of $2.7 million due to interruptions which decreased production by 22% compared to Q4 2021. Adjusted Q4 net earnings were $101.8 million, or $0.08 per share, compared with $335.1 million or $0.27 per share for Q4 2020.

The decrease was due to the suspension of operations after a mill fire at the Tasiast mine in Mauritania as well as deferred activity at Round Mountain, Nevada, where wall instability was detected in Q1 2021. Earnings were also hit by a non-cash write-down of $106.1 million from a reduced estimate of recoverable ounces at Bald Mountain, Nevada.

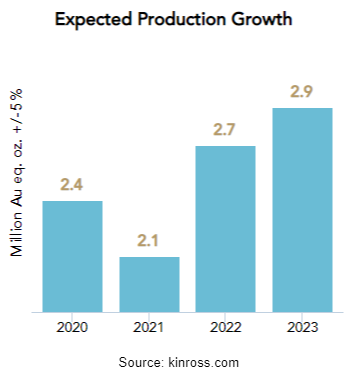

Results included some positive points such as returning $250 million in capital to shareholders and finalizing an agreement with the government of Mauritania regarding licenses near the Tasiast operation. The updated development outlook was also positive with a net reserve increase of 2.7 million oz. In the latest earnings call, CEO Paul Rollinson gave an average annual production estimate of at least 2.5 million oz over the rest of the decade.

While depressed production will persist into 2022, stronger numbers are expected in the latter half of the year. Annual production estimates were lowered slightly to 2.65 and 2.8 million GEOs for 2022 and 2023, respectively. (Previous estimates were 2.7 and 2.9 million.)

Turning the corner on capital allocation challenges

Some analysts have pointed to Kinross’ capital allocation challenges, including share dilution to finance expensive acquisitions in the post-2008 gold bull market, followed by impairment charges and underperforming assets.

Capital allocation concerns were echoed following the recent $1.42 billion acquisition of Great Bear Resources Ltd. The market punished Kinross in December of last year for what many felt was an expensive bid for Great Bear’s Dixie project, an exploration stage asset that had no resource estimate.

While it remains to be seen whether $1.42 billion was a good investment, other aspects of the capital allocation strategy (such as paying off debt and returning capital to shareholders) could be gauged in the nearer-term. Kinross repaid $500 million of senior debt in 2021 and maintains a low debt-to-equity ratio of 0.21. The company also returned $250 million to shareholders in 2021 through $150 million in dividends and $100 million in buybacks.

The longer-term success of Kinross’ capital allocation strategy will depend on their ability to maintain these trends which, in turn, would require strong sustained cash flows from production and gold prices. To appease the market on the expansion side of the strategy, the Dixie project would need a resource estimate of at least 7-8 million oz.

Russian operations and sanctions

About 20% of 2021 production came from the Kupol mine in Russia. The company issued a statement in response to the February 22 sanctions, maintaining that operations were unaffected. Whether this holds in light of developing events, remains to be seen.

Source: kinross.com

In response to a question in the Q4 earnings call, CEO Paul Rollinson highlighted their 25 year operating success in Russia, as well as the fact that 98% of site employees are Russian and mine supplies are procured regionally. Even if supply chains were disrupted, the remote site is stocked to operate well into 2022.

Rollinson also pointed out that Kinross operations were not affected by sanctions after the 2014 Crimea crisis. In fact, the subsequent decline in the ruble enhanced margins. Moreover, it is expected that Kupol will account for a lower percentage of total production (13%) in 2022 as they transition to mining narrower veins.

Basis for improved equity performance

The silver lining of Kinross’ recent underperformance is a relatively cheap equity price with strong fundamentals. Their relatively favourable ESG rankings could also be a positive should institutional capital reenter the sector.

For 2022, investors will be looking for a return to forecasted production together with a resource estimate indicating Dixie was a good investment.

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan

Comments are closed.